In the aftermath of the Supreme Court ruling overturning Roe v. Wade, there has been an increased focus on the use of telehealth as a way to both expand and restrict access to medication abortion at both the federal and state level. Several states that support abortion rights have enacted “shield” laws which aim to reduce the legal risks for clinicians who provide abortion medication via telehealth to patients who live in states where abortion is banned or restricted. An estimated one in four abortions are obtained via telehealth, and about half those are from abortion providers practicing in states with shield laws who mailed abortion pills to people living in states with bans or early stage gestational abortion restrictions. Recently, Louisiana and Texas, two states with abortion bans, filed lawsuits against a New York doctor for mailing medication abortion into their states. At the federal level, the possible enforcement of the Comstock Act, an 1873 anti-vice law, a recently initiated federal Food and Drug Administration (FDA) review of mifepristone safety, along with the potential reinstatement of FDA restrictions for mifepristone could result in the limitation or prohibition of the use of telehealth for medication abortion and restrict the availability of mifepristone nationwide.

The tension between the state right to ban or restrict abortion and federal jurisdiction to regulate medication abortion is a central issue in ongoing legal challenges. In addition, there is a conflict also playing out in the courts between states that ban abortion and those seeking to protect abortion providers in their states. Organizations on both sides of the abortion issue are advocating for the Trump administration’s FDA to take action to address access to mifepristone. This brief reviews current state and federal policies, ongoing litigation, and potential federal actions that may impact access to telehealth for medication abortion.

FDA Regulation of Medication Abortion

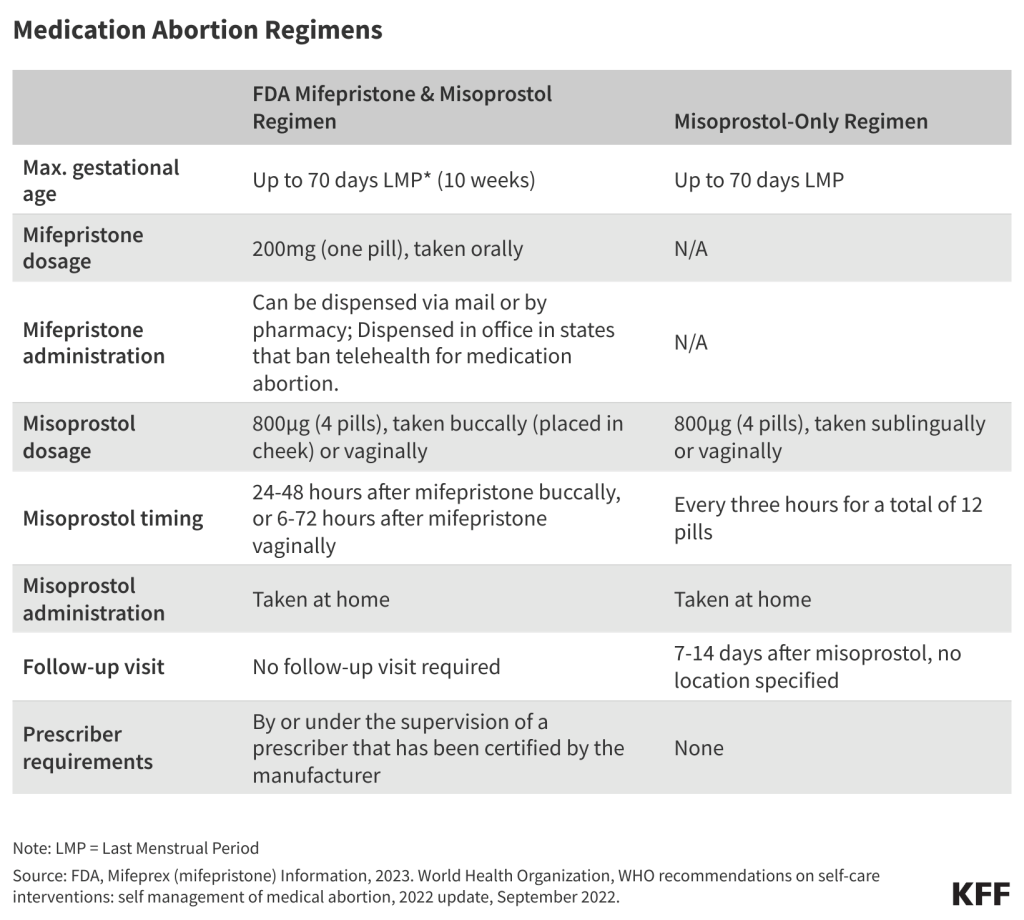

Mifepristone, often referred to as medication abortion, RU-486, or the abortion pill, was approved by the FDA as a medication to end pregnancy 25 years ago. A regimen of mifepristone, followed by misoprostol, is the FDA approved protocol for abortion during the first 70 days or up to 10 weeks after the first day of a missed period. Mifepristone works by blocking progesterone, a hormone essential to the development of a pregnancy, and thereby preventing an existing pregnancy from progressing. Misoprostol, taken 24–48 hours after mifepristone, works to empty the uterus by causing cramping and bleeding, similar to an early miscarriage. The national median self-pay price for medication abortion at a bricks and mortar provider in 2023 was $563, although the cost was significantly lower when obtained through a virtual clinic ($150). Medication abortions account for two-thirds (63%) of all abortions in the US and it is a safe and highly effective method of pregnancy termination. The pregnancy is terminated successfully 99.6% of the time, with a 0.4% risk of major complications, and an associated mortality rate of less than 0.001 percent (0.00064%).

A robust body of research has confirmed that the use of telehealth for medication abortion is safe and effective. Studies have found similar pregnancy termination rates without the need of interventions between telehealth and in-person abortion patients. Adverse events (such as infections, blood transfusions or hospital admissions) are very rare (<1%) among both in-person and telehealth patients. Telehealth patients also report high satisfaction rates with their use of telehealth. Despite the high share of states with abortion bans and early-stage gestational restrictions, the total number of abortions in the US has increased in the three years since the Dobbs decision. While this increase is due to a number of factors, telehealth has played a role in that increase. By the end of 2024, one in four abortions in the U.S. were provided via telehealth.

Since 2011, how mifepristone is dispensed has been subject to the FDA’s Risk Evaluation and Mitigation Strategy (REMS) restrictions. Currently, the REMS for mifepristone do not require in-person dispensing and allow certified non-physicians and pharmacies to prescribe and dispense the drug (Table 1). The original 2011 REMS only permitted certified physicians to prescribe and dispense mifepristone and required three in-person visits, thereby restricting the use of telehealth for medication abortion across the country. Over the years as new research has emerged, the FDA has modified the REMS, and in 2021 it removed the in-person dispensing requirements, which were formalized in 2023. In addition, in 2016, the FDA updated and approved a new evidence-based regimen and drug label for medication abortion. This protocol approved the use of medical abortions for up to 70 days (10 weeks) of pregnancy. Until 2019, mifepristone was only sold under the brand name Mifeprex, manufactured by Danco Laboratories. In 2019, the FDA approved GenBioPro, Inc.’s application for generic mifepristone.

State Policies Affecting Telehealth for Medication Abortion

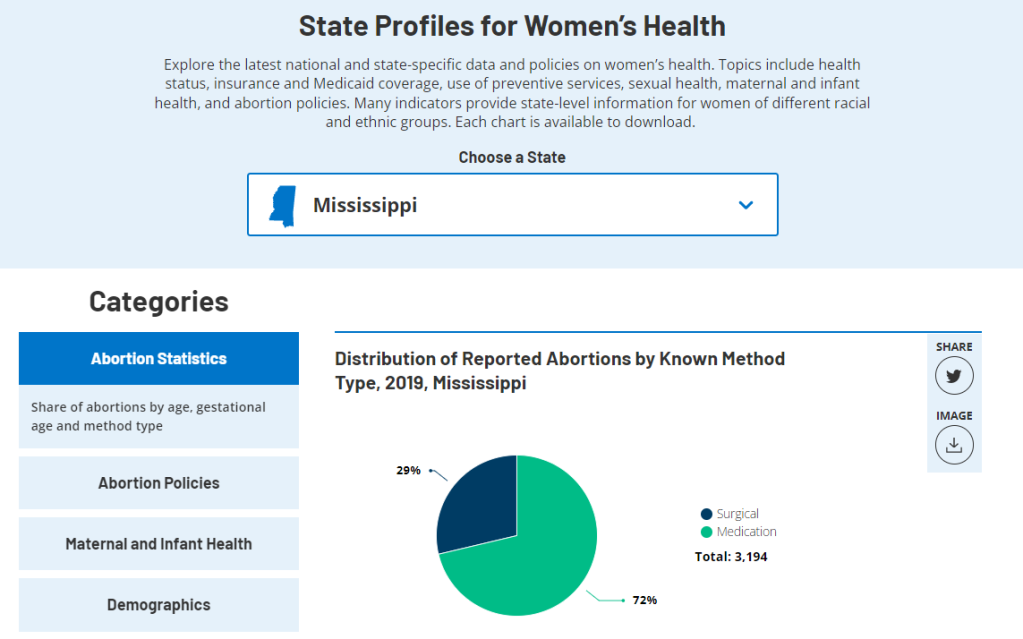

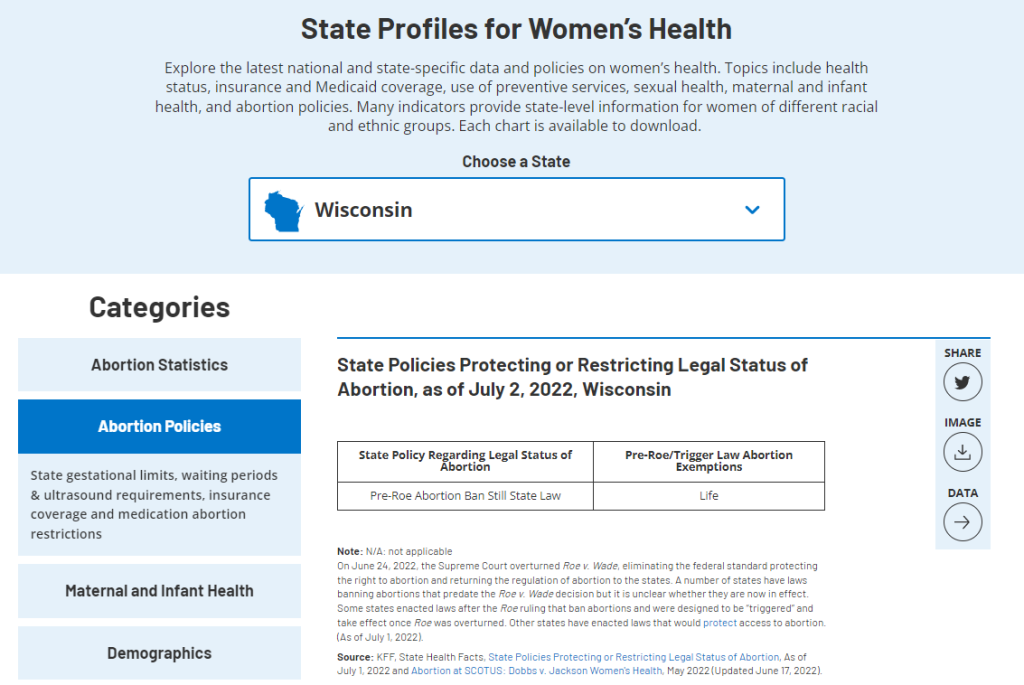

Access to medication abortion hinges on whether state laws ban or restrict abortion, abortion-specific regulations that are on the books in many states, and the FDA prescribing and dispensing protocol (Appendix 1). As of July 2025, 12 states have laws banning abortion and four states have a 6-week LMP gestational limit, often before many women know that they are pregnant. State laws that ban or restrict abortion apply to both medication and procedural abortions.

Currently nine states (AZ, AR, FL, IN, KY, OK, SC, TX and WV) have laws in place explicitly prohibiting the use of telehealth for medication abortion and/or the mailing of medication abortion drugs. Six of these states also have total abortion bans in place, and two have 6-week abortion bans, limiting access to all abortion services in the state. In Arizona, the only state with these laws in place that does not have a law banning or restricting abortion, doctors have filed a lawsuit contending that the state’s telehealth ban and the ban on mailing medication abortion drugs violate the state’s constitutional amendment protecting the right to abortion up to viability that was approved by voters in the November 2024 election.

In addition to the laws banning abortion or directly banning the use of telehealth for abortion, other state regulations—including ultrasound and counseling requirements, waiting periods, and specific in-person dispensing mandates—also play a role in limiting the feasibility of using telehealth for medication abortion (Figure 1). In states without these restrictions, people do not need to make any in-person visits to a clinic to safely have a medication abortion under the supervision of a health care provider.

In the aftermath of the Dobbs decision, some states started passing “shield” laws. These laws aim to protect physicians from prosecution brought by states where abortion is banned as long as the physician is located within the state with the shield law and the care they provided is legal in that same state, regardless of patient location. As of July 2025, eight states have shield laws in place that explicitly protect providers regardless of where the patient lives. By the end of 2024, over one in seven (15%) abortions in the U.S. were medication abortions for which the pills were mailed by providers practicing in states with shield laws to states where abortion is banned, with 6-week gestational limits, or the state has telehealth restrictions in place (Figure 2).

Potential Federal Actions that Could Restrict Medication Abortion

Questions remain about what actions the federal government can and/or will take to restrict the use of telehealth for medication abortion. The Comstock Act – an 1873 anti-vice law banning the mailing of obscene matter and articles used to produce abortion could be used to sharply restrict abortion nationwide. In the aftermath of the Supreme Court’s Dobbs decision, anti-abortion activists have argued in federal court that the Comstock Act prohibits the mailing of mifepristone directly to patients, as well as the general distribution of the medication to physicians, hospitals, and pharmacies.

A literal interpretation of the Act could potentially apply to materials used to produce all abortions, not just medication abortions; would not have exceptions; and could affect other medical care, such as miscarriage management. The Biden administration’s Department of Justice determined that the Act only applies when the sender intends for material or drug to be used for an illegal abortion, and because there are legal uses of abortion drugs in every state including to save the life of the pregnant person, there is no way to determine the intent of the sender. While he was running for a second term, President Trump made inconsistent statements about whether he would enforce the Act. If the Trump administration follows the Project 2025 blueprint and enforces the Comstock Act people across the country would be impacted, even those that have a guaranteed right to abortion in their state constitutions.

The Secretary of Health and Human Services (HHS), Robert F. Kennedy Jr., has directed the FDA commissioner, Dr. Martin Makary, to launch a safety review of mifepristone following the release of a report which has been criticized as having methodological flaws and lack of data transparency aiming to cast doubt on the long-standing research on the safety of mifepristone. Project 2025 and other anti-abortion advocates have long been calling for the FDA to retract the approval of mifepristone or for the FDA to revert to the older FDA mifepristone REMS that would reduce the gestational period for the use of mifepristone, prohibit telehealth appointments, and access through pharmacies.

Four citizen petitions have recently been filed with the FDA about mifepristone, calling for the agency to either restrict or expand access to the drug (Table 2). FDA citizen petitions allow individuals and organizations to petition the agency to issue, change, or cancel regulations. The FDA is required to respond to citizen petitions within 180 days by granting or denying the request, or saying it needs more time. The FDA must document its position in its response.

Current Litigation on Mifepristone Access

There are multiple ongoing cases seeking either to restrict or expand the availability of medication abortion (Table 3). In June 2024, the Supreme Court dismissed the case filed by the Alliance for Hippocratic Medicine, finding that the anti-abortion doctors and organization did not have standing to sue the FDA. Before this case was reviewed by the Supreme Court, three states (Missouri, Idaho, and Kansas) intervened as parties in this case at the district court level. This case is now proceeding as State of Missouri v. FDA, and the states are seeking the reinstatement of the in-person dispensing requirement for mifepristone and the requirement for three in-person visits which would prohibit the use of telehealth for medication abortion. In May 2025, the Trump administration filed a motion asking for the dismissal or transfer the states’ lawsuit to an appropriate venue instead of allowing the case to be considered by the federal district court in the northern district of Texas. GenBioPro, a manufacturer of generic mifepristone, filed a lawsuit in April 2023 in a federal district court in Maryland to prevent other federal court rulings from suspending FDA approval of mifepristone without following the required statutory and regulatory procedures. This case is currently paused pending the Texas district court decision in the case, Missouri v. FDA.

In February 2023, the Oregon and Washington Attorneys General joined by 16 other states filed a case in federal district court in the eastern district of Washington challenging the FDA’s decision-making about mifepristone, calling into question the FDA’s decision to impose restrictions on prescribing and dispensing mifepristone through the Risk Evaluation and Mitigation System (REMS). In April 2023, the judge in this case issued a preliminary injunction blocking the FDA from changing any rules that would impact the availability of mifepristone in states bringing the lawsuit (WA, OR, CO, CT, IL, NV, AZ, RI, OR, DE, MI, NM, VT, HA, MD, ME, MN, PA, and DC). The states alleged that the REMS imposes “hurdles” to drug access “without any corresponding medical benefit” in violation of the Federal Food, Drug and Cosmetic Act (FDCA). In July 2025, the federal district court vacated the preliminary injunction and dismissed the case finding that the “FDA did assess whether mifepristone qualifies for REMS…based on the criteria” set forth in the law, and came to a “reasonable conclusion.”

In addition, in May 2023, Whole Woman’s Health and other independent abortion providers in Virginia, Montana and Kansas filed a lawsuit challenging the imposition of REMS on mifepristone. The federal district court for the western district of Virginia heard the case on May 19, 2025, and is expected to rule on the case soon. A similar case originally filed in October 2017, now called Hawaii, Purcell v. Kennedy, is pending in the Hawaii District Court, where a hearing is scheduled for August 22, 2025.

There are two cases challenging state restrictions that go beyond what the FDA requires, contending the FDA rules preempt state laws regulating mifepristone. One of these cases was brought by GenBioPro, a manufacturer of generic mifepristone, challenging West Virginia’s law banning telehealth for medication abortion and the other case was brought by a North Carolina physician contending that North Carolina cannot require in-person dispensing only by a physician in a hospital or clinic certified by the state. On July 15, 2025, the 4th Circuit Court of Appeals ruled on the West Virginia case, affirming the District Court’s decision in favor of West Virginia. The North Carolina case is currently pending in the 4th Circuit Court of Appeals.

There is one active case in Louisiana state court that could impact the availability of mifepristone. After Louisiana reclassified misoprostol and mifepristone as controlled substances, subjecting these drugs to stricter regulation in the state, a doula collective, two patients, a physician and a pharmacist brought a legal challenge contending that the law violates the state constitution.

Challenges to State Shield Laws

States with abortion bans are testing the use of shield laws in the courts. In December 2024, in the first action testing a shield law, the Texas Attorney General filed a lawsuit against a New York doctor for mailing medication abortion pills into the state. The lawsuit alleges the physician violated Texas law by practicing medicine in the state of Texas without a Texas license and for violating the state’s abortion ban and prohibitions on telehealth for abortion care. On February 13, 2025, after the physician did not respond to the lawsuit or appear at court proceedings, a trial court issued a default judgment for the state, blocking the physician from prescribing medication abortions to Texas residents and ordering her to pay $100,000 in civil fines. Additionally, in January 2025, a Louisiana grand jury indicted the same New York physician for violating Louisiana’s abortion ban and restrictions. The New York shield law has blocked enforcement of the Texas and Louisiana judgments. A county clerk has refused the Texas Attorney General’s request to file the Texas judgment twice, once in March 2025 and again in July 2025. The New York’s Governor cited the shield law when she blocked an extradition request from Louisiana’s Governor. Louisiana and Texas might seek help from a federal court to enforce their orders in New York, and this would serve as test case for shield laws and their ability to protect clinicians providing abortion care via telehealth to patients located in states that ban or restrict abortion. In another case filed in Texas on July 20, 2025, citing Texas state law and the Comstock Act, a man is seeking civil damages from a California doctor for mailing medication abortion drugs to his girlfriend.

Appendix 1: State Policies Affecting Access to Medication Abortion via Telehealth