2022 Employer Health Benefits Survey

Section 2: Health Benefits Offer Rates

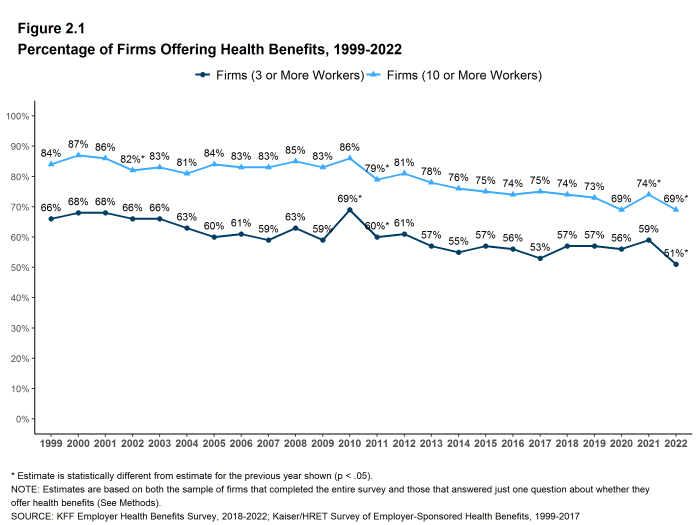

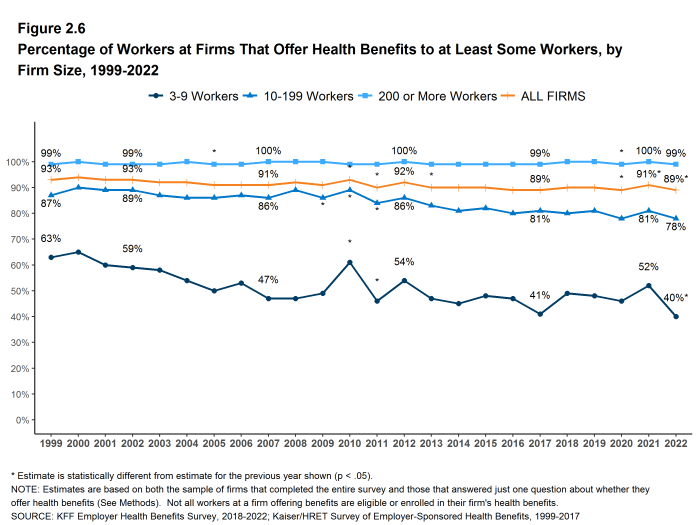

While nearly all large firms (200 or more workers) offer health benefits to at least some workers, small firms (3-199 workers) are significantly less likely to do so. The percentage of all firms offering health benefits in 2022 (51%) is lower than the the percentage of firms offering health benefits last year (59%) but similar to the percentage five years ago (53%).

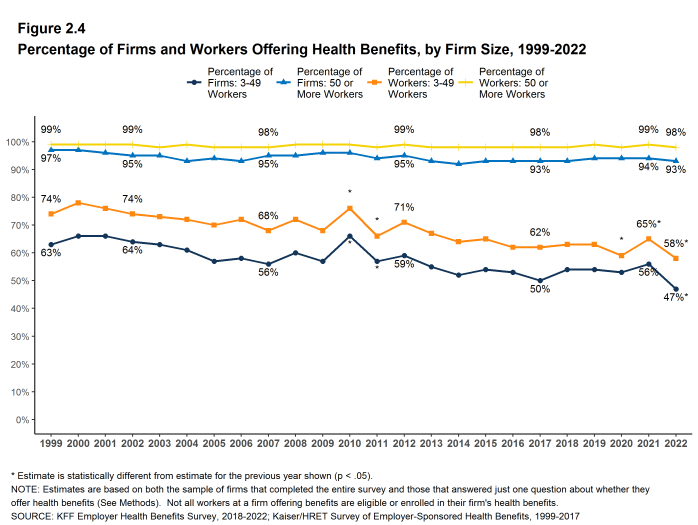

A majority of firms are very small, so the considerable fluctuation we see across years in the offer rate for these small firms drives the overall offer rate. Most workers, however, work for larger firms, where offer rates are high and much more stable. Over ninety percent (93%) of firms with 50 or more workers offers health benefits in 2022; this percentage has remained consistent over the last 10 years. Overall, 89% of workers employed in firms with 3 or more workers are employed at a firm that offers healh benefits to at least some of its workers.

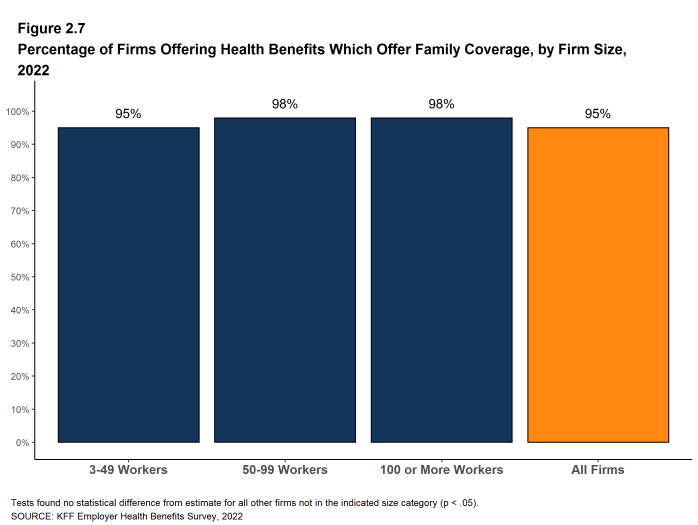

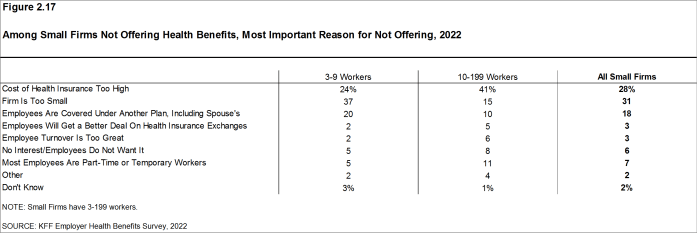

Small firms not offering health benefits say that “the cost of insurance is too high” and that “the firm is too small” are the most important reasons they do not offer coverage. Almost all (95%) firms that offer coverage offer both single and family coverage.

FIRM OFFER RATES

- In 2022, 51% of firms offer health benefits, lower than the percentage last year [Figure 2.1].

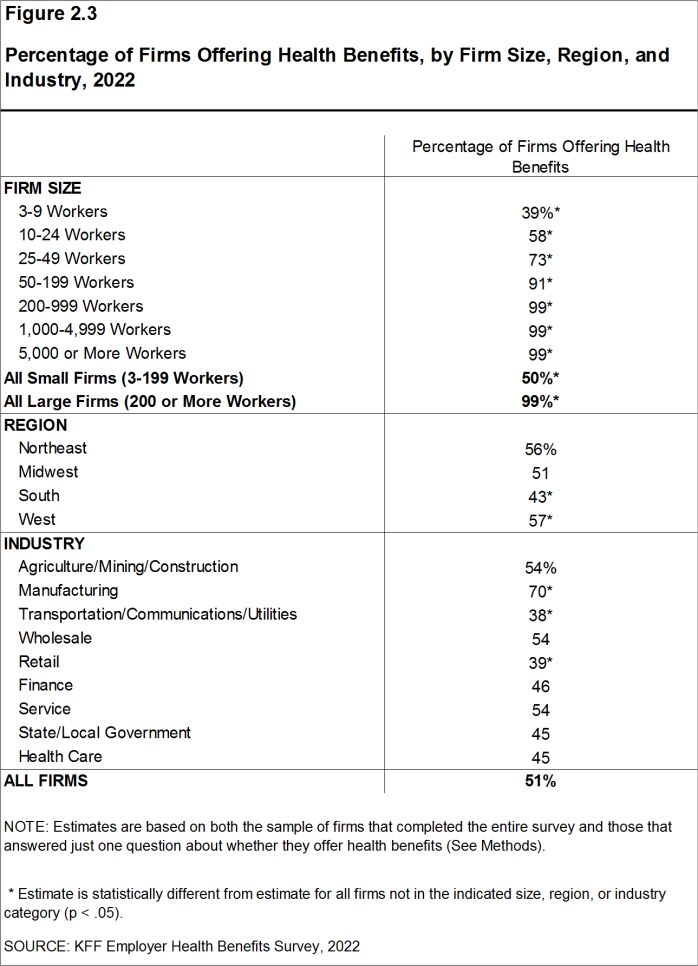

- The smallest-sized firms are least likely to offer health insurance: 39% of firms with 3-9 workers offer coverage, compared to 58% of firms with 10-24 workers, 73% of firms with 25-49 workers, and 91% of firms with 50-199 workers [Figure 2.3]. Since most firms in the country are small, variation in the overall offer rate is driven largely by changes in the percentages of the smallest firms (3-9 workers) offering health benefits [Figure 2.4]. For more information on the distribution of firms in the country, see the Survey Design and Methods Section and [Figure M.5].

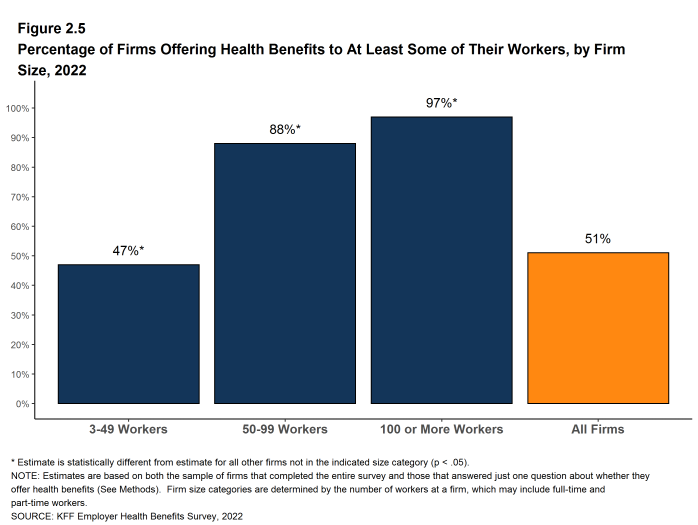

- Only 47% of firms with 3-49 workers offer health benefits to at least some of their workers, compared to 93% of firms with 50 or more workers [Figure 2.5].

- Because most workers are employed by larger firms, most workers work at a firm that offers health benefits to at least some of its employees. Eighty-nine percent of all workers are employed by a firm that offers health benefits to at least some of its workers [Figure 2.6].

Figure 2.5: Percentage of Firms Offering Health Benefits to at Least Some of Their Workers, by Firm Size, 2022

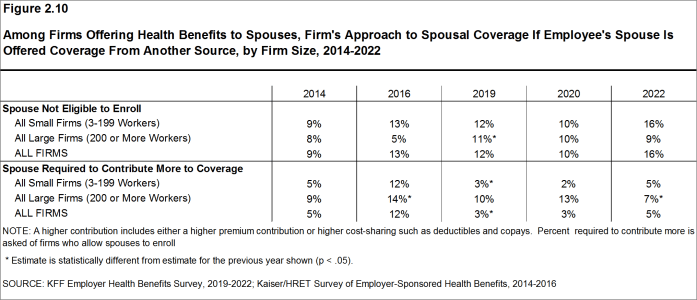

SPOUSAL SURCHARGES

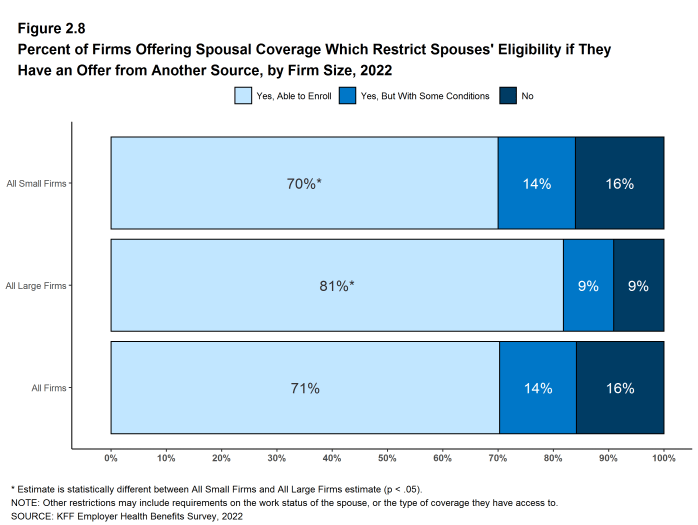

Among firms offering health benefits, the vast majority extend that offer to dependents [Figure 2.7]. Some employers place conditions on the ability of dependent spouses to enroll in a health plan if the spouse is offered health insurance from another source, such as his or her own place of work.

- Among firms offering health benefits to spouses, 71% say that an employee’s spouse is able to enroll in the employee’s health plan even if the spouse is offered coverage from another source, 14% say the spouse can enroll subject to some conditions (for example, the type of coverage offered), and 16% say that the spouse is not eligible to enroll [Figure 2.8].

- Among firms offering coverage (with or without conditions) to spouses with access to other coverage, 5% require such spouses to pay more if they enroll than spouses without access to other coverage, such as a higher premium contribution or higher cost sharing [Figure 2.10].

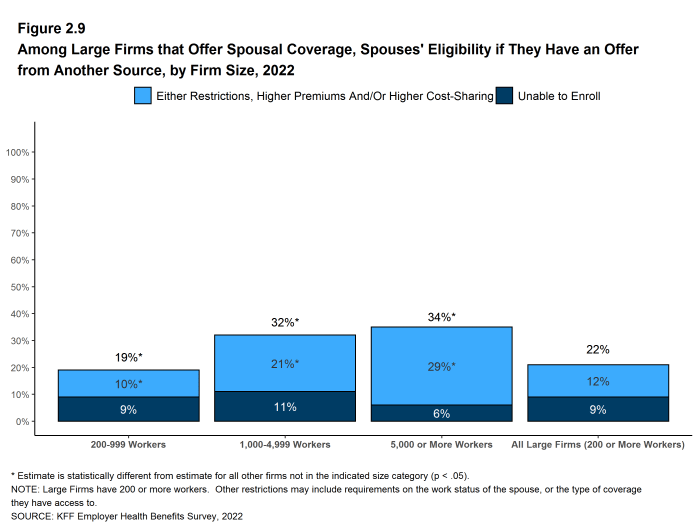

- Firms with 1,000 or more employees are more likely to have restrictions or assess higher costs to spouses with access to other coverage [Figure 2.9].

Figure 2.7: Percentage of Firms Offering Health Benefits Which Offer Family Coverage, by Firm Size, 2022

Figure 2.8: Percent of Firms Offering Spousal Coverage Which Restrict Spouses’ Eligibility If They Have an Offer From Another Source, by Firm Size, 2022

Figure 2.9: Among Large Firms That Offer Spousal Coverage, Spouses’ Eligibility If They Have an Offer From Another Source, by Firm Size, 2022

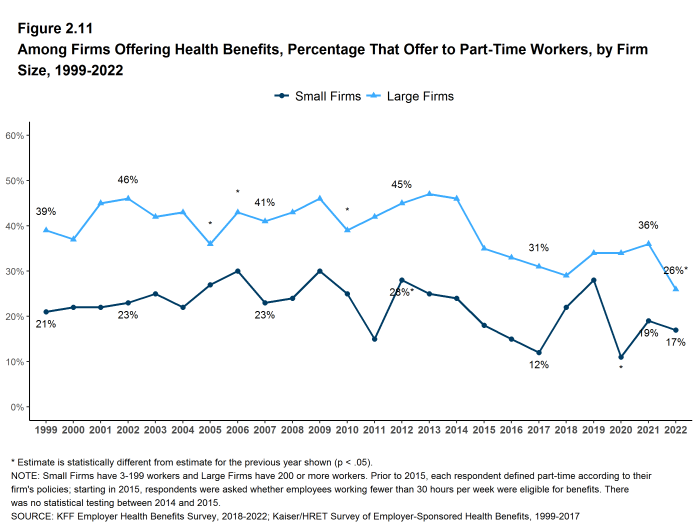

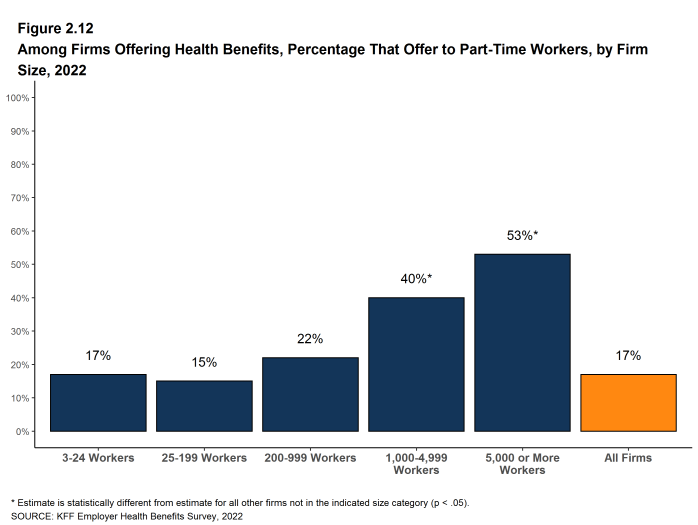

PART-TIME WORKERS

Among firms offering health benefits, relatively few offer benefits to their part-time workers.

The Affordable Care Act (ACA) defines full-time workers as those who on average work at least 30 hours per week, and part-time workers as those who on average work fewer than 30 hours per week. The employer shared responsibility provision of the ACA requires that firms with at least 50 full-time equivalent employees offer most full-time employees coverage that meets minimum standards or be assessed a penalty.11

Beginning in 2015, we modified the survey to explicitly ask employers whether they offered benefits to employees working fewer than 30 hours. Our previous question did not include a definition of “part-time”. For this reason, historical data on part-time offer rates are shown, but we did not test whether the differences between 2014 and 2015 were significant. Many employers may work with multiple definitions of part-time; one for their compliance with legal requirements and another for internal policies and programs.

- Twenty-six percent of large firms that offer health benefits in 2022 offer health benefits to part-time workers, lower than the percentage in 2021 [Figure 2.11]. The share of large firms offering health benefits to part-time workers increases with firm size [Figure 2.12].

Figure 2.11: Among Firms Offering Health Benefits, Percentage That Offer to Part-Time Workers, by Firm Size, 1999-2022

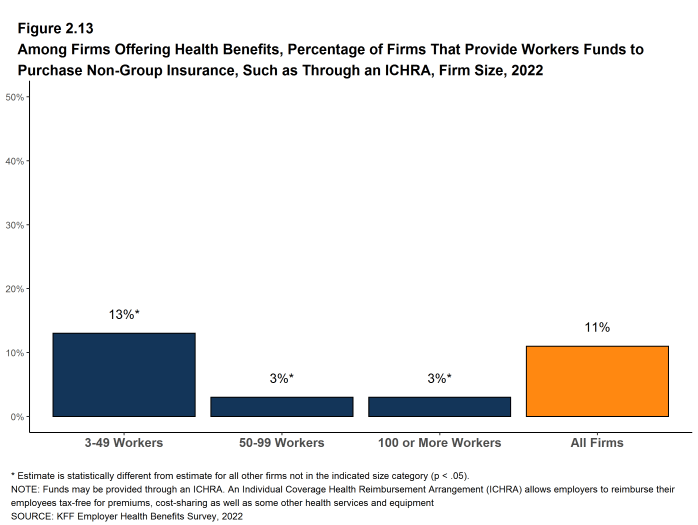

ASSISTING EMPLOYEES TO PURCHASE COVERAGE IN THE NON-GROUP MARKET

Some employers provide funds to some or all of their employees to help them purchase coverage in the individual (“non-group”) market. Employers that do not otherwise offer health benefits may do this as an alternative to offering a group plan, or employers that offer a group plan to some employees may use this approach for some types or classes of workers, such as part-time employees. One way an employer can provide tax-preferred assistance for employees to purchase non-group coverage is through an Individual Coverage Health Reimbursement Arrangement, or ICHRA. Both employers that offer and those that do not offer health benefits were asked if they provide funds to any employee to purchase non-group coverage.

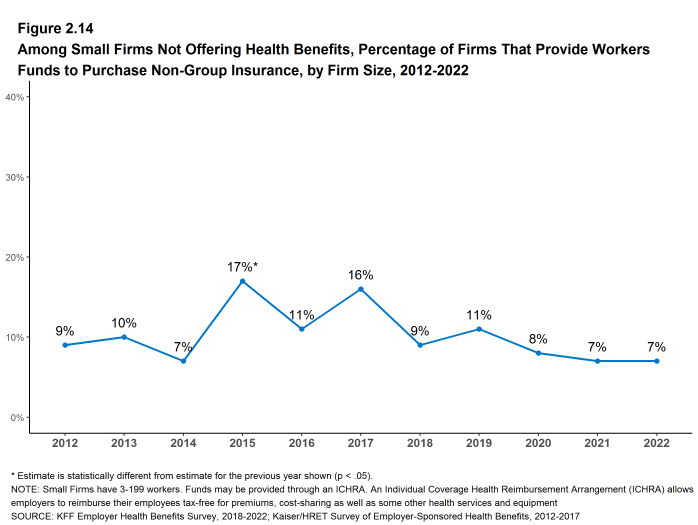

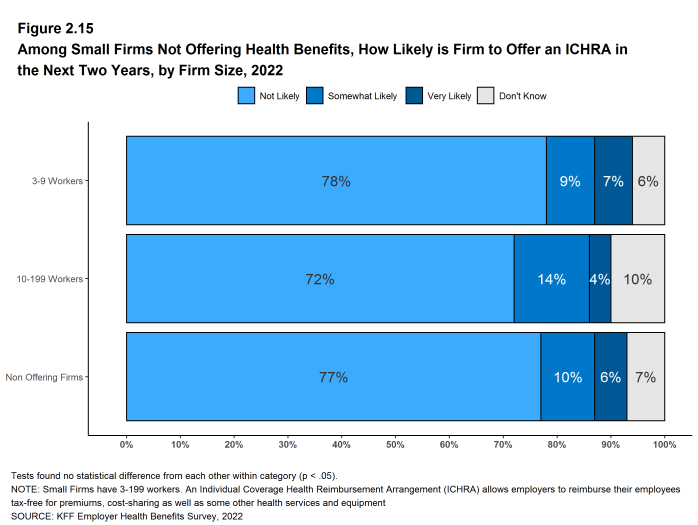

- Eleven percent of firms offering health benefits and 7% of firms not offering health benefits offer funds to one or more of their employees to purchase non-group coverage in 2022 [Figure 2.14] and [Figure 2.15].

- Among small firms not offering health benefits, 7% offer funds to one or more of their employees to purchase non-group coverage, the same percentage (7%) as last year [Figure 2.14].

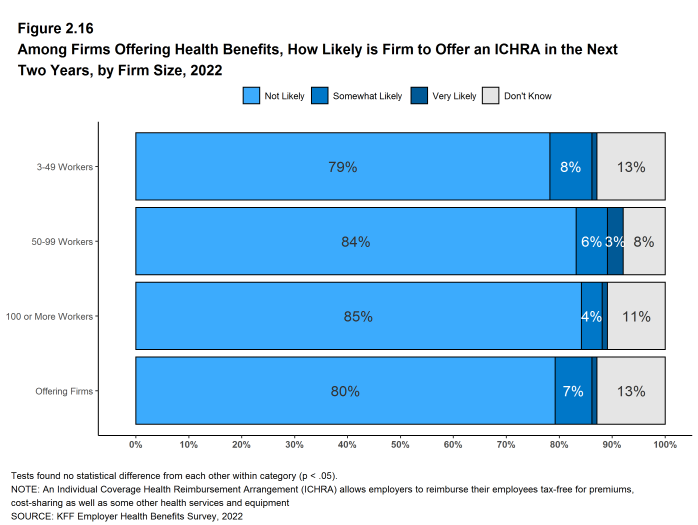

- Among all firms (offering and not offering health benefits) that do not offer funds to any employees to purchase non-group coverage in 2022, only 3% are “very likely” and an additional 9% are “somewhat likely” to offer an ICHRA to at least some employees in the next two years.

Figure 2.13: Among Firms Offering Health Benefits, Percentage of Firms That Provide Workers Funds to Purchase Non-Group Insurance, Such As Through an ICHRA, Firm Size, 2022

Figure 2.14: Among Small Firms Not Offering Health Benefits, Percentage of Firms That Provide Workers Funds to Purchase Non-Group Insurance, by Firm Size, 2012-2022

Figure 2.15: Among Small Firms Not Offering Health Benefits, How Likely Is Firm to Offer an ICHRA in the Next Two Years, by Firm Size, 2022

FIRMS NOT OFFERING HEALTH BENEFITS

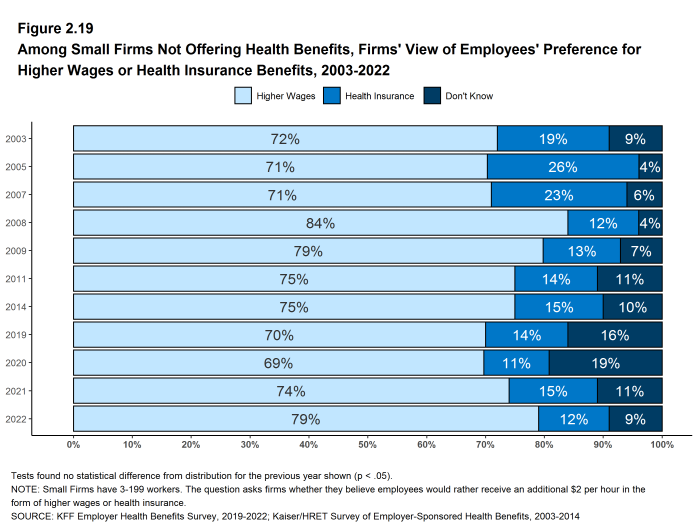

- The survey asks firms that do not offer health benefits several questions, including whether they have offered insurance or shopped for insurance in the recent past, their most important reasons for not offering coverage, and their opinion on whether their employees would prefer an increase in wages or health insurance if additional funds were available to increase their compensation. Because such a small percentage of large firms report not offering health benefits, we present responses for small non-offering firms only.

- The “firm is too small” and the “cost of insurance is too high” are the most common reasons small firms cite for not offering health benefits. Among small firms asked about the most important reason for not offering health benefits, 31% say the “firm is too small”, 28% say the cost of insurance is too high, 18% say their “employees are covered under another plan, including coverage on a spouse’s plan” and 6% say their employees are not intetested. Few small firms indicate that they do not offer because they believe employees will get a better deal on the health insurance exchanges (3%) [Figure 2.17].

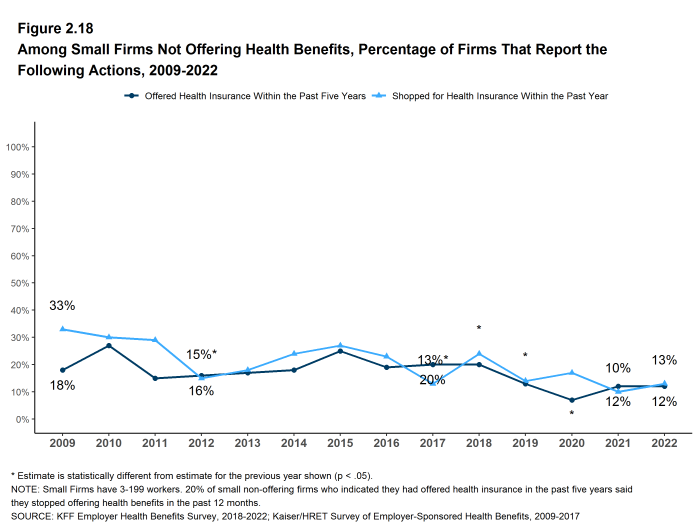

- Some small non-offering firms have either offered health insurance in the past five years or shopped for health insurance in the past year.

- Twelve percent of small non-offering firms have offered health benefits in the past five years, similar to than the percentage reported last year [Figure 2.18].

- Thirteen percent of small non-offering firms have shopped for coverage in the past year, similar to the percentage last year (10%) [Figure 2.18].

- Among small non-offering firms that report they stopped offering coverage within the past five years, 20% stopped offering coverage within the past year.

- Seventy-nine percent of small firms not offering health benefits believed that their employees would prefer a two dollar per hour increase in wages rather than health insurance. [Figure 2.19].

Figure 2.17: Among Small Firms Not Offering Health Benefits, Most Important Reason for Not Offering, 2022

Figure 2.18: Among Small Firms Not Offering Health Benefits, Percentage of Firms That Report the Following Actions, 2009-2022

- Internal Revenue Code. 26 U.S. Code § 4980H – Shared responsibility for employers regarding health coverage. 2011. https://www.gpo.gov/fdsys/pkg/USCODE-2011-title26/pdf/USCODE-2011-title26-subtitleD-chap43-sec4980H.pdf↩︎