2012 Employer Health Benefits Survey

Section 14: Employer Opinions and Health Plan Practices

Employers play a significant role in health insurance coverage – so their opinions and experiences are important factors in health policy discussions. Employers were asked how they view different approaches to containing cost increases, the prevalence of Flexible Spending Accounts (FSA) and Section 125 plans, and whether they shopped for a new insurance carrier recently.

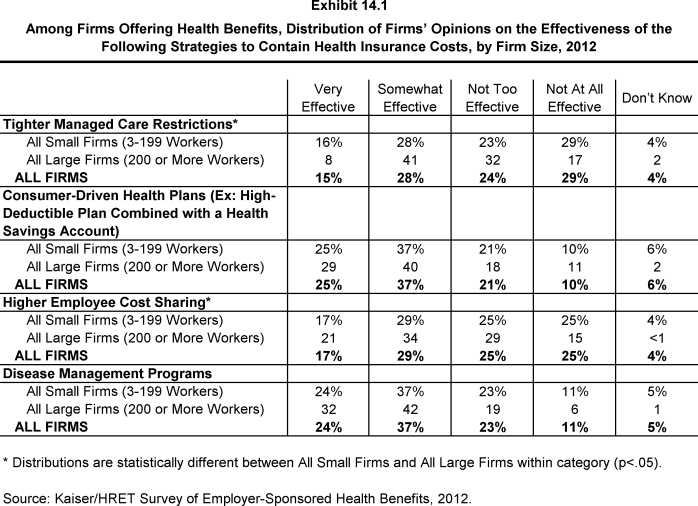

Employer Opinions on Cost Containment

Firms offering health benefits were asked to rate how effective several different strategies, such as tighter managed care restrictions, higher employee cost sharing, or disease management programs, would be in reducing the growth of health insurance costs. Relatively few firms rate any of the suggested strategies as “very effective” at controlling costs (between 15% and 25%, depending on the strategy). Roughly one third of firms (between 28% and 37%) report that each of the approaches we asked about would be “somewhat effective” at controlling cost growth (Exhibit 14.1).

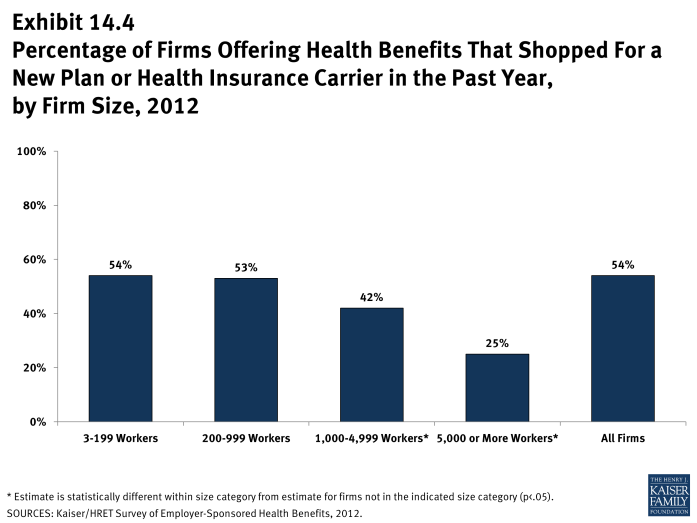

Shopping for Health Coverage

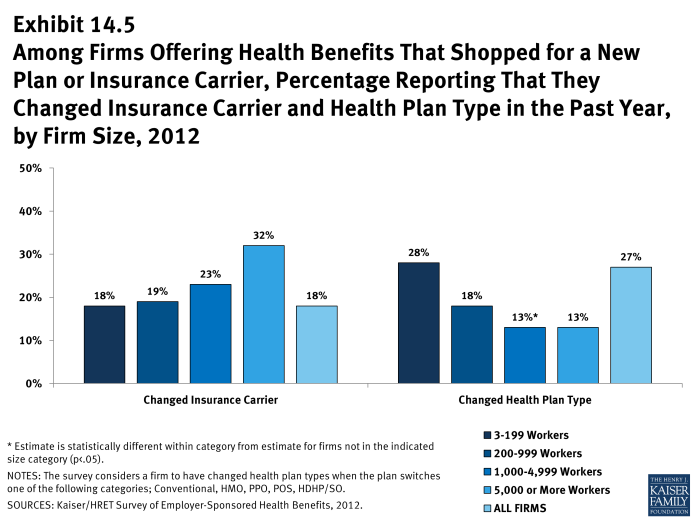

More than one-half (54%) of firms offering health benefits reported shopping for a new health plan or a new insurance carrier in the past year, suggesting that the market is quite dynamic (Exhibit 14.4). Among firms that shopped, 18% changed insurance carriers and 27% reported changing the type of health plan provided to employees. There were no significant differences between small firms (3 to 199 workers) and larger firms on any of these measures (Exhibit 14.5).

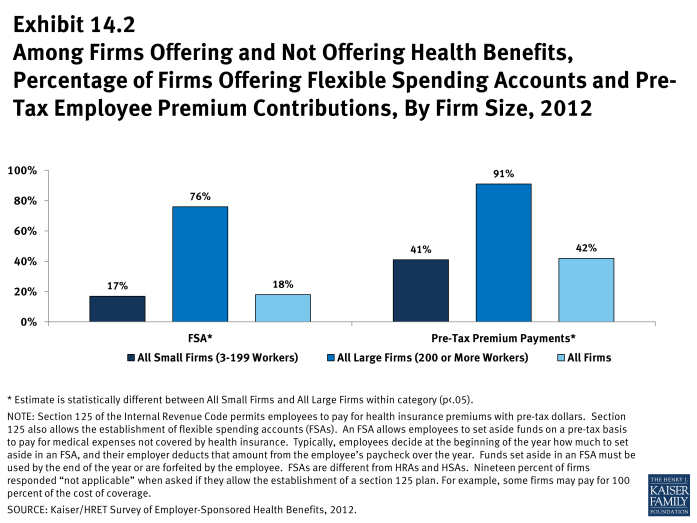

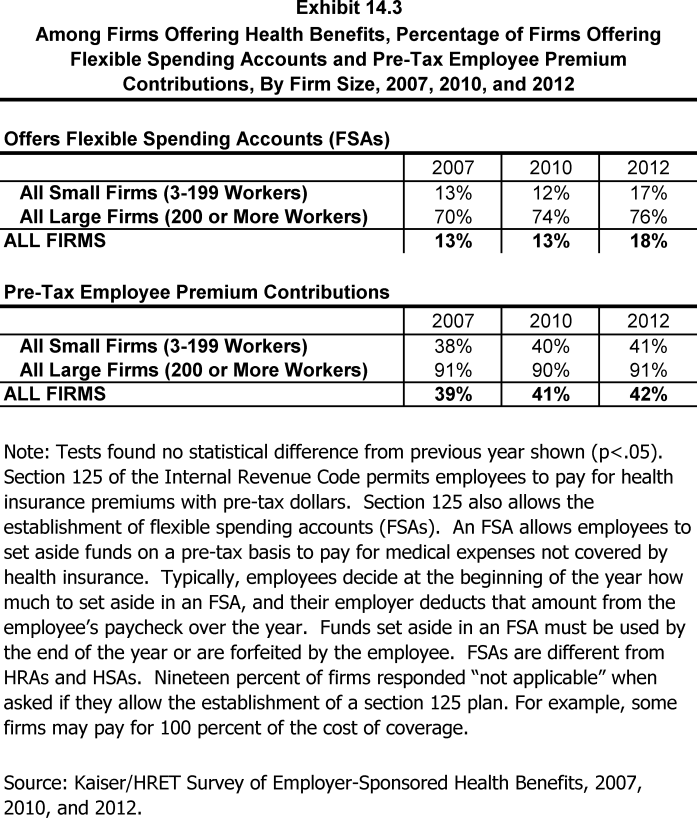

Pre-Tax Premium Contributions

Forty-one percent of small firms (3 to 199 workers) and 91% of larger firms have a plan under section 125 of the Internal Revenue Service Code (sometimes called a premium-only plan) to allow employees to use pre-tax dollars to pay for their share of health insurance premiums (Exhibit 14.2).

Flexible Spending Accounts

Seventeen percent of small firms (3 to 199 workers) and 76% of larger firms offer employees the option of contributing to a flexible spending account (or FSA). FSAs permit employees to make pre-tax contributions that may be used during the year to pay for eligible medical expenses (Exhibit 14.2).

Workplace Health Clinics

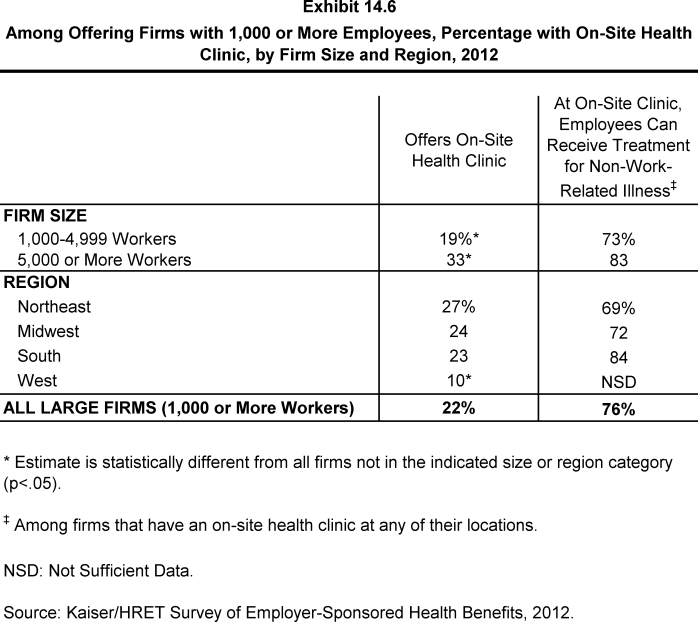

Twenty-two percent of firms with 1,000 or more employees have an on-site health clinic at least one of their major locations to treat employees for work-related or non-work-related conditions. Among firms with health clinics, about 3 in 4 (76%) provide treatment for non-work-related medical conditions (Exhibit 14.6).