2012 Employer Health Benefits Survey

Section 11: Retiree Health Benefits

Retiree health benefits are an important consideration for older workers making decisions about their retirement. Health benefits for retirees provide an important supplement to Medicare for retirees age 65 or older. Among firms offering health benefits to their workers, large firms (200 or more workers) are much more likely than small firms (3-199 workers) to offer retiree health benefits.

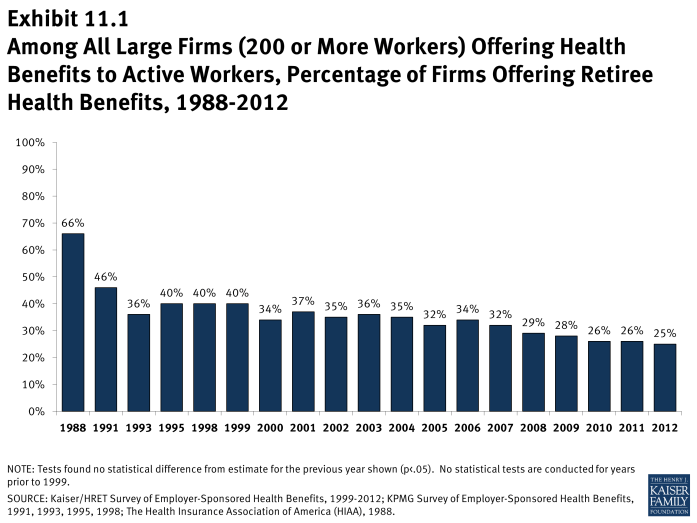

- Twenty-five percent of large firms (200 or more workers) that offer health benefits to their employees offer retiree coverage in 2012, similar to 26% in 2011. There has been a downward trend in the percentage of firms offering retirees coverage, from 32% in 2005 and 66% in 1988 (Exhibit 11.1).

- The offering of retiree health benefits varies considerably by firm characteristics.

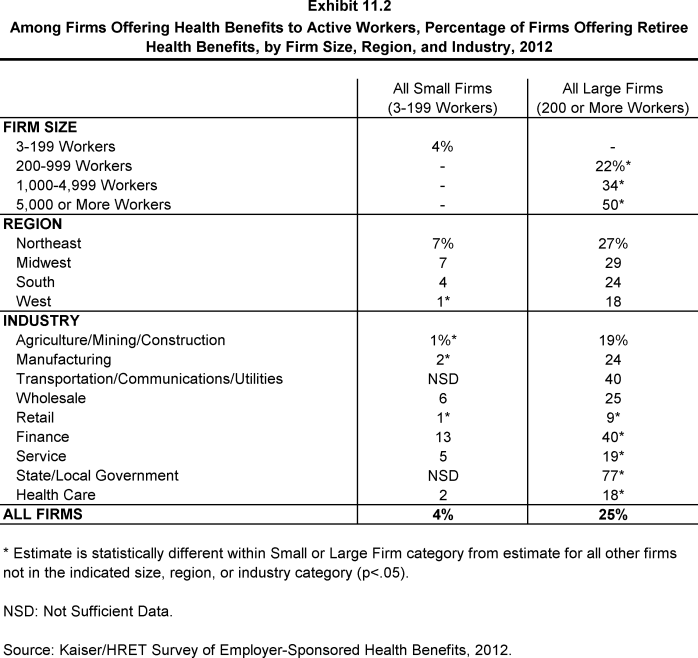

- Large firms are much more likely to offer retiree health benefits than small firms – 25% vs. 4% (Exhibit 11.2).

- Among large firms that offer health benefits, state and local governments are more likely (77%) than large firms in other industries to offer retiree health benefits. In contrast, large firms in the retail industry are less likely (9%) to offer retiree health benefits when compared to large firms in other industries (Exhibit 11.2).

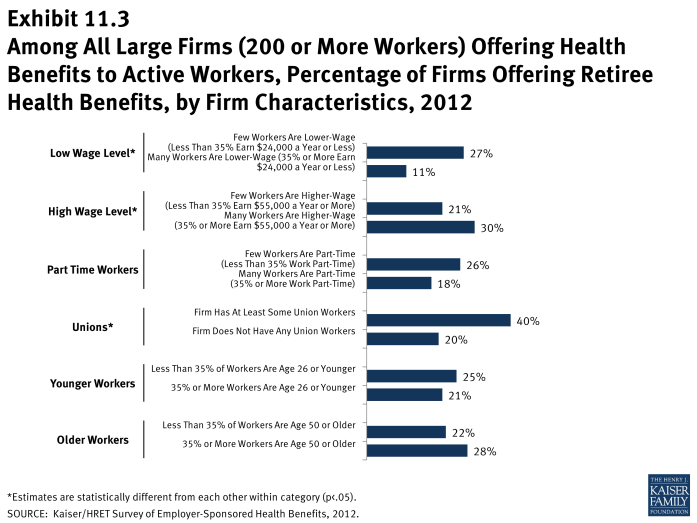

- Large firms with fewer lower-wage workers (less than 35% of workers earn $24,000 or less annually) are more likely to offer retiree health benefits than large firms with many lower-wage workers (35% or more of workers earn $24,000 or less annually) (27% vs. 11%) (Exhibit 11.3). A comparable pattern exists in firms with a larger proportion of higher-wage workers (35% or more earn $55,000 or more annually).

- Large firms with union workers are more likely to offer retiree health benefits than large firms without union workers – 40% vs. 20% (Exhibit 11.3).

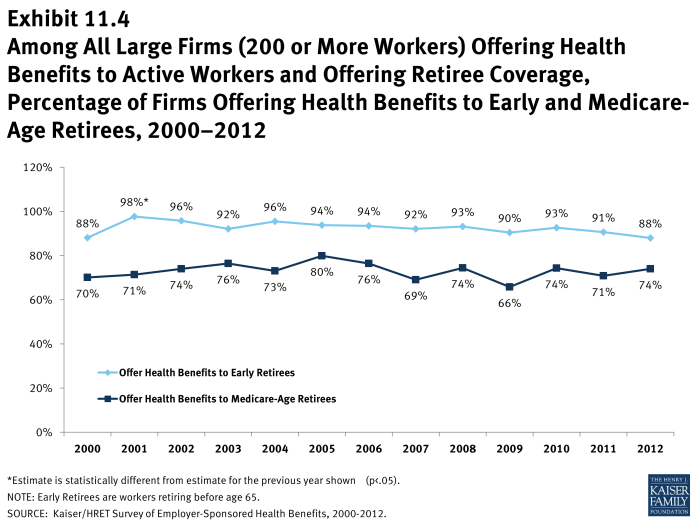

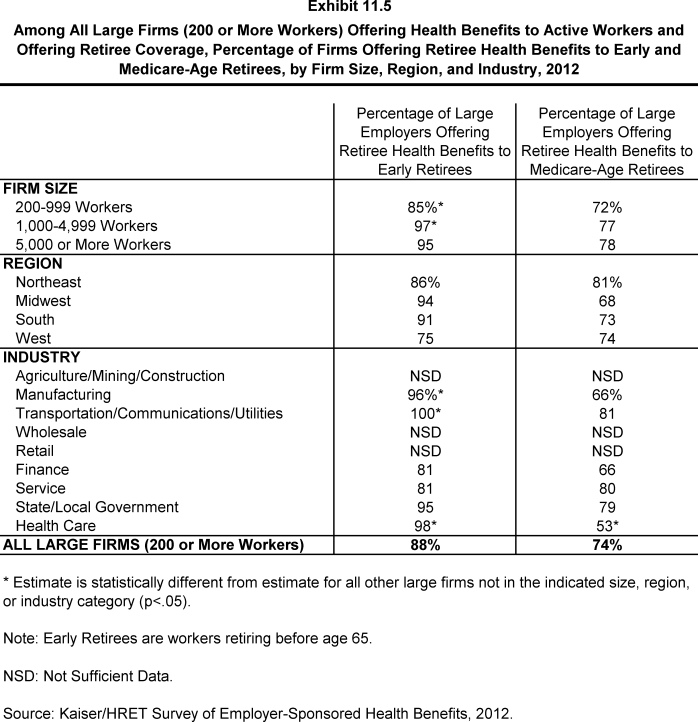

- Among firms offering retiree health benefits, most large firms offer them to early retirees under the age of 65 (88%). A lower percentage (74%) of large firms offering retiree health benefits offer them to Medicare-age retirees .

x

Exhibit 11.1

x

Exhibit 11.2

x