5 Key Facts About Immigrants and Medicaid

Confusion persists about immigrants’ eligibility for federal programs, with about half or more of U.S. adults and immigrants adults saying they are unsure or incorrectly believe that most immigrants to the U.S. are eligible to enroll in federal health insurance programs, including Medicaid, as soon as they arrive to the U.S. Eligibility for Medicaid and the Children’s Health Insurance Program (CHIP) is limited to citizens and certain lawfully present immigrants. Many citizens and lawfully present immigrants live in families with mixed immigration status, which may include undocumented immigrants. For example, 19 million or one in four children in the U.S. has an immigrant parent, including one in ten (12%) or 9 million who are citizen children with a noncitizen parent. Although most immigrant families have a full-time worker in the household, they tend to have lower incomes. As such, Medicaid and CHIP help keep uninsured rates for children in these families low and provide an affordable coverage option to eligible lawfully present immigrants. Despite having lower incomes, among those under age 65, immigrants are less likely than U.S.-born citizens to have Medicaid or CHIP coverage (19% vs. 23%) and eligible noncitizen immigrants account for just 6% of Medicaid and CHIP enrollees.

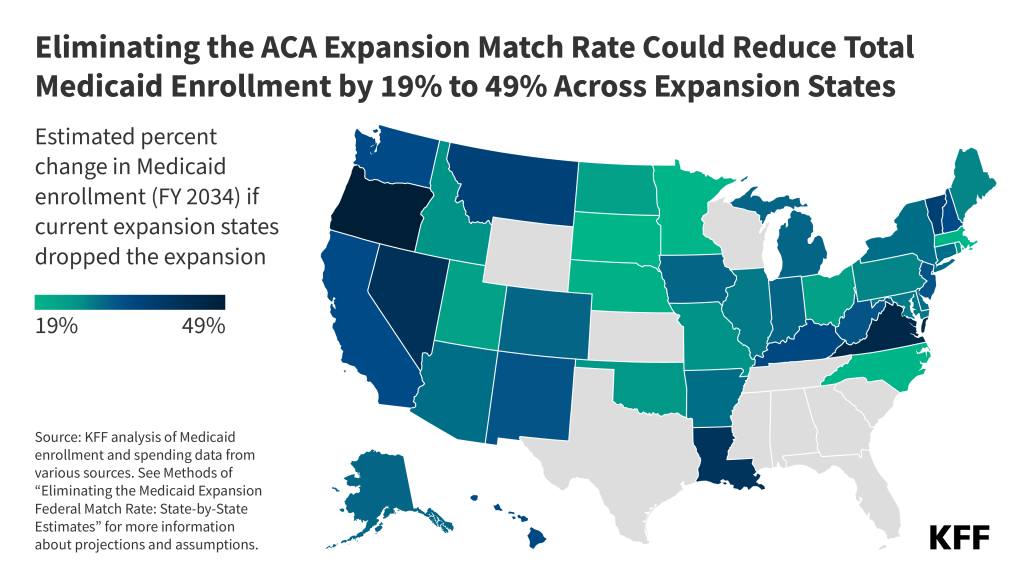

The Congress is considering options to reduce federal Medicaid spending in order to offset the cost of tax cuts, including reinstating changes made to public charge immigration rules that were made under the first Trump administration and reducing federal funding for states that use state-only funds to expand coverage for immigrants. Proposals also suggest restricting eligibility for federal health programs to lawfully present immigrants, although this restriction is already in place. At the same time, the Trump administration has implemented an array of restrictive immigration policies that will likely increase fears among immigrant families about lawfully present immigrants and citizens accessing health coverage for which they are eligible. These changes may lead to disenrollment and coverage losses among lawfully present immigrants and citizens in immigrant families, which could have negative short and long-term effects on their health and reduce their productivity. The savings achieved from such changes are likely to be modest given that noncitizens account for a small share of Medicaid and CHIP enrollees. This brief provides five key facts on Medicaid and immigrants as context for understanding the potential impacts of the changes under consideration.

1. Undocumented immigrants are not eligible for Medicaid or CHIP, and only some lawfully present immigrants qualify subject to eligibility restrictions.

Undocumented immigrants are not eligible to enroll in federally funded coverage including Medicaid, CHIP, or Medicare or to purchase coverage through the ACA Marketplaces. Emergency Medicaid spending reimburses hospitals for emergency care they are obligated to provide to individuals who meet other Medicaid eligibility requirements (such as income) but who do not have an eligible immigration status, including undocumented immigrants and lawfully present immigrants who remain ineligible for Medicaid or CHIP.

Lawfully present immigrants may qualify for Medicaid or CHIP but are subject to eligibility restrictions. In general, in addition to meeting other eligibility requirements, lawfully present immigrants must have a “qualified” immigration status to be eligible for Medicaid or CHIP (Table 1), and many, including most lawful permanent residents or “green card” holders, must wait five years after obtaining qualified status before they may enroll. They may enroll in Marketplace coverage and receive subsidies during this five-year waiting period. Some immigrants with qualified status, such as refugees and asylees, as well as citizens of Compact of Free Association (COFA) nations, do not have to wait five years before enrolling. Some immigrants, such as those with temporary protected status, are lawfully present but do not have a qualified status and are not eligible to enroll regardless of their length of time in the country. Individuals with Deferred Action for Childhood Arrivals (DACA) status are not eligible for Medicaid or CHIP, and implementation of a Marketplace coverage expansion for them remains subject to ongoing litigation. States must verify citizenship and immigration status with the Social Security Administration and Department of Homeland Security to determine eligibility for coverage.

2. Despite having lower household incomes, immigrants under age 65 are less likely to be covered by Medicaid than their U.S.-born citizen counterparts.

In 2023, 19% of immigrants under age 65 were covered by Medicaid compared to 23% of U.S.-born citizens (Figure 1). Eligible noncitizen immigrants represent a small share of people covered by Medicaid, comprising just 6% of individuals under age 65 with Medicaid. Immigrants are also not more likely than U.S.-born citizens to receive assistance with food or housing. Data from the 2023 KFF/LA Times Survey of Immigrants show that, overall, about a quarter (28%) of both immigrant adults and U.S.-born citizen adults say they received assistance with food, housing, or health care in the past 12 months.

Many families face barriers to enrolling eligible lawfully present immigrants and citizen children in assistance programs due to fear, confusion about eligibility policies, difficulty navigating the enrollment process, and language access challenges. Restrictive immigration policies, including increases in enforcement actions, being implemented by the Trump administration will likely increase fears of enrolling in coverage and accessing health care. Even prior to the Trump administration, in 2023, nearly one in ten (8%) immigrants said they avoided applying for food, housing, or health care assistance in the past year because they didn’t want to draw attention to their immigration status or the status of someone in their family.

3. Emergency Medicaid spending makes up less than 1% of total Medicaid spending.

Emergency Medicaid spending represented less than 1% of overall Medicaid spending between fiscal years 2017 and 2023. Spending on Emergency Medicaid was $3.8 billion in FY 2023 and was 0.4% of total Medicaid spending that year (Figure 2). Emergency Medicaid spending reimburses hospitals for emergency care they are obligated to provide to individuals who meet other Medicaid eligibility requirements (such as income) but who do not have an eligible immigration status. These include lawfully present immigrants who are subject to a five-year waiting period for Medicaid or who remain ineligible for Medicaid and undocumented immigrants. Emergency services include those requiring immediate attention to prevent death, serious harm or disability, although states have some discretion to determine reimbursable services. Much of Emergency Medicaid spending goes toward labor and delivery costs. Without Emergency Medicaid, the costs of care would be shifted to hospitals that are required to treat individuals in emergency situations or fully to states.

4. States have expanded Medicaid coverage for lawfully present immigrant children and pregnant people, and some have fully state-funded coverage for immigrants.

For children and pregnant people, states can eliminate the five-year waiting period for Medicaid and CHIP coverage. As of January 2025, 37 states plus D.C. have taken up this option for children, and 31 states plus D.C. have elected the option for pregnant individuals (Figure 3). Additionally, 23 states plus D.C. provide prenatal care and pregnancy-related benefits to low-income children beginning from conception to end-of-pregnancy regardless of their parent’s citizenship or immigration status under the CHIP From-Conception-to-End-of-Pregnancy option. Some states have fully state-funded health coverage programs for immigrants regardless of status, particularly children. Research suggests that state coverage expansions for immigrants lead to increases in coverage and improvements in health care access and use.

5. Immigrants use less health care and have lower health care costs than people born in the U.S.

Research shows that immigrants use less health care and have lower health care costs than U.S.-born citizens. Lower use of health care among immigrants likely reflects a combination of them being younger and healthier than their U.S.-born counterparts as well as them facing increased barriers to care, including language access challenges, confusion, and immigration-related fears. Prior KFF analysis found that Trump-era policies amplified these fears and contributed to greater reluctance to access care. Reflecting their lower use of health care, immigrants have lower health care expenditures than their U.S.-born counterparts. Consistent with other research, KFF analysis of 2021 medical expenditure data shows that, on average, annual per capita health care expenditures for immigrants are about two-thirds those of U.S.-born citizens ($4,875 vs. $7,277), with no significant difference in the average amount paid by Medicaid for immigrants ($854) and U.S.-born people ($830). Given the Medicaid eligibility restrictions for immigrants, it is likely that a greater share of Medicaid spending for immigrants goes toward pregnancy-related care and emergency care, which tend to be costly. In contrast, U.S.-born enrollees include a high share of children, who typically utilize lower cost care.

Immigrants contribute to the economy through their role in the workforce and tax payments, with research showing that they help subsidize health care for U.S.- born people and stabilize Medicare and Social Security. Immigrants support the nation’s workforce by filling unmet labor market needs, and research suggests that they do not take jobs away from U.S.-born people. They play a disproportionate role filling jobs in essential industries such as construction and agriculture. In addition, immigrants as well as the adult children of immigrants play outsized roles in the health care workforce as physicians, surgeons, nurses, and long-term care workers (Figure 4). They also play a particularly large role as direct care workers in home and community-based settings. As health care workforce shortages are projected to continue and the U.S. 65 and older population grows, immigrants could help mitigate these shortages. Analysis also shows that undocumented immigrants contribute billions in federal, state, and local taxes each year, and research shows that they pay more into the health care system through taxes and health insurance premiums than they utilize, helping to subsidize health care for U.S.-born citizens.

Irving Washington

Irving Washington  Hagere Yilma

Hagere Yilma