Disability and Technical Issues Were Key Barriers to Meeting Arkansas’ Medicaid Work and Reporting Requirements in 2018

Introduction

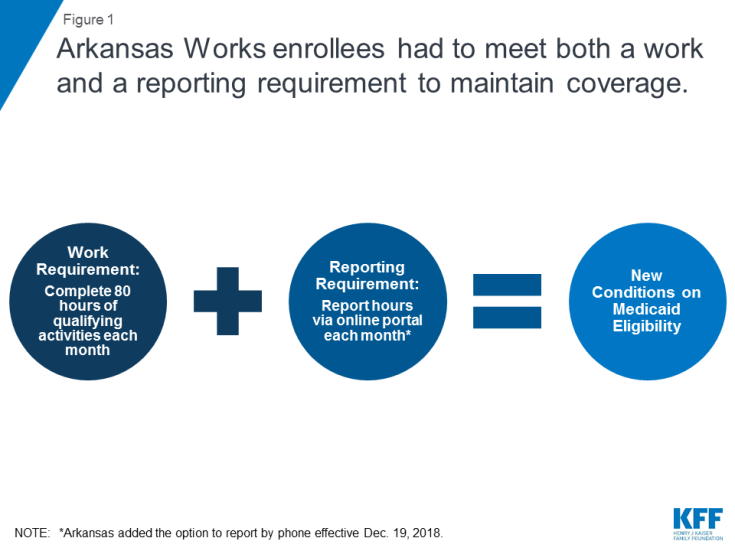

Over 18,000 people lost Medicaid coverage in Arkansas in 2018, due to work and reporting requirements imposed under a Section 1115 demonstration waiver known as Arkansas Works. The requirements were phased in for enrollees ages 30 to 49 from June through September 2018. Unless exempt, enrollees had to meet two separate but related requirements to maintain coverage: a requirement to complete 80 hours of work or other qualifying activities each month, and a requirement to report their hours each month (Figure 1). Individuals lost coverage after failing to meet the requirements for any three months in the calendar year. While the requirements started to apply to additional populations in 2019, no coverage losses have occurred this year to date because the requirements subsequently were set aside by a court; the case is currently on appeal.

Figure 1: Arkansas Works enrollees had to meet both a work and a reporting requirement to maintain coverage.

This issue brief analyzes the impact of measures intended to safeguard coverage for people with disabilities and others who should not have been subject to the work and reporting requirements. It draws on data newly available from Arkansas’ 2018 annual waiver report to CMS and monthly data released by the state while the requirements were in effect. The data reveal that few people used these safeguard measures relative to the number of people who lost coverage due to the new requirements. Among those who accessed the safeguards, the vast majority did so due to disability/other health issues or technical issues, primarily related to reporting.

Background

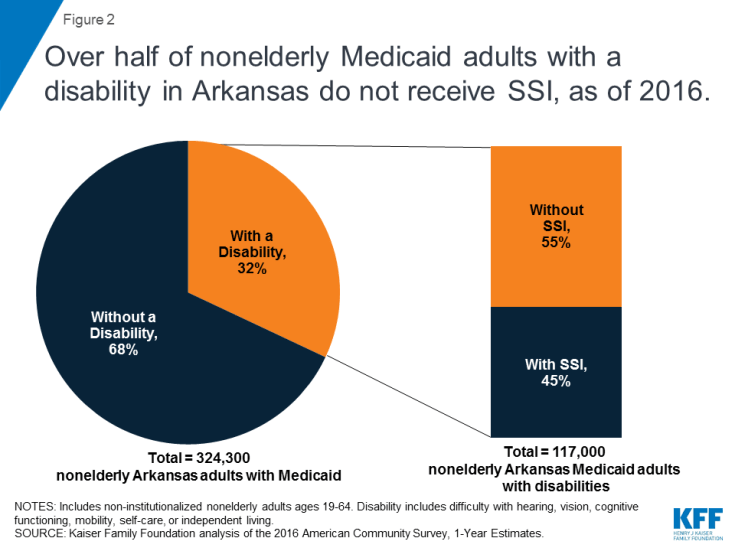

While proponents of work and reporting requirements sometimes describe them as applying to “able-bodied” adults, some people with disabilities are subject to the requirements. Only people who receive federal Supplemental Security Income (SSI) benefits or are otherwise eligible for Medicaid based on a disability are entirely excluded from the requirements. However, 55% of nonelderly Medicaid adults in Arkansas who report a disability do not receive SSI (Figure 2 ).

Figure 2: Over half of nonelderly Medicaid adults with a disability in Arkansas do not receive SSI, as of 2016.

Federal survey data classify a person as having a disability if they have a functional limitation that results in a participation limitation. This includes people who report serious difficulty with hearing, vision, cognitive functioning (concentrating, remembering, or making decisions), mobility (walking or climbing stairs), self-care (dressing or bathing), or independent living (doing errands, such as visiting a doctor’s office or shopping, alone).1 The SSI disability standard is more stringent.2 In addition, SSI financial eligibility criteria are more restrictive than those for Medicaid expansion adults and other disability-related Medicaid coverage pathways.3 As a result, people with disabilities who do not receive SSI can be eligible for Medicaid as expansion adults or low-income parents or through an optional disability-related pathway.4

Key Findings Related to Measures Intended to Safeguard Coverage

There were four safeguards that were intended to prevent people with disabilities and others who should not have been subject to the work and reporting requirements from losing coverage under Arkansas’ waiver (Figure 3). For example, the safeguards were intended to protect coverage for people who should not have been required to work due to a disability as well as for enrollees who did work the required number of hours but had difficulty navigating the monthly reporting process.

Figure 3: There are multiple processes intended to safeguard coverage for people with disabilities and others who should not have lost coverage under the requirements.

Two safeguards applied to protect coverage under the waiver for enrollees with disabilities. People with disabilities or health conditions that limited their ability to work were exempt from the requirements if they were identified as “medically frail.” People with disabilities also could request a “reasonable accommodation” to receive assistance or follow modified rules to meet the requirements.

The other two safeguards applied to people with disabilities as well as other enrollees who should not have lost coverage under the work and reporting requirements. Enrollees who were not exempt from the requirements and subsequently were determined to be non-compliant could have their status changed and ask the state to excuse them from meeting the requirements by submitting a “good cause” request. Enrollees also could file an appeal to have a hearing to review the state’s decision to terminate their coverage under the requirements.

The four safeguards intended to protect coverage for people with disabilities and others who should not have been subject to the requirements are strikingly complex. Each safeguard has a different operational process and can be invoked at different times. More detail about each safeguard and related data about enrollee use of the safeguards is presented below.

Medical Frailty

People with disabilities or health conditions that limit their ability to work are exempt from Medicaid work and reporting requirements if they are identified as medically frail. Federal rules require that medically frail adults include at least those with disabling mental disorders, including serious mental illness; chronic substance use disorders; serious and complex medical conditions; physical, intellectual or developmental disabilities that significantly impair the ability to perform one or more activities of daily living; and those with a disability determination based on Social Security Administration criteria.5 In Arkansas, enrollees must self-identify as potentially medically frail to initiate the process.6 While health plans may have claims data or other information showing that an enrollee may be medically unable to work, health plans cannot initiate the medical frailty process in Arkansas. Final medical frailty determinations are made by the enrollee’s health plan and the state Medicaid agency and must be renewed annually.

Arkansas already was determining medical frailty before the work and reporting requirements took effect, but obtaining this status took on greater significance for enrollees under the new requirements than it had in the past. Previously, medically frail enrollees were exempt only from mandatory enrollment in Marketplace health plans and instead able to receive the traditional Medicaid benefit package. As the new requirements took effect, medically frail enrollees also became exempt from having to meet the work and reporting requirements as a condition of maintaining coverage. Although the notice sent to enrollees informing them that they are eligible for Medicaid and will be enrolled in a Marketplace health plan under Arkansas’ waiver must describe how to request a medical frailty determination,7 this information was not included in notices informing enrollees about the work and reporting requirements.8 In an early look at implementation of Arkansas’ work and reporting requirements, some interviewees expressed concern about enrollees’ ability to understand that they potentially might qualify for a medical frailty exemption and to successfully navigate that process, especially for those with mental health needs. Safety net providers reported that individuals who are homeless and those who have more serious physical or mental health disabilities may be less likely to be aware of the requirements and more likely to have problems working or complying with monthly reporting.

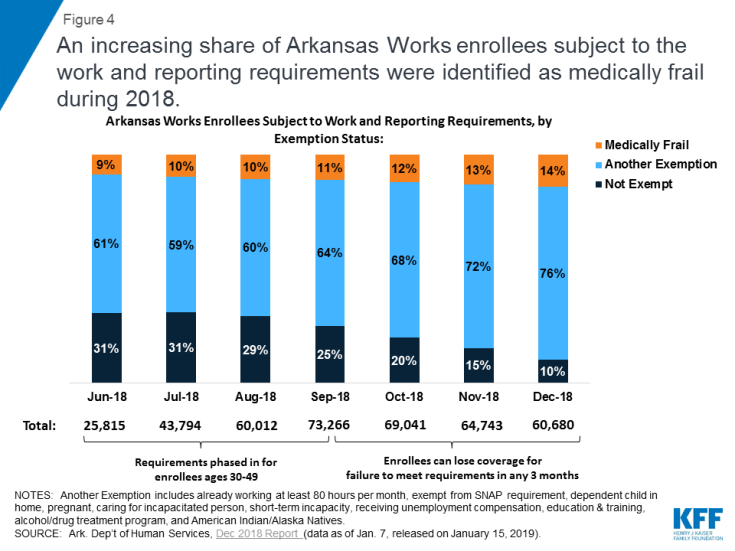

Among the subset of enrollees who were subject to the work and reporting requirements, an increasing share were identified as medically frail while the requirements were in effect (Figure 4). The work and reporting requirements did not apply to all waiver enrollees in 2018, but instead were phased in for enrollees ages 30 to 49 from June through September 2018. As the requirements took effect, the share of enrollees subject to the requirements who were identified as medically frail increased from 9% (about 2,200 people) in June to 14% (about 8,400 people) in December 2018. The share of enrollees who qualified for another exemption also increased during this period, leaving just 10% of enrollees not exempt by December.

Figure 4: An increasing share of Arkansas Works enrollees subject to the work and reporting requirements were identified as medically frail during 2018.

Good Cause

Enrollees who were not exempt from the work and reporting requirements and subsequently were determined non-compliant could request that the state Medicaid agency grant them a good cause exemption, but very few (just over 900) did so relative to the over 18,000 people who lost coverage. The state could decide that an enrollee had good cause for not completing the required number of work activity hours and/or not reporting their hours or an exemption. Circumstances that constituted good cause included those related to an enrollee’s disability or health condition as well as other reasons. At a minimum, under Arkansas’ waiver, good cause exemptions had to be recognized for enrollees who were unable to meet the requirements for reasons related to a disability, hospitalization, or serious illness experienced by themselves or an immediate family member with whom they live; the birth or death of a family member in the enrollee’s home; severe inclement weather including natural disasters; and a family emergency or other life-changing event such as divorce or domestic violence.9

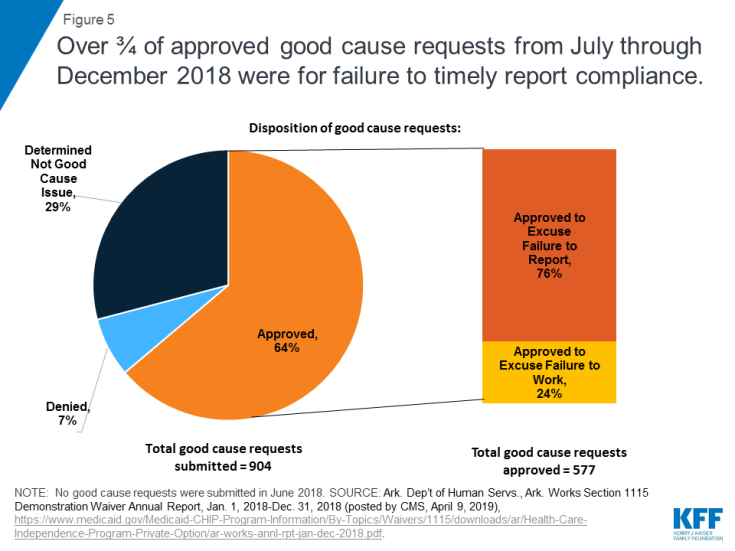

Nearly two-thirds of the 904 good cause requests received from July through December 2018 were approved, with most approvals excusing enrollees from meeting the reporting requirement (Figure 5). This means that these enrollees had successfully completed the required number of work activity hours in a given month but nevertheless initially had been found non-compliant because they were unable to successfully report that they had done so. The remaining good cause approvals excused enrollees from completing the required number of work activity hours in a given month. Most good cause requests that were not approved were determined by the state to “not constitute a good cause issue.” No further information is available about these requests. By contrast, a smaller number of good cause requests were formally denied.

Figure 5: Over ¾ of approved good cause requests from July through December 2018 were for failure to timely report compliance.

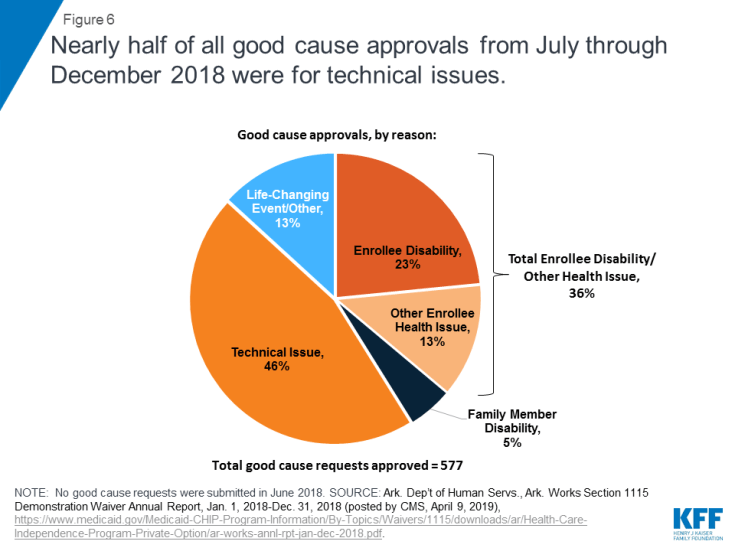

Among the good cause requests approved by the state, just under half were attributed to technical issues (Figure 6 and Table 1). These included client support issues, agency issues, and other unspecified technical issues. In the subset of good cause approvals related to the reporting requirement, technical issues were the chief reason that enrollees were excused from meeting the reporting requirement (Table 1). This finding is consistent with other research that shows that additional reporting or administrative burdens create barriers to eligible people retaining coverage. In addition, technical issues were the second most frequently cited reason in the subset of good cause approvals excusing enrollees from meeting the work requirement (Table 1).

Figure 6: Nearly half of all good cause approvals from July through December 2018 were for technical issues.

| Table 1: Arkansas Works Good Cause Approvals, by Reason, July-December 2018 | |||

| Good Cause Reason | Share of All Good Cause Approvals | Share of Good Cause Approvals to Excuse Work Hours | Share of Good Cause Approvals to Excuse Reporting |

| Technical Issue | 46% | 17% | 55% |

| Enrollee Disability | 23% | 56% | 13% |

| Other Enrollee Health Issue | 13% | 9% | 14% |

| Family Member Disability | 5% | 7% | 4% |

| Life-Changing Event/Other | 13% | 11% | 14% |

| Total: | 100% (577 requests) | 100% (140 requests) | 100% (437 requests) |

| NOTES: Work and reporting requirements were phased in for enrollees ages 30-49 from June-December 2018, but no good cause requests were submitted in June. Other Enrollee Health Issue includes hospitalization and serious illness. Technical Issue includes technical agency issue, technical client support, and unspecified technical issues. Life Changing Event/Other also includes birth or death of household family member. SOURCE: Ark. Dep’t of Human Servs., Ark. Works Section 1115 Demonstration Waiver Annual Report, Jan. 1, 2018-Dec. 31, 2018 (posted by CMS, April 9, 2019), https://www.medicaid.gov/Medicaid-CHIP-Program-Information/By-Topics/Waivers/1115/downloads/ar/Health-Care-Independence-Program-Private-Option/ar-works-annl-rpt-jan-dec-2018.pdf |

|||

Over one-third of all approved good cause requests were attributed to enrollee disability or another health issue, such as hospitalization or serious illness (Figure 6 and Table 1). This means that these enrollees were determined to have physical or mental health issues that prevented them from working the required number of hours or reporting their compliance, even though they had not previously been identified as medically frail and do not receive SSI benefits. This finding is consistent with research finding that people who are penalized for not meeting the TANF work requirement are more likely to have a disability compared to those who are not so penalized. In the subset of good cause approvals related to the work requirement, disability/health issues were the chief reason that enrollees were excused from completing the required number of hours (Table 1). In addition, disability/health issues were the second most frequently cited reason in the subset of good cause approvals excusing enrollees from meeting the reporting requirement (Table 1).

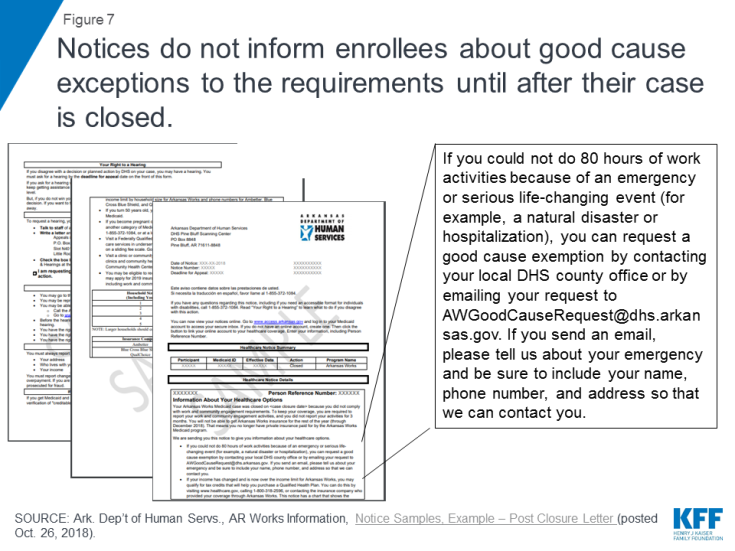

Not all enrollees who were eligible for a good cause exemption may have requested one. Just over 900 good cause requests were submitted, while over 18,000 enrollees lost coverage under the work and reporting requirements in 2018. An early look at implementation of the work and reporting requirements in Arkansas found that the good cause policies and process were not finalized until fall 2018, resulting in confusion about how to make these requests. Information about the good cause process was included in the notice informing enrollees that their case was closed due to three months of non-compliance (Figure 7), but this information was not included in earlier notices about the work and reporting requirements. In addition, the notice language describing good cause referred to “an emergency or serious life-changing event (for example, a natural disaster or hospitalization)” but did not include the broader list of good cause reasons that Arkansas must recognize, such as disability or serious illness (that may not have resulted in a hospitalization but nonetheless interfered with the enrollee’s ability to meet the requirements) as described above. Finally, the process for requesting good cause differed from the process to report work hours and exemptions; instead of using the online portal, good cause was requested via email.

Figure 7: Notices do not inform enrollees about good cause exceptions to the requirements until after their case is closed.

Reasonable Accommodations

Arkansas received and granted very few — a total of 17 — reasonable accommodations for people with disabilities from June through December 2018, primarily for help using the online portal to report compliance.10 The state data do not indicate whether any support services necessary for people with disabilities to participate in the work and reporting requirements were provided. While federal Medicaid funds cannot be used to pay for supportive services in work requirement waivers, the state has an independent obligation to provide equal access to people with disabilities under other federal laws. As required by the Americans with Disabilities Act (ADA), Section 504 of the Rehabilitation Act, and Section 1557 of the Affordable Care Act, Arkansas had to provide reasonable accommodations to ensure that enrollees with disabilities had an equal opportunity to meet the work and reporting requirements. Examples of reasonable accommodations in the waiver terms approved by CMS included but were not limited to assistance with demonstrating eligibility for good cause exemptions; appealing disenrollments; documenting work activities and other documentation requirements; understanding notices and program rules related to community engagement requirements; navigating ADA compliant web sites; exemptions from participation where an individual is unable to participate or report for disability-related reasons; modification in the number of hours of participation required; and provision of support services necessary to participate.11

The very low number of these requests likely reflects a lack of knowledge among enrollees about the availability of reasonable accommodations for people with disabilities. For example, the notices sent to enrollees about the work and reporting requirements did not include information about the availability of reasonable accommodations or how to request them.12 While enrollees generally must initiate the request for a reasonable accommodation, the waiver terms and conditions also provided that the “state should evaluate individuals’ ability to participate and the types of reasonable modifications and supports needed.”13 No information about these efforts is provided in the state’s 2018 annual waiver report to CMS.

Appeals

A total of just 69 people requested an appeal related to the work and reporting requirements from June through December 2018,14 a fraction of the over 18,000 enrollees who lost coverage under the requirements. This could indicate that individuals do not know about appeals, are unable to successfully navigate the process, or believe that filing an appeal is futile. No information was provided about the outcome of requested appeals. While information about how to request an appeal was included in the notices, an early look at implementation of the work and reporting requirements in Arkansas found concerns among advocates and providers that the notices were confusing and may not have sufficiently accounted for low literacy and lack of English proficiency among some enrollees. Focus groups conducted in fall 2018 revealed that enrollees did not fully read or understand the notices. Many enrollees said that they did not focus on the notices because they had to attend to more immediate and pressing needs, such as alcoholism recovery or meeting basic needs like affording food and utility bills.

Looking Ahead

The impact of the measures intended to safeguard coverage for individuals with disabilities and others who should not have been subject to the work and reporting requirements has implications for Arkansas as well as other states pursing similar waivers. While the Arkansas requirements, along with those in Kentucky, have been set aside by a court, they could be reinstated on appeal. In addition, work and reporting requirements currently are in effect in Indiana and New Hampshire, although the New Hampshire requirements also are being challenged in court. Other states have or are actively seeking CMS approval to implement similar requirements, and the Trump Administration’s FY 2020 budget includes a proposal to adopt these requirements across the Medicaid program.15

Few enrollees used the safeguards relative to the number who lost coverage, likely at least in part due to the safeguards’ complexity. While the medical frailty and good cause processes enabled some enrollees to retain the coverage for which they remained eligible, there were few good cause requests (about 900) relative to the number of enrollees who lost coverage in 2018 (over 18,000). Even fewer enrollees requested a reasonable accommodation (17) or requested an appeal (69) related to the work and reporting requirements. These low numbers may reflect a lack of knowledge among enrollees about the availability of these safeguards and/or challenges successfully navigating the required processes. Each safeguard had a different operational process and can be invoked at different times. Because over half of nonelderly Medicaid adults in Arkansas repot a disability but do not receive SSI, it is likely that more enrollees qualified for relief from the requirements but did not navigate the process.

People with disabilities were particularly vulnerable to losing coverage under the work and reporting requirements, despite remaining eligible. An increasing share of Arkansas enrollees subject to the work and reporting requirements were identified as medically frail and therefore exempt from complying while the requirements were implemented. Still, this process did not identify all enrollees whose disabilities or health conditions prevented them from complying, as over one-third of good cause requests approved to excuse enrollees from meeting the work or reporting requirements were based on a disability or another enrollee health issue.

Administrative processes such as reporting requirements present barriers to eligible people retaining coverage beyond just those with disabilities. Over three-quarters of approved good cause requests excused enrollees from the reporting requirement. This means that these enrollees had successfully completed the required number of work activity hours in a given month but nevertheless initially had been found non-compliant because they were unable to successfully report that they had done so. Technical issues were the most frequently cited basis for approved good cause requests, followed by enrollee disability or other health issues.

The four safeguards are important protections to help eligible people remain covered, but their benefits may not have been fully realized due to the complexity of the processes. The extent of disability and technical issues, primarily related to reporting, experienced by those who ultimately were exempted from the requirements raises questions about whether additional individuals who lost coverage under the waiver might in fact remain eligible but were unable to retain coverage due to a disability or another difficulty navigating the reporting process.