2020 Employer Health Benefits Survey

Section 9: Prescription Drug Benefits

Nearly all (99%) covered workers are at a firm that provides prescription drug coverage in its largest health plan. Many employer plans have increasingly complex benefit designs for prescriptions drugs, as employers and insurers expand the use of formularies with multiple cost-sharing tiers as well as other management approaches. To reduce the burden on respondents, we ask offering firms about the attributes of prescription drug coverage only for their largest health plan. This survey asks employers about the cost-sharing in up to four tiers, and for a tier exclusively for specialty drugs. Some plans may have more than one tier for specialty drugs or other variations. There also may be considerable variation in how plans structure their formularies.

DISTRIBUTION OF COST SHARING

- The large majority of covered workers (89%) are in a plan with tiered cost sharing for prescription drugs [Figure 9.1]. Cost-sharing tiers generally refer to a health plan placing a drug on a formulary or preferred drug list that classifies drugs into categories that are subject to different cost sharing or management. It is common for there to be different tiers for generic, preferred and non-preferred drugs. In recent years, plans have created additional tiers that may, for example, be used for specialty drugs or expensive biologics. Some plans may have multiple tiers for different categories; for example, a plan may have preferred and non-preferred specialty tiers. The survey obtains information about the cost-sharing structure for up to five tiers.

- Eighty-three percent of covered workers are in a plan with three, four, or more tiers of cost sharing for prescription drugs [Figure 9.1]. These totals include tiers that cover only specialty drugs, even though the cost-sharing information for those tiers is reported separately.

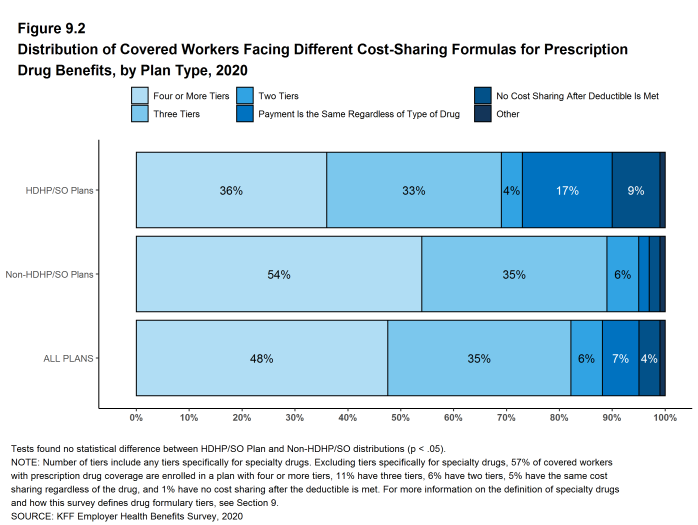

- Although the overall distribution of HDHP/SOs does not statistically differ from non-HDHP/SO plans, certain segments of that distribution have a different cost-sharing pattern for prescription drugs than other plan types. Compared to covered workers in other plan types, those in HDHP/SOs are more likely to be in a plan with the same cost sharing regardless of drug type (17% vs. 2%) or in a plan that has no cost sharing for prescriptions once the plan deductible is met (9% vs. 2%) [Figure 9.2].

Figure 9.1: Distribution of Covered Workers Facing Different Cost-Sharing Formulas for Prescription Drug Benefits, by Firm Size, 2020

TIERS NOT EXCLUSIVELY FOR SPECIALTY DRUGS

- Even when formulary tiers covering only specialty drugs are not counted, a large share (77%) of covered workers are in a plan with three or more tiers of cost sharing for prescription drugs. The cost-sharing statistics presented in this section do not include information about tiers that cover only specialty drugs. In cases in which a plan covers specialty drugs on a tier with other drugs, they will still be included in these averages. Cost-sharing statistics for tiers covering only specialty drugs are presented further down in this section.

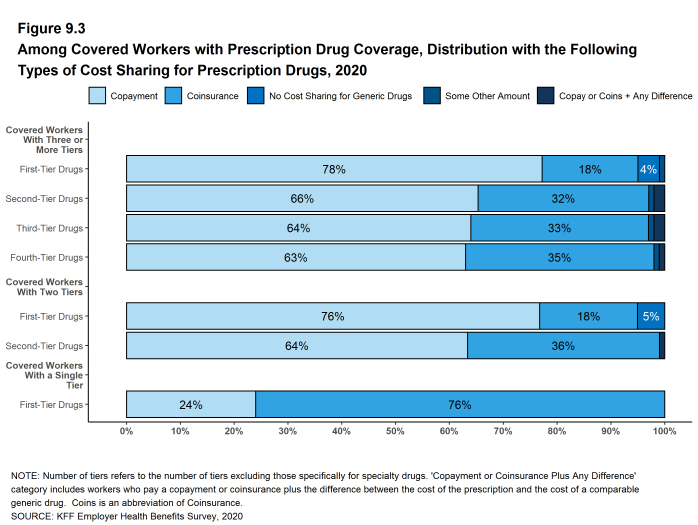

- For covered workers in a plan with three or more tiers of cost sharing for prescription drugs, copayments are the most common form of cost sharing in the first four tiers and coinsurance is the next most common [Figure 9.3].

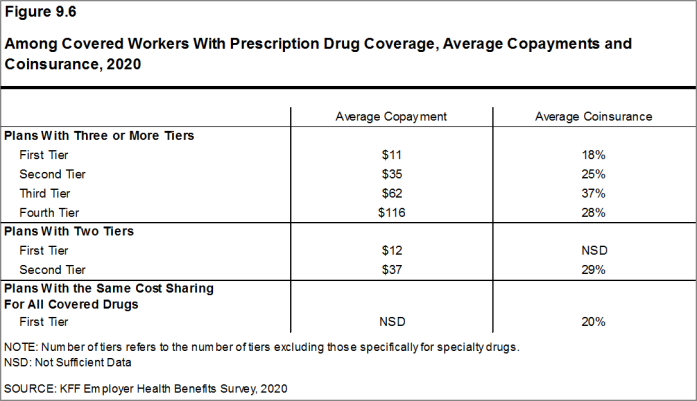

- Among covered workers in plans with three or more tiers of cost sharing for prescription drugs, the average copayments are $11 for first-tier drugs, $35 second-tier drugs, $62 for third-tier drugs, and $116 for fourth-tier drugs [Figure 9.6].

- Among covered workers in plans with three or more tiers of cost sharing for prescription drugs, the average coinsurance rates are 18% for first-tier drugs, 25% second-tier drugs, 37% third-tier drugs, and 28% for fourth-tier drugs [Figure 9.6].

- Eleven percent of covered workers are in a plan with two tiers for prescription drug cost sharing (excluding tiers covering only specialty drugs).

- For these workers, copayments are more common than coinsurance for first-tier and second-tier drugs [Figure 9.3]. The average copayment for the first tier is $12 and the average copayment for the second tier is $37 [Figure 9.6].

- Six percent of covered workers are in a plan with the same cost sharing for prescriptions regardless of the type of drug (excluding tiers covering only specialty drugs).

- Among these workers, 24% have copayments and 76% have coinsurance [Figure 9.3]. The average coinsurance rate is 20% [Figure 9.6].

Figure 9.3: Among Covered Workers With Prescription Drug Coverage, Distribution With the Following Types of Cost Sharing for Prescription Drugs, 2020

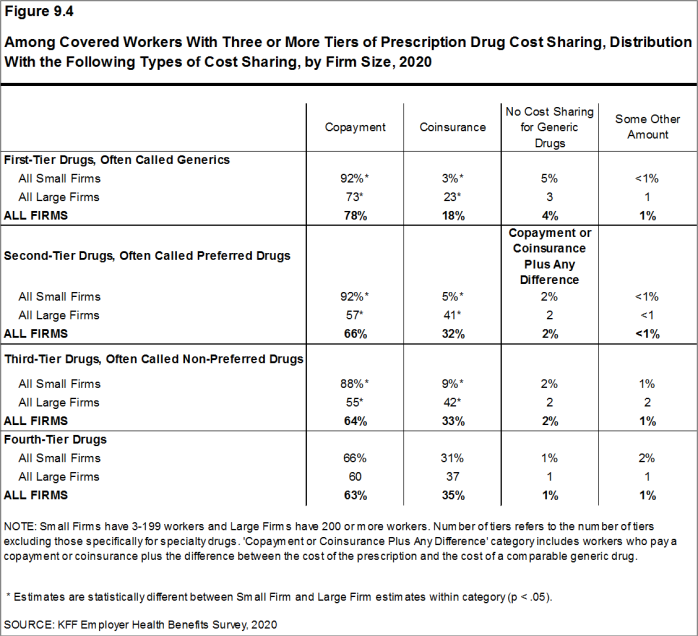

Figure 9.4: Among Covered Workers With Three or More Tiers of Prescription Drug Cost Sharing, Distribution With the Following Types of Cost Sharing, by Firm Size, 2020

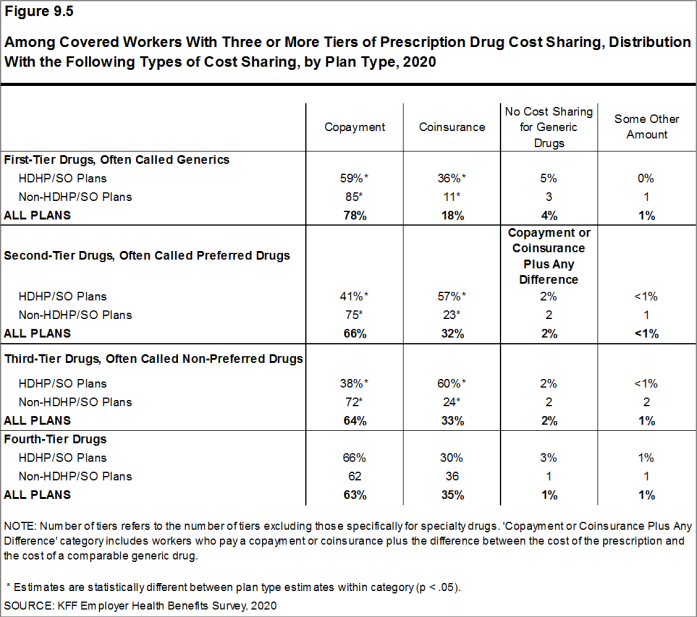

Figure 9.5: Among Covered Workers With Three or More Tiers of Prescription Drug Cost Sharing, Distribution With the Following Types of Cost Sharing, by Plan Type, 2020

COINSURANCE MAXIMUMS

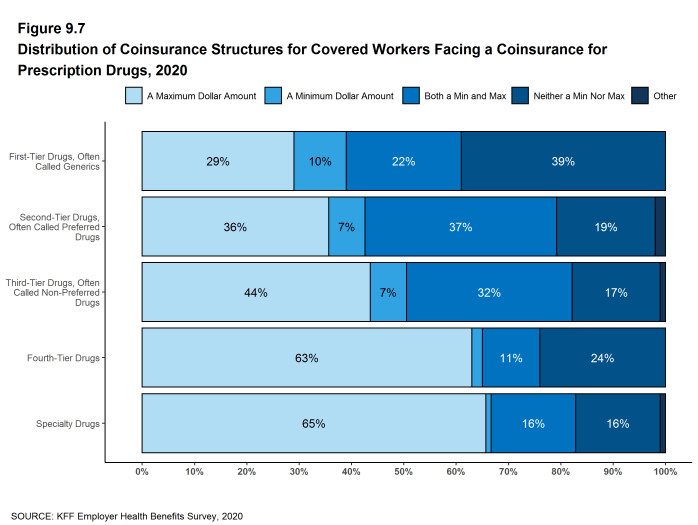

- Coinsurance rates for prescription drugs often include maximum and/or minimum dollar amounts. Depending on the plan design, coinsurance maximums may significantly limit the amount an enrollee must spend out-of-pocket for higher-cost drugs. Even in plans without explicit coinsurance maximum amounts, the overall plan out-of-pocket maximum limits enrollee cost sharing on covered services, including prescription drugs.

- These coinsurance minimum and maximum amounts vary across the tiers.

- For example, among covered workers in a plan with coinsurance for the first cost-sharing tier, 29% have only a maximum dollar amount attached to the coinsurance rate, 10% have only a minimum dollar amount, 22% have both a minimum and maximum dollar amount, and 39% have neither. For those in a plan with coinsurance for the fourth cost-sharing tier, 63% have only a maximum dollar amount attached to the coinsurance rate, 2% have only a minimum dollar amount, 11% have both a minimum and maximum dollar amount, and 24% have neither [Figure 9.7].

SEPARATE TIERS FOR SPECIALTY DRUGS

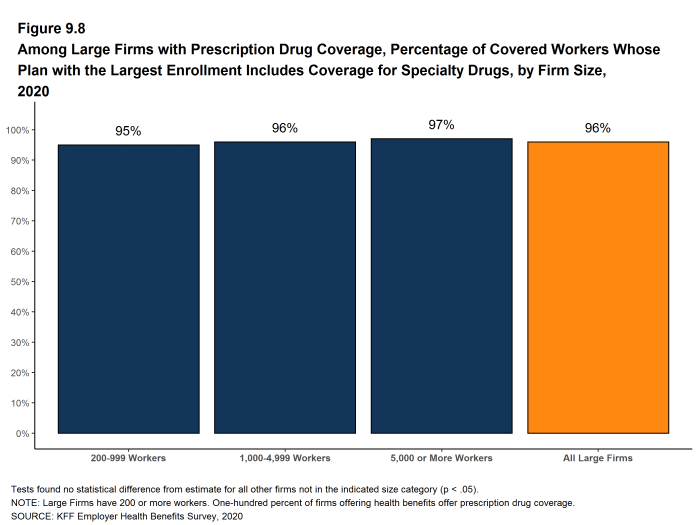

- Specialty drugs, such as biologics that may be used to treat chronic conditions, or some cancer drugs, can be quite expensive and often require special handling and administration. We revised our questions beginning with the 2016 survey to obtain more information about formulary tiers that are exclusively for specialty drugs. We are reporting results only among large firms because a small firm respondents had large shares of “don’t know” responses to some of these questions.

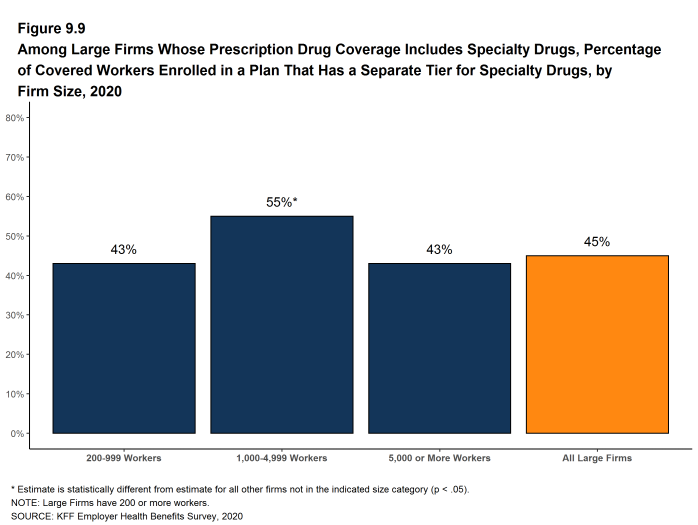

- Ninety-six percent of covered workers at large firms have coverage for specialty drugs [Figure 9.8]. Among these workers, 45% are in a plan with at least one cost-sharing tier just for specialty drugs [Figure 9.9].

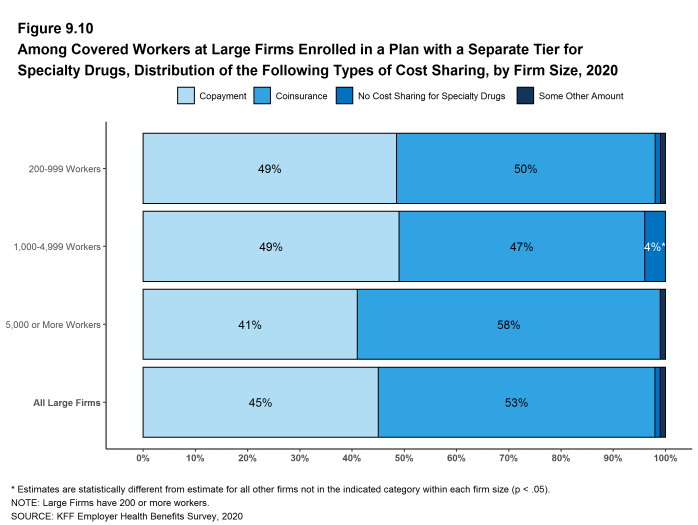

- Among covered workers at large firms in a plan with at least one separate tier for specialty drugs, 45% have a copayment for specialty drugs and 53% have coinsurance [Figure 9.10]. The average copayment is $109 and the average coinsurance rate is 26% [Figure 9.11]. Eighty-seven percent of those with coinsurance have a maximum dollar limit on the amount of coinsurance they must pay.

Figure 9.8: Among Large Firms With Prescription Drug Coverage, Percentage of Covered Workers Whose Plan With the Largest Enrollment Includes Coverage for Specialty Drugs, by Firm Size, 2020

Figure 9.9: Among Large Firms Whose Prescription Drug Coverage Includes Specialty Drugs, Percentage of Covered Workers Enrolled in a Plan That Has a Separate Tier for Specialty Drugs, by Firm Size, 2020

Figure 9.10: Among Covered Workers at Large Firms Enrolled in a Plan With a Separate Tier for Specialty Drugs, Distribution of the Following Types of Cost Sharing, by Firm Size, 2020

Figure 9.11: Among Covered Workers at Large Firms Enrolled in a Plan With a Separate Tier for Specialty Drugs, Average Copayments and Coinsurance, by Firm Size, 2020

- Generic drugs

- Drugs that are no longer covered by patent protection and thus may be produced and/or distributed by multiple drug companies.

- Preferred drugs

- Drugs included on a formulary or preferred drug list; for example, a brand-name drug without a generic substitute.

- Non-preferred drugs

- Drugs not included on a formulary or preferred drug list; for example, a brand-name drug with a generic substitute.

- Fourth-tier drugs

- New types of cost-sharing arrangements that typically build additional layers of higher copayments or coinsurance for specifically identified types of drugs, such as lifestyle drugs or biologics.

- Specialty drugs

- Specialty drugs such as biological drugs are high cost drugs that may be used to treat chronic conditions such as blood disorder, arthritis or cancer. Often times they require special handling and may be administered through injection or infusion.