2020 Employer Health Benefits Survey

Published:

Section 6: Worker and Employer Contributions for Premiums

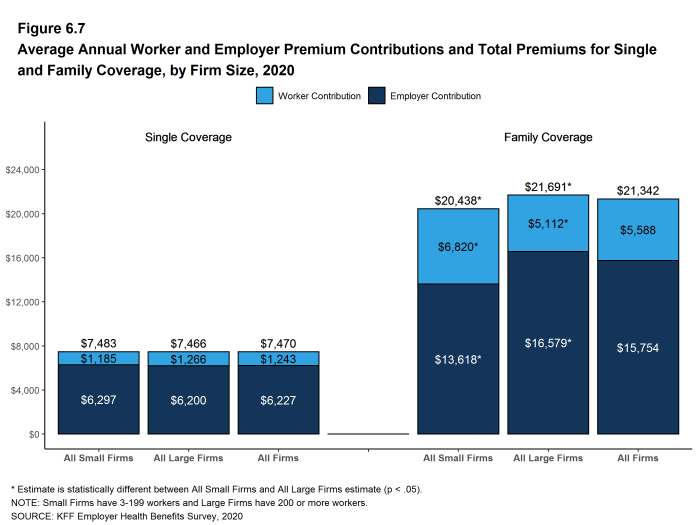

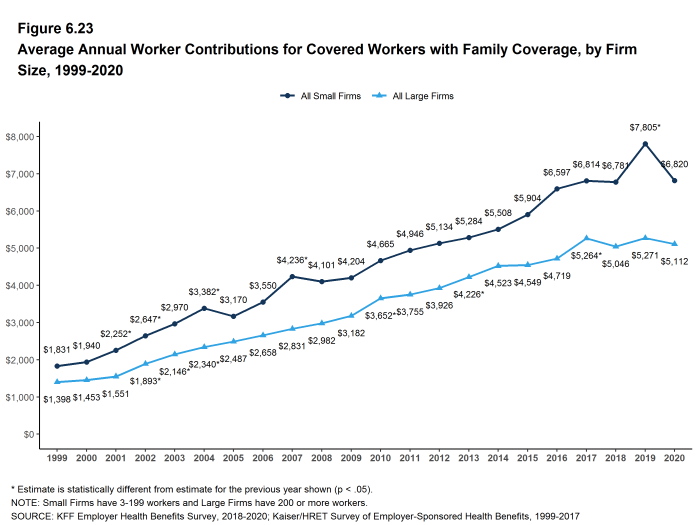

In 2020, covered workers on average contribute 17% of the premium for single coverage and 27% of the premium for family coverage.17 The average monthly worker contributions are $104 for single coverage ($1,243 annually) and $466 for family coverage ($5,588 annually). The average contribution amount for family coverage is higher for covered workers in small firms (3-199 workers) than for covered workers in large firms (200 or more workers) ($6,820 vs. $5,112).

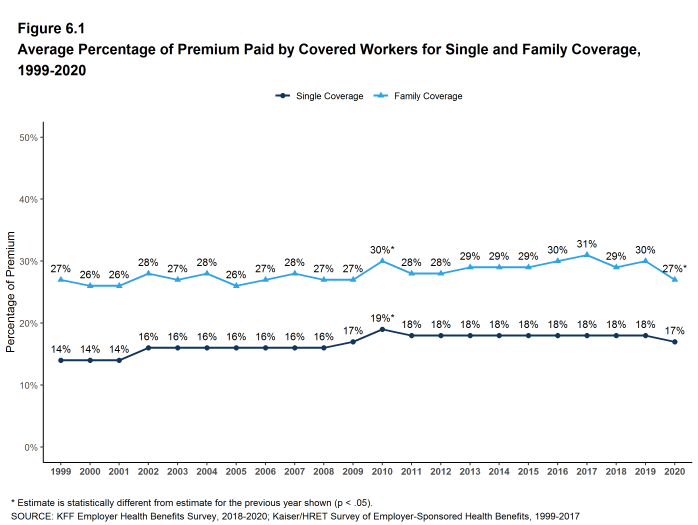

- In 2020, covered workers on average contribute 17% of the premium for single coverage and 27% of the premium for family coverage. The average percentage contributed for single coverage has remained stable in recent years. The average percentage contributed for family coverage is lower in 2020 than the percentage (30%) last year [Figure 6.1].18

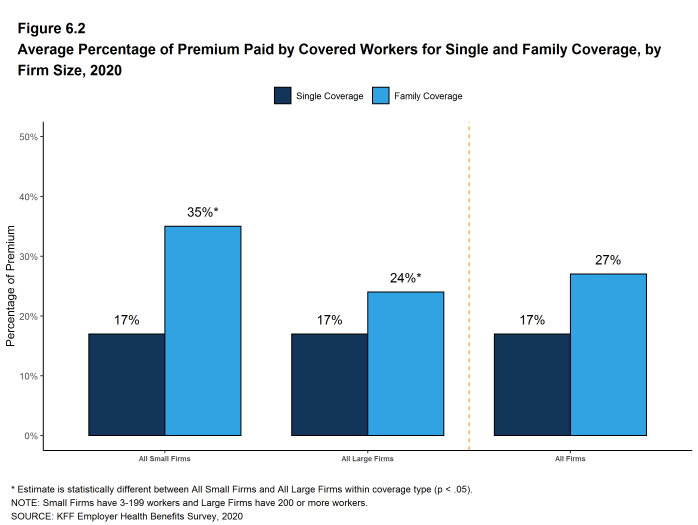

- Covered workers in small firms on average contribute a much higher percentage of the premium for family coverage (35% vs. 24%) than covered workers in large firms [Figure 6.2].

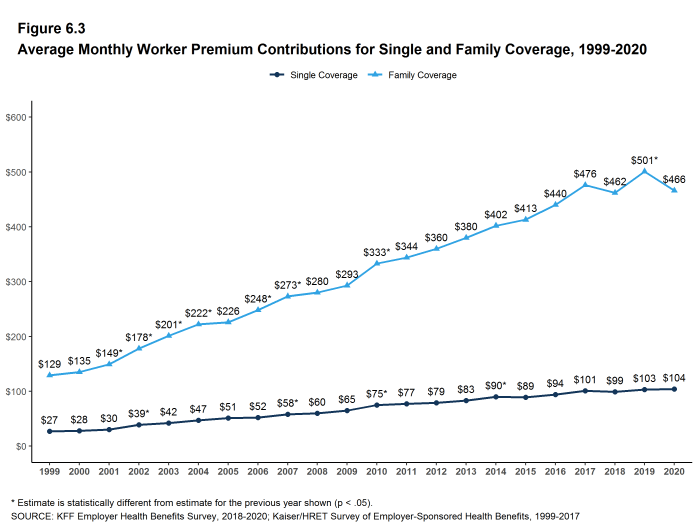

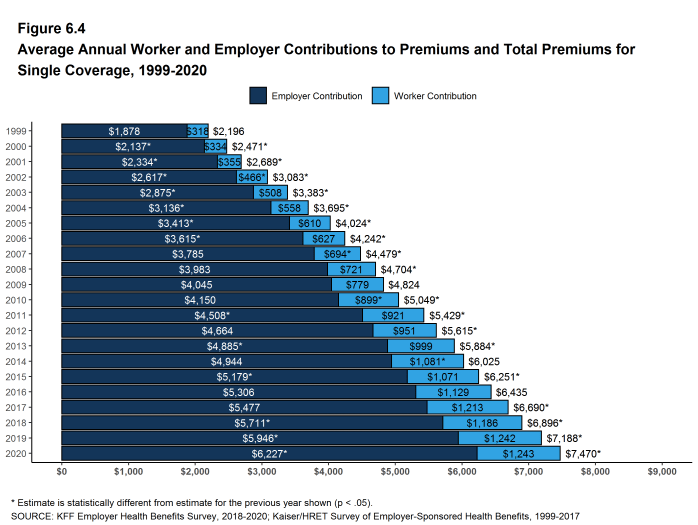

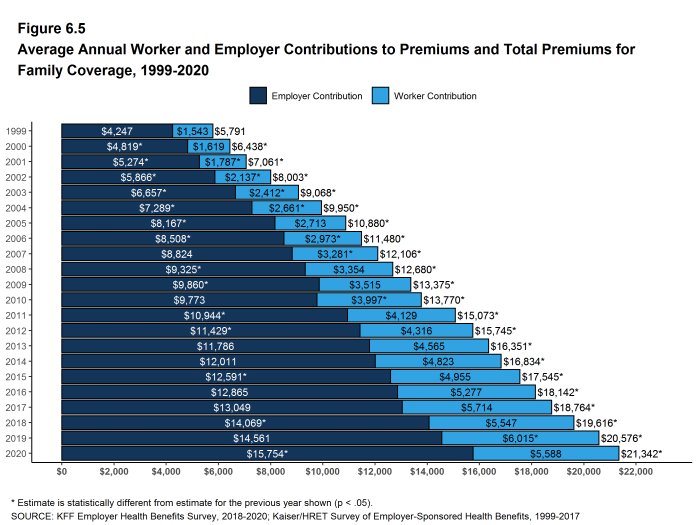

- Workers with single coverage have an average contribution of $104 per month ($1,243 annually), and workers with family coverage have an average contribution of $466 per month ($5,588 annually) toward their health insurance premiums [Figure 6.3], [Figure 6.4], and [Figure 6.5].

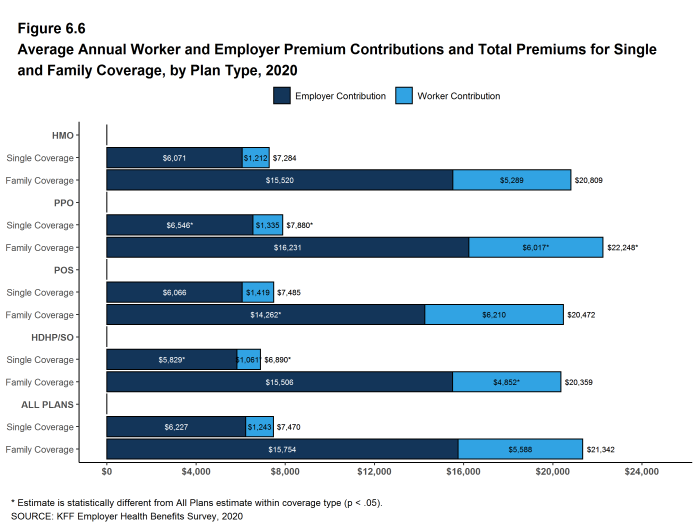

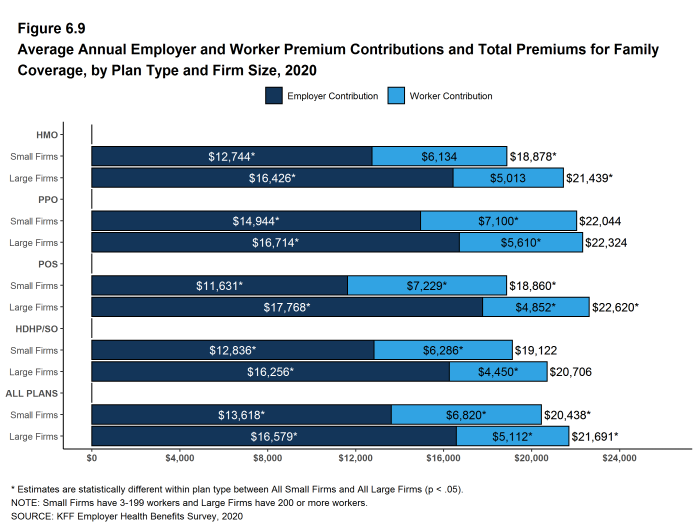

- The average worker contributions in HDHP/SOs are lower than the overall average worker contribution for single coverage ($1,061 vs. $1,243) and family coverage ($4,852 vs. $5,588). The average worker contributions in PPOs are higher than the overall average worker contribution for family coverage ($6,017 vs. $5,588) [Figure 6.6].

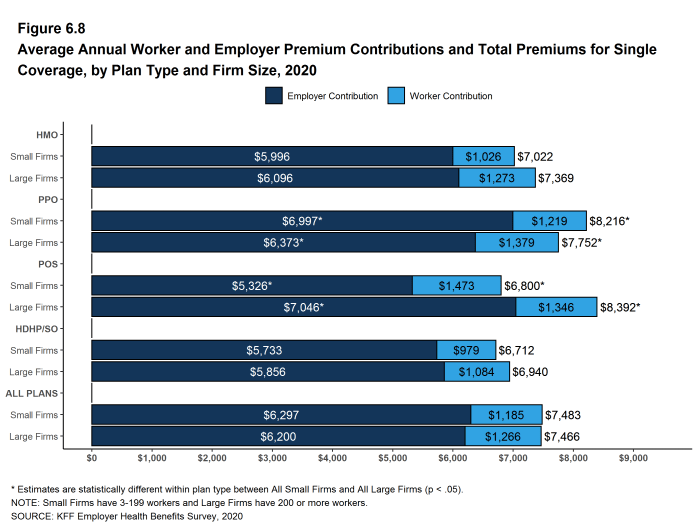

- Worker contributions also differ by firm size.

- Covered workers in small firms on average contribute significantly more annually for family coverage than covered workers in large firms ($6,820 vs. $5,112). The average contributions amounts for covered workers in small and large firms are similar for single coverage [Figure 6.7].

Figure 6.1: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, 1999-2020

Figure 6.2: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 2020

Figure 6.4: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Single Coverage, 1999-2020

Figure 6.5: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Family Coverage, 1999-2020

Figure 6.6: Average Annual Worker and Employer Premium Contributions and Total Premiums for Single and Family Coverage, by Plan Type, 2020

Figure 6.7: Average Annual Worker and Employer Premium Contributions and Total Premiums for Single and Family Coverage, by Firm Size, 2020

Figure 6.8: Average Annual Worker and Employer Premium Contributions and Total Premiums for Single Coverage, by Plan Type and Firm Size, 2020

Figure 6.9: Average Annual Employer and Worker Premium Contributions and Total Premiums for Family Coverage, by Plan Type and Firm Size, 2020

DISTRIBUTIONS OF WORKER CONTRIBUTIONS TO THE PREMIUM

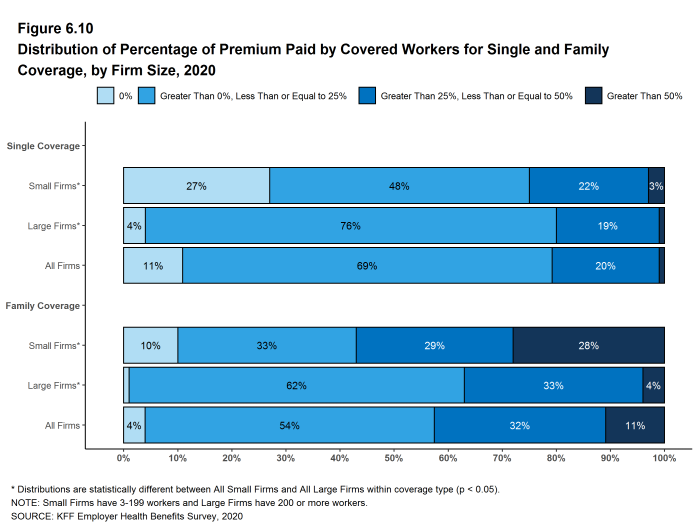

- About nine-tenths of covered workers are in a plan where the employer contributes at least half of the premium for both single and family coverage.

- Eleven percent of covered workers are in a plan where the employer pays the entire premium for single coverage, while only 4% of covered workers are in a plan where the employer pays the entire premium for family coverage [Figure 6.10].

- Covered workers in small firms are much more likely than covered workers in large firms to be in a plan where the employer pays the entire premium.

- Twenty-seven percent of covered workers in small firms have an employer that pays the full premium for single coverage, compared to 4% of covered workers in large firms [Figure 6.10].

- For family coverage, 10% of covered workers in small firms have an employer that pays the full premium, compared to 1% of covered workers in large firms [Figure 6.10].

- Eleven percent of covered workers are in a plan with a worker contribution of more than half of the premium for family coverage [Figure 6.10].

- Twenty-eight percent of covered workers in small firms work in a firm where the worker contribution for family coverage is more than 50% of the premium, a much higher percentage than the 4% of covered workers in large firms [Figure 6.10].

- Small shares of covered workers in small firms (3%) and large firms (1%) must pay more than 50% of the premium for single coverage [Figure 6.10].

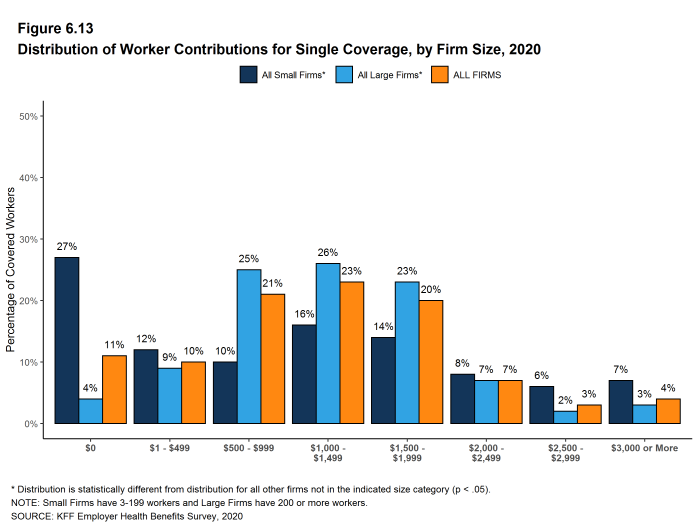

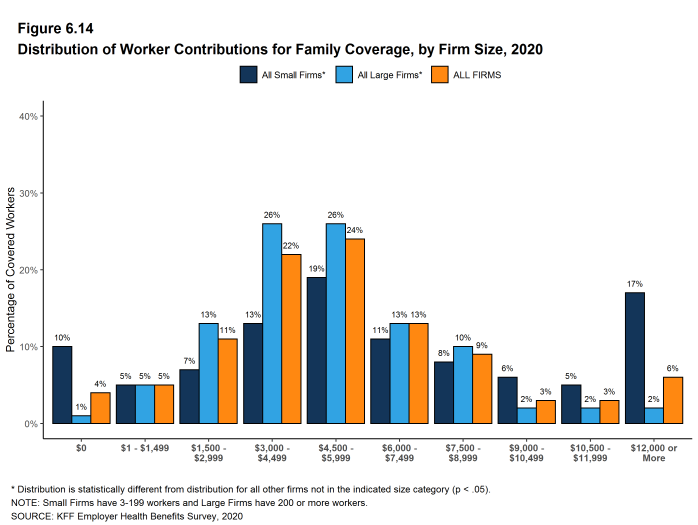

- There is substantial variation among workers in both small and large firms in the dollar amounts they must contribute.

- Among covered workers in small firms, 39% have a contribution for single coverage of less than $500, while 21% have a contribution of $2,000 or more. For family coverage, 15% have a contribution of less than $1,500, while 22% have a contribution of $10,500 or more [Figure 6.13] and [Figure 6.14].

- Among covered workers in large firms, 13% have a contribution for single coverage of less than $500, while 12% have a contribution of $2,000 or more. For family coverage, 6% have a contribution of less than $1,500, while only 4% have a contribution of $10,500 or more [Figure 6.13] and [Figure 6.14].

Figure 6.10: Distribution of Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 2020

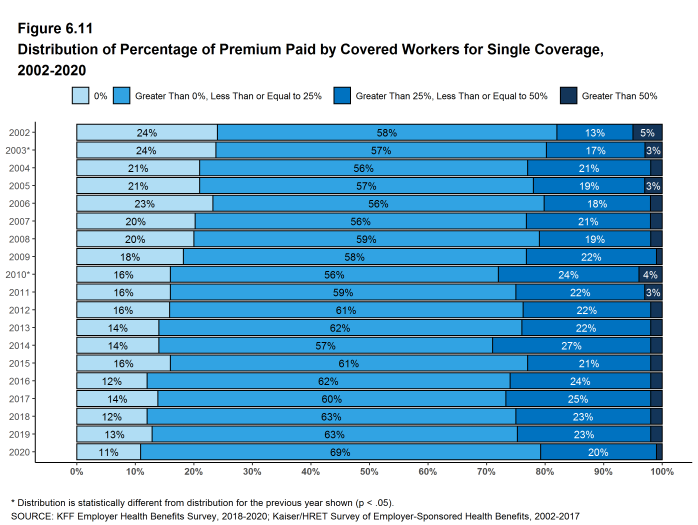

Figure 6.11: Distribution of Percentage of Premium Paid by Covered Workers for Single Coverage, 2002-2020

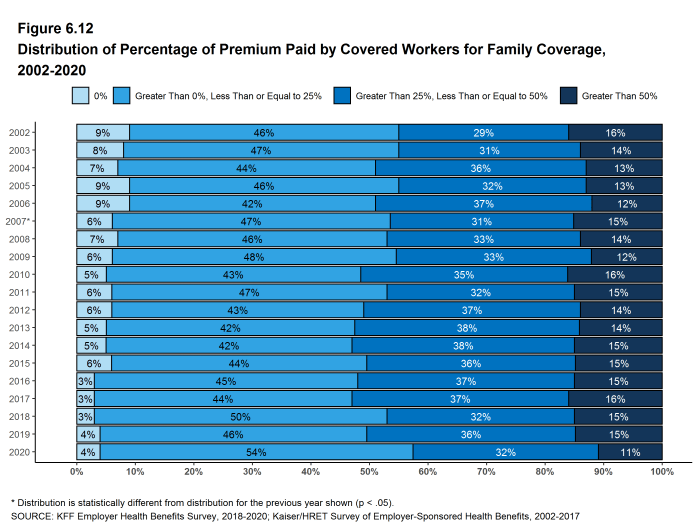

Figure 6.12: Distribution of Percentage of Premium Paid by Covered Workers for Family Coverage, 2002-2020

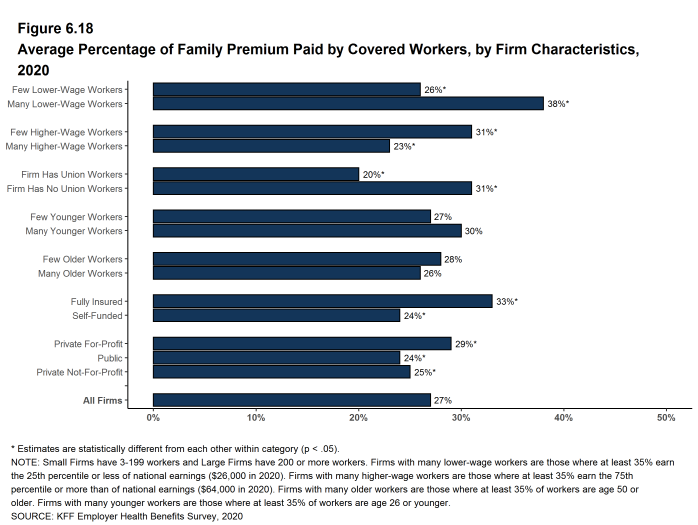

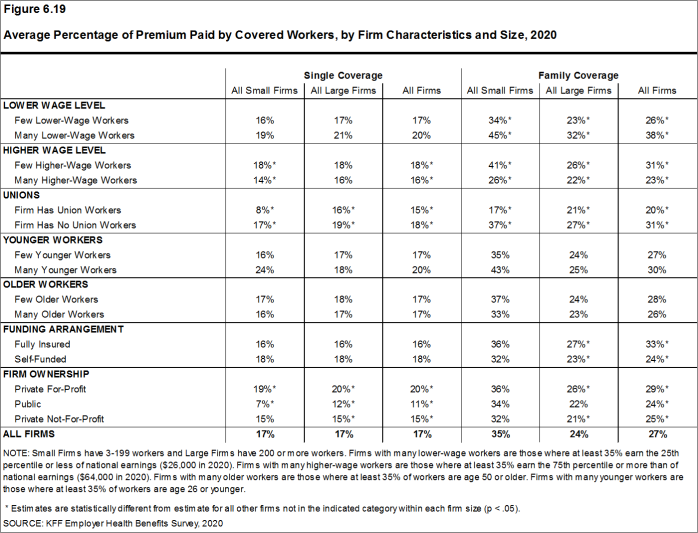

DIFFERENCES BY FIRM CHARACTERISTICS

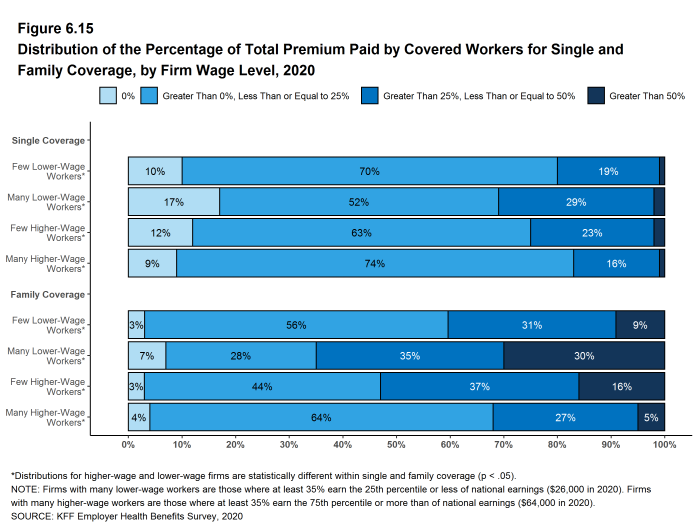

- The percentage of the premium paid by covered workers also varies by firm characteristics.

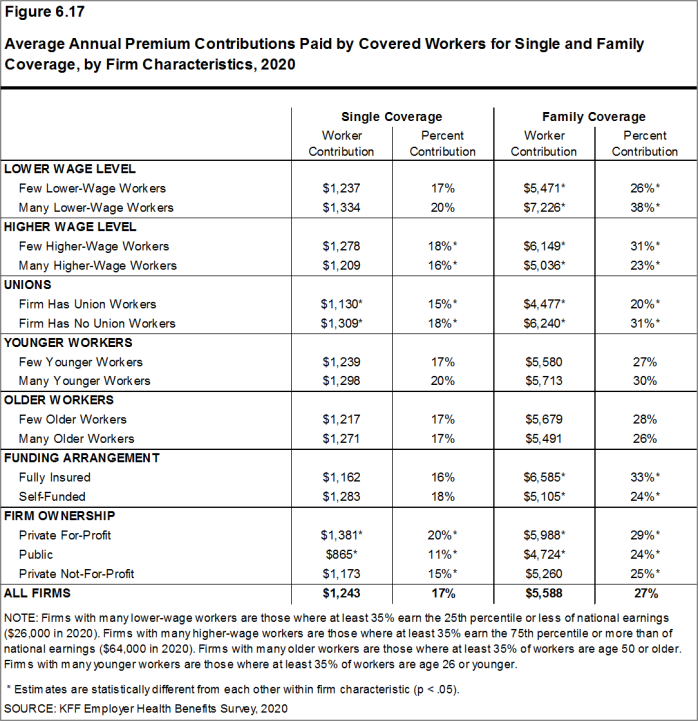

- Covered workers in private, for-profit firms have relatively high premium contributions for single ($1,381) and family ($5,988) coverage. Covered workers in public firms have relatively low premium contributions for single ($865) and family ($4,724) coverage [Figure 6.17] .

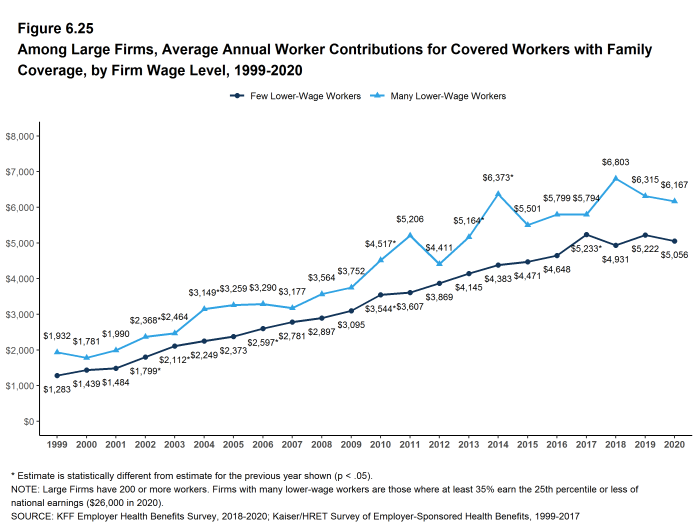

- Covered workers in firms with a relatively large share of lower-wage workers (where at least 35% of workers earn $26,000 a year or less) have a higher average contribution rate for family coverage (38% vs. 26%) than those in firms with a smaller share of lower-wage workers [Figure 6.17].

- Covered workers in firms with a relatively large share of higher-wage workers (where at least 35% earn $64,000 or more annually) have lower average contribution rates for single coverage (16% vs. 18%) and for family coverage (23% vs. 31%) than those in firms with a smaller share of higher-wage workers [Figure 6.17].

- Covered workers in firms that have at least some union workers have lower average contribution rates for single coverage (15% vs. 18%) for family coverage (20% vs. 31%) than those in firms without any union workers [Figure 6.17].

- Covered workers in firms that are partially or completely self-funded on average have a lower average contribution rate for family coverage than workers in firms that are fully-insured (24% vs. 33%) [Figure 6.17].19

Figure 6.15: Distribution of the Percentage of Total Premium Paid by Covered Workers for Single and Family Coverage, by Firm Wage Level, 2020

Figure 6.16: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Single and Family Coverage, by Firm Wage Level, 2020

Figure 6.17: Average Annual Premium Contributions Paid by Covered Workers for Single and Family Coverage, by Firm Characteristics, 2020

Figure 6.18: Average Percentage of Family Premium Paid by Covered Workers, by Firm Characteristics, 2020

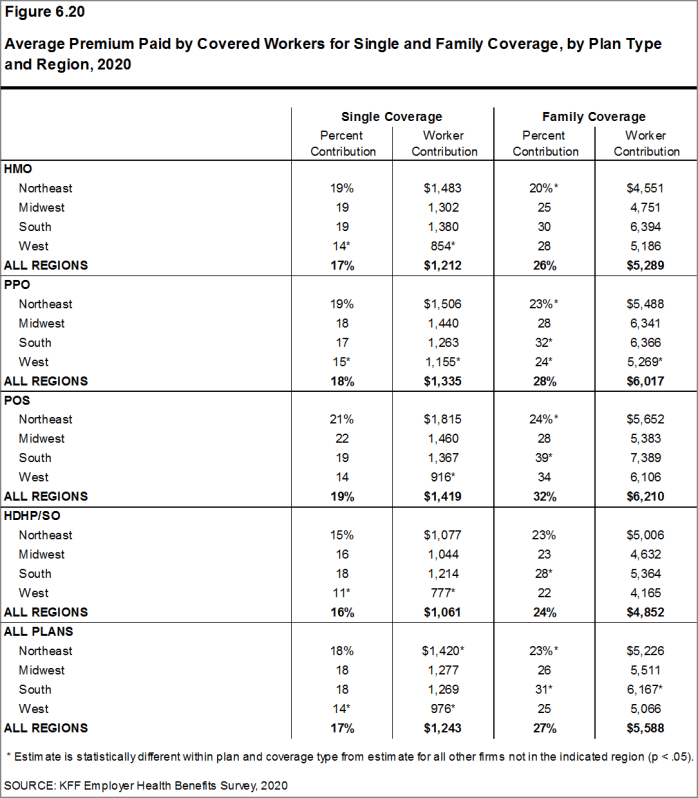

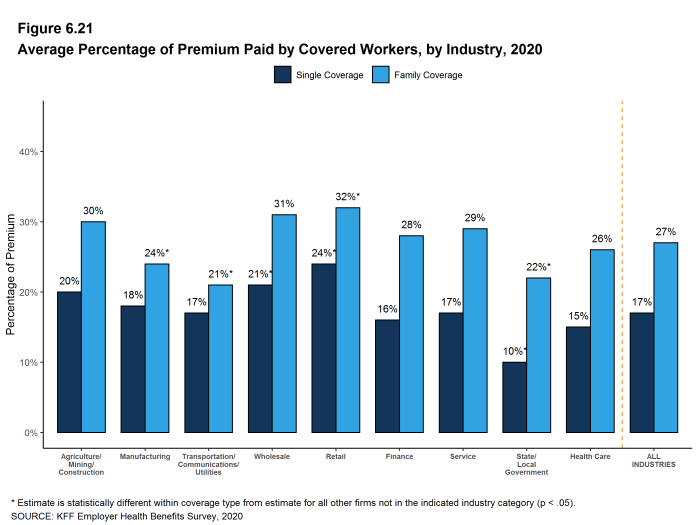

DIFFERENCES BY REGION AND INDUSTRY

- The average worker contribution rate for single coverage is lower in the West (14%) than in other regions [Figure 6.20].

- The average worker contribution rate for family coverage is lower in the Northeast (23%) and higher in the South (31%) than in other regions [Figure 6.20].

- There is considerable variation in average worker contribution rates across industries for both single and family coverage [Figure 6.21].

Figure 6.20: Average Premium Paid by Covered Workers for Single and Family Coverage, by Plan Type and Region, 2020

CHANGES OVER TIME

- The average worker contribution for single coverage ($1,243 in 2020) is similar to the amount last year. The average worker contribution for family coverage ($5,588 in 2020) appears lower than the average contribution for family coverage last year ($6,015), but the difference is not statistically significant [Figure 6.4] and [Figure 6.5].

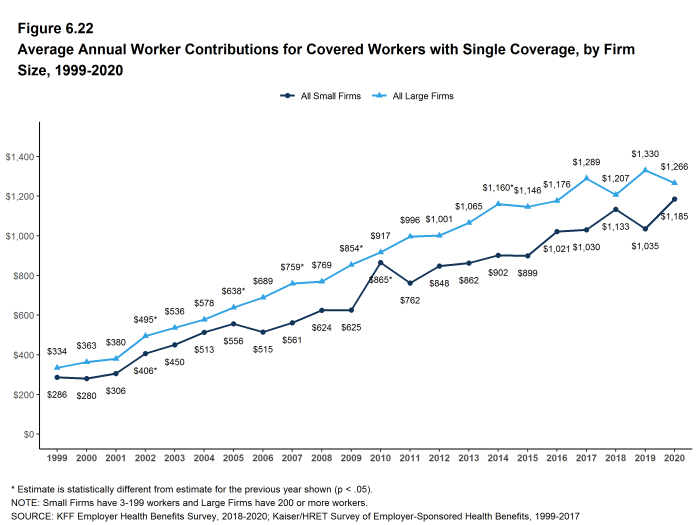

- The average worker contributions for single and family coverage have increased over the last five years (16% and 13%, respectively) and over the last 10 years (38% and 40%, respectively).

Figure 6.22: Average Annual Worker Contributions for Covered Workers With Single Coverage, by Firm Size, 1999-2020

Figure 6.23: Average Annual Worker Contributions for Covered Workers With Family Coverage, by Firm Size, 1999-2020

- Estimates for premiums, worker contributions to premiums, and employer contributions to premiums presented in Section 6 do not include contributions made by the employer to Health Savings Accounts (HSAs) or Health Reimbursement Arrangements (HRAs). See Section 8 for estimates of employer contributions to HSAs and HRAs.↩︎

- The average percentage contribution is calculated as a weighted average of all a firm’s plan types and may not necessarily equal the average worker contribution divided by the average premium.↩︎

- For definitions of self-funded and fully-insured plans, see the introduction to Section 10.↩︎

Sections

- Section 1: Cost of Health Insurance

- Section 2: Health Benefits Offer Rates

- Section 3: Employee Coverage, Eligibility, and Participation

- Section 4: Types of Plans Offered

- Section 5: Market Shares of Health Plans

- Section 6: Worker and Employer Contributions for Premiums

- Section 7: Employee Cost Sharing

- Section 8: High-Deductible Health Plans with Savings Option

- Section 9: Prescription Drug Benefits

- Section 10: Plan Funding

- Section 11: Retiree Health Benefits

- Section 12: Health Screening and Health Promotion and Wellness Programs

- Section 13: Employer Practices, Alternative Sites of Care and Provider Networks