2020 Employer Health Benefits Survey

Section 13: Employer Practices, Alternative Sites of Care and Provider Networks

Employers frequently review and modify their health plans to incorporate new options or adapt to new circumstances. We monitor new options, such as telemedicine, and ask about changes in the health or policy environments. This year employers have been dealing with the coronavirus pandemic, which affects health, access to care, workplace health programs and even open enrollments. Because the survey started fielding in January, before the full impacts of the pandemic became apparent, we did not include questions about employers responses to it this year.

We note that there is a significant increase in the percentage of firms, particularly smaller firms (50-199 workers), reporting that they cover some services through telemedicine. While telemedicine has grown in recent years, it is possible that some of the growth reflects plan changes in response to the coronavirus pandemic as well as to the increased awareness in telemedicine that has occurred over the spring and summer. About one-half of the responses to this year’s survey occurred after March, which is when people began to shelter at home and seek alternative ways to get medical care. It will be important to monitor how plans and employers adapt over the longer term when concerns over the coronavirus have ended.

SHOPPING FOR HEALTH COVERAGE

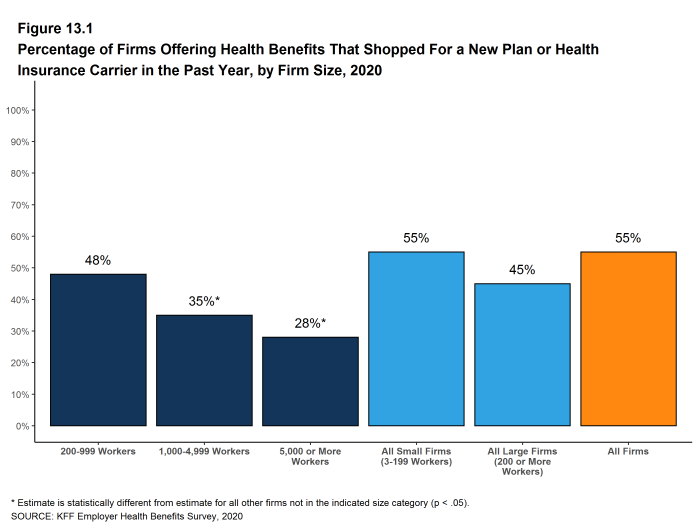

Fifty-five percent of firms offering health benefits reported shopping for a new health plan or a new insurance carrier in the past year, similar to the percentage last year. Firms with 5,000 or more workers were less likely to shop for coverage (28%) than firms in other size categories [Figure 13.1].

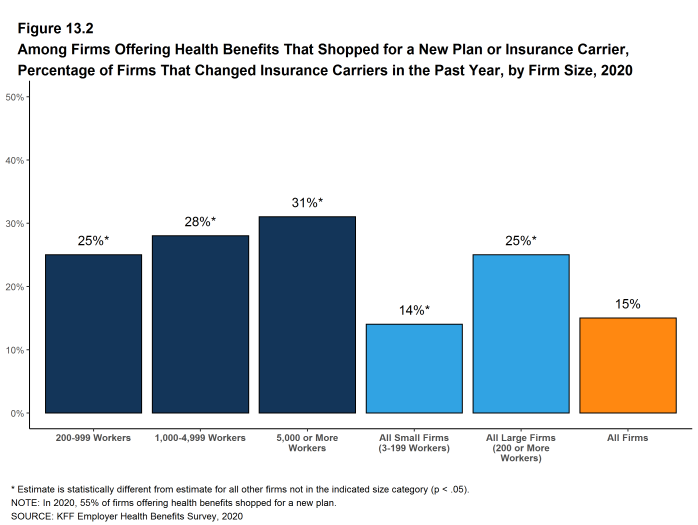

- Among firms that offer health benefits and who shopped for a new plan or carrier in the past year, 15% changed insurance carriers [Figure 13.2].

Figure 13.1: Percentage of Firms Offering Health Benefits That Shopped for a New Plan or Health Insurance Carrier in the Past Year, by Firm Size, 2020

ALTERNATIVE CARE SETTINGS: TELEMEDICINE AND RETAIL CLINICS

Many firms provide coverage for health services delivered outside typical provider settings. Telemedicine is the delivery of health care services through telecommunications to a patient from a provider who is at a remote location, including video chat and remote monitoring. This generally would not include the mere exchange of information via email, exclusively web-based resources, or online information a plan may make available unless a health professional provides information specific to the enrollee’s condition. We note that during the coronavirus pandemic, some plans have eased their definitions to allow more types of digital communication to be reimbursed.

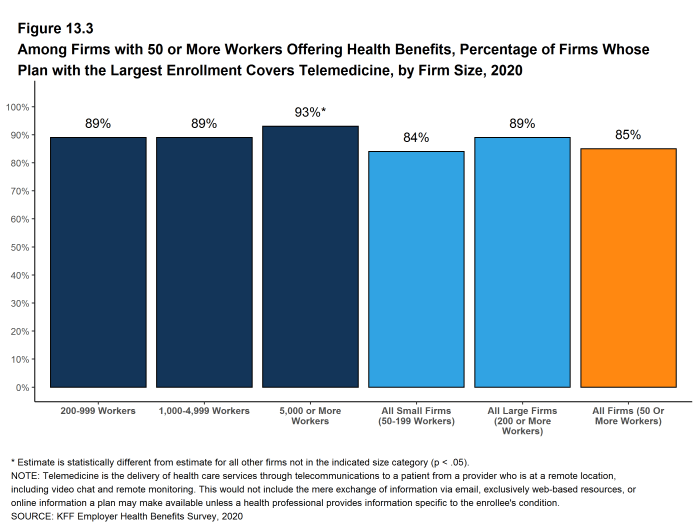

- Eighty-five percent of firms with 50 or more workers that offer health benefits cover the provision of some health care services through telemedicine in their largest health plan, a significant increase from the percentage (69%) in 2019. [Figure 13.3].

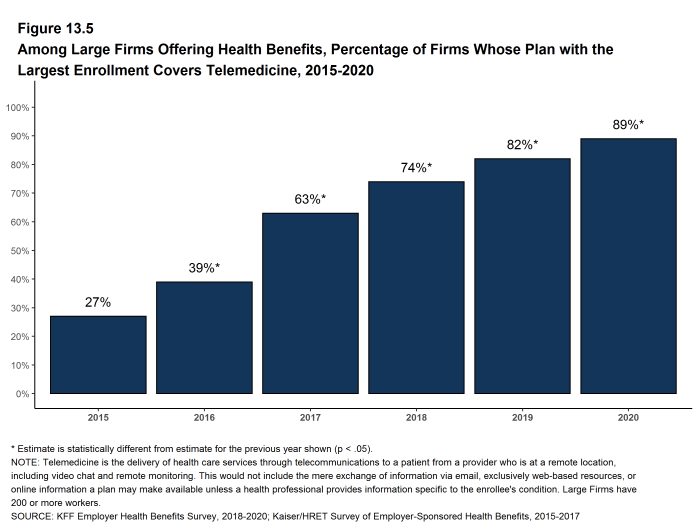

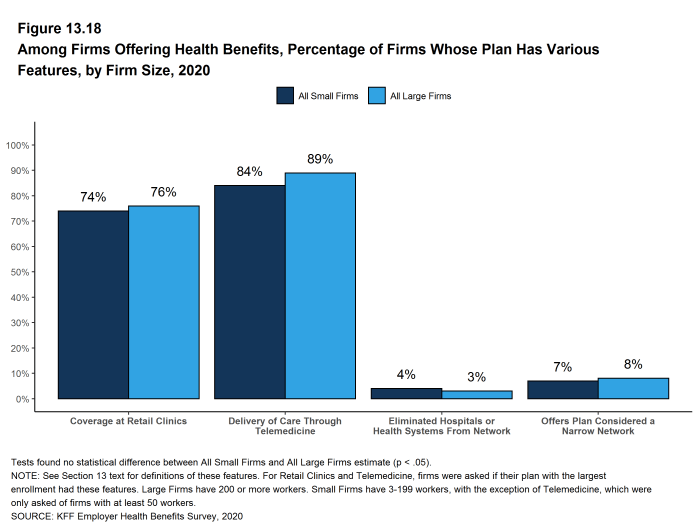

- Over the last year, the percentage of small firms (50-199 workers) reporting that they cover services through telemedicine increased from 65% last year to 84% this year and the percentage of large firms increased from 82% to 89% [Figure 13.5].

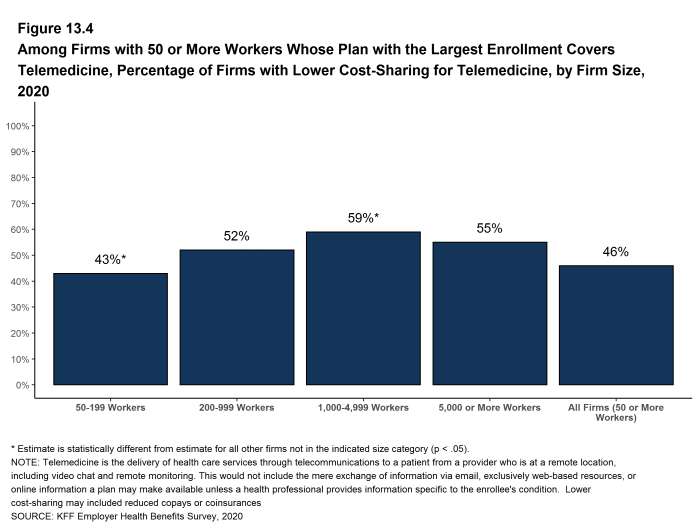

- Among firms with 50 or more workers with plans that cover health services through telemedicine, 46% provide a financial incentive for workers to use telemedicine instead of visiting a traditional physician’s office in-person, similar to the percentage in 2019 [Figure 13.4].

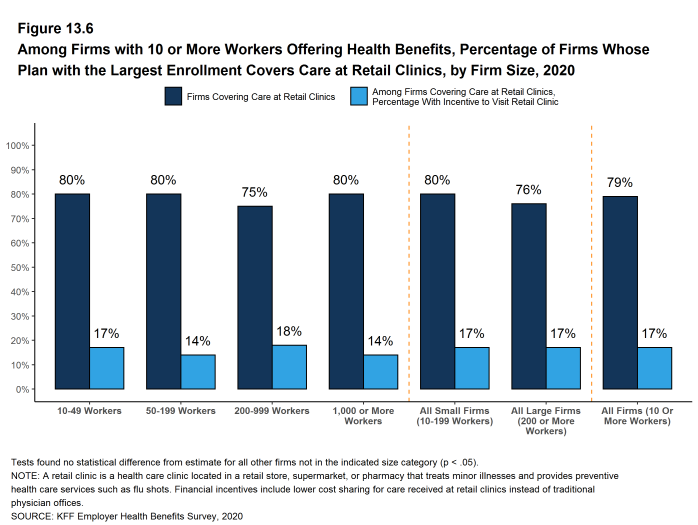

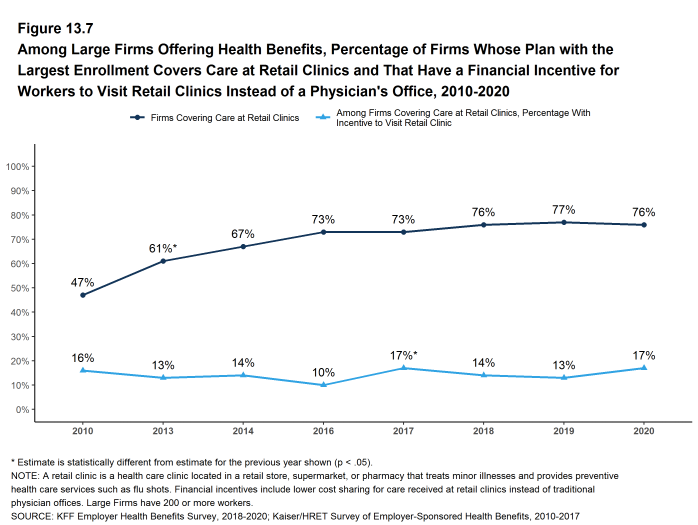

- Seventy-nine percent of firms with 10 or more employees that offer health benefits cover health care services received in retail clinics, such as those located in pharmacies, supermarkets and retail stores, in their largest health plan [Figure 13.6]. These clinics are often staffed by nurse practitioners or physician assistants and treat minor illnesses and provide preventive services.

- Among firms with 10 or more employees covering health services received in retail clinics in their largest plan, 17% provide a financial incentive for workers to use a retail health clinic instead of visiting a traditional physician’s office [Figure 13.6].

Figure 13.3: Among Firms With 50 or More Workers Offering Health Benefits, Percentage of Firms Whose Plan With the Largest Enrollment Covers Telemedicine, by Firm Size, 2020

Figure 13.4: Among Firms With 50 or More Workers Whose Plan With the Largest Enrollment Covers Telemedicine, Percentage of Firms With Lower Cost-Sharing for Telemedicine, by Firm Size, 2020

Figure 13.5: Among Large Firms Offering Health Benefits, Percentage of Firms Whose Plan With the Largest Enrollment Covers Telemedicine, 2015-2020

Figure 13.6: Among Firms With 10 or More Workers Offering Health Benefits, Percentage of Firms Whose Plan With the Largest Enrollment Covers Care at Retail Clinics, by Firm Size, 2020

FIRM APPROACHES TO PLAN NETWORKS

Firms and health plans can structure their networks of providers and their cost sharing to encourage enrollees to use providers who are lower cost or who provide better care. Periodically we ask employers about network strategies, such as using tiered or narrow networks.

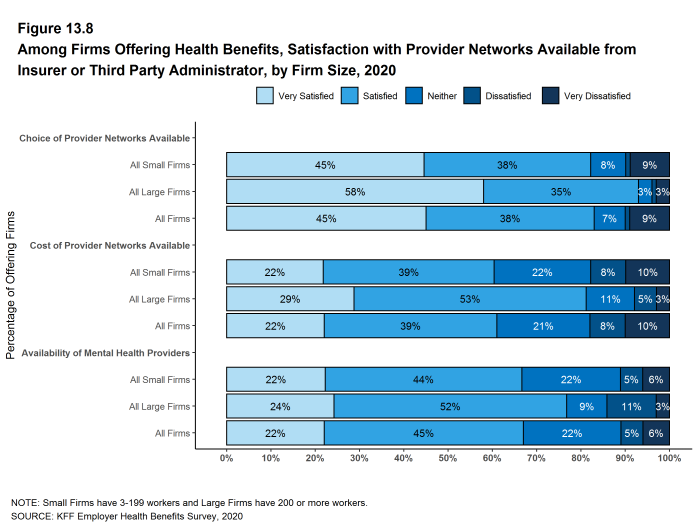

- Employers overall report being quite satisfied with the choice of provider networks made available to them by their insurer or plan administrator.

- Among employers offering health benefits, 45% of firms report being ‘very satisfied’ and 38% report being ‘satisfied’ by the choice of provider networks available to them. Large firms are more likely to be ‘very satisfied’ with the available network choices than smaller firms. [Figure 13.8].

- Employers are somewhat less satisfied with the cost of the provider networks available to them from their insurer or administrator. Among employers offering health benefits, only 22% of firms report being ‘very satisfied’ while 39% report being ‘satisfied’ with the cost of provider networks available to them. Small firms are more likely to be ‘very dissatisfied’ with the cost of the provider networks available to them [Figure 13.8].

- One way that employers and health plans can affect the cost and quality of services in their provider networks is to eliminate hospitals or health systems that are not performing well.

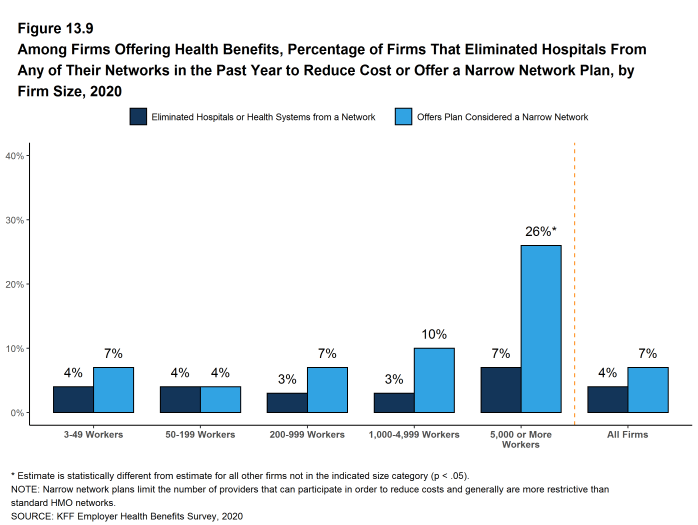

- Only a small share (4%) of firms offering health benefits say that either they or their insurer eliminated a hospital or health system from a provider network during the past year in order to reduce the plan’s cost [Figure 13.9].

- Another approach that employers can use is to offer a health plan with a relatively small, or narrow network of providers. Narrow network plans limit the number of providers that can participate in order to reduce costs and generally are more restrictive than standard HMO networks.

- Seven percent of firms offering health benefits report that they offer at least one plan that they considered to be a narrow network plan, similar to the percentage reported last year [Figure 13.9].

- Firms with 5,000 or more workers offering health benefits are more likely than firms of other sizes to offer at least one plan with a narrow network (26%) [Figure 13.9].

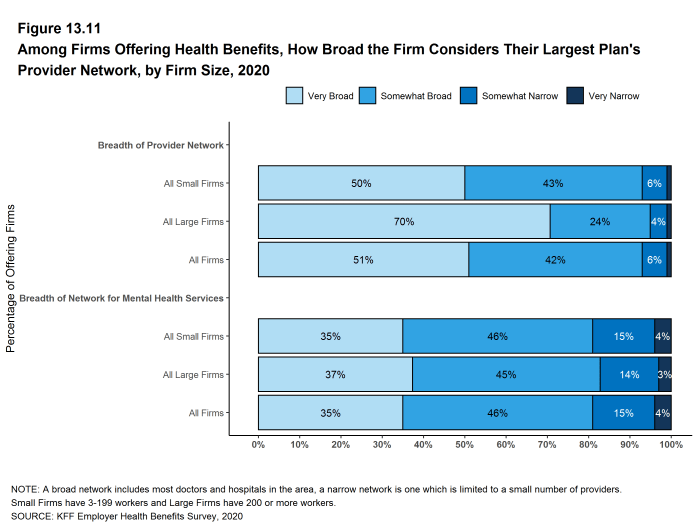

- Employers offering health benefits were asked to characterize the breadth of the provider network in their plan with the largest enrollment. Fifty-one percent of firms say that the network in the plan with the largest enrollment is ‘very broad’, 42% say it is ‘somewhat broad’, and 6% say it is ‘somewhat narrow’ [Figure 13.11].

Employees with mental or behavioral health claims disproportionately receive services from providers outside of plan networks.27 The coronavirus pandemic has placed a spotlight on the importance of mental and behavioral health care and access to these services, and many plans have been able to enhance access to these services through telemedicine. We asked employers if they were satisfied with the availability of mental health providers in their provider networks. We note that the survey was conducted between January and July this year, so it is possible that employer views changed over the period as the scope of the pandemic became more apparent and as alternative means of providing services became available.

- Only about one-in-five (22%) employers is very satisfied with the availability of mental health providers in their provider networks. The share does not vary with firm size [Figure 13.8].

- Employers offering health benefits also were asked to characterize the breadth of the network for mental health and substance abuse in their plan with the largest enrollment. Thirty-five percent of firms say that the network for mental health and substance abuse in the plan with the largest enrollment is ‘very broad’, 46% say it is ‘somewhat broad’, 15% say it is ‘somewhat narrow’, and 4% say it is ‘very narrow’. The responses do not vary for by firm size. [Figure 13.11]

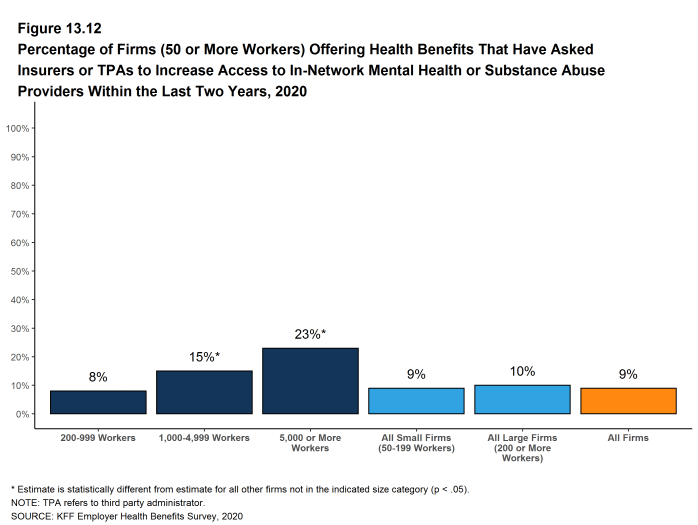

- Among employers with 50 or more employees offering health benefits, 9% asked their insurer or third party administrator to increase access to in-network mental health and substance abuse providers over the last two years. Firms with 1,000 or more employees were more likely to request more in-network access for these services [Figure 13.12].

Figure 13.8: Among Firms Offering Health Benefits, Satisfaction With Provider Networks Available From Insurer or Third Party Administrator, by Firm Size, 2020

Figure 13.9: Among Firms Offering Health Benefits, Percentage of Firms That Eliminated Hospitals From Any of Their Networks in the Past Year to Reduce Cost or Offer a Narrow Network Plan, by Firm Size, 2020

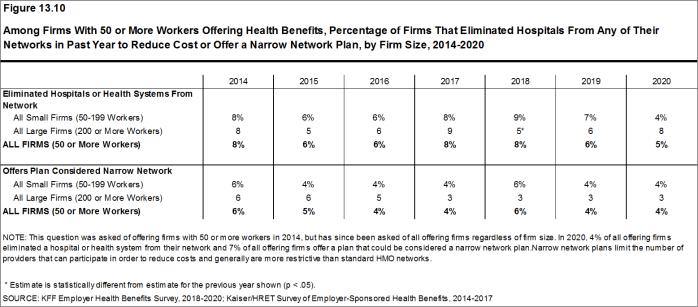

Figure 13.10: Among Firms With 50 or More Workers Offering Health Benefits, Percentage of Firms That Eliminated Hospitals From Any of Their Networks in Past Year to Reduce Cost or Offer a Narrow Network Plan, by Firm Size, 2014-2020

Figure 13.11: Among Firms Offering Health Benefits, How Broad the Firm Considers Their Largest Plan’s Provider Network, by Firm Size, 2020

CHRONIC CONDITIONS

In recent years employers and health plans have taken steps to encourage people with chronic illnesses to obtain the services they may need to maintain their health. Efforts may include communications, case and disease management, or reducing financial barriers, such as cost sharing.

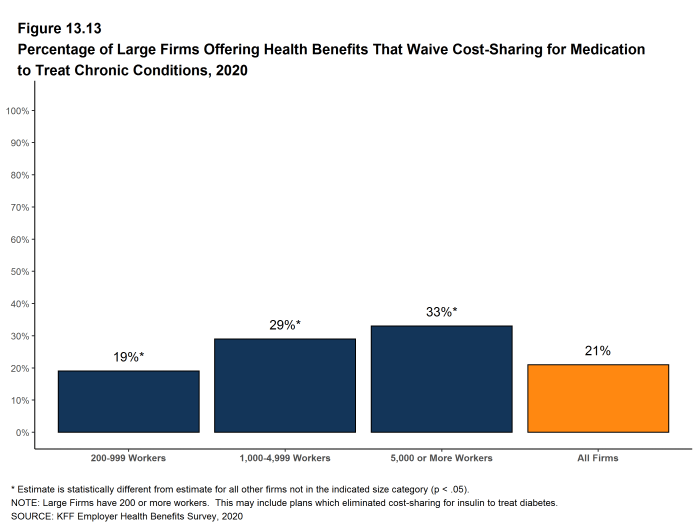

- Among employers with 200 or more employees offering health benefits, 21% say that their health plan with the largest enrollment waives cost sharing for some medications or supplies to encourage employees with chronic illnesses to follow their treatment. This likelihood increases with firm size [Figure 13.13].

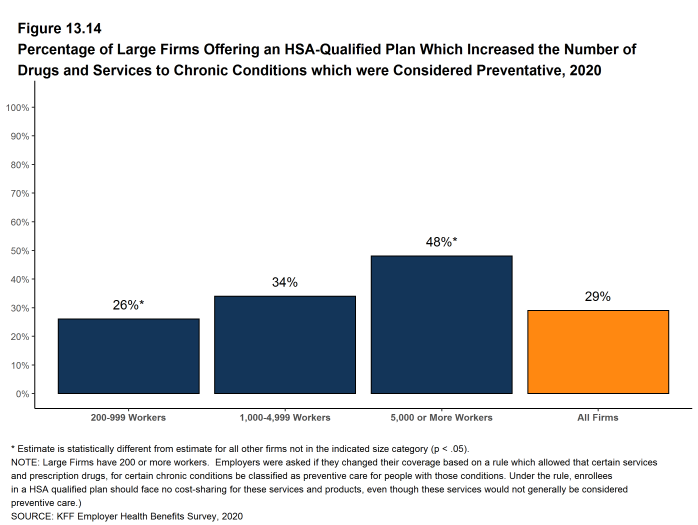

In 2019, the federal government issued new rules that expanded the number and types of items and services that may be considered preventive by HSA-qualified health plans, which means that plan sponsors may pay for part or all of these services before enrollees meet the plan deductibles in these plans.28

- Among employers with 200 or more employees offering an HSA-qualified health plan, 29% say that they changed the services or products that individuals with chronic conditions could receive without first meeting their deductibles. Firms with 5,000 or more employees (48%) are more likely and firms with 200 to 999 employees are less likely (26%) to say they changed the services or products available before the deductible is met [Figure 13.14].

Figure 13.13: Percentage of Large Firms Offering Health Benefits That Waive Cost-Sharing for Medication to Treat Chronic Conditions, 2020

LOWER WAGE WORKERS

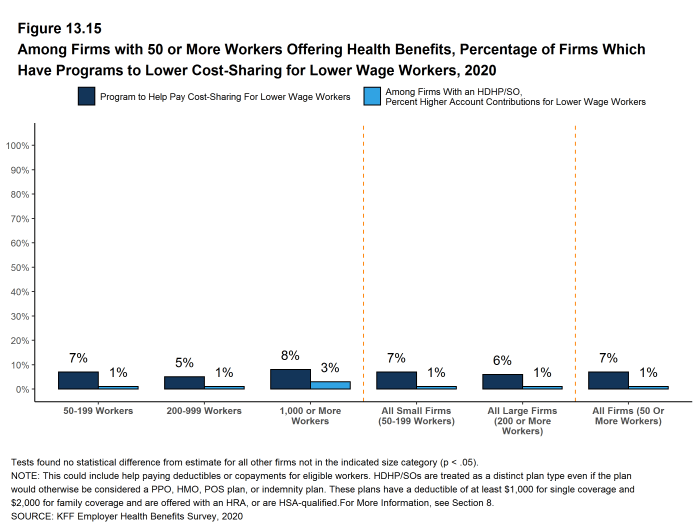

Some firms help lower-wage workers by reducing or subsidizing their cost sharing liability.

- Among employers with 50 or more employees offering health benefits, 7% have a program that reduces cost sharing for lower-wage workers. Among firms with 50 or more employees offering health benefits that make contributions to workers’ HSA or HRAs, 1% provide larger account contributions for their lower-wage workers [Figure 13.15].

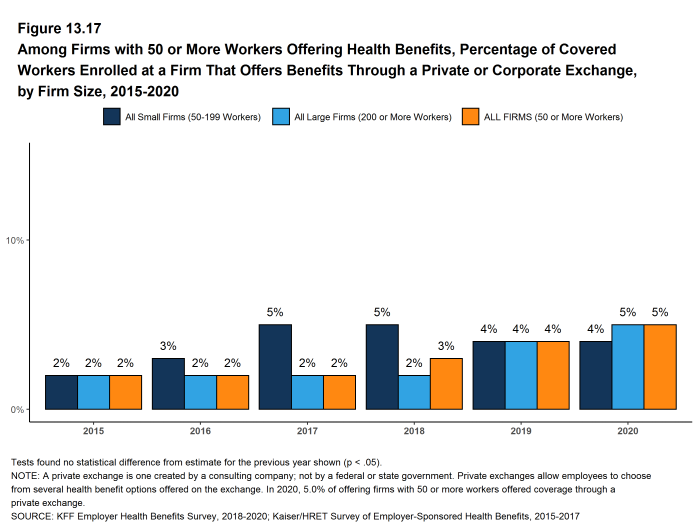

PRIVATE EXCHANGES AND DEFINED CONTRIBUTIONS

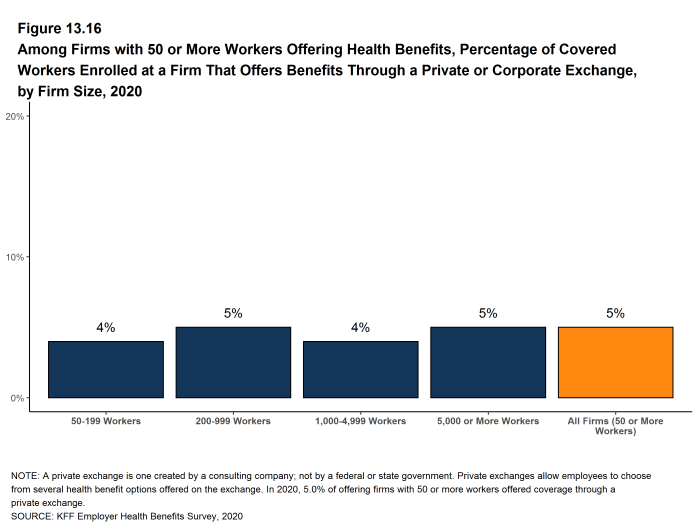

A private exchange is a virtual market that allows employers to provide their workers with a choice of several different health benefit options, often including voluntary or ancillary benefits options. Private exchanges generally are created by consulting firms, insurers, or brokers, and are different than the public exchanges run by the states or the federal government. There is considerable variation in the types of exchanges currently offered: some exchanges allow workers to choose between multiple plans offered by the same carrier while in other cases multiple carriers participate. Private exchanges have been operating for several years, but enrollment remains modest.

- Five percent of firms offering health benefits with 50 or more workers offer coverage through a private exchange. These firms provide coverage to 5% of covered workers in firms with 50 or more workers. These percentages are similar to those in 2019.

Figure 13.16: Among Firms With 50 or More Workers Offering Health Benefits, Percentage of Covered Workers Enrolled at a Firm That Offers Benefits Through a Private or Corporate Exchange, by Firm Size, 2020

Figure 13.17: Among Firms With 50 or More Workers Offering Health Benefits, Percentage of Covered Workers Enrolled at a Firm That Offers Benefits Through a Private or Corporate Exchange, by Firm Size, 2015-2020

- Internal Revenue Service. Additional Preventive Care Benefits Permitted to be Provided by a High Deductible Health Plan Under § 223 [Internet]. NOTICE 2019-45; 2019. Available from: https://www.irs.gov/pub/irs-drop/n-19-45.pdf↩︎