2013 Employer Health Benefits Survey

Section Two: Health Benefits Offer Rates

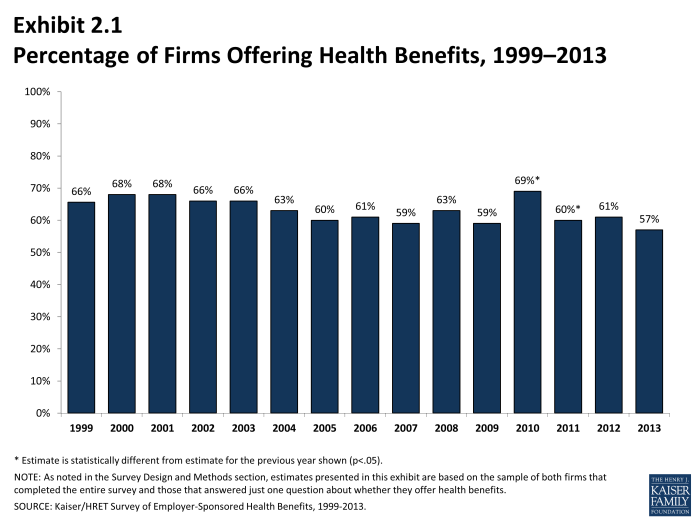

While nearly all large firms (200 or more workers) offer health benefits, small firms (3-199 workers) are significantly less likely to do so. The percentage of all firms offering health benefits in 2013 (57%) is statistically unchanged from 2012 and 2011 (61% and 60%).

- In 2013, 57% of firms offer health benefits, statistically unchanged from the 61% reported in 2012 (Exhibit 2.1).

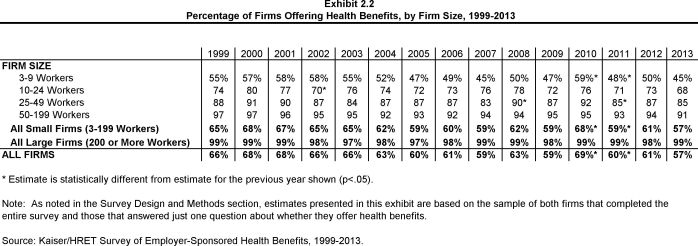

- Similar to 2012, 99% of large firms (200 or more workers) offer health benefits to at least some of their workers (Exhibit 2.2). In contrast, only 57% of small firms (3-199 workers) offer health benefits in 2013.

- Between 1999 and 2013, the offer rate for large firms (200 or more workers) has consistently remained at or above 97%. Since most firms in the country are small, variation in the overall offer rate is driven primarily by changes in the percentages of the smallest firms (3-9 workers) offering health benefits.

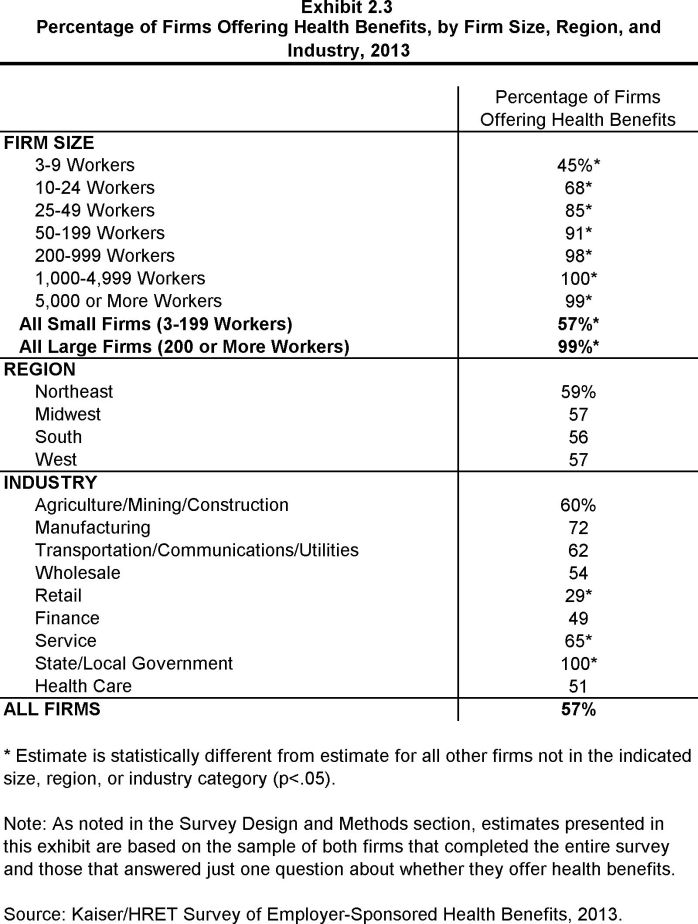

- Offer rates vary across different types of firms.

- Smaller firms are less likely to offer health insurance: 45% of firms with 3 to 9 workers offer coverage, compared to 68% of firms with 10 to 24 workers, 85% of firms with 25 to 49 workers, and 91% of firms with 50 to 199 employees (Exhibit 2.3).

- Offering rates throughout different firm size categories in 2013 remained similar to those in 2012 (Exhibit 2.2).

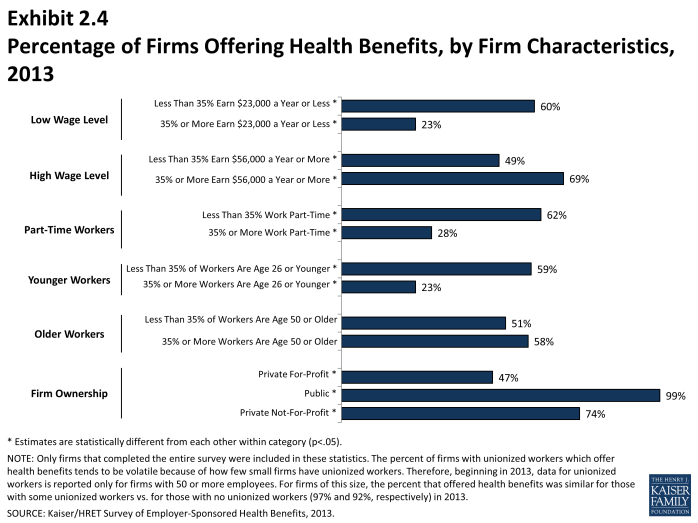

- Firms with fewer lower-wage workers (less than 35% of workers earn $23,000 or less annually) are significantly more likely to offer health insurance than firms with many lower-wage workers (35% or more of workers earn $23,000 or less annually) (60% vs. 23%) (Exhibit 2.4). The offer rate for firms with many lower-wage workers is not significantly different from the 28% reported in 2012. We observe a similar pattern among firms with many higher-wage workers (35% or more of workers earn $56,000 or more annually) (Exhibit 2.4).

- The age of the workforce significantly affects the probability of a firm offering health benefits. Firms where 35% or more of its workers are age 26 or younger are less likely to offer health benefits than firms where less than 35% of workers are age 26 or younger (23% and 59%, respectively) (Exhibit 2.4).

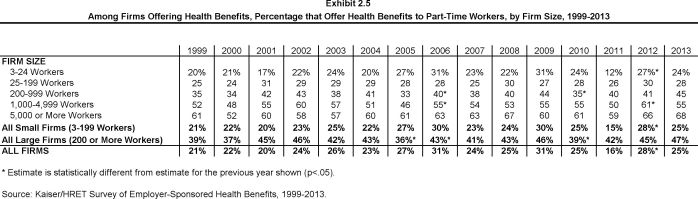

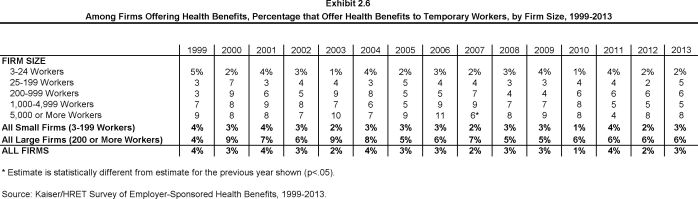

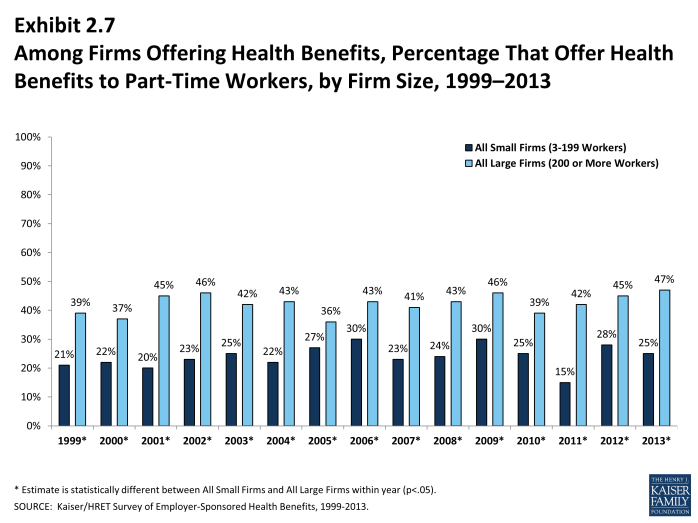

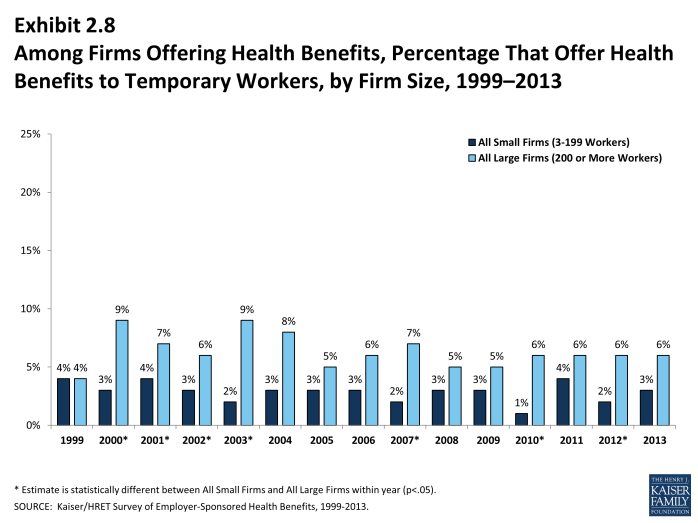

- Among firms offering health benefits, relatively few offer benefits to their part-time and temporary workers.

- In 2013, 25% of all firms that offer health benefits offer them to part-time workers, similar to the 28% reported in 2012 (Exhibit 2.5). Offering firms with 200 or more workers are more likely to offer health benefits to part-time employees than firms with 3 to 199 workers (47% vs. 25%) (Exhibit 2.7).

- Consistently, a very small percentage (3% in 2013) of firms offering health benefits have offered them to temporary workers (Exhibit 2.6). The percentage of firms offering temporary workers benefits is similar for small firms (3-199 workers) and large firms (200 or more workers) (3% vs. 6%) (Exhibit 2.8). The percentage of firms offering health benefits to temporary workers has been stable over time.

Firms Not Offering Health Benefits

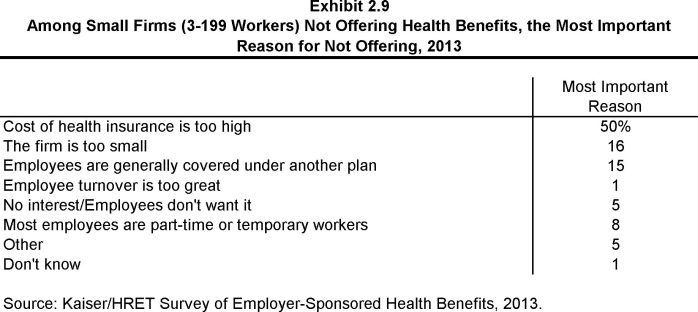

- The survey asks firms that do not offer health benefits if they have offered insurance or shopped for insurance in the recent past, and about their most important reasons for not offering. Because such a small percentage of large firms report not offering health benefits, we present responses for smaller firms (3 to 199 workers) that do not offer health benefits.

- The cost of health insurance remains the primary reason cited by firms for not offering health benefits. Among small firms (3-199 workers) not offering health benefits, 50% cite high cost as “the most important reason” for not doing so, followed by: “firm is too small” (16%) and “employees are generally covered under another plan” (15%) (Exhibit 2.9).

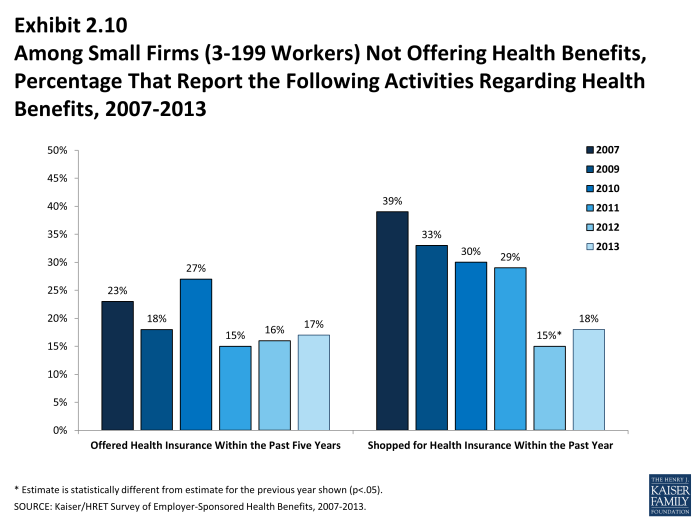

- Many non-offering, small firms have either offered health benefits in the past five years, or shopped for alternative coverage options recently.

- Seventeen percent of non-offering, small firms (3-199 workers) have offered health benefits in the past five years, while 18% have shopped for coverage in the past year (Exhibit 2.10).

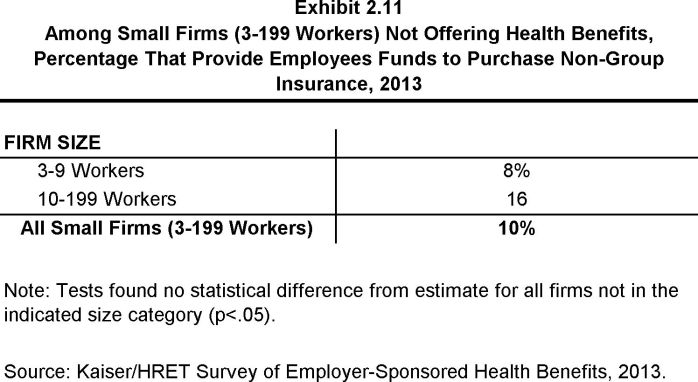

- Among non-offering, small firms (3-199 workers), 10% report that they provide funds to their employees to purchase health insurance through the individual (non-group) market (Exhibit 2.11).

Section One: Cost of Health Insurance

Section Three: Employee Coverage, Eligibility, and Participation

x

Exhibit 2.1

x

Exhibit 2.2

x

Exhibit 2.3

x

Exhibit 2.4

x

Exhibit 2.5

x

Exhibit 2.7

x

Exhibit 2.6

x

Exhibit 2.8

x

Exhibit 2.9

x

Exhibit 2.10

x