2013 Employer Health Benefits Survey

Section Ten: Plan Funding

Federal law (the Employee Retirement Income Security Act of 1974, or ERISA) exempts self-funded plans from state insurance laws, including reserve requirements, mandated benefits, premium taxes, and consumer protection regulations. Three in five covered workers are in a self-funded health plan. Self-funding is common among larger firms because they can spread the risk of costly claims over a large number of employees and dependents. Many self-funded plans use insurance, often called stoploss coverage, to limit the plan sponsor’s liability for very large claims. Almost three in five covered workers in self-funded plans are in plans with stoploss protection.

Self-Funded Plan: An insurance arrangement in which the employer assumes direct financial responsibility for the costs of enrollees’ medical claims. Employers sponsoring self-funded plans typically contract with a third-party administrator or insurer to provide administrative services for the self-funded plan. In some cases, the employer may buy stop-loss coverage from an insurer to protect the employer against very large claims.

Fully Insured Plan: An insurance arrangement in which the employer contracts with a health plan that assumes financial responsibility for the costs of enrollees’ medical claims.

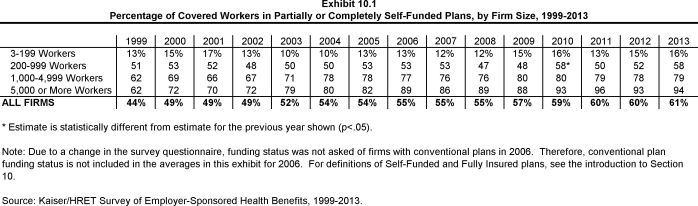

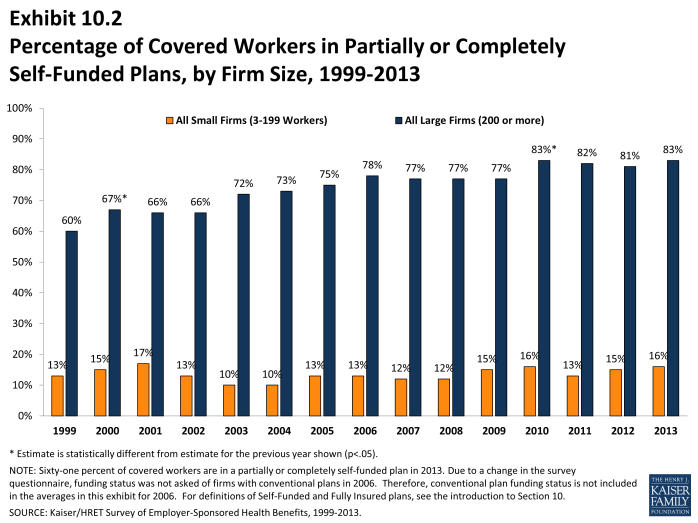

- Sixty-one percent of covered workers are in a self-funded plan, similar to the percentage reported in 2012 (Exhibit 10.1). The percentage of covered workers who are in a plan that is completely or partially self-funded has increased over time from 49% in 2000 to 54% in 2005 and to 59% in 2010.

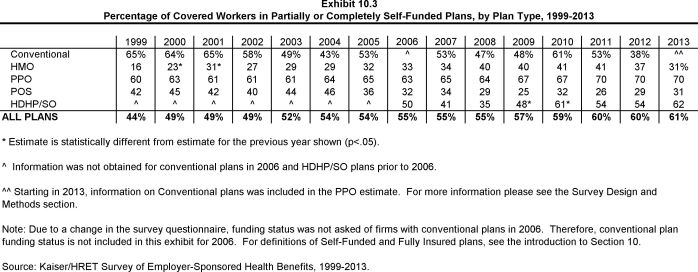

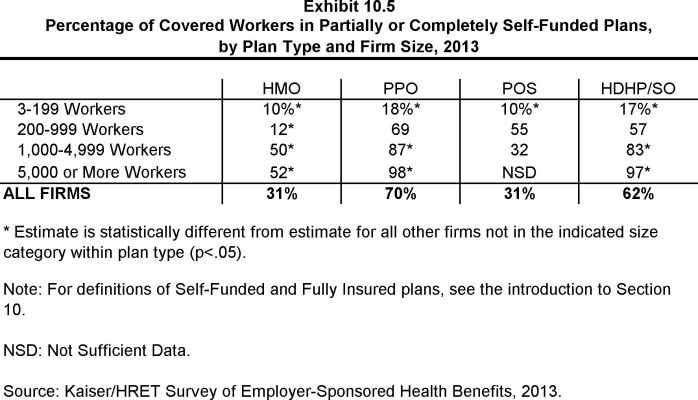

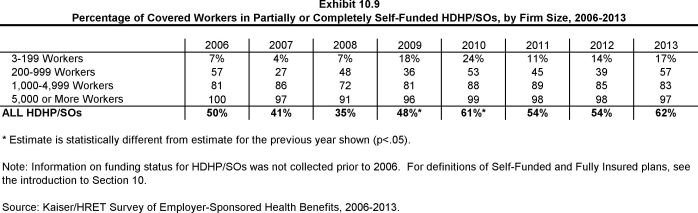

- The percentage of covered workers differs by plan type: 70% of covered workers in PPOs, 62% in HDHP/SOs, 31% in HMOs, and 31% in POS plans are in a self-funded plan (Exhibit 10.5).

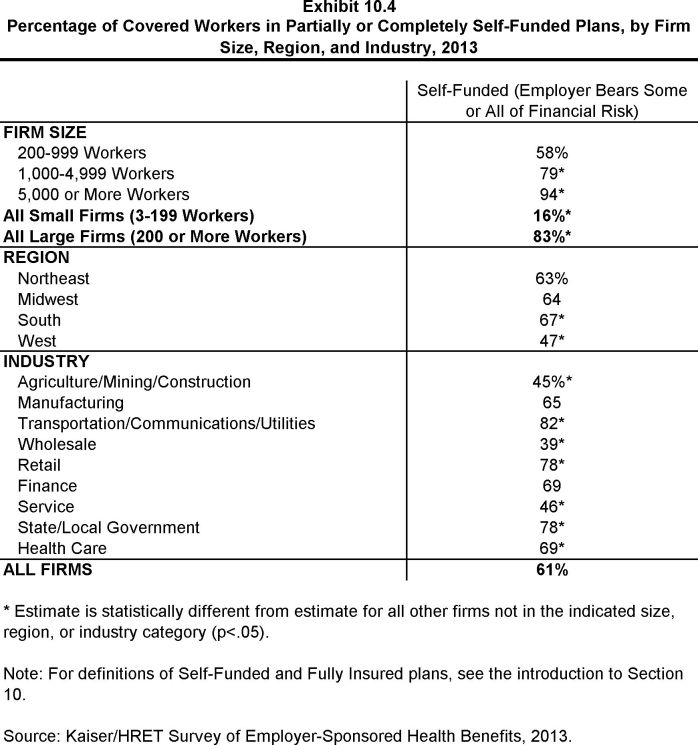

- As expected, covered workers in large firms (200 or more workers) are significantly more likely to be in a self-funded plan than covered workers in small firms (3-199 workers) (83% vs. 16%) (Exhibit 10.4). The percentage of covered workers in self-funded plans increases as the number of employees in a firm increases. Seventy-nine percent of covered workers in firms with 1,000 to 4,999 workers and 94% of covered workers in firms with 5,000 or more workers are in self-funded plans in 2013 (Exhibit 10.4).

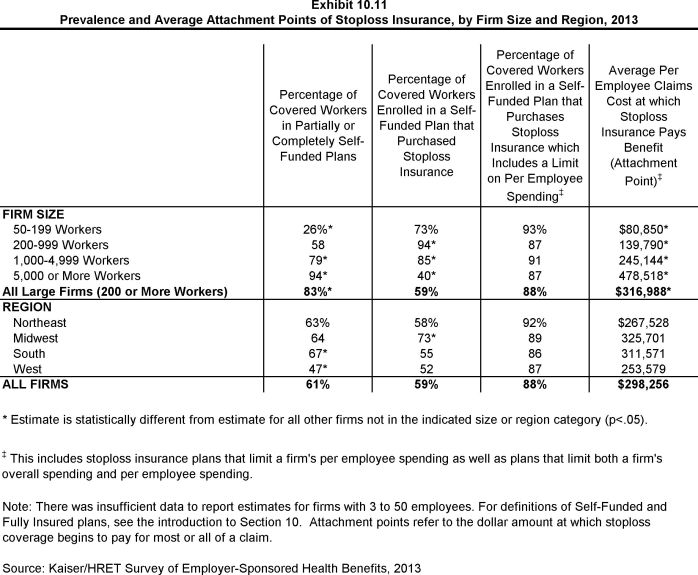

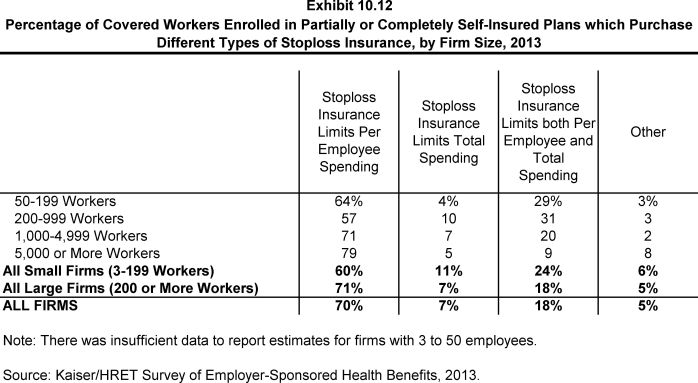

- Fifty-nine percent of workers in self-funded health plans are in plans that have stoploss insurance (Exhibit 10.10). Stoploss coverage limits the amount that a plan sponsor has to pay in claims. Stoploss coverage may limit the amount of claims that must be paid for each employee or may limit the total amount the plan sponsor must pay for all claims over the plan year.

- Eighty-eight percent of covered workers in self-funded plans that have stoploss protection are in plans where the stoploss insurance limits the amount that the plan must spend on each employee (Exhibit 10.11).1

- Firms with per enrollee stoploss coverage were asked for the dollar amount where the stoploss coverage would start to pay for most or all of the claim (called an attachment point). The average attachment point in small firms (50-199 workers) is about $96,000. For larger firms (200 or more workers), the average attachment point is about $317,000 (Exhibit 10.11).

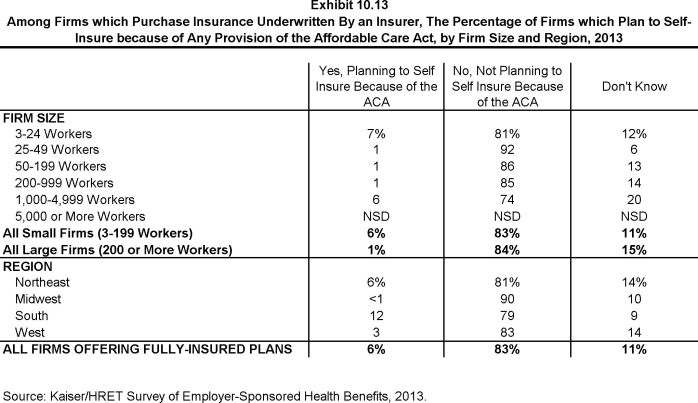

- In anticipation of major provisions of the Affordable Care Act (ACA) going into effect in 2014, firms offering health benefits were asked whether they plan to self-insure. Self-funded plans are not required to comply with the medical loss ratio or the essential health benefits rules that apply to some fully insured plans.

- Six percent of firms offering fully-insured plans reported they plan to self-insure, 83% reported that they did not plan to self-insure, and 11% did not know (Exhibit 10.13). There were no significant differences between small and large firms.