2013 Employer Health Benefits Survey

Section Thirteen: Grandfathered Health Plans

The Affordable Care Act (ACA) is bringing about a number of meaningful changes for the American health care system, including for the employer-sponsored health insurance market. While many of the most significant provisions of the ACA will begin in 2014, some are already in effect (for more information, see the health reform implementation timeline at http://www.kff.org/interactive/implementation-timeline/). The ACA exempts certain health plans that were in effect when the law was passed, referred to as grandfathered plans, from some of the new standards in the law; these include requirements to cover preventive benefits without cost sharing, have an external appeals process, or comply with the new benefit and rating provisions in the small group market. Overall, 54% of firms offering health benefits have at least one health plan that is a grandfathered plan in 2013.

Although some important provisions of the ACA will become effective sometime in 2014, we generally did not ask employers in the 2013 survey how they planned to respond to the new requirements. In many cases, rules were not finalized until after the interview process began, so employers did not have all the information necessary to formulate proper responses. We will track employer responses to changes in the market in future surveys.

Grandfathering

For the employer-sponsored market, health plans that were in place when the ACA was enacted (March 2010) can be grandfathered health plans. Interim final rules released by the Department of Health and Human Services on June 17, 2010, and amended on November 17, 2010, stipulate that firms cannot significantly change cost sharing, benefits, employer contributions, or access to coverage in grandfathered plans.1 New employees can enroll in a grandfathered plan as long as the firm has maintained consecutive enrollment in the plan.

While grandfathered plans are exempted from many of the ACA’s new requirements, they must comply with many provisions as they become effective, including: (1) provide a uniform explanation of coverage, (2) report medical loss ratios and provide premium rebates if medical loss ratios are not met, (3) prohibit lifetime and annual limits on essential health benefits, (4) extend dependent coverage to age 26, (5) prohibit health plan rescissions, (6) prohibit waiting periods greater than 90 days, and (7) prohibit coverage exclusions for pre-existing health conditions.2 Firms must decide whether to grandfather their insurance plans, which limits the changes they can make to their plans, or whether to comply with the full set of new health reform requirements.

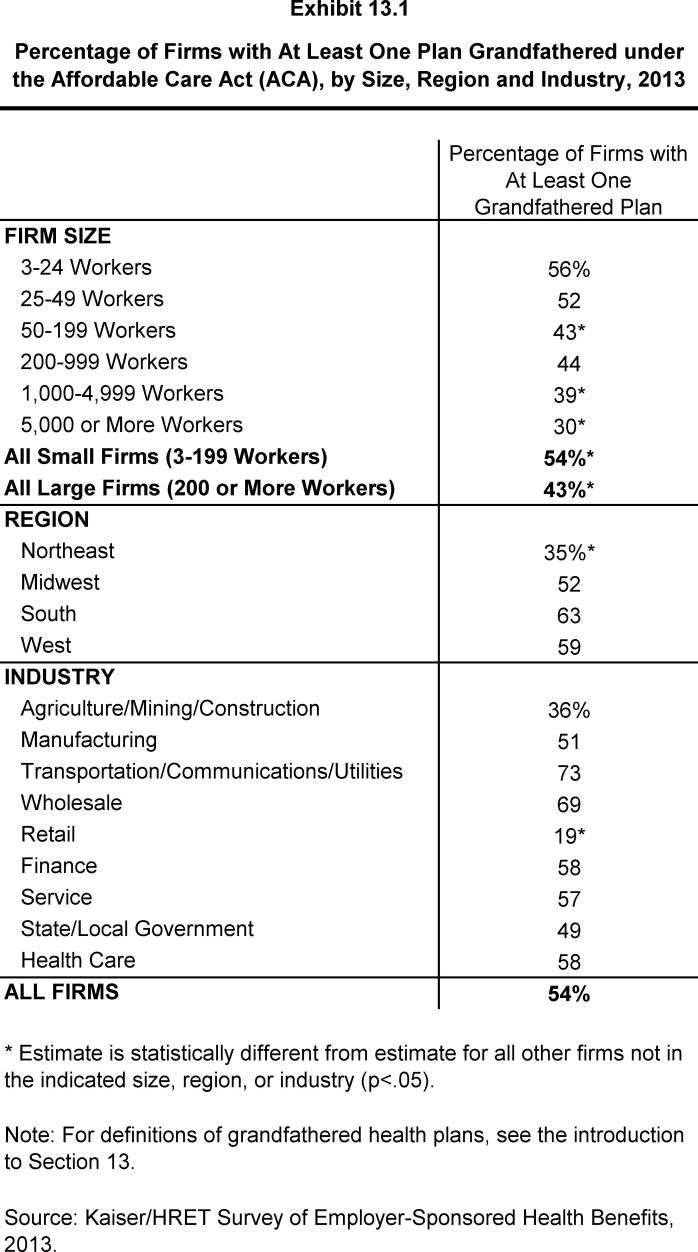

- Fifty-four percent of firms offering health benefits have at least one health plan that is a grandfathered plan in 2013 (Exhibit 13.1), similar to the 58% of offering firms with at least one grandfathered plan in 2012, but lower than the 64% in 2011.

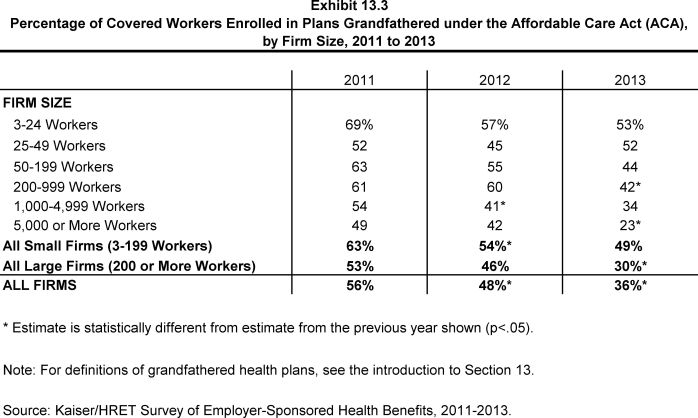

- Worker enrollment in grandfathered plans has decreased, with 36% of covered workers enrolled in a grandfathered health plan in 2013, down from 48% in 2012 and 56% in 2011 (Exhibit 13.3).

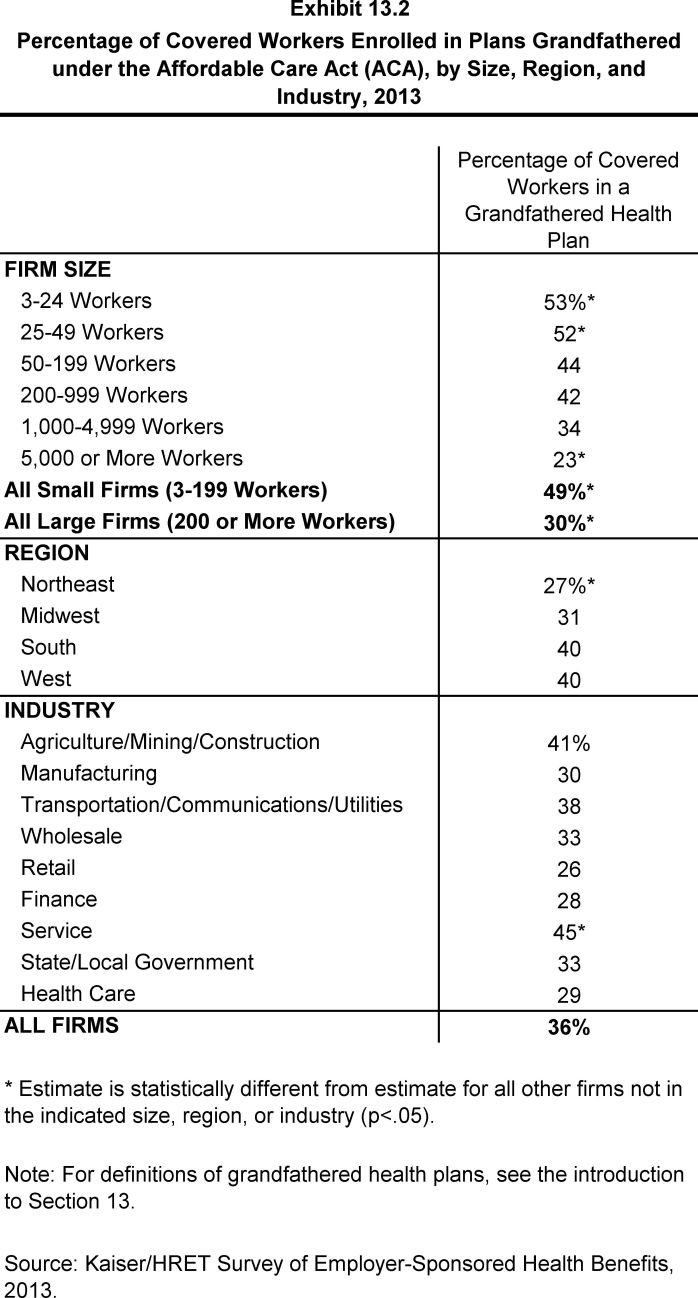

- There are differences in the percentage of covered workers enrolled in grandfathered plans by firm size and region.

- Fewer covered workers at large firms (200 or more workers) are enrolled in a grandfathered health plan than covered workers at smaller firms (30% vs. 49%).

- Fewer covered workers in the Northeast region (27%) are enrolled in grandfathered health plans than covered workers in other regions.