An Early Assessment of Hurricane Harvey’s Impact on Vulnerable Texans in the Gulf Coast Region: Their Voices and Priorities to Inform Rebuilding Efforts

Executive Summary

In late August 2017, Hurricane Harvey pummeled the Texas Gulf Coast, dropping record amounts of rainfall and causing damage with estimates ranging as high as $190 million.1 In an effort to understand the needs and circumstances of vulnerable Texans affected by the hurricane, the Kaiser Family Foundation and the Episcopal Health Foundation partnered to conduct a representative survey of adults living in 24 counties along the Texas coast that were particularly hard-hit. The survey – which was conducted between two to three months after Harvey made landfall – allows for examination of the views and experiences of residents in these counties overall, as well as in four distinct geographic regions: Harris County (the county where Houston is located and the largest in terms of population); the counties surrounding Harris that are part of the same Regional Council of Governments (“Outside Harris”); the three counties (Orange, Jefferson, and Hardin) that make up the “Golden Triangle” area east of Houston where the cities of Beaumont, Orange, and Port Arthur are located; and several counties to the southwest of Houston that make up the coastal area including Corpus Christi and Rockport (“Coastal”). In addition to the survey, the partners conducted three focus groups in Houston and two in Beaumont with low- and middle-income residents who were affected by the storm.

Key findings from the survey include:

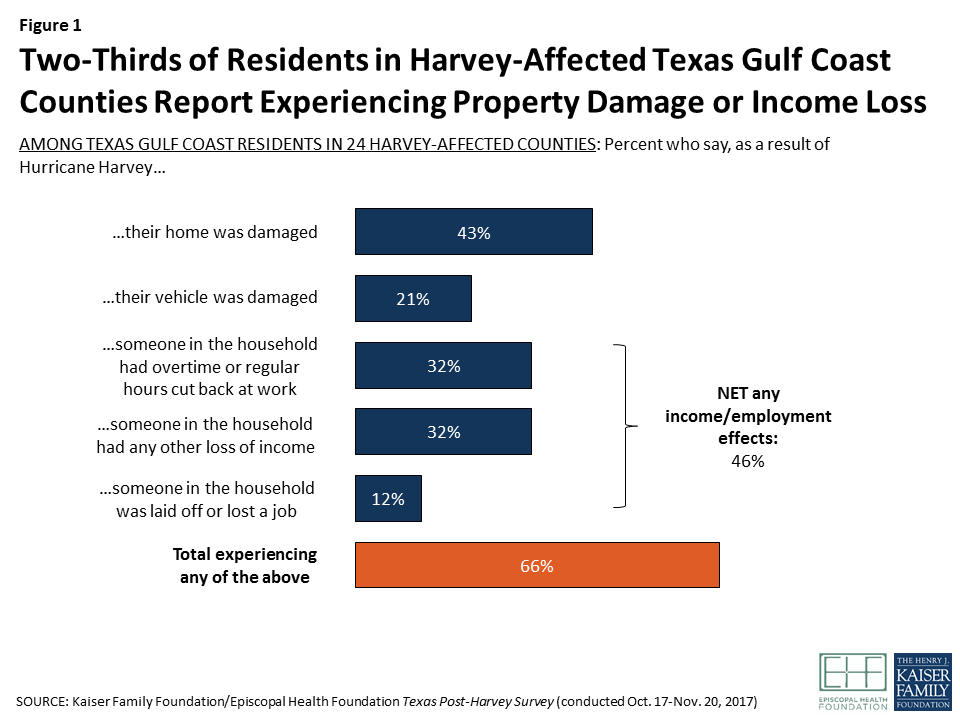

Two-thirds of residents of the 24 hard-hit Texas counties surveyed report being affected by Hurricane Harvey in terms of damage to their homes or vehicles, employment disruption, or income loss. Four in ten sustained damage to their home, nearly half experienced an interruption or loss of employment or some other loss of income, and one in five had a vehicle that was damaged. One in nine remain displaced from their homes at the time of the survey.

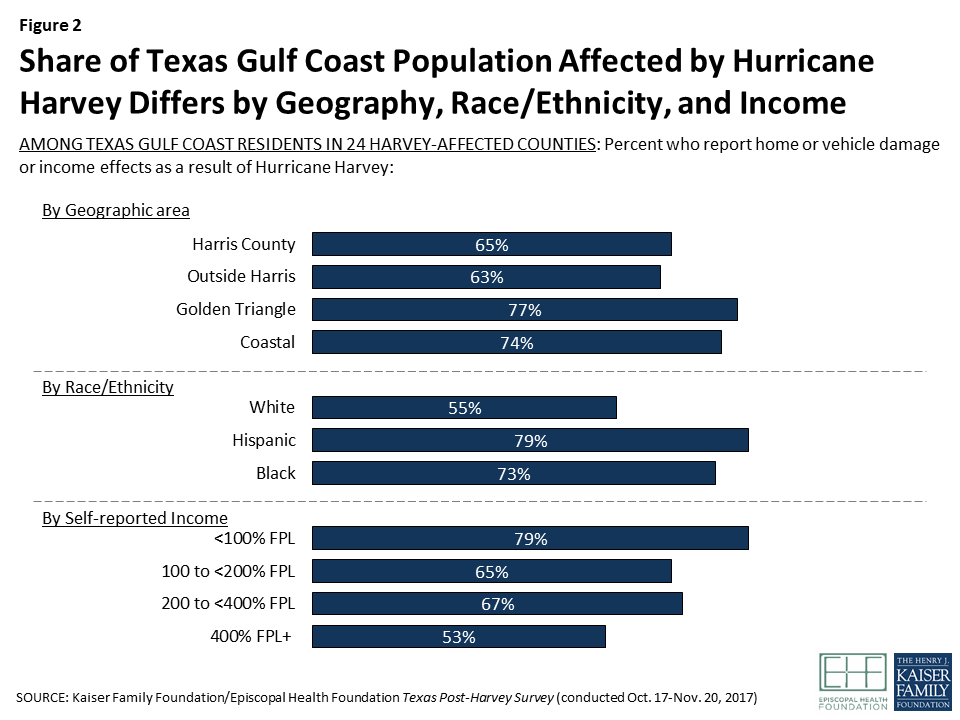

Effects of the hurricane were unevenly distributed by geography and demographics. Black and Hispanic residents, those with lower incomes, and those living in the Golden Triangle and Coastal areas were more likely to be affected by property damage or income loss than other residents.

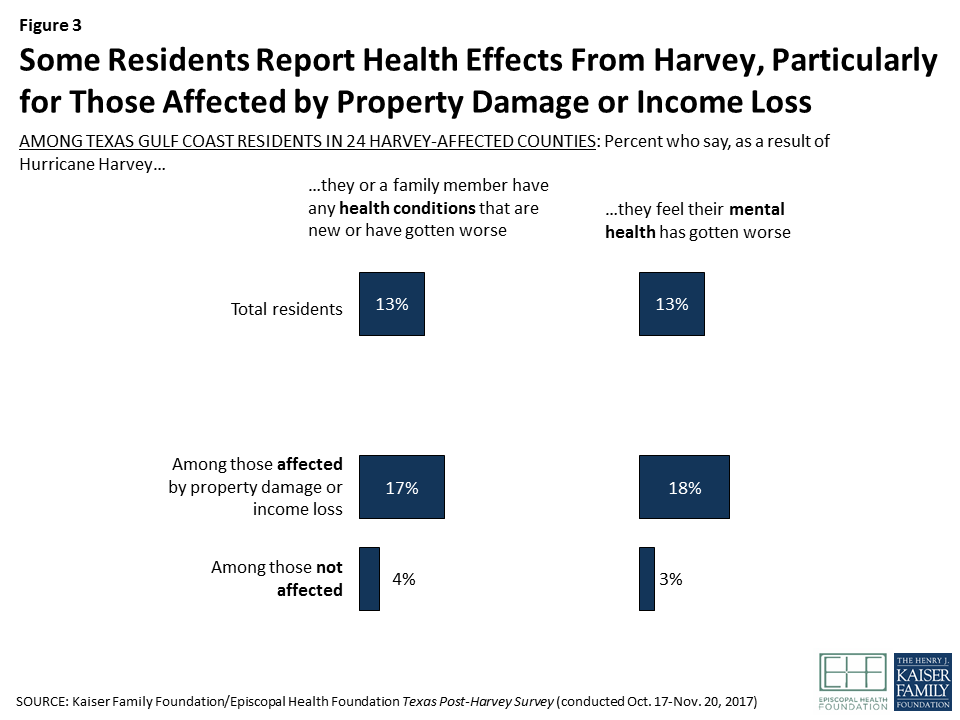

Health and mental health issues affected a smaller share of the population, but some residents report struggling to get needed health care, and focus groups suggest some may have unmet mental health needs. One in six affected residents say someone in their household has a health condition that is new or worse as a result of Harvey, and nearly two in ten feel that their own mental health is worse because of the storm. Among those with a new or worsened health condition, six in ten say they have skipped or postponed needed medical or dental care, cut back on prescriptions, or had problems getting mental health care since the storm.

About half of those who have applied for disaster assistance from FEMA or the SBA say their application is still pending or has been denied, and many of those who were denied say they were not told the reason for the denial and were not given information on how to resubmit their application. About a quarter of those whose homes were damaged say they had any flood insurance. Four in ten of those who were affected say they expect none of their financial losses to be covered by insurance or other assistance.

The financial situations of most people affected by Harvey are tenuous. About half of affected residents say they have no savings whatsoever, and another quarter say that if they lost their job or other source of income, their savings would be exhausted in less than 6 months.

Survey: Three months after Hurricane Harvey, nearly half of affected Texas residents say they are not getting the help they need to recover

Nearly half of affected residents say they are not getting the help they need to recover from the hurricane. Particular areas that stand out where residents say they need more help include applying for disaster assistance and repairing damage to their homes.

Local, county, and state governments receive high marks from residents for their response to Hurricane Harvey so far. Residents are more mixed in their views of how the U.S. Congress has responded, and responses tilt negative when it comes to President Trump’s response. Four in ten affected residents are not confident relief funds will benefit those most in need.

For the community overall, including for affected residents, the top priorities seen for the recovery focus on basic needs, including financial assistance and housing. Top priorities are getting financial assistance to those who need it, rebuilding destroyed homes, and making more affordable permanent and temporary housing available.

Key Findings: Introduction

Hurricane Harvey made landfall as a Category 4 hurricane near Rockport, Texas on August 25, 2017. Three months later, many Texans in the affected areas continue to recover and rebuild their lives and their communities from this unprecedented natural disaster.

With a record 52 inches of rainfall and massive winds in parts of the region, the flooding caused by the storm had widespread and devastating effects. A total of 41 counties in Southeast Texas were designated as federal disaster areas. As of mid-November, 888,866 individual assistance applications had been received by the Federal Emergency Management Agency (FEMA) and $8.73 billion in federal funds had been provided to affected Texans.2 In some of the hardest hit communities, many residents remain displaced from their homes, and finding continued shelter for these individuals is a major public policy concern. The storm also affected more than 1 million students and 220 school districts across the region.

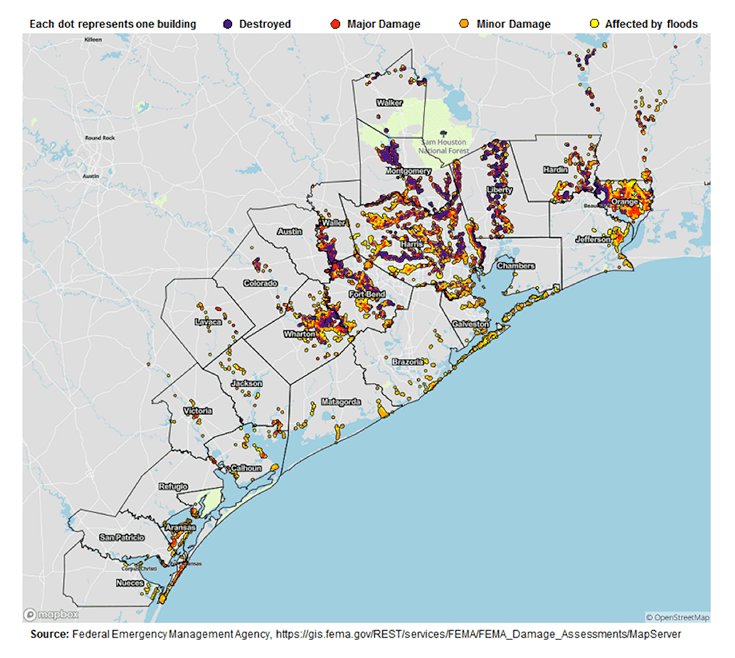

In order to provide policymakers, funders, and others working on the recovery effort with reliable information about how Texas residents were affected by Hurricane Harvey and what their needs and priorities are when it comes to recovery, the Kaiser Family Foundation and the Episcopal Health Foundation partnered to conduct a representative survey of residents in 24 counties along the Texas Gulf Coast that were heavily impacted by property damage from the storm. Both partners worked together to design the survey and analyze the results. The 24 counties were chosen based on a mapping analysis of Harvey property damage developed by FEMA (see Appendix A Figure One), in an effort to examine a contiguous area of counties that suffered the largest share of property damage. The region surveyed divides into four groupings of counties: Harris County (the county where Houston is located and the largest in terms of population); the counties surrounding Harris that are part of the same Regional Council of Governments (“Outside Harris”); the three counties that make up the “Golden Triangle” area east of Houston where the cities of Beaumont, Orange, and Port Arthur are located; and several counties to the southwest of Houston that make up the coastal area including Corpus Christi and Rockport (“Coastal”).3

These 24 counties are home to approximately 7.95 million people, which represents 94 percent of the total population in the 41 counties that were declared as federal disaster areas. This region is incredibly diverse in terms of race and ethnicity (40 percent White, 36 percent Hispanic, 16 percent Black, six percent Asian, and two percent others). On average about 15 percent of the people in the affected region are officially designated as living in poverty, with wide variations in poverty across the counties.4 These counties are also diverse in their population density; eight of the counties we surveyed were designated as rural counties and 16 as urban counties.

The survey was designed to represent the views of residents living in the region overall, and also be able to describe the views and experiences of those living in each of the four regions. In order to represent some of the most vulnerable groups affected by the storm, the survey also included oversamples of lower-income residents, Black and Hispanic residents, and those living in the areas that had the largest amount of property damage as reported by FEMA. Results for the region overall have been weighted to reflect the demographics of the overall population. The survey was fielded from late October through late November, roughly two to three months after Harvey made landfall.

In addition to the survey, the partners conducted five focus groups (three in Houston and two in Beaumont) on October 8 and 9 with lower- and middle-income residents who experienced damage to their homes and/or a loss of income as a result of Hurricane Harvey. The focus group findings highlighted in this report help provide context and add the human story behind some of the quantitative findings from the survey.

Key Findings: Section 1: The Big Picture: Who Was Affected By Harvey And How?

Housing, Property Damage, Employment, and Income Effects

Hurricane Harvey left a trail of physical destruction along the Texas Gulf Coast, and the survey finds that a large share of area residents felt the effects in their own lives. Overall, two-thirds of adults in the 24 Texas Gulf Coast counties surveyed say they were adversely affected by the hurricane, either because their home or vehicle was damaged or because they or a family member in their household experienced the loss of a job, decreased wages, or other lost income.

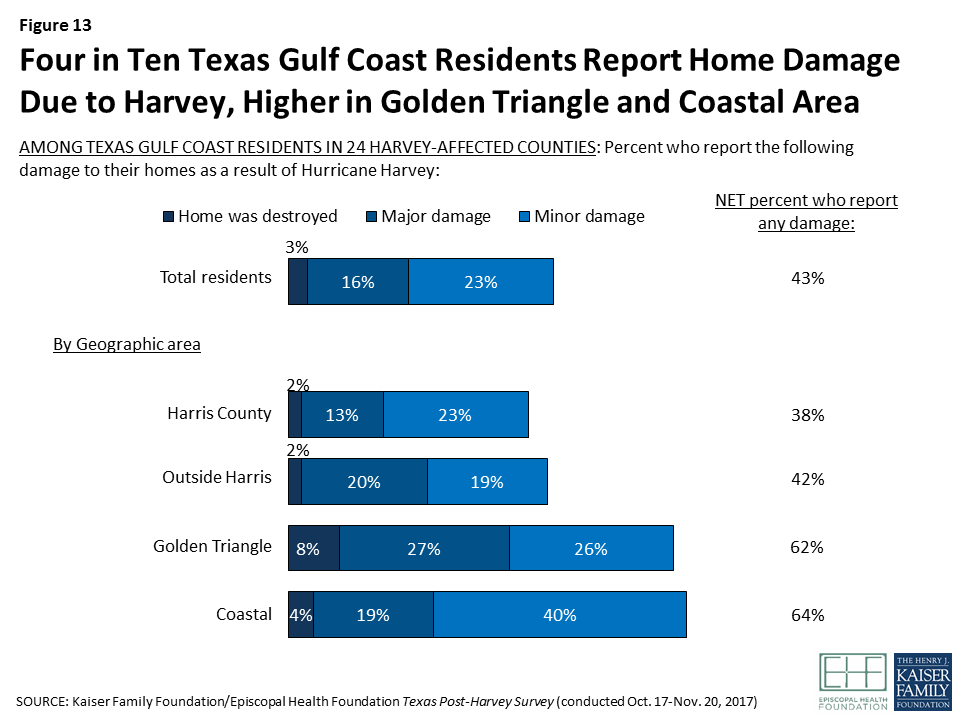

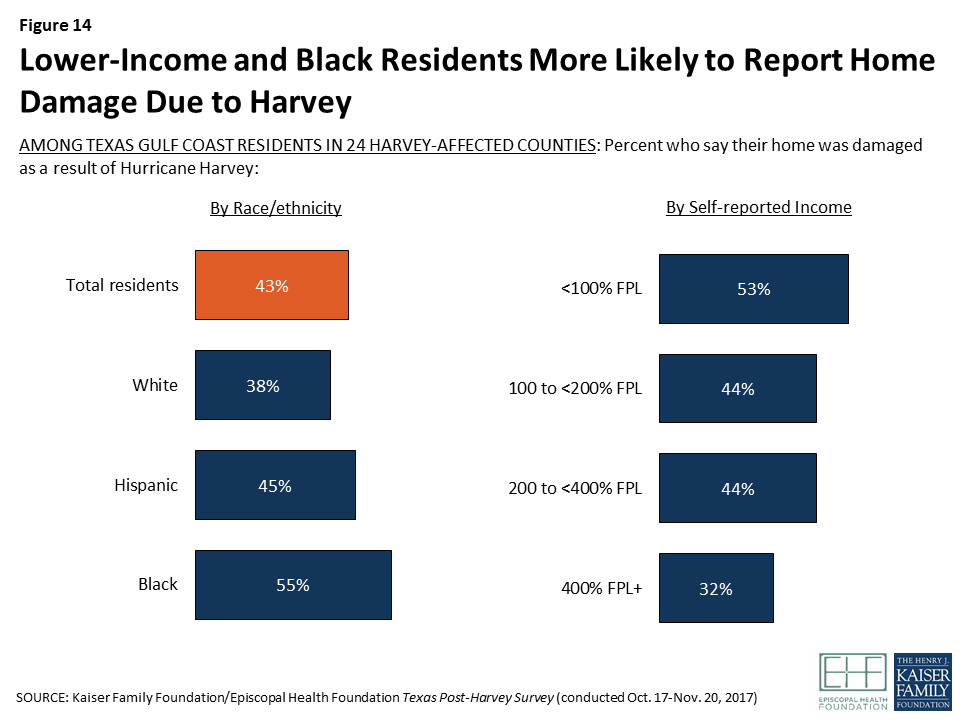

More specifically, more than four in ten residents (43 percent) report that their home was damaged, including one in five who say their home had major damage (16 percent) or was completely destroyed (3 percent). About one in five (21 percent) also say they owned a vehicle that was damaged or destroyed by Harvey. Nearly half (46 percent) say they or someone in their household experienced employment-related effects of the hurricane, including losing a job or being laid off (12 percent), having hours cut back at work (32 percent), or some other loss of income such as from a small business or unpaid missed days of work (32 percent).

For more detail on residents’ housing and transportation situation, see Section 4For more detail on residents’ employment and financial situation, see Section 5

The effects of Hurricane Harvey were felt more heavily in some communities than others. Geographically, those in the Golden Triangle (77 percent) and Coastal counties (74 percent) were more likely to report being affected than those in Harris County and the counties that surround it (65 percent and 63 percent, respectively), with differences largely driven by higher rates of property damage. Effects were also distributed unevenly across demographic groups, with Black and Hispanic residents and those with lower incomes more likely to report being affected. For Hispanics, this disparity is largely driven by higher rates of employment- related effects, while for Blacks it is driven both by employment effects and by higher rates of damage to their homes and vehicles. Not surprisingly, those with lower incomes – who are less likely to hold salaried jobs and more likely to work on an hourly or contract basis – are more likely to report adverse effects on employment and income as a result of the storm. However, the income disparity is not limited to employment effects; lower- and middle-income individuals are also more likely to report damage to their homes compared to those with higher incomes.

| Table 1: Detailed Effects of Hurricane Harvey by Geographic Region, Race/Ethnicity, and Income | |||||||||||

| Percent who report the following as a result of Hurricane Harvey: | Geographic Region | Race/Ethnicity | Self-reported Income(% of FPL) | ||||||||

| Harris County | Outside Harris | Golden Triangle | Coastal | White | Black | Hisp. | <100 | 100 to <200 | 200 to <400 | 400+ | |

| Home was damaged (NET) | 38% | 42% | 62% | 64% | 38% | 55% | 45% | 53% | 44% | 44% | 32% |

| Major damage/ destroyed | 15 | 22 | 35 | 23 | 21 | 23 | 16 | 22 | 20 | 19 | 17 |

| Minor damage | 23 | 19 | 26 | 40 | 16 | 32 | 29 | 31 | 24 | 24 | 14 |

| Vehicle was damaged | 24 | 15 | 32 | 14 | 16 | 30 | 23 | 25 | 23 | 20 | 18 |

| Someone in household experienced income/job loss | 49 | 40 | 46 | 44 | 31 | 46 | 65 | 59 | 50 | 48 | 29 |

| NET Affected in any of above ways | 65 | 63 | 77 | 74 | 55 | 73 | 79 | 79 | 65 | 67 | 53 |

Since race and income are correlated, it can be difficult to determine whether the disparities in storm-related effects are driven more by one factor or the other. Our analysis indicates that both race/ethnicity and income play a role, but that some racial and ethnic differences persist regardless of income. For example, Hispanic residents at both higher and lower income levels are more likely than their white counterparts to say someone in their household experienced employment-related disruptions as a result of the storm – specifically having hours cut back at work. Nearly six in ten (58 percent) Hispanics who report incomes below 200 percent of the federal poverty level (FPL) say this happened, compared with three in ten lower-income Blacks (31 percent) and two in ten lower-income whites (19 percent). And for those with self-reported incomes above 200 percent of poverty, Hispanics are almost twice as likely as whites to say a family member had their hours cut back (37 percent versus 20 percent).5

| Table 2: Percent Reporting Different Effects from Hurricane Harvey by Race and Income | |||||

| Percent who report the following as a result of Hurricane Harvey: | Self-reported Income <200% FPL | Self-reported Income 200% FPL or higher | |||

| White | Hispanic | Black | White | Hispanic | |

| Home was damaged | 46% | 48% | 59% | 35% | 42% |

| Vehicle was damaged | 16 | 25 | 32* | 17 | 20 |

| Someone in household was laid off or lost a job | 14 | 17 | 22 | 5 | 6 |

| Someone in household had hours cut back at work | 19 | 58* | 31* | 20 | 37* |

| Someone in household had other loss of income | 31 | 45* | 37 | 19 | 36* |

| NET Affected in any of above ways | 61 | 82* | 74* | 53 | 71* |

| Note: * indicates statistically significant difference from white residents in the same income category. | |||||

Effects on Physical and Mental Health

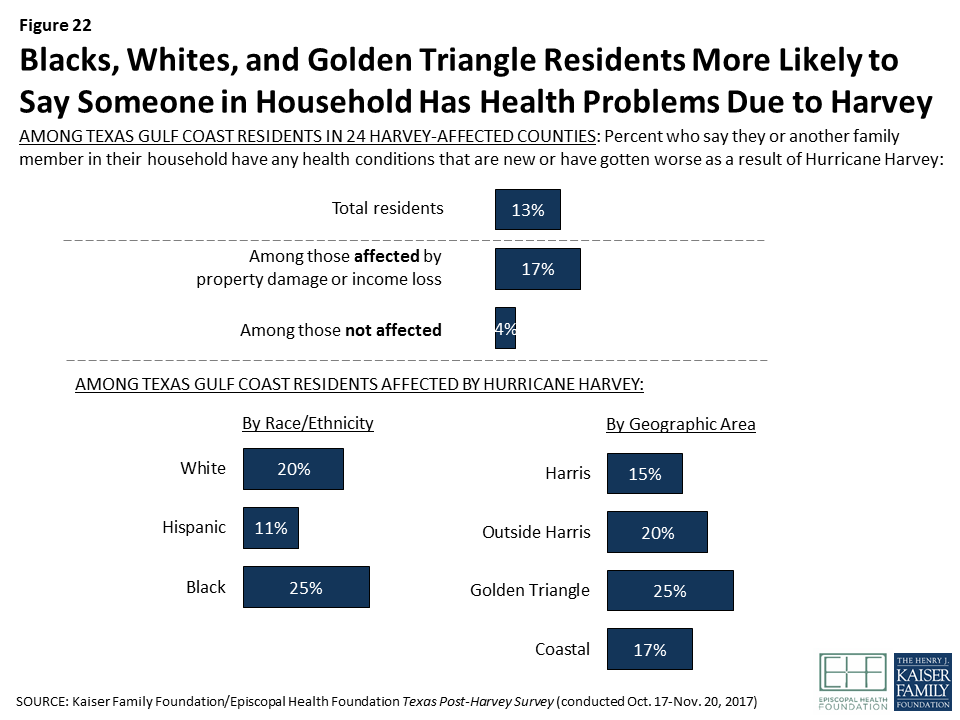

In addition to the reported effects on people’s finances and living situations, some residents also report problems with their physical and mental health as a result of Hurricane Harvey. Overall, 13 percent of residents in the 24-county area (including 17 percent of those who suffered property damage or income losses and 4 percent of those who did not) say someone in their household has a health condition that is new or has gotten worse as a result of Harvey. Similarly, 13 percent of all residents (including 18 percent of those who suffered property or income losses and 3 percent of those who did not) feel that their own mental health has gotten worse as a result of the hurricane.

For more detail on residents’ health care challenges, see Section 6

Key Findings: Section 2: Are Affected Residents Getting The Help They Need?

Residents’ General Level of Recovery

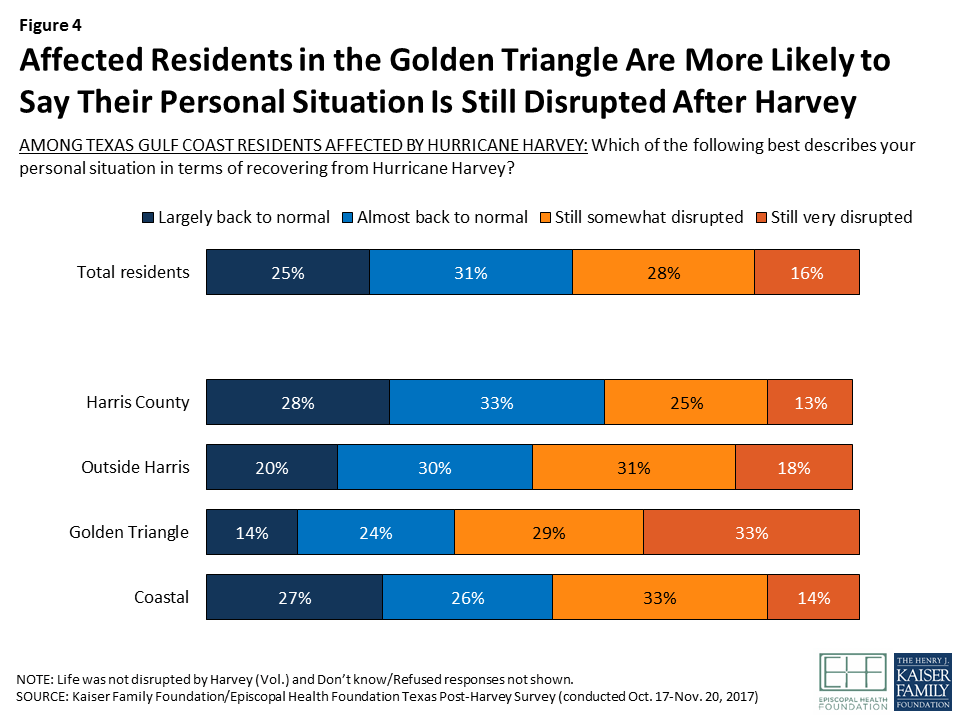

Three months after the storm, residents’ self-reported level of recovery from Hurricane Harvey is somewhat mixed. Among those who were affected by property damage or income loss from the storm, just over half say their lives are largely (25 percent) or almost back to normal (31 percent), while about four in ten say their lives are still somewhat (28 percent) or very disrupted (16 percent). Once again, those living in the Golden Triangle area appear to be the hardest hit, with roughly six in ten affected residents saying their lives are still somewhat (29 percent) or very disrupted (33 percent).

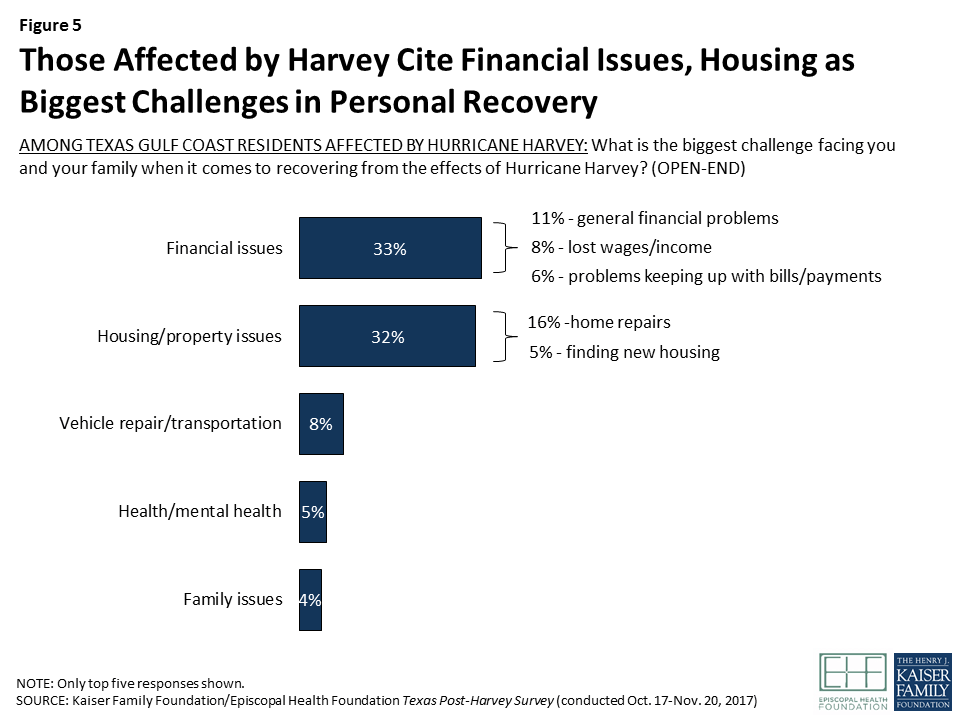

When asked to name in their own words the biggest challenge facing their family in recovering from Hurricane Harvey, affected residents focus on basic needs like housing and financial stability. One-third (33 percent) say their biggest challenges are financial, including general financial problems (11 percent), making up lost wages (8 percent), and problems keeping up with bills (6 percent). Another third (32 percent) mention housing-related challenges, including 16 percent who mention home repairs and 5 percent who mention trying to find a new living situation. Eight percent mention transportation issues including the need to repair or replace a vehicle, five percent mention health challenges, including mental health or stress, and four percent name family-related issues.

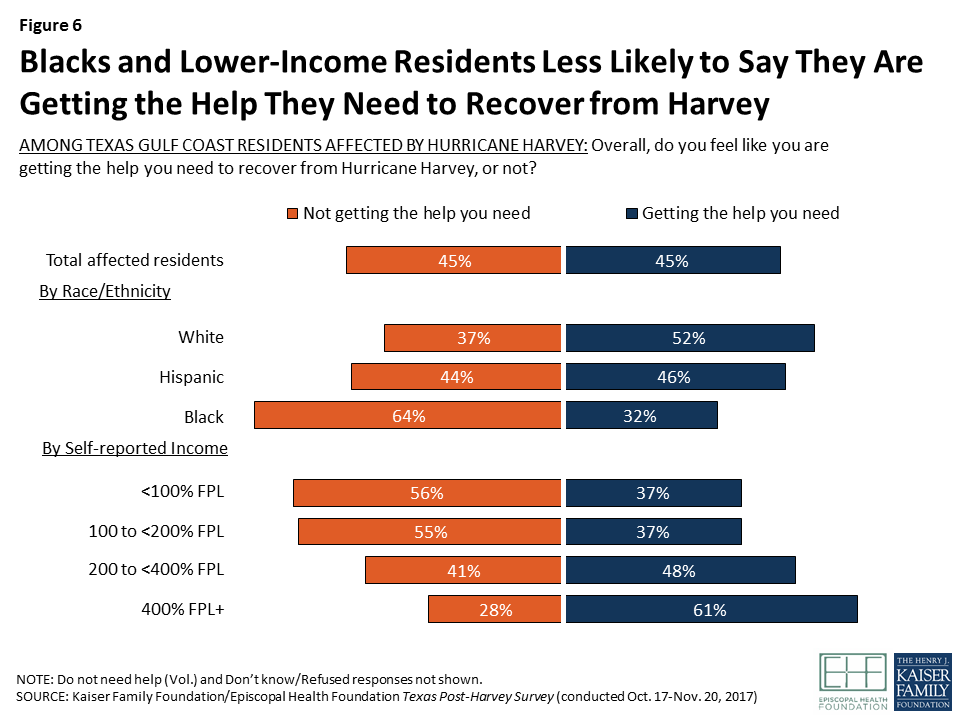

The survey shows there is room for progress in getting needed help to affected residents. Nearly half (45 percent) of those who were affected in terms of property damage or income loss say they are getting the help they need to recover from Hurricane Harvey, while an equal share (45 percent) say they are not. Here, too, progress is uneven, with Black residents and those with lower incomes more likely to say they’re not getting the help they need.

Experiences with Disaster Assistance

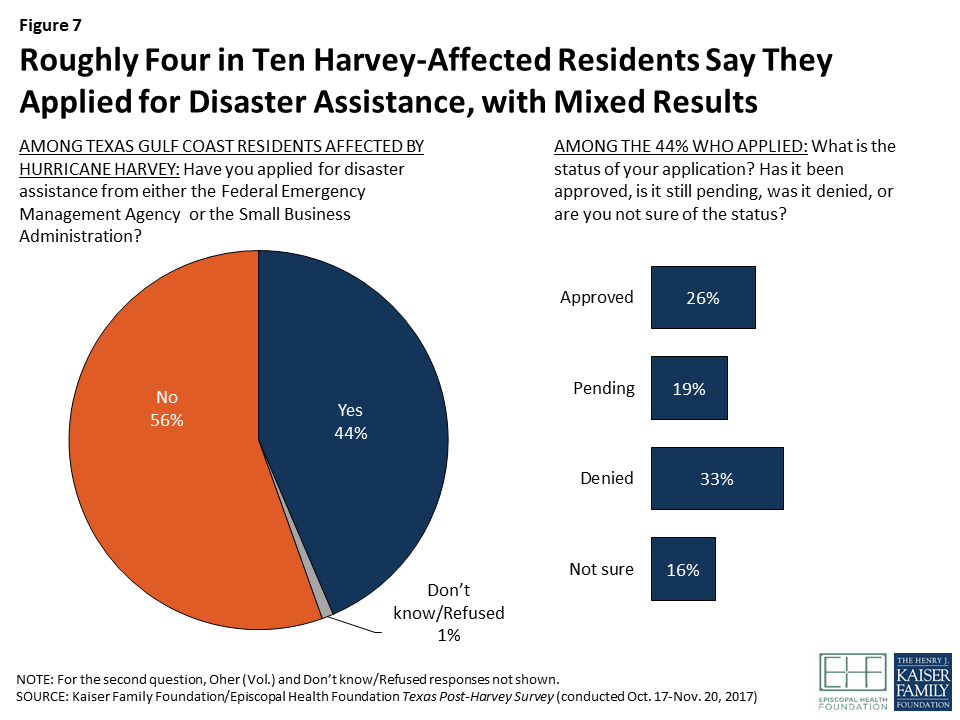

One major source of help for people affected by natural disasters in the U.S. is disaster assistance provided by the Federal Emergency Management Agency (FEMA) and low-interest loans provided by the U.S. Small Business Administration (SBA). Overall, about four in ten (44 percent) residents who were affected by Hurricane Harvey, including 59 percent of those whose homes were damaged, say they have applied for assistance from FEMA or the SBA. Among those who applied, one quarter (26 percent) say their application has been approved and one-third (33 percent) say it was denied. Another 19 percent say their application is still pending, and 16 percent are not sure of the status.

Among those who applied for assistance from FEMA or the SBA, those who report incomes at least four times FPL (45 percent) and those whose home had major damage or was destroyed (36 percent) are more likely to say their application was approved. In addition, white and Hispanic residents who applied for assistance are more likely than Black residents who applied to say their application was approved (34 percent, 28 percent, and 13 percent, respectively).

Among the 30 percent of those who applied for FEMA or SBA assistance who say their application was denied, four in ten (38 percent) say they were not told why their application was denied, and six in ten (59 percent) say they were not given information on how to revise and resubmit their application.

When those who did not apply for FEMA assistance were asked why they did not apply, most (63 percent) said they had only minor damage or did not feel they needed the help. However, some said they lacked information about how to apply (12 percent), they didn’t think they would qualify (8 percent), or they thought it would be too much hassle or too difficult to go through the process (5 percent).

Focus group highlight: Disaster assistance

The focus group discussions indicated that there is a lot of confusion and misinformation among affected residents about the different ways to get assistance. Participants were frustrated by the bureaucracy of applying for help, which they don’t feel they have time for while taking care of their families, trying to find work, and rebuilding their homes (a few participants said it took at least 3 hours of waiting to speak with a live operator on a FEMA call). There was also the perception that FEMA adjusters were temporary hires, not well-trained or familiar with the affected communities, and that your likelihood of getting approved for assistance depended on the particular adjuster who visited your home.

In the Hispanic groups in particular, there was a resistance to taking out loans that they’d be repaying for many years. Many thought that SBA loans would come with high interest rates. Others were frustrated that in order to get an SBA loan you need to have money in the bank and a minimum credit score, which many of them did not have, and some undocumented immigrants mentioned the need to have a social security number to apply. These discussions suggest that people could benefit from navigators to understand the different sources of help (FEMA, SBA, Red Cross and other charities) and to navigate the application and appeals process.

“And then the FEMA lines are, you can’t even get through. Then you have to go through the whole process with FEMA. They may still come out and, just like [indicates another focus group participant], I was denied just like him. Right now, even if I want to try and go through a whole process to even fight with FEMA, I have to go through a whole entire appeal. My roof is still…there’s still big bubbles in the roof.” – 40-year-old Black female, Houston

“They came to my house and they walked [around] my house and saw the damage. And they gave me $364.29. I know people who didn’t have as much damage as I had that got thousands… I think it just all depends on the person that came to your house. The man that came to my house, he was like giving us real serious. He wasn’t caring, he wasn’t compassionate. He was in and out. But I have a friend that had a lady and she was very nice. She came and walked through the house. She was compassionate. She didn’t even have as much damage as I did and she got like $2500.” – 59-year-old Black female, Beaumont

“There’s a certain way you have to answer it [the application for assistance]. If you answer one question [ wrong ], even if you misunderstood or didn’t understand it or comprehend the question, they deny you.” – 29-year-old Hispanic male, Beaumont

“If FEMA was referring us to the Small Business Loan, why do have to have all this credit score and amount of money saved up? We could go through a regular bank.” – 40-year-old Black female, Houston

Areas where Additional Help is Needed

Related to this confusion around accessing FEMA benefits, the most common area in which residents say they need more help is applying for disaster assistance, with 34 percent of affected residents saying they need help in this area. A close second is repairing damaged homes, an area in which 29 percent of affected residents say they need assistance. Some also say they need help finding affordable permanent or temporary housing, finding a job, getting transportation, and accessing medical care and mental health care. For most of these areas, Black residents, those with lower incomes, and those in the Golden Triangle area are more likely than others to say they need more help.

| Table 3: Many Affected Residents Say They Need Help in Different Areas | ||||

| Percent of those AFFECTED by Harvey who say they need more help in each area: | Total affected residents | Golden Triangle | Self-reported Income <200% FPL | Black residents |

| Applying for disaster assistance | 34% | 47% | 43% | 55% |

| Repairing damage to home | 29 | 52 | 35 | 38 |

| Finding affordable permanent housing | 17 | 25 | 23 | 27 |

| Getting medical care | 17 | 22 | 26 | 27 |

| Finding temporary housing | 13 | 24 | 20 | 24 |

| Finding a job | 13 | 17 | 20 | 19 |

| Getting transportation | 10 | 12 | 15 | 23 |

| Getting mental health care | 10 | 13 | 14 | 21 |

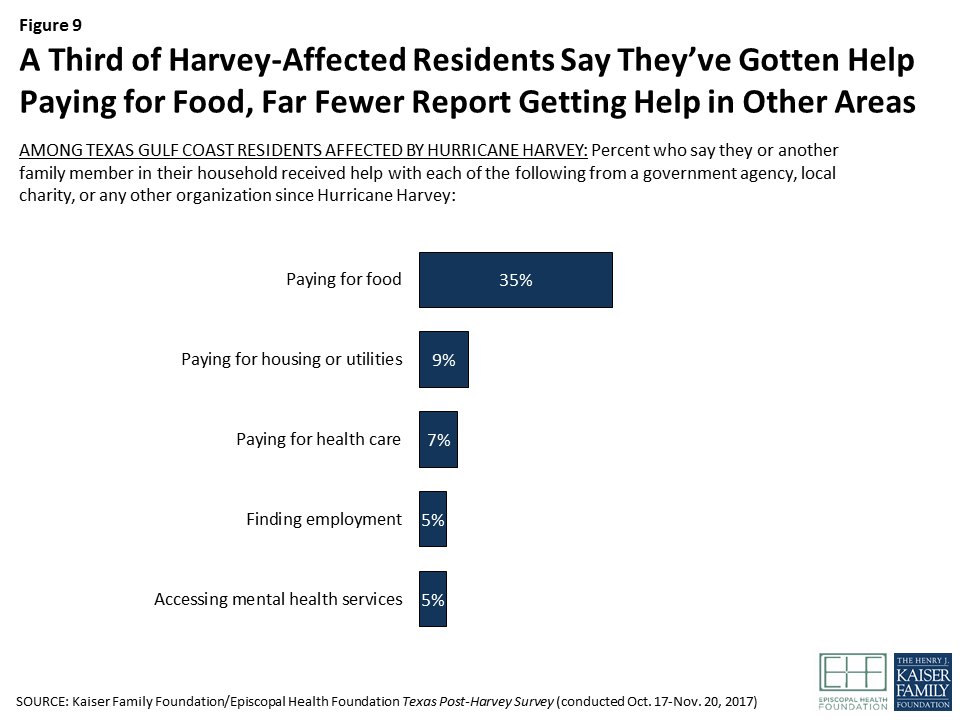

When asked about the different types of help they may have received from government agencies, local charities, or other organizations, about a third of affected residents (35 percent) say they’ve gotten help paying for food, including half (51 percent) of those living in the Coastal region and 41 percent living in the Golden Triangle area. Much smaller shares of affected residents say they’ve gotten help paying for housing or utilities (9 percent), paying for health care (7 percent), finding employment (5 percent), or accessing mental health services (5 percent).

Key Findings: Section 3: What Do Residents See As The Biggest Priorities For Recovery, And How Do They Rate The Local, State, And Federal Response?

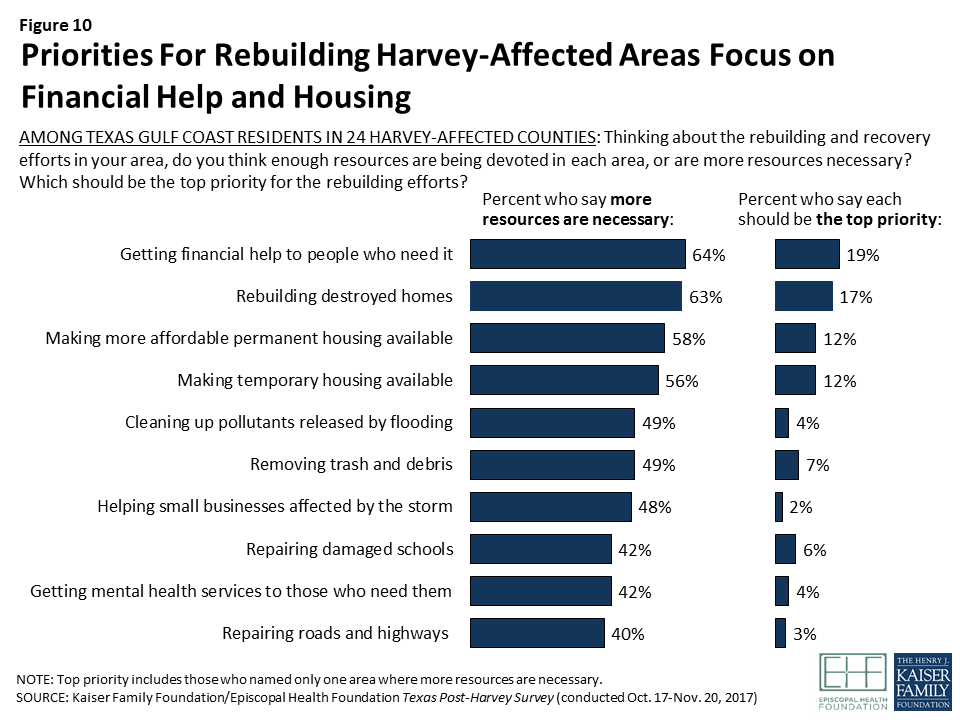

When asked about priorities for rebuilding and recovery in their area, Texas Gulf Coast residents – including those who were affected by the hurricane and those who weren’t – identify many areas where more resources are needed, with the largest focus being on financial help and housing for those in need. The highest-ranking priority overall is getting financial help to people who need it; 64 percent say more resources are necessary in this area and when forced to choose, 19 percent pick it as the top priority. A close second is rebuilding destroyed homes (63 percent say more resources are necessary and 17 percent choose it as the top priority). Ranking third and fourth are making more affordable permanent and temporary housing available, with nearly six in ten saying more resources are necessary and 12 percent choosing each as the top priority. About half also say more resources are needed in cleaning up pollutants released by the flooding (49 percent), removing trash and debris (49 percent), and helping small businesses affected by the storm (48 percent), while about four in ten say the same about repairing damaged schools (42 percent), getting mental health services to those who need them (42 percent), and repairing roads and highways (40 percent). Ranking of priorities is similar when looking at responses only among those who were directly affected by the storm.

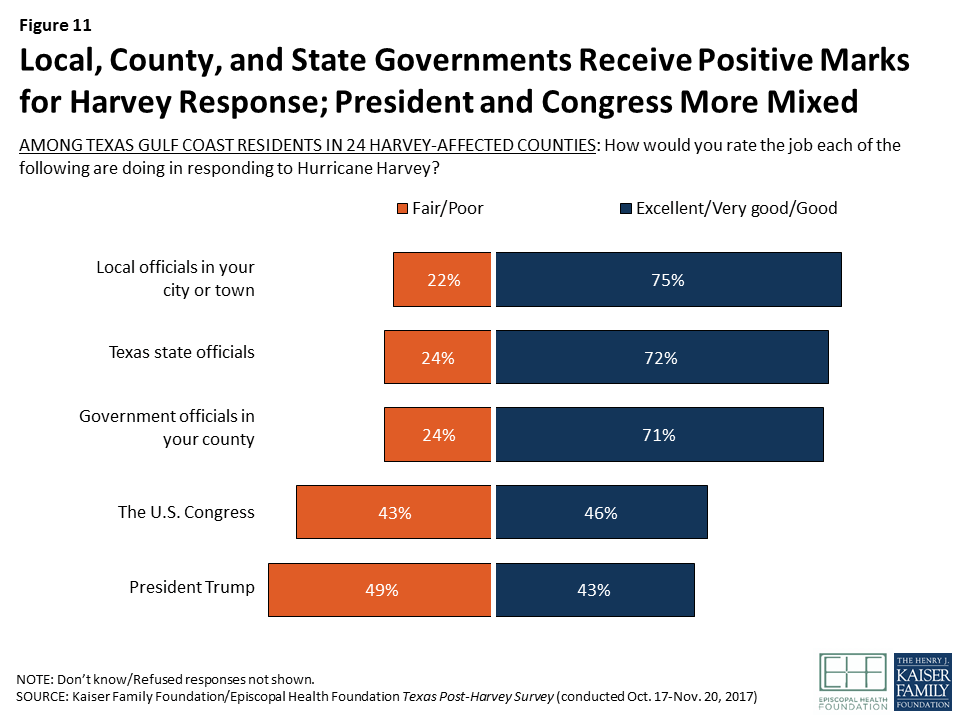

Looking at residents overall – including those who were affected by the storm and those who weren’t – most give their local, county, and state governments positive marks for the job they’re doing responding to Hurricane Harvey, with about seven in ten saying each is doing an excellent, very good, or good job. Ratings are more divided when it comes to the U.S. Congress, with 46 percent saying they’re doing at least a good job and 43 percent saying they’re doing a fair or poor job. Ratings are more negative for President Trump, with half (49 percent) saying the president is doing a fair or poor job responding to the hurricane and about four in ten (43 percent) giving him positive ratings.

Among those who were directly affected by the storm, views of the government’s response are similar, but tend to lean more negative than among the public overall. In particular, affected residents living in the Golden Triangle area, the counties surrounding Harris County, are more likely than those living in Harris and the Coastal counties to say each level of government is doing a fair or poor job responding to the hurricane. For example, about four in ten residents of the Golden Triangle and the counties surrounding Harris say that government officials in their county are doing a fair or poor job responding to Harvey, compared with about a quarter in Harris County and the Coastal counties. The exception to this pattern is in ratings of President Trump, whom Harris County residents rate more negatively than others.

| Table 4: Ratings of Government Response to Harvey Among Those Directly Affected | |||||

| Percent of those AFFECTED by Harvey who say each is doing a “fair” or “poor” job responding to Hurricane Harvey: | Total affected residents | Harris County | Outside Harris | Golden Triangle | Coastal |

| Local officials in your city or town | 25% | 22% | 31% | 35%* | 23% |

| Government officials in your county | 28 | 24 | 36* | 38* | 25 |

| Texas state officials | 25 | 24 | 28 | 33* | 22 |

| The U.S. Congress | 44 | 41 | 50 | 49 | 43 |

| President Trump | 53 | 58* | 46 | 48 | 46 |

| Note: * indicates statistically significant difference from at least one other region. | |||||

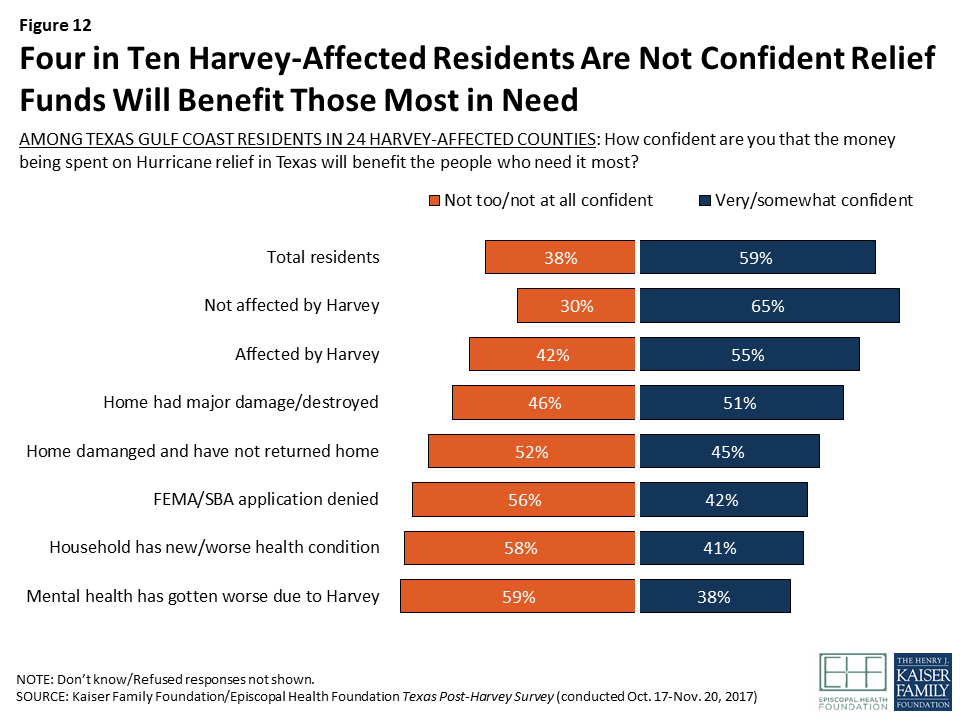

Overall, about six in ten residents – including majorities in each of the four geographic areas – say they are very or somewhat confident that the money being spent on hurricane relief in Texas will benefit the people who need it most, while 38 percent say they are not too or not at all confident. However, those who were directly affected by the storm are more likely than those who were not affected to say they are not confident that money spent on relief will reach those who need it most (42 percent versus 30 percent, rising to nearly half – 46 percent – among those whose homes had major damage or were destroyed). Those who remain displaced from their homes (52 percent), those who say their FEMA application was denied (56 percent), those who say they or a family member have a health condition that is new or worse as a result of the storm (58 percent), and those who feel their own mental health is worse (59 percent) are particularly likely to lack confidence that funds will reach the people who need them most.

Focus group highlight: Equity in distribution of aid

In each of the five focus groups, when asked about the channels for receiving help after the hurricane, participants raised concerns about some people abusing the system and getting help they don’t need, while others who really need help are going without it. There was some tension in the groups between the need to verify information from people applying for aid to make sure abuse doesn’t happen, and wanting the process to be simpler so people who need help can get it faster.

“I’ve dealt with this in Wisconsin. I’ve dealt with FEMA like on three different occasions. It was nothing near as dramatic as I dealt with here. And I had less problems there than I had here. I just don’t get it. They can pick and choose. Is it cherry-picking? How do they do it? Do they cherry-pick, just like with Red Cross?” – 40-year-old Black female, Houston

“So many millions of dollars – they said that on TV. They don’t know where the money is, where the help is. The economic help. It’s not gonna reach us. It’s gonna reach those who have the money, who have insurance.” – 45-year-old undocumented Hispanic male, Houston

“I know people that came from Louisiana in 2005 after Katrina. They were living large. They were exchanging FEMA checks…and getting stuff they didn’t need.” – 42-year-old Hispanic male, Houston

Key Findings: Section 4: More Details On Housing And Transportation Issues

HOUSING DAMAGE AND DISPLACEMENT

The most visible and catastrophic harm wrought by Hurricane Harvey was the damage – sometimes irreparable – to residents’ homes and living spaces. As noted in Section 1, more than four in ten residents (43 percent) of the 24 counties surveyed say their home was damaged as a result of the hurricane, including 3 percent who say it was completely destroyed, 16 percent who say it suffered major damage requiring more than a month to repair, and 23 percent who say there was minor damage that could be repaired within a month. The numbers are starkest in the Golden Triangle, where 62 percent reported damage, including 35 percent who say their home either had major damage or was destroyed. Reported home damage was also common, but less severe, in the Coastal counties; 64 percent in that area say their home was damaged, with the major portion (40 percent) saying the damage was minor and could be repaired within a month.

In addition to these geographic disparities, Black residents and those with lower incomes were also somewhat more likely than their white and higher-income counterparts to report damage to their homes.

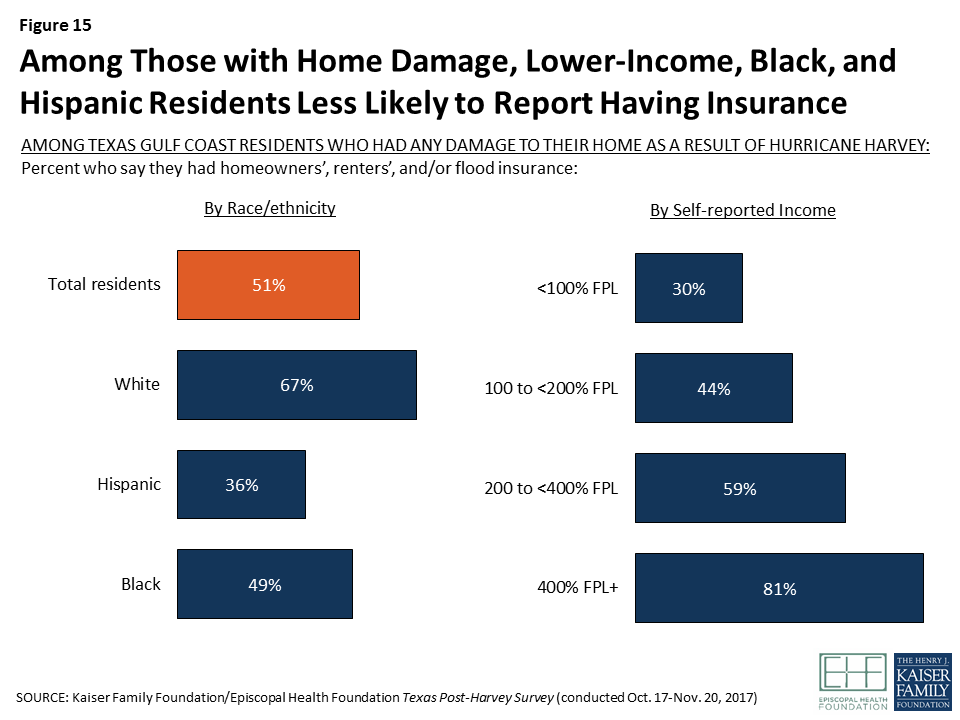

More than half (55 percent) of those whose homes were damaged by Harvey are homeowners, but 42 percent (including 60 percent of those with self-reported incomes below the federal poverty level) are renters. Renters are more likely than owners to report that the damage to their home was minor (62 percent versus 48 percent), while owners whose homes were damaged are more likely to say the damage was major or that their home was destroyed (50 percent versus 37 percent).

Among those whose homes were damaged, half (48 percent) say they had homeowners’ or renters’ insurance and 23 percent had flood insurance; combined, 51 percent report having at least one type of insurance. Lower-income residents are much less likely to report having insurance; three in ten (30 percent) of those with self-reported incomes below 100 percent FPL whose homes were damaged say they had any. Similarly, Black and Hispanic residents are less likely than whites to report having insurance; among those whose homes were damaged, two-thirds of whites, half of Blacks, and one-third of Hispanics say they had any insurance.

Focus group highlight: Homeowners and flood insurance

Among focus group participants, many homeowners did not have flood insurance and either say they were told they didn’t need it or that they just didn’t think it was worth the cost. Even among those who have purchased flood insurance, many seemed to lack the knowledge and skills (literacy) to navigate the insurance system.

“In my area they tell me, you don’t need flood insurance because you don’t live next to a lake, or you don’t have any water near you. So you don’t need flood insurance, just the hazard insurance in case you have a fire or something. How can you imagine that everything was going to flood like this?” – 58-year-old Hispanic male, Houston

“I’ve been paying for this insurance all this time and I think I got one thing, but I just never went to just actually get a full low-down on what it was. I come to find out…I got this insurance, but the water would have to come through the window.” – 64-year-old Black male, Beaumont

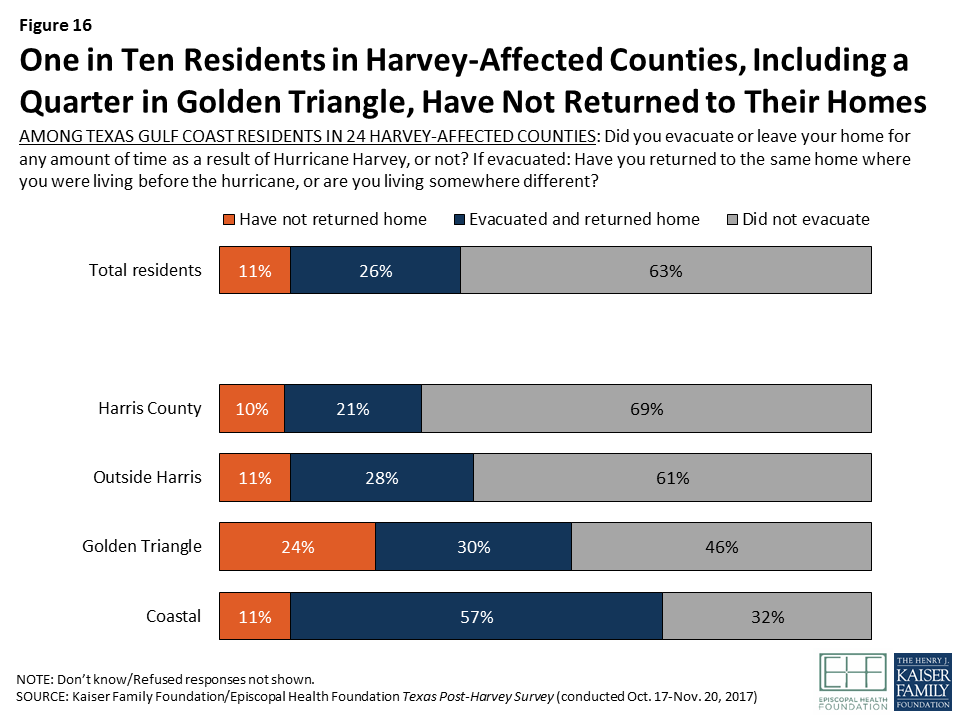

Overall, 37 percent of those living in the 24 Texas counties surveyed, rising to 54 percent in the Golden Triangle area and 68 percent in the Coastal counties, say they evacuated or left their home for some amount of time as a result of Hurricane Harvey. About one in nine residents overall (11 percent), including 24 percent in the Golden Triangle area, were still displaced from their homes at the time of the survey. Among those who have not returned to their pre-Harvey home, half say their housing costs have increased, including 28 percent who say they’ve increased a lot.

Most residents who evacuated temporarily say they feel safe after returning to their homes, however some report that they are living in unsafe conditions. Among those who evacuated and have returned to their homes, 32 percent say they moved back in before they felt it was safe, including 13 percent (rising to 24 percent in the Golden Triangle area) who still felt their home was unsafe at the time of the survey.

Focus group highlight: Living conditions

Most focus group participants who have returned to their homes said they felt safe because they’re more comfortable at home than anywhere else (those who were staying with relatives pointed out how stressful that can be). Still, many reported living in unsafe conditions: one woman with a hole in her roof has to take out buckets each time it rains, another sleeping on the couch in her living room can’t cook in her kitchen because of debris falling from the ceiling. While most renters said their landlords were treating them well overall, a few had complaints about landlords not fixing things and sometimes leaving them living in dangerous situations. Many were also afraid to push back on their landlords for fear that they would have to move out and would have nowhere else to go.

“We’ve got this, like a lot of people, just this open roof, where water…I have two buckets where the water is draining in. And I’ve had quotes come in to fix the roof, and it’s too much. We don’t have thousands of dollars sitting in the bank. I’m living there, but every time it rains I’m like, ‘Okay, get the buckets out.’ I’ve got plastic draped over it. And I’m going through a lot of health issues…I’m not working too well right now. I’m home watching this water drain in, and I’m like, ‘What else is gonna come in through the roof?’ I mean I had a rat come in the house once. I’m scared to death. It’s just an awful way of living.” – 55-year-old white female, Houston

“My landlords, they know I have 3 babies – 8 months, 2 years, and 4 years. I have a sewer problem. I have sewer water that’s underneath about half of my house. When the hurricane hit, I had water raise up, probably about the full 3 feet under the house. And my floors are like bowing now. They’ve been taking my rent money, promising me to come fix stuff. And they just haven’t come… I’m a single mom of three, and I just don’t have – it’s what about $150 to go to court? I know the options I can take…going, taking them to small claims court. In the end, we’d have to move. My closest family is in Austin. I don’t have anybody down here. I don’t wanna be like the other people at the homeless shelter with my babies. Housing’s limited right now.” – 29-year-old white female, Beaumont

“I’m still scrubbing and it’s moldy and it stinks. I tell [my landlords] and they say, ‘You know we have other people, I’ll get to you.’ They do the best they can here and there. – 53-year-old Black female, Houston

“It’s hard staying with relatives though. It’s fine to visit relatives, but when you actually have to stay, it’s not the same.” – 47-year-old Black female, Houston

Vehicle Damage and Transportation Issues

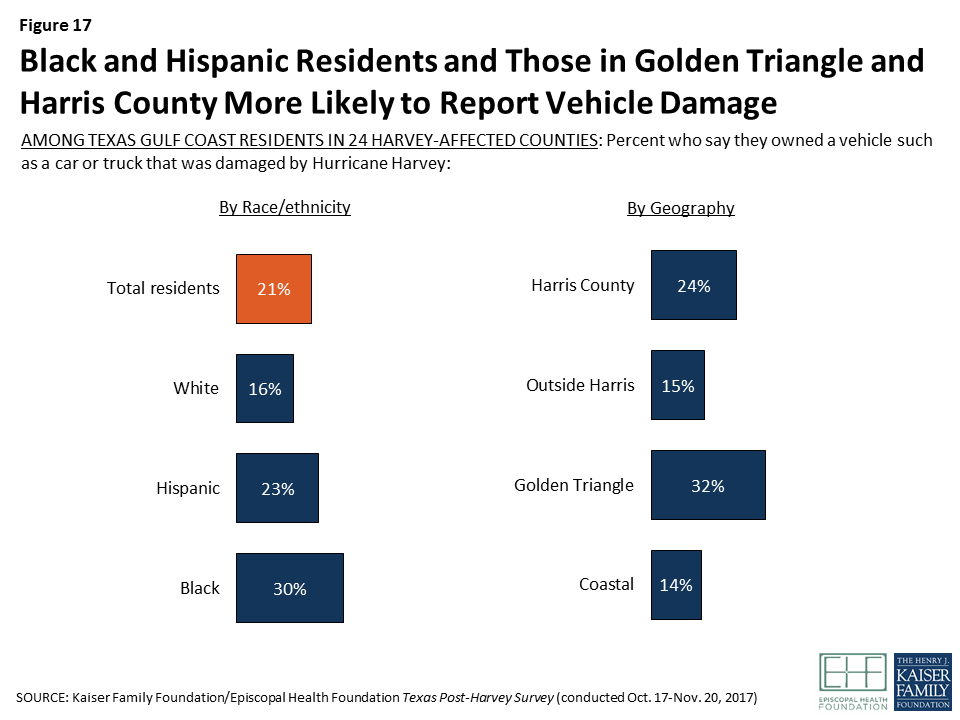

Beyond damage to their homes, many residents report having damage to a vehicle as a result of the hurricane. Overall, 21 percent of residents say they had a vehicle such as a car or truck that was damaged by Harvey, including somewhat larger shares of those living in the Golden Triangle and Harris County compared with other areas, and a larger share of Black residents compared with whites.

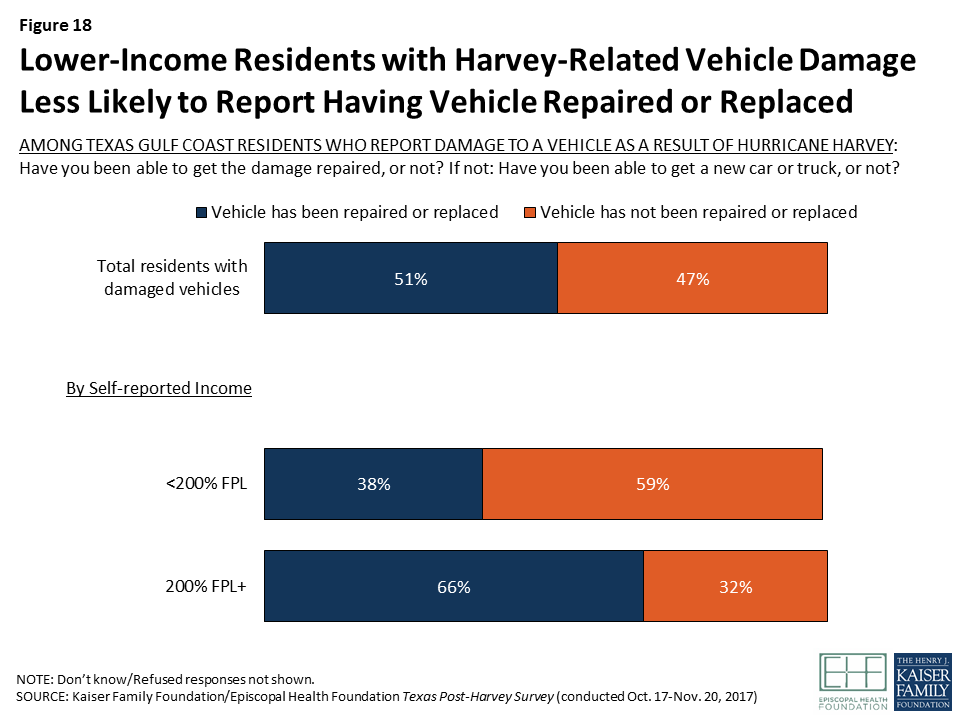

Among those whose vehicle was damaged, about half (51 percent) say they have been able to repair or replace their vehicle, while the other half (47 percent) say they have not. Lower-income adults who experienced vehicle damage are less likely than those with higher incomes to say they’ve been able to repair or replace their vehicle. Among those who have not been able to repair or replace their vehicle, about half (51 percent) say there is convenient public transportation in their area that allows them to get to work or other places they need to go, while the other half (48 percent) say there is not.

Key Findings: Section 5: More Details On Employment And Financial Issues

Employment Disruption and Loss of Income

While damage to homes and other property was surely the most visible impact of Hurricane Harvey, interruptions in employment were a common occurrence and caused financial disruptions for many residents, particularly when combined with the cost of repairing damage to their home or repairing or replacing a damaged vehicle. Overall, nearly half (46 percent) of residents say they experienced some type of job or income loss as a result of Harvey, including 12 percent who say they or a family member was laid off or lost a job, 32 percent who say someone in their household had their hours cut back at work, and 32 percent who say they experienced another loss of income, such as from a small business or unpaid missed days of work.

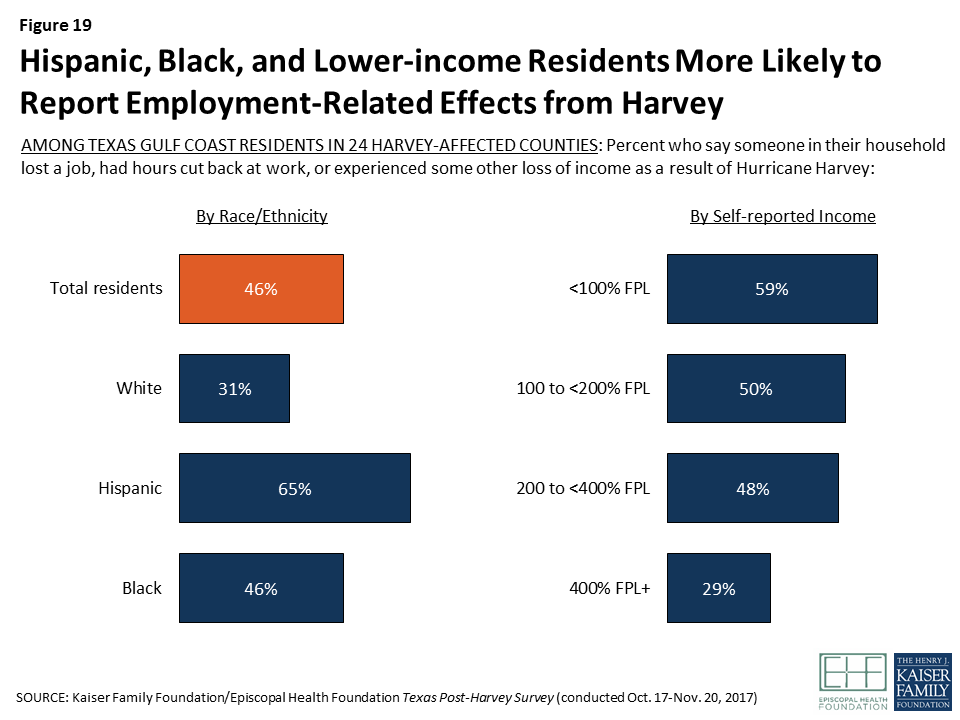

Job and income effects were evenly distributed geographically for the most part, but were much more commonly reported among Hispanic (65 percent) and Black residents (46 percent) compared with whites (31 percent), and among those with lower incomes compared to those with higher incomes.

On the other hand, some residents report taking on extra work since the hurricane; three in ten residents affected by the storm say that since Harvey, they or another family member in their household has taken on an extra job or worked more hours to make ends meet.

Focus group highlight: Employment disruptions

Focus group participants reported a range of employment disruptions in the wake of Hurricane Harvey. For many, the effects were temporary, while others were still struggling to find work three months after the storm. Many participants were self-employed or contract or hourly workers who lost several weeks of work due to the storm, but had since returned to work. Some reported that they still had less work than they did before Harvey, while others said their work level returned to normal after several weeks. A few who work in construction or home repairs said that after a lull, they now have more work than they did before the storm. On the other hand, a few participants – particularly in the Beaumont groups – reported that they had lost their jobs entirely and were still without work several months after the hurricane.

“I work installing alarm systems. It was touch and go, like everyone said, for about almost a month because I didn’t have places to go to, then the traffic was so bad. We were doing 10% of what we normally do on a day because we couldn’t get around. It was slow because in this industry you start getting clients slowly. You start putting clients on the line, and by the time they’re ready to go, then that’s when you start doing installations…I would say 5-6 weeks before I was really back into it.” – 38-year-old Hispanic male, Houston

“I’m still without a job. My whole job was destroyed. I worked at a library, and they don’t know when it will be open. I’m still looking for a job. I filed for unemployment but it will stop next week. I need to find work before next week.” – 24-year-old Black female, Beaumont

“There is more work now. Absolutely more work. Everybody that works construction, cleaning – a lot of work.” – 58-year-old Hispanic male, Houston

Financial Circumstances of Affected Individuals

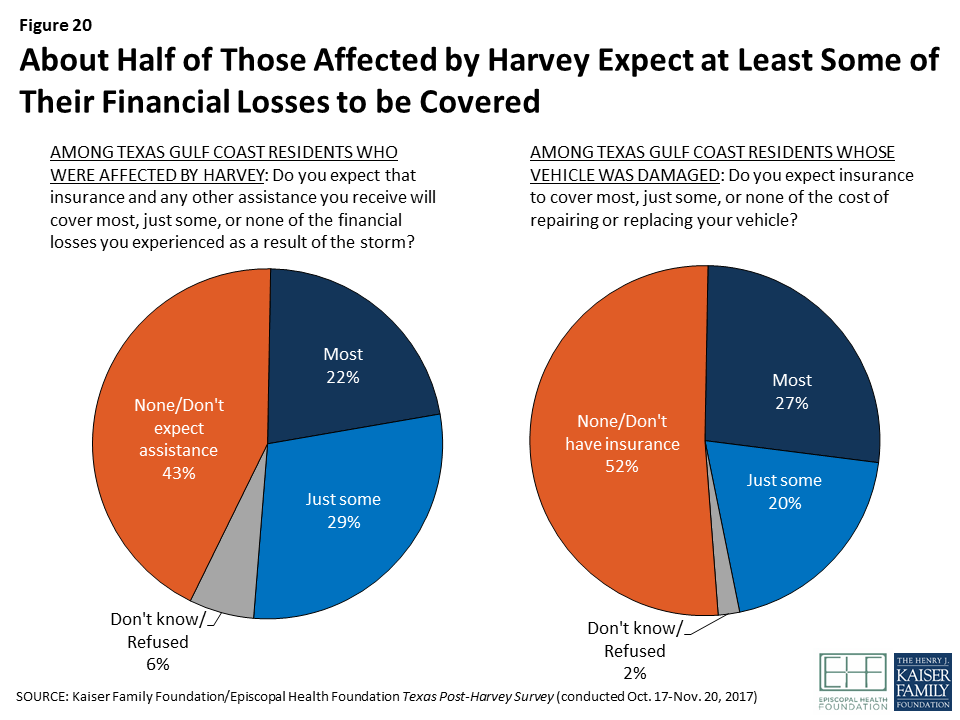

While insurance payments and FEMA assistance may be a financial help for some, many residents either don’t have access to these benefits or don’t expect them to cover a major portion of their financial losses. Among all those who were affected by the storm, just one in five (22 percent) expect that insurance and other financial assistance they receive will cover most of the financial losses they experienced. Three in ten (29 percent) say they expect it to cover just some of their losses, and 42 percent say they expect none of their losses to be covered.

Similarly, among those who had a vehicle damaged, half say they expect insurance to cover none of the cost of repairing or replacing their vehicle, while 27 percent expect insurance to cover most of the cost and one in five say it will cover just some. Lower-income adults are much less likely than those with higher incomes to say insurance will cover most of the cost of repairing or replacing a vehicle (19 percent of those who report incomes below 200 percent FPL versus 4o percent of those with higher incomes).

The financial impacts of Hurricane Harvey have led to serious consequences for some residents who were affected by the storm, particularly among Black and Hispanic residents and those with lower incomes. For example, three in ten (29 percent) affected residents – rising to 36 percent of Hispanics and 40 percent of those who report incomes below the poverty level – say that since Harvey, they have fallen behind in paying their rent or mortgage. One quarter of affected residents, including 37 percent of Black residents, say they have had problems paying for food since the storm. In addition, about four in ten affected residents say that since the hurricane, they have borrowed money from friends or relatives (39 percent), and one in eight (13 percent) say they have borrowed from a payday lender to make ends meet.

| Table 5: Financial Problems Reported by Those Affected by Hurricane Harvey | ||||||||||||||||||||||||||

| Total residents | Race/Ethnicity | Self-reported Income (% of FPL) | ||||||||||||||||||||||||

| White | Black | Hispanic | <100 | 100 to <200 | 200 to <400 | 400+ | ||||||||||||||||||||

| Percent of AFFECTED residents who say each has happened since Harvey: | ||||||||||||||||||||||||||

| Fallen behind in paying rent or mortgage | 29% | 18% | 31% | 36% | 40% | 29% | 32% | 8% | ||||||||||||||||||

| Had problems paying for food | 25 | 17 | 37 | 25 | 33 | 29 | 24 | 10 | ||||||||||||||||||

| Had utilities turned off because you didn’t pay the bill | 10 | 5 | 12 | 14 | 17 | 12 | 7 | 3 | ||||||||||||||||||

| Percent of AFFECTED residents who say they have done the following since Harvey to make ends meet: | ||||||||||||||||||||||||||

| Borrowed money from friends or relatives | 39 | 28 | 55 | 41 | 50 | 47 | 36 | 18 | ||||||||||||||||||

| Taken on an extra job or worked extra hours | 30 | 28 | 28 | 33 | 30 | 33 | 43 | 19 | ||||||||||||||||||

| Borrowed money from a payday lender | 13 | 2 | 14 | 20 | 17 | 16 | 13 | 3 | ||||||||||||||||||

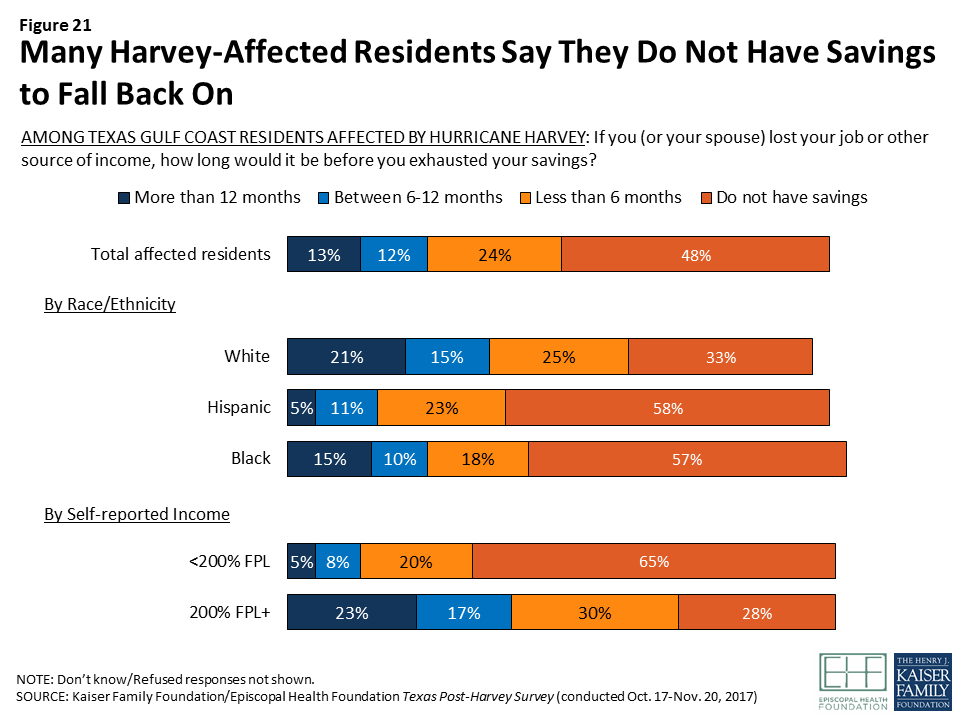

It’s worth noting that the financial circumstances of many of those who were affected by Harvey were tenuous even before the hurricane, and few report having many financial resources to fall back on. About half (48 percent) of affected residents say they have no savings whatsoever, and another quarter (24 percent) say that if they lost their job or other source of income, their savings would be exhausted in less than 6 months. This level of financial instability is much more common among Black and Hispanic residents compared with whites, and among those with lower incomes compared with higher-income individuals.

Focus group highlight: Financial stress

Most focus group participants we spoke with were feeling financially stressed. Many were living paycheck-to-paycheck before Hurricane Harvey hit, and did not have the means to absorb the financial hit of missing several weeks of work because of the storm. They feel behind on their bills and prioritize financial help to allow them to catch up. Some are still struggling to pay for food and basic items like clothing for their children. For many (particularly among Hispanics), there was pride associated with working one’s own way back from a bad situation and not taking “handouts.” Many thought of themselves as entrepreneurs and didn’t want something for free, but would like a boost to help get their business going or to find more work.

“Yes, we’re still catching up. We’re still catching up with our bills. We’re not at where we were at before. And now you’re having to limit a lot… My son wanted a pizza. They’re charging me like $5 for a pizza I pay $1 for at the store…I was trying to save a few bucks that I do have, but for my son of course I’m going to do it for him. I spent that $5 even though we were not going to have enough to eat again for the next couple days.” – 42-year-old Hispanic female, Houston

“The stress we get is because we don’t have the money to fix things, so the help to cope with stress will be economic help actually.” – 37-year-old undocumented Hispanic female, Houston

“[Asked what type of help you need] Financing to help you get through until the insurance money comes. For a lot of people, by the time the insurance money comes you had to take money from so many other places, borrow so much money from family and friends. Some of that money you have to use just to get even on what you got behind on.” – 64-year-old Black male, Beaumont

Key Findings: Section 6: More Details On Health And Mental Health Issues

Health Conditions and Access to Care

Below the surface, and often related to the housing and financial problems they are facing, some residents report problems with their physical and/or mental health as a result of their experiences with Hurricane Harvey. Overall, one in eight residents (13 percent) say they or another family member in their household has a health condition that is new or has gotten worse as a result of the storm. Those who were affected by home damage or income loss are more likely to report a new or worsened health condition (17 percent), but still a small share of those who were not affected (4 percent) report such a condition. Among those who were affected, Black and residents and those living in the Golden Triangle are somewhat more likely to report a decline in the health of someone in their household (25 percent each).

Among those who report that someone in their household has a new or worsened health condition, 38 percent mention a respiratory condition such as asthma, allergies, or cough, and 20 percent mention mental health issues including anxiety, depression, and general stress.

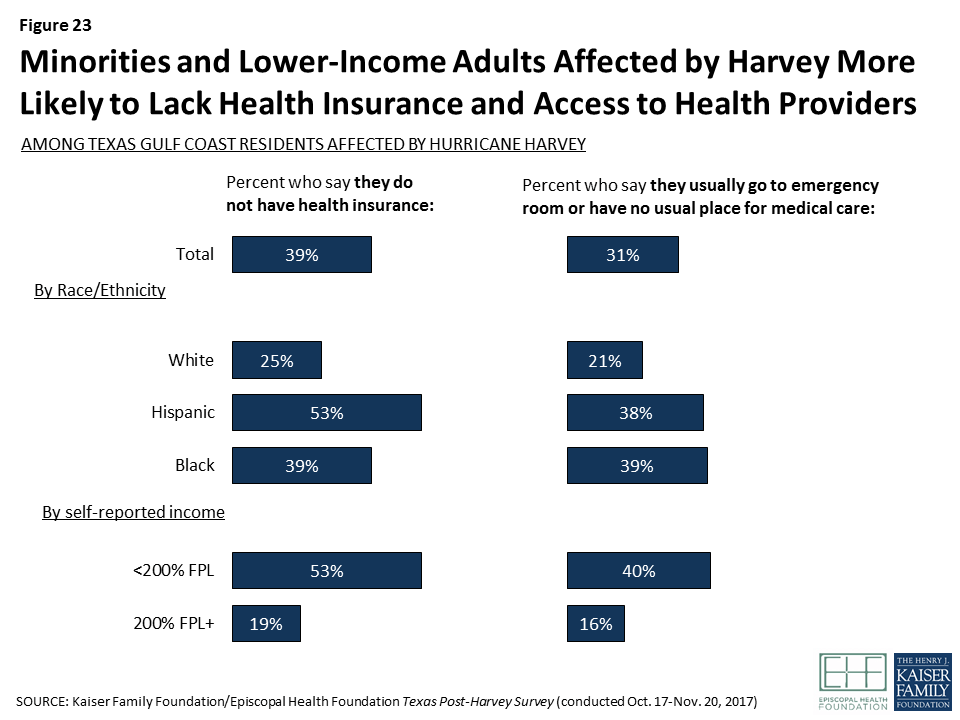

While Hurricane Harvey may have led to new or worsened health problems for some residents, it’s worth noting that many affected residents lacked consistent access to health insurance and health care providers even before the storm. Four in ten (39 percent) of those who were affected by Harvey say that they do not have health insurance. Reported lack of coverage is highest among Hispanic (53 percent) and Black residents (39 percent) affected by the storm, as well as those who report incomes below 200 percent of the poverty level (53 percent).

In addition, three in ten Harvey-affected residents (31 percent) say they have no usual place they go for care when they are sick or need advice about their health, or that their usual source of care is a hospital emergency room. This is highest among affected Black (39 percent) Hispanic residents (38 percent) and those with self-reported incomes below 200 percent of poverty (40 percent).

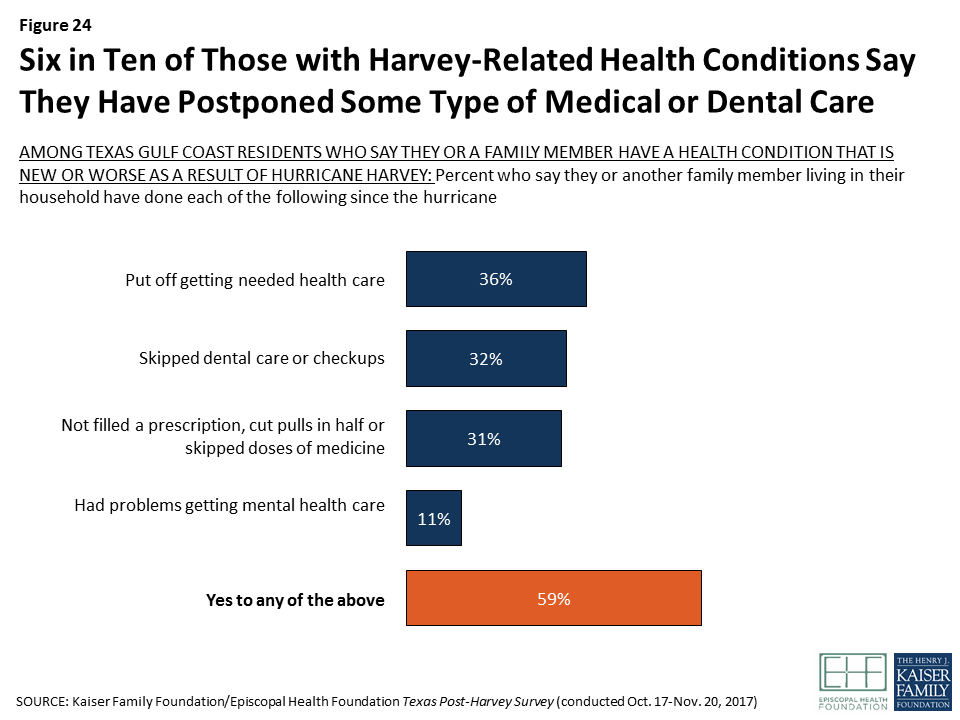

Since Hurricane Harvey, some residents report skipping or postponing medical care or having problems paying medical bills, with much higher rates among those who have someone in their household with a new or worse health condition resulting from the storm. For example, 36 percent of those who say someone in their household has a new or worse health condition due to Harvey say that they or another family member has put off or postponed getting needed health care since the storm, 32 percent say a family member has skipped dental care or check-ups, and 31 percent say they have not filled a prescription, cut pills in half, or skipped doses of a medicine. In addition, 10 percent of residents overall, including 26 percent of those with a health problem due to Harvey, say they’ve had problems paying medical bills since the storm.

Focus group highlight: Accessing health care

Many participants in the focus groups did not have health insurance, though some who were working have insurance through their jobs and some others in Houston have access to a county health program. Most of the uninsured said insurance was just too expensive and they prefer to deal with health issues as they happen. Many reported relying on home remedies or visiting clinics or urgent care centers when they get sick.

“My insurance just went out, and I know it’s gonna cost me going to the clinic. I’m just kind of calling around trying to figure out what’s going to be the cheapest one. Because even with unemployment, I’m not getting what I was getting when I was working.” – 29-year-old white female, Beaumont

“Whatever your gramma told you to do, that’s the remedy. Ibuprofen for pain and tea for your throat. That’s it. And you save $250 on doctor’s visits.” – 33-year-old undocumented Hispanic female, Houston

Stress and Mental Health Issues

The trauma associated with living through a disaster like Harvey and its aftermath can lead to increased stress and declines in mental health for some people. While most residents of the Texas counties surveyed (64 percent) say their mental health is excellent or very good, those who were affected by Harvey are less likely than those who were not affected to rate their mental health as excellent (35 percent versus 48 percent) and more likely to rate it as fair or poor (17 percent versus 7 percent).

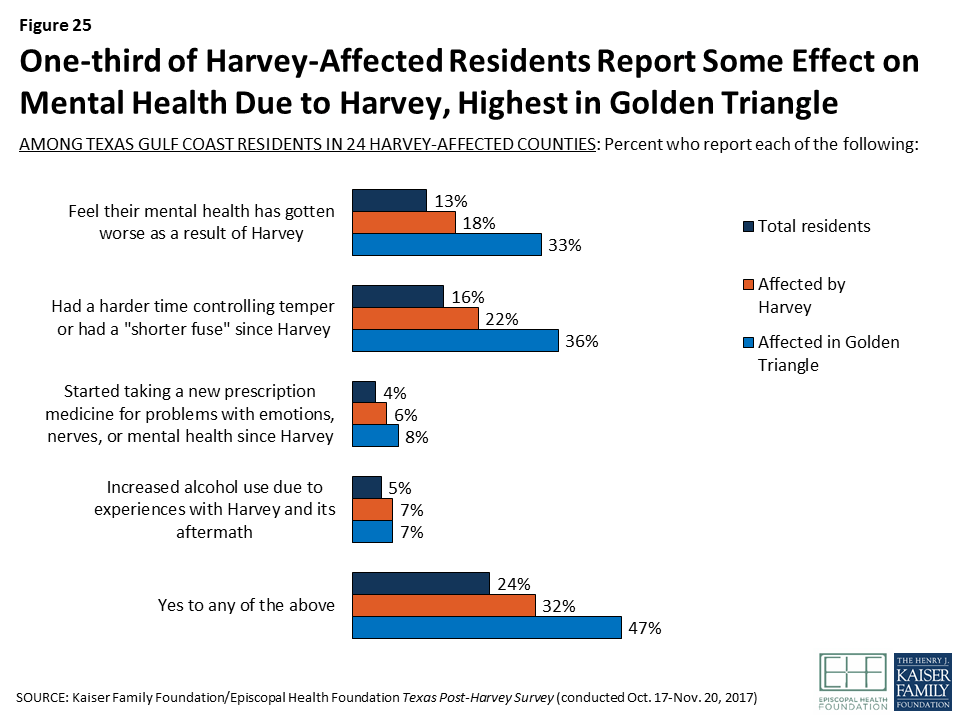

Overall, 13 percent of residents – including 18 percent of those who were affected by property damage or income loss and 3 percent of those who were not affected – feel that their mental health has gotten worse as a result of the storm. Among those who were affected, some also say they have had a harder time controlling their temper or felt they had a shorter fuse since Harvey (22 percent), that they’ve increased their alcohol use (7 percent), or that they’ve started a new medication for mental health problems since Harvey (6 percent).

Mental health needs may be most acute in the Golden Triangle area. Among affected residents, those living in the Golden Triangle are more likely to say their mental health has gotten worse (33 percent) and that they’ve had a harder time controlling their temper since the storm (36 percent).

Access to care is also a problem for some with mental health needs. Fifteen percent of those who say their mental health is worse as a result of the hurricane say they or a family member have had problems getting mental health care since the storm.

In addition to formal mental health services, informal support networks can be a key source of help for individuals coping with the stress of living through a disaster like Hurricane Harvey. The survey finds that few affected residents report having a robust support network of relatives and friends living nearby. Just one in five affected residents (19 percent) say they have “a lot” of people nearby who they can rely on for help or support, with another 17 percent saying they have “a fair amount.” Six in ten say they have “just a few” (47 percent) or no people living nearby who they can rely on (17 percent). Black and Hispanic residents and those with lower incomes are also more likely than others to say they lack a robust support network.

| Table 6: Many Affected Residents Say They Lack Nearby Support Networks | ||||||||||

| Thinking about your personal support network – how many people do you have living nearby who you can rely on for help and support? | Total affected residents | Race/Ethnicity | Self-reported Income(% of FPL) | |||||||

| White | Black | Hispanic | <100 | 100 to <200 | 200 to <400 | 400+ | ||||

| A lot/A fair amount (NET) | 36% | 48% | 26% | 31% | 25% | 25% | 42% | 57% | ||

| A lot | 19 | 29 | 12 | 16 | 13 | 14 | 21 | 34 | ||

| Fair amount | 17 | 19 | 14 | 15 | 12 | 12 | 21 | 23 | ||

| Just a few/No people living nearby (NET) | 64 | 52 | 74 | 68 | 75 | 75 | 58 | 42 | ||

| Just a few | 47 | 39 | 51 | 53 | 55 | 57 | 43 | 32 | ||

| No people living nearby | 17 | 14 | 24 | 15 | 20 | 18 | 14 | 10 | ||

Focus group highlight: Mental health issues

Most focus group participants reported some level of increased stress or mental strain due to the storm. Several said that whenever it starts raining, they have flashbacks or start worrying. Others said the stress comes from the financial problems they face and multiple worries about how they are going to find enough work to get back on their feet financially, while finding time to fix up their house and take care of their families. Some mentioned their children’s stress levels, or the strain of trying to keep things “normal” for their kids while they were personally stressed. To deal with stress, some people said they focus on work, others said they spend time with family, have a few drinks, and fire up the barbecue. Many (particularly in Beaumont) said they turned to prayer.

While acknowledging mental health problems, most participants tended to downplay the importance of seeking professional help and see their ability to address other stressors, especially economic and housing, as key to resolve their mental stress. When asked about whether they sought mental health counseling, most hadn’t considered it, with the exception of one young woman in Beaumont. But many seem to have unmet mental health needs. One young man who was unemployed said, “I really don’t have a way of coping with it, I just live with it,” and another young man sitting next to him said, “You took the words right out of my mouth.”

“Whenever it rains I get very scared that it’s gonna start over.” – 52-year-old Hispanic female, Houston

“I feel stressed out still. Even though it’s over, I still have that stress. You know, thinking that we have to fix that room, that we need another car, my husband has been working only for a week and a half. He needs to switch jobs now because the person he was working with, his home was flooded.” – 37-year-old undocumented Hispanic female, Houston

“My mother is 83 and she is a cancer survivor for over 17 years. Now, she’s going to her sister’s house during the week and then she’ll come stay with me on the weekends… My mom is such a ticker for worrying about being a burden on someone else… Thanksgiving is a major holiday for her. We may have a hundred people at our house… We’ll cook dinner, and we’ll cook for everybody there. And like, ‘Okay, what are we going to do this year?’ She’s always saying, ‘This may be my last year’… Sometimes the weight can be really, really heavy – not just for you but for everybody. Our family’s close. So when something affects one, it’s like a domino effect because it’s gonna affect everybody. But we pull together.” – 53-year-old Black female, Beaumont

“We survived today, and we’re gonna get through tomorrow. I’m not gonna go pay $65 an hour to go talk to somebody about what’s going on.” – 42-year-old Hispanic female, Houston

“I pray, but it’s getting to the point to where it’s starting to affect where like my stress on being able to take care of my kids is overwhelming. They have like MMHR I think, and they have like just the counseling. I’ve been thinking of calling…just because I feel like it’s just overwhelming.” – 29-year-old white female, Beaumont

Key Findings: Section 7: Language And Immigration Issues

Immigrants, particularly those who do not speak English well or do not have legal resident status in the U.S., can be particularly vulnerable to the effects of natural disasters and their aftermath for many reasons, including that they may lack the literacy necessary to navigate the systems in place to help people affected, they may be ineligible for benefits, or they may be hesitant to seek help for fear of exposing their own or a family member’s legal status.

The survey used questions to determine the likely immigration status of respondents by asking those who were born outside the U.S. whether they were a permanent resident (i.e. had a green card) when they came to the U.S. or if their status had been changed to permanent resident since arriving. Overall, 12 percent of residents in the 24-county area, including 27 percent of Hispanics, say they have not been granted permanent resident status, indicating that they are likely to be undocumented immigrants. Of this group, seven in ten (73 percent) were directly affected by Harvey, including two-thirds (68 percent) who experienced a disruption in their employment and three in ten who say their home was damaged.

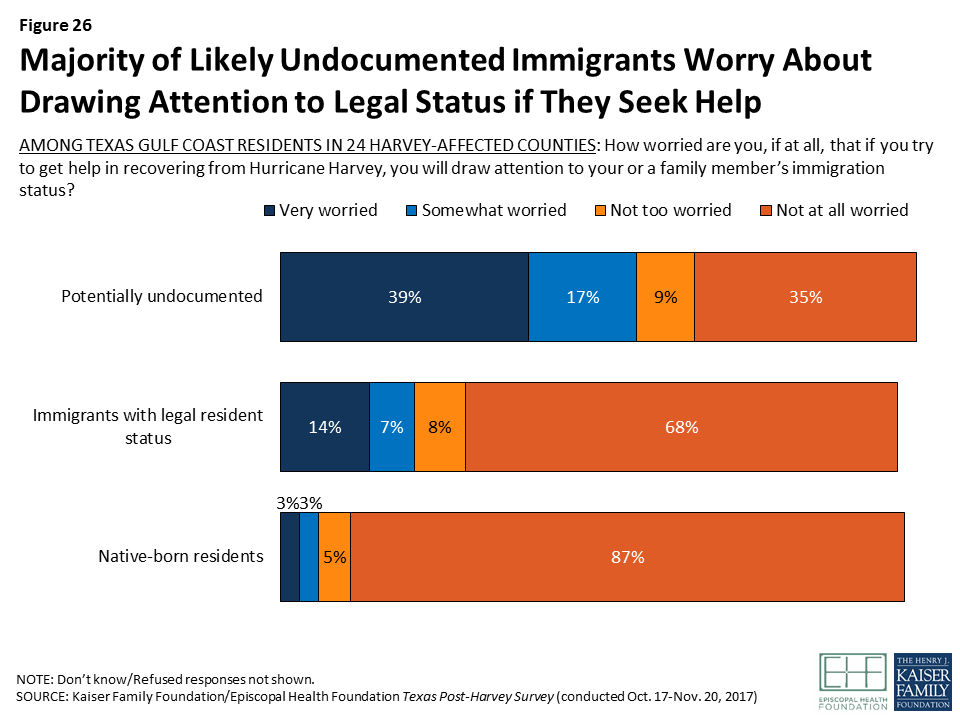

Among those who are likely to be undocumented immigrants, a majority says they are very worried (39 percent) or somewhat worried (17 percent) that if they try to get help in recovering from the hurricane, they will draw attention to their own immigration status or that of a family member. Even among immigrants who are legal residents, about one in five (21 percent) worry about drawing attention to someone else’s status.

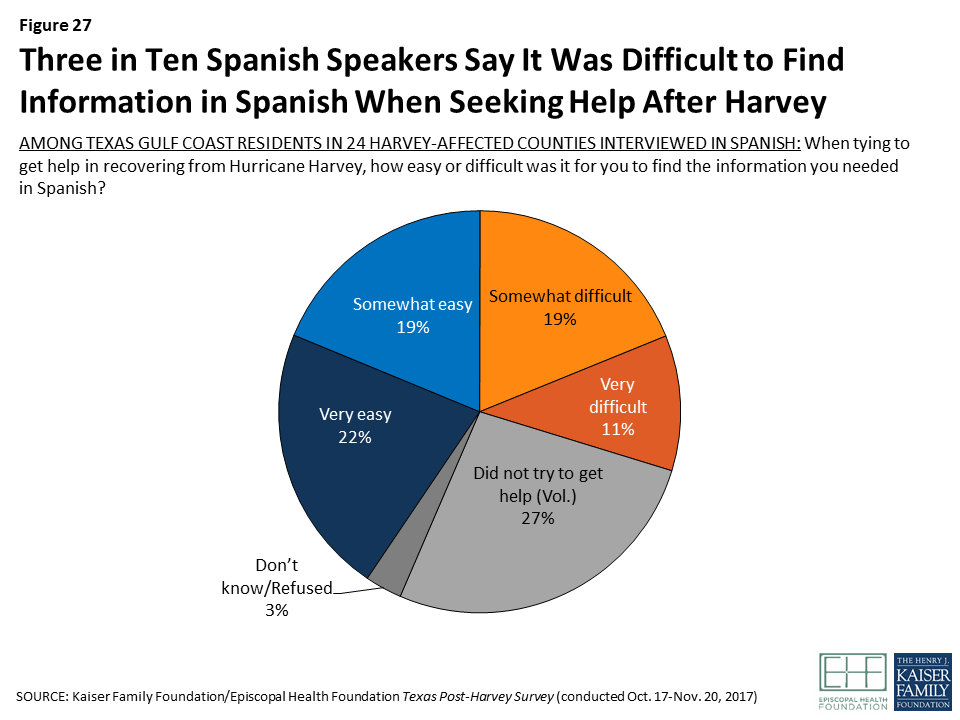

Language issues also presented a barrier for some individuals, regardless of immigration status. Among Hispanics who completed the survey in Spanish (42 percent of all Hispanics), three in ten say it was very or somewhat difficult to find the information they needed in Spanish when trying to get recovery help, while four in ten say it was easy and another quarter say they did not seek help.

Focus group highlight: Language and immigration issues

Two of the focus groups in Houston were conducted in Spanish, including one with individuals who identified as undocumented immigrants. Most Spanish speakers said that when seeking information or help since the hurricane, they were able to find people to help them in Spanish. However, most also felt that it took longer to get help in Spanish than in English, and that Hispanics were getting less help than others. For those who are undocumented, some said they did not want to seek assistance because they expected to be asked for a social security number, or they feared being reported to immigration. Most turned to informal networks (friends, families, and neighbors) for help rather than official sources.

“They check it [identification] for everything. Even for giving you help, they want your social security. They want to look at your taxes.” – 45-year-old undocumented Hispanic male, Houston

“My sister-in-law, they were gonna cut off her power and the company said to call an organization. First thing they told her is, ‘If you don’t have a Texas ID, we cannot help you.’” –42-year-old undocumented Hispanic female, Houston

“What happens is, as Hispanics in the Hispanic community, we don’t really have a federal program or a government program to help the small businesses like ours. We don’t really have an agency that we can go to.” – 58-year-old Hispanic male, Houston

Key Findings: Conclusion

Overall, the survey and focus group results provide an early snapshot of the biggest challenges facing vulnerable Texas Gulf Coast residents three months after Hurricane Harvey cut its wide swath across the region. With about half of affected individuals saying they are not getting the help they need to recover from the storm, residents prioritize basic needs like repairing damaged homes, help finding temporary and permanent shelter, and financial assistance to help affected individuals get back on their feet. The results also suggest that there is ongoing confusion about the different ways to get financial assistance, and that many affected residents could benefit from navigators or other resources to help with the application process. Finally, these results demonstrate that lower-income individuals, Black and Hispanic residents, and those living in the Golden Triangle area were particularly hard-hit by the effects of Harvey and continue to lag in the recovery, suggesting that organizations focused on recovery should keep a focus on these communities as they move forward from short-term to long-term recovery efforts.

Appendices

Appendix A: Survey and Focus Group Methodology

Survey Methodology

The Kaiser Family Foundation/Episcopal Health Foundation Post-Harvey Survey was conducted by telephone October 17 – November 20, 2017 among a random representative sample of 1,635 adults age 18 and older living in 24 counties along the Texas Gulf Coast. The counties were chosen based on a mapping analysis of Harvey property damage developed by FEMA, in an effort to examine a contiguous area of counties that suffered the largest share of property damage (see Figure 1). The region was further divided into four groupings of counties: 1) Harris County; 2) Counties surrounding Harris (Liberty, Chambers, Galveston, Brazoria, Matagorda, Wharton, Colorado, Austin, Waller, Fort Bend, Montgomery, and Walker counties); 3) Golden Triangle (Jefferson, Hardin, and Orange counties); and 4) Coastal counties (Nueces, San Patricio, Refugio, Aransas, Calhoun, Victoria, Jackson, and Lavaca counties).

Interviews were administered in English and Spanish, combining random samples of both cellular and landline telephones (note: persons without a telephone could not be included in the random selection process). Sampling, data collection, weighting and tabulation were managed by SSRS in close collaboration with Kaiser Family Foundation and Episcopal Health Foundation researchers. Episcopal Health Foundation paid for the costs of the survey fieldwork, and Kaiser Family Foundation contributed the time of its research staff. Both partners worked together to design the survey and analyze the results.

The sampling procedures were designed to reach set numbers of respondents in each of the four county-groups and to oversample particular vulnerable subpopulations who were likely to require assistance in the aftermath of the hurricane, namely: people who experienced property damage as a result of the hurricane, those with household incomes near or under poverty level, Hispanic residents (in particular, non-native Hispanics), and Black residents. Some respondents were reached by oversampling cellular and landline numbers matching directory-listings in areas where data from the Federal Emergency Management Agency (FEMA) indicated large amounts of property damage due to Harvey. The sampling and screening procedures included an oversample component designed to increase the number of low-income respondents, specifically low-income Hispanic and Black respondents. This included 104 respondents who were reached by calling back respondents in the affected areas who had previously completed an interview on the SSRS Omnibus poll and indicated they fit one of the oversample criteria (based on income and race).

The dual frame cellular and landline phone sample was generated by Survey Sampling International (SSI) using random digit dial (RDD) procedures. All respondents were screened to verify that they resided in one of the 24 counties covered by this study at the time Harvey hit Texas. For the landline sample, respondents were selected by asking for the youngest adult male or female currently at home based on a random rotation. If no one of that gender was available, interviewers asked to speak with the youngest adult of the opposite gender. For the cell phone sample, interviews were conducted with the adult who answered the phone.

A multi-stage weighting design was applied to ensure an accurate representation of the population of each county-group. The first stage of weighting involved corrections for sample design, including accounting for oversampling of the most-affected areas, as well as non-response for the callback sample. In the second weighting stage, demographic adjustments were applied to account for systematic non-response along known population parameters, within each county-group. Population parameters included gender, age, race, Hispanic origin (broken down by nativity), educational attainment, and phone status (cell phone only or reachable by landline). This stage excluded the low-income oversample component. Based on this second stage of weighting, estimates were derived for the share of low-income respondents (Black, Hispanic and other) in the population. The third stage of weighting included all respondents in each county-group and included income-status (low or high) by race/ethnicity based on the previous stage’s outcomes. In the last stage each county-group was weighted to accurately represent its adult-population share within the 24-county region. Weighting parameters were provided by SSI based on estimates from the U.S. Census Bureau’s 2016 American Community Survey (ACS) for Harris County and 5-year (2011-2015) cumulative data from the ACS for other county groups.

The margin of sampling error, including the design effect for the full sample, is plus or minus 3 percentage points. Numbers of respondents and margins of sampling error for key subgroups are shown in the table below. For results based on other subgroups, the margin of sampling error may be higher. Sample sizes and margins of sampling error for other subgroups are available by request. Note that sampling error is only one of many potential sources of error in this or any other public opinion poll. Kaiser Family Foundation public opinion and survey research is a charter member of the Transparency Initiative of the American Association for Public Opinion Research.

| Group | N (unweighted) | Margin of sampling error |

| Total residents | 1,635 | +/-3 percentage points |

| Harris | 714 | +/-5 percentage points |

| Outside Harris | 310 | +/-7 percentage points |

| Golden Triangle | 305 | +/-7 percentage points |

| Coastal | 306 | +/-6 percentage points |

| Affected by Harvey | 1,113 | +/-4 percentage points |

| Harris | 461 | +/-6 percentage points |

| Outside Harris | 186 | +/-9 percentage points |

| Golden Triangle | 239 | +/-8 percentage points |

| Coastal | 227 | +/-8 percentage points |

Focus Group Methodology

As part of this project, the Kaiser Family Foundation and the Episcopal Health Foundation conducted focus groups to gather qualitative data from vulnerable populations affected by Hurricane Harvey. Topics covered in the focus groups were similar to those covered in the survey. The groups were held in Houston on November 8-9, 2017 and Beaumont on November 9, 2017. In total, five two-hour groups were conducted with eight participants each.

To qualify for each group, individuals must have said: 1) that their total family income from all sources in 2016, before taxes, was less than $60,000; and 2) that they experienced damage to their home or vehicle or lost job-related income as a result of Hurricane Harvey, and that the loss was at least a minor problem for them and their family. In addition, participants in each session were recruited with several additional aims: That at least half said their loss of income or property was a major problem for them and their family, and at least half said they their home had major damage or was destroyed. Recruitment also aimed to target a mix of owners and renters.

In Houston, two groups were conducted with Hispanics in Spanish – one of which consisted of participants who self-identified as undocumented immigrants. A third Houston group, consisting of mixed races/ethnicities, was conducted in English. In Beaumont, two groups were conducted in English, one with Black residents and the other with participants of mixed races/ethnicities. Participants in four of the groups were given an incentive of $100, and participants in one Houston group were given $125 since the group was conducted in the morning, a more difficult time to recruit for.

ConneXion Research recruited and provided moderator services for each group. The Houston groups were held at ConneXion’s research facility, and the Beaumont groups were held at a health service organization. The screener questionnaire and discussion guide was developed by researchers at the Kaiser Family Foundation and the Episcopal Health Foundation. Groups were audio and video recorded with participants’ permission. Focus group costs were paid for by the Episcopal Health Foundation.

Appendix B: Additional Resources

In Episcopal Health Foundation’s (EHF) initial effort to study the scope of property damage caused by Harvey, staff created a user-friendly, interactive map by using a geographic information system (GIS) mapping file from the FEMA website. The analysis was conducted using parcel data on buildings and homes, as well as flood inundation data showing the depth of water levels in different areas. EHF staff also overlaid the CDC-developed social vulnerability index data on these maps, identifying communities in need of additional support to prepare or recover from a disaster. Staff further identified and analyzed FEMA application data at the zip code level across the 41 counties, showing tremendous diversity of needs in the region.

Endnotes

- Vox News, “The stunning price tags for Hurricanes Harvey and Irma, Explained,” September 18, 2017. https://www.vox.com/explainers/2017/9/18/16314440/disasters-are-getting-more-expensive-harvey-irma-insurance-climate ↩︎

- Office of the Texas Governor, Commission to Rebuild Texas Update: Issue 10, November 2017. https://gov.texas.gov/news/post/commission-to-rebuild-texas-update-issue-10 ↩︎

- The counties included in each cluster are: Cluster One: Harris County; Cluster Two (Surrounding Harris): Liberty, Chambers, Galveston, Brazoria, Matagorda, Wharton, Colorado, Austin, Waller, Fort Bend, Montgomery, and Walker counties; Cluster Three (Golden Triangle): Orange, Jefferson and Hardin; and Cluster Four (Coastal): Nueces, San Patricio, Refugio, Aransas, Calhoun, Victoria, Jackson, and Lavaca counties. ↩︎

- Analysis of U.S. Census Bureau American Community Survey data. ↩︎

- There were not enough higher-income Black residents in the sample to analyze. ↩︎