People with Medicare have the option of receiving their Medicare benefits through the traditional Medicare program administered by the federal government or through a private Medicare Advantage plan, such as an HMO or PPO. In Medicare Advantage, the federal government contracts with private insurers to provide Medicare benefits to enrollees. Medicare pays insurers a set amount per enrollee per month, which varies depending on the county in which the plan is located, the health status of the plan’s enrollees, and the plan’s estimated costs of covering Medicare Part A and Part B services.

The plans use these payments to pay for Medicare-covered services, and in most cases, also pay for supplemental benefits, reduced cost sharing and lower out-of-pocket limits, which are attractive to enrollees. Plans are able to offer these additional benefits, often without charging an additional premium for Part D prescription drugs or supplemental benefits, because they receive an additional $2,329 per enrollee above their estimated costs of providing Medicare-covered services. This portion of plan payments, also called the rebate, has increased substantially in the last several years, more than doubling since 2018. At the same time, Medicare Advantage plans can use cost management tools, such as prior authorization requirements, which can impose barriers to receiving care, and limited networks of providers, which can restrict beneficiary choice of physicians and hospitals. More than half (56%) of Medicare Advantage beneficiaries are enrolled in HMO plans that typically do not cover out-of-network services.

This brief provides information about Medicare Advantage plans in 2024, including premiums, out-of-pocket limits, supplemental benefits, and prior authorization, as well as trends over time. A companion analysis examines trends in Medicare Advantage enrollment.

While data on Medicare Advantage plan availability, enrollment and plan offerings is robust, the same cannot be said about service utilization (especially for supplemental benefits) and out-of-pocket spending patterns (though some of this data is starting to be collected), which would allow assessment of how well the program is meeting its goals in terms of value and quality and help Medicare beneficiaries compare coverage options. As enrollment in Medicare Advantage and federal payments to private plans continue to grow, greater transparency and more comprehensive information will become increasingly relevant for people with Medicare program oversight.

Highlights for 2024:

- In 2024, three quarters (75%) of enrollees in individual Medicare Advantage plans with prescription drug coverage pay no premium other than the Medicare Part B premium, which is a big selling point for beneficiaries, particularly those living on modest incomes and savings.

- Most Medicare Advantage enrollees are in plans that offer supplemental benefits not covered by traditional Medicare, such as vision, hearing and dental. From 2023 to 2024, Medicare Advantage enrollees overall did not experience a significant loss in benefits despite concerns that changes in Medicare Advantage payment would lead to a drastic reduction in benefits or increase in premiums, though there were small declines in the share of enrollees in plans with access to some benefits from 2023 to 2024.

- Nearly all Medicare Advantage enrollees (99%) are in plans that require prior authorization for some services, which is generally not used in traditional Medicare. Prior authorization is most often required for relatively expensive services, such as skilled nursing facility stays (99%), Part B drugs (98%), inpatient hospital stays (acute: 98%; psychiatric: 93%) and outpatient psychiatric services (82%) and is rarely required for preventive services (6%).

In 2024, three quarters of Medicare Advantage enrollees (75%) are in plans with no supplemental premium (other than the Part B premium)

In 2024, most people (75%) enrolled in individual Medicare Advantage plans with prescription drug coverage (MA-PDs) pay no premium other than the Medicare Part B premium ($174.70 in 2024) (Figure 1). The MA-PD premium includes both the cost of Medicare-covered Part A and Part B benefits and Part D prescription drug coverage. In 2024, 97% of Medicare Advantage enrollees in individual plans open for general enrollment are in plans that offer prescription drug coverage.

Altogether, including those who do not pay a premium, the average enrollment-weighted premium in 2024 is $14 per month, and averages $9 per month for just the Part D portion of covered benefits, substantially lower than the average premium of $43 for stand-alone prescription drug plans (PDP) in 2024. Higher average PDP premiums compared to the MA-PD drug portion of premiums is due in part to the ability of MA-PD sponsors to use rebate dollars from Medicare payments to lower their Part D premiums. When a plan’s estimated costs for Medicare-covered services are below the maximum amount the federal government will pay private plans in an area (known as the benchmark), the plan retains a portion of the difference, known as the “rebate”. According to the Medicare Payment Advisory Commission (MedPAC), rebates average over $2,300 per enrollee in 2024.

For the remaining 25% of beneficiaries who are in plans with a MA-PD premium (5.0 million), the average premium is $56 per month, and averages $36 for the Part D portion of covered benefits.

Premiums paid by Medicare Advantage enrollees have declined since 2015.

Average MA-PD premiums have declined from $36 per month in 2015 to $14 per month in 2024. Average MA-PD premiums have declined markedly for local PPOs, declining from $65 per month in 2015 to $16 per month in 2024. Premiums for HMOs have also declined steadily from $28 per month in 2015 to $12 per month in 2024. Only regional PPOs, which represent a very small and declining share of enrollment, have seen an increase in plan premiums over this time from $36 per month in 2015 to $55 per month in 2024. Nearly 6 in 10 Medicare Advantage enrollees are in HMOs (56%), 43% are in local PPOs, and 1% are in regional PPOs in 2024. The reduction for nearly all plans is driven in part by the decline in premiums for local PPOs and HMOs, that account for a rising share of enrollment over this time period, as well as the increase in rebates paid by Medicare to these plans.

Since 2015, a rising share of plans estimate that their cost of providing Medicare Part A and Part B services (the “bid”) is below the maximum amount that CMS will pay in the area where the plan operates (the “benchmark”). The difference between bids and benchmarks enables plans to offer coverage that typically includes extra benefits without charging an additional premium. As plan bids have declined, the rebate portion of plan payments has increased, and plans are allocating some of those rebate dollars to lower the part D portion of the MA-PD premium. According to MedPAC, rebates have increased from an average of about $900 per enrollee in 2015 to over $2,300 per enrollee in 2024. This trend contributes to greater availability of zero-premium plans, which brings down average premiums.

The average out-of-pocket limit for Medicare Advantage enrollees is $4,882 for in-network services and $8,707 for both in-network and out-of-network services (PPOs).

Since 2011, federal regulation has required Medicare Advantage plans to provide an out-of-pocket limit for services covered under Parts A and B. In contrast, traditional Medicare does not have an out-of-pocket limit for covered services.

In 2024, the out-of-pocket limit for Medicare Advantage plans may not exceed $8,850 for in-network services and $13,300 for in-network and out-of-network services combined. These out-of-pocket limits apply to Part A and B services only, and do not apply to Part D spending. Due to a provision in the Inflation Reduction Act, there is a cap in Part D spending of around $3,300 in 2024, and in 2025, Medicare beneficiaries will pay no more than $2,000 out of pocket for prescription drugs covered under Part D.

HMOs generally only cover services provided by in-network providers so typically do not have a limit for out-of-network services. However, about 5 million Medicare Advantage enrollees are in HMOs that are Point-of-Service plans (HMOPOS), which allow out-of-network care for certain services, though they typically cost more than services received in-network. PPOs also cover services delivered by out-of-network providers but charge enrollees higher cost sharing for this care. The size of Medicare Advantage provider networks for physicians and hospitals vary greatly both across counties and across plans in the same county.

In 2024, the enrollment-weighted average for out-of-pocket limits for Medicare Advantage enrollees is $4,882 for in-network services and $8,707 for in-network and out-of-network services combined. For enrollees in HMOs, the average out-of-pocket (in-network) limit is $3,965 (Figure 3). Enrollees in HMOs are generally responsible for 100% of costs incurred for out-of-network care. For local and regional PPO enrollees, the average out-of-pocket limit for both in-network and out-of-network services is $8,634, and $10,728, respectively.

The average out-of-pocket limit for in-network services has generally trended down from 2017 ($5,297), though increased slightly from $4,835 in 2023 to 4,882 to 2024. The average combined in- and out-of-network limit for PPOs slightly increased from $8,659 in 2023 to $8,707 in 2024.

Most Medicare Advantage enrollees, including enrollees in special needs plans (SNPs), are in plans that offer some benefits not covered by traditional Medicare in 2024

Virtually all enrollees in individual Medicare Advantage plans (those generally available to Medicare beneficiaries) are in plans that offer primarily health related supplemental benefits including eye exams and/or glasses (more than 99%), dental care (98%) hearing exams and/or aids (96%), and a fitness benefit (95%) (Figure 4). Similarly, most enrollees in SNPs are in plans that offer these benefits. However, benefits such as Part B drug rebate are less common for enrollees in both individual plans (12%) and SNPs (7%). This analysis excludes employer-group health plans because employer plans do not submit bids, and available data on supplemental benefits may not be reflective of what employer plans actually offer.

Though these benefits are widely available, the scope of specific services varies. For example, a dental benefit may include preventive services only, such as cleanings or x-rays, or more comprehensive coverage, such as crowns or dentures. Plans also vary in terms of cost sharing for various services and limits on the number of services covered per year, many impose an annual dollar cap on the amount the plan will pay toward covered service, and some have networks of dental providers beneficiaries must choose from.

Enrollees in SNPs have greater access than other Medicare Advantage enrollees to transportation (91% vs 36%), meal benefits (85% vs 74%), bathroom safety devices (49% vs 31%), and in-home support services (23% vs 9%). However, as noted above, it is not known what share of enrollees have used these benefits because data are not yet available.

As of 2020, Medicare Advantage plans have been allowed to include telehealth benefits as part of the basic Medicare Part A and B benefit package – beyond what was allowed under traditional Medicare prior to the public health emergency, and was extended to December 2024. Therefore, these benefits are not included in the figure above because their cost is not covered by either rebates or supplemental premiums. Medicare Advantage plans may also offer supplemental telehealth benefits via remote access technologies and/or telemonitoring services, which can be used for those services that do not meet the requirements for coverage under traditional Medicare or the requirements for additional telehealth benefits (such as the requirement of being covered by Medicare Part B when provided in-person). The majority of enrollees in both individual plans and SNPs are in plans that offer remote access technologies (72% and 78%, respectively), but just 4% of enrollees in individual plans and 1% of enrollees in SNPs have access to telemonitoring services.

Nearly all Medicare Advantage enrollees are in plans that offer vision, dental, and hearing benefits, similar to 2023, with the share of enrollees in plans that offer many benefits increasing substantially since 2015.

In 2024, there were modest changes to the share of enrollees in plans that offer specific benefits compared to 2023. Similar shares of enrollees in individual plans are in plans that offer eye exams and/or eyeglasses (100% in 2023 and 2024), dental benefits (98% in 2023 and 2024), and hearing exams and/or aids (99% in 2023 vs 96% in 2024) (Figure 5). Smaller shares of enrollees are in plans that offer transportation benefits (44% in 2023 vs 36% in 2024) while a larger share of enrollees is in plans that offer bathroom safety devices (10% in 2023 vs 31% in 2024).

For those in Special Needs Plans, similar shares of enrollees are in plans that offer eye exams and/or eyeglasses (97% in 2023 vs 98% in 2024), dental benefits (95% in 2023 and 2024), and hearing exams and/or aids (92% in 2023 vs 93% in 2024). Larger shares of SNP enrollees are in plans that offer over the counter benefits (84% in 2023 vs 96% in 2024) and bathroom safety devices (15% in 2023 vs 49% in 2024).

Overall, Medicare Advantage enrollees have not experienced a significant loss in benefits despite concerns that changes in Medicare Advantage payment would lead to a drastic reduction in benefits or increase in premiums. While the share enrolled in plans that offer benefits appears to have remained mostly stable from 2023 to 2024 and has increased substantially from 2015 for many benefits, this analysis does not account for any changes to the design of benefits, which could be less robust, even if the benefits are still offered by the plan, such as restrictions on eligibility for these benefits, narrower networks of providers or less comprehensive coverage.

Enrollees in SNPs are more likely to be in plans that offer Special Supplemental Benefits for the Chronically Ill (SSBCI) than other Medicare Advantage enrollees.

Beginning in 2020, Medicare Advantage plans have also been able to offer supplemental benefits that are not primarily health related for chronically ill beneficiaries, known as Special Supplemental Benefits for the Chronically Ill (SSBCI). In addition, Medicare Advantage plans participating in the Value-Based Insurance Design Model may also offer these non-primarily health related supplemental benefits to their enrollees, but can use different eligibility criteria than required for SSBCI, including offering them based on an enrollee’s socioeconomic status (e.g., LIS eligibility) or whether the enrollee lives in an underserved area.

The vast majority of individual plan enrollees and about half of SNP Medicare Advantage enrollees are in plans that do not offer these benefits. However, while the share in plans that are offered these benefits varies widely, this often translates to a similar number of enrollees. For example, the share of Medicare Advantage enrollees who are offered SSBCI benefits in 2024 is highest for food and produce – 15% for individual plans or about 3.1 million enrollees, while 49% of SNP enrollees are offered these benefits, or about 3.3 million enrollees (Figure 6).

The other SSBCI benefits that are most commonly offered are general supports for living (e.g., housing, utilities) (10% in individual plans and 43% for SNPs) and transportation for non-medical needs (9% for individual plans and 29% for SNPs). A similar share of enrollees in individual plans (5%) are offered pest control, a social needs benefit (e.g., community programs), and meals beyond a limited basis though the share of enrollees in SNPs who have access to these benefits is higher (17%, 15%, and 12%, respectively). Smaller shares of enrollees are in plans that offer indoor air quality equipment and services (e.g., air conditioning units) (4% in individual plans and 12% for SNPs), services supporting self-direction (e.g., power of attorney for health services, financial literacy classes) (3% in individual plans and 12% for SNPs), complementary therapies (those offered alongside traditional medical treatment) (3% in individual plans and 12% for SNPs) and structural home modifications (0.02% for individual plans and 1% for SNPs).

In addition to the 10 initially enumerated examples of SSBCI provided by CMS, plans are also able to offer “other” extra benefits specified by the plan, including pet care/service animal supplies (5% in individual plans and 18% for SNPs) and personal care (2% in individual plans and 9% for SNPs)(Figure 6). About 2% of SNP enrollees are in plans that offer roadside and travel assistance and home cleaning (less than 1% in individual plans), and less than 1% are in SNPs or individual plans that offer hairstyling and beauty care (data not shown), though this is not an exhaustive list of additional benefits plans may offer.

While the share of enrollees with plans that offer some SSBCI benefits has increased since 2021, such as food and produce, growth for other benefits has been much slower.

Though the share of SNP enrollees in plans with food and produce benefits, general supports for living benefits, and transportation for non-medical needs has grown considerably since 2021, the share of enrollment in plans for other SSBCI benefits has grown much more slowly, particularly for enrollees in individual plans (Figure 7). For example, the share of SNP Medicare Advantage enrollees with food and produce benefits in SNPs has more than doubled from 21% in 2021 to 49% in 2024, while for individual plans, the share of enrollees with these benefits has also doubled, but only from 7% to 15%. For general supports for living benefits, the share of SNP Medicare Advantage enrollees with these benefits has more than quadrupled from 10% to 43%, while for individual plans, the share has more than tripled, but only from 3% to 10%.

Like for other supplemental benefits, the scope of services for SSBCI benefits varies. For example, many plans offer a specified dollar amount that enrollees can use toward a variety of benefits, such as food and produce, utility bills, rent assistance, and transportation for non-medical needs, among others. This dollar amount is often loaded onto a flex card or spending card that can be used at participating stores and retailers, which can vary depending on the vendor administering the benefit. Depending on the plan, this may be a monthly allowance that expires at the end of each month or rolls over month to month until the end of the year, when any unused amount expires.

Nearly all Medicare Advantage enrollees are in plans that require prior authorization for many higher-cost services

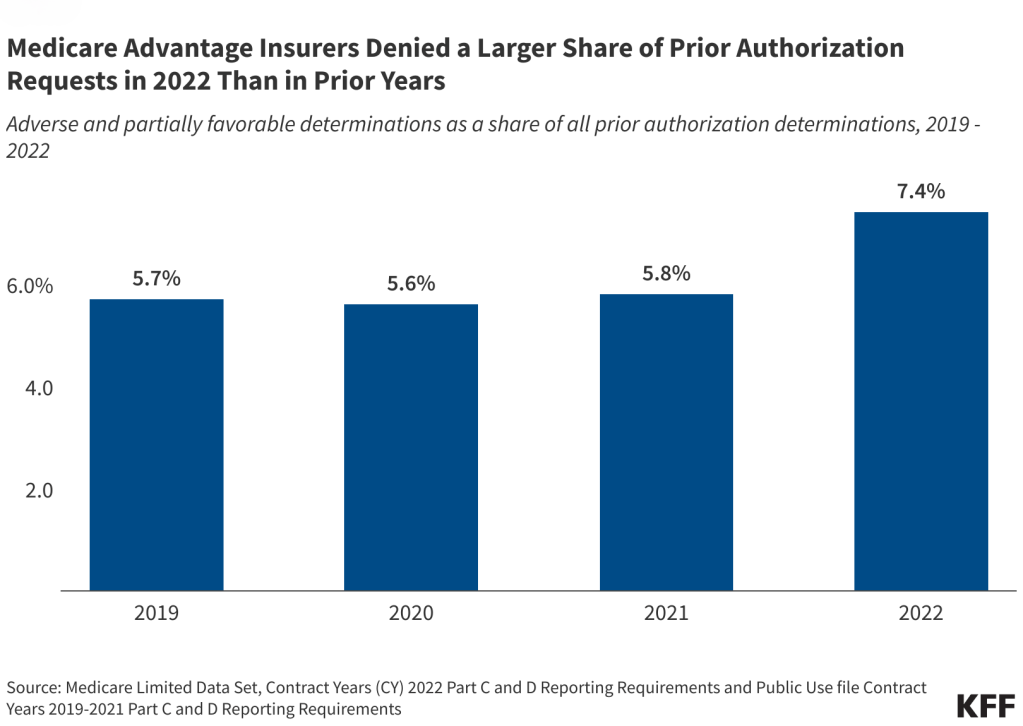

Medicare Advantage plans can require enrollees to receive prior authorization before a service will be covered, and nearly all Medicare Advantage enrollees (99%) are in plans that require prior authorization for some services in 2024 (Figure 8). Prior authorization is most often required for relatively expensive services, such as skilled nursing facility stays (99%), Part B drugs (98%), inpatient hospital stays (acute: 98%; psychiatric: 93%) and outpatient psychiatric services (82%) and is rarely required for preventive services (6%). Prior authorization is also required for the majority of enrollees for some extra benefits (in plans that offer these benefits), including comprehensive dental services, and hearing and eye exams. The number of enrollees in plans that require prior authorization for one or more services stayed around the same from 2023 to 2024. In contrast to Medicare Advantage plans, traditional Medicare does not generally require prior authorization for services and does not require step therapy for Part B drugs.

Meredith Freed, Jeannie Fuglesten Biniek, and Tricia Neuman are with KFF. Anthony Damico is an independent consultant.

Methods

This analysis uses data from the Centers for Medicare & Medicaid Services (CMS) Medicare Advantage Enrollment, Benefit and Landscape files for the respective year.

In previous years, KFF had used the term Medicare Advantage to refer to Medicare Advantage plans as well as other types of private plans, including cost plans, PACE plans, and HCPPs. However, since 2022, KFF has excluded cost plans, PACE plans, HCPPs in addition to MMPs. We exclude these other plans as some may have different enrollment requirements than Medicare Advantage plans (e.g., may be available to beneficiaries with only Part B coverage) and in some cases, may be paid differently than Medicare Advantage plans. These exclusions are reflected in both current data as well as data displayed trending back to 2010.