The Effects of Ending the Affordable Care Act’s Cost-Sharing Reduction Payments

Controversy has emerged recently over federal payments to insurers under the Affordable Care Act (ACA) related to cost-sharing reductions for low-income enrollees in the ACA’s marketplaces.

The ACA requires insurers to offer plans with reduced patient cost-sharing (e.g., deductibles and copays) to marketplace enrollees with incomes 100-250% of the poverty level. The reduced cost-sharing is only available in silver-level plans, and the premiums are the same as standard silver plans.

To compensate for the added cost to insurers of the reduced cost-sharing, the federal governments makes payments directly to insurance companies. The Congressional Budget Office (CBO) estimates the cost of these payments at $7 billion in fiscal year 2017, rising to $10 billion in 2018 and $16 billion by 2027.

The U.S. House of Representatives sued the Secretary of the U.S. Department of Health and Human Services under the Obama Administration, challenging the legality of making the cost-sharing reduction (CSR) payments without an explicit appropriation. A district court judge has ruled in favor of the House, but the ruling was appealed by the Secretary and the payments were permitted to continue pending the appeal. The case is currently in abeyance, with status reports required every three months, starting May 22, 2017.

If the CSR payments end – either through a court order or through a unilateral decision by the Trump Administration, assuming the payments are not explicitly authorized in an appropriation by Congress – insurers would face significant revenue shortfalls this year and next.

Many insurers might react to the end of subsidy payments by exiting the ACA marketplaces. If insurers choose to remain in the marketplaces, they would need to raise premiums to offset the loss of the payments.

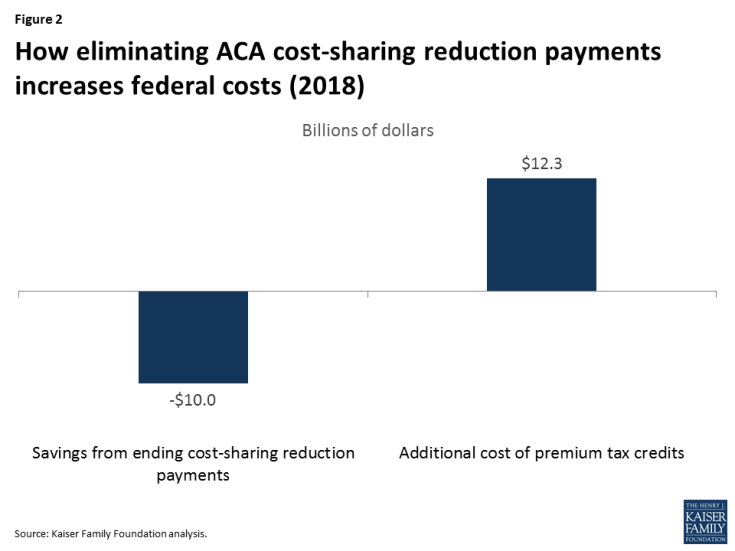

We have previously estimated that insurers would need to raise silver premiums by about 19% on average to compensate for the loss of CSR payments. Our assumption is that insurers would only increase silver premiums (if allowed to do so by regulators), since those are the only plans where cost-sharing reductions are available. The premium increases would be higher in states that have not expanded Medicaid (and lower in states that have), since there are a large number of marketplace enrollees in those states with incomes 100-138% of poverty who qualify for the largest cost-sharing reductions.

There would be a significant amount of uncertainty for insurers in setting premiums to offset the cost of cost-sharing reductions. For example, they would need to anticipate what share of enrollees in silver plans would be receiving reduced cost-sharing and at what level. Under a worst case scenario – where only people eligible for sharing reductions enrolled in silver plans – the required premium increase would be higher than 19%, and many insurers might request bigger rate hikes.

Figure 1: How much silver premiums would have to rise to compensate for loss of cost-sharing reduction payments

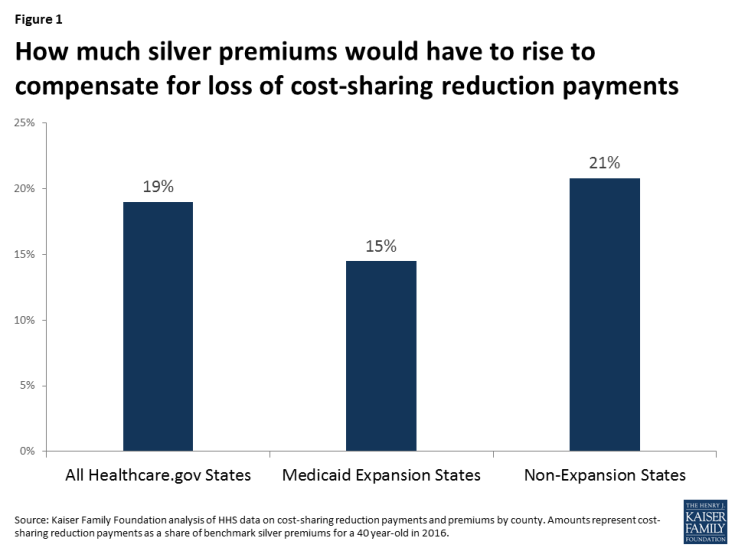

While the federal government would save money by not making CSR payments, it would face increased costs for tax credits that subsidize premiums for marketplace enrollees with incomes 100-400% of the poverty level.

The ACA’s premium tax credits are based on the premium for a benchmark plan in each area: the second-lowest-cost silver plan in the marketplace. The tax credit is calculated as the difference between the premium for that benchmark plan and a premium cap calculated as a percent of the enrollee’s household income (ranging from 2.04% at 100% of the poverty level to 9.69% at 400% of the poverty in 2017).

Any systematic increase in premiums for silver marketplace plans (including the benchmark plan) would increase the size of premium tax credits. The increased tax credits would completely cover the increased premium for subsidized enrollees covered through the benchmark plan and cushion the effect for enrollees signed up for more expensive silver plans. Enrollees who apply their tax credits to other tiers of plans (i.e., bronze, gold, and platinum) would also receive increased premium tax credits even though they do not qualify for reduced cost-sharing and the underlying premiums in their plans might not increase at all.

We estimate that the increased cost to the federal government of higher premium tax credits would actually be 23% more than the savings from eliminating cost-sharing reduction payments. For fiscal year 2018, that would result in a net increase in federal costs of $2.3 billion. Extrapolating to the 10-year budget window (2018-2027) using CBO’s projection of CSR payments, the federal government would end up spending $31 billion more if the payments end.

This assumes that insurers would be willing to stay in the market if CSR payments are eliminated.

Methods

We previously estimated that the increase in silver premiums necessary to offset the elimination of CSR payments would be 19%.

To estimate the average increase in premium tax credits per enrollee, we applied that premium increase to the average premium for the second-lowest-cost silver plan in 2017. The Department of Health and Human Services reports that the average monthly premium for the lowest-cost silver plan in 2017 is $433. Our analysis of premium data shows that the second-lowest-cost silver plan has a premium 4% higher than average than the lowest-cost silver plan.

We applied our estimate of the average premium tax credit increase to the estimated total number of people receiving tax credits in 2017. This is based on the 10.1 million people who selected a plan during open enrollment and qualified for a tax credit, reduced by about 17% to reflect the difference between reported plan selections in 2016 and effectuated enrollment in June of 2016.

We believe the resulting 23% increase in federal costs is an underestimate. To the extent some people not receiving cost-sharing reductions migrate out of silver plans, the required premium increase to offset the loss of CSR payments would be higher. Selective exits by insurers (e.g., among those offering lower cost plans) could also drive benchmark premiums higher. In addition, higher silver premiums would somewhat increase the number of people receiving tax credits because currently some younger/higher-income people with incomes under 400% of the poverty level receive a tax credit of zero because their premium cap is lower than the premium for the second-lowest-cost silver plan. We have not accounted for any of these factors.

Our analysis produces results similar to recent estimates for California by Covered California and a January 2016 analysis from the Urban Institute.