A Primer on Medicare: Key Facts About the Medicare Program and the People it Covers

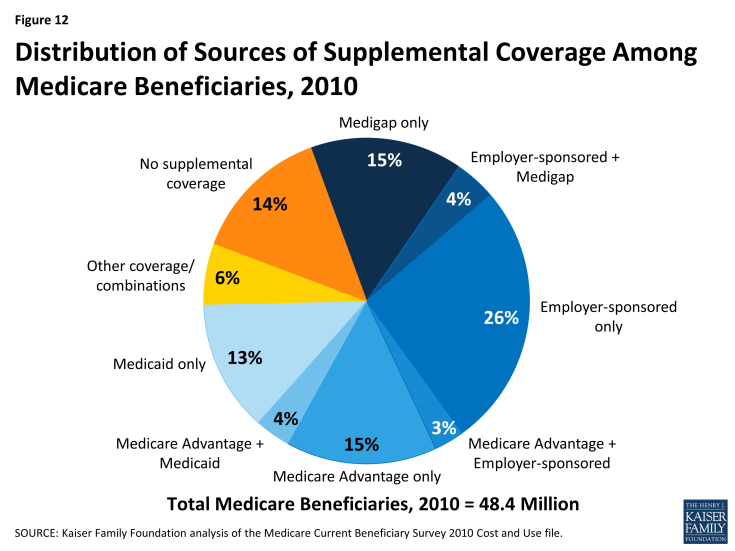

What types of supplemental insurance do beneficiaries have?

Many Medicare beneficiaries have some type of supplemental insurance coverage to help fill the gaps in Medicare’s benefit package and help with Medicare’s cost-sharing requirements.

Medicare provides protection against the costs of many health care services, but traditional Medicare has relatively high deductibles and cost-sharing requirements and places no limit on beneficiaries’ out-of-pocket spending. Moreover, traditional Medicare does not pay for some services vital to older people and those with disabilities, including long-term services and supports, dental services, eyeglasses, and hearing aids.

In light of Medicare’s benefit gaps and cost-sharing requirements, most beneficiaries in traditional Medicare have some form of supplemental coverage to help cover cost-sharing expenses required for Medicare-covered services (Figure 12). Other beneficiaries—30 percent in 2014—are covered under Medicare Advantage plans. However, 14 percent of all Medicare beneficiaries had no supplemental coverage in 2010, including a disproportionate share of beneficiaries under age 65 with disabilities, the near poor (those with incomes between $10,000 and $20,000), and black beneficiaries.1

Employer and union-sponsored plans are a leading source of supplemental coverage, providing coverage to about three in ten Medicare beneficiaries.

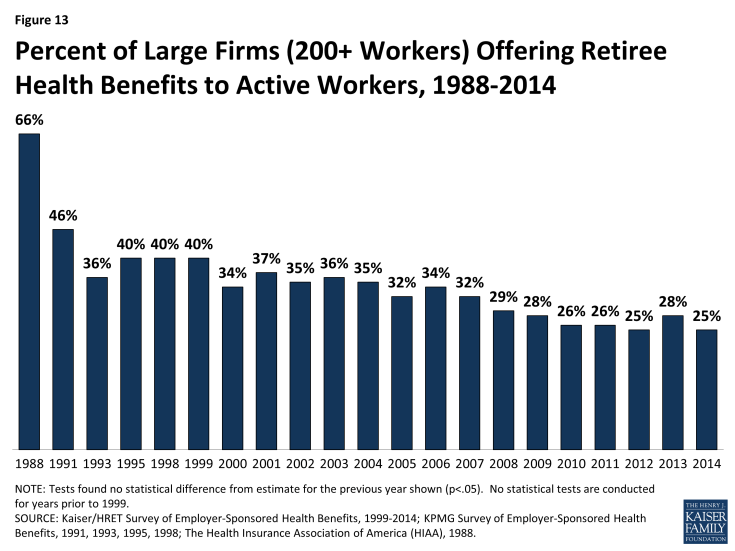

Employer-sponsored retiree coverage is a primary source of supplemental coverage for Medicare beneficiaries, but access to retiree health benefits is on the decline. In 2014, 25 percent of large firms (those with 200 or more workers) offered retiree health benefits to active workers, a sharp decline from the two-thirds offering health benefits for retirees in 1988 (Figure 13). Employer plans often provide additional benefits, such as additional prescription drug coverage and limits on retirees’ out-of-pocket health expenses. For some Medicare beneficiaries who are working (or have working spouses), employer plans are their primary source of health insurance coverage, and Medicare is the secondary payer.

Figure 13: Percent of Large Firms (200+ Workers) Offering Retiree Health Benefits to Active Workers, 1988-2014

Medicare Advantage plans are another source of supplemental coverage for people on Medicare.

Enrollment in private Medicare Advantage health plans has increased in recent years, and 30 percent of Medicare beneficiaries were enrolled in Medicare Advantage plans in 2014 (up from one-fourth in 2010). Medicare beneficiaries who enroll in private Medicare Advantage plans often receive supplemental benefits that are not covered under traditional Medicare, such as vision and dental benefits. Medicare Advantage plans are required to have a limit on beneficiaries’ out-of-pocket expenses for Medicare Part A and Part B covered services of $6,700 in 2014. (See What is Medicare Advantage? for additional information.)

Medigap policies, also called Medicare Supplement Insurance, are sold by private insurance companies and help cover Medicare’s cost-sharing requirements and fill gaps in the benefit package.

Medigap policies assist beneficiaries with their coinsurance, copayments, and deductibles for Medicare-covered services. Medigap policies help to shield beneficiaries from sudden, out-of-pocket costs resulting from an unpredictable medical event, allow beneficiaries to more accurately budget their health care expenses, and reduce the paperwork burden associated with medical claims. In 2010, about one in five Medicare beneficiaries had an individually-purchased Medicare supplement insurance policy. Currently, there are 10 standard Medigap plans (labeled Plan A-N; Plans E, H, I, and J are no longer available for sale); all Medigap policies of the same letter provide the same benefits (see Appendix 2: Standard Medigap Plan Benefits).2 Premiums vary by plan type, insurer, age of the enrollee, and state of residence.

Medicaid, the federal-state program that provides health and long-term care coverage to low-income people, is a source of supplemental coverage for nearly 10 million Medicare beneficiaries with low incomes and modest assets. These beneficiaries are known as dual eligible beneficiaries because they are eligible for both Medicare and Medicaid.

Medicaid helps to make Medicare affordable for low-income beneficiaries, given gaps in the Medicare benefit package, premiums, deductibles, and other cost-sharing requirements (see Appendix 3: Common Medicaid Eligibility Pathways and Benefits for Medicare Beneficiaries, 2014). In total, about one in five Medicare beneficiaries also had Medicaid coverage in 2010. Most dual-eligible beneficiaries qualify for full Medicaid benefits, including long-term care. These dual eligible beneficiaries also get help with Medicare’s premiums and cost-sharing requirements, and receive subsidies that help pay for drug coverage under Medicare Part D plans. (See What is the role of Medicare for dual-eligible beneficiaries? for additional information.)

In addition, some low-income Medicare beneficiaries do not qualify for full Medicaid benefits, but receive help with Medicare premiums and/or some cost-sharing requirements through the Medicare Savings Programs (MSPs).3 Eligibility for this assistance is based on a beneficiary’s income and resources (the latter generally must be less than $7,160 for a single person and $10,750 for a married couple in 2014).4