Growth in Medicaid MCO Enrollment during the COVID-19 Pandemic

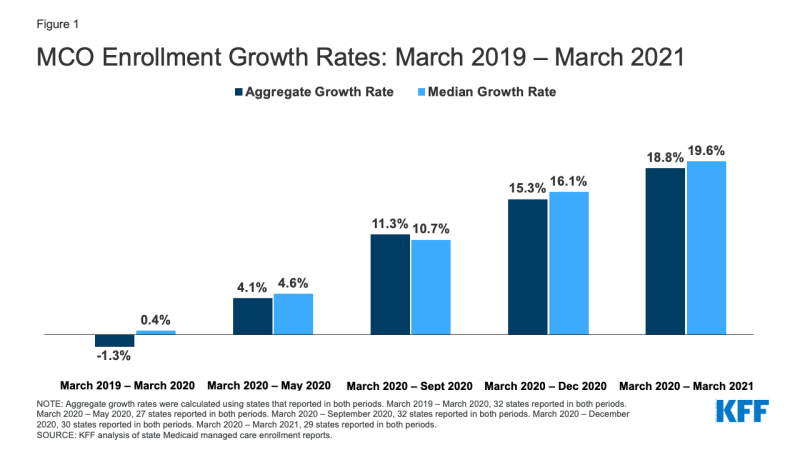

This data note looks at state Medicaid managed care enrollment data through March 2021 to assess the impact of the COVID-19 pandemic and economic crisis on Medicaid enrollment. Data collected for 29 states show that the rate of Medicaid managed care enrollment growth was 18.8% when comparing managed care enrollment from March 2020 through March 2021 (Figure 1). The rate accelerated compared to March 2020 through September 2020 and reversed the trend seen from March 2019 to March 2020 when aggregate growth declined. Recent trends mirror national enrollment trends that show enrollment growth has been accelerating since the start of the pandemic. Enrollment growth is primarily attributable to the economic downturn as well as the “maintenance of eligibility” (MOE) requirements tied to a 6.2 percentage point increase in the federal match rate (FMAP) authorized by the Families First Coronavirus Response Act (FFCRA) – which prevents states from disenrolling Medicaid beneficiaries if they accept the additional federal funding.

Why are recent state MCO enrollment data an important indicator? Preliminary national Medicaid and CHIP enrollment data collected by the Centers for Medicare and Medicaid Services (CMS) is lagged and currently available through January 2021. These data show an increase in Medicaid and CHIP enrollment of 9.3 million or 13.1% from February 2020 through January 2021. Our KFF Medicaid Managed Care Tracker tracks Medicaid enrollment in comprehensive Medicaid managed care organizations (MCOs) for all states that make these data publicly available. These data are updated in our tracker annually with March enrollment data, but given changes related to the pandemic we have updated the tracker more frequently to provide a more current look at enrollment trends.

These data are informative as more than two-thirds of beneficiaries nationally receive most or all of their care through risk-based MCOs and almost two-thirds of states that contract with MCOs enroll 75% or more of their Medicaid beneficiaries in MCOs. Children and nonelderly adults are groups more likely to be affected by changes in the economy and are also more likely to be enrolled in Medicaid MCOs. Increased enrollment in MCOs is directly tied to spending without immediate regard to utilization of care. While utilization may be rebounding, it decreased during the pandemic for non-urgent care. However, since states make upfront capitation payments to MCOs to provide access to a range of services, analyzing growth in Medicaid MCO enrollment specifically is valuable beyond signaling broader trends in Medicaid enrollment.

What were the trends prior to the pandemic? Data show that prior to the pandemic, there was an aggregate enrollment decline among reporting states. Specifically, among the 32 states reporting data for March 2019 and March 2020 (of the 40 states, including DC, that contract with MCOs), there was an aggregate decline of 1.3% (Table 1). The median change was essentially flat, showing a 0.4% increase, and there were a relatively equal number of states reporting enrollment gains and enrollment declines (17 and 15 respectively). In 2018, these states accounted for over 90% of the total share of enrollment in Medicaid MCOs nationally.

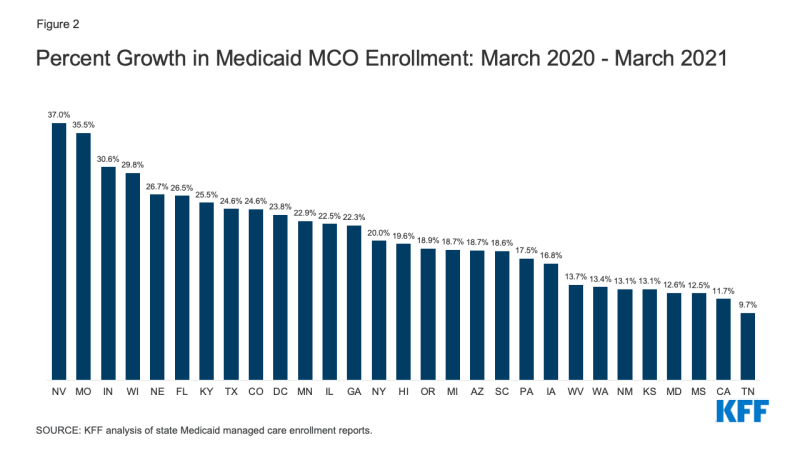

What are the more recent trends? Negative growth seen from March 2019 to March 2020 reversed and started to accelerate following the start of the COVID-19 pandemic. Among states that reported data in the respective months, when compared to March 2020, states saw an increase in enrollment growth of 4.1% in May 2020, 11.3% in September 2020, 15.3% in December 2020, and 18.8% in March 2021 with similar median growth rates in each time period (Figure 1).1 Growth rates from March 2020 to March 2021 across states ranged from 9.7% (Tennessee) to 37.0% (Nevada) (Figure 2).

Overall growth in Medicaid enrollment likely reflects both changes in the economy, as people experience income and job loss and become eligible for and enroll in Medicaid coverage, and the FFCRA MOE provisions that require states to ensure continuous coverage for current Medicaid enrollees through the end of the month in which the PHE ends. There is significant variation in MCO enrollment growth across states; however, the variation appears to align with the variation seen in overall Medicaid enrollment growth rates across states.

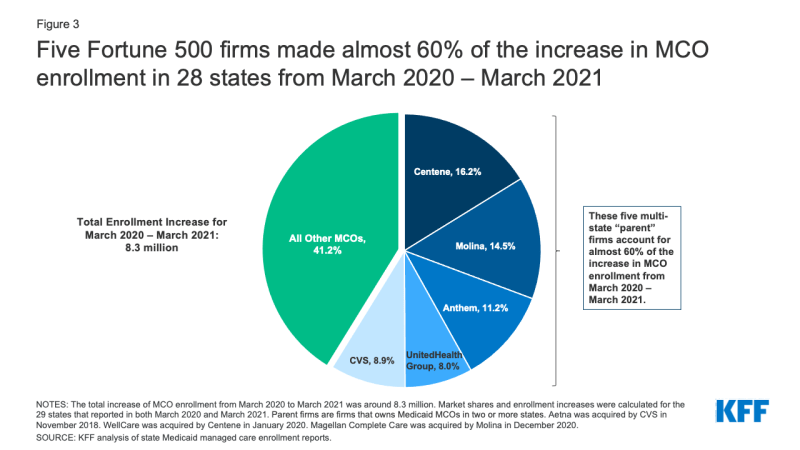

Parent firms, firms that own Medicaid MCOs in two or more states, have seen large increases in both enrollment and market share. As of July 2018 (the latest period with national data) six parent firms – UnitedHealth Group, Centene, Anthem, Molina, Aetna, and WellCare – accounted for over 47% of all Medicaid MCO enrollment. In November 2018, Aetna was acquired by CVS and in 2020, WellCare was acquired by Centene. From March 2020 to March 2021, overall Medicaid MCO enrollment increased by around 8.3 million enrollees of which the five parent firms accounted for almost 60% (Figure 3).

Figure 3: Five Fortune 500 firms made almost 60% of the increase in MCO enrollment in 28 states from March 2020 – March 2021

What should we watch going forward? Last summer, states projected that the MOE requirements and the continued economic downturn would maintain upward pressure on Medicaid enrollment in FY 2021 (which ends June 30, 2021 for most states). While the current PHE declaration expires 90 days from April 21, 2021, the Biden Administration has notified states that the PHE will likely remain in place throughout CY 2021 and that states will receive 60 days-notice before the end of the PHE. Additionally, with the Biden administration’s executive order to reopen the enrollment in the federal ACA Marketplace and the “no wrong door” application process, more individuals may enroll in Medicaid coverage in the coming months.2 Enrollment may continue to grow while the MOE remains in place, during ACA open enrollment period that continues through August 15, 2021, and because enrollment growth may be lagged and continue even as national indicators begin to improve. This effect was observed following the end of the Great Recession in 2009 when Medicaid spending and enrollment continued to grow in 2010 and 2011. Continued growth in MCO enrollment could put pressure on overall state budgets. Therefore, states may want to continue to review utilization patterns as well as options to mitigate risks related to potential overpayments to MCOs.

| Table 1: Change in MCO Enrollment, March 2019 – March 2021 | ||||||||

| Enrollment | Percent Change | |||||||

| State | March 2019 | March 2020 | September 2020 | March 2021 | March 2019 – March 2020 | March 2020 – September 2020 | March 2020 – March 2021 | |

| Overall | 33 States Reporting | 33 States Reporting | 34 States Reporting | 29 States Reporting | -1.3% | 11.3% | 18.8% | |

| Arizona | 1,514,431 | 1,517,228 | 1,692,948 | 1,800,529 | 0.2% | 11.6% | 18.7% | |

| California | 10,452,386 | 10,166,418 | 10,857,552 | 11,353,379 | -2.7% | 6.8% | 11.7% | |

| Colorado | 110,965 | 121,435 | 138,312 | 151,270 | 9.4% | 13.9% | 24.6% | |

| Delaware | 200,194 | 198,477 | 213,216 | NR | -0.9% | 7.4% | – | |

| District of Columbia | 194,896 | 182,530 | 200,049 | 225,989 | -6.3% | 9.6% | 23.8% | |

| Florida | 2,975,428 | 2,906,434 | 3,389,302 | 3,677,298 | -2.3% | 16.6% | 26.5% | |

| Georgia | 1,360,907 | 1,387,641 | 1,607,743 | 1,696,673 | 2.0% | 15.9% | 22.3% | |

| Hawaii | 344,254 | 340,541 | 378,100 | 407,422 | -1.1% | 11.0% | 19.6% | |

| Illinois | 2,144,696 | 2,197,501 | 2,549,635 | 2,691,162 | 2.5% | 16.0% | 22.5% | |

| Indiana | 1,078,209 | 1,116,114 | 1,307,448 | 1,458,069 | 3.5% | 17.1% | 30.6% | |

| Iowa | 562,432 | 578,226 | 635,790 | 675,185 | 2.8% | 10.0% | 16.8% | |

| Kansas | 380,022 | 389,754 | 419,109 | 440,681 | 2.6% | 7.5% | 13.1% | |

| Kentucky | 1,233,360 | 1,195,787 | 1,305,929 | 1,500,939 | -3.0% | 9.2% | 25.5% | |

| Louisiana | 1,533,075 | NR | 1,611,537 | 1,706,781 | – | – | – | |

| Maryland | 1,197,185 | 1,212,628 | 1,294,436 | 1,364,957 | 1.3% | 6.7% | 12.6% | |

| Massachusetts | 695,290 | 717,029 | 787,379 | NR | 3.1% | 9.8% | – | |

| Michigan | 1,760,122 | 1,772,762 | 1,975,341 | 2,105,078 | 0.7% | 11.4% | 18.7% | |

| Minnesota | 835,528 | 841,347 | 967,376 | 1,033,751 | 0.7% | 15.0% | 22.9% | |

| Mississippi | 437,194 | 431,523 | 462,070 | 485,435 | -1.3% | 7.1% | 12.5% | |

| Missouri | 676,539 | 549,116 | 680,421 | 744,224 | -18.8% | 23.9% | 35.5% | |

| Nebraska | 233,431 | 232,991 | 257,589 | 295,175 | -0.2% | 10.6% | 26.7% | |

| Nevada | 466,227 | 434,252 | 543,650 | 595,001 | -6.9% | 25.2% | 37.0% | |

| New Mexico | 660,646 | 674,343 | 727,421 | 762,714 | 2.1% | 7.9% | 13.1% | |

| New York | 4,344,939 | 4,210,483 | 4,776,592 | 5,054,373 | -3.1% | 13.4% | 20.0% | |

| North Dakota | NR | 19,814 | 22,593 | NR | – | 14.0% | – | |

| Ohio | 2,344,075 | 2,055,454 | NR | NR | -12.3% | – | – | |

| Oregon | 853,185 | 898,749 | 994,631 | 1,068,563 | 5.3% | 10.7% | 18.9% | |

| Pennsylvania | 2,274,092 | 2,235,532 | 2,461,326 | 2,626,383 | -1.7% | 10.1% | 17.5% | |

| South Carolina | 794,184 | 788,253 | 872,574 | 934,517 | -0.7% | 10.7% | 18.6% | |

| Tennessee | 1,389,600 | 1,421,145 | 1,493,081 | 1,558,446 | 2.3% | 5.1% | 9.7% | |

| Texas | 3,688,147 | 3,614,486 | 4,126,940 | 4,504,285 | -2.0% | 14.2% | 24.6% | |

| Virginia | NR | NR | 1,513,132 | 1,634,786 | – | – | – | |

| Washington | 1,332,557 | 1,529,039 | 1,645,684 | 1,734,004 | 14.7% | 7.6% | 13.4% | |

| West Virginia | 390,546 | 402,303 | 437,061 | 457,534 | 3.0% | 8.6% | 13.7% | |

| Wisconsin | 756,650 | 766,477 | 910,960 | 995,094 | 1.3% | 18.9% | 29.8% | |

| NOTES: Select time periods for percent change in MCO enrollment growth rates are shown in this table. “NR” – Not Reported. Methodology for reporting enrollment data varies across states: some states report point in time (PIT) counts while other states report monthly averages. AR, NH, NJ, RI, and UT did not report any data for any time periods. Aggregate growth rates were calculated using states that reported in both periods. From March 2019 – March 2020, 32 states reported in both periods. From March 2020 – September 2020, 32 states reported in both periods. From March – March 2021, 29 states reported in both periods. Data for DC in March 2021 were preliminary. Data for TX were preliminary and February 2021, while data for GA and NE were from January 2021 to represent March 2021 as those were the most up-to-date data available. SOURCES: KFF analysis of state Medicaid managed care enrollment reports. |

||||||||

Endnotes

Growth rates were calculated using states that reported in both periods. From March 2019 – March 2020, 32 states reported in both periods. From March 2020 – May 2020, 27 states reported in both periods. From March 2020 – September 2020, 32 states reported in both periods. From March – December 2020, 30 states reported in both periods. From March 2020 – March 2021, 29 states reported in both periods.

The Biden Administration originally reopened enrollment in the Federal ACA Marketplace from February 15 to May 15, 2021 but extended this period through August 15, 2021.