The Uninsured Population in Texas: Understanding Coverage Needs and the Potential Impact of the Affordable Care Act

Financial Security Among Uninsured Adults in Texas

Poor and moderate-income families in Texas face multiple financial challenges on a daily basis, but a major challenge is the cost of health care. Poor and moderate -income adults without coverage are particularly vulnerable, facing even more financial strain than their insured counterparts. Both insured and uninsured adults in Texas struggle with medical bills and debt. Coverage expansions, assistance with premium costs, and limits on out-of-pocket costs under the ACA have the potential to ameliorate the financial issues associated with the cost of health care, but many uninsured adults, primarily poor adults, will be left without any assistance.

Health care costs pose a challenge for poor and moderate-income families in Texas, particularly if they are uninsured.

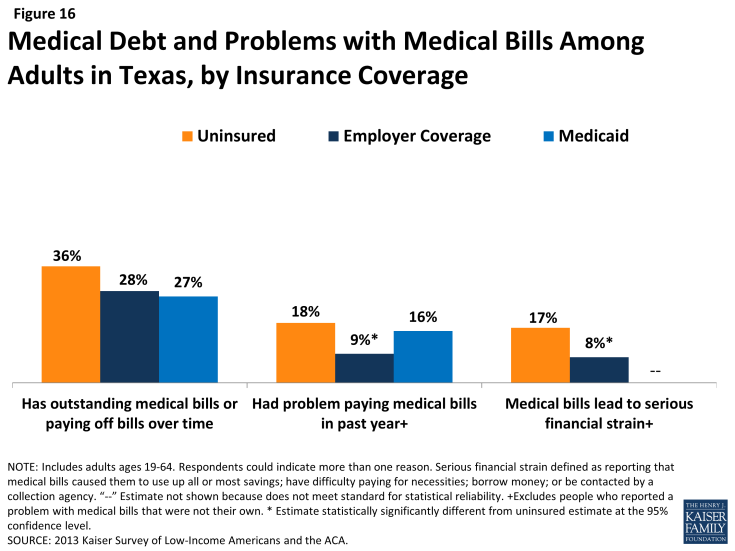

Health care accounts for a major budget item for low-income families, and affordability is a concern for many. Health care costs translate to medical debt for many poor adults. Over a third (36%) uninsured adults in Texas have outstanding medical bills (Figure 16). Notably, many insured Texas adults also report having medical bills that are unpaid or being paid off over time. However, given that the uninsured use less care than the insured, the high rates of medical debt among the uninsured indicate particular financial burden of having to pay the full cost of care on their own.

People may report medical debt but not have a problem paying that debt. However, when asked directly whether they had problems paying medical bills in the past year, notable shares of uninsured adults (18%) and adults with Medicaid (16%) reported that they did (Figure 16). In many cases, the problems people had paying medical bills were severe. Many reported that medical bills caused them to either use up all or most of their savings, have difficulty paying for necessities, borrow money, or be contacted by a collection agency.

Figure 16: Medical Debt and Problems with Medical Bills Among Adults in Texas, by Insurance Coverage

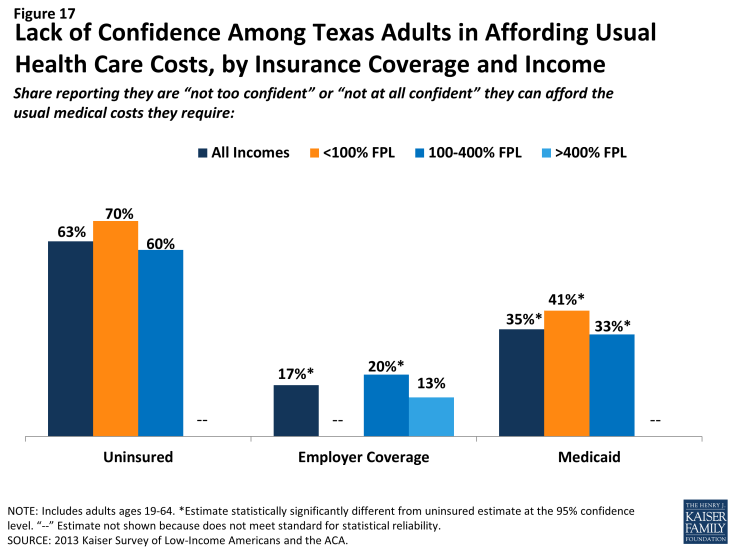

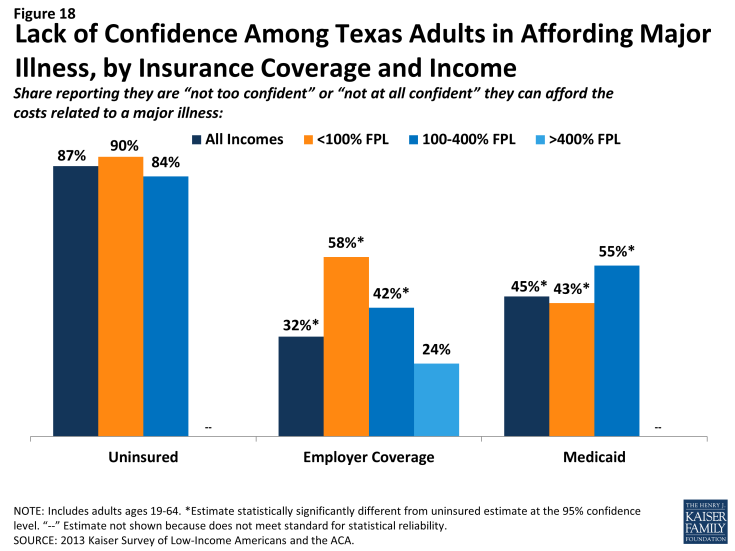

In addition to many poor adults in Texas reporting that they experienced financial strain or difficulty with health care costs, many live with worry about their ability to afford costs in the future. The vast majority of uninsured Texas adults across all income groups reported that they lack confidence that they can afford either the cost of care for services they typically require (Figure 17) or the cost of care should they face a major illness (Figure 18). While not surprising, this finding indicates that uninsured adults in Texas are aware of the high cost of health care services, as even those with moderate or high incomes do not believe they can afford these costs.

Figure 17: Lack of Confidence Among Texas Adults in Affording Usual Health Care Costs, by Insurance Coverage and Income

Figure 18: Lack of Confidence Among Texas Adults in Affording Major Illness, by Insurance Coverage and Income

Affordability provisions in the ACA could ameliorate some of the challenges that poor insured Texans face in affording care. Under the law, qualified health plans must cover preventive services with no cost sharing and are prohibited from placing annual or lifetime caps on the dollar value of insurance coverage. In addition, plans may not exclude coverage for pre-existing conditions, which often were excluded from nongroup plans in the past and may have led to high out-of-pocket costs for insured individuals. Last, Texans who purchase coverage through the Texas Marketplace and have incomes up to 400% FPL receive tax credits to help them pay for their premiums, and those with incomes up to 250% FPL also receive subsidies to help with cost sharing under their plans. However, given survey findings that many poor insured people continue to face financial challenges related to health care, people may perceive even limited out-of-pocket costs to be unaffordable. It will be important to track whether there are ongoing financial barriers as people enroll in coverage and seek care. Further, many poor uninsured adults in the state will remain ineligible for financial assistance and are likely to continue to face financial hardship due to health care costs.

Uninsured adults living in poverty face fragile financial circumstances.

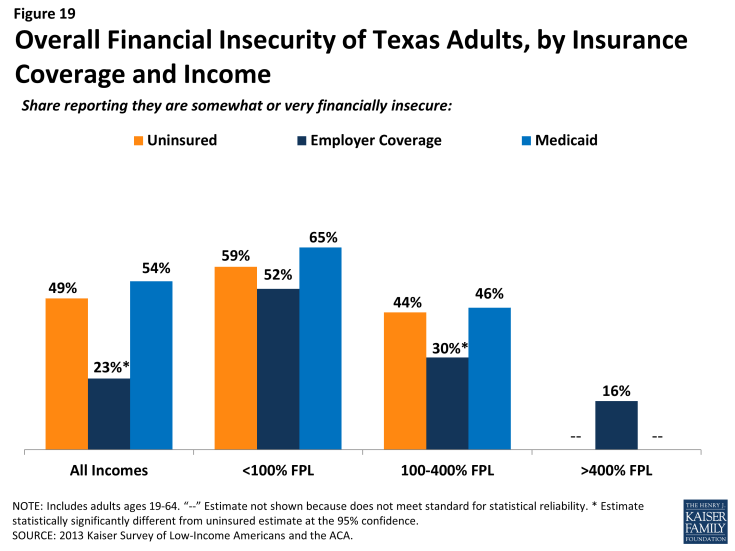

Difficulty or worry about paying for health care translates to expenses in other areas as well, and poor and moderate-income adults across coverage groups reported not being financially secure. However, adults in Texas who are poor and uninsured or covered by Medicaid are particularly vulnerable to financial insecurity even outside of health care. Among those with incomes <100% FPL, almost six in ten uninsured adults (59%) reported that they feel generally financially insecure (Figure 19). Notably, there are no significant differences across coverage groups among poor adults. This pattern may reflect the tenuous financial situation of adults with incomes below 100% FPL, regardless of insurance.

Figure 19: Lack of Confidence Among Texas Adults in Affording Major Illness, by Insurance Coverage and Income

General financial insecurity translates to concrete financial difficulties in making ends meet. Uninsured adults and those enrolled in Medicaid are more likely than those with employer coverage to have difficulty paying for other necessities, such as food, housing, or utilities, with 58% and 67%, respectively, reporting such difficulty, compared to 20% of those with employer coverage (Table 5). While poor adults (<100% FPL) in Texas across the coverage spectrum reported high rates of difficulty paying for necessities, those with employer coverage reported the lowest rates in this income group. These individuals may have the stronger or more stable ties to employment than their counterparts with other or no insurance coverage. A similar pattern holds for people’s ability to get ahead financially, either saving money or paying off debt.

Large shares of adults across income and coverage groups have also reported that they have taken on debt or taken money out of their savings to pay bills in the past year. About a third of uninsured adults and of those enrolled in Medicaid report changing their living situation or postponing marriage or children for financial reasons (Table 5).

| Table 5: Financial Difficulty Among Adults in Texas, by Income and Coverage | ||||

| Uninsured | Insured | |||

| Employer | Medicaid | |||

| Has difficulty paying for necessities | ||||

| All incomes | 58% | 20%* | 67% | |

| <100% FPL | 68% | 53% | 84%* | |

| 100-400% FPL | 54% | 24%* | 53% | |

| >400% FPL | — | 14% | — | |

| Has difficulty saving money | ||||

| All incomes | 84% | 49%* | 83% | |

| <100% FPL | 89% | 83% | 85% | |

| 100-400% FPL | 80% | 57%* | 86% | |

| >400% FPL | — | 40% | — | |

| Has difficulty paying off debt | ||||

| All incomes | 58% | 37%* | 53% | |

| <100% FPL | 62% | 71% | 65% | |

| 100-400% FPL | 55% | 41%* | 48% | |

| >400% FPL | — | 31% | — | |

| Taken on debt or took money out of savings to pay bills | ||||

| All incomes | 47% | 40% | 36% | |

| <100% FPL | 41% | 41% | 23%* | |

| 100-400% FPL | 51% | 44% | 57% | |

| >400% FPL | — | 38% | — | |

| Changed living situation or postponed marriage/children for financial reasons | ||||

| All incomes | 33% | 21%* | 31% | |

| <100% FPL | 34% | 42% | 35% | |

| 100-400% FPL | 33% | 21%* | — | |

| >400% FPL | — | 18% | — | |

| Notes: “–“: Estimates with relative standard errors > 30% or sample size too small for analysis are not provided. *Estimate statistically significantly different from uninsured estimate at the 95% confidence level. SOURCE: 2013 Kaiser Survey of Low-Income Americans and the ACA. |

||||

Though it is not surprising that many poor families are in a precarious financial situation, it is notable that poor adults who lack insurance coverage or who were covered by Medicaid before the ACA are more financially unstable than their privately-insured counterparts. This finding is of particular concern given many poor adults remain ineligible for Medicaid in the state. In Texas, Medicaid coverage for adults is targeted to those with the greatest need, and this role is reflected in the fact that they face similar financial challenges as their uninsured counterparts. While insurance coverage can provide financial protection in the event of illness or injury, it is not curative of all of the financial burdens faced by poor families. Given their overall situation, health insurance alone may not lift poor people out of poverty, and many poor adults may continue to face financial challenges even after gaining coverage. Coverage under the ACA may help address some of the consequences of financial instability among moderate-income families, and linking adults with other support systems may help address the broader financial challenges that they face.