Medicare Advantage 2020 Spotlight: First Look

Plan Offerings in 2020

Number of Plans

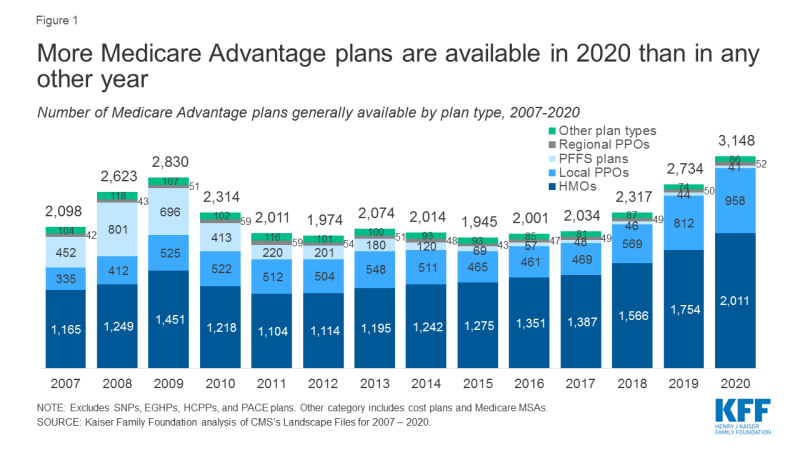

Total Number of Plans. In total, 3,148 Medicare Advantage plans will be available nationwide for individual enrollment in 2020 – a 15 percent increase (414 more plans) from 2019 and the largest number of plans ever available (Figure 1; Appendix Table 1). These numbers exclude employer or union-sponsored group plans and Special Needs Plans, which are only available to select populations. Similar to prior years, HMOs continue to account for about two-thirds (64%) of all plans offered in 2020.

The growth in number of plans varies across states and counties, with the preponderance of the growth in plans occurring in California and Florida (61 more and 42 more plans, respectively; data not shown). Indiana and Puerto Rico will have 5 fewer plans available in 2020 than in 2019, while Utah will have 2 fewer plans, and Maryland and Hawaii will each have one fewer plan available in 2020 than in 2019.

While many employers and unions also offer Medicare Advantage plans to their retirees, no information about these plans is made available by CMS to the public during the Medicare open enrollment period because these plans are not available to the general Medicare population.

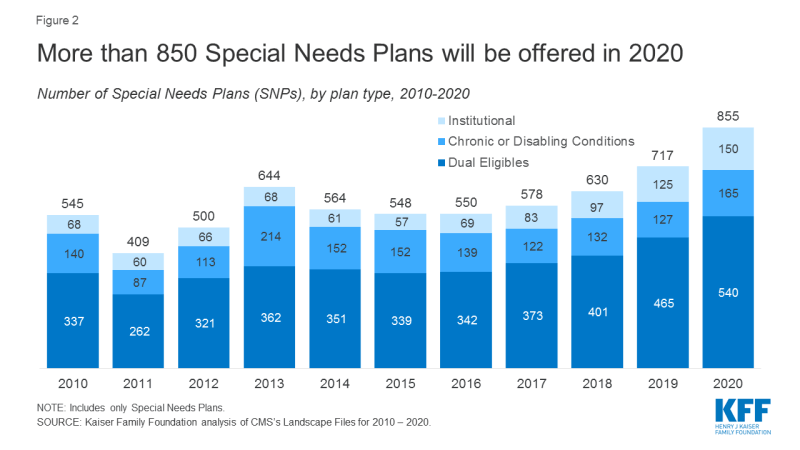

Special Needs Plans (SNPs). More SNPs will be available in 2020 than in any year since they were authorized, increasing from 717 plans in 2019 to 855 plans in 2019, a 19 percent increase (Figure 2). The SNP market may be an especially attractive market because potential overpayments to plans may be largest for those plans that are serving the sickest beneficiaries.

The rise in SNPs for people who require an institutional-level of care (I-SNPs) has been particularly notable, more than doubling from 69 plans in 2016 to 150 plans in 2020. I-SNPs may be attractive to insurers because they tend to have much lower marketing costs than other plan types since they are often the only available option for people to receive their Medicare benefits in certain retirement communities and nursing homes. The number of SNPs for people dually eligible for Medicare and

Medicaid (D-SNPs) has also greatly increased over the past five years (58% increase since 2016), suggesting insurers’ continue to be interested in managing the care of this high-need population.

Most SNPs for people with chronic conditions (C-SNPs) will continue to target people with diabetes, heart disease, or lung conditions in 2020, as has been the case since the inception of SNPs. In 2020, three firms will offer C-SNPs for people with dementia (up from two firms in 2019) and one firm will continue to offer a C-SNP for people with mental health conditions in California. Four firms will continue to offer C-SNPs for people with end-stage renal disease (similar to 2019) and two firms will offer C-SNPs for people with HIV/AIDS (similar to 2019).

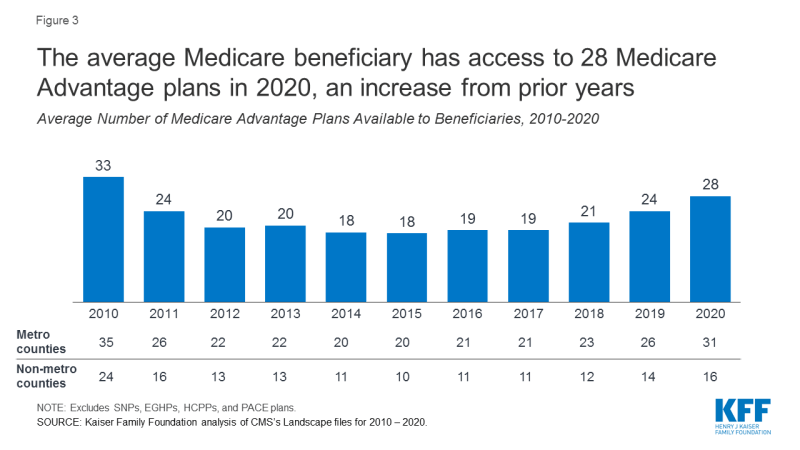

Number of Plans Available to Beneficiaries. In 2020, the average Medicare beneficiary will have access to 28 Medicare Advantage plans available for individual enrollment, the highest number of plans available to the average beneficiary since 2011 (Figure 3). Among the 28 Medicare Advantage plans available to the average Medicare beneficiary, 24 of the plans will include prescription drug coverage (MA-PDs); 90 percent of all Medicare Advantage plans offered will include prescription drug coverage in 2020.

Figure 3: The average Medicare beneficiary has access to 28 Medicare Advantage plans in 2020, an increase from prior years

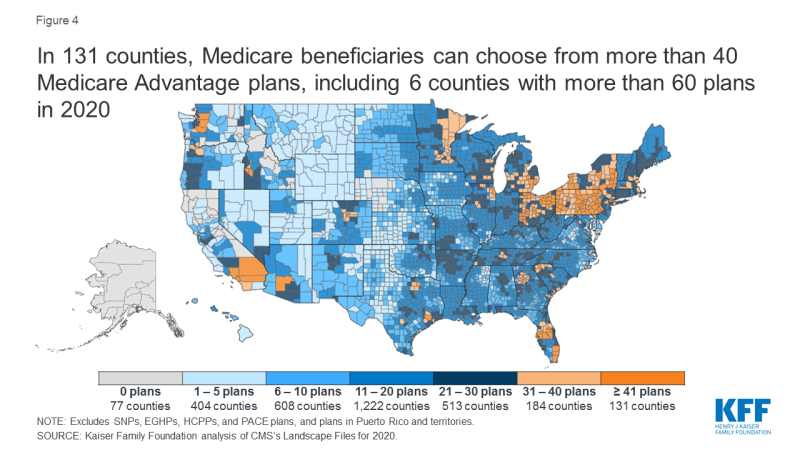

Variation in the Number of Plans, by Geographic Area. On average, beneficiaries in metropolitan areas will be able to choose from more than twice as many Medicare Advantage plans as beneficiaries in non-metropolitan areas (31 plans versus 16 plans, respectively). In ten percent of counties (accounting for 40% of beneficiaries), beneficiaries can choose from more than 30 plans in 2020, including four counties in Ohio (Mahoning, Medina, Trumbull, and Summit) and two counties in Pennsylvania (Bucks and Lancaster) where more than 60 plans will be available (Figure 4). In contrast, in 6 percent of counties (accounting for 1% of beneficiaries), beneficiaries can choose from two or fewer Medicare Advantage plans, including 59 counties in which only one plan will be available to beneficiaries. The number of counties with no Medicare Advantage plans will decline from 115 in 2019 to 77 in 2020. Additionally, no Medicare Advantage plans are available in territories other than Puerto Rico, similar to previous years.

Figure 4: In 131 counties, Medicare beneficiaries can choose from more than 40 Medicare Advantage plans, including 6 counties with more than 60 plans in 2020

Access to Medicare Advantage Plans, by Plan Type

As in recent years, virtually all Medicare beneficiaries (99%) will have access to a Medicare Advantage plan as an alternative to traditional Medicare, including almost all beneficiaries in metropolitan areas (99.9%) and the vast majority of beneficiaries in non-metropolitan areas (97%). In non-metropolitan counties, a smaller share of beneficiaries will have access to HMOs (81% in non-metropolitan versus 99% in metropolitan counties) or local PPOs (86% in non-metropolitan versus 95% in metropolitan counties), and a slightly larger share of beneficiaries will have access to regional PPOs (77% in non-metropolitan counties versus 72% in metropolitan counties).

Number of Firms

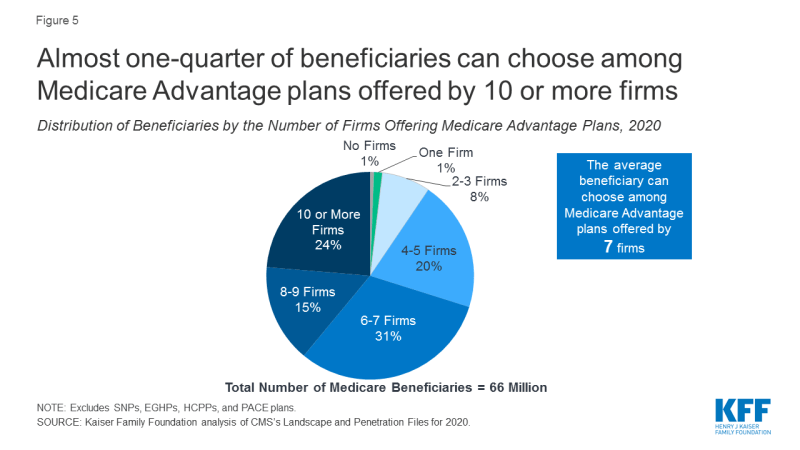

The average Medicare beneficiary will be able to choose from plans offered by 7 firms, on average, in 2020, similar to 2019 (Figure 5). Almost one-quarter of beneficiaries (24%) will be able to choose from plans offered by 10 or more firms. Fourteen firms will offer Medicare Advantage plans in six counties: Los Angeles, Orange, Riverside, and San Bernardino counties in California, Cook County (Chicago) in Illinois, and Summit County (Akron) in Ohio. In each of these metropolitan counties, per capita spending for traditional Medicare and the share of beneficiaries enrolled in Medicare Advantage plans are much higher than the national average. In contrast, in 146 counties, most of which are rural counties with relatively few Medicare beneficiaries, only one firm will offer Medicare Advantage plans in 2020, a reduction from 194 such counties in 2019.

Figure 5: Almost one-quarter of beneficiaries can choose among Medicare Advantage plans offered by 10 or more firms

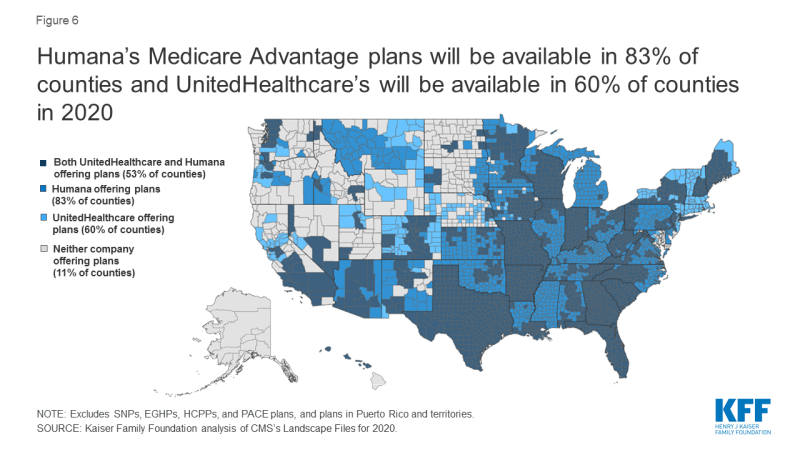

UnitedHealthcare and Humana, the two firms with the most Medicare Advantage enrollees, have large footprints across the country, offering plans in most counties. UnitedHealthcare is offering plans in 60 percent of counties, Humana is offering plans in 83 percent of counties, and both firms are offering plans in more than half of all counties (53%) in 2020 (Figure 6). More than 8 in 10 (85%) of Medicare beneficiaries have access to at least one Humana plan and 82 percent have access to at least one UnitedHealthcare plan.

Figure 6: Humana’s Medicare Advantage plans will be available in 83% of counties and UnitedHealthcare’s will be available in 60% of counties in 2020

New Market Entrants and Exits

Medicare Advantage continues to be an attractive market for insurers, with 13 firms entering the market for the first time in 2020, collectively accounting for about 7 percent of the growth in the number of plans available for general enrollment and about 5 percent of the growth in SNPs (Table 1). Ten new entrants will be offering HMOs available for individual enrollment. Five of the new entrants will be offering SNPs; three firms will be offering D-SNPs and two firms will be offering I-SNPs, including one firm (MoreCare) that will also be offering a C-SNP for people with HIV/AIDS. All of the new entrants are offering plans in one of ten states (FL, IL, LA, MI, NC, NY, SC, TN, TX, and VA).

Similar to prior years, some of the new entrants, such as Oscar and Troy Medicare, are funded by venture capital firms, joining about a dozen other venture capital-funded firms offering Medicare Advantage plans in 2020. While well over 100 insurers offered Medicare Advantage plans in 2019, only one insurer will be exiting the market in 2020, a sign that the vast majority of plans in the Medicare Advantage market are profitable. The exiting insurer had about 8,000 enrollees in Puerto Rico in 2019.

| Table 1. Entrants and Exiting Insurers in Medicare Advantage Markets, by Plan Type and Plan Locations, 2020 | |||||||

| Company Name | Total Number of Plans Offered | Plans for Individual Enrollment | Special Needs Plans (SNPs) | States in Which Plans Are Offered | |||

| HMOs | Other |

D-SNPs

|

C-SNPs | I-SNPs | |||

| New Entrants | |||||||

| ApexHealth, Inc. | 13 | X | X | NC, SC, TN, and VA | |||

| Clarion Health | 1 | X | FL | ||||

| Community Health Choice | 1 | X | TX | ||||

| Dignity Health Plan | 1 | X | LA | ||||

| El Paso Health Advantage | 1 | X | TX | ||||

| Experience Health, Inc. | 1 | X | NC | ||||

| Mary Washington Medicare Advantage | 2 | X | VA | ||||

| MoreCare | 4 | X | X | X | IL | ||

| Oscar | 2 | X | NY and TX | ||||

| PHP Medicare | 6 | X | MI | ||||

| Reliance Medicare Advantage | 2 | X | MI | ||||

| Troy Medicare | 1 | X | NC | ||||

| Zing Health | 1 | X | IL | ||||

| Exiting Insurers | |||||||

| Constellation Health | 8 | X | X | X | PR | ||

| Note: D-SNPs are plans for people dually eligible for Medicare and Medicaid; C-SNPs are plans for people with certain chronic conditions; and I-SNPs are plans for people that require an institutional level of care.

Source: Kaiser Family Foundation analysis of CMS Landscape Files for 2019 and 2020. |

|||||||

Premiums

The vast majority of Medicare Advantage plans for individual enrollment (90%) will include prescription drug coverage (MA-PDs), and 49 percent of these plans will charge no premium, other than the Part B premium, similar to 2019. More than nine out of ten beneficiaries (93%) will have access to a MA-PD with no monthly premium in 2020. However, in three rural states (AK, MT and WY), beneficiaries will not have access to a zero-premium MA-PD, and in four other states (MD, SD, ID, and ND), less than half of beneficiaries will have access to a zero-premium MA-PD. The average premium for MA-PDs (not weighted by enrollment) will be $36 per month in 2020, down from $40 per month in 2019. Medicare Advantage enrollees typically choose low premium plans, and enrollment-weighted premiums are often lower than the average premium across plans.

Extra Benefits

Medicare Advantage plans may provide extra benefits that are not offered in traditional Medicare, and can use rebate dollars (including bonus payments) to help cover the cost of these extra benefits. Beginning in 2020, Medicare Advantage plans can offer extra benefits that are not primarily health related. Plans may also restrict the availability of these extra benefits to certain subgroups of beneficiaries, making different benefits available to different enrollees. Further research is needed to assess the comprehensiveness of coverage for these extra benefits, and the extent to which the benefits are only available to certain subgroups of enrollees.

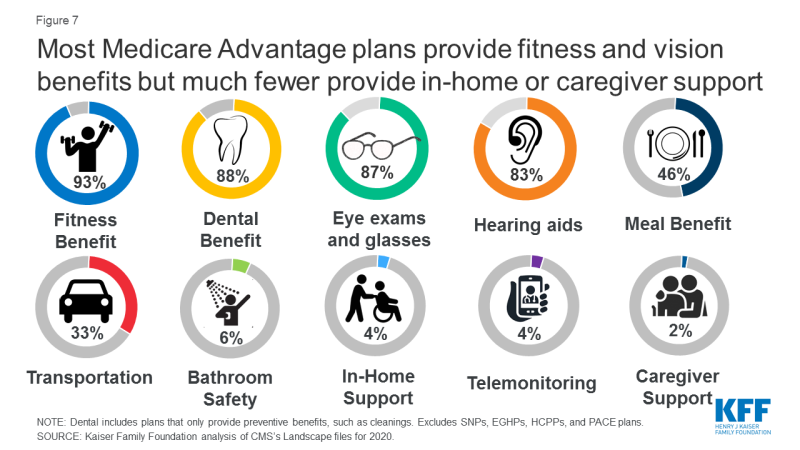

Availability of Extra Benefits in Plans for General Enrollment. More than 80 percent of plans provide some dental, vision, hearing, or fitness benefits (Figure 7); nearly 6 in 10 plans (58%) provide all of these four benefits in 2020. One-third of plans (33%) provide some transportation benefit in 2020, and almost half (46%) provide a meal benefit, such as a cooking class, nutrition education, or meal delivery. Less than 10 percent of plans provide bathroom safety devices (6%), in-home support (4%), telemonitoring (4%), or support for caregivers of enrollees (2%).

Figure 7: Most Medicare Advantage plans provide fitness and vision benefits but much fewer provide in-home or caregiver support

Availability of Extra Benefits in Special Needs Plans. SNPs are designed to serve a disproportionately high-need population, and a somewhat larger percentage of SNPs than plans for other Medicare beneficiaries provide their enrollees with transportation benefits (84%) and meal benefits (60%). Similar to plans available for general enrollment, a relatively small share of SNPs provide bathroom safety devices (7%), in-home support (13%), telemonitoring (10%), and support for caregivers (8%).

Access to Extra Benefits. Nearly all Medicare beneficiaries have access to a Medicare Advantage plan with some extra benefits not covered by traditional Medicare, with 97% having access to some dental, fitness, vision, and hearing benefits in 2020. The vast majority of beneficiaries also have access to transportation assistance (92%) and a meal benefit (96%), but far fewer have access to in-home support (54%), bathroom safety (49%), telemonitoring services (29%), and support for caregivers of enrollees (12%).

Discussion

More Medicare Advantage plans will be offered in 2020 than any other year. Thirteen insurers will be entering the Medicare Advantage market for the first time, and only one insurer will be exiting the market, suggesting that the Medicare Advantage market remains an attractive, profitable market for insurers. As in prior years, some (mostly non-metropolitan) counties are less attractive to insurers, with fewer firms and plans available. Overall, less than 1 percent of beneficiaries will not have access to a Medicare Advantage plan in 2020, similar to prior years. With more firms offering SNPs and the number of SNPs rapidly growing, there may be greater focus on how well high-need, vulnerable beneficiaries are being served by Medicare Advantage plans, including SNPs as well as plans for general enrollment. As Medicare Advantage enrollment continues to grow, insurers seem to be responding by offering more plans and choices to the people on Medicare.

Gretchen Jacobson, Meredith Freed, and Tricia Neuman are with KFF.

Anthony Damico is an independent consultant.