Medicare Part D: A First Look at Prescription Drug Plans in 2020

During the Medicare open enrollment period from October 15 to December 7 each year, beneficiaries can enroll in a plan that provides Part D drug coverage, either a stand-alone prescription drug plan (PDP) as a supplement to traditional Medicare, or a Medicare Advantage prescription drug plan (MA-PD), which covers all Medicare benefits, including drugs. Among the 45 million Part D enrollees in 2019, 20.6 million (46%) are in PDPs (excluding employer-only group PDPs). This issue brief provides an overview of PDPs that will be available in 2020 and highlights key changes from prior years.

Key Findings

- The average Medicare beneficiary will have a choice of 28 PDPs in 2020, one more PDP option than in 2019, and six more than in 2017, a 29% increase. A total of 948 PDPs will be offered in the 34 PDP regions in 2020 (plus another 11 PDPs in the territories), an increase of 202 PDPs since 2017.

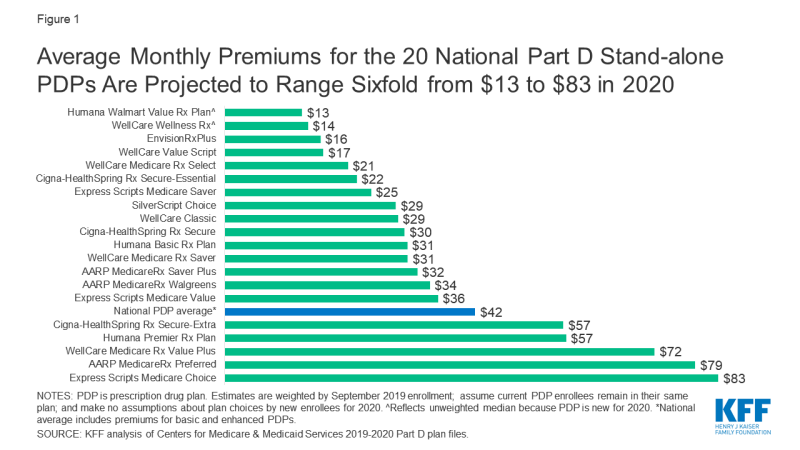

- PDP premiums will vary widely across plans in 2020, as in previous years (Figure 1). Among the 20 PDPs available nationwide, average premiums will range sixfold from a low of $13 per month for Humana Walmart Value Rx Plan to a high of $83 per month for Express Scripts Medicare Choice.

- Two-thirds of Part D enrollees without low-income subsidies (9.0 million enrollees) will see their monthly premium increase in 2020 if they stay in their same plan, while one-third (4.3 million) face premium decreases. As an example, the 1.9 million enrollees without low-income subsidies in the Humana Walmart Rx Plan, the third most popular PDP in 2019, will see their monthly premium double in 2020, from $28 to $57, unless they switch plans. This is due to plan changes and consolidations, with Humana consolidating two of its PDPs (Humana Walmart Rx and Humana Enhanced) into one PDP for 2020 and renaming it Humana Premier Rx, with a $57 monthly premium.

- The estimated national average monthly PDP premium for 2020 is projected to increase by 7% to $42.05, weighted by September 2019 enrollment. The actual average premium in 2020 may be lower if current enrollees switch to, and new enrollees choose, lower-premium plans during open enrollment.

- In 2020, all PDPs will have a benefit design with five or six tiers for covered generic, brand-name, and specialty drugs, and cost sharing other than the standard 25% coinsurance, similar to 2019. More than eight in 10 PDPs (86%) will charge a deductible, with most PDPs charging the standard deductible of $435 in 2020.

- Among all PDPs, median cost sharing is $0 for preferred generics and just $3 for generics, but $42 for preferred brands and 38% coinsurance for non-preferred drugs (the maximum allowed is 50%), plus 25% for specialty drugs (the maximum allowed is 33%).

- Medicare beneficiaries receiving the Low-Income Subsidy (LIS) will have a choice of seven premium-free PDPs in 2020, on average, one more than in 2019. In 2020, nearly 20% of all LIS PDP enrollees who are eligible for premium-free Part D coverage (1.3 million LIS enrollees) will pay Part D premiums averaging $18 per month unless they switch or are reassigned by CMS to premium-free plans.