Medicare Advantage 2016 Data Spotlight: Overview of Plan Changes

Plan Premiums

Premiums are the most visible and the easiest factor for beneficiaries to compare across plans. While other factors, such as limits on out-of-pocket spending, cost-sharing, prescription drugs, extra benefits, and provider networks, can have an even larger impact on beneficiaries’ out-of-pocket spending on health care and access to providers, information on them is less readily accessible and often more difficult to interpret. For cost-sharing and provider networks in particular, it is nearly impossible from publicly available data to construct an apples-to-apples comparison across plans that appropriately weights all factors. As a result, many people use the plan premiums to choose among plans.

Medicare beneficiaries enrolled in Medicare Advantage plans pay the Part B premium like other beneficiaries (less any rebate provided by the Medicare Advantage plan), and may also pay an additional monthly premium charged by the Medicare Advantage plan for benefits and prescription drug coverage. This analysis of premiums includes only Medicare Advantage plans that offer prescription drug coverage (MA-PDs). The minority of Medicare Advantage plans (13%) that do not cover prescription drugs are not included in the analysis, in order to better compare premiums across plan types and years.

Monthly Premiums (Unweighted by Enrollment)

To examine how premiums for all plans available to beneficiaries will change between 2015 and 2016, this spotlight first examines the change in premiums for all MA-PDs, without weighting them by the number of enrollees in each plan. The analysis includes plans with no premiums as well as plans with monthly premiums. In 2016, the average premium for MA-PDs (unweighted by plan enrollment) will be $53 per month – similar to 2015 (Table A3). Premiums for HMOs will average $39 per month, up $1 from 2015. Similar to prior years, HMOs will continue to have lower premiums than regional PPOs ($75 per month), local PPOs ($79 per month) and PFFS plans ($91 per month). Similar to 2015, regional PPOs will have the largest change in premiums, on average, and average premiums will increase $7, on average, from $68 per month in 2015. In contrast, premiums for local PPOs will decrease by $2, on average, from $81 per month in 2015.

Monthly Premiums (Weighted by Enrollment), Assuming Enrollees Remain in the Same Plan

To examine how premiums will change for Medicare Advantage enrollees, assuming they remain in the same plan between 2015 and 2016, this spotlight examines the premiums among MA-PDs offered in both years and weight the premiums by plan enrollment in 2015. These enrollee “weighted average” premiums are a clearer indication than unweighted premiums of the amount paid by the average Medicare Advantage enrollee because enrollment across plans is uneven. Similar to the prior analysis, this analysis includes plans with no premiums as well as plans with monthly premiums. Enrollees may be able to prevent or reduce increases in premiums by switching to another plan. After the open enrollment period, we will analyze the premiums for plans selected by all Medicare Advantage enrollees in 2016.1 In recent years, average premiums, weighted by actual enrollment, have tended to be lower than estimates of weighted premiums based on prior year enrollment. The difference reflects the net impact of beneficiaries making enrollment changes between one year and the next, and plan choices among new Medicare Advantage enrollees.

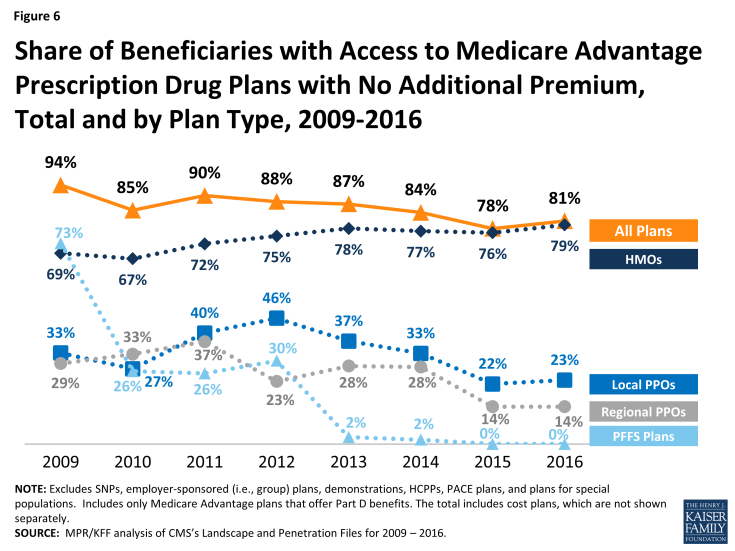

Based on plan enrollment in the Fall of 2015, the average Medicare Advantage enrollee in a plan that will continue to be offered in 2016 will pay about $41 per month, an increase of $3 per month (or 8%) compared to 2015, if they stay in the same plan (Figure 5). In percentage terms, enrollees in PFFS plans will experience a larger increase in premiums (13% on average) than enrollees in other types of Medicare Advantage plans, and average premiums for PFFS plan enrollees will rise from $52 per month to $58 per month, assuming no change in enrollment. The average increase in enrollment weighted premiums is lower than it has been since 2012 when there was a 3 percent increase. Premiums could be rising at a somewhat slower pace for many reasons including the fact that the changes in payments to plans as a result of the ACA are fully implemented in most counties. Monthly premiums, weighted for 2015 enrollment will be lower for enrollees in HMOs ($31 per month) than for enrollees in other types of Medicare Advantage plans, and higher for enrollees in local PPOs ($68 per month), on average.

Figure 5: Weighted Average Monthly Premiums for Medicare Advantage Prescription Drug Plans, Total and by Plan Type, 2015-2016

In general, enrollees in MA-PDs that will continue to be offered in 2016 had somewhat lower premiums in 2015, on average, than enrollees in plans that will be exiting the Medicare Advantage market in 2016 (Table A1). The 2015 premiums for plans remaining in the market in 2016 averaged $38 per month as compared to $41 per month for those exiting the market. However, the difference varies across plan types and these changes are difficult to interpret because plan premiums are a function of many plan-specific factors (e.g., benefits, cost-sharing, provider networks), as well regional-specific factors (e.g., local practice patterns, payments from the Medicare program).

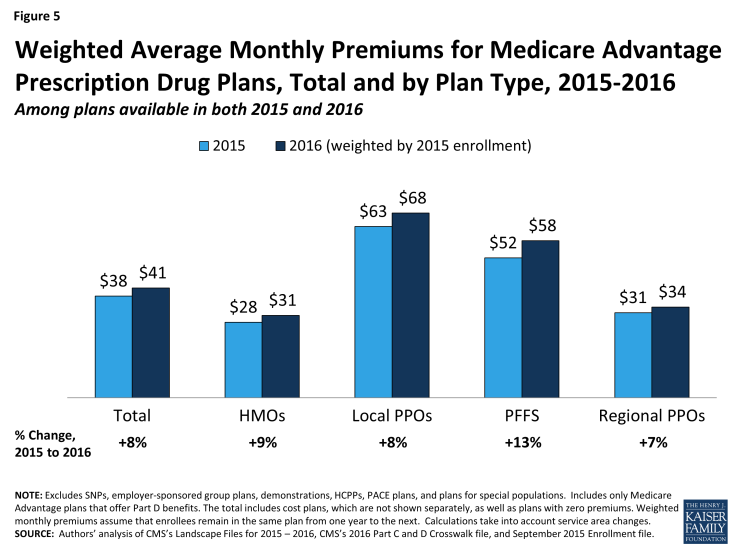

Access to Plans with No Premium

Medicare Advantage plans with no additional premium (other than the Medicare Part B premium) – so called “zero premium plans” – have been a feature of the Medicare Advantage landscape for many years. About four-fifths (81%) of all beneficiaries will have access to a zero-premium MA-PD in 2016, an increase from 78 percent in 2015 (Figure 6). The continued availability of zero-premium plans mainly reflects offerings among HMOs since zero-premium plans are less common among other plan types.