Medicaid Reforms to Expand Coverage, Control Costs and Improve Care: Results from a 50-State Medicaid Budget Survey for State Fiscal Years 2015 and 2016

Eligibility, Enrollment, Premiums and Cost-Sharing

| Key Section Findings |

Tables 2, 3 and 4 at the end of this section include additional details on eligibility, premiums and cost-sharing policy changes in FYs 2015 and 2016. These tables are also available in a downloadable PDF. |

Changes to Eligibility Standards

The ACA included a number of significant changes to Medicaid eligibility and enrollment policies. One of the most significant changes was to extend Medicaid coverage to nearly all non-elderly adults with incomes up to 138 percent of the federal poverty level (FPL) ($16,242 per year for an individual in 2015), ending the historic exclusion of adults without dependent children, or childless adults, from the program. However, the June 2012 Supreme Court ruling on the constitutionality of the ACA effectively made the Medicaid expansion optional for states. Regardless of whether states implement the Medicaid expansion, all states were required to implement a range of other changes to eligibility and enrollment under the ACA. These changes included transitioning to use of Modified Adjusted Gross Income (MAGI) to determine financial eligibility for children, pregnant women, parents and low-income adults; eliminating asset limits for these same groups; establishing a new minimum eligibility limit of 138 percent FPL for children in Medicaid, which resulted in the transition of older children from the Children’s Health Insurance Program (CHIP) to Medicaid in some states; and providing new streamlined application, enrollment, and renewal processes for individuals. In addition, Medicaid agencies must coordinate eligibility determination and enrollment processes with the new Marketplaces. Altogether, the eligibility changes in 2014 represent historic program changes. Most of these changes occurred in FY 2014. As a result, very few changes in eligibility standards occurred for FY 2015 and FY 2016.

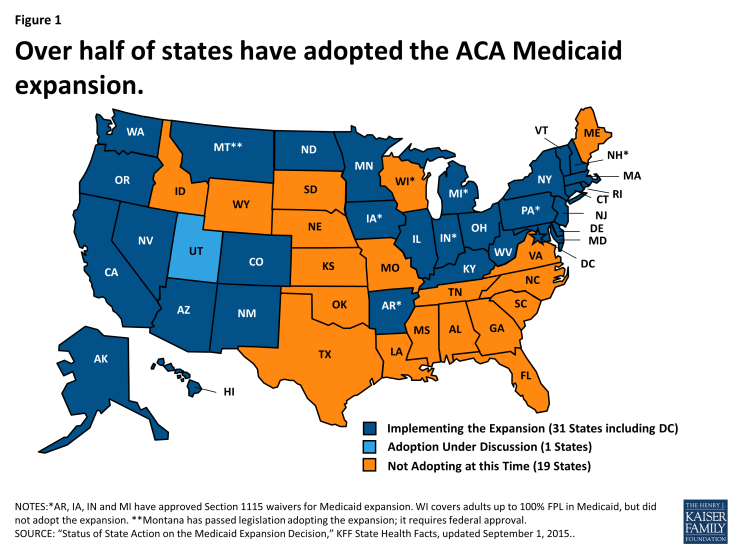

As of October 2015, 31 states (including DC) had adopted the Medicaid expansion. (Figure 1) In Utah, discussions continue about implementing the Medicaid expansion, and other states may re-visit the decision in the next legislative session. Most states that have adopted the ACA Medicaid expansion did so in FY 2014 (26 states). In FY 2015, three additional states adopted the ACA Medicaid expansion (Indiana, New Hampshire and Pennsylvania.) In FY 2016, two states to date have adopted the ACA Medicaid expansion; Alaska implemented in September 2015, and Montana plans to implement in January 2016 pending federal waiver approval.

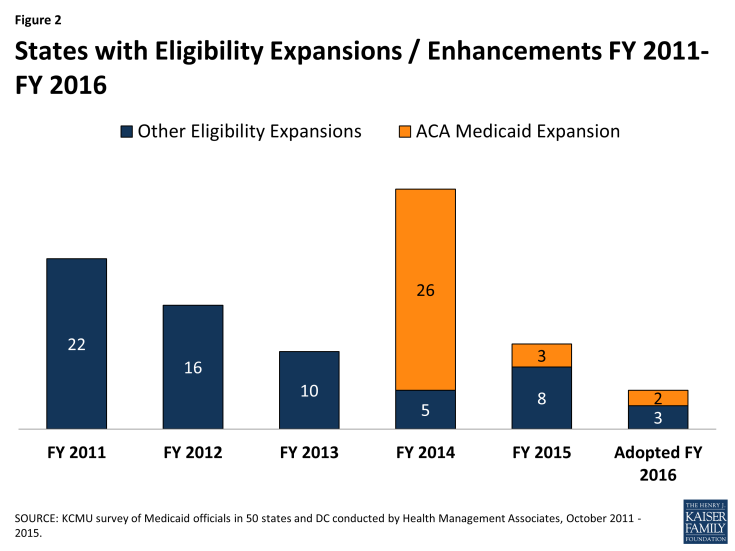

Other eligibility changes in FY 2015 and FY 2016 were limited and targeted to small numbers of beneficiaries. For FY 2015, a total of eleven states made changes that expanded Medicaid eligibility and for FY 2016, five states plan to implement Medicaid eligibility expansions. (Figure 2) Only one state in FY 2015 and three states in FY 2016 made or are planning eligibility restrictions that were likely to leave individuals without other coverage options. A number of states are making changes to existing Medicaid eligibility pathways due to the availability of new coverage options; these changes are not counted as restrictions or expansions in this report.

Coverage Transitions

As reported last year, with more coverage options available across the income spectrum, some states made changes to existing Medicaid pathways. These changes are discussed below and are noted in Tables 2 and 3 as “(#)” meaning they are not counted as a positive or negative eligibility change.

Medicaid expansion states reducing eligibility for adults over 138 percent FPL. Both Minnesota and New York previously covered adults with incomes above traditional Medicaid eligibility levels through Medicaid waiver programs but have transferred those groups to their Basic Health Plans, discussed below. In addition, Connecticut reported plans to reduce Medicaid parent eligibility levels to 150 percent FPL in FY 2016; many parents previously eligible at the higher levels should be eligible for Marketplace subsidies.

| Basic Health Plan |

New York and Minnesota both implemented a Basic Health Plan (BHP) in FY 2015. Under the BHP provisions of the ACA, a state receives 95 percent of what the federal government would have spent on premium and cost-sharing subsidies in the Marketplace for the eligible population. The state then provides coverage through a state-managed BHP. While the BHP is not part of Medicaid, it affected Medicaid in these states.

|

States reducing or eliminating optional and limited Medicaid eligibility pathways. With new coverage options available either through the Medicaid expansion or the Marketplace, states have new options about how they treat some existing eligibility pathways for more limited Medicaid coverage, such as pregnancy related coverage, family planning-only programs, some spend-down programs, and the Breast and Cervical Cancer Treatment (BCCT) program.2 Prior to the implementation of the major ACA coverage changes, it was not clear if states would eliminate or scale back some of these programs in response to the new coverage options. While most states reported no current plans to change such pathways, many states indicated that enrollment in these groups has declined as more individuals are eligible under the adult Medicaid expansion group. However, a few states did note eligibility changes. (Table 1) In these cases, states generally plan to not allow new enrollment through these pathways but will continue coverage for those already enrolled.

| Table 1: States Eliminating Coverage for Optional and Limited Medicaid Eligibility Pathways | ||

| Program | In Place in 2013 (Prior to the ACA) | Eliminated or Plans to Eliminate |

| Breast and Cervical Cancer Treatment | 51 | Arkansas and Maryland (FY 2014), Illinois (FY 2016) |

| Medically Needy / Spend Down Adults | 36 | Hawaii and Illinois (FY 2014); Pennsylvania1 (FY 2015) |

| Pregnant Women Coverage > 138% FPL | 43 | Louisiana2 (FY 2014) |

| Family Planning Waivers or State Plan | 33 | Arizona, Arkansas, Delaware, Louisiana3 and Michigan4 (FY 2014); Illinois (FY 2015); Ohio and Pennsylvania5 (FY 2016) |

|

NOTES:

1 Pennsylvania eliminated spend-down for the disabled only; it is reinstating this coverage in FY 2016.

2 Louisiana reported that pregnant women with income above 133% FPL were eligible for coverage under CHIP. 3 Louisiana converted its family planning waiver to a SPA, but eligibility declined to 133% FPL. 4 Michigan closed its family planning waiver to new enrollment in April 2014. 5 Pennsylvania is converting its family planning wavier to a SPA but is no longer accepting new enrollment. |

||

Other Eligibility Changes

Other eligibility changes were more targeted or limited. These changes are noted in Table 2, but a few include:

- In FY 2016, Colorado is implementing the option to eliminate the five-year bar on Medicaid eligibility for lawfully-residing immigrant children.

- In FY 2015, Montana increased the cap on enrollment in its Mental Health Services Plan (MHSP) waiver from 2,000 to 6,000 adults with serious mental illness (before the state adopted the Medicaid expansion).

- Virginia implemented a Section 1115 waiver to provide limited benefits to some uninsured adults with serious mental illness as part of the Governor’s Action Plan in FY 2015. (State legislation later reduced eligibility for this waiver from 100 percent FPL to 60 percent FPL, effective July 1, 2015.)

- A number of states made changes to increase eligibility for the aged, blind and individuals with disabilities including eliminating the asset test (Vermont in FY 2015)and increasing income and asset limits for working individuals with disabilities (Virginia, New Jersey, Florida and Michigan).

Only one state in FY 2015 (Wisconsin) and three states in FY 2016 (Ohio, Tennessee and Virginia) made or plan to make eligibility restrictions that are likely to leave individuals without other coverage options. These are targeted restrictions that would affect small groups of beneficiaries.

In addition, California mentioned plans in FY 2016 to extend coverage to all undocumented children. This is a state-funded initiative and not funded through Medicaid; therefore, it is not counted as a Medicaid policy change in this report.

Enrollment Policies and Changes

Renewals

As of January 1, 2014, new streamlined renewal policies for Medicaid also went into effect under the ACA. However, many states were delayed in implementing new renewal procedures. Recognizing this delay, during 2014, CMS allowed states to suspend renewals for existing enrollees for specified periods of time in order to free up staff resources to process new applicants and continue to update eligibility systems to implement new streamlined renewal procedures based on MAGI rules. States were asked if, at the time of the survey, they were experiencing challenges processing MAGI-based renewals and to describe those challenges.

A number of states reported that they were experiencing challenges processing MAGI-based renewals at the time of the survey. Most of the issues reported were related to new eligibility systems, high volume of renewals, challenges matching data, and issues with pre-populated renewal forms. Most of these challenges were seen as temporary issues, but were not yet fully resolved in some states at the start of FY 2016.

Hospital Presumptive Eligibility (HPE)

Starting in January 2014, the ACA allowed qualified hospitals to make Medicaid presumptive eligibility determinations. States were asked to describe the level of participation among hospitals in their states. Thirty-three (33) states reported that they have implemented HPE and have at least one hospital participating in the initiative; the remaining states noted that either they were still working to implement HPE or that no hospitals had signed up to participate at the time of the survey.

Premiums and Cost-Sharing

In July 2013, CMS released final rules designed to streamline and simplify regulations around Medicaid premiums and cost-sharing, consolidate existing law and provide for individual market premium assistance. Under the new rules, CMS clarified that total Medicaid premiums and cost-sharing incurred by all individuals in a Medicaid household may not exceed an aggregate limit of five percent of the family’s income, applied on either a quarterly or monthly basis. To enforce this, the new rules also extended the requirement that states track aggregate premiums and cost-sharing and suspend such payments if the household reached the five percent cap.3 In this year’s survey, several states commented on the difficulty of implementing a process to track these limits. In some cases, this has resulted in delays or reversals of plans to increase beneficiary cost-sharing.

Premiums

With certain exceptions, Medicaid generally is not allowed to charge premiums to Medicaid beneficiaries with incomes at or below 150 percent FPL, although in limited cases certain populations may be charged premiums (sometimes referred to as “buy-in” programs) including: working individuals with disabilities eligible under the Ticket to Work and Work Incentives Improvement Act (TWWIIA) and children with disabilities in families with incomes that otherwise exceed Medicaid limits eligible under the Family Opportunity Act (FOA). States are also permitted under certain circumstances to impose premiums on parents receiving Transitional Medical Assistance (TMA) coverage. Prior to the ACA Medicaid expansion, a number of states also received Section 1115 waiver authority to expand coverage to higher income groups who were not otherwise eligible for Medicaid and to subject them to a premium requirement. Under the ACA, a few states have received federal waivers to impose premiums on their Medicaid expansion populations.

In this year’s survey, states identified very few changes to premiums. Six states reported premium changes, including some with multiple changes. Five states made or proposed changes related to ACA coverage expansions (Arkansas, Indiana, Iowa, Michigan and Montana) and are described following the next section. Two states (Michigan and Minnesota) increased premiums for working individuals with disabilities.4

Copayment Requirements

Most state Medicaid programs require beneficiary copayments, but to varying degrees. Six states reported new copayment requirements in either FY 2015 or FY 2016; each of these states reported new copayment requirements for their Medicaid expansion populations. Indiana reported new copayments in FY 2015 and FY 2016 aside from the new Medicaid expansion group. Only three states reported any other actual or planned copayment increases for either FY 2015 (one state) or FY 2016 (two states). Two states reported elimination of copayments in FY 2015 and three states reported reductions in copayments in either FY 2015 (two states) or FY 2016 (one state).

Increases for the ACA Expansion Population. Two states in FY 2015 (Indiana and Iowa) and four states in FY 2016 (Arizona, Montana, New Hampshire and New Mexico) adopted new copayments for their expansion populations. Four of these states (Arizona, Indiana, Iowa and New Mexico) noted changes in copayments related to non-emergent use of the Emergency Department (ED) for the expansion group; all but one (Indiana) planned to increase such copayments under existing state plan authority (up to $8). Indiana received a waiver under Section 1916(f) to test the effects of higher copayments ($8 for the first use of the ED and then $25 for subsequent use) than otherwise allowed under federal law (Section 1115 waiver authority does not extend to Medicaid cost-sharing requirements).5 Additionally, two states (New Hampshire and Michigan) reported plans to increase copayments for some expansion adults in FY 2016.

Pharmacy. A few states reported changes to pharmacy copayments in either FY 2015 or FY 2016. The nature and direction of these changes varied based on policy goals. New Mexico added pharmacy copayments for its expansion population. New Hampshire increased pharmacy copayments for its Medicaid expansion population, but eliminated pharmacy copayments for adults with incomes below 100 percent FPL. Two states reported decreased pharmacy copayments – an across the board reduction for working individuals with disabilities in New Mexico and a reduction in copayments for high value drugs (such as those for diabetes or mental illness) in South Carolina.

| ACA Medicaid Expansion Premium Waivers |

| Five states (Arkansas, Indiana, Iowa, Michigan and Montana) used or plan to use Section 1115 demonstration waiver authority to implement premium requirements for their expansion populations. (Pennsylvania also received waiver authority to implement premiums for this population beginning January 1, 2016, but Governor Wolf chose to transition its Medicaid expansion from a waiver to a state plan amendment by September 2015, without premiums.) Arkansas, Indiana, Iowa, Michigan and Montana all implemented or plan to implement changes to premiums for their expansion populations in FY 2015 or FY 2016.

Arkansas, in February 2015, added monthly contributions of $10 to $15 depending on income as part of Health Care Independence Accounts (HIA) available to newly eligible adults with incomes between 100 and 138 percent FPL in lieu of paying cost-sharing obligations. If individuals do not pay the HIA amounts, they would be assessed copayments at the point of service. Indiana’s Medicaid expansion waiver, Healthy Indiana Plan 2.0, requires most newly eligible adults with incomes from 0 to 138 percent FPL to contribute to a Personal Wellness and Responsibility (POWER) Account. Contributions range from $1 per month for individuals with incomes from zero to five percent FPL to $27 per month for individuals with incomes between 100 and 138 percent FPL. Payment is required before Medicaid enrollment is effective. Individuals have 90 days from the date of their invoice to make the required contributions without penalty. Failure to make contributions to the POWER accounts would result in a more limited benefits package and point of service copayments for those with incomes below 100 percent FPL and would result in a six month “lockout” from Medicaid eligibility for those with incomes above 100 percent FPL. Under Iowa’s Medicaid expansion waiver, enrollees with incomes over 50 percent FPL are required to make a monthly premium contribution, beginning in the second year of coverage (January 2015 at the earliest), which could be waived if the beneficiary completes specified wellness activities. Beneficiaries can also receive a hardship exemption if they cannot pay the premiums. In Iowa, there are no copayment requirements except for non-emergency use of the emergency department, which were waived during the first year of enrollment. This copayment was adopted under a SPA, not a waiver. The Healthy Michigan Plan requires contributions equal to two percent of annual income for persons between 100 and 138 percent FPL after they have been in the health plan for six months. (This is equivalent to the premiums that this population would face if they were enrolled in the Marketplace if the state had not expanded Medicaid). Total cost-sharing, including copayments (determined based on the past six months of services use) cannot exceed five percent of annual household income and is paid through the use of a dedicated health account called the “MI Health Account.” Enrollees can reduce their annual cost-sharing by participating in healthy behavior activities which include completing an annual health risk assessment. The imposition of these contributions began in FY 2015.6 Failure to pay premiums would not result in a loss of eligibility. Montana’s Medicaid expansion waiver request would impose a premium of two percent of income for the entire ACA expansion group (from 0 to 138 percent FPL) as of January 1, 2016. Montana proposes dis-enrolling beneficiaries from 100-138 percent FPL for failing to pay premiums and seeks waiver authority to lock-out these individuals until overdue premiums are paid, or there is an assessment from the Department of Revenue against income taxes. Additionally, the waiver mentions that participation in a wellness program could exempt a beneficiary from disenrollment, but details were not provided. While the state is not requesting waiver authority, the proposal would require copayments according to maximum state plan amounts and consistent with federal law for all newly eligible beneficiaries.7 |

Table 2: Changes to Eligibility Standards in all 50 States and DC, FY 2015 and 2016

|

Eligibility Standard Changes |

||||||

|

STATES |

FY 2015 |

FY 2016 |

||||

|

(+) |

(-) |

(#) |

(+) |

(-) |

(#) |

|

|

Alabama |

||||||

|

Alaska |

X – Medicaid Expansion |

|||||

|

Arizona |

||||||

|

Arkansas |

||||||

|

California |

||||||

|

Colorado |

X |

|||||

|

Connecticut |

X |

|||||

|

Delaware |

||||||

|

DC |

||||||

|

Florida |

X |

|||||

|

Georgia |

||||||

|

Hawaii |

||||||

|

Idaho |

||||||

|

Illinois |

X |

X |

||||

|

Indiana |

X – Medicaid Expansion |

|||||

|

Iowa |

||||||

|

Kansas |

X |

|||||

|

Kentucky |

||||||

|

Louisiana |

X |

X |

||||

|

Maine |

||||||

|

Maryland |

||||||

|

Massachusetts |

||||||

|

Michigan |

X |

|||||

|

Minnesota |

X |

|||||

|

Mississippi |

||||||

|

Missouri |

||||||

|

Montana |

X |

X – Medicaid Expansion |

||||

|

Nebraska |

X |

|||||

|

Nevada |

||||||

|

New Hampshire |

X – Medicaid Expansion |

|||||

|

New Jersey |

X |

|||||

|

New Mexico |

||||||

|

New York |

X |

|||||

|

North Carolina |

X |

|||||

|

North Dakota |

||||||

|

Ohio |

X |

X |

||||

|

Oklahoma |

||||||

|

Oregon |

||||||

|

Pennsylvania |

X – Medicaid Expansion |

X |

X |

|||

|

Rhode Island |

||||||

|

South Carolina |

||||||

|

South Dakota |

||||||

|

Tennessee |

X |

|||||

|

Texas |

||||||

|

Utah |

||||||

|

Vermont |

X |

|||||

|

Virginia |

X |

X |

X |

|||

|

Washington |

||||||

|

West Virginia |

||||||

|

Wisconsin |

X |

|||||

|

Wyoming |

||||||

|

Totals |

11 |

1 |

6 |

5 |

3 |

4 |

| NOTES: Positive changes from the beneficiary’s perspective that were counted in this report are denoted with (+). Negative changes from the beneficiary’s perspective that were counted in this report are denoted with (-). Several states made reductions to Medicaid eligibility pathways in response to either the availability of coverage through the Marketplaces and/or through the Medicaid expansion; these changes were denoted as (#) since most affected beneficiaries will have access to coverage through an alternative pathway.

SOURCE: Kaiser Commission on Medicaid and the Uninsured Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2015. |

||||||

Table 3: Eligibility Changes in all 50 States and DC, FY 2015 and FY 2016*

| State | Fiscal Year | Eligibility Changes |

| Alabama | 2015 | |

| 2016 | ||

| Alaska | 2015 | |

| 2016 | Adults (+): Medicaid expansion on September 1, 2015. (Estimated first year enrollment of 20,000) | |

| Arizona | 2015 | |

| 2016 | ||

| Arkansas | 2015 | |

| 2016 | ||

| California | 2015 | |

| 2016 | ||

| Colorado | 2015 | |

| 2016 | Other (+): Implement the option to eliminate the 5-year bar on eligibility for lawfully residing immigrant children. (Estimated to affect 1,699 individuals) | |

| Connecticut | 2015 | |

| 2016 | Adults (#): Reduction in income limits for parent/caretakers to 150% of FPL (with disregard, effectively 155%) (Estimated to affect 23,700 individuals, of whom 1,350 are not eligible for Transitional Medical Assistance and will lose Medicaid eligibility effective 9/1/2015) | |

| Delaware | 2015 | |

| 2016 | ||

| District of Columbia | 2015 | |

| 2016 | Adults (nc): Section 1115 waiver expires 12/31/2015. Plan to transition adults with incomes above 138% FPL from a Medicaid waiver to Medicaid state plan. (Estimated to affect 7,000 or more individuals) | |

| Florida | 2015 | Elderly and Disabled (+): Increased the minimum monthly maintenance income allowance and excess standard for community spouses of institutionalized people. (The number of nursing home residents eligible for Medicaid is also affected by 2015 cost of living adjustments and increases in the average private pay nursing home used to set LTSS policy.) |

| 2016 |

|

|

| Georgia | 2015 | |

| 2016 | ||

| Hawaii | 2015 | |

| 2016 | ||

| Idaho | 2015 | |

| 2016 |

|

|

| Illinois | 2015 | Adults (#): Family planning waiver expired December 31, 2014.

Adults (nc): The state’s previous 1115 waiver (Cook County Care) ended June 30, 2014; adults transitioned to the new Medicaid expansion adult group July 2014. |

| 2016 | Adults (#): Plan to eliminate Breast and Cervical Cancer Treatment Program, with the expectation that these individuals qualify under the ACA expansion. (current enrollment is about 1,200) | |

| Indiana | 2015 | Adults (+): Adult expansion under HIP 2.0. (Affects an estimated 357,000 individuals) |

| 2016 | ||

| Iowa | 2015 | |

| 2016 | ||

| Kansas | 2015 | Adults (+): Presumptive Eligibility for Pregnant Women. (Estimated fewer than 500) |

| 2016 | ||

| Kentucky | 2015 | |

| 2016 | ||

| Louisiana | 2015 | Adults (#): Eliminated Family Planning waiver for those over 138% FPL. Those with income below 133% FPL will move from waiver to state plan. (8,700 individuals)

Adults (+): Family Planning SPA includes more services and adds coverage for men. |

| 2016 | ||

| Maine | 2015 | |

| 2016 | ||

| Maryland | 2015 | |

| 2016 | ||

| Massachusetts | 2015 | |

| 2016 | ||

| Michigan | 2015 | |

| 2016 | Adults (+): Income and asset expansion for working disabled adults. | |

| Minnesota | 2015 | Adults (#): Eliminated MinnesotaCare coverage for those with incomes between 133% and 200% FPL. Change is neutral for enrollees because Minnesota implemented a Basic Health Plan for those with incomes between 133% and 200% FPL. |

| 2016 | ||

| Mississippi | 2015 | |

| 2016 | ||

| Missouri | 2015 | |

| 2016 | ||

| Montana | 2015 | Adults (+): Raised cap on 1115 Mental Health Services Plan (MHSP) waiver from 2,000 to 6,000 adults with SMI. |

| 2016 | Adults (+): Waiver request in process to implement ACA expansion, including request for 12 month continuous coverage. | |

| Nebraska | 2015 | |

| 2016 | Other (+): Individuals age 19-21 who entered into a subsidized guardianship or adoption at age 16 or older. (13 individuals) | |

| Nevada | 2015 | |

| 2016 | ||

| New Hampshire | 2015 | Adults (+): Implemented the Medicaid expansion as of July 1, 2014. Coverage became effective August 15, 2014. The expansion was originally implemented through existing managed care programs and transitioned to a waiver January 2016. (estimated 50,000 individuals) |

| 2016 | ||

| New Jersey | 2015 | Elderly and Disabled (+): New Jersey implemented the “Miller Trust” option. New applicants formerly eligible for the Medically Needy program will establish qualified income trust, resulting in an expanded benefit package (beyond just long-term care services). Individuals in the “Medically Needy Spend-Down Adults” group on November 30, 2014, were grandfathered into this program.8 (209 additional enrollees) |

| 2016 | ||

| New Mexico | 2015 | |

| 2016 | ||

| New York | 2015 | Adults (#): Transfer some Medicaid waiver coverage (parents with incomes from 138% FPL to 150% FPL that receive an additional premium wrap to purchase coverage in the Marketplace) to Essential Plan (New York’s BHP). |

| 2016 | ||

| North Carolina | 2015 | Adults (+): Income and resource disregard of payments from the Eugenics Compensation Program. |

| 2016 | ||

| North Dakota | 2015 | |

| 2016 | ||

| Ohio | 2015 | |

| 2016 | Adults (#): Ending Family Planning coverage group as of 1/1/16.

Other (-): Change in transitional Medicaid for families from 12 months of eligibility to six months of eligibility with possible coverage for two consecutive six-month reporting periods. (Affects estimated 50,000 individuals) |

|

| Oklahoma | 2015 | |

| 2016 | ||

| Oregon | 2015 | |

| 2016 | ||

| Pennsylvania | 2015 | Adults (+): Implemented the Healthy PA Section 1115 waiver January 1, 2015, which increased Medicaid eligibility for adults up to 138% FPL. (605,180 individuals) State converted this to a SPA starting in FY 2015 with completion in FY 2016.

Adults (#); Medically-Needy Spend-down disabled adult coverage was discontinued with the implementation of Healthy PA; however, it is scheduled for reinstatement in FY 2016. (Affects 3,346 individuals) |

| 2016 | Adults (nc): Family Planning waiver converted to a SPA. Review of family planning enrollees for possible eligibility for full health care. (90,000 individuals)

Adults (#): Reinstatement of medically needy spend-down for disabled adults. (3,346 individuals) Adults (nc): Converted all individuals enrolled in Medicaid expansion under the Healthy PA 1115 waiver to the Health Choices Medicaid expansion state plan as of September 1st. |

|

| Rhode Island | 2015 | |

| 2016 | ||

| South Carolina | 2015 | |

| 2016 | ||

| South Dakota | 2015 | |

| 2016 | ||

| Tennessee | 2015 | |

| 2016 | Elderly and Disabled (-): In FY 2016 (7/1/2015), will begin limiting new LTSS enrollment into a 1915(i)-like group (offered under 1115 authority) to those eligible for SSI only. People already enrolled in the group under institutional income standards will be grandfathered. (Affects estimated 915 individuals) | |

| Texas | 2015 | |

| 2016 | ||

| Utah | 2015 | |

| 2016 | ||

| Vermont | 2015 | Other (+): Submitted SPA to disregard asset tests for non-ABD medically needy. |

| 2016 | ||

| Virginia | 2015 | Adults (#): Restored income eligibility for Family Planning coverage to 200% FPL. (Limit had been cut to 100% FPL on 1/1/2014.)

Elderly and Disabled (+): For Ticket to Work disabled population, three changes: Adults (+): Implemented a Section 1115 waiver program to expand limited benefit coverage to uninsured adults with incomes up to 100% FPL with serious mental illness. |

| 2016 | Adults (-): Per state legislation, income eligibility for the Section 1115 waiver program that expanded limited benefit coverage to uninsured adults with serious mental illness was reduced from 100% FPL to 60% FPL. | |

| Washington | 2015 | |

| 2016 | ||

| West Virginia | 2015 | |

| 2016 | ||

| Wisconsin | 2015 | Elderly and Disabled (-): Treating promissory notes as an asset. (Estimate of 40 individuals) |

| 2016 | ||

| Wyoming | 2015 | |

| 2016 | ||

| * Positive changes from the beneficiary’s perspective that were counted in this report are denoted with (+). Negative changes from the beneficiary’s perspective that were counted in this report are denoted with (-). Several states made reductions to Medicaid eligibility pathways in response to either the availability of coverage through the Marketplaces and/or through the Medicaid expansion; these changes were denoted as (#) since most affected beneficiaries will have access to coverage through an alternative pathway. Other changes to Medicaid eligibility that are not likely to affect beneficiaries but were reported by states are denoted with (nc). | ||

Table 4: Premium and Copayment Actions Taken in all 50 States and DC, FY 2015 and 2016*

| State | Fiscal Year | Premium and Copayment Changes |

| Alabama | 2015 | |

| 2016 | ||

| Alaska | 2015 | |

| 2016 | ||

| Arizona | 2015 | |

| 2016 | Copays (New only for expansion group): Impose mandatory copays to federal statutory limits and an $8 copay for non-emergent use of the ER on expansion adults. (Upon CMS approval) | |

| Arkansas | 2015 | Premiums (New only for expansion group): Added monthly contributions as part of Health Independence Accounts available to newly eligible adults with incomes between 100-138% FPL. Contributions to the HIAs are in lieu of point of service copayments. (February 2015) |

| 2016 | ||

| California | 2015 | |

| 2016 | ||

| Colorado | 2015 | |

| 2016 | ||

| Connecticut | 2015 | |

| 2016 | ||

| Delaware | 2015 | |

| 2016 | ||

| District of Columbia | 2015 | |

| 2016 | ||

| Florida | 2015 | |

| 2016 | ||

| Georgia | 2015 | |

| 2016 | ||

| Hawaii | 2015 | |

| 2016 | ||

| Idaho | 2015 | |

| 2016 | ||

| Illinois | 2015 | |

| 2016 | ||

| Indiana | 2015 | Premiums (New only for expansion group): POWER Account Contributions under HIP 2.0 for all low-income parents/caretakers and the new adult group (0-138% FPL) on a sliding scale. Those that fail to pay premiums within a 60-day grace period with income at or below 100% FPL are moved to a more limited benefit package and those with income over 100% FPL will be dis-enrolled from coverage and barred from re-enrolling for 6 months. (Feb 2015)

Premiums (New): Non-expansion parent/caretaker relatives and those receiving TMA have the option of paying premiums to get additional benefits and in lieu of copays for services. Copays (New): Testing graduated copays ($8 then $25) for non-emergency use of the ER for non-expansion parent/caretakers and newly eligible adults under § 1916(f) authority. Copays (New for expansion group): Beneficiaries with income at or below 100% FPL who fail to pay premiums will be required to make copays in state plan amounts. Copays (Elimination): Remove copays for ABD enrollees in managed care. (April 2015) |

| 2016 | Copays (New): Restore copays for ABD enrollees in managed care (Jan 2016) | |

| Iowa | 2015 | Premiums (New only for expansion group): Under the Iowa Health and Wellness Plan (IHWP), enrollees with incomes over 50 percent FPL are required to make a monthly premium contribution, beginning in the second year of coverage, which could be waived if they complete specified wellness activities. Premium amounts are $5 per month for those with incomes between 50% to 100% FPL and $10 per month for those with incomes over 100% FPL. Individuals can file a hardship exemption if they are not able to pay. (Jan 2015)

Copays (New only for expansion group): All enrollees in the expansion group are be subject to $8 copay for non-emergent use of the ED. (Jan 2015) |

| 2016 | ||

| Kansas | 2015 | |

| 2016 | ||

| Kentucky | 2015 | |

| 2016 | ||

| Louisiana | 2015 | |

| 2016 | ||

| Maine | 2015 | |

| 2016 | ||

| Maryland | 2015 | |

| 2016 | ||

| Massachusetts | 2015 | |

| 2016 | ||

| Michigan | 2015 | Premiums (New only for expansion group): Healthy Michigan Plan requires MI Health Account contributions equal to 2% of annual income for persons between 100% and 133% FPL after they have been in the health plan for 6 months. (Oct 2014) |

| 2016 | Premiums (Increase): Legislation expanding the income and asset levels for Freedom to Work Medicaid (TWIIAA) included a revised premium schedule. (Oct 2015)

Copays (Increase): Increase in prescription, hospital, and office visit copays for Healthy Michigan Plan enrollees with incomes above 100% FPL. (Unknown date due to systems issues and CMS approval requirements.) |

|

| Minnesota | 2015 | Cost-Sharing (Neutral Effect): The family deductible for adults in Medicaid was decreased to $2.75 per month, retroactive to 1/1/2014. (MCOs can waive the deductible.) |

| 2016 | Premiums (Decreased): Minimum premium for Medical Assistance for Employed Persons with Disabilities (MA-EPD) reduced. (Sep 2015)

Copays (Decreased): Decreased copayment amounts for MA-EPD group. (Sep 2015) |

|

| Mississippi | 2015 | |

| 2016 | ||

| Missouri | 2015 | |

| 2016 | ||

| Montana | 2015 | |

| 2016 | Premiums (New only for expansion group): Waiver request to impose premiums (2% of income) for the entire ACA expansion group.

Copays (New only for expansion group): Individuals with incomes up to 138% FPL will be required to pay copayments up to the maximum allowable amount under federal law. |

|

| Nebraska | 2015 | |

| 2016 | ||

| Nevada | 2015 | |

| 2016 | ||

| New Hampshire | 2015 | Copays (Eliminated): Eliminating pharmacy copays for adults under 100% FPL. (July 2014) |

| 2016 | Copays (Increased): Pharmacy copays for the expansion group (those above 100% FPL) are being increased from $1/$4 (generic/brand) to $2/$8. (Jan 2016)

Copays (New only for expansion group): Expansion group will be subject to copays on some medical services. (Jan 2016) |

|

| New Jersey | 2015 | |

| 2016 | ||

| New Mexico | 2015 | Copays (Decreased): Pharmacy copayment decreased from $5.00 to $4.00 for working disabled Individuals. (FY 2015) |

| 2016 | Copays (New only for expansion group): Copays for non-emergency use of the emergency department and for brand-name prescriptions when there is a less expensive generic equivalent medicine available. (FY 2016) | |

| New York | 2015 | |

| 2016 | ||

| North Carolina | 2015 | |

| 2016 | ||

| North Dakota | 2015 | |

| 2016 | ||

| Ohio | 2015 | |

| 2016 | ||

| Oklahoma | 2015 | Copays (Increased): Most SoonerCare copays increased. (July 2014) |

| 2016 | ||

| Oregon | 2015 | |

| 2016 | ||

| Pennsylvania | 2015 | |

| 2016 | ||

| Rhode Island | 2015 | |

| 2016 | ||

| South Carolina | 2015 | |

| 2016 | Copays (Decrease): Exempting certain high value drugs (including maintenance and certain psychiatric drugs) from copay requirements for all full benefit Medicaid beneficiaries. (July 2015) | |

| South Dakota | 2015 | |

| 2016 | ||

| Tennessee | 2015 | |

| 2016 | ||

| Texas | 2015 | |

| 2016 | ||

| Utah | 2015 | |

| 2016 | ||

| Vermont | 2015 | |

| 2016 | ||

| Virginia | 2015 | |

| 2016 | ||

| Washington | 2015 | |

| 2016 | ||

| West Virginia | 2015 | |

| 2016 | ||

| Wisconsin | 2015 | |

| 2016 | ||

| Wyoming | 2015 | |

| 2016 | ||

| * New premiums or copays as well as new requirements (i.e. making copays enforceable) are noted as (NEW). Increases in existing premiums or copays are noted as (Increased), while decreases are noted as (Decreased) and eliminations are noted as (Eliminated). | ||