Medicaid Moving Ahead in Uncertain Times: Results from a 50-State Medicaid Budget Survey for State Fiscal Years 2017 and 2018

Provider Rates and Taxes

| Key Section Findings |

| Provider rate changes are often tied to the economy. In FY 2017 and FY 2018, with relatively stable economic conditions in most states, more states made, or are planning, provider rate increases compared to restrictions. This holds true across provider types, except for inpatient hospital rates (hospital rate restrictions are primarily rate freezes, which are counted as restrictions in this report). All states except Alaska rely on provider taxes and fees to fund a portion of the non-federal share of the costs of Medicaid. Three states indicate plans for new provider taxes in FY 2018 and 13 states plan at least one provider tax increase.

What to watch:

Tables 12 through 14 provide complete listings of Medicaid provider rate changes and provider taxes and fees in place in FY 2017 and FY 2018. |

Provider Rates

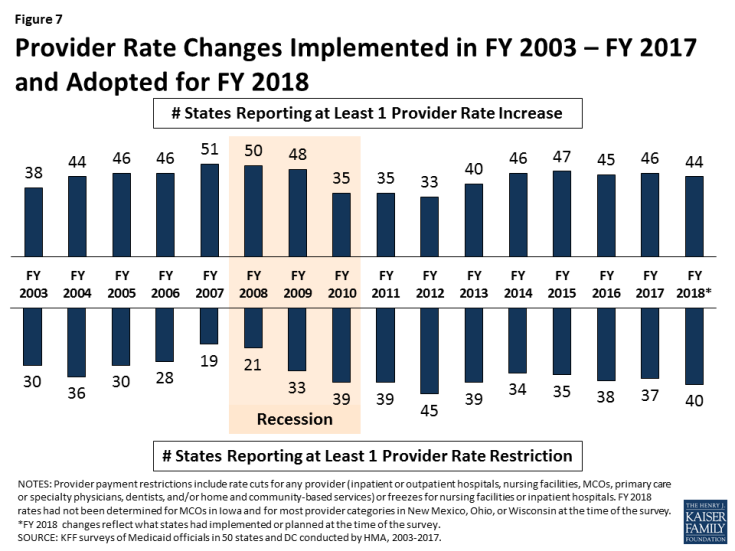

Provider rate changes are often tied to the economy. During economic downturns and budget shortfalls, states often turn to rate restrictions to contain costs and are more likely to increase rates during periods of recovery and revenue growth. This report examines rate changes across major provider categories: inpatient hospital, nursing facilities, MCOs, outpatient hospital, primary care physicians, specialists, dentists, and home and community-based services (HCBS). States were asked to report aggregate rate changes for each provider category in their FFS programs. In FY 2017, more states implemented rate increases for at least one category of providers (46 states) compared to rate restrictions (37 states) (Figure 7 and Table 12). Compared with what states projected for FY 2017 on last year’s survey, this year’s survey responses showed that six more states implemented rate increases in FY 2017 and four fewer states implemented rate restrictions.

For FY 2018, the number of states with at least one implemented or planned rate increase (44 states) is greater than the number of states with at least one implemented or planned rate restriction (40 states) (Table 13).

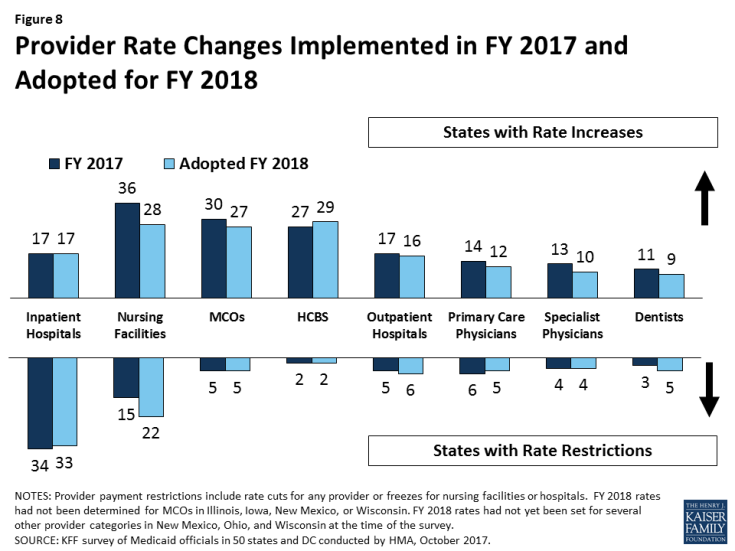

The number of states with rate increases exceeded the number of states with restrictions in FY 2017 and FY 2018 across all major categories of providers (physicians, MCOs, and nursing facilities) with the exception of rates for inpatient hospital services1 (Figure 8). For the purposes of this report, cuts or freezes in rates for inpatient hospitals and nursing facilities are counted as restrictions.2 Most of the restrictions are for rate freezes. Four states in FY 2017 and five states in FY 2018 had implemented or planned reductions to inpatient hospital rates; only one state cut nursing facility rates in FY 2017, and two states plan to cut nursing facility rates in FY 2018.

The number of states planning to increase nursing facility rates dropped in FY 2018 (28) compared to FY 2017 (36 states). HCBS providers were among those most likely to receive rate increases (27 states in FY 2017 and 29 states in FY 2018).

Capitation payments for MCOs are generally bolstered by the federal requirement that states pay actuarially sound rates. In FY 2017 and FY 2018, the majority of the 39 states with Medicaid MCOs either implemented or planned increases in MCO rates. Five states reported MCO rate cuts in FY 2017, and five states plan to cut MCO rates in FY 2018. Four states were not able to report MCO rate changes for FY 2018 because rate development was not complete. States are increasingly moving to calendar year MCO contracts.

Tables 12 and 13 provide state level details on provider rate changes in FY 2017 and FY 2018.

MCO Rate Requirements

In many states, MCOs make most of the Medicaid payments to providers. States were asked whether they require their MCOs to make changes to their provider payments when the state makes changes to FFS rates (such as rate increases). Of the 39 states with MCOs, 19 states indicated that they had no such requirement, 18 states have such a requirement for some provider types, and two states (Louisiana and Mississippi) required MCOs to make these changes for all types of Medicaid providers. States were also asked if their MCO contracts mandate minimum provider reimbursement rates. Of the 39 MCO states, ten indicated that they had no rate floors, 24 states indicated that they had rate floors for some provider types, and five states said they had minimum MCO payment requirements for all Medicaid provider types.

Provider Taxes and Fees

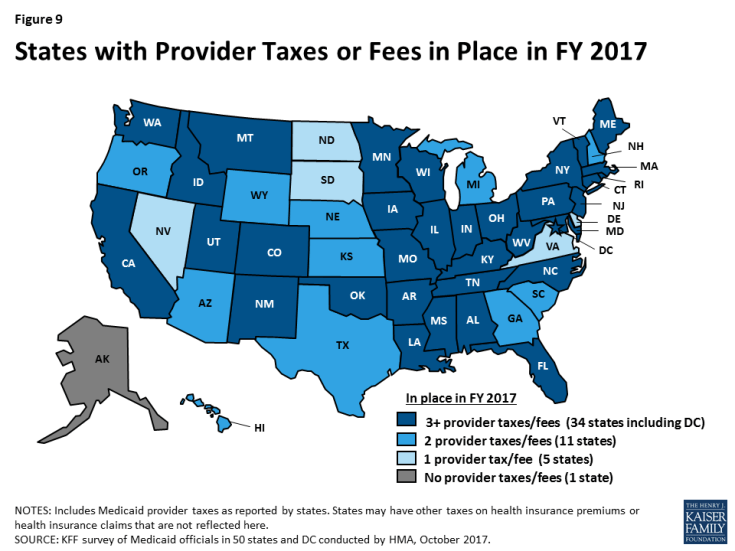

Provider taxes are an integral source of Medicaid financing. In this year’s survey, states reported continuing or increased reliance on provider taxes and fees to fund a portion of the non-federal share of Medicaid costs in FY 2017 and FY 2018. At the beginning of FY 2003, 21 states had at least one provider tax in place. Over the next decade, a majority of states imposed new taxes or fees and increased existing tax rates and fees to raise revenue to support Medicaid. By FY 2013, all but one state (Alaska) had at least one provider tax or fee in place.3 In FY 2017, 34 states had three or more provider taxes in place (Figure 9).

The most common Medicaid provider taxes in place in FY 2017 were taxes on nursing facilities (44 states), followed by taxes on hospitals (42 states) and taxes on intermediate care facilities for the intellectually disabled (36 states) (Table 14). Three states reported plans to add new taxes in FY 2018. Oregon reported a new MCO tax, Ohio’s MCO tax transitioned from a sales tax on premium revenues to a member month tax, and Tennessee expects to have a new ground ambulance provider assessment, which was enacted by the Tennessee General Assembly during its 2017 legislative session. Thirteen states reported increases to one or more provider taxes in FY 2018, compared to only five states reporting provider tax decreases.4

Recent federal health reform legislation5 under consideration in the Senate proposed phasing down the limit on state use of provider taxes (the “safe harbor threshold”) from the current allowable level, 6.0 percent of net patient revenues, to 5.0 percent of net patient revenues by FY 2025.6 Another proposal would lower the threshold to 4.0 percent in FY 2025.7 In this year’s budget survey, 29 states reported having at least one provider tax exceeding 5.5 percent of net patient revenues and 46 states reported having at least one provider tax exceeding 3.5 percent as of July 1, 2017. These data suggest that federal action to lower the safe harbor threshold would restrict states’ ability to supply the non-federal share to finance Medicaid and could therefore shift additional costs to states. If states were not able to find additional funds to replace provider tax funding, limits on provider taxes could result in program cuts with implications for Medicaid providers and beneficiaries.

TABLE 12: PROVIDER RATE CHANGES IN ALL 50 STATES AND DC, FY 2017

| States | Inpatient Hospital | Outpatient Hospital | Primary Care Physicians | Specialists | Dentists | Managed Care Organizations | Nursing Facilities | HCBS | Total | |||||||||

| Rate Change | + | – | + | – | + | – | + | – | + | – | + | – | + | – | + | – | + | – |

| Alabama | X | — | — | X | X | X | ||||||||||||

| Alaska | X | X | X | X | — | — | X | X | X | |||||||||

| Arizona | X | X | X | X | X | X | ||||||||||||

| Arkansas | X | — | — | X | X | X | ||||||||||||

| California | X | X | X | X | X | X | X | |||||||||||

| Colorado | X | X | X | X | X | |||||||||||||

| Connecticut | X | X | — | — | X | X | ||||||||||||

| Delaware | X | X | X | X | X | X | X | X | X | |||||||||

| DC | X | X | X | X | X | X | X | X | X | |||||||||

| Florida | X | X | X | X | X | X | X | |||||||||||

| Georgia | X | X | X | X | X | X | X | |||||||||||

| Hawaii | X | X | X | X | X | X | X | X | X | |||||||||

| Idaho | X | X | X | X | — | — | X | X | X | |||||||||

| Illinois | X | X | X | X | X | |||||||||||||

| Indiana | X | X | X | X | X | X | ||||||||||||

| Iowa | X | X | X | |||||||||||||||

| Kansas | X | X | X | X | X | X | X | X | X | X | ||||||||

| Kentucky | X | X | X | X | X | X | X | |||||||||||

| Louisiana | X | X | X | X | X | |||||||||||||

| Maine | X | — | — | X | X | X | ||||||||||||

| Maryland | X | X | X | X | X | X | ||||||||||||

| Massachusetts | X | X | X | X | X | X | ||||||||||||

| Michigan | X | X | X | X | X | X | ||||||||||||

| Minnesota | X | X | X | X | X | X | X | X | ||||||||||

| Mississippi | X | X | X | X | X | X | X | X | ||||||||||

| Missouri | X | X | X | X | X | X | X | X | X | X | ||||||||

| Montana | X | X | X | — | — | X | X | X | X | |||||||||

| Nebraska | X | X | X | X | X | X | X | X | ||||||||||

| Nevada | X | X | X | X | X | X | ||||||||||||

| New Hampshire | X | X | X | X | X | |||||||||||||

| New Jersey | X | X | X | X | X | X | X | X | ||||||||||

| New Mexico | X | X | X | X | X | X | X | X | X | |||||||||

| New York | X | X | X | X | X | X | ||||||||||||

| North Carolina | X | — | — | X | X | X | ||||||||||||

| North Dakota | X | X | X | X | X | X | X | |||||||||||

| Ohio | X | X | X | X | X | X | ||||||||||||

| Oklahoma | X | — | — | X | X | |||||||||||||

| Oregon | X | X | X | X | X | X | ||||||||||||

| Pennsylvania | X | X | X | X | X | |||||||||||||

| Rhode Island | X | X | X | X | X | X | ||||||||||||

| South Carolina | X | X | X | X | X | X | ||||||||||||

| South Dakota | X | X | X | X | X | — | — | X | X | |||||||||

| Tennessee | X | X | X | |||||||||||||||

| Texas | X | X | X | X | X | X | ||||||||||||

| Utah | X | X | X | X | X | X | X | |||||||||||

| Vermont | X | X | X | — | — | X | X | X | X | |||||||||

| Virginia | X | X | X | X | X | X | ||||||||||||

| Washington | X | X | X | X | X | |||||||||||||

| West Virginia | X | X | X | X | X | |||||||||||||

| Wisconsin | X | X | X | X | X | X | X | |||||||||||

| Wyoming | X | X | X | X | — | — | X | X | X | X | ||||||||

| Totals | 17 | 34 | 17 | 5 | 14 | 6 | 13 | 4 | 11 | 3 | 30 | 5 | 36 | 15 | 27 | 2 | 46 | 37 |

| NOTES: “+” refers to provider rate increases and “-” refers to provider rate restrictions. HCBS: Home and community-based services. For the purposes of this report, provider rate restrictions include cuts to rates for physicians, dentists, outpatient hospitals, managed care organizations, and HCBS as well as both cuts or freezes in rates for inpatient hospitals and nursing facilities. There are 12 states that did not have Medicaid MCOs in operation in FY 2017; they are denoted as ‘–‘ in the MCO column. SOURCE: Kaiser Family Foundation Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2017. |

||||||||||||||||||

TABLE 13: PROVIDER RATE CHANGES IN ALL 50 STATES AND DC, FY 2018

| States | Inpatient Hospital | Outpatient Hospital | Primary Care Physicians | Specialists | Dentists | Managed Care Organizations | Nursing Facilities | HCBS | Total | |||||||||

| Rate Change | + | – | + | – | + | – | + | – | + | – | + | – | + | – | + | – | + | – |

| Alabama | X | — | — | X | X | X | ||||||||||||

| Alaska | X | X | X | X | X | — | — | X | X | |||||||||

| Arizona | X | X | X | X | X | X | X | X | ||||||||||

| Arkansas | X | — | — | X | X | X | ||||||||||||

| California | X | X | X | X | X | X | X | X | X | |||||||||

| Colorado | X | X | X | X | X | X | X | X | ||||||||||

| Connecticut | X | X | — | — | X | X | ||||||||||||

| Delaware | X | X | X | X | X | X | X | X | X | |||||||||

| DC | X | X | X | X | X | X | ||||||||||||

| Florida | X | X | X | X | X | X | X | |||||||||||

| Georgia | X | X | X | X | X | X | X | X | X | |||||||||

| Hawaii | X | X | X | X | X | X | X | X | X | X | ||||||||

| Idaho | X | X | X | X | — | — | X | X | X | X | ||||||||

| Illinois | X | TBD | TBD | X | X | X | X | |||||||||||

| Indiana | X | X | X | X | X | |||||||||||||

| Iowa | X | X | TBD | TBD | X | X | X | |||||||||||

| Kansas | X | X | X | X | X | X | X | X | X | |||||||||

| Kentucky | X | X | X | X | X | X | ||||||||||||

| Louisiana | X | X | X | X | X | X | ||||||||||||

| Maine | X | — | — | X | X | X | X | |||||||||||

| Maryland | X | X | X | X | X | |||||||||||||

| Massachusetts | X | X | X | X | X | X | X | X | X | |||||||||

| Michigan | X | X | X | X | X | X | ||||||||||||

| Minnesota | X | X | X | X | X | X | X | |||||||||||

| Mississippi | X | X | X | X | X | X | ||||||||||||

| Missouri | X | X | X | X | X | X | X | X | X | X | ||||||||

| Montana | X | X | X | X | X | — | — | X | X | X | X | |||||||

| Nebraska | X | X | X | X | ||||||||||||||

| Nevada | X | X | X | X | X | X | X | X | X | |||||||||

| New Hampshire | X | X | X | X | X | X | ||||||||||||

| New Jersey | X | X | X | X | X | X | X | |||||||||||

| New Mexico | TBD | TBD | TBD | TBD | TBD | TBD | TBD | TBD | TBD | TBD | TBD | TBD | TBD | TBD | TBD | TBD | TBD | TBD |

| New York | X | X | X | X | X | X | ||||||||||||

| North Carolina | X | — | — | X | X | |||||||||||||

| North Dakota | X | X | X | X | X | |||||||||||||

| Ohio | X | X | TBD | TBD | TBD | TBD | TBD | TBD | X | X | TBD | TBD | X | X | ||||

| Oklahoma | X | — | — | X | X | |||||||||||||

| Oregon | X | X | X | X | X | X | X | |||||||||||

| Pennsylvania | X | X | X | X | ||||||||||||||

| Rhode Island | X | X | X | X | X | X | X | |||||||||||

| South Carolina | X | X | X | X | X | X | X | |||||||||||

| South Dakota | X | — | — | X | X | X | X | |||||||||||

| Tennessee | X | X | X | X | X | X | X | |||||||||||

| Texas | X | X | X | X | X | |||||||||||||

| Utah | X | X | X | X | X | X | ||||||||||||

| Vermont | X | X | X | — | — | X | X | X | X | |||||||||

| Virginia | X | X | X | X | X | X | ||||||||||||

| Washington | X | X | X | X | X | |||||||||||||

| West Virginia | X | X | X | X | X | |||||||||||||

| Wisconsin | X | X | TBD | TBD | TBD | TBD | TBD | TBD | TBD | TBD | X | X | ||||||

| Wyoming | X | — | — | X | X | X | X | |||||||||||

| Totals | 17 | 33 | 16 | 6 | 12 | 5 | 10 | 4 | 9 | 5 | 27 | 5 | 28 | 22 | 29 | 2 | 44 | 40 |

| NOTES: “+” refers to provider rate increases and “-” refers to provider rate restrictions. HCBS: Home and community-based services. For the purposes of this report, provider rate restrictions include cuts to rates for physicians, dentists, outpatient hospitals, managed care organizations, and HCBS as well as both cuts or freezes in rates for inpatient hospitals and nursing facilities. There are 12 states that did not have Medicaid MCOs in operation in FY 2017; they are denoted as “–” in the MCO column. TBD: At the time of the survey, calendar year 2018 MCO rates had not been set for Illinois, Iowa, or New Mexico. FY 2018 rates had not been determined for several categories of providers in Ohio and Wisconsin. New Mexico reported that rate decisions would be made “as needed” during FY 2018. SOURCE: Kaiser Family Foundation Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2017. |

||||||||||||||||||

TABLE 14: PROVIDER TAXES IN PLACE IN ALL 50 STATES AND DC, FY 2017 AND FY 2018

| States | Hospitals | Intermediate Care Facilities | Nursing Facilities | Other | ||||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | |

| Alabama | X | X | X | X | X | X | ||

| Alaska | ||||||||

| Arizona | X | X | X | X | ||||

| Arkansas | X | X | X | X | X | X | ||

| California | X | X | X | X | X | X | X | X |

| Colorado | X | X | X | X | X | X | ||

| Connecticut | X | X | X | X | X | X | X | X |

| Delaware | X | X | ||||||

| DC | X | X | X | X | X | X | X | X |

| Florida | X | X | X | X | X | X | ||

| Georgia | X | X | X | X | ||||

| Hawaii | X | X | X | X | ||||

| Idaho | X | X | X | X | X | X | ||

| Illinois | X | X | X | X | X | X | ||

| Indiana | X | X | X | X | X | X | ||

| Iowa | X | X | X | X | X | X | ||

| Kansas | X | X | X | X | ||||

| Kentucky | X | X | X | X | X | X | X* | X* |

| Louisiana | X | X | X | X | X | X | X* | X* |

| Maine | X | X | X | X | X | X | X | X |

| Maryland | X | X | X | X | X | X | X | X |

| Massachusetts | X | X | X | X | X | X | ||

| Michigan | X | X | X | X | ||||

| Minnesota | X | X | X | X | X | X | X | X |

| Mississippi | X | X | X | X | X | X | X | X |

| Missouri | X | X | X | X | X | X | X* | X* |

| Montana | X | X | X | X | X | X | ||

| Nebraska | X | X | X | X | ||||

| Nevada | X | X | ||||||

| New Hampshire | X | X | X | X | ||||

| New Jersey | X | X | X | X | X | X | X* | X* |

| New Mexico | X* | X* | ||||||

| New York | X | X | X | X | X | X | X* | X* |

| North Carolina | X | X | X | X | X | X | ||

| North Dakota | X | X | ||||||

| Ohio | X | X | X | X | X | X | X | X |

| Oklahoma | X | X | X | X | X | X | ||

| Oregon | X | X | X | X | X | |||

| Pennsylvania | X | X | X | X | X | X | X* | X* |

| Rhode Island | X | X | X | X | X | X | ||

| South Carolina | X | X | X | X | ||||

| South Dakota | X | X | ||||||

| Tennessee | X | X | X | X | X | X | X | X* |

| Texas | X | X | X | X | ||||

| Utah | X | X | X | X | X | X | X | X |

| Vermont | X | X | X | X | X | X | X* | X* |

| Virginia | X | X | ||||||

| Washington | X | X | X | X | X | X | ||

| West Virginia | X | X | X | X | X | X | X* | X* |

| Wisconsin | X | X | X | X | X | X | X | X |

| Wyoming | X | X | X | X | ||||

| Totals | 42 | 42 | 36 | 36 | 44 | 44 | 24 | 25 |

| NOTES: This table includes Medicaid provider taxes as reported by states. Some states also have premium or claims taxes that apply to managed care organizations and other insurers. Since this type of tax is not considered a provider tax by CMS, these taxes are not counted as provider taxes in this report. (*) has been used to denote states with multiple “other” provider taxes. SOURCE: Kaiser Family Foundation Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2017. |

||||||||