How State Medicaid Programs are Managing Prescription Drug Costs: Results from a State Medicaid Pharmacy Survey for State Fiscal Years 2019 and 2020

Payment, Supplemental Rebates and Rebate Management

How are states addressing payment for prescription drugs?

Medicaid payments for prescription drugs are determined by a complex set of policies, at both the federal and state levels, that draw on price benchmarks to set both ingredient costs and determine rebates under the federal Medicaid drug rebate program (MDRP). States set policies within federal guidelines on beneficiary cost-sharing while federal regulations guide the payment methodology for prescription drug ingredient cost reimbursement and professional dispensing fees. The final cost to Medicaid is then offset by any rebates received under the federal MDRP. In addition to federal statutory rebates under MDRP, most states negotiate with manufacturers for supplemental rebates on prescription drugs, frequently using placement on a PDL as leverage. States have also formed multi-state purchasing pools when negotiating supplemental Medicaid rebates to increase their negotiating power. In addition, most MCO states allow their MCOs to negotiate their own supplemental rebate agreements with manufacturers. A few states have also used their supplemental rebate authority to negotiate alternative payment models with manufacturers, and states continue to show interest in these arrangements.

Supplemental Rebates

Most states use competitive procurement to select an entity to negotiate supplemental rebates, and a majority of states with supplemental rebate programs rely on a purchasing pool to negotiate the rebates. Of the 46 states reporting supplemental rebate programs, 24 states reported that a purchasing pool handled negotiations, six states indicated a PBM, five states indicated the state Medicaid agency, seven states indicated another vendor, and four states reported that more than one entity was responsible for negotiations (Appendix Table 8). Three-quarters of the states (35) reported that the negotiating entity was selected through a competitive procurement.

Approximately two-thirds of the states with supplemental rebate programs (30 of 46 states) have entered into multi-state purchasing pools to enhance their negotiating leverage and collections. As shown in Table 8, as of July 1, 2019, 30 states reported participating in three different multi-state purchasing pools. Two states (Louisiana and Maine) also reported participating in an intrastate purchasing pool, where multiple agencies within the state consolidate their purchasing,1 and one other state (Nevada) reported new state legislation, effective January 1, 2020, allowing state agencies and non-profits to “pool” their pharmacy expenditures with Medicaid FFS for rebate purposes.

| Table 8: Multi-State Purchasing Pool Participation, July 1, 2019 | ||

| Pool | # of States | States (50 States Responding) |

| National Medicaid Pooling Initiative (NMPI) | 11 | AK, DC, KY, MI, MN, MT, NC, NH, NY, RI, SC |

| Sovereign States Drug Consortium (SSDC) | 10 | DE, IA, ME, MS, ND, OH, OK, OR, VT, WY |

| Top Dollar Program (TOP$) | 9 | CT, ID, LA, MD, NE, TN, WA, WI, WV |

| None | 20 | AL, AR, AZ, CA, CO, FL, GA, HI, IL, IN, KS*, MA, MO, NJ, NM, NV, PA, SD, TX, VA |

| NOTES: *KS reported that contract with a multi-state pool was in place but not used. SOURCE: 2019 KFF and Health Management Associates (HMA) survey of Medicaid officials in 50 states and DC, April 2020. |

||

Most states anticipate supplemental rebates to remain steady or increase as a share of pharmacy expenditures. Of the 46 responding states with supplemental rebate programs, nearly three-quarters (34) expected rebates to remain “about the same” in FY 2020 compared to FY 2019, while 11 states expected higher rebates.2 Only one state (Tennessee) projected lower rebate collections due to patent expirations and orphan drug approvals.

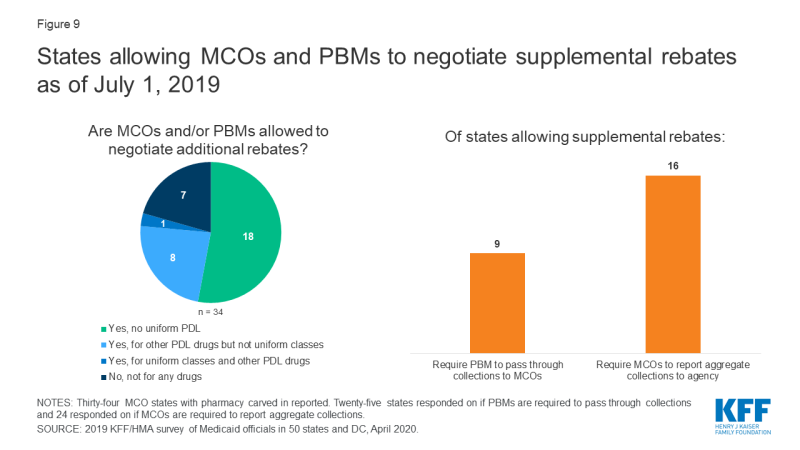

Most states with managed care allow MCOs to negotiate supplemental rebates beyond the state supplemental rebate. Twenty-seven of the 34 responding non-carve-out MCO states3 reported allowing MCOs to negotiate supplemental rebates (Figure 9 and Appendix Table 9). Of these 27 states, eight reported having a uniform PDL for one or more classes and that MCOs were not permitted to negotiate supplemental rebates for uniform classes. One MCO state with a uniform PDL (Kansas) reported that it allowed MCOs to negotiate rebates for all classes of drugs, even for classes that are governed by a universal PDL. Seven MCO states reported that MCOs were not permitted to negotiate rebates for any drugs. About one-third of the MCO states that allow MCOs to negotiate supplemental rebates (9 of 25 reporting) indicated that the MCOs’ PBMs were required to pass through supplemental rebate collections to the MCO and nearly two-thirds (16 of 24 reporting states) required MCOs to report aggregate supplemental rebate collections to the state Medicaid agency.

Pharmacy Copays

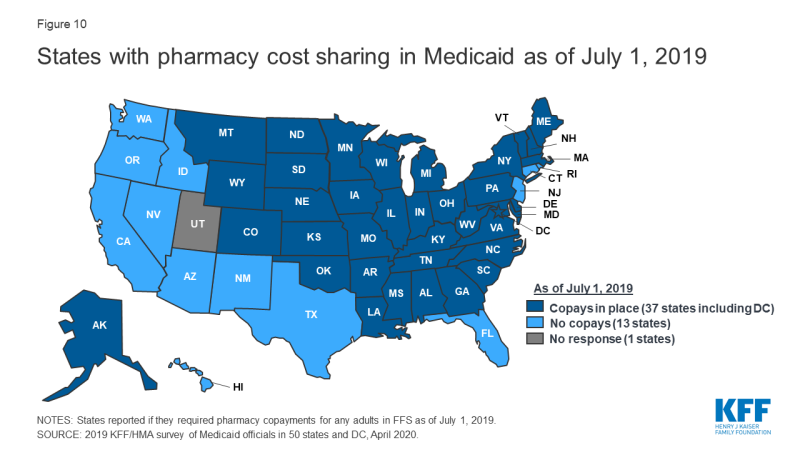

Most states impose pharmacy cost sharing, and many structure copayment requirements to favor lower-cost generic and preferred brands. As of July 1, 2019, nearly three-quarters of the 50 responding states (37 states) reported requiring FFS pharmacy copayments for non-exempt adults (Figure 10 and Appendix Table 10). All but four of these 37 states (Kentucky, Maine, Missouri, and Ohio) reported that reimbursement to the pharmacy provider was decreased by the copayment amount. Also, 17 states reported lower copays for generics compared to brands, 11 states reported uniform copays for generics and brands, eight states reported that copay amounts varied based on the cost of the drug, and one state reported copays varied based on PDL placement. A few states also mentioned copay exemptions for selected therapeutic classes.

Most of the responding states with copay requirements that had implemented the ACA Medicaid expansion as of July 1, 2019 (20 of 24 states) reported that copayment requirements for the expansion population were the same as for non-expansion adults. Only four expansion states reported different requirements: two states reported no copay requirements (Arkansas and Iowa) and two states reported higher copay requirements (Indiana and Michigan). Also, of the 24 responding states that imposed FFS copayments and included pharmacy as a covered benefit under an MCO arrangement as of July 1, 2019, 13 reported no difference in the pharmacy copayment requirement applicable to MCOs, and 11 reported that MCOs either charged no copays or had flexibility to charge or waive copays. A few states reported plans to implement copayment changes in FY 2020: DC and Ohio reported plans to remove copay requirements for selected drugs; Louisiana indicated plans to increase copays to the maximum amount allowed based on household income; North Dakota reported plans to eliminate required copays; and Montana reported plans to eliminate copays for Medicaid expansion adults.

Medication Therapy Management (MTM)

Few states are reimbursing pharmacists for medication therapy management (MTM) services in their FFS programs. MTM, often provided by pharmacists, is intended to ensure the best therapeutic outcomes for patients by addressing issues of polypharmacy, preventable adverse drug events, medication adherence, and medication misuse. MTM typically includes five core elements: medication therapy review, a personal medication record, a medication-related action plan, intervention or referral, and documentation and follow-up.4 Only 9 of 49 responding states5 reported the state paid pharmacists to provide MTM services in the FFS program as of July 1, 2019 (Table 9).

| Table 9: Medication Therapy Management Programs, July 1, 2019 | ||

| State | MTM Conditions/Enrollees | MCOs Required to Cover Same MTM services? |

| Colorado | Drug-drug interactions, drug duplication, adverse reactions and to improve overall patient outcomes | No |

| Michigan | Persons with one or more chronic conditions | No* |

| Minnesota | Persons with one or more chronic conditions | Yes, in part+ |

| Missouri | Diabetes, Asthma, Chronic Obstructive Pulmonary Disease (COPD), Congestive Heart Failure (CHF) | NA – Rx carved out of MCO contract |

| Montana | Persons with one or more chronic conditions | NA – No MCOs |

| North Dakota | Asthma, COPD, Diabetes, compliance, transitions of care, high-risk use medications | No |

| New Mexico | Medication overutilization including narcotic overutilization and use with benzodiazepines and/or antipsychotics, and antipsychotic use by children and those specifically in foster care | Yes |

| Oregon | Clozapine monitoring, birth control prescribing, must include covered services on the prioritized list and be a collaboration | No^ |

| Wisconsin | The member takes four or more prescription medications to prevent two or more chronic conditions, one of which must be hypertension, asthma, chronic kidney disease, CHF, dyslipidemia, COPD, or depression. Also, diabetes would qualify a member for MTM eligibility. | N/A – pharmacy carved out of MCO contract |

| NOTES: *MTM services in MI are carved out and paid in FFS. +MCOs in MN must provide at least the same benefit as FFS. ^Most MCOs in OR have the capability to cover MTM services if they choose. SOURCE: 2019 KFF and Health Management Associates (HMA) survey of Medicaid officials in 50 states and DC, April 2020. |

||

Value-Based Arrangements

A small, but growing number of states are employing alternative payment methods to increase supplemental rebates through “value-based arrangements” (VBAs) negotiated with individual pharmaceutical manufacturers. Two states reported having a VBA in place as of July 1, 2019: Oklahoma reported having four VBAs covering two long-acting injectable antipsychotics, and an epilepsy drug, and an antibiotic used mainly in the emergency room;6 and Washington reported having a modified subscription model VBA (also known as the “Netflix model”) for hepatitis C antiviral drugs.7,8 An additional eight states (Arizona, Arkansas, Colorado, Georgia, Indiana, Louisiana, Massachusetts, and Michigan) reported plans to submit a VBA State Plan Amendment to CMS or implement a VBA in FY 2020, and eight states (Connecticut, DC, Idaho, Kentucky, New Jersey, North Carolina, South Carolina, and Virginia) indicated VBAs were under consideration or being explored.

States cited a range of barriers or challenges to implementing VBAs. The most frequently cited barrier or challenge, cited by 10 states, was the administrative resources needed to develop and negotiate VBAs. Eight states indicated that the CMS approval process was a challenge; eight states commented on the data collection and measurement requirements associated with VBAs; five states noted the time needed for implementation and to measure value; five states cited the lack of willing manufacturers; and four states mentioned the risk to the state or challenge of calculating a return on investment. Other challenges mentioned by two states included: the need to obtain stakeholder agreement; the inability to include 340B-eligible drugs; the overall complexity; and limited feasibility for smaller states with smaller volume/utilization.

Other Payment Initiatives

A small number of states use limited pharmacy networks for specialty drugs. Unlike MCOs that sometimes limit the size of provider networks, including retail pharmacy networks (when permitted by the state), to achieve better pricing or higher quality, Medicaid FFS programs typically enroll “any willing,” qualified, and appropriately credentialed provider. Three states, however, reported selective contracting or limited network arrangements for FFS specialty pharmacy drugs in place as of July 1, 2019: Arizona competitively procured a vendor to provide specialty pharmacy services for anti-hemophilic product and other blood disorder medications; Pennsylvania competitively procured two preferred vendors to provide specialty pharmacy drugs, ancillary items and services and clinical supports; and DC created a mental health specialty pharmacy network in 2010 to allow selected physician-administered injectable antipsychotics to be billed as a pharmacy benefit through the pharmacy point-of-sale system. Pharmacies interested in dispensing these medications directly to physician offices or other healthcare facilities may opt in as a provider for this pharmacy network. No state reported having a limited FFS network for non-specialty drugs.

Some states have mandated dispensing fees for MCOs. As described in Table 10 below, nine states (Arizona, Iowa, Kansas, Kentucky, Louisiana, Mississippi, North Dakota, Nebraska, and New Mexico) reported having have some form of mandated dispensing fee in place as of July 1, 2019. Two states (Illinois and Ohio), plan to add a mandated fee requirement in 2020: Illinois will require MCOs to pay the Department’s dispensing fee for Critical Access Pharmacies, which are, generally, independent pharmacies located in counties with less than 50,000 residents, and Ohio reported plans to implement a supplemental dispensing fee pilot to support independent pharmacies and small chains, especially those who serve a large number of Medicaid beneficiaries.9

| Table 10: Mandated Dispensing Fees, July 1, 2019 | |

| State | Description of Fee |

| AZ | Must pay FQHCs a $8.75 dispensing fee |

| IA | Must pay same dispensing fee as FFS |

| KS | Must pay $0 for Usual and Customary claims and Medicare Part D copay assistance and $10.50 for all other claims, unless there is third party liability, which may have an impact |

| KY | Must pay $2 more in dispensing fees paid to pharmacies by MCOs 10 |

| LA | Must pay non-chain pharmacies (local) at the same rate as FFS |

| MS | Must pay the same as FFS, $11.29 for brand/generic; $61.14 for specialty drugs on state’s Specialty Drug List |

| ND | Must pay FFS rates as of January 1, 2019 |

| NE | Minimum dispensing fee defined for independent pharmacies of 6 or fewer |

| NM | Must pay $2.00 in addition to contracted dispensing fee |

| SOURCE: 2019 KFF and Health Management Associates (HMA) survey of Medicaid officials in 50 states and DC, April 2020. | |

Some, but not all, states have policies in place to manage medical benefit drugs, or drugs delivered outside of Medicaid’s pharmacy benefit. Some drugs covered by Medicaid are paid through the medical benefit rather than the pharmacy benefit. These drugs are sometimes not in a PDL or managed by PBMs; rather, they are approved through the medical management department. These drugs are often high-cost drugs administered in physician offices, infusion suites, or hospitals. There can be wide variability on how these drugs are authorized, and states continue to seek utilization controls. Over half of responding states reported having policies or tools in place to ensure that drugs are paid at the lowest cost benefit including prior authorization, paying for all drugs through the pharmacy benefit, prohibitions on “white bagging,”11 and delegating policy making to MCOs.