Pricing and Payment for Medicaid Prescription Drugs

The cost of prescription drugs is a leading health policy issue in the United States, with 79% of the public believing that the cost of prescription drugs is unreasonable1 and both major parties introducing legislation aimed at lowering drug costs.2 Though much of the focus of the current debate is on the effect of drug prices on consumer spending within Medicare and commercial insurance, proposed policy changes may have implications for Medicaid as well. In addition, as part of ongoing efforts to control drug costs, there is renewed interest in drug prices and reimbursement within Medicaid as a major component of Medicaid spending, along with utilization. Changes made in 2016 to federal rules governing how state Medicaid programs pay for drugs aimed to make the prices paid more accurate, but increased reliance on pharmacy benefit managers (PBMs) poses challenges to drug price transparency. This brief explains Medicaid prescription drug prices to help policymakers and others understand Medicaid’s role in drug pricing and any potential consequences of policy changes for the program by answering the following questions:

- What factors determine Medicaid prices for prescription drugs?

- How do prices impact Medicaid spending?

- What are policy debates and proposals about Medicaid pricing?

What factors determine Medicaid prices for prescription drugs?

Medicaid payments for prescription drugs are determined by a complex set of policies, at both the federal and state levels, that draw on price benchmarks (Box 1). States have some flexibility within federal guidelines to set the payment amounts. Price benchmarks represent prices paid by different parties at different stages in the drug manufacturing, acquisition, and dispensing processes. Because price benchmarks are related to one another, the prices paid throughout the drug distribution process have an effect on the final price that Medicaid pays.

| Box 1: Key Terms and Prices in Medicaid Drug Pricing |

| AAC: Actual Acquisition Cost is the state Medicaid agency’s determination of pharmacy providers’ actual prices paid to acquire drug products marketed or sold by a specific manufacturer. AAC is the current Medicaid benchmark to set payment for drug ingredients.

AMP: Average Manufacturer Price is the average price paid to the manufacturer by wholesalers and retail community pharmacies that purchase drugs directly from the manufacturer. AMP is used to calculate drug rebates under the Medicaid Drug Rebate Program. AWP: Average Wholesale Price is the published list price for a drug sold by wholesalers to retail pharmacies and nonretail providers. It is akin to a sticker price and used as a starting point for negotiation for payments to retail pharmacies. Best Price: The lowest available price to any wholesaler, retailer, or provider, excluding certain government programs like the 340B drug pricing program and the health program for veterans. EAC: Estimated Acquisition Cost is a benchmark previously used by many state Medicaid programs to set payment for drug ingredient cost. FUL: The Federal Upper Limit sets a reimbursement limit for some generic drugs; calculated as 175% AMP. MAC: Maximum Allowable Cost is a reimbursement limit set by states in addition to the FUL. NADAC: The National Average Drug Acquisition Cost is intended to be a national average of the prices at which pharmacies purchase a prescription drug from manufacturers or wholesalers, including some rebates. NADAC can be used to calculate AAC. WAC: Wholesale Acquisition Cost is the manufacturer’s list price to wholesalers. The WAC represents manufacturers’ published catalog, or list, price for sales of a drug (brand-name or generic) to wholesalers. However, in practice, the WAC is not what wholesalers pay for drugs. |

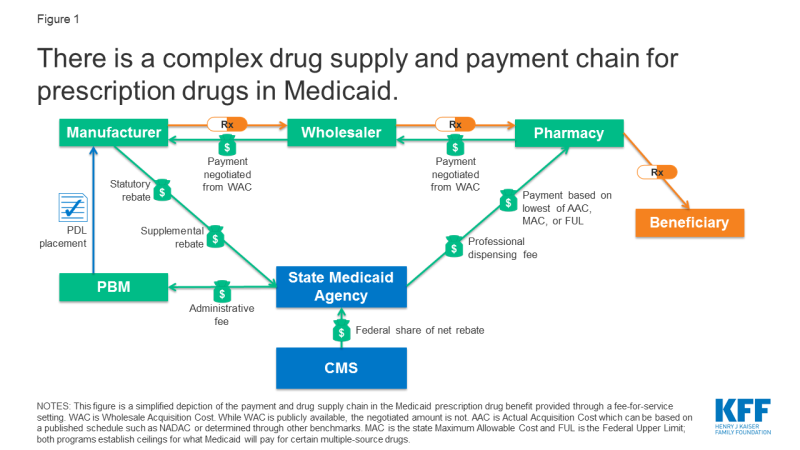

State Medicaid programs reimburse pharmacies for prescription drugs based on the ingredient costs for the drug and a dispensing fee for filling the prescription.3 Medicaid agencies do not buy drugs directly from manufacturers. Rather, they reimburse retail pharmacies that fill prescriptions written for Medicaid enrollees. The amount the pharmacy receives is based on the ingredient cost of the drug and professional dispensing fees paid by Medicaid, plus any cost sharing paid by the beneficiary (Figure 1). For beneficiaries who receive their drug benefit through managed care organizations (MCOs), MCOs reimburse the pharmacy, usually through the use of a PBM.

States set policies on dispensing fees and, within federal guidelines, beneficiary cost-sharing, while federal regulations guide payment levels for ingredient costs. With the exception of some multiple-source drugs for which there are specific federal or state limits, federal regulations require Medicaid programs to reimburse pharmacies based on the lesser of the (1) ingredient cost, as defined by federal guidelines, plus a professional dispensing fee; or (2) the pharmacy’s “usual and customary charge” to the public.4 The final cost to Medicaid is then offset by any rebates received under the federal Medicaid Drug Rebate Program or state-negotiated supplemental rebates.

Ingredient Cost

The ingredient cost reflects the price to the pharmacy of actually acquiring the drug from a manufacturer or wholesaler and is calculated based on percentages of what pharmacies and wholesalers pay for the drug.5 Payment for ingredient cost is governed by average acquisition cost (AAC), which is the benchmark for setting payment for ingredient cost, capped at the lower of federal upper limits (FULs) or state maximum allowable costs (MAC) for some drugs. FULs and MACs may lead to lower prices for ingredient costs than AAC. States generally pay the lowest of the three benchmarks for any given drug.

Actual acquisition cost

In 2016, the Centers for Medicare & Medicaid Services (CMS) finalized regulations that changed Medicaid payment for ingredient cost from an “estimated acquisition cost” (EAC) to an “actual acquisition cost” (AAC).6 CMS defines AAC as the state Medicaid agency’s determination of pharmacy providers’ actual prices paid to acquire drug products marketed or sold by a specific manufacturer. States have flexibility within federal rules to calculate AAC, and CMS approves the states’ methodologies for calculation through the Medicaid state plan amendment (SPA) process. To determine AAC, states may survey pharmacies, use national survey data, or use the AMP data that manufacturers already are required to report to enable calculations of federal rebates and FUL pricing. States were required to be in compliance with the AAC rules by April 1, 2017.

CMS also publishes the NADAC, a federal survey of pharmacies that helps states to determine AAC. NADAC is designed to be a national reference file for determining AAC and consists of survey data from retail pharmacies to determine the prices they pay to manufacturers and wholesalers.7 NADAC is a voluntary survey of retail pharmacies of invoice prices; the prices do not include off-invoice discounts or rebates paid to plans or PBMs from manufacturers.

Federal upper Limits (FUL)

The Federal Upper Limit (FUL) program caps ingredient reimbursement for certain multiple-source drugs.8 Prices can vary widely between generic drugs.9 The intent of the FUL program is to make the government a prudent buyer — and reduce Medicaid expenditures — by basing payments on market prices for these drugs. CMS calculates a FUL amount for specific forms and strengths for each multiple-source drug that meets the established criteria. The federal government establishes maximum payment amounts for about 700 multiple-source drugs including both generics and originator brands for which generic versions are now available. The Affordable Care Act and subsequent rules set reimbursement at 175% of the weighted average of the most recently reported average manufacturer prices (AMP) for that drug. Federal law defines AMP as the average price paid to the manufacturer for the drug in the United States by (1) wholesalers for drugs distributed to retail community pharmacies and (2) retail community pharmacies that purchase drugs directly from the manufacturer.10 In instances in which FUL is less than AAC, FUL is calculated using a higher multiplier to reflect average retail community pharmacies’ acquisition costs. The revised FUL calculation is estimated to save Medicaid $2.7 billion from FY 2016 to FY 2020.11

State maximum allowable costs

Nearly all states apply maximum allowable cost (state MAC, or SMAC) limits to multiple-source drugs, which establish ceilings on reimbursement for the drug products included on state MAC lists.12 These state MAC amounts generally are part of a complex “lesser of” formula, where the state agency sets reimbursement for multiple-source drugs at the lowest amount for each drug based on (1) the state’s AAC formula, (2) the FUL (if applicable), (3) the state MAC or (4) the pharmacy’s usual and customary charge to the public. State MAC programs frequently include other drugs that do not have established FULs: a 2013 analysis by the U.S. Department of Health and Human Services’ Office of Inspector General (OIG) found that state MAC programs include 50-60% more drugs than FULs. States have flexibility in how they set MAC benchmarks: of 41 states that identified a pricing benchmark for their state MAC programs, 29 used pharmacy acquisition costs as part of the benchmark to set state MAC prices.13

Dispensing Fees

The dispensing fee is intended to cover reasonable costs associated with providing the drug to a Medicaid beneficiary. This cost includes the pharmacist’s services and the overhead associated with maintaining the facility and equipment necessary to operate the pharmacy. States establish dispensing fees for the pharmacies that fill prescriptions for Medicaid beneficiaries. In most states, these fees typically range between $9 and $12 for each prescription.14 After moving to AAC, most states increased dispensing fees while ingredient costs decreased. A number of states reported that they expected savings or a neutral budgetary impact from implementing the changes.15 However, though AAC is less than EAC, savings are dependent on the total of ingredient cost plus dispensing fee. States may vary the professional dispensing fee by type of pharmacy, pharmacy prescription volume, or type of drug. For example, Medicaid may pay more in dispensing fees for a specialty drug or to a pharmacy filling fewer prescriptions.

Beneficiary Cost Sharing

States may impose nominal cost sharing for prescription drugs for some beneficiaries. A final component of Medicaid reimbursement for prescription drugs is cost sharing paid by the beneficiary. Federal law caps these amounts to $4 for preferred drugs and $8 for non-preferred drugs for individuals with incomes at or below 150% of the federal poverty level (FPL), with slightly higher caps for beneficiaries with higher incomes.16 Fifteen states do not impose cost-sharing for prescription drugs,17 and some beneficiary groups, such as children and pregnant women, or drug classes like family planning and tobacco cessation drugs are generally exempt from cost sharing requirements. In addition, pharmacies are required to dispense the drug regardless of the beneficiary’s ability to pay, resulting in inconsistent collection of this component of reimbursement at cost to the pharmacy.

Drug Reimbursement Under MCOs and PBMs

MCOs and PBMs play an increasingly large role in administering Medicaid pharmacy benefits. This growth has occurred as states have enrolled more beneficiaries into managed care, more states opt to “carve in” their pharmacy benefits under contracts with MCOs, and states rely on PBMs for administrative support, negotiation of supplemental rebates, and clinical drug class reviews.18 In 2017, approximately two-thirds of Medicaid gross drug spending was administered through managed care.19

PBMs perform a variety of financial and clinical services for Medicaid programs, including price negotiation for MCOs.20 States may utilize PBMs in both managed care and fee-for-service (FFS) settings. PBMs acting on behalf of managed care companies negotiate individual prices with pharmacies and can set proprietary maximum allowable costs (MACs).21 PBMs operating under Medicaid FFS must abide by federal and state rules regarding drug pricing and reimbursement.

MCOs do not need to base pharmacy payment rates on AAC. Federal rules state that MCOs must set payment rates sufficient to guarantee beneficiary access, but MCOs are not bound by rules regarding ingredient costs like drugs purchased through FFS.22 Plans may have their own MAC lists and negotiate additional rebates with manufacturers. MCOs also may contract with a PBM that negotiates individual rates with pharmacies rather than a set payment rate.23

The use of MCOs and PBMs means prices paid for drugs for Medicaid beneficiaries are not always transparent, because MCOs are not subject to the same drug payment rules as in FFS. Many prices are not publicly known or even known to states, as MCOs keep some pricing information proprietary in their negotiations with pharmacies. This lack of transparency is particularly true for generic drugs, which represent around 84% of total paid claims and 18% of total spending.24

How do drug prices affect Medicaid spending?

Drug list prices affect not only the reimbursement paid to the pharmacy in ingredient costs but also the amount of rebates the Medicaid program receives. Under the Medicaid Drug Rebate Program, Medicaid receives a rebate for prescription drugs reimbursed under the program. Rebates are calculated based on a share of the average price paid to manufacturers and include an inflationary component to account for rising drug prices over time. Thus, the larger the gross price of a drug and the faster the price increases over time, the larger the rebate that Medicaid receives. The rebate program substantially offsets Medicaid spending on drugs: In 2018, Medicaid spent $60 billion on drugs and received $36 billion in rebates.25 While gross prescription drug spending has increased substantially over time, rebates have held net spending growth to a much slower rate.

Because of the large role of rebates in reducing Medicaid drug costs, the drug with the lowest price is not always the drug that costs the least. Because generic drugs are usually lower-cost but still therapeutically equivalent to brand name drugs, most state Medicaid programs require generic substitution unless the prescriber specifies that the brand is medically necessary. However, there are some instances where, due to the structure of the rebate program, the generic drug is not the lowest cost drug to the program.

States are increasingly comparing the net cost of the brand drug to the net cost of the generic drug to make sure that the state is paying the lowest price, also known as “brand-over-generic” programs.26 Estimates suggest these programs can lead to substantial savings. This is especially the case at the initial entrance of a generic equivalent into the market, when a state may still have supplemental rebate agreements and other large rebates that offset the price of the brand drug. New York is one state with a specific program that promotes the use of brand-name drugs over generics whenever the brand name drug is less expensive to the program. As of the release of this brief, there are 30 drugs on the program list.27

What are policy debates and proposals about Medicaid pricing?

Given increased national attention on drug prices, there are myriad policy proposals at both the state and federal level to lower drug costs. Many of these proposals may impact Medicaid’s ultimate payment for drugs, such as a use of value-based purchasing, the “Netflix” subscription model, and changes to rebates, but not all are specifically aimed at underlying drug prices. Drug importation proposals to allow payers or customers in the US to purchase drugs from foreign nations at those nations’ prices have gained traction in some states and at the federal level, but the impact on Medicaid prices is unclear at this point as these proposals are still under development. Two policy areas that may directly affect Medicaid prices are market-wide trends in drug prices and efforts to address drug price transparency.

Market Prices and Trends and Their Effect on Medicaid

The cost burden of high-cost and specialty drugs makes new and first-in-class drugs a pressing policy area for Medicaid agencies. Because of the structure of the Medicaid drug rebate program, states must cover nearly all drugs, including new, blockbuster drugs once they are approved by the Food and Drug Administration (FDA).28 Some “blockbuster” drugs can cost from tens of thousands to over a million dollars. The introduction of new drugs can be particularly challenging for Medicaid programs in the initial phases of coverage, as states work out prior authorization requirements or coverage guidelines. States identified the cost of specialty drugs as one of the factors behind a projected increase in Medicaid spending in 2020.29

While generics are priced lower than brand name drugs, the cost of generics has also been rising in recent years.30 These price increases reflect a combination of factors, including decreasing competition within the generic market and a drop in the number of generic manufacturers, as well as delays in FDA generic approvals and supply or manufacturing challenges for some drugs, among other reasons.22 Despite the rebate calculation including an inflationary component, the complex, interrelated nature of pricing and reimbursement means that cost increases for generic drugs in Medicaid are not necessarily limited. Additionally, some believe that even limiting Medicaid spending for generics to inflation is problematic, as the expectation is that the price of generic drugs will decline over time due to competition.31

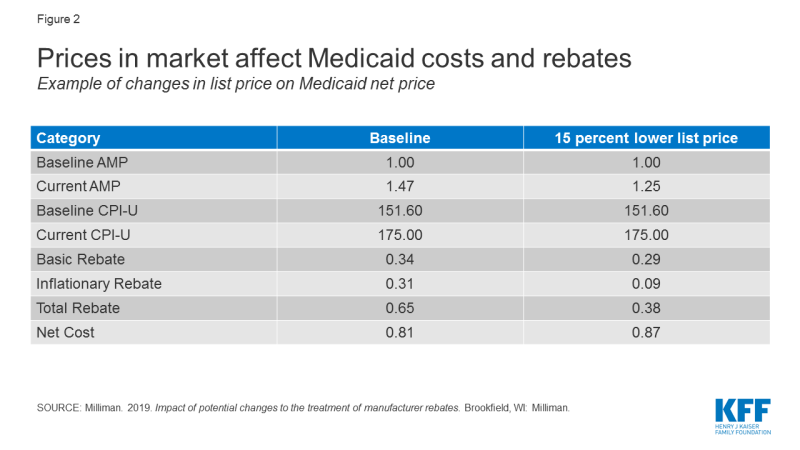

Though they are not specifically targeted to Medicaid, policy proposals to change the structure of rebates or prices in Medicare and the private market also affect Medicaid. These indirect effects occur because many proposals affect list prices or AMP, which in turn affect Medicaid rebate calculations and reimbursement rates to pharmacies. For example, proposals (such as those made by the Trump Administration32 and by House Democrats) to align Medicare drug prices more closely with drug prices in other countries could have implications for Medicaid drug spending by changing drug list prices. Policy changes that would allow the federal government to negotiate Medicare prices also may have implications for Medicaid, depending on how the price applies to the wider marketplace and the prices used to set Medicaid rebates.33 Because a large share of Medicaid rebates for some drugs can be attributed to inflationary increases, proposals that lower the baseline price of a drug may actually increase the net cost of the drug to the Medicaid program by significantly reducing the inflationary rebate (Figure 2).

Price Transparency

There are many opaque aspects to the pricing of prescription drugs in general and specifically within Medicaid. Though price benchmarks like WAC and AWP are collected, they are not always easily accessible, and determining actual prices paid is difficult without access to a private database. Many negotiated prices are proprietary and known only to the parties involved. In addition, manufacturers do not provide public information on how they set this list price and historically have not been required to explain changes in a product’s list price.34 PBMs add another layer of opacity, as the prices they pay manufacturers and reimbursement they pay pharmacies is often unknown. Proposals to make drug pricing information more publicly available at the federal level include making NADAC a mandatory survey and increasing the amount of information collected by the survey.

Although most believe it would not directly lower drug costs, some feel that increased drug pricing transparency would help policymakers better understand which prescription drugs and which parts of the supply chain are spending drivers. 35 Transparency laws would make information that may be available only to a state Medicaid agency or PBM available to the general public and other state lawmakers.36 The public highly favors drug pricing transparency, with a recent poll finding that 86% of Americans would like drug companies to publicly release information on how prices are set.37

Several states have included public reporting as a component in broader prescription drug initiatives, and several states have passed laws focused on pricing transparency. These laws vary in scope, focus of drug class, and actor, as well as how they report information.38 Laws promoting drug transparency tend to focus on manufacturers and WACs, but the pharmaceutical industry has argued that policymakers should also seek transparency throughout the supply chain, including PBMs.39 Policy proposals at the federal level also address drug price transparency. The Senate Finance Committee bill would require manufacturers to report information to the Secretary of HHS to justify certain increases in the WAC of prescription drugs.40

Manufacturer price transparency

Manufacturer transparency laws focus on publicizing information about WACs, which feed into prices and payment throughout the system. Many laws focus on requiring manufacturers to disclose their methodology for setting prices or setting formularies or provide advance notice of some price increases. Vermont was the first state to pass drug transparency legislation in June 2016. It did so with the purpose of understanding drug cost drivers statewide. The Vermont law directs the two separate agencies to collaborate to identify up to 15 costly drugs from separate drug classes with large WAC increases, posting them online. The manufacturers must then provide justification for these price increases to the Attorney General, who presents findings to the General Assembly.41 Oregon and Nevada require manufacturers to report profits for certain drugs, and in Maine, manufacturers must report to the state’s all-payer claims data program when they increase the WAC of a drug by a certain threshold42,43,44. Those skeptical of the impact of some state laws argue that most are still focused on list prices and WAC and thus do not reveal true transaction prices.45

PBM transparency

Price transparency is a particular challenge under PBM arrangements, as PBM drug prices are opaque, particularly for generic drugs where prices vary considerably.46 PBMs that negotiate prices on behalf of MCOs are not subject to the same rules about AAC-based payment and set their own pharmacy payments that are not known to states.47 Managed care programs usually pay PBMs a discount off the AWP, akin to a sticker price, for generic claims. The AWP does not reflect the acquisition cost for generic drugs.48 PBMs pay pharmacies a negotiated MAC that is proprietary and is also not known to states. The difference between the AWP-based payment and the MAC is referred to as the “spread,” or profit of the PBM. Because the components of the spread are often unknown, many states do not know how much profit PBMs retain.

Lack of transparency is leading some states to question whether these management methods produce savings or generate additional costs. 49 In 2018, a report by Ohio’s state auditor found that PBMs cost the state program nearly $225 million through spread pricing in managed care.50,51 Similar analysis by the Massachusetts Health Policy Commission found that PBMs charged MassHealth MCOs more than the acquisition price for generic drugs in 95% of the analyzed pharmaceuticals in the last quarter of 2018.52 Michigan found that PBMs had collected spread of more than 30% on generic drugs and a report found that the state had been overcharged $64 million.53 Other states have released similar reports finding high amounts of spread on generic prescriptions.54 Concerns about Medicaid spread pricing led CMS to issue guidance in May 2019 about how managed care plans should report spread pricing.55

States are addressing concerns about PBM spread pricing through a variety of policies, like licensure requirements, reporting requirements, and increased oversight. For example, after the 2018 report, Ohio prohibited its managed care plans from contracting with PBMs that use spread pricing.56 Since then, the state has announced it will move to contract with a single PBM for its entire managed care program starting July 2020, with enhanced transparency reporting requirements.57 Michigan is planning to no longer use PBMs and to use FFS to pay for its prescription drugs.58 Other states like Nevada have implemented policies establishing PBMs as fiduciaries with a duty to act in the best interest of pharmacies and beneficiaries.59 Federal legislative proposals would prohibit spread pricing by PBMs in Medicaid managed care.60

Summary

The price Medicaid pays for drugs is the result of a complex set of factors and inputs. Recent changes to price benchmarks attempt to move payments closer to actual pharmacy acquisition costs. Attention to high list prices continues at both the state and federal levels with a number of policy proposals aimed at lowering drug prices. Policy changes to lower drug prices will have implications for the Medicaid program so it is important to understand the program’s role and how the program pays for drugs.

| This work was supported in part by Arnold Ventures. We value our funders. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities. |