2019 Employer Health Benefits Survey

Section 3: Employee Coverage, Eligibility, and Participation

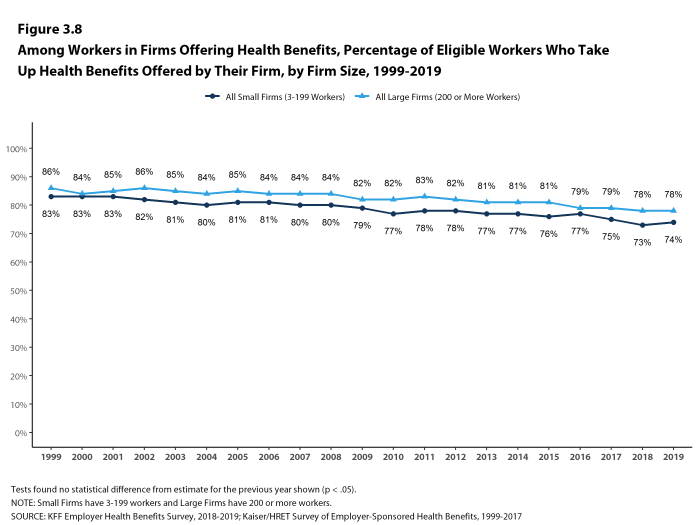

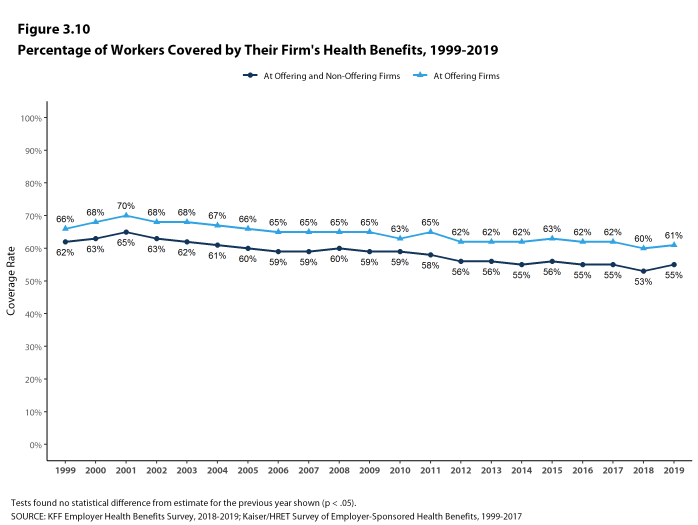

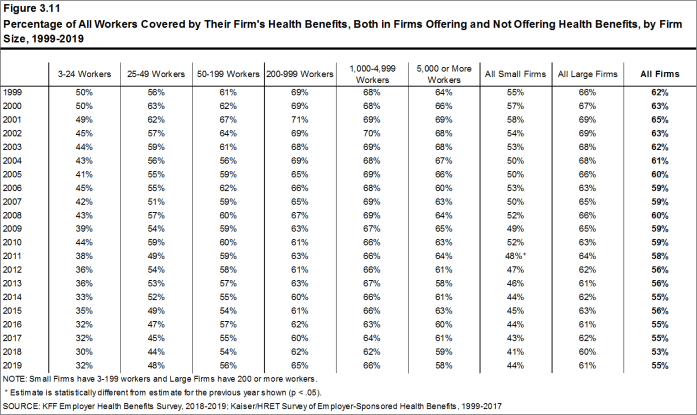

Employers are the principal source of health insurance in the United States, providing health benefits for about 153 million non-elderly people in America.13 Most workers are offered health coverage at work, and most of the workers who are offered coverage take it. Workers may not be covered by their own employer for several reasons: their employer may not offer coverage, they may not be eligible for the benefits offered by their firm, they may elect to receive coverage through their spouse’s employer, or they may refuse coverage from their firm. In 2019, 61% of workers in firms offering health benefits are covered by their own firm, similar to the percentages last year and five years ago, but lower than the share (65%) in 2009. The share of eligible workers taking up benefits in offering firms (76%) is lower than the share in 2014 (80%) and in 2009 (81%)

ELIGIBILITY

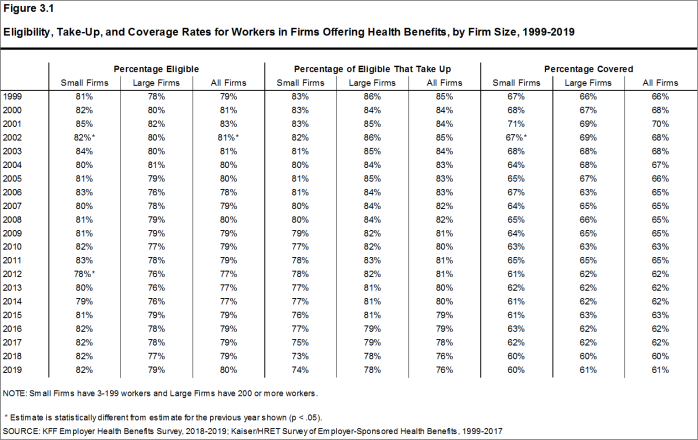

- Even in firms that offer health benefits, some workers may not be eligible to participate.14 Many firms, for example, do not offer coverage to part-time or temporary workers. Among workers in firms offering health benefits in 2019, 80% are eligible to enroll in the benefits offered by their firm, similar to the percentages last year, five years ago, and 10 years ago, for both small and large firms [Figure 3.1].

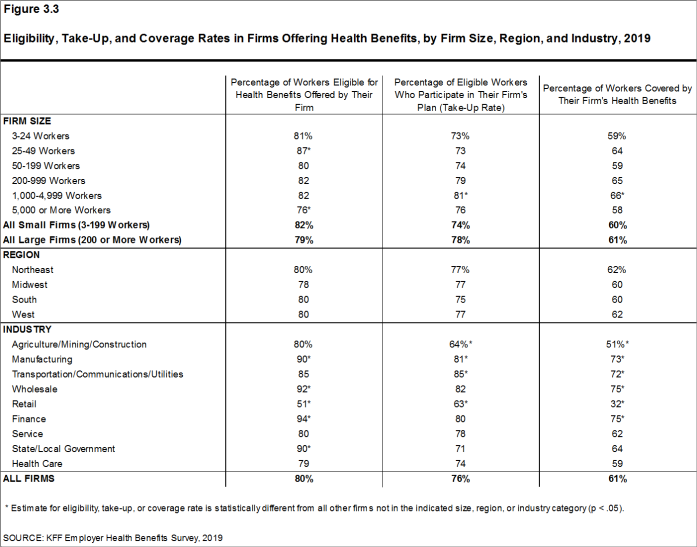

- The percentage of workers eligible to enroll in health benefits at their firm is relatively higher in firms with 25-49 workers (87%), and relatively lower in firms with 5,000 or more workers (76%) [Figure 3.3].

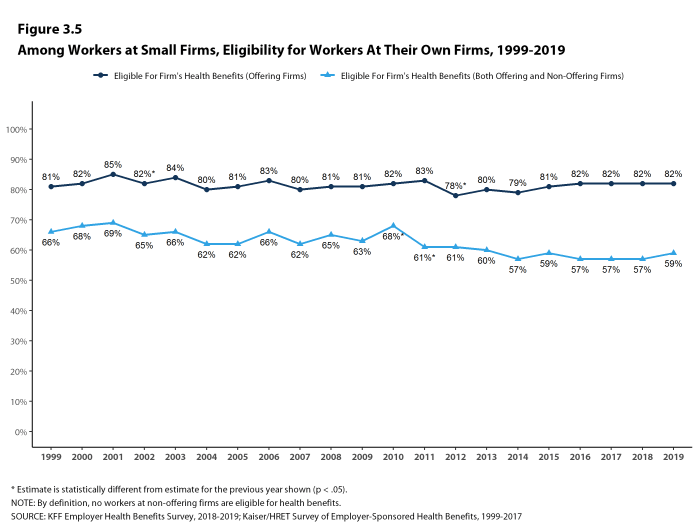

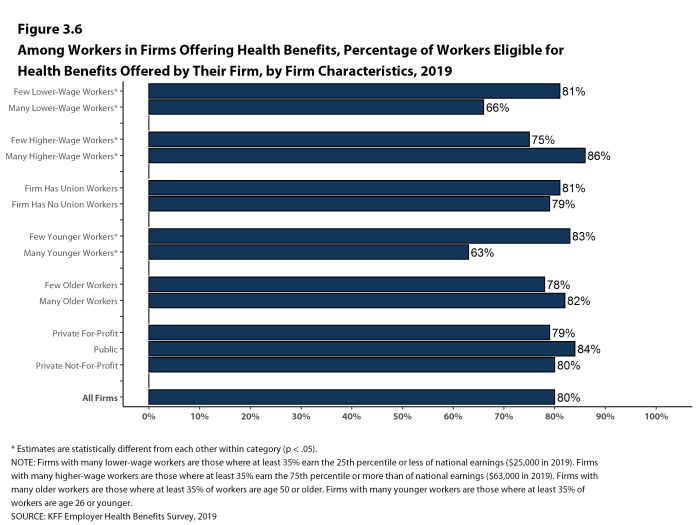

- Eligibility varies considerably by firm wage level. Workers in firms with a relatively large share of lower-wage workers (where at least 35% of workers earn $25,000 a year or less) have a lower average eligibility rate than workers in firms with a smaller share of lower-wage workers (66% vs. 81%) [Figure 3.6].

- Workers in firms with a relatively large share of higher-wage workers (where at least 35% earn $63,000 or more annually) have a higher average eligibility rate than workers in firms with a smaller share of higher-wage workers (86% vs. 75%) [Figure 3.6].

- Eligibility also varies by the age of the workforce. Those in firms with a relatively small share of younger workers (where fewer than 35% of the workers are age 26 or younger) have a higher average eligibility rate than those in firms with a larger share of younger workers (83% vs. 63%) [Figure 3.6].

- Eligibility rates vary considerably for workers in different industries. The average eligibility rate remains particularly low for workers in retail firms (51%) [Figure 3.3].

Figure 3.1: Eligibility, Take-Up, and Coverage Rates for Workers in Firms Offering Health Benefits, by Firm Size, 1999-2019

Figure 3.3: Eligibility, Take-Up, and Coverage Rates in Firms Offering Health Benefits, by Firm Size, Region, and Industry, 2019

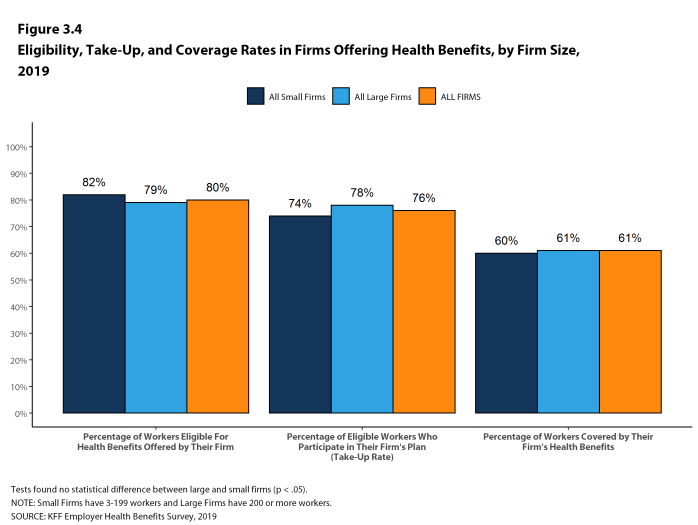

Figure 3.4: Eligibility, Take-Up, and Coverage Rates in Firms Offering Health Benefits, by Firm Size, 2019

TAKE-UP RATE

- Seventy-six percent of eligible workers take up coverage when it is offered to them, similar to the percentage last year [Figure 3.1].15

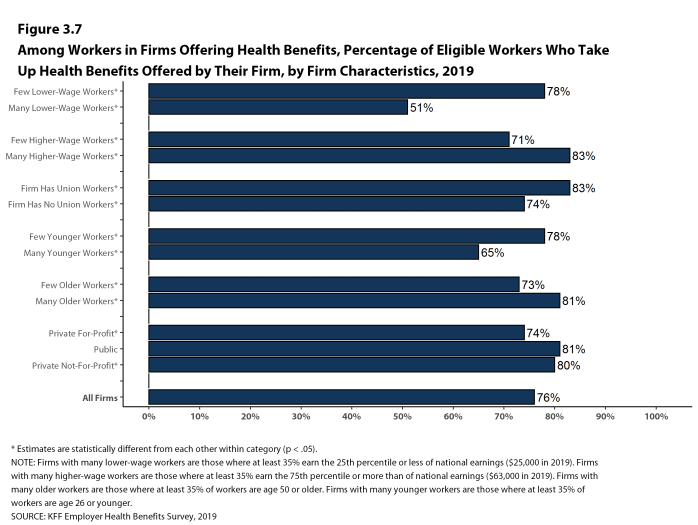

- The likelihood of a worker accepting a firm’s offer of coverage varies by firm wage level. Eligible workers in firms with a relatively large share of lower-wage workers have a lower average take up rate than eligible workers in firms with a smaller share of lower-wage workers (51% vs. 78%) [Figure 3.7].

- Eligible workers in firms with a relatively large share of higher-wage workers have a higher average take up rate than those in firms with a smaller share of higher-wage workers (83% vs. 71%) [Figure 3.7].

- The likelihood of a worker accepting a firm’s offer of coverage also varies with the age distribution of the workforce. Eligible workers in firms with a relatively large share of younger workers have a lower average take up rate than those in firms with a smaller share of younger workers (65% vs. 78%) [Figure 3.7].

- Eligible workers in firms with a relatively large share of older workers have a higher average take up rate than those in firms with a smaller share of older workers (81% vs. 73%) [Figure 3.7].

- Eligible workers in private, for-profit firms firms have a lower average take up rate (74%) than workers in other firm types [Figure 3.7].

- Eligible workers in firms with some union workers have a higher average takeup rate than those in firms with no union workers (83% vs. 74%) [Figure 3.7].

- The percentage of eligible workers taking up benefits in offering firms also varies by industry [Figure 3.3].

- The share of eligible workers taking up benefits in offering firms (76%) is lower than the share in 2014 (80%) and in 2009 (81%) [Figure 3.1].

Figure 3.7: Among Workers in Firms Offering Health Benefits, Percentage of Eligible Workers Who Take Up Health Benefits Offered by Their Firm, by Firm Characteristics, 2019

COVERAGE

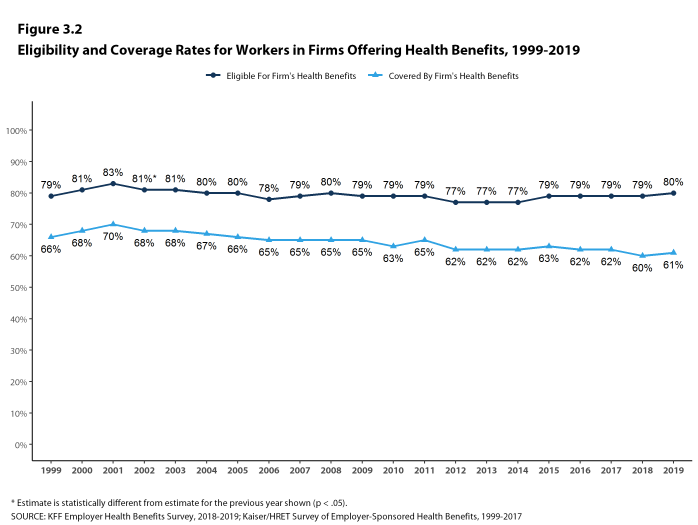

- In 2019, the percentage of workers at firms offering health benefits covered by their firm’s health plan is 61%, similar to the percentage last year [Figure 3.1] and [Figure 3.2].

- The coverage rate at firms offering health benefits is similar for small firms and large firms in 2019. These rates are similar to the rates last year for both small firms and large firms [Figure 3.1].

- There is significant variation by industry in the coverage rate among workers in firms offering health benefits. The average coverage rate is particularly low in the retail industry (32%) [Figure 3.3].

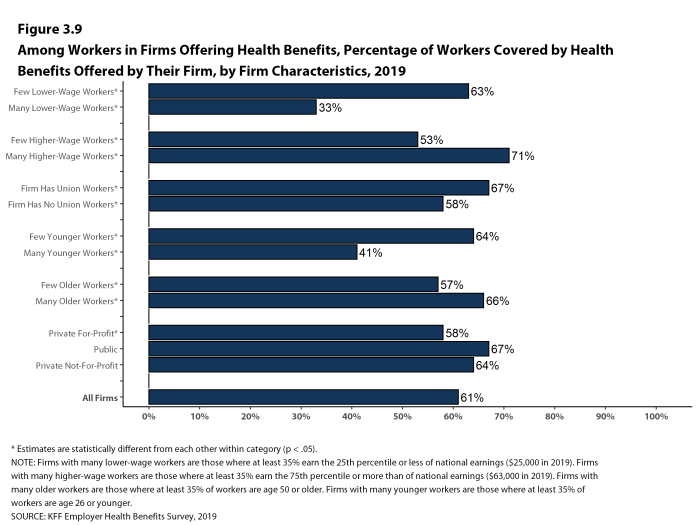

- There also is variation by firm wage levels. Among workers in firms offering health benefits, those in firms with a relatively large share of lower-wage workers are less likely to be covered by their own firm than workers in firms with a smaller share of lower-wage workers (33% vs. 63%). A comparable pattern exists in firms with a relatively large share of higher-wage workers, with workers in these firms being more likely to be covered by their employer’s health benefits than those in firms with a smaller share of higher-wage workers (71% vs. 53%) [Figure 3.9].

- The age profile of workers is also related to variation in coverage rates. Among workers in firms offering health benefits, those in firms with a relatively small share of younger workers are more likely to be covered by their own firm than those in firms with a larger share of younger workers (64% vs. 41%). Similarly, workers in offering firms with a relatively large share of older workers are more likely to be covered by their own firm than those in firms with a smaller share of older workers (66% vs. 57%) [Figure 3.9].

- Among workers in firms offering health benefits, those working in private, for-profit firms are less likely than workers in other firm types to be covered by their own firm [Figure 3.9].

- Among workers in all firms, including those that offer and those that do not offer health benefits, 55% are covered by health benefits offered by their employer, similar to last year, but lower than the coverage rate in 2009 (59%) [Figure 3.10].

Figure 3.9: Among Workers in Firms Offering Health Benefits, Percentage of Workers Covered by Health Benefits Offered by Their Firm, by Firm Characteristics, 2019

- The Uninsured: A Primer – Key Facts about Health Insurance and the Uninsured Under the Affordable Care Act. Washington (DC): The Commission; 2019 Jan (cited 2019 Aug 12). https://www.kff.org/uninsured/report/the-uninsured-a-primer-key-facts-about-health-insurance-and-the-uninsured-under-the-affordable-care-act/. See supplemental tables – Table 1: 267.5 million non-elderly people, 57.1% of whom are covered by employer-sponsored insurance (ESI).↩

- See Section 2 for part-time and temporary worker offer rates.↩

- In 2009, we began weighting the percentage of workers that take up coverage by the number of workers eligible for coverage. The historical take-up estimates have also been updated. See the Survey Design and Methods section for more information.↩