2019 Employer Health Benefits Survey

Section 2: Health Benefits Offer Rates

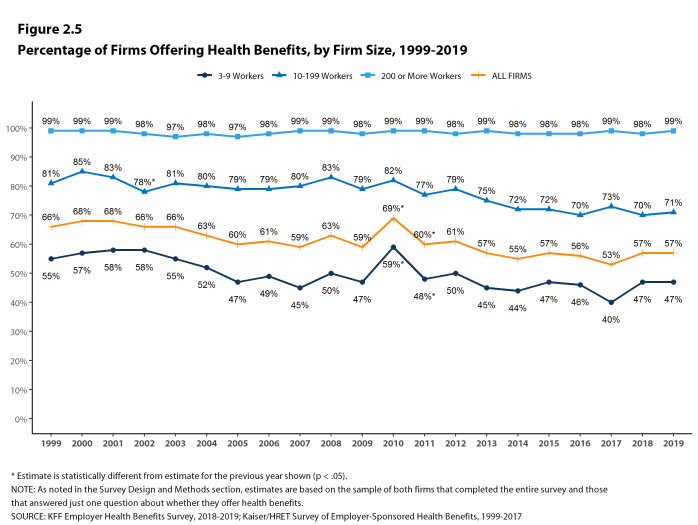

While nearly all large firms (200 or more workers) offer health benefits to at least some workers, small firms (3-199 workers) are significantly less likely to do so. The percentage of all firms offering health benefits in 2019 (57%) is similar to the percentages of firms offering health benefits last year (57%), five years ago (55%), and ten years ago (59%).

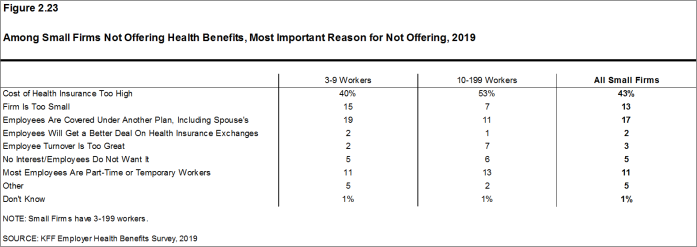

Firms not offering health benefits continue to cite cost as the most important reason they do not do so. Almost all firms that offer coverage offer benefits to dependents such as children and the spouses of eligible employees.

FIRM OFFER RATES

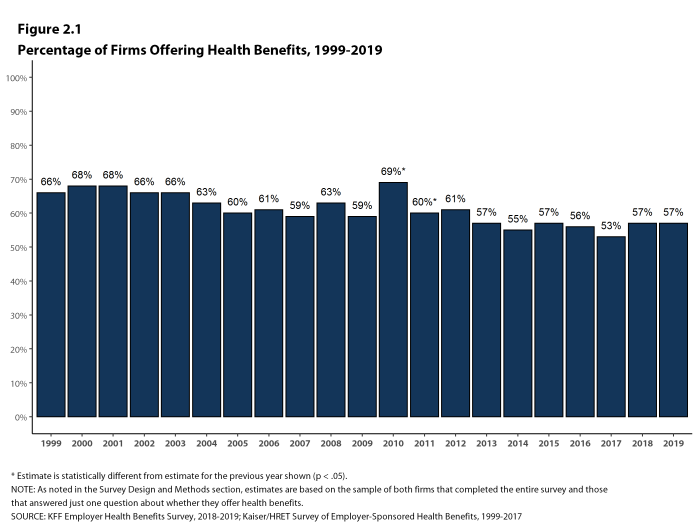

- In 2019, 57% of firms offer health benefits, the same percentage as last year [Figure 2.1].

- The overall percentage of firms offering health benefits in 2019 is similar to the percentages offering health benefits in 2014 (55%) and in 2009 (59%) [Figure 2.1].

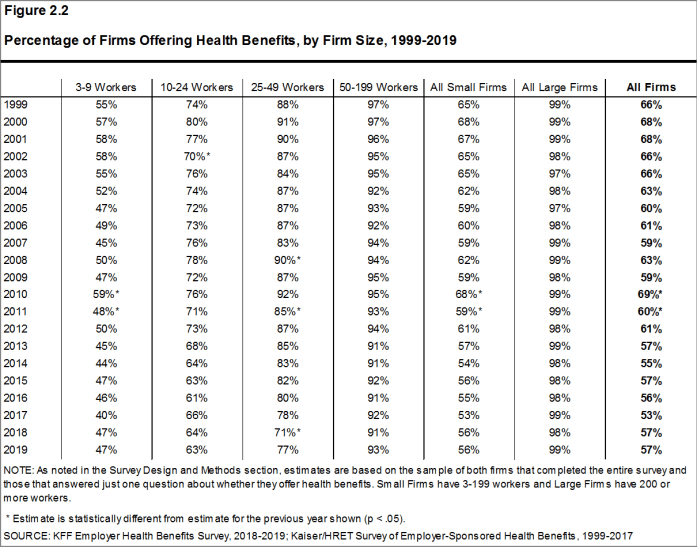

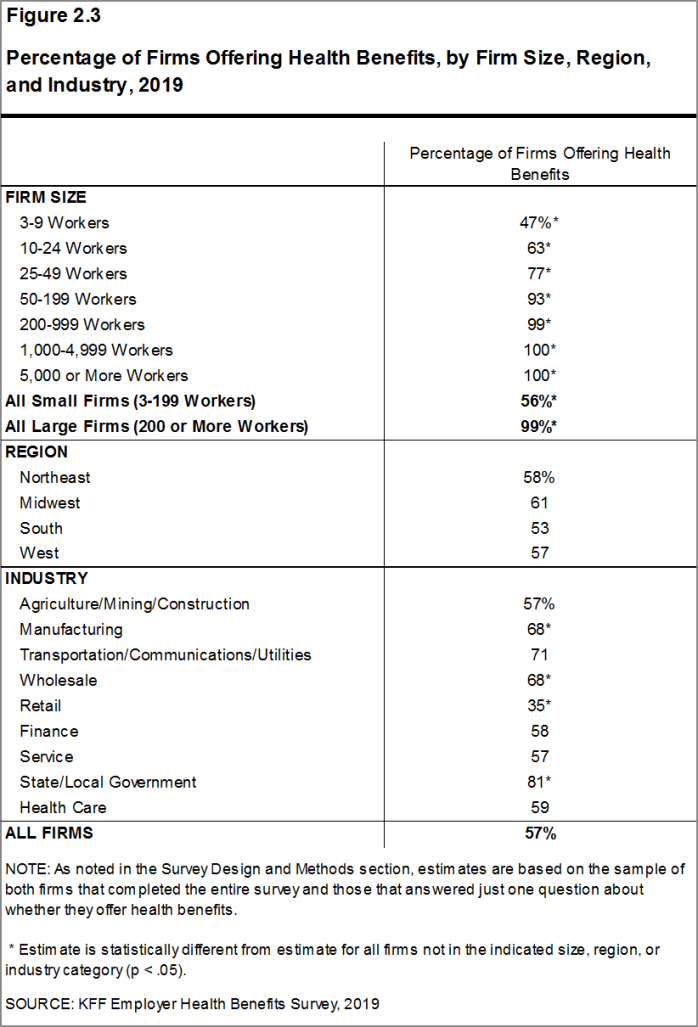

- Ninety-nine percent of large firms offer health benefits to at least some of their workers. In contrast, only 56% of small firms offer health benefits [Figure 2.2] and [Figure 2.3]. The percentages of both small and large firms offering health benefits to at least some of their workers are similar to last year [Figure 2.2].

- The smallest-sized firms are least likely to offer health insurance: 47% of firms with 3-9 workers offer coverage, compared to 77% of firms with 25-49 workers, and 93% of firms with 50-199 workers [Figure 2.3]. Since most firms in the country are small, variation in the overall offer rate is driven largely by changes in the percentages of the smallest firms (3-9 workers) offering health benefits. For more information on the distribution of firms in the country, see the Survey Design and Methods Section and Figure M.6.

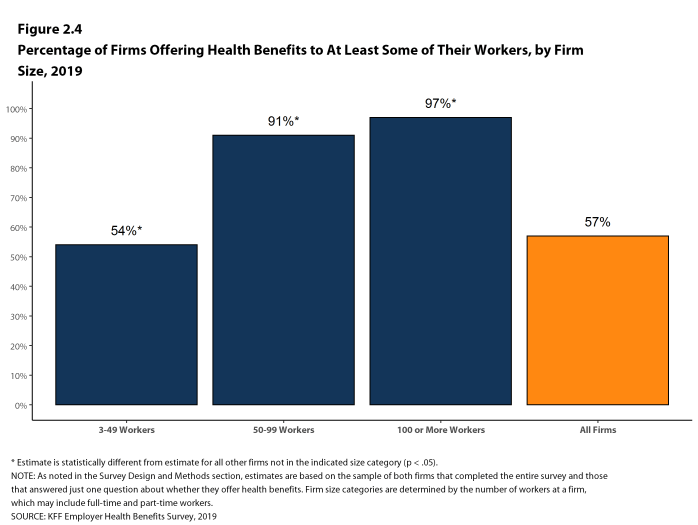

- Only fifty-four percent of firms with 3-49 workers offer health benefits to at least some of their workers, compared to 94% of firms with 50 or more workers [Figure 2.4].

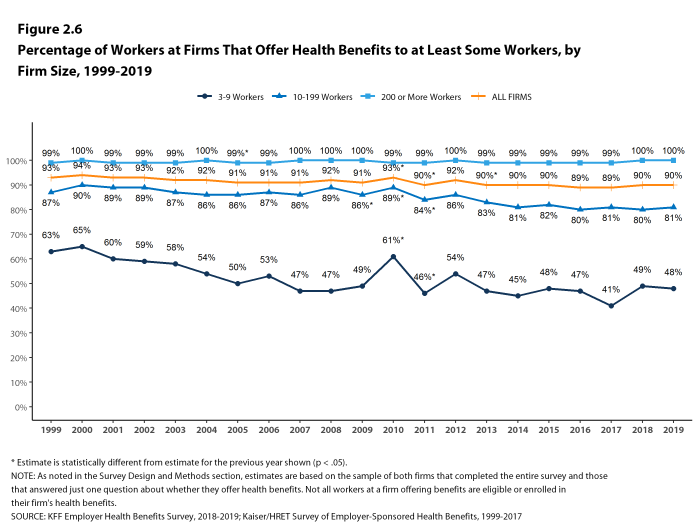

- Because most workers are employed by larger firms, most workers work at a firm that offers health benefits to at least some of its employees. Ninety percent of all workers are employed by a firm that offers health benefits to at least some of its workers [Figure 2.6].

Figure 2.4: Percentage of Firms Offering Health Benefits to at Least Some of Their Workers, by Firm Size, 2019

PART-TIME AND TEMPORARY WORKERS

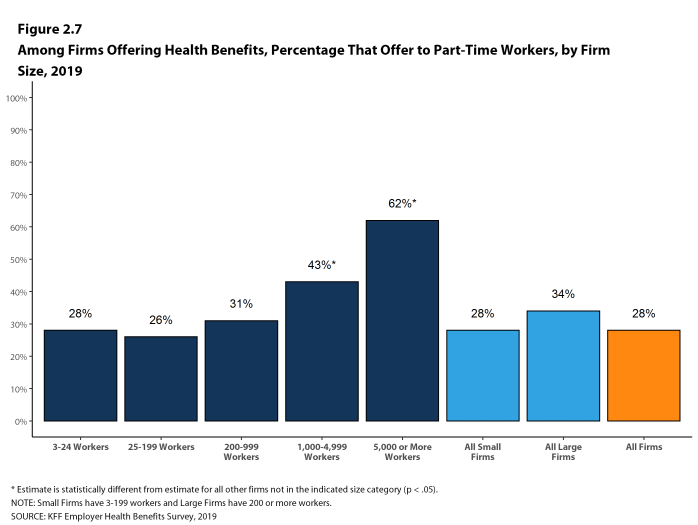

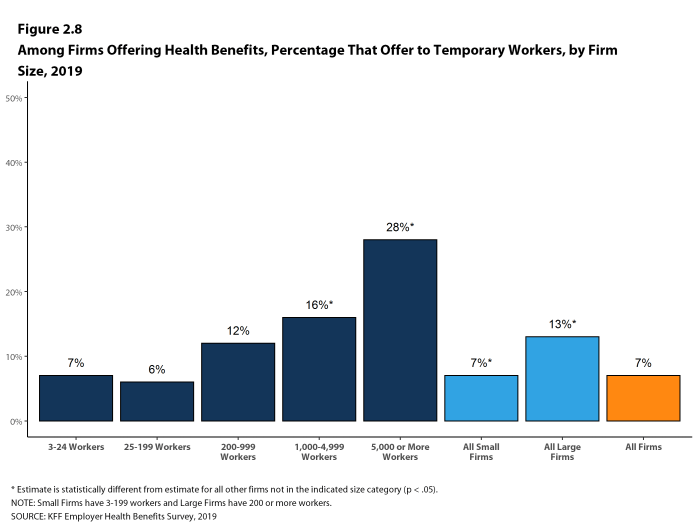

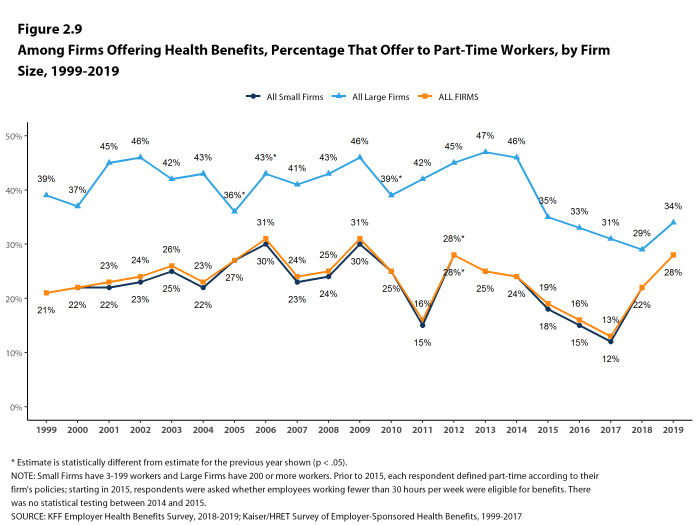

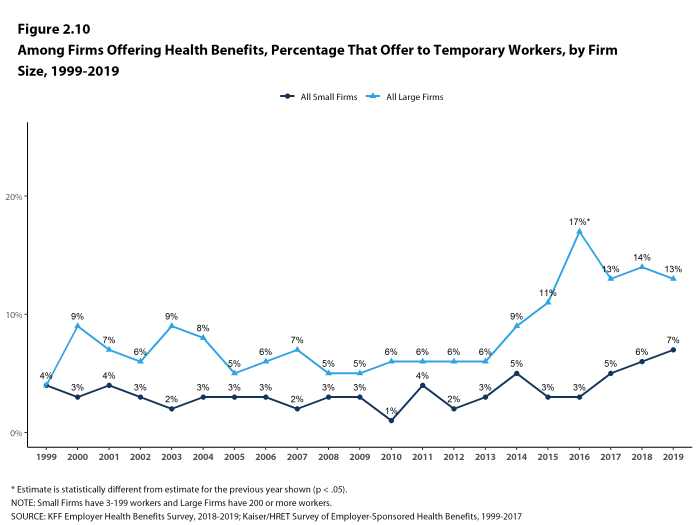

- Among firms offering health benefits, relatively few offer benefits to their part-time and temporary workers.

- The Affordable Care Act (ACA) defines full-time workers as those who on average work at least 30 hours per week, and part-time workers as those who on average work fewer than 30 hours per week. The employer shared responsibility provision of the ACA requires that firms with at least 50 full-time equivalent employees offer most full-time employees coverage that meets minimum standards or be assessed a penalty.12

Beginning in 2015, we modified the survey to explicitly ask employers whether they offered benefits to employees working fewer than 30 hours. Our previous question did not include a definition of “part-time”. For this reason, historical data on part-time offer rates are shown, but we did not test whether the differences between 2014 and 2015 were significant. Many employers may work with multiple definitions of part-time; one for their compliance with legal requirements and another for internal policies and programs.

- In 2019, 28% of all firms that offer health benefits offer them to part-time workers. Small firms and large firms have similar rates of offering to part-time workers [Figure 2.7].

- A small percentage (7%) of firms offering health benefits offer them to temporary workers [Figure 2.8].

- Among firms offering health benefits, large firms are more likely than small firms to offer benefits to temporary workers (13% vs. 7%) [Figure 2.8].

- The percentage of large firms offering health benefits to temporary workers is not statistically different from the 14% reported in 2018, but is an increase from ten years ago (5%) [Figure 2.10].

Figure 2.7: Among Firms Offering Health Benefits, Percentage That Offer to Part-Time Workers, by Firm Size, 2019

Figure 2.8: Among Firms Offering Health Benefits, Percentage That Offer to Temporary Workers, by Firm Size, 2019

Figure 2.9: Among Firms Offering Health Benefits, Percentage That Offer to Part-Time Workers, by Firm Size, 1999-2019

SPOUSES, DEPENDENTS, AND DOMESTIC PARTNER BENEFITS

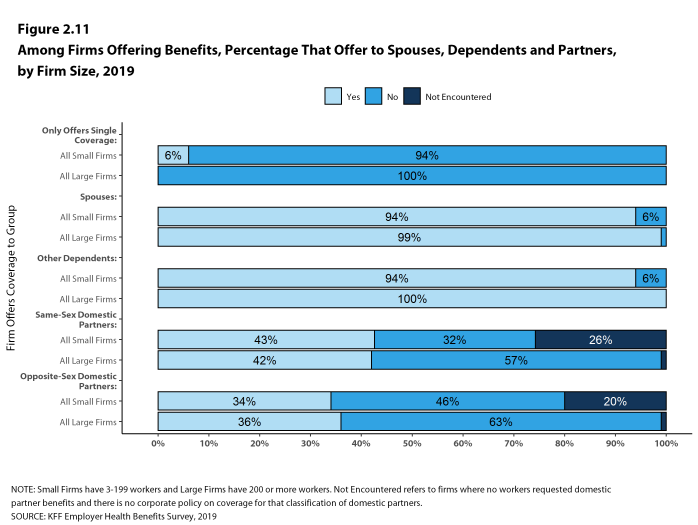

- The vast majority of firms offering health benefits offer to spouses and dependents, such as children.

- In 2019, 94% of firms offering health benefits offer coverage to spouses, similar to the percentage last year [Figure 2.11].

- Ninety-four percent of small firms and 100% of large firms offering health benefits cover dependents other than spouses, such as children, similar to the percentages last year [Figure 2.11].

- Six percent of small firms offering health benefits offer only single coverage to their workers, similar to the percentage last year [Figure 2.11].

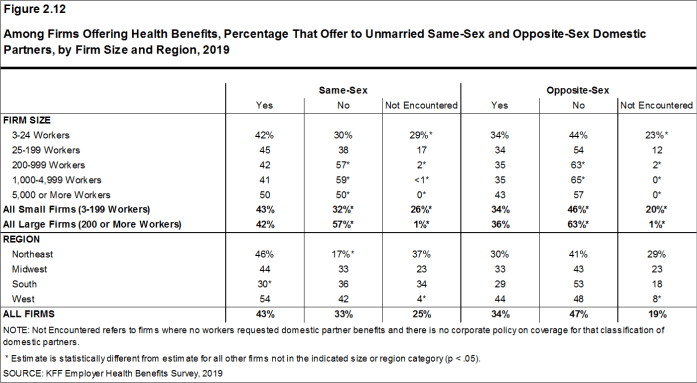

- Firms were also asked whether they offer health benefits to same-sex or opposite-sex domestic partners. While definitions may vary, employers often define domestic partners as an unmarried couple who has lived together for a specified period of time. Firms may define domestic partners separately from any legal requirements a state may have.

- Thirty-four percent of firms offering health benefits offer coverage to opposite-sex domestic partners, similar to the 45% that did so last year.

- Forty-three percent of firms offering health benefits offer coverage to same-sex domestic partners, similar to the 45% that did so last year.

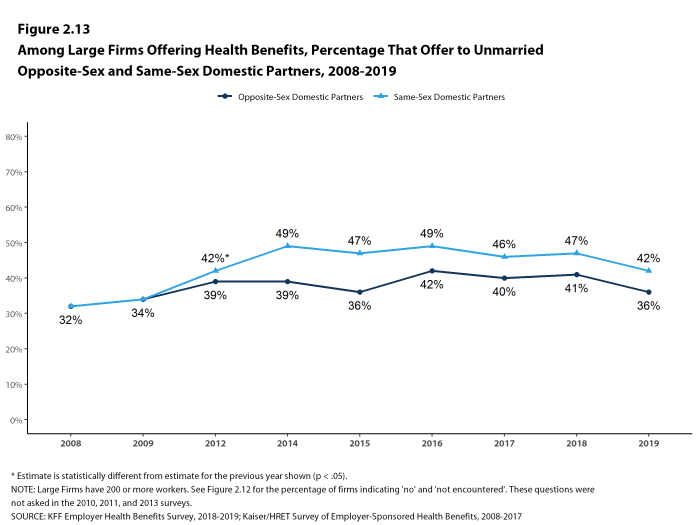

- Thirty-six percent of large firms offering health benefits offer coverage to opposite-sex domestic partners, similar to the 41% that did so last year [Figure 2.13].

- Forty-two percent of large firms offering health benefits offer coverage to same-sex domestic partners, similar to the 47% that did so last year [Figure 2.13].

- When firms are asked if they offer health benefits to opposite or same-sex domestic partners, many small firms report that they have not encountered this issue. These firms may not have formal human resource policies on domestic partners simply because none of the firm’s workers have asked to cover a domestic partner. Regarding health benefits for opposite-sex domestic partners, 20% of small firms report that they have not encountered this request or that the question was not applicable. Similarly, for health benefits for same-sex domestic partners, 26% of small firms report that they have not encountered the request or that the question was not applicable [Figure 2.12].

- Thirty-four percent of firms offering health benefits offer coverage to opposite-sex domestic partners, similar to the 45% that did so last year.

Figure 2.11: Among Firms Offering Benefits, Percentage That Offer to Spouses, Dependents and Partners, by Firm Size, 2019

Figure 2.12: Among Firms Offering Health Benefits, Percentage That Offer to Unmarried Same-Sex and Opposite-Sex Domestic Partners, by Firm Size and Region, 2019

SPOUSAL SURCHARGES

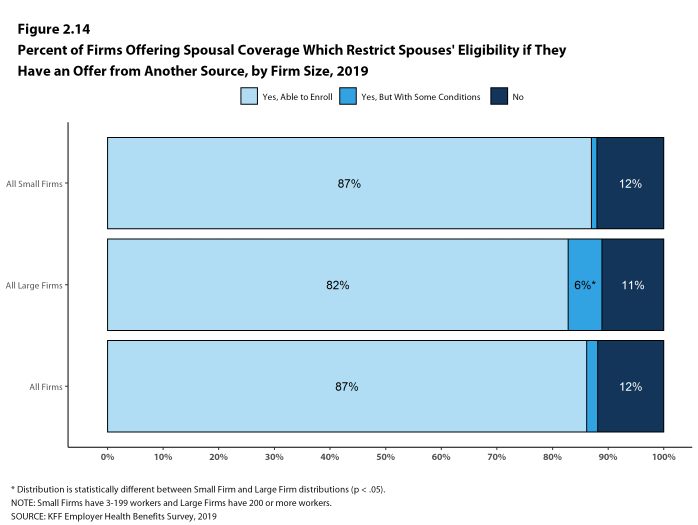

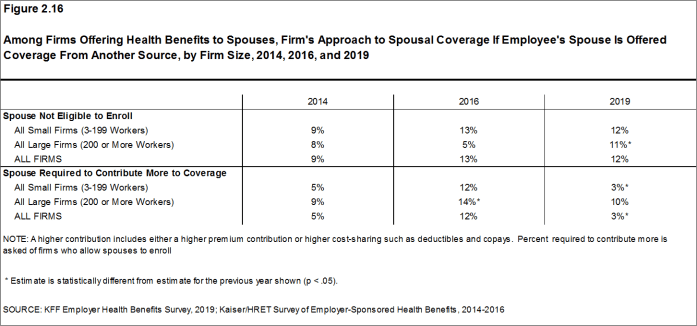

Some employers place conditions on the ability of dependent spouses to enroll in a health plan if the spouse is offered health insurance from another source, such as his or her own place of work.

- Among firms offering health benefits to spouses, 87% say that an employee’s spouse is able to enroll in the employee’s health plan even if the spouse is offered coverage from another source, 2% say the spouse can enroll subject to some conditions (for example, the type of coverage offered), and 12% say that the spouse is not eligible to enroll [Figure 2.14].

- Among large firms that say that spouses are eligible to enroll in an employee’s health plan even if the spouse has access to coverage from another source, 10% require the spouse to pay more to enroll than other spouses, such as a higher premium contribution or cost sharing [Figure 2.15].

Figure 2.14: Percent of Firms Offering Spousal Coverage Which Restrict Spouses’ Eligibility If They Have an Offer From Another Source, by Firm Size, 2019

Figure 2.15: Among Large Firms That Offer Spousal Coverage, Spouses’ Eligibility If They Have an Offer From Another Source, by Firm Size, 2019

VOLUNTARY INSURANCE BENEFITS

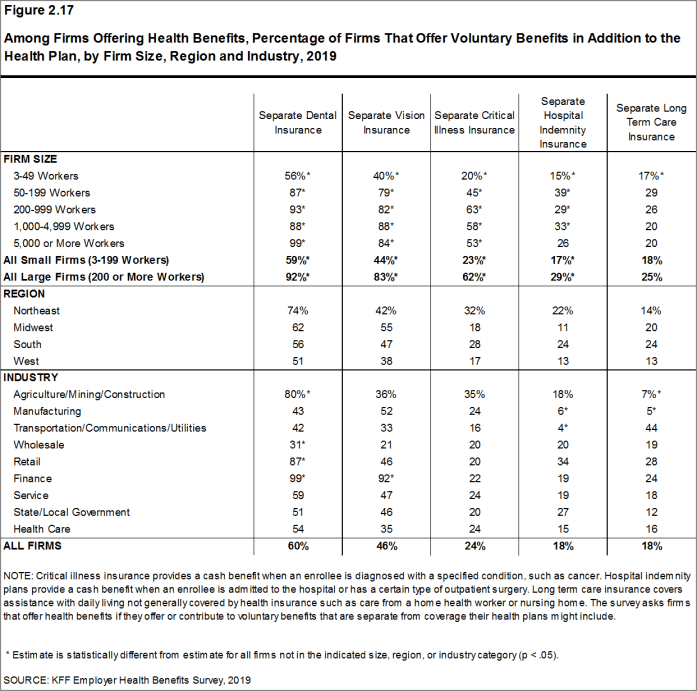

Many firms offer voluntary benefits to their workers, separate from coverage provided through their health plans. These plans can help with costs that are not covered by the health plan or provide additional financial assistance if the enrollee is hospitalized or develops a serious health condition. Employers sometimes contribute toward the cost of these benefits, while other times employees pay the entire cost.

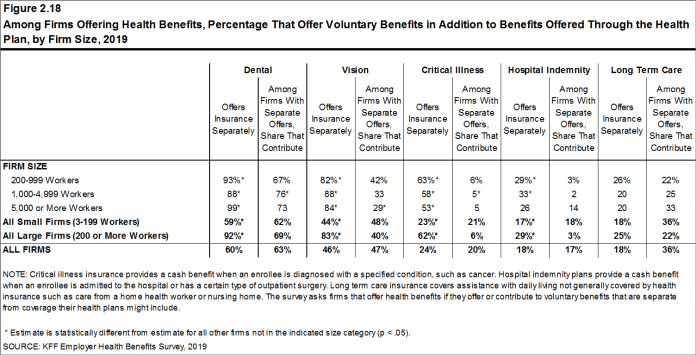

- Among firms offering health benefits in 2019, 59% of small firms and 92% of large firms offer a dental insurance program to their workers seperate from any plan included in their plan [Figure 2.17].

- Sixty-three percent of firms offering a dental program to their workers make a contribution toward the cost of the coverage [Figure 2.18].

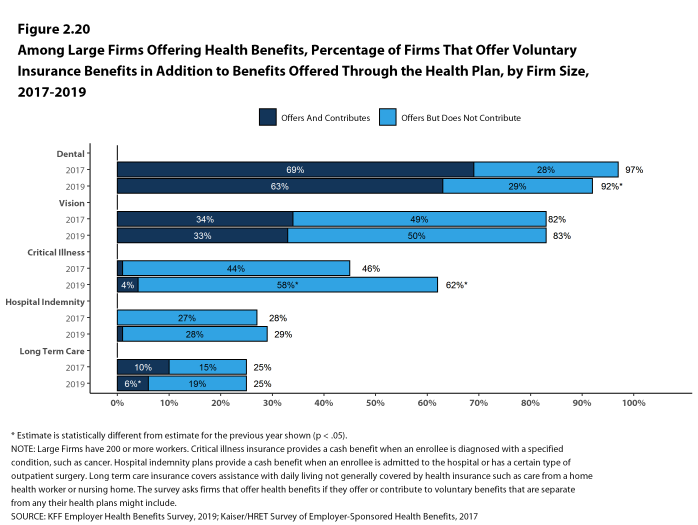

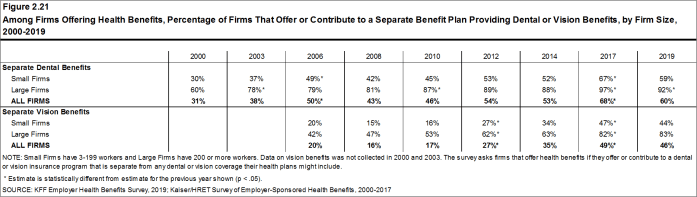

- Among large firms offering health benefits in 2019, 92% offer a dental insurance program to their workers, a change from 97% in 2017 when this question was last asked [Figure 2.20]. However, among large firms that offer health benefits, offers of both dental and vision coverage have increased since 2010 from 87% and 53%, respectively [Figure 2.21].

- Among firms offering health benefits in 2019, 44% of small firms and 83% of large firms offer a vision insurance program to their workers seperate from any plan included in their plan [Figure 2.17].

- Forty-seven percent of firms offering a vision program to their workers make a contribution toward the cost of the coverage [Figure 2.18].

- Among firms offering health benefits in 2019, 23% of small firms and 62% of large firms offer critical illness insurance to their workers [Figure 2.17].

- Twenty percent of firms offering critical insurance to their workers make a contribution toward the cost of the coverage [Figure 2.18].

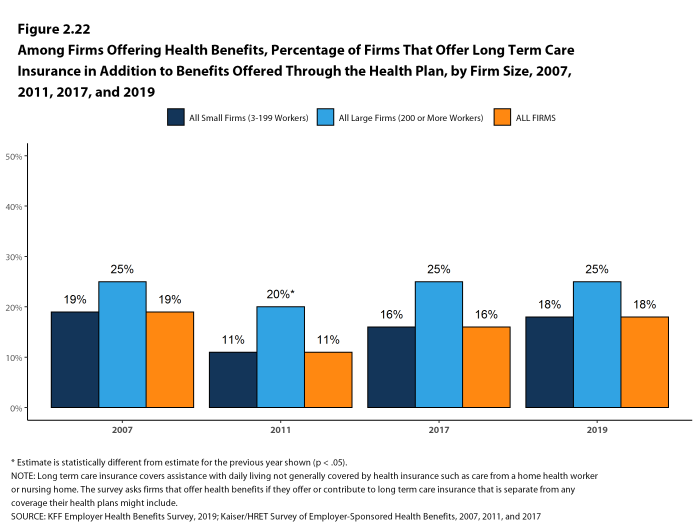

- Among firms offering health benefits in 2019, 18% offer long-term care insurance to their workers [Figure 2.17].

- Thirty-six percent of firms offering long-term care insurance to their workers make a contribution toward the cost of the coverage [Figure 2.18].

Figure 2.17: Among Firms Offering Health Benefits, Percentage of Firms That Offer Voluntary Benefits in Addition to the Health Plan, by Firm Size, Region and Industry, 2019

Figure 2.18: Among Firms Offering Health Benefits, Percentage That Offer Voluntary Benefits in Addition to Benefits Offered Through the Health Plan, by Firm Size, 2019

Figure 2.19: Among Firms Offering Health Benefits, Percentage of Firms That Offer Voluntary Insurance Benefits in Addition to Benefits Offered Through the Health Plan, by Firm Size, 2019

Figure 2.20: Among Large Firms Offering Health Benefits, Percentage of Firms That Offer Voluntary Insurance Benefits in Addition to Benefits Offered Through the Health Plan, by Firm Size, 2017-2019

Figure 2.21: Among Firms Offering Health Benefits, Percentage of Firms That Offer or Contribute to a Separate Benefit Plan Providing Dental or Vision Benefits, by Firm Size, 2000-2019

FIRMS NOT OFFERING HEALTH BENEFITS

- The survey asks firms that do not offer health benefits if they have offered insurance or shopped for insurance in the recent past, and about their most important reasons for not offering coverage. Because such a small percentage of large firms report not offering health benefits, we present responses for small non-offering firms only.

- The cost of health insurance remains the primary reason cited by firms for not offering health benefits. Among small firms not offering health benefits, 43% cite high cost as “the most important reason” for not doing so, followed by employees being covered by another plan (17%), then “the firm is too small” (13%). Few small firms indicate that they do not offer because they believe employees will get a better deal on the health insurance exchanges (2%) [Figure 2.23].

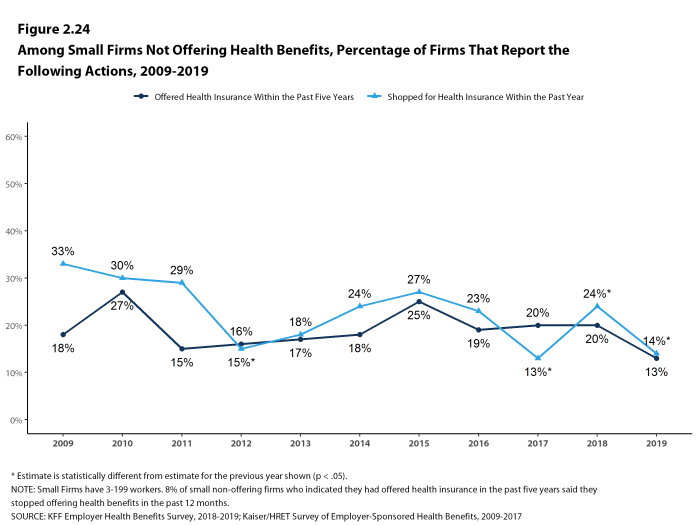

- Some small non-offering firms have either offered health insurance in the past five years or shopped for health insurance in the past year.

- Thirteen percent of small non-offering firms have offered health benefits in the past five years, similar to the percentage reported last year [Figure 2.24].

- Fourteen percent of small non-offering firms have shopped for coverage in the past year, a decrease from last year (24%) [Figure 2.24].

- Among small non-offering firms that report they stopped offering coverage within the past five years, 8% stopped offering coverage within the past year, similar to the percentage reported last year.

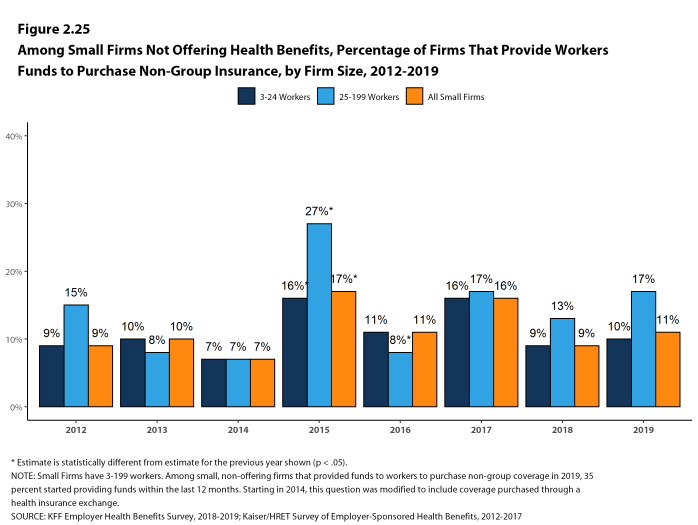

- Among small non-offering firms, 11% report that they provide funds to their employees to purchase health insurance on their own in the individual market or through a health insurance exchange [Figure 2.25].

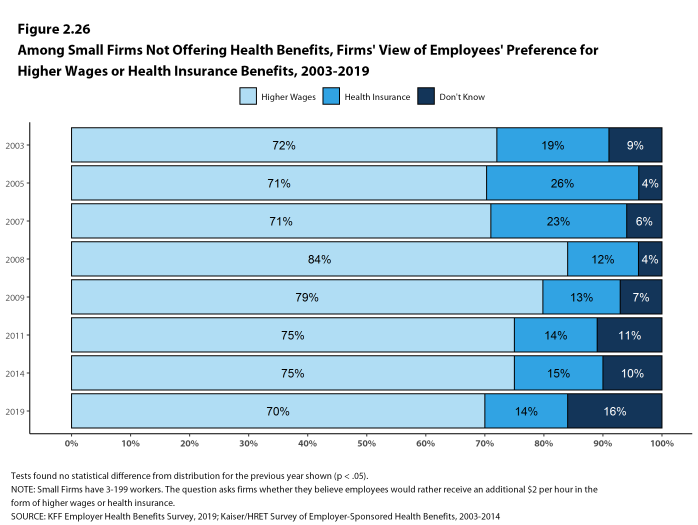

- Seventy percent of small firms (3-199 employees) not offering health benefits believed that their employees would prefer a two dollar per hour increase in wages rather than health insurance. [Figure 2.26]. The percentage of small employers who believe that their employees would prefer a wage increase is the similar as 2014, the last time the survey asked this question.

Figure 2.23: Among Small Firms Not Offering Health Benefits, Most Important Reason for Not Offering, 2019

Figure 2.24: Among Small Firms Not Offering Health Benefits, Percentage of Firms That Report the Following Actions, 2009-2019

Figure 2.25: Among Small Firms Not Offering Health Benefits, Percentage of Firms That Provide Workers Funds to Purchase Non-Group Insurance, by Firm Size, 2012-2019

- Internal Revenue Code. 26 U.S. Code § 4980H – Shared responsibility for employers regarding health coverage. 2011. https://www.gpo.gov/fdsys/pkg/USCODE-2011-title26/pdf/USCODE-2011-title26-subtitleD-chap43-sec4980H.pdf↩