2019 Employer Health Benefits Survey

Section 9: Prescription Drug Benefits

Nearly all (more than 99%) covered workers are at a firm that provides prescription drug coverage in its largest health plan. Many employer plans have increasingly complex benefit designs for prescriptions drugs, as employers and insurers expand the use of formularies with multiple cost-sharing tiers as well as other management approaches. To reduce the burden on respondents, we ask offering firms about the attributes of prescription drug coverage only for their largest health plan. This survey asks employers about the cost-sharing in up to four tiers, and a tier exclusively for specialty drugs. There may be considerable variation in how plans structure their formularies.

DISTRIBUTION OF COST SHARING

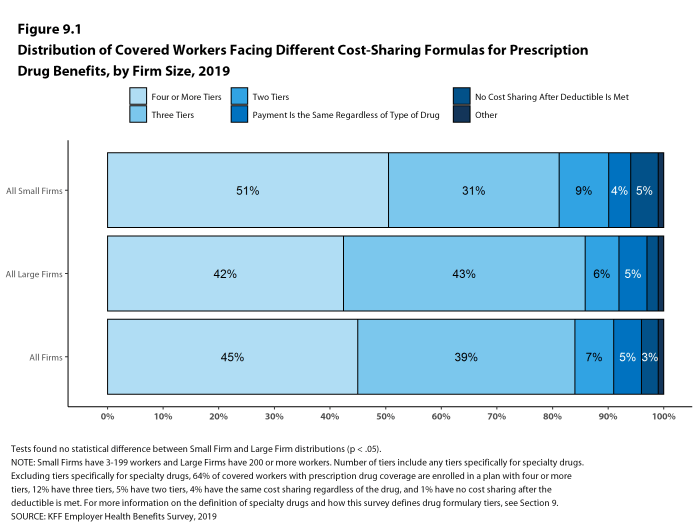

- The large majority of covered workers (91%) are in a plan with tiered cost sharing for prescription drugs [Figure 9.1]. Cost-sharing tiers generally refer to a health plan placing a drug on a formulary or preferred drug list that classifies drugs into categories that are subject to different cost sharing or management. It is common for there to be different tiers for generic, preferred and non-preferred drugs. In recent years, plans have created additional tiers that may, for example, be used for specialty drugs or expensive biologics. Some plans may have multiple tiers for different categories; for example, a plan may have preferred and non-preferred specialty tiers. The survey obtains information about the cost-sharing structure for up to five tiers.

- Eighty-four percent of covered workers are in a plan with three, four, or more tiers of cost sharing for prescription drugs [Figure 9.1]. These totals include tiers that cover only specialty drugs, even though the cost-sharing information for those tiers is reported separately.

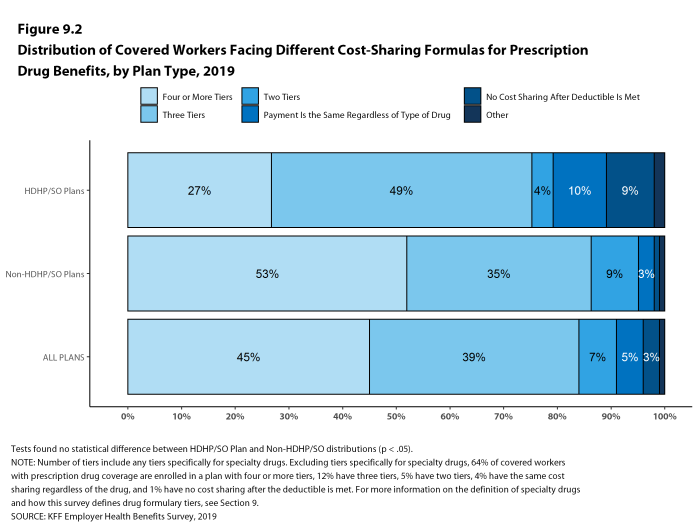

- HDHP/SOs have a different cost-sharing pattern for prescription drugs than other plan types. Compared to covered workers in other plan types, those in HDHP/SOs are more likely to be in a plan with the same cost sharing regardless of drug type (10% vs. 3%) or in a plan that has no cost sharing for prescriptions once the plan deductible is met (9% vs. 1%) [Figure 9.2].

- Among firms that cover prescription drugs very few firms limit their coverage to only generics drugs. Of firms with prescription drug coverage, the percent of small firms that cover only generic drugs is 1% and the percentage of large firms that cover only generic drugs is 1%.

Figure 9.1: Distribution of Covered Workers Facing Different Cost-Sharing Formulas for Prescription Drug Benefits, by Firm Size, 2019

TIERS NOT EXCLUSIVELY FOR SPECIALTY DRUGS

- Even when formulary tiers covering only specialty drugs are not counted, a large share (78%) of covered workers are in a plan with three or more tiers of cost sharing for prescription drugs. The cost-sharing statistics presented in this section do not include information about tiers that cover only specialty drugs. In cases in which a plan covers specialty drugs on a tier with other drugs, they will still be included in these averages. Cost-sharing statistics for tiers covering only specialty drugs are presented in the next section.

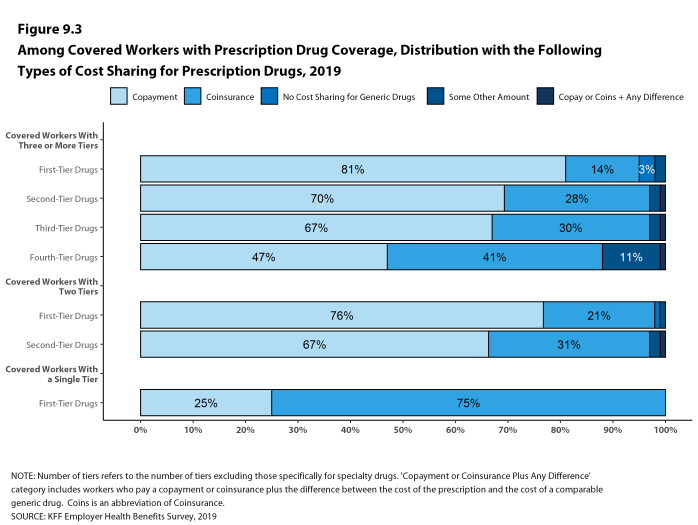

- For covered workers in a plan with three or more tiers of cost sharing for prescription drugs, copayments are the most common form of cost sharing in the first three tiers and coinsurance is the next most common [Figure 9.3].

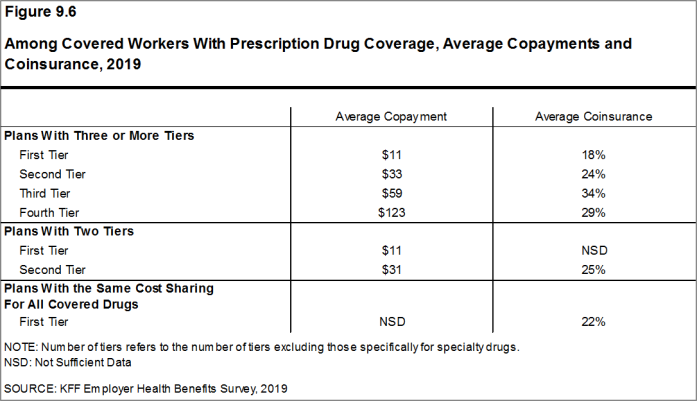

- Among covered workers in plans with three or more tiers of cost sharing for prescription drugs, the average copayments are $11 for first-tier drugs, $33 second-tier drugs, $59 for third-tier drugs, and $123 for fourth-tier drugs [Figure 9.6].

- Among covered workers in plans with three or more tiers of cost sharing for prescription drugs, the average coinsurance rates are 18% for first-tier drugs, 24% second-tier drugs, 34% third-tier drugs, and 29% for fourth-tier drugs [Figure 9.6].

- Twelve percent of covered workers are in a plan with two tiers for prescription drug cost sharing (excluding tiers covering only specialty drugs).

- For these workers, copayments are more common than coinsurance for first-tier and second-tier drugs [Figure 9.3]. The average copayment for the first tier is $11 and the average copayment for the second tier is $31 [Figure 9.6].

- Five percent of covered workers are in a plan with the same cost sharing for prescriptions regardless of the type of drug (excluding tiers covering only specialty drugs).

- Among these workers, 25% have copayments and 75% have coinsurance [Figure 9.3]. The average coinsurance rate is 22% [Figure 9.6].

Figure 9.3: Among Covered Workers With Prescription Drug Coverage, Distribution With the Following Types of Cost Sharing for Prescription Drugs, 2019

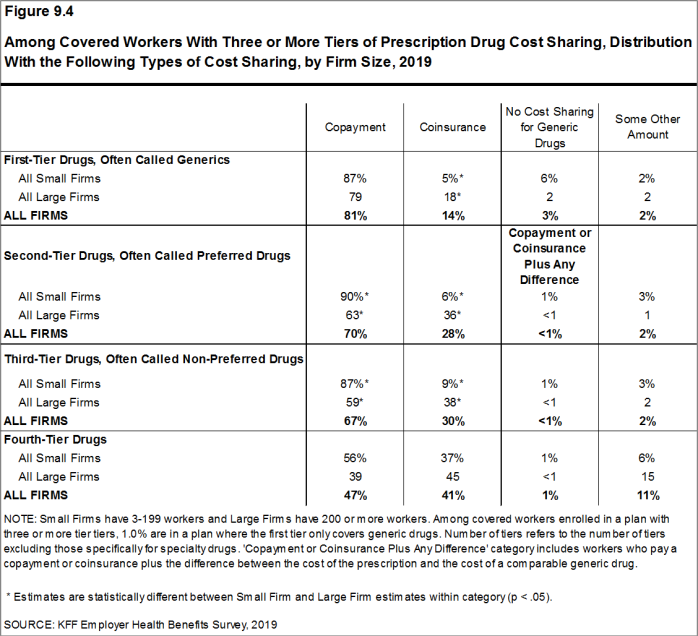

Figure 9.4: Among Covered Workers With Three or More Tiers of Prescription Drug Cost Sharing, Distribution With the Following Types of Cost Sharing, by Firm Size, 2019

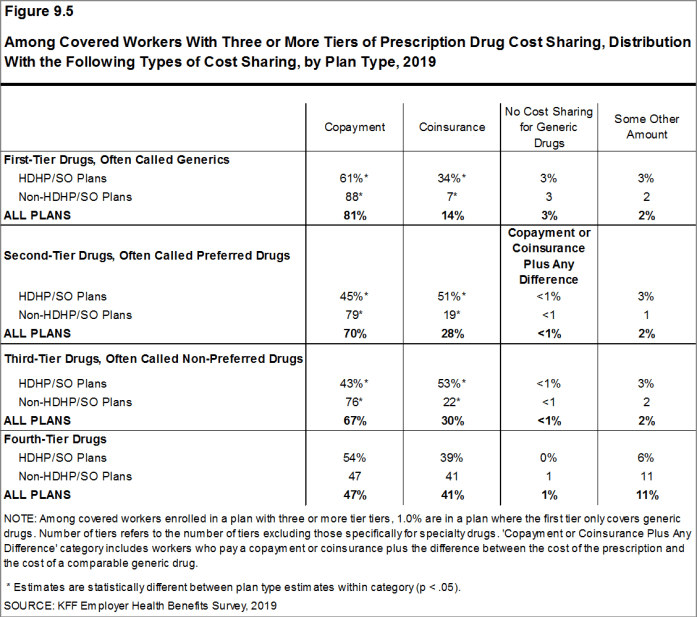

Figure 9.5: Among Covered Workers With Three or More Tiers of Prescription Drug Cost Sharing, Distribution With the Following Types of Cost Sharing, by Plan Type, 2019

COINSURANCE MAXIMUMS

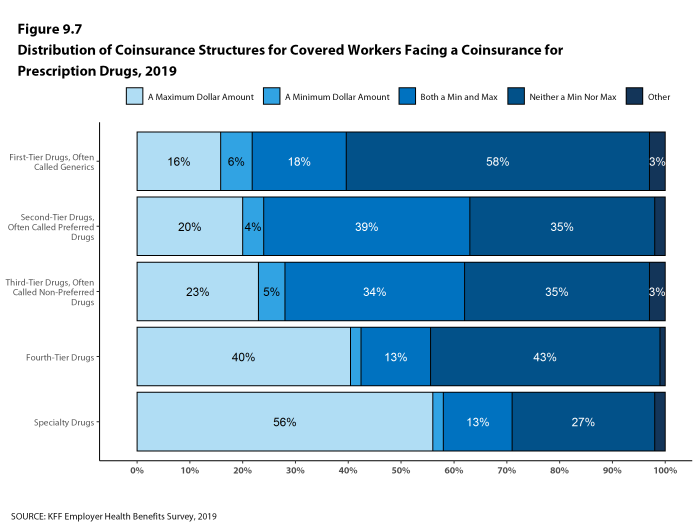

- Coinsurance rates for prescription drugs often include maximum and/or minimum dollar amounts. Depending on the plan design, coinsurance maximums may significantly limit the amount an enrollee must spend out-of-pocket for higher-cost drugs.

- These coinsurance minimum and maximum amounts vary across the tiers.

- For example, among covered workers in a plan with coinsurance for the first cost-sharing tier, 16% have only a maximum dollar amount attached to the coinsurance rate, 6% have only a minimum dollar amount, 18% have both a minimum and maximum dollar amount, and 58% have neither. For those in a plan with coinsurance for the fourth cost-sharing tier, 40% have only a maximum dollar amount attached to the coinsurance rate, 2% have only a minimum dollar amount, 13% have both a minimum and maximum dollar amount, and 43% have neither [Figure 9.7].

SEPARATE TIERS FOR SPECIALTY DRUGS

- Specialty drugs, such as biologics that may be used to treat chronic conditions, or some cancer drugs, can be quite expensive and often require special handling and administration. We revised our questions beginning with the 2016 survey to obtain more information about formulary tiers that are exclusively for specialty drugs. We are reporting results only among large firms because a relatively large share of small firms were unsure whether their largest plan covered these drugs.

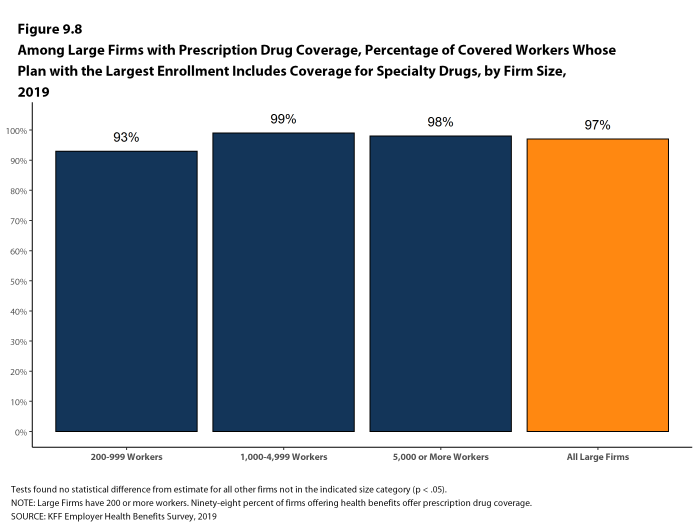

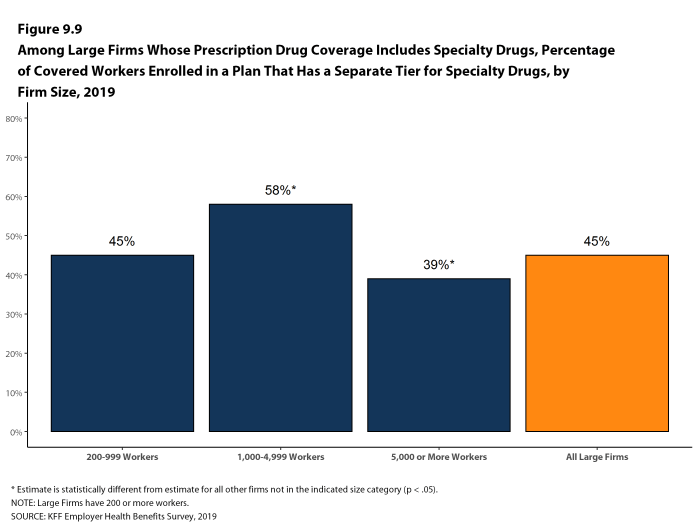

- Ninety-seven percent of covered workers at large firms have coverage for specialty drugs [Figure 9.8]. Among these workers, 45% are in a plan with at least one cost-sharing tier just for specialty drugs [Figure 9.9].

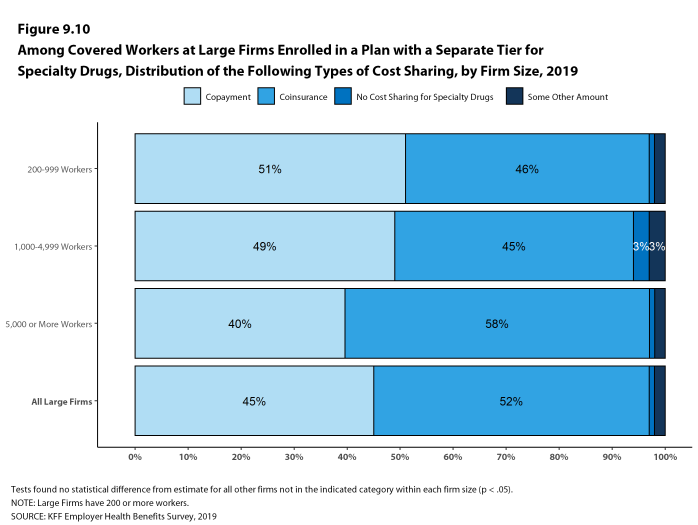

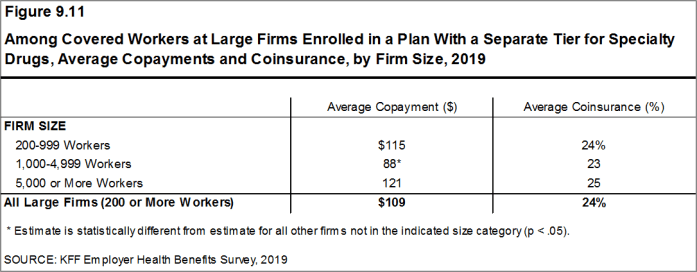

- Among covered workers in a plan with at least one separate tier for specialty drugs, 45% have a copayment for specialty drugs and 52% have coinsurance [Figure 9.10]. The average copayment is $109 and the average coinsurance rate is 24% [Figure 9.11]. Seventy percent of those with coinsurance have a maximum dollar limit on the amount of coinsurance they must pay.

Figure 9.8: Among Large Firms With Prescription Drug Coverage, Percentage of Covered Workers Whose Plan With the Largest Enrollment Includes Coverage for Specialty Drugs, by Firm Size, 2019

Figure 9.9: Among Large Firms Whose Prescription Drug Coverage Includes Specialty Drugs, Percentage of Covered Workers Enrolled in a Plan That Has a Separate Tier for Specialty Drugs, by Firm Size, 2019

Figure 9.10: Among Covered Workers at Large Firms Enrolled in a Plan With a Separate Tier for Specialty Drugs, Distribution of the Following Types of Cost Sharing, by Firm Size, 2019

MAIL ORDER PHARMACIES

- Many plans allow enrollees to fill prescriptions through the mail. In some cases, there may be financial incentive, such as lower cost sharing for enrollees to use this process.

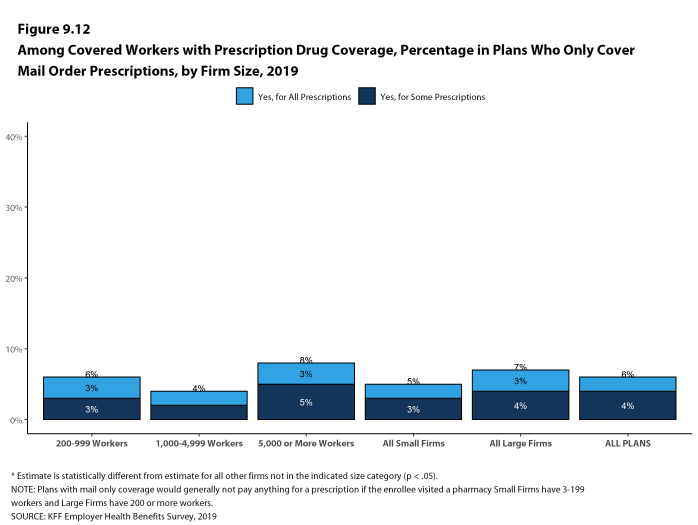

- In 2019, a very small share of workers 2% were in plans that only covered prescription drugs provided through the mail and 4% were in plans which only covered some prescriptions through the mail [Figure 9.12]. For these workers, the plan would generally not pay anything for a prescription if the enrollee visited a physical pharmacy.

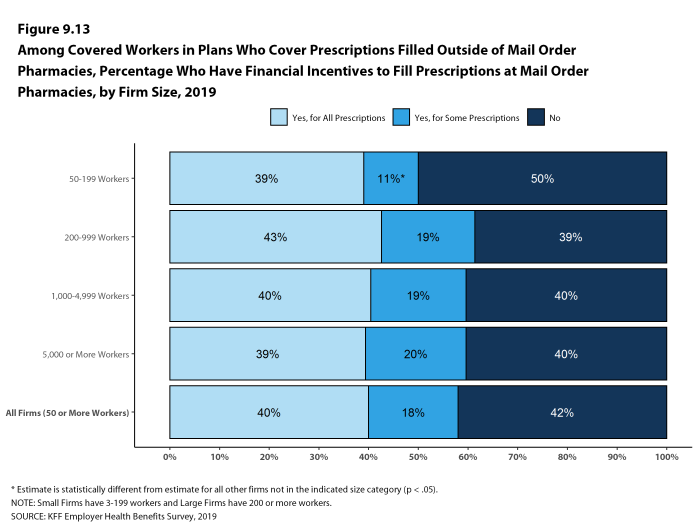

- Among workers at firms with 50 or more employees that offer coverage for prescription drugs, 58% have a financial incentive for enrollees to fill some or all prescriptions through a mail order pharmacy [Figure 9.13].

Figure 9.12: Among Covered Workers With Prescription Drug Coverage, Percentage in Plans Who Only Cover Mail Order Prescriptions, by Firm Size, 2019

MAINTENANCE DRUGS FOR CHROINIC CONDITIONS

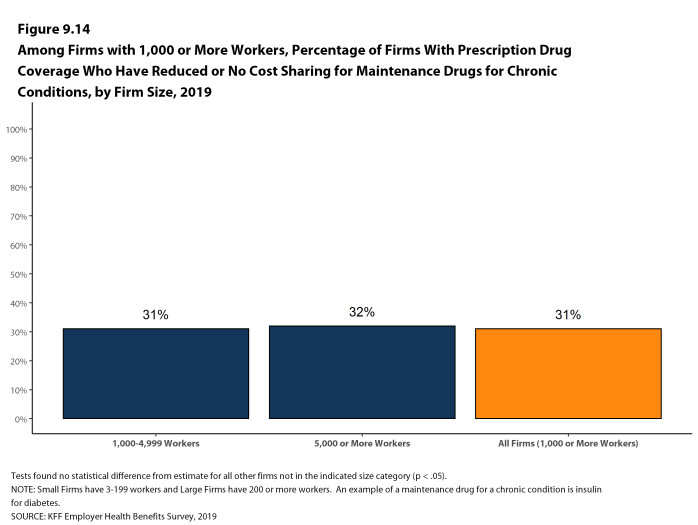

- Among firms with 1,000 or more employees that offer coverage for prescription drugs, 31% have reduced or zero cost sharing for maintenance drugs for chronic conditions, such as insulin for diabetes [Figure 9.14].

SEPARATE ANNUAL DEDUCTIBLE

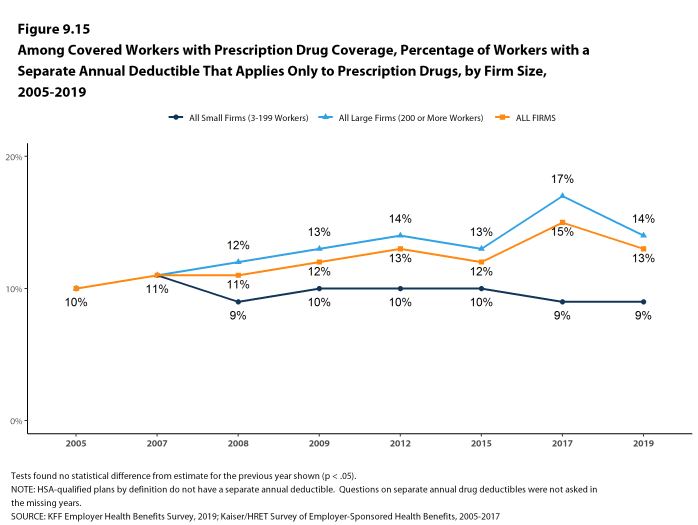

- Among covered workers in a plan with coverage for prescription drugs, 13% are enrolled in a plan that that has a separate annual deductible that applies only to prescription drugs.

- Covered workers in small firms are less likely than those in large firms to be enrolled in a plan with a separate annual deductible for prescription drugs (9% vs. 14%) [Figure 9.15].

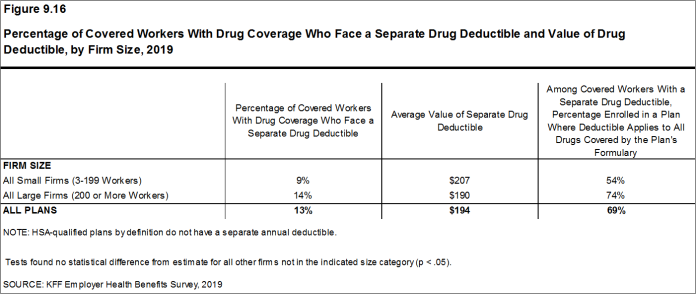

- For covered workers in a plan with a separate annual deductible for prescription drugs, the average prescription drug deductible is $194 [Figure 9.16].

- Sixty-nine percent of covered workers in a plan with a separate annual deductible for prescription drugs are in a plan that applies the deductible to all covered drugs [Figure 9.16].

Figure 9.15: Among Covered Workers With Prescription Drug Coverage, Percentage of Workers With a Separate Annual Deductible That Applies Only to Prescription Drugs, by Firm Size, 2005-2019

Figure 9.16: Percentage of Covered Workers With Drug Coverage Who Face a Separate Drug Deductible and Value of Drug Deductible, by Firm Size, 2019

- Generic drugs

- Drugs that are no longer covered by patent protection and thus may be produced and/or distributed by multiple drug companies.

- Preferred drugs

- Drugs included on a formulary or preferred drug list; for example, a brand-name drug without a generic substitute.

- Non-preferred drugs

- Drugs not included on a formulary or preferred drug list; for example, a brand-name drug with a generic substitute.

- Fourth-tier drugs

- New types of cost-sharing arrangements that typically build additional layers of higher copayments or coinsurance for specifically identified types of drugs, such as lifestyle drugs or biologics.

- Specialty drugs

- Specialty drugs such as biological drugs are high cost drugs that may be used to treat chronic conditions such as blood disorder, arthritis or cancer. Often times they require special handling and may be administered through injection or infusion.