2019 Employer Health Benefits Survey

Section 11: Retiree Health Benefits

Retiree health benefits are an important consideration for older workers making decisions about their retirement. Retiree benefits can be a crucial source of coverage for people retiring before Medicare eligibility. For retirees with Medicare coverage, retiree health benefits can provide an important supplement to Medicare, helping them pay for cost sharing and benefits not otherwise covered by Medicare.

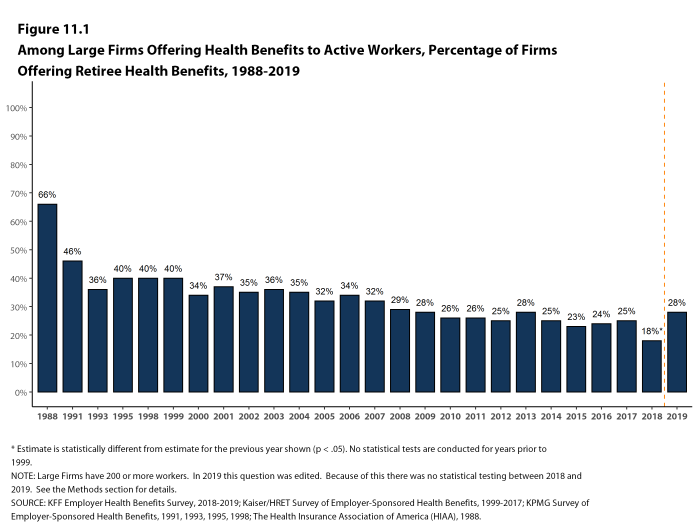

For 2019, we modified the question that we use to ask firms whether or not they provide retiree health benefits; particularly, we explicitly stated that firms that had terminated retiree health benefits but still has some retirees getting coverage, or that had current employees who will get retiree health coverage in the future, should answer ‘yes’ to the question. We made this clarification in response to a large decline in the 2018 survey in the prevalence of retiree coverage (from 25% in 2017 to 18% in 2018). In the 2018 survey, we expressed concern that the then current focus on public entities eliminating retiree benefits for future (not existing) retirees may be influencing the responses we were getting and said that we were going to clarify the survey question in future years.

This year’s survey finds that 28% of large firms offering health benefits offer retiree health benefits. While this percentage is similar to percentages of firms offering retirees prior to the 2018 decline, we are concerned that the change to the question compromises the comparability of the responses before and after the change. For this reason, estimates of retiree health benefits from the 2019 survey may not be comparable to those from prior surveys.

This survey asks retiree health benefits questions only of large firms (200 or more workers).

EMPLOYER RETIREE BENEFITS

- In 2019, 28% of large firms that offer health benefits offer retiree health benefits for at least some current workers or retirees [Figure 11.1]. See the Methods section for a discussion of changes to survey question on retiree health benefits for 2019 survey. Due to this change, we did not test if the 2018 and 2019 estimates were statistically different from each other.

- Retiree health benefits offer rates vary considerably by firm characteristics.

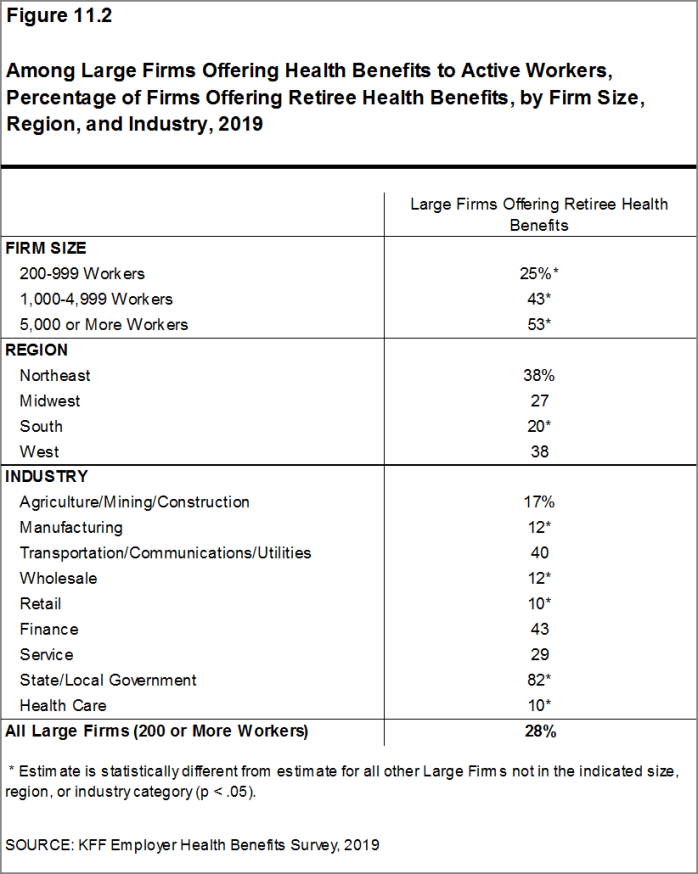

- Among large firms offering health benefits, the likelihood that a firm will offer retiree health benefits increases with firm size [Figure 11.2].

- The share of large firms offering retiree health benefits varies considerably by industry [Figure 11.2].

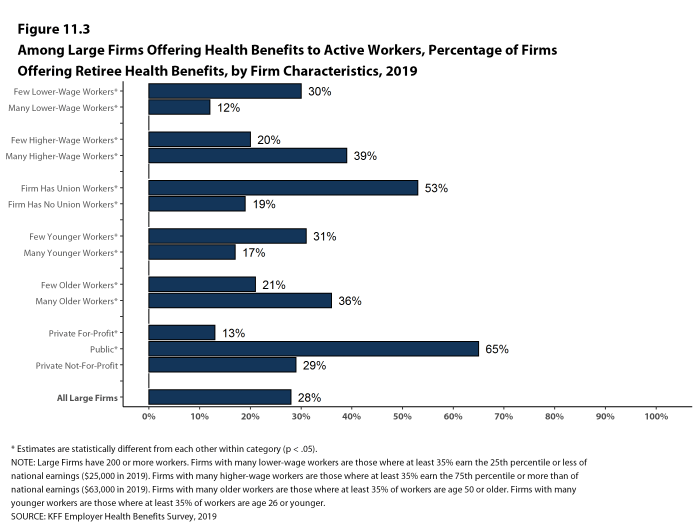

- Among large firms offering health benefits, private for-profit firms are less likely (13%) and public employers are more likely (65%) to offer retiree health benefits [Figure 11.3].

- Large firms offering health benefits with at least some union workers are more likely to offer retiree health benefits than large firms without any union workers (53% vs. 19%) [Figure 11.3].

- Large firms offering health benefits with a relatively large share of older workers (where at least 35% of the workers are age 50 or older) are more likely to offer retiree health benefits than large firms with a smaller share of older workers (36% vs. 21%) [Figure 11.3].

- Large firms offering health benefits with a relatively small share of younger workers (where fewer than 35% of the workers are age 26 or younger) are more likely to offer retiree health benefits than large firms with a larger share of younger workers (31% vs. 17%) [Figure 11.3].

- Large firms offering health benefits with a relatively large share of higher-wage workers (where at least 35% of workers earn $63,000 a year or more) are more likely to offer retiree health benefits than large firms with a smaller share of higher-wage workers (39% vs. 20%) [Figure 11.3].

- Large firms offering health benefits with a relatively small share of lower-wage workers (where at least 35% of workers earn $25,000 a year or less) are more likely to offer retiree health benefits than large firms with a larger share of lower-wage workers (30% vs. 12%) [Figure 11.3].

Figure 11.1: Among Large Firms Offering Health Benefits to Active Workers, Percentage of Firms Offering Retiree Health Benefits, 1988-2019

Figure 11.2: Among Large Firms Offering Health Benefits to Active Workers, Percentage of Firms Offering Retiree Health Benefits, by Firm Size, Region, and Industry, 2019

EARLY RETIREES, MEDICARE-AGE RETIREES AND SPOUSES

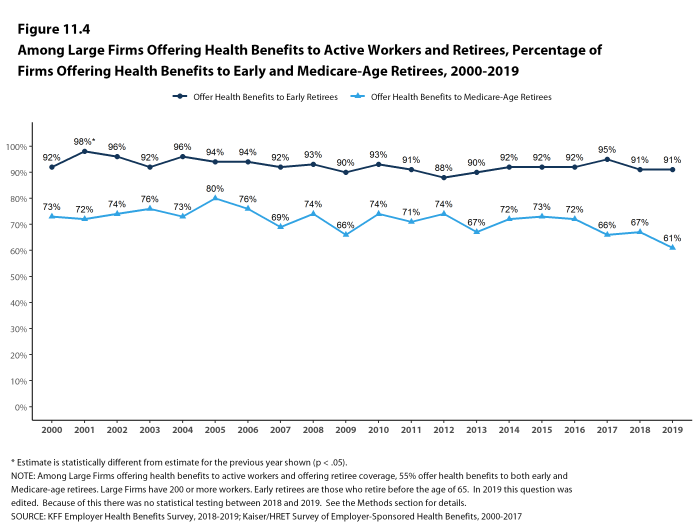

- Among large firms offering retiree health benefits, a large share offer benefits to early retirees under the age of 65 (91%). A lower percentage (61%) of large firms offering retiree health benefits offer to Medicare-age retirees [Figure 11.4]. Among all large firms offering health benefits to current workers, 17% offer retiree health benefits to Medicare-age retirees.

- Among large firms offering retiree health benefits, 55% offer benefits to both early and Medicare-age retirees.

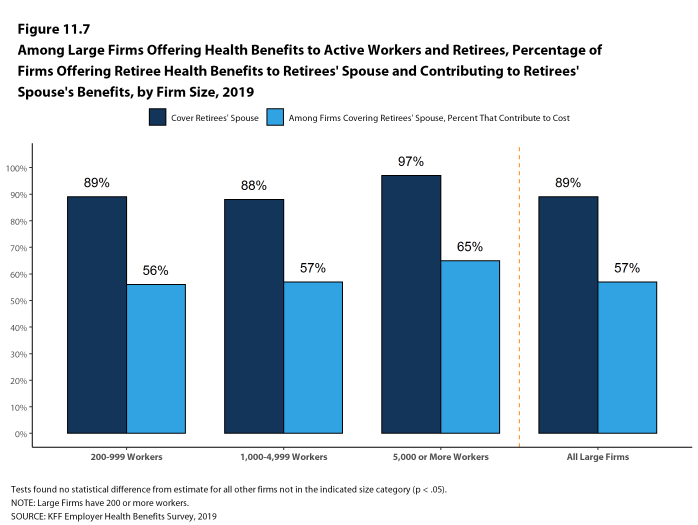

- Among large firms offering retiree benefits, a large share (89%) report offering health benefits to the spouses of retirees [Figure 11.7].

Figure 11.4: Among Large Firms Offering Health Benefits to Active Workers and Retirees, Percentage of Firms Offering Health Benefits to Early and Medicare-Age Retirees, 2000-2019

CONTRIBUTIONS TO COVERAGE

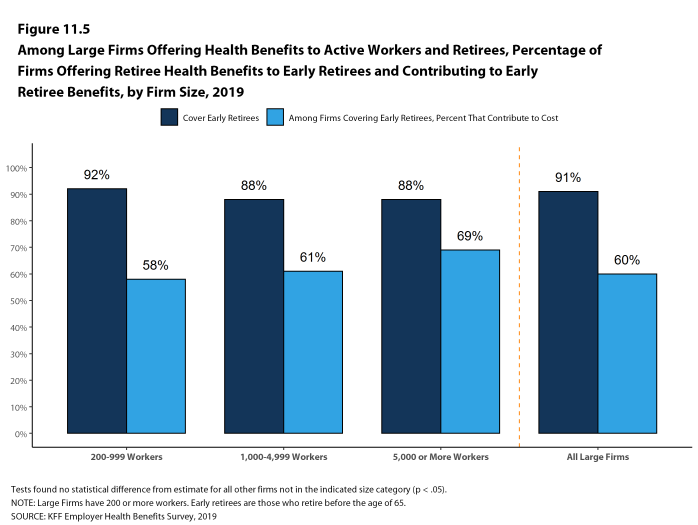

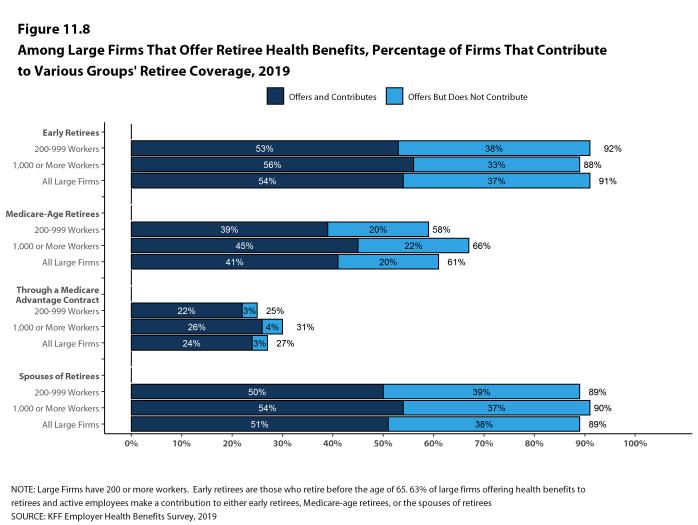

- Among large employers offering retiree health benefits to at least some early retirees, 60% say that they contribute to the cost for at least some early retirees [Figure 11.5].

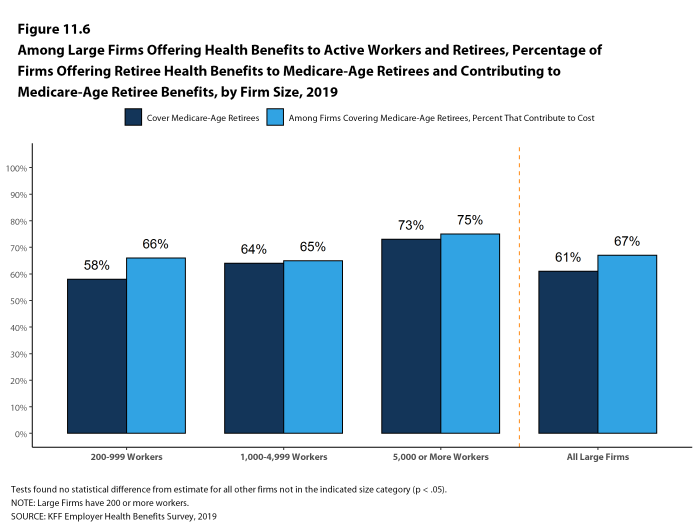

- Among large employers offering retiree health benefits to at least some Medicare-age retirees, 67% say that they contribute to the cost for at least some Medicare-age retirees [Figure 11.6].

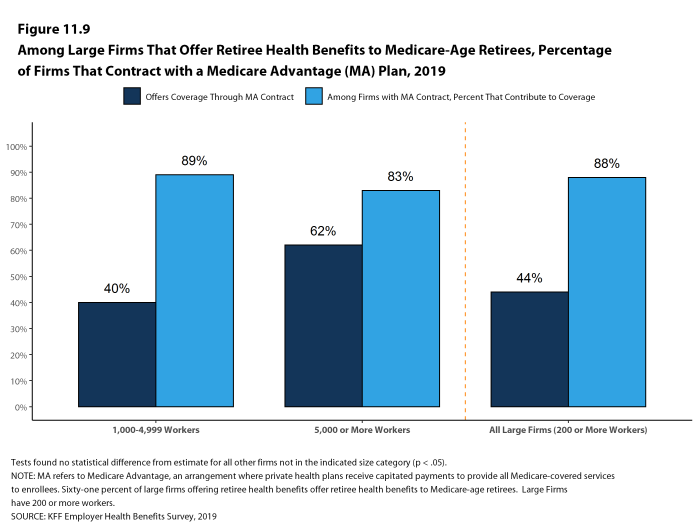

- Among large employers offering retiree health benefits to at least some Medicare-age retirees through a contract with a Medicare Advantage Plan, 88% say that they contribute to the cost of the coverage [Figure 11.9].

- Among large employers offering retiree health benefits to at least some spouses of retirees, 57% say that they contribute to the cost of the coverage for the spouse [Figure 11.7].

Figure 11.6: Among Large Firms Offering Health Benefits to Active Workers and Retirees, Percentage of Firms Offering Retiree Health Benefits to Medicare-Age Retirees and Contributing to Medicare-Age Retiree Benefits, by Firm Size, 2019

Figure 11.7: Among Large Firms Offering Health Benefits to Active Workers and Retirees, Percentage of Firms Offering Retiree Health Benefits to Retirees’ Spouse and Contributing to Retirees’ Spouse’s Benefits, by Firm Size, 2019

MEDICARE ADVANTAGE

- Forty-four percent of large employers offering retiree health benefits to Medicare-age retirees offer coverage to at least some Medicare-age retirees through a contract with a Medicare Advantage plan [Figure 11.9].

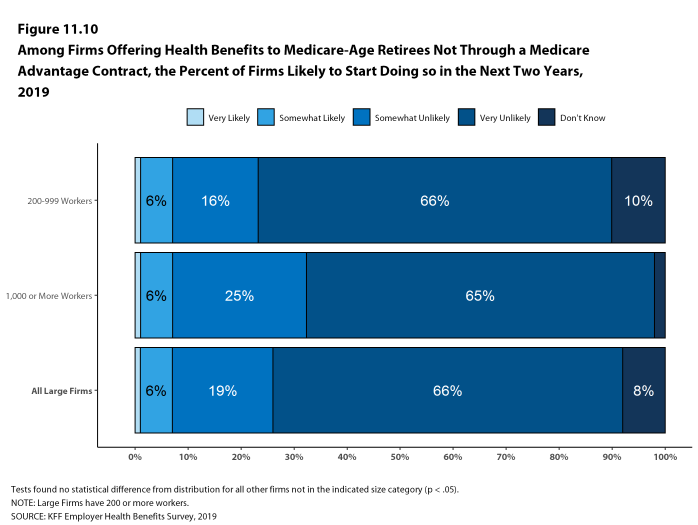

- Among large employers offering retiree health benefits to Medicare-age retirees that do not offer coverage through a Medicare Advantage plan, only 7% say that they are ‘very likely’ or ‘somewhat likely’ to do so in the next two years [Figure 11.10].

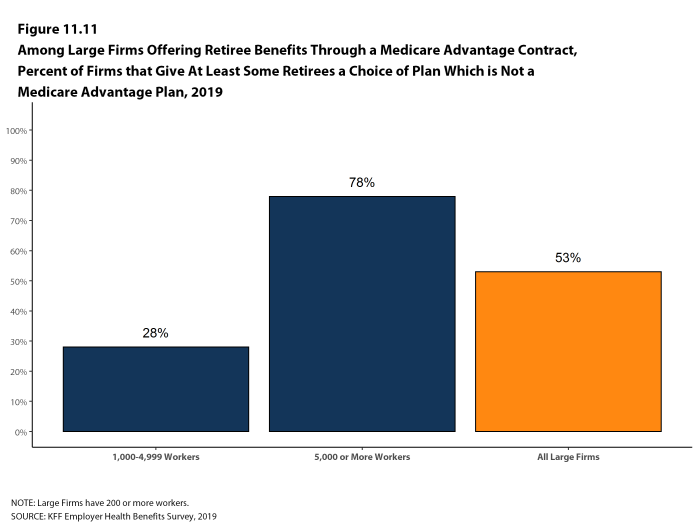

- Among large employers offering retiree health benefits to Medicare-age retirees through a contract with a Medicare Advantage plan, 53% provide retirees with the opportunity to choose a plan other than a Medicare Advantage plan for retiree health benefits [Figure 11.11].

Figure 11.9: Among Large Firms That Offer Retiree Health Benefits to Medicare-Age Retirees, Percentage of Firms That Contract With a Medicare Advantage (MA) Plan, 2019

Figure 11.10: Among Firms Offering Health Benefits to Medicare-Age Retirees Not Through a Medicare Advantage Contract, the Percent of Firms Likely to Start Doing So in the Next Two Years, 2019

BENEFIT ELIGIBILITY

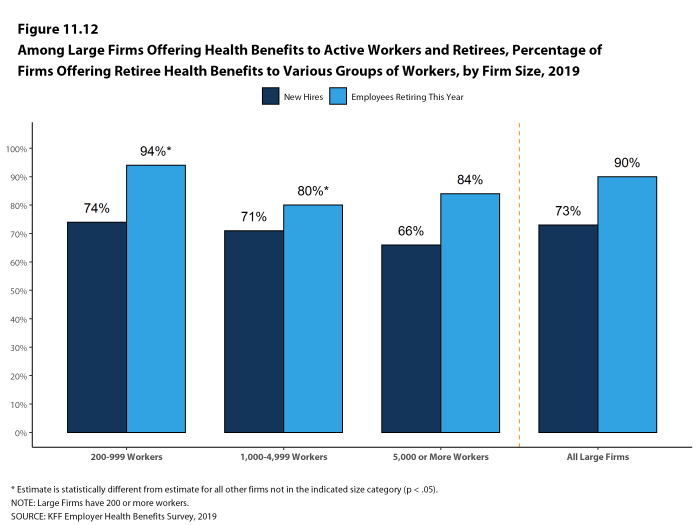

- Among large firms offering retiree health benefits, 90% say that at least some current employees will be eligible for retiree health benefits after meeting any age and/or length of service requirements [Figure 11.12].

- Among large firms offering retiree health benefits, 73% say that new hires will be eligible for the firm’s retiree health benefits after meeting any age and/or length of service requirements [Figure 11.12].

COST REDUCTION STRATEGIES

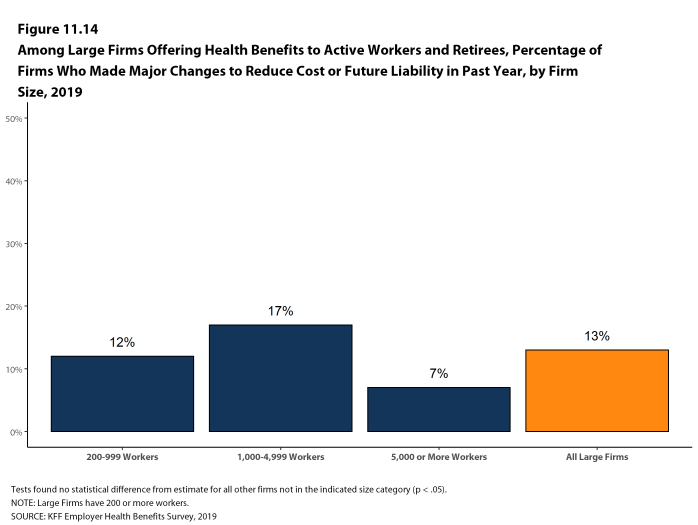

- Among large firms offering retiree health benefits, 13% say the firm made a major change in retiree health benefits in the past year to cut costs or reduce its future liability [Figure 11.14].

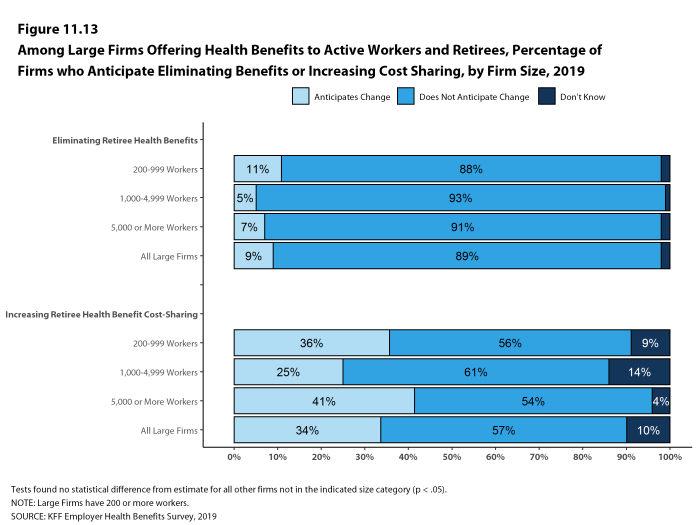

- Thirty-four percent of large firms offering retiree health benefits say they anticipate that the firm will increase retiree premium contributions or cost-sharing for services in the next two years [Figure 11.13].

- Nine percent of large firms offering retiree health benefits say that the firm will eliminate retiree health benefits offered to at least some current employees or retirees in the next two years [Figure 11.13].

Figure 11.13: Among Large Firms Offering Health Benefits to Active Workers and Retirees, Percentage of Firms Who Anticipate Eliminating Benefits or Increasing Cost Sharing, by Firm Size, 2019