2017 Employer Health Benefits Survey

Section 9: Prescription Drug Benefits

Almost all covered workers have coverage for prescription drugs. Over the years that we have conducted the survey, coverage for prescriptions has become more complex as employers and insurers expanded the use of formularies with multiple cost-sharing tiers as well as other management approaches. Collecting information about these practices is challenging and was burdensome to respondents with multiple plans to report on.

Beginning in 2016, to reduce burden on respondents, we revised the survey to ask respondents about the attributes of prescription drug coverage only in their largest health plan; previously, we asked about prescription coverage in their largest plan for each of the plan types that they offered. After reviewing the responses and comparing them to prior years where we asked about each plan type, we find that the information we are receiving is quite similar to responses from previous years. For this reason, we will continue to report our results for these questions weighted by the number of covered workers in responding firms. There is a more detailed discussion in the survey design and methods section on this topic.

In addition, because of the significant policy interest in access to and the cost of specialty drugs, in 2016 we also began asking employers to report separately about the cost sharing for tiers that cover only specialty drugs. In cases in which a tier covers only specialty drugs, we report its attributes under the specialty banner, rather than as one of the standard tiers. This entails revising the way we group formulary tiers: for example, a three-tier formulary where the third tier covers exclusively specialty drugs is now consider a two-tier plan with an additional tier. This approach allows us to report on the cost sharing for specialty drugs regardless of the number of tiers in the formulary. For this reason, we are not presenting statistical comparisons of estimates relying on tiers to prior years.31 This change is also discussed more fully in the survey design and methods section.

- Nearly all (99%) covered workers work at a firm that provides prescription drug coverage in their largest health plan.

DISTRIBUTION OF COST-SHARING

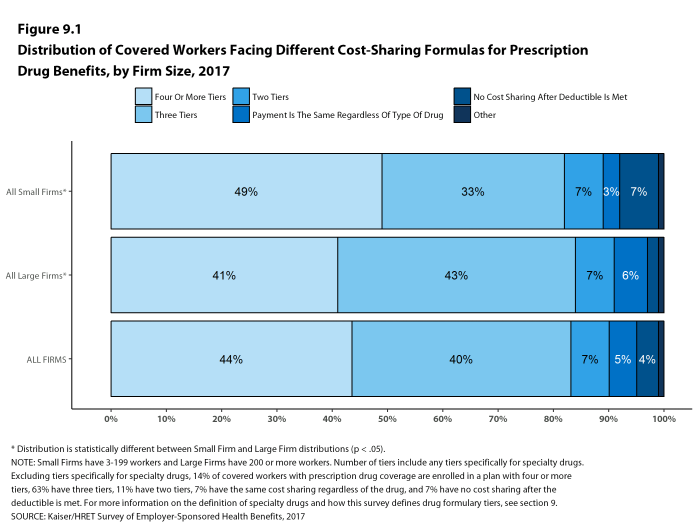

- A large share of covered workers (91%) are in a plan with a tiered cost-sharing formula for prescription drugs [Figure 9.1]. Cost-sharing tiers generally refer to a health plan placing a drug on a formulary or preferred drug list that classifies drugs into categories that are subject to different cost sharing or management. It is common for there to be different tiers for generic, preferred and non-preferred drugs. In recent years, plans have created additional tiers which, for example, may be used for lifestyle drugs or expensive biologics. Some plans may have multiple tiers for different categories; for example, a plan may have preferred and non-preferred specialty tiers. The survey obtains information about the cost-sharing structure for up to five tiers.

- Eighty-three percent of covered workers are in a plan with three, four, or more tiers of cost sharing for prescription drugs [Figure 9.1]. These totals include tiers that cover only specialty drugs, even though the cost-sharing information for those tiers is reported separately.

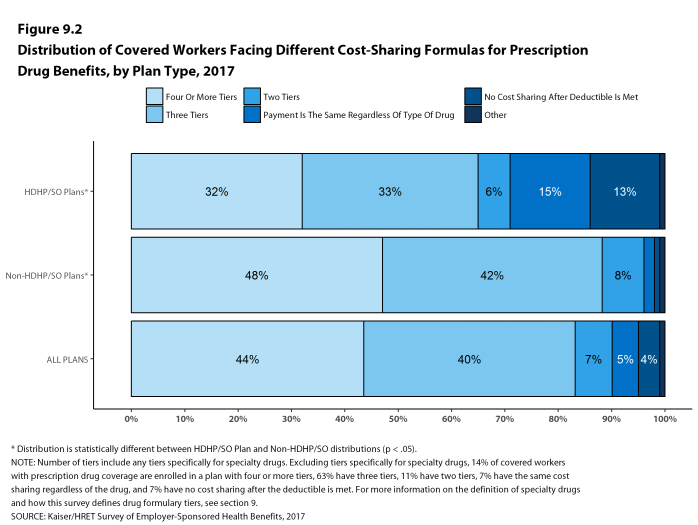

- HDHP/SOs have a different cost-sharing pattern for prescription drugs than other plan types. Covered workers in HDHP/SOs are more likely to be in a plan with the same cost sharing regardless of drug type (15% vs. 2%) or in a plan that has no cost sharing for prescriptions once the plan deductible is met (13% vs. <1%) as compared to covered workers in other types of plans [Figure 9.2].

Figure 9.1: Distribution of Covered Workers Facing Different Cost-Sharing Formulas for Prescription Drug Benefits, by Firm Size, 2017

AVERAGE COST-SHARING NOT INCLUDING TIERS EXCLUSIVELY COVERING SPECIALTY DRUGS

- Even when formulary tiers covering only specialty drugs are not included, a large share (77%) of covered workers are in a plan with three or more tiers of cost sharing for prescription drugs. The cost-sharing statistics presented in this section do not include information about tiers that cover only specialty drugs. In cases in which a plan covers specialty drugs on a tier with other drugs, they will still be included in these averages. Cost-sharing statistics for tiers covering only specialty drugs are presented in the next section.

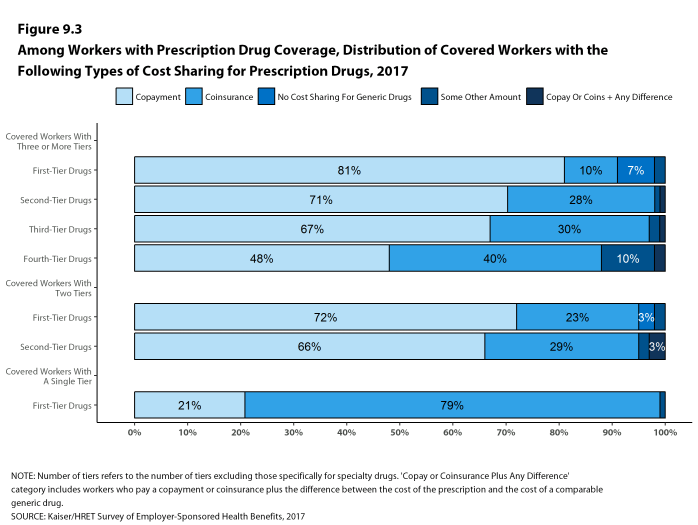

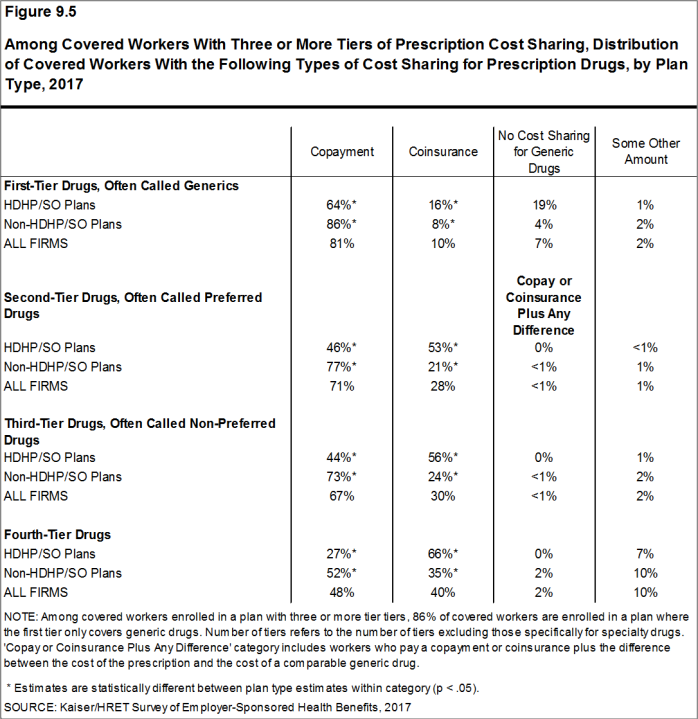

- For covered workers in a plan with three or more tiers of cost sharing for prescription drugs, copayments are the most common form of cost sharing in the first three tiers and coinsurance is the next most common. Among those with a fourth tier, the difference between the percentage with a copayment and a coinsurance requirement is not statistically significant [Figure 9.3].

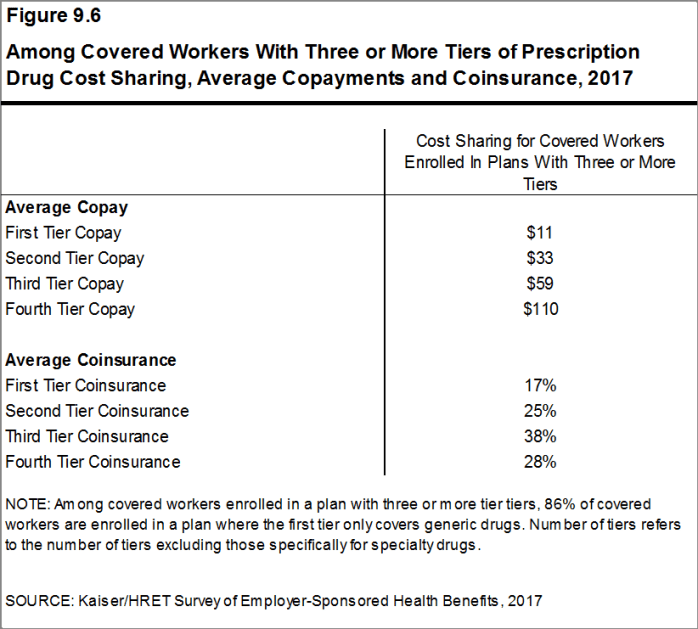

- Among covered workers in plans with three or more tiers of cost sharing for prescription drugs, the average copayments are $11 for first-tier drugs, $33 second-tier drugs, $59 for third-tier drugs, and $110 for fourth-tier drugs [Figure 9.6].

- Among covered workers in plans with three or more tiers of cost sharing for prescription drugs, the average coinsurance rates are 17% for first-tier drugs, 25% second-tier drugs, 38% third-tier drugs, and 28% for fourth-tier drugs [Figure 9.6].

- Eleven percent of covered workers are in a plan with two tiers for prescription drug cost sharing (excluding tiers covering only specialty drugs).

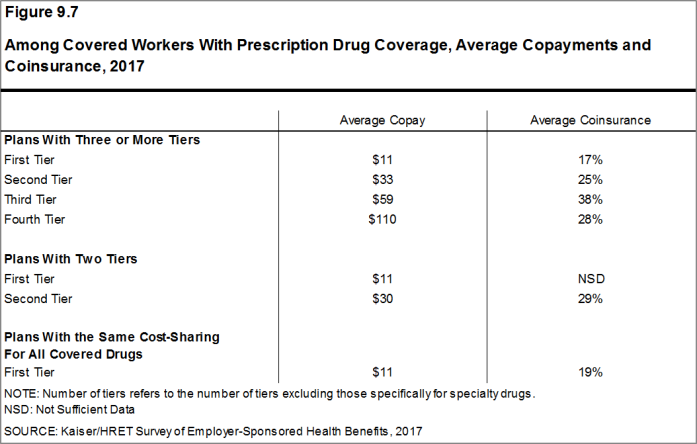

- For these workers, copayments are more common than coinsurance for both first-tier and second-tier drugs. The average copayment for the first tier is $11 and the average copayment for the second tier is $30 [Figure 9.3].

- Seven percent of covered workers are in a plan with the same cost sharing for prescriptions regardless of the type of drug (excluding tiers covering only specialty drugs).

- Among these workers, 21% have copayments and 79% have coinsurance [Figure 9.3]. The average coinsurance rate is 19% and the average copayment is $11 [Figure 9.7].

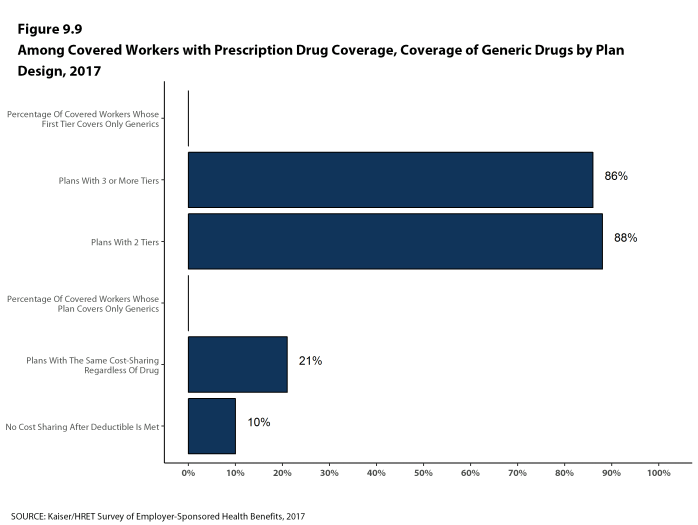

- Twenty-one percent of these workers are in a plan that limits coverage for prescriptions to generic drugs [Figure 9.9].

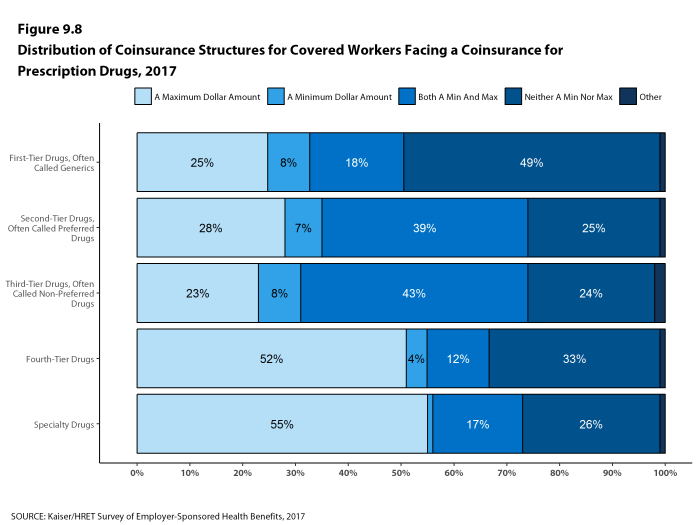

- Coinsurance rates for prescription drugs often have maximum and/or minimum dollar amounts associated with the coinsurance rate. Depending on the plan design, coinsurance maximums may significantly limit the amount an enrollee must spend out-of-pocket for higher cost drugs.

- These coinsurance minimum and maximum amounts vary across the tiers.

- For example, among covered workers in a plan with coinsurance for the first cost-sharing tier, 25% have only a maximum dollar amount attached to the coinsurance rate, 8% have only a minimum dollar amount, 18% have both a minimum and maximum dollar amount, and 49% have neither. For those in a plan with coinsurance for the fourth cost-sharing tier, 52% have only a maximum dollar amount attached to the coinsurance rate, 4% have only a minimum dollar amount, 12% have both a minimum and maximum dollar amount, and 33% have neither. [Figure 9.8].

Figure 9.3: Among Workers With Prescription Drug Coverage, Distribution of Covered Workers With the Following Types of Cost Sharing for Prescription Drugs, 2017

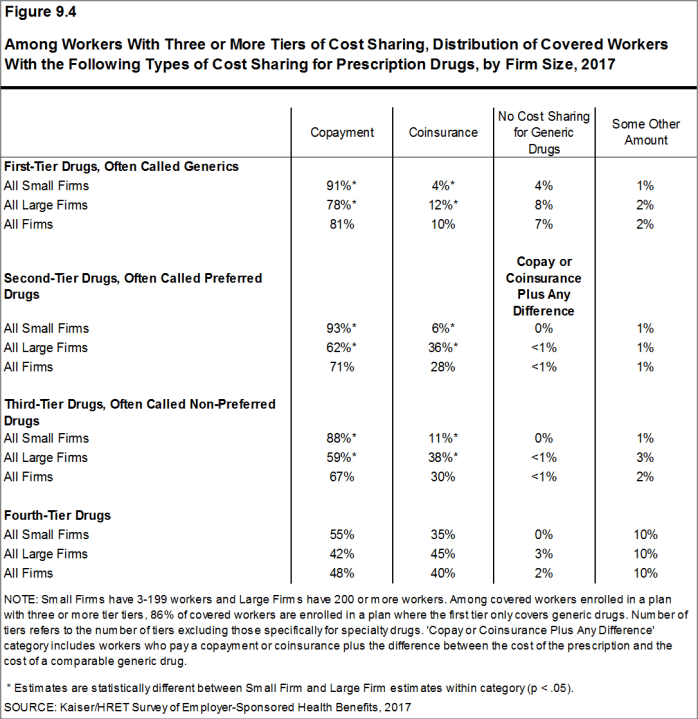

Figure 9.4: Among Workers With Three or More Tiers of Cost Sharing, Distribution of Covered Workers With the Following Types of Cost Sharing for Prescription Drugs, by Firm Size, 2017

Figure 9.5: Among Covered Workers With Three or More Tiers of Prescription Cost Sharing, Distribution of Covered Workers With the Following Types of Cost Sharing for Prescription Drugs, by Plan Type, 2017

Figure 9.6: Among Covered Workers With Three or More Tiers of Prescription Drug Cost Sharing, Average Copayments and Coinsurance, 2017

Figure 9.7: Among Covered Workers With Prescription Drug Coverage, Average Copayments and Coinsurance, 2017

Figure 9.8: Distribution of Coinsurance Structures for Covered Workers Facing a Coinsurance for Prescription Drugs, 2017

SPECIALTY DRUGS

- Specialty drugs, such as biologics that may be used to treat chronic conditions or some cancer drugs, can be quite expensive and often require special handling and administration. We revised our questions beginning with the 2016 survey to obtain more information about formulary tiers that are exclusively for specialty drugs. We are reporting results only among large firms because a substantial share of small firms were unsure whether their largest plan covered these drugs.

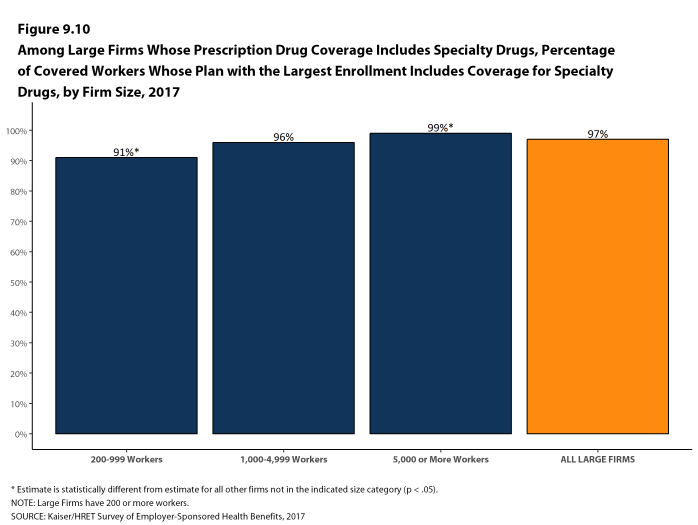

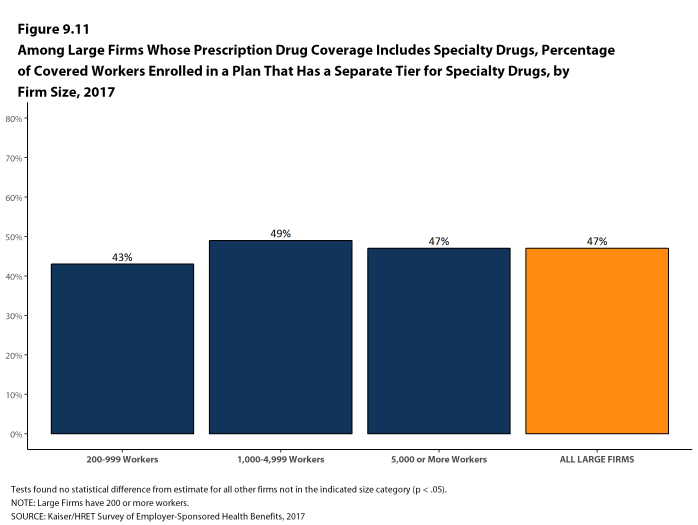

- Ninety-seven percent of covered workers at large firms have coverage for specialty drugs [Figure 9.10]. Among these workers, 47% are in a plan with at least one cost-sharing tier just for specialty drugs [Figure 9.11].

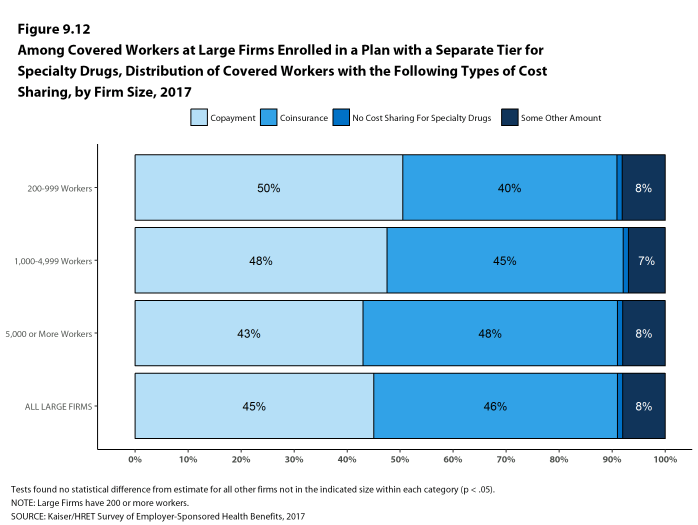

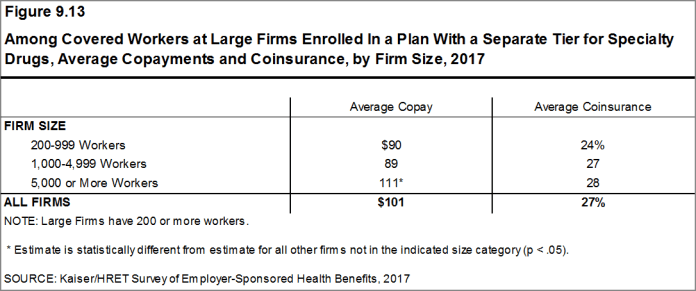

- Among covered workers in a plan with a separate tier for specialty drugs, 45% have a copayment for specialty drugs and 46% have a coinsurance [Figure 9.12]. The average copayment is $101 and the average coinsurance rate is 27% [Figure 9.13]. Eighty percent of those with a coinsurance have a maximum dollar limit on the amount of coinsurance they must pay.

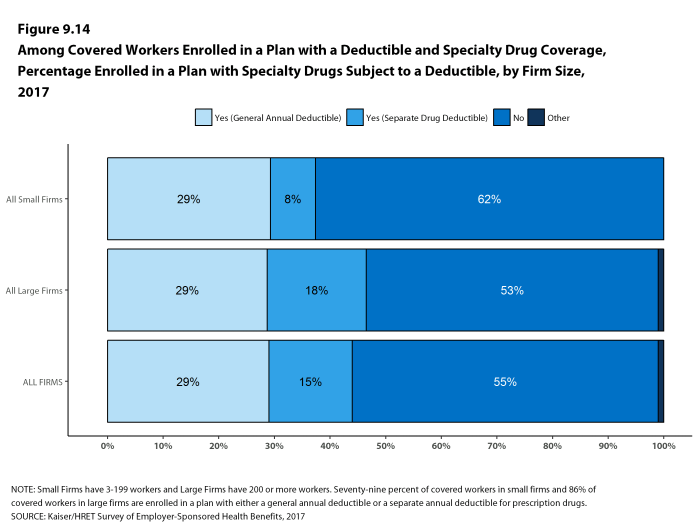

- Some covered workers are also required to meet a deductible before the plan covers specialty drugs. Among covered workers enrolled in a plan with a deductible and specialty drug coverage, 29% must meet the general annual deductible and 15% must meet a separate drug deductible before specialty drugs are covered [Figure 9.14].

Figure 9.10: Among Large Firms Whose Prescription Drug Coverage Includes Specialty Drugs, Percentage of Covered Workers Whose Plan With the Largest Enrollment Includes Coverage for Specialty Drugs, by Firm Size, 2017

Figure 9.11: Among Large Firms Whose Prescription Drug Coverage Includes Specialty Drugs, Percentage of Covered Workers Enrolled in a Plan That Has a Separate Ties for Specialty Drugs, by Firm Size, 2017

Figure 9.12: Among Covered Works at Large Firms Enrolled in a Plan with a Separate Tier for Specialty Drugs, Distribution of Covered Works with the Following Types of Cost Charing, by Firm Size, 2017

Figure 9.14: Among Covered Workers Enrolled In a Plan With a Deductible and Specialty Drug Coverage, Percentage Enrolled In a Plan With Specialty Drugs Subject to a Deductible, by Firm Size, 2017

SEPARATE ANNUAL DRUG DEDUCTIBLES

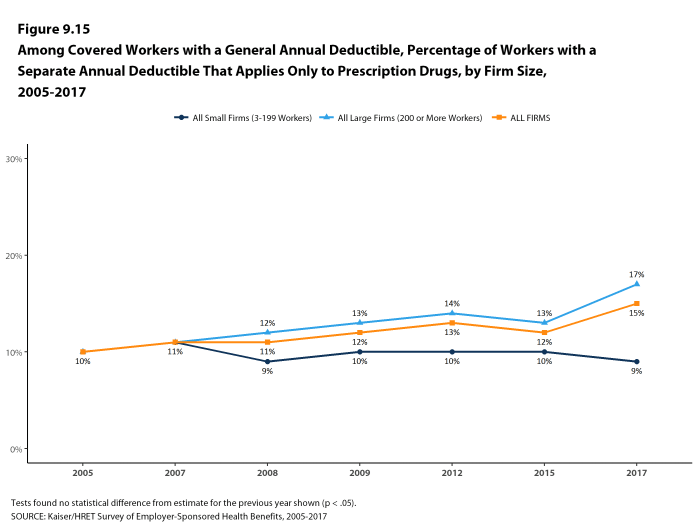

- In addition to other cost sharing, some covered workers are also required to meet a separate prescription drug deductible before the plan covers some or all drugs. Fifteen percent of covered workers are in a plan with a separate annual deductible for prescription drugs [Figure 9.15]. These prescription drug deductibles are separate from any general annual deductible and may apply to all or a select number of tiers.

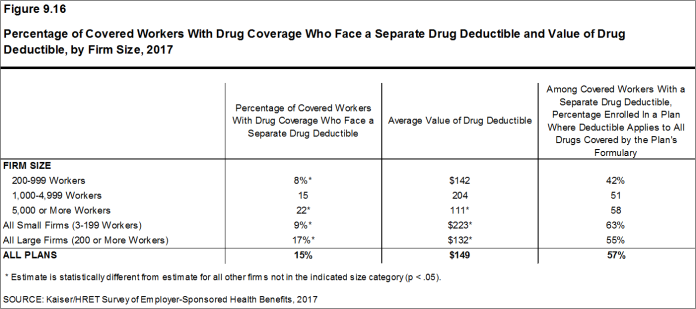

- For 57% of covered workers in firms with a separate deductible for prescription drugs, the deductible applies to all drugs on each of the formulary tiers [Figure 9.16].

- The average annual deductible among covered workers in firms who face a separate annual deductible is $149 [Figure 9.16].

Figure 9.15: Among Covered Workers with a General Annual Deductible, Percentage of Workers with a Separat Annual Deductible That Applies Only to Prescription Drugs, by Firm Size, 2005-2017

Figure 9.16: Percentage of Covered Workers with Drug Coverage Who Face a Separate Drug Deductible and Value of Drug Deductible, by Firm Size, 2017

- Generic drugs

- Drugs that are no longer covered by patent protection and thus may be produced and/or distributed by multiple drug companies.

- Preferred drugs

- Drugs included on a formulary or preferred drug list; for example, a brand-name drug without a generic substitute.

- Non-preferred drugs

- Drugs not included on a formulary or preferred drug list; for example, a brand-name drug with a generic substitute.

- Fourth-tier drugs

- New types of cost-sharing arrangements that typically build additional layers of higher copayments or coinsurance for specifically identified types of drugs, such as lifestyle drugs or biologics.

- Specialty drugs

- Specialty drugs such as biological drugs are high cost drugs that may be used to treat chronic conditions such as blood disorder, arthritis or cancer. Often times they require special handling and may be administered through injection or infusion.

- See the Methods Section for more information. In cases in which a firm indicated that one of their tiers was exclusively for specialty drugs, we reported the cost-sharing structure and any copay or coinsurance information under the specialty drug banner. Therefore, a firm that has three tiers of cost sharing may only have plan attributes for the generic and preferred tiers.↩