2017 Employer Health Benefits Survey

Section 10: Plan Funding

Many firms, particularly larger firms, choose to pay for the health services of their workers directly from their own funds rather than by purchasing health insurance for them. This is called self-funding. Federal law (the Employee Retirement Income Security Act of 1974, or ERISA) exempts self-funded plans established by private employers from most state insurance laws, including reserve requirements, mandated benefits, premium taxes, and consumer protection regulations. Sixty percent of covered workers are in a self-funded health plan. Self-funding is common among larger firms because they can spread the risk of costly claims over a large number of workers and dependents.

Many firms with self-funded plans also use insurance, often called stoploss coverage, to limit their liability for very large claims or an unexpected level of expenses. About three-fifths of covered workers in fully or partially self-funded plans are in plans with stoploss insurance.

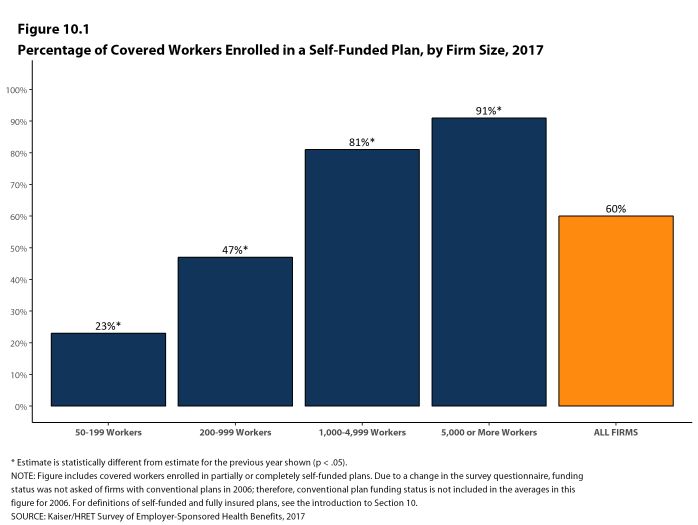

- Sixty percent of covered workers are in a plan that is completely or partially self-funded, similar to last year [Figures 10.1 and 10.2].

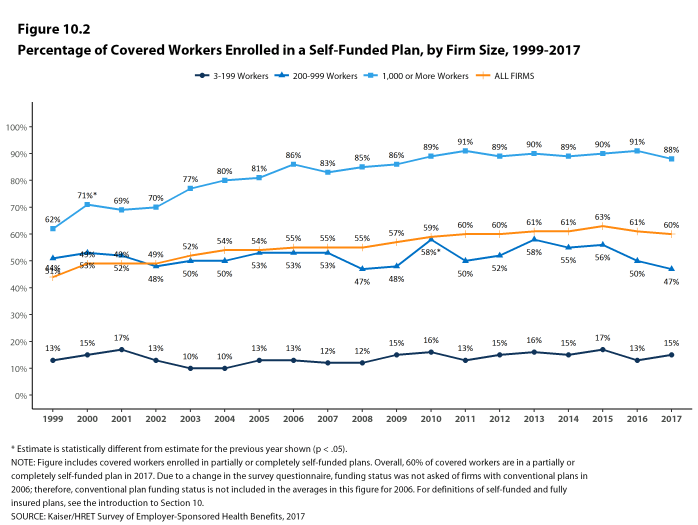

- The percentage of covered workers enrolled in self-funded plans has been stable in recent years across firm sizes [Figure 10.2].

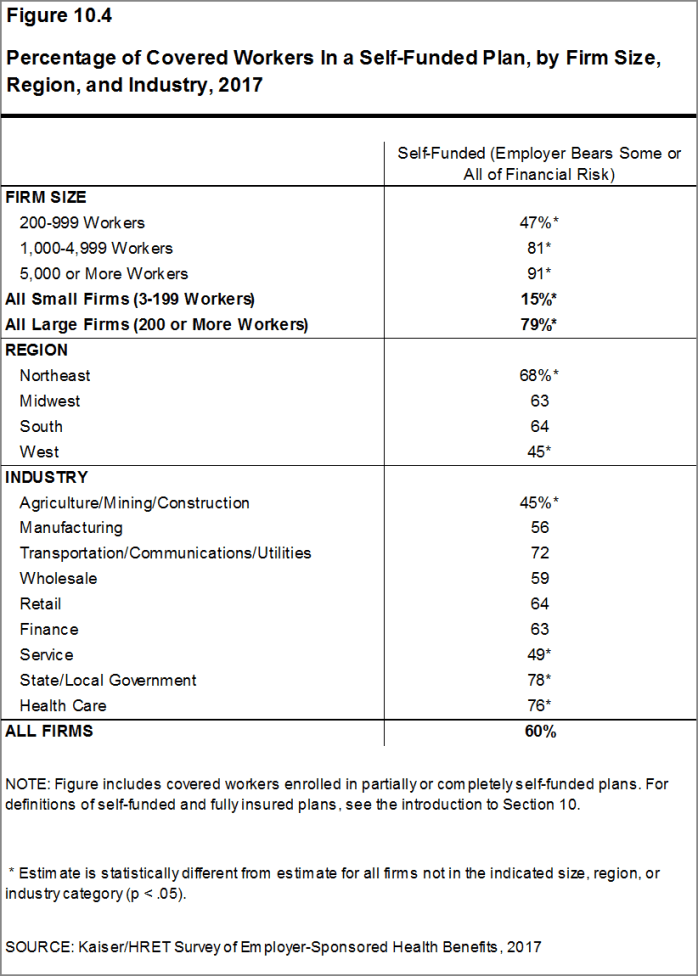

- As expected, covered workers in large firms are significantly more likely to be in a self-funded plan than covered workers in small firms (79% vs. 15%). The percentage of covered workers in self-funded plans increases as the number of workers in a firm increases. Eighty-one percent of covered workers in firms with 1,000 to 4,999 workers and 91% of covered workers in firms with 5,000 or more workers are in self-funded plans in 2017 [Figures 10.1 and 10.4].

Figure 10.4: Percentage of Covered Workers In a Self-Funded Plan, by Firm Size, Region, and Industry, 2017

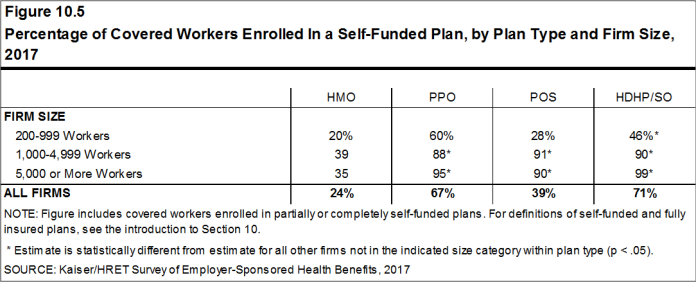

Figure 10.5: Percentage of Covered Workers Enrolled In a Self-Funded Plan, by Plan Type and Firm Size, 2017

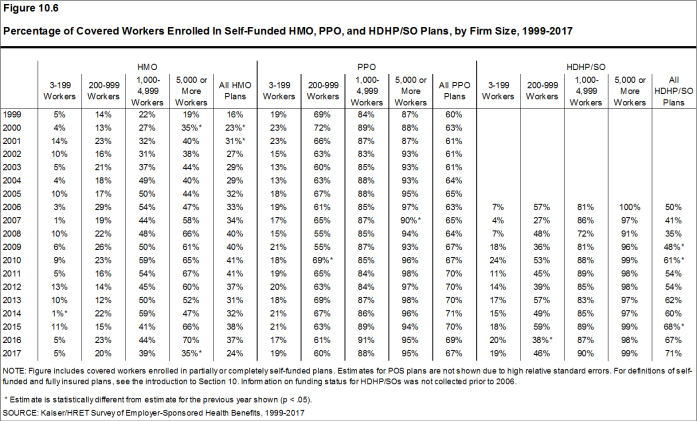

Figure 10.6: Percentage of Covered Workers Enrolled In Self-Funded HMO, PPO, and HDHP/SO Plans, by Firm Size, 1999-2017

STOPLOSS COVERAGE AND ATTACHMENT POINTS

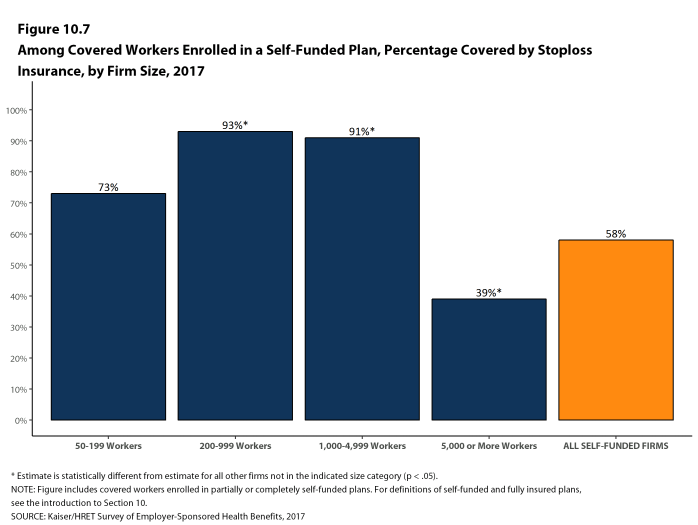

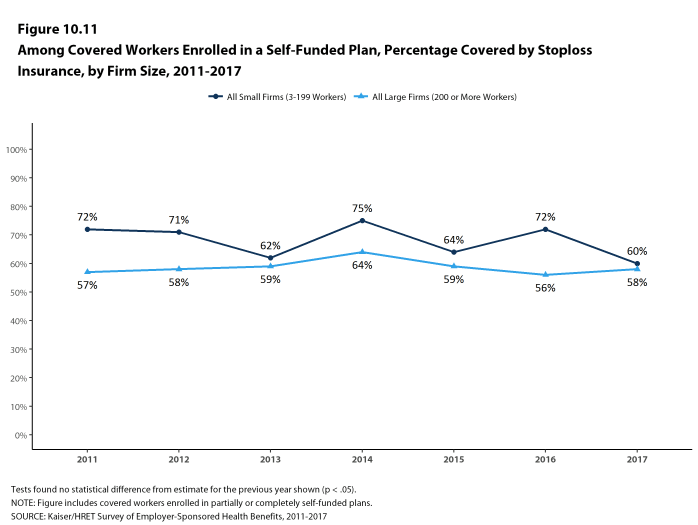

- Fifty-eight percent of covered workers in self-funded health plans are in plans that have stoploss insurance [Figure 10.7]. Stoploss coverage may limit the amount of claims that must be paid for each worker or may limit the total amount the plan sponsor must pay for all claims over the plan year.

- The percentage of covered workers in self-funded plans with stoploss insurance (58%) is similar to the value when the survey first asked about stoploss insurance in 2011 (58%).

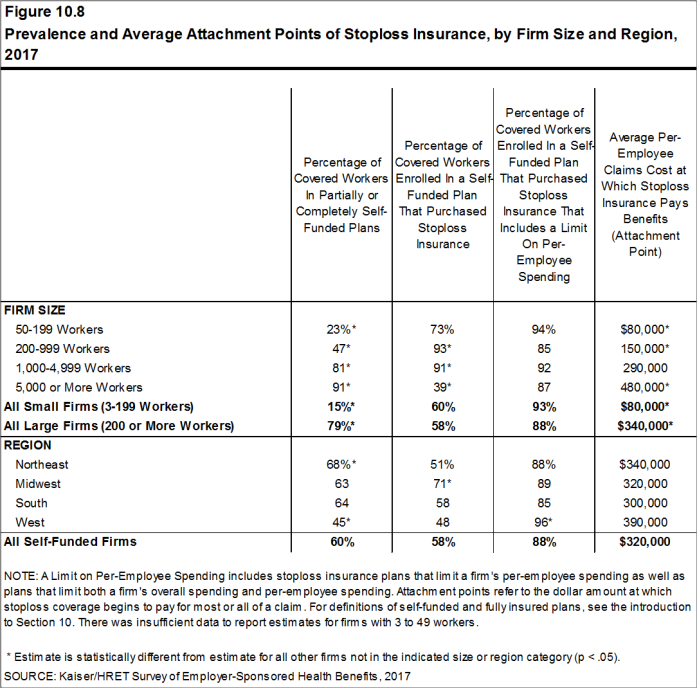

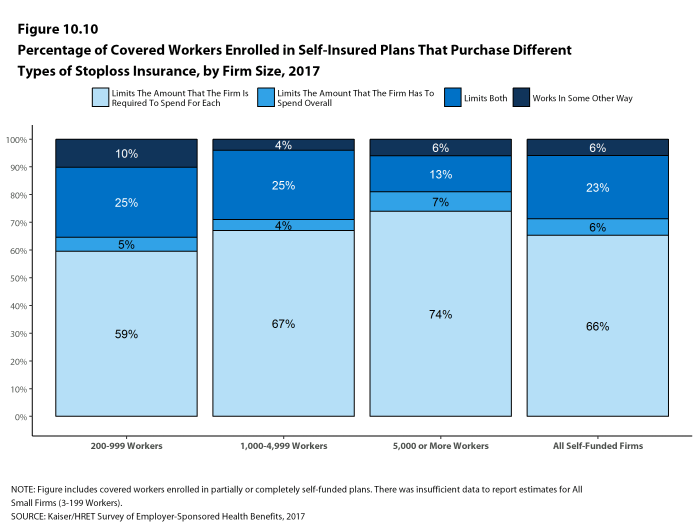

- Eighty-eight percent of covered workers in self-funded plans that have stoploss protection are in plans where the stoploss insurance limits the amount that the plan must spend on each worker. This includes stoploss insurance plans that limit a firm’s per-employee spending and plans that limit both a firm’s overall spending and per-employee spending [Figure 10.8].

- Firms with per-enrollee stoploss coverage were asked for the dollar amount where the stoploss coverage would start to pay for most or all of the claim (called an attachment point). The average attachment point in small firms is $80,000. For large firms with a per-person limit, the average attachment point is $340,000 [Figure 10.8].

Figure 10.7: Among Covered Workers Enrolled In a Self-Funded Plan, Percentage Covered by Stoploss Insurance, by Firm Size, 2017

Figure 10.8: Prevalence and Average Attachment Points of Stoploss Insurance, by Firm Size and Region, 2017

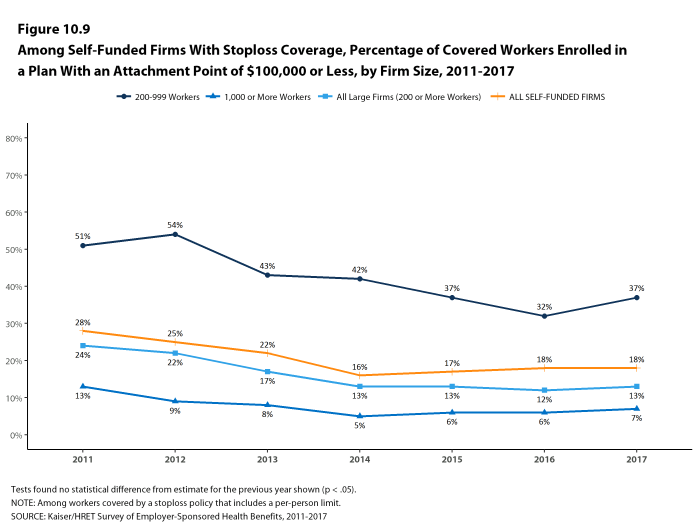

Figure 10.9: Among Self-Funded Firms With Stoploss Coverage, Percentage of Covered Workers Enrolled In a Plan With an Attachment Point of $100,000 or Less, by Firm Size, 2011-2017

Figure 10.10: Percentage of Covered Workers Enrolled In Self-Insured Plans That Purchase Different Types of Stoploss Insurance, by Firm Size, 2017

Figure 10.11: Among Covered Workers Enrolled In a Self-Funded Plan, Percentage Covered by Stoploss Insurance, by Firm Size, 2011-2017

- Self-Funded Plan

- An insurance arrangement in which the employer assumes direct financial responsibility for the costs of enrollees’ medical claims. Employers sponsoring self-funded plans typically contract with a third-party administrator or insurer to provide administrative services for the self-funded plan. In some cases, the employer may buy stoploss coverage from an insurer to protect the employer against very large claims.

- Fully Insured Plan

- An insurance arrangement in which the employer contracts with a health plan that assumes financial responsibility for the costs of enrollees’ medical claims.