2017 Employer Health Benefits Survey

Published:

Section 6: Worker and Employer Contributions for Premiums

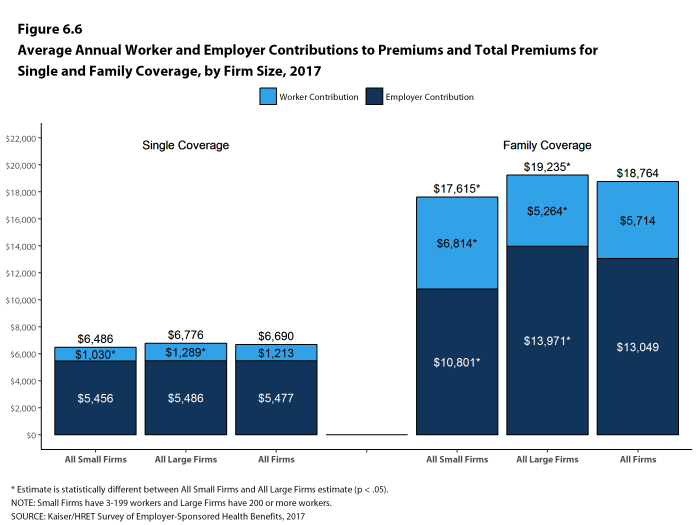

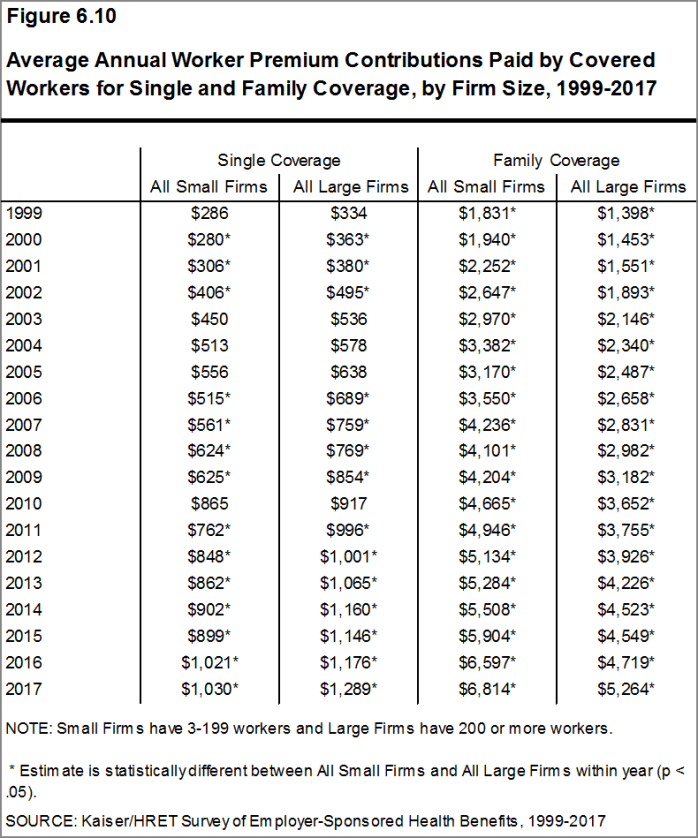

In 2017, premium contributions by covered workers average 18% for single coverage and 31% for family coverage.21 The average monthly worker contributions are $101 for single coverage ($1,213 annually) and $476 for family coverage ($5,714 annually).22 Covered workers in small firms (3-199 workers) have a lower average contribution amount for single coverage ($1,030 vs. $1,289), but a higher average contribution amount for family coverage ($6,814 vs. $5,264) than covered workers in large firms (200 or more workers).

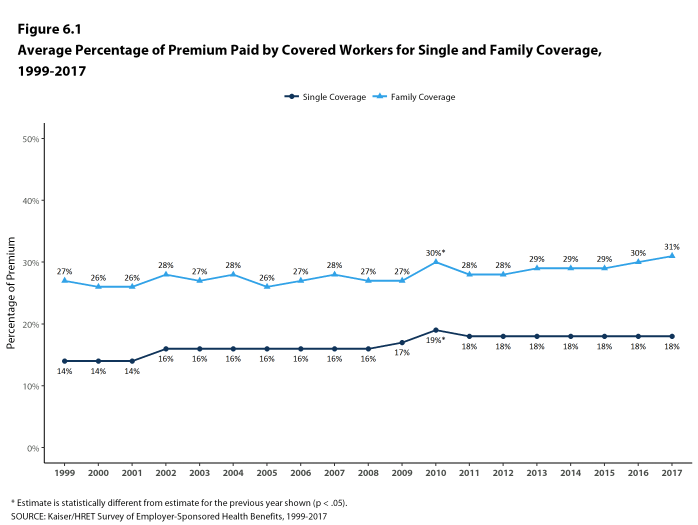

- In 2017, covered workers on average contribute 18% of the premium for single coverage and 31% of the premium for family coverage [Figure 6.1]. The average contribution percentage for single coverage has remained stable in recent years. The average contribution percentage for family coverage is higher in 2017 than in 2012 (31% vs. 28%).

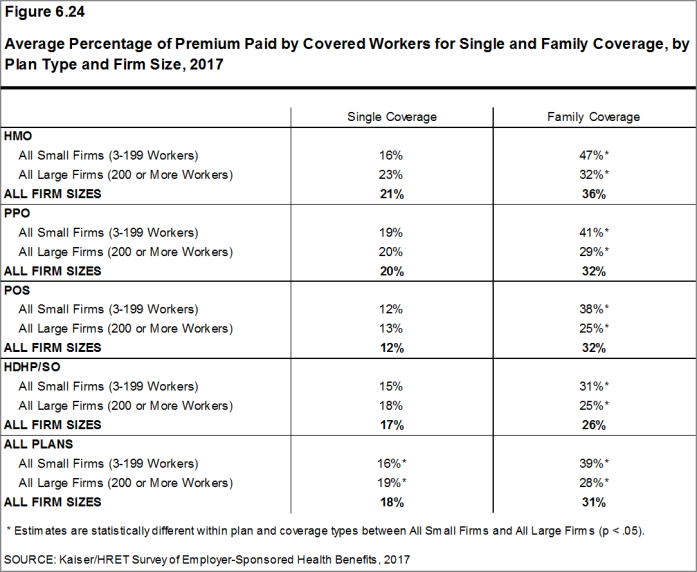

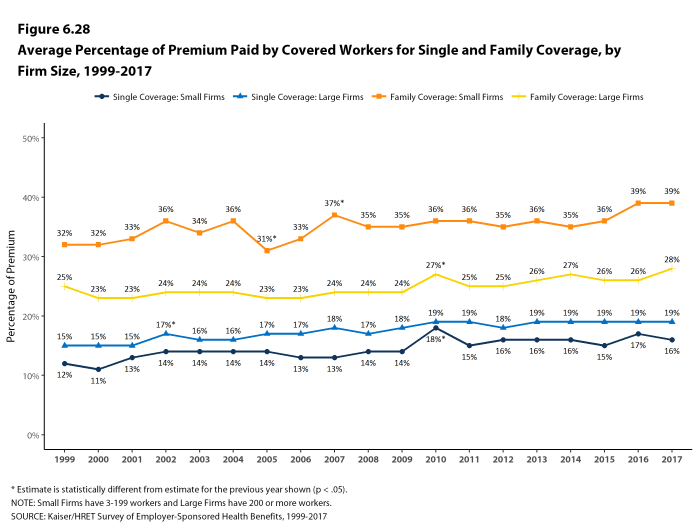

- Covered workers in small firms on average contribute a lower percentage of the premium for single coverage (16% vs. 19%) and a higher percentage of the premium for family coverage (39% vs. 28%) than covered workers in large firms [Figure 6.24].

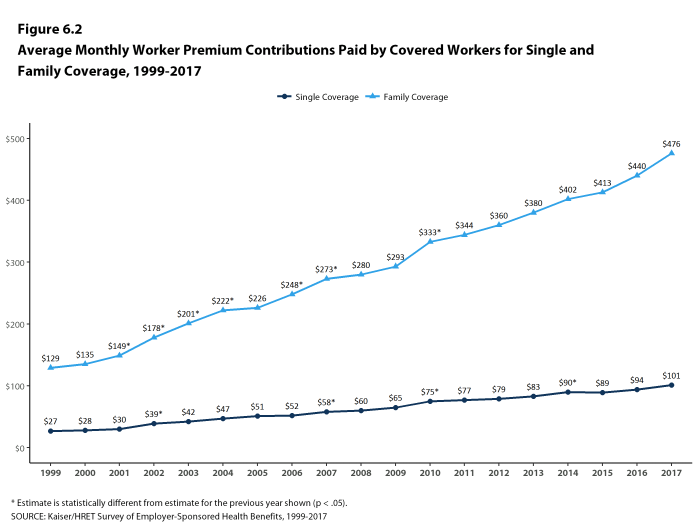

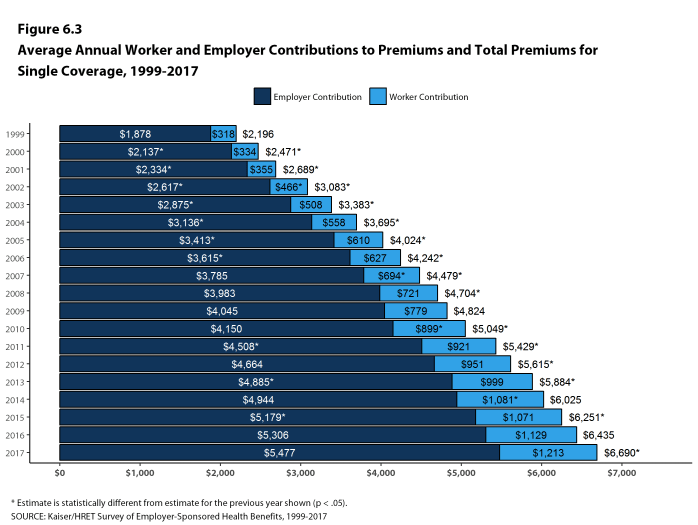

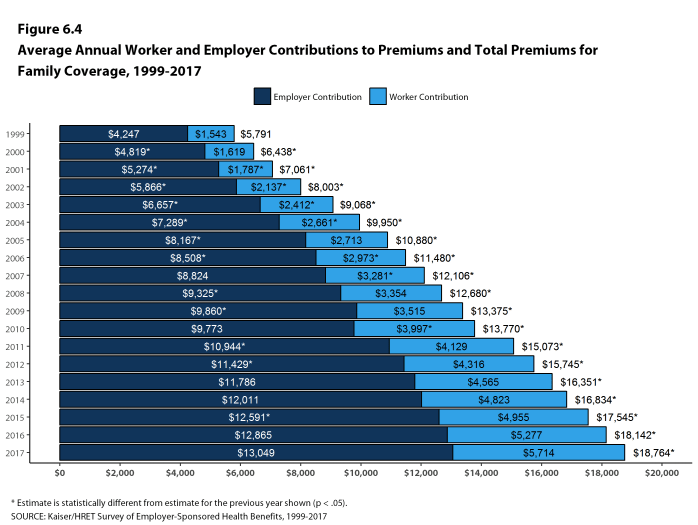

- Workers with single coverage have an average contribution of $101 per month ($1,213 annually), and workers with family coverage have an average contribution of $476 per month ($5,714 annually) toward their health insurance premiums [Figures 6.2, 6.3, and 6.4].

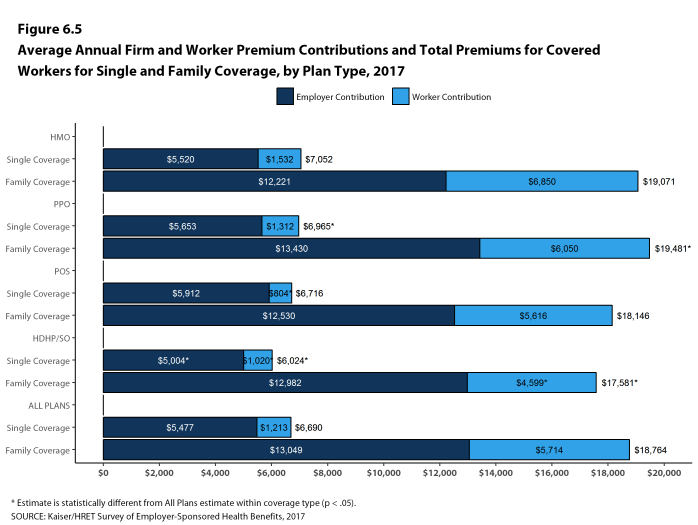

- The average worker contributions in HDHP/SOs are lower than the overall average worker contribution for single coverage ($1,020 vs. $1,213) and family coverage ($4,599 vs. $5,714) [Figure 6.5].

- Worker contributions also differ by firm size. As in previous years, workers in small firms on average contribute a lower amount annually for single coverage than workers in large firms ($1,030 vs. $1,289). In contrast, workers in small firms on average contribute significantly more annually for family coverage than workers in large firms ($6,814 vs. $5,264) [Figure 6.6].

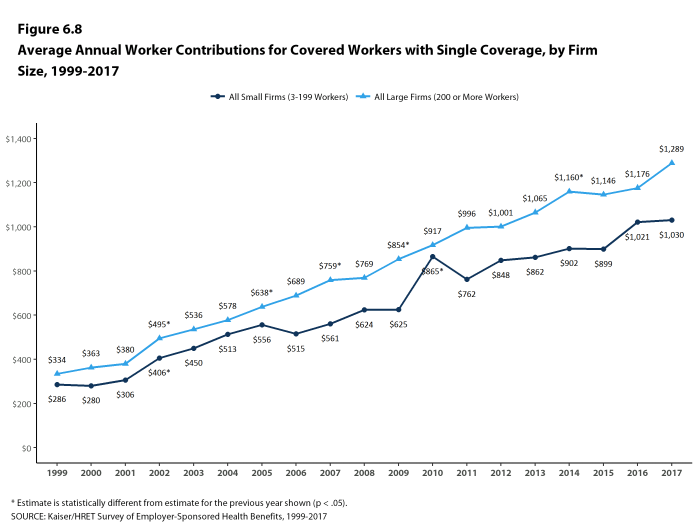

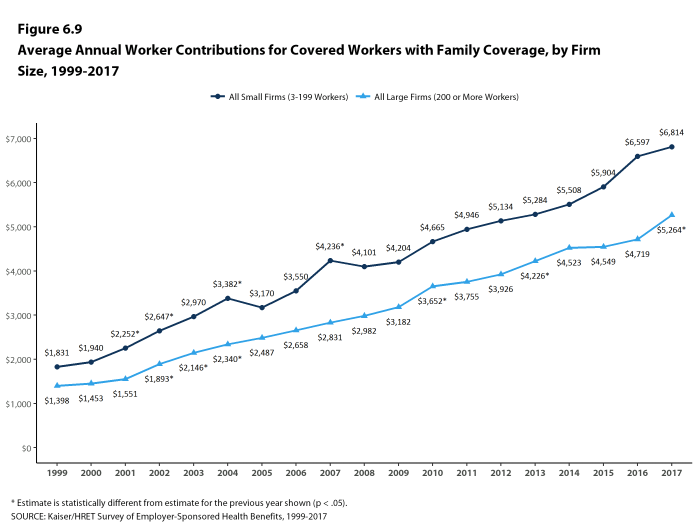

- The average worker contributions for single and family coverage in small firms and for single coverage in large firms are similar to last year. The average worker contribution for family coverage in large firms increased from $4,719 to $5,264 [Figures 6.8 and 6.9].

Figure 6.1: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, 1999-2017

Figure 6.2: Average Monthly Worker Premium Contributions Paid by Covered Workers for Single and Family Coverage, 1999-2017

Figure 6.3: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Single Coverage, 1999-2017

Figure 6.4: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Family Coverage, 1999-2017

Figure 6.5: Average Annual Firm and Worker Premium Contributions and Total Premiums for Covered Workers for Single and Family Coverage, by Plan Type, 2017

Figure 6.6: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Single and Family Coverage, by Firm Size, 2017

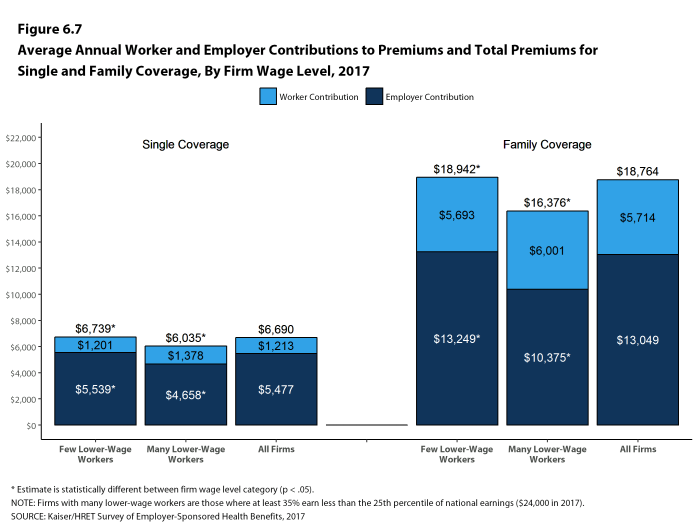

Figure 6.7: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Single and Family Coverage, by Firm Wage Level, 2017

Figure 6.8: Average Annual Worker Contributions for Covered Workers With Single Coverage, by Firm Size, 1999-2017

Figure 6.9: Average Annual Worker Contributions for Covered Workers With Family Coverage, by Firm Size, 1999-2017

Figure 6.10: Average Annual Worker Premium Contributions Paid by Covered Workers for Single and Family Coverage, by Firm Size, 1999-2017

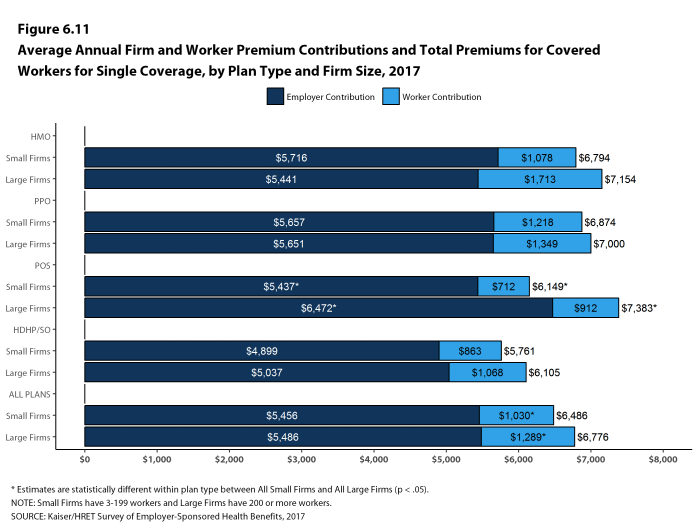

Figure 6.11: Average Annual Firm and Worker Premium Contributions and Total Premiums for Covered Workers for Single Coverage, by Plan Type and Firm Size, 2017

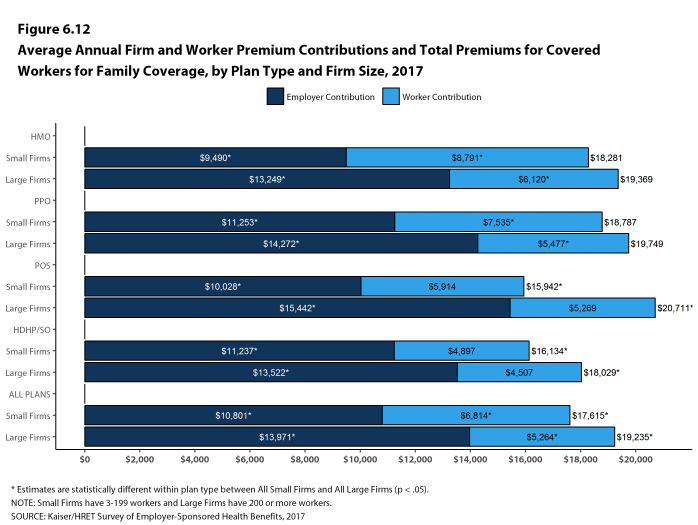

Figure 6.12: Average Annual Firm and Worker Premium Contributions and Total Premiums for Covered Workers for Family Coverage, by Plan Type and Firm Size, 2017

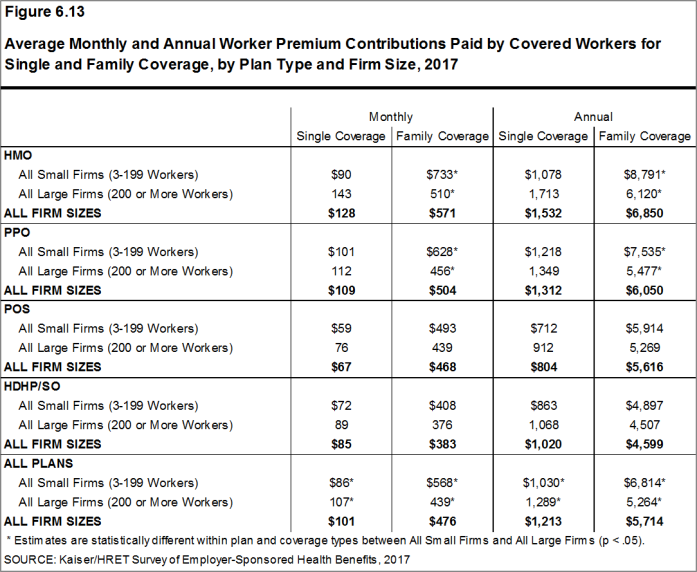

Figure 6.13: Average Monthly and Annual Worker Premium Contributions Paid by Covered Workers for Single and Family Coverage, by Plan Type and Firm Size, 2017

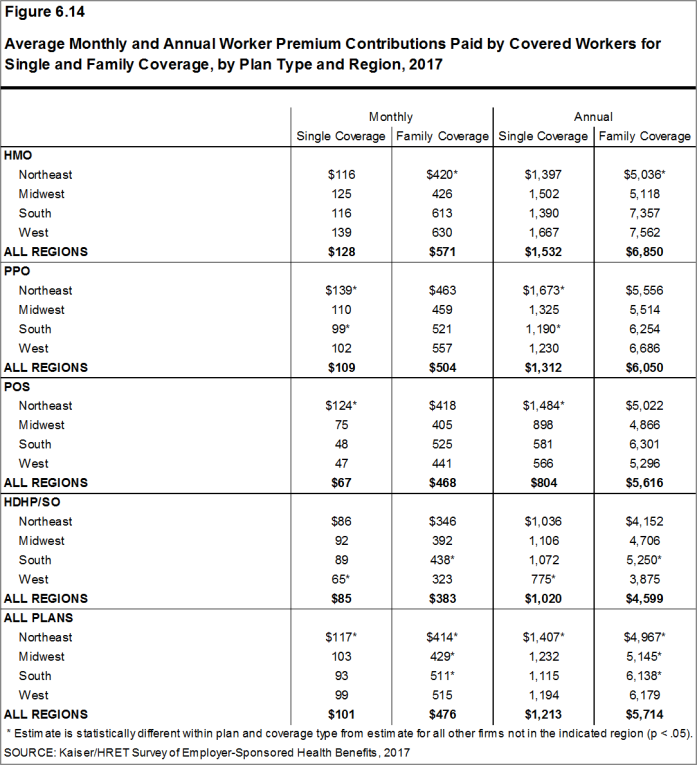

Figure 6.14: Average Monthly and Annual Worker Premium Contributions Paid by Covered Workers for Single and Family Coverage, by Plan Type and Region, 2017

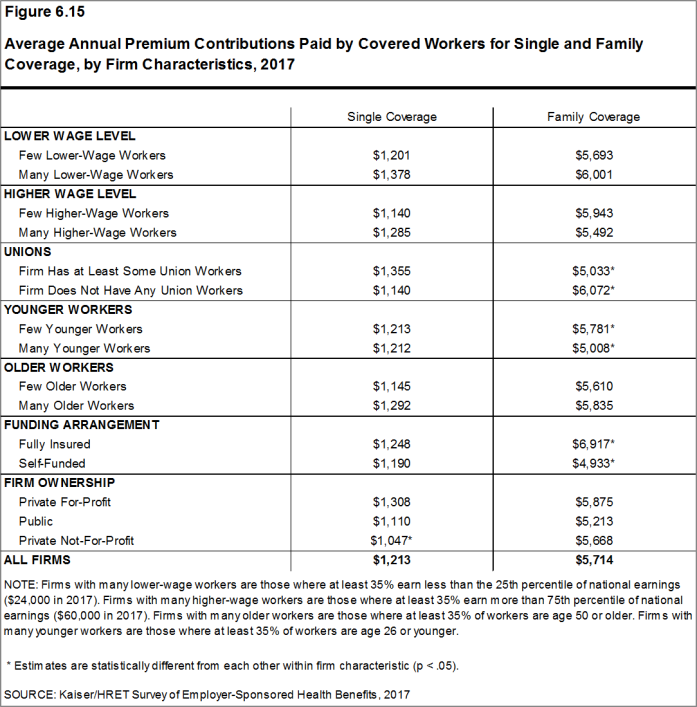

Figure 6.15: Average Annual Premium Contributions Paid by Covered Workers for Single and Family Coverage, by Firm Characteristics, 2017

VARIATION IN WORKER CONTRIBUTIONS TO THE PREMIUM

- About four-fifths of covered workers are in a plan where the employer contributes at least half of the premium for both single and family coverage.

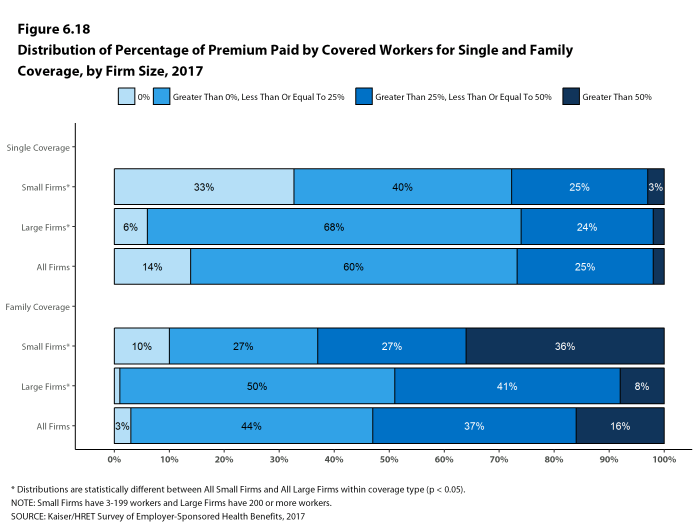

- Fourteen percent of covered workers are in a plan where the employer pays the entire premium for single coverage; 3% of covered workers are in a plan where the employer pays the entire premium for family coverage [Figure 6.18].

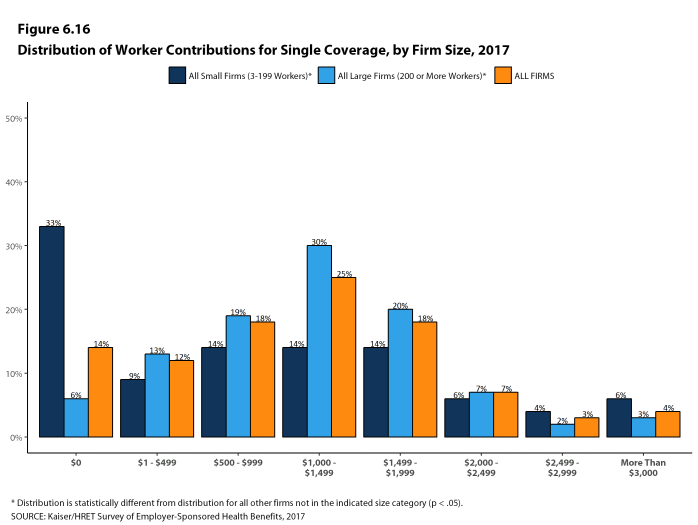

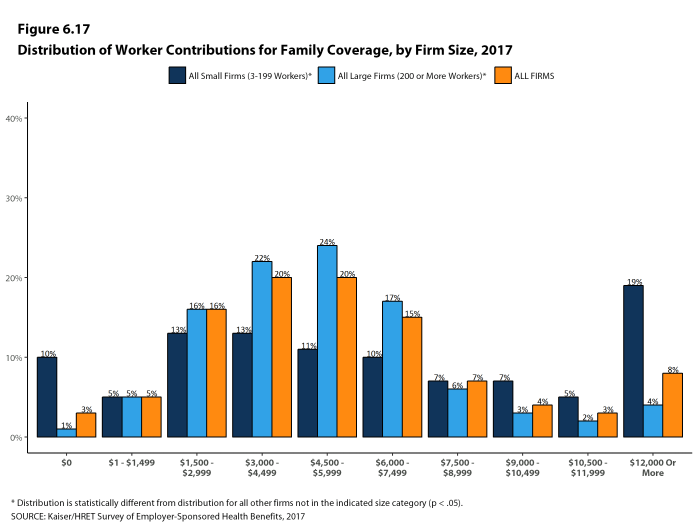

- Covered workers in small firms are much more likely than covered workers in large firms to be in a plan where the employer pays 100% of the premium. Thirty-three percent of covered workers in small firms have an employer that pays the full premium for single coverage, compared to 6% of covered workers in large firms [Figure 6.17]. For family coverage, 10% of covered workers in small firms have an employer that pays the full premium, compared to 1% of covered workers in large firms [Figure 6.16].

- Sixteen percent of covered workers are in a plan where enrollees have a contribution of more than 50% of the premium for family coverage [Figure 6.18].

- Thirty-six percent of covered workers in small firms work in a firm where the enrollee contribution for family coverage is more than 50% of the premium, compared to 8% of covered workers in large firms [Figure 6.18].

- For single coverage, 3% of covered workers in small firms and 2% of covered workers in large firms are in a plan where the enrollee contribution is more than 50% of the premium. The difference between the estimates for small and large firms is not statistically significant [Figure 6.18].

- There is substantial variation among workers in small firms and workers in large firms in the dollar amounts they contribute for single and family coverage. For example, among covered workers in small firms, 10% have no contribution for family coverage, while 19% have a contribution of more than $12,000. Among covered workers in large firms, 1% have no contribution for family coverage, while 4% have a contribution of more than $12,000 [Figure 6.16].

Figure 6.18: Distribution of Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 2017

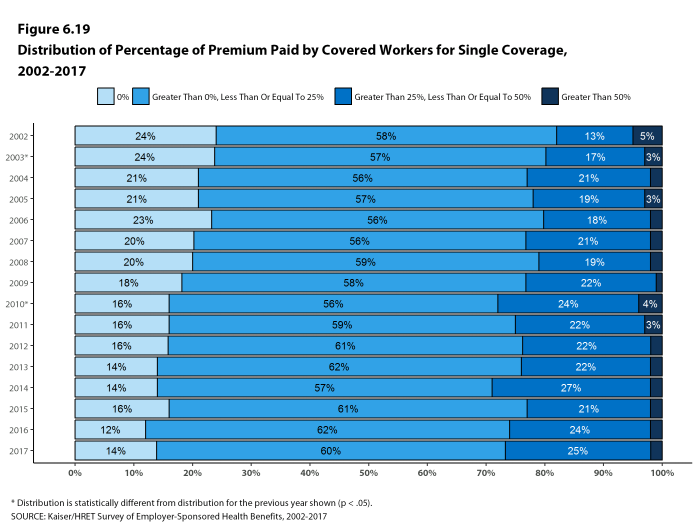

Figure 6.19: Distribution of Percentage of Premium Paid by Covered Workers for Single Coverage, 2002-2017

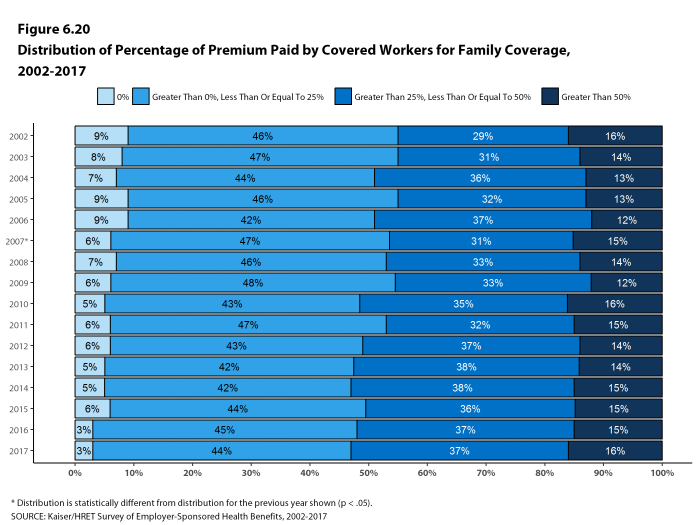

Figure 6.20: Distribution of Percentage of Premium Paid by Covered Workers for Family Coverage, 2002-2017

DIFFERENCES BY FIRM CHARACTERISTICS

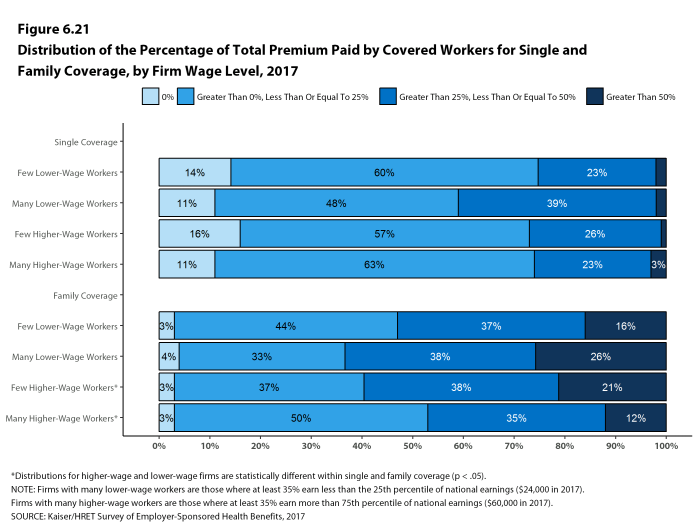

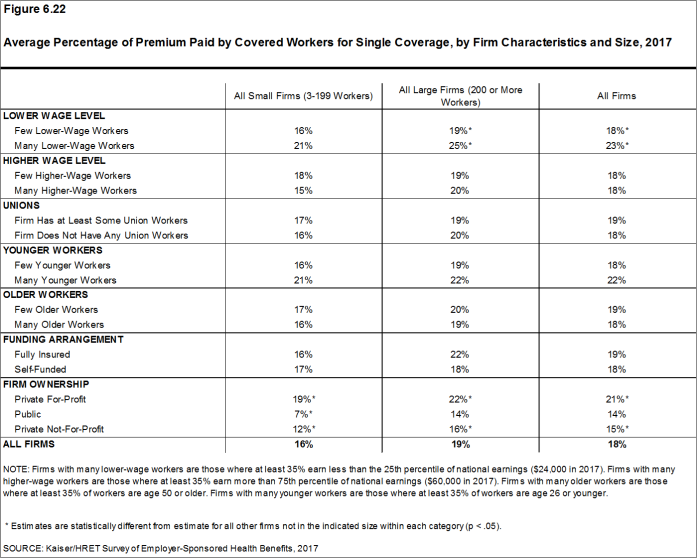

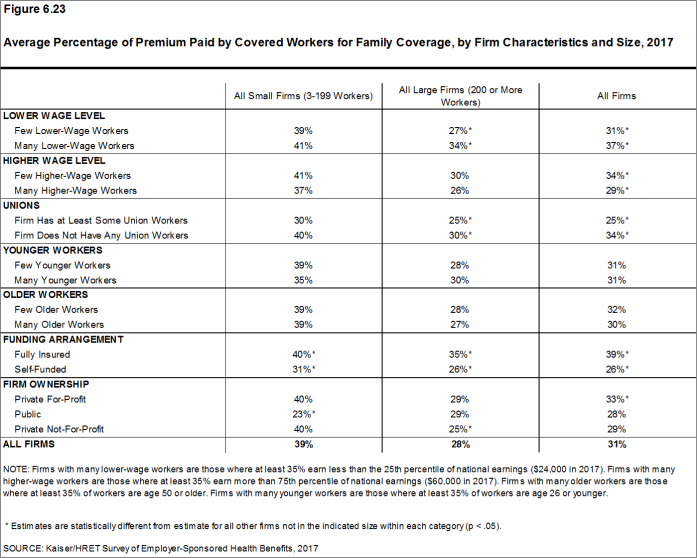

- The percentage of the premium paid by covered workers also varies by firm characteristics.

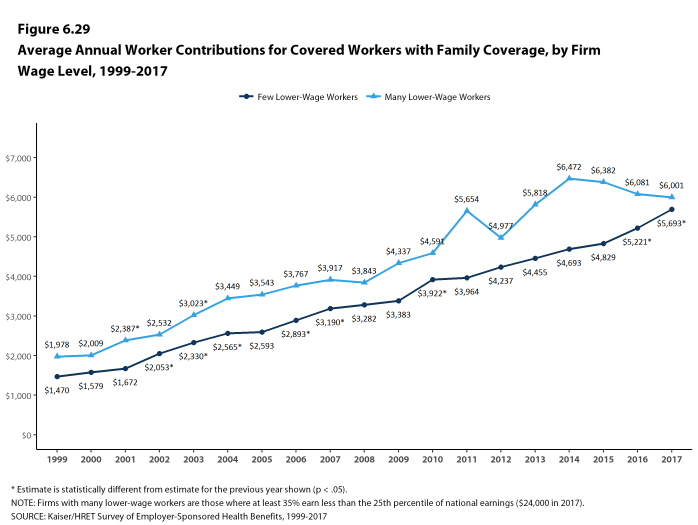

- Covered workers in firms with a relatively large share of lower-wage workers (where at least 35% of workers earn $24,000 a year or less) on average have higher contribution rates for single coverage (23% vs. 18%) and family coverage (37% vs. 31%) than those in firms with a smaller share of lower-wage workers [Figures 6.22 and 6.23].

- Covered workers in firms with a relatively large share of higher-wage workers (where at least 35% earn $60,000 or more annually) on average have lower contribution rates for family coverage than those in firms with a smaller share of higher-wage workers (29% vs. 34%) [Figure 6.23].

- Covered workers in large firms that have at least some union workers on average have lower contribution rates for family coverage than those in firms without any union workers (25% vs. 30%) [Figures 6.23].

- Covered workers in large firms that are partially or completely self-funded on average have lower contribution rates for family coverage than workers in large firms that are fully insured (26% vs. 35%) [Figure 6.23].23

- Covered workers in private for-profit firms on average have higher contribution rates for both single coverage (21%) and family coverage (33%) than workers in public organizations and private not-for-profit firms [Figures 6.22 and 6.23].

Figure 6.22: Average Percentage of Premium Paid by Covered Workers for Single Coverage, by Firm Characteristics and Size, 2017

Figure 6.23: Average Percentage of Premium Paid by Covered Workers for Family Coverage, by Firm Characteristics and Size, 2017

Figure 6.24: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Plan Type and Firm Size, 2017

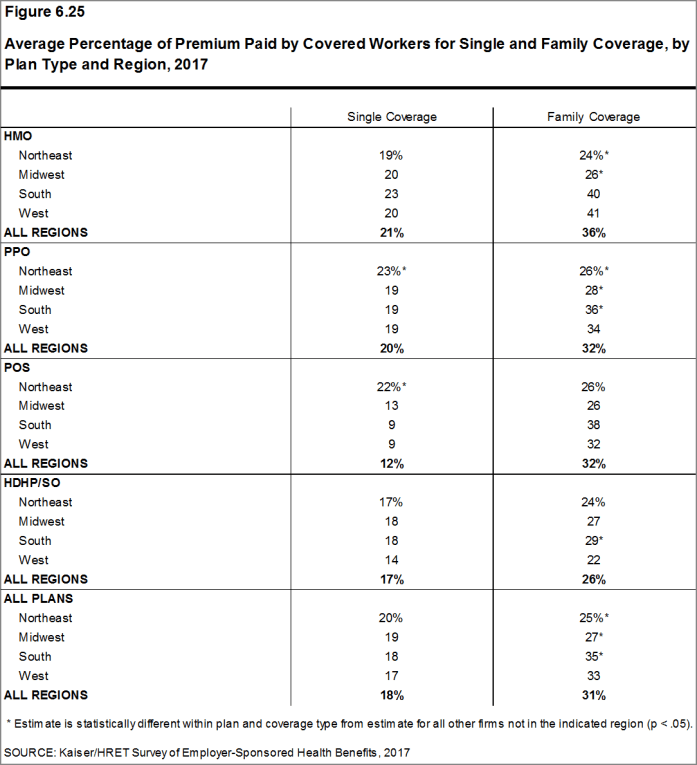

Figure 6.25: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Plan Type and Region, 2017

CONTRIBUTION APPROACHES

- Firms take different approaches for contributing toward family coverage. Among firms offering health benefits, 45% of small firms and 15% of large firms contribute the same dollar amount for single coverage as for family coverage, which means that the worker must pay the entire difference between the cost of single and family coverage if they wish to enroll their family members. Forty-five percent of small firms and 75% of large firms make a larger dollar contribution for family coverage than for single coverage [Figure 6.27].

CHANGES OVER TIME

- The average worker contributions for single and family coverage have increased 75% and 74%, respectively, over the last 10 years, and 28% and 32%, respectively, over the last five years.

- Over the last five years, the average worker contribution for family coverage has increased faster than the average employer contribution for family coverage (32% vs. 14% ) and the last ten years (74% vs. 48% ).

Figure 6.28: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 1999-2017

- Estimates for premiums, worker contributions to premiums, and employer contributions to premiums presented in Section 6 do not include contributions made by the employer to Health Savings Accounts (HSAs) or Health Reimbursement Arrangements (HRAs). See Section 8 for estimates of employer contributions to HSAs and HRAs.↩

- The average percent contribution is calculated as a weighted average of all a firm’s plan types and may not necessarily equal the average worker contribution divided by the average premium.↩

- For definitions of Self-Funded and Fully-Insured plans, see the introduction to Section 10.↩

Sections

- Section 1: Cost of Health Insurance

- Section 2: Health Benefits Offer Rates

- Section 3: Employee Coverage, Eligibility, and Participation

- Section 4: Types of Plans Offered

- Section 5: Market Shares of Health Plans

- Section 6: Worker and Employer Contributions for Premiums

- Section 7: Employee Cost Sharing

- Section 8: High-Deductible Health Plans with Savings Option

- Section 9: Prescription Drug Benefits

- Section 10: Plan Funding

- Section 11: Retiree Health Benefits

- Section 12: Health and Wellness Programs

- Section 13: Grandfathered Health Plans

- Section 14: Employer Practices and Health Plan Networks