2015 Employer Health Benefits Survey

Section One: Cost of Health Insurance

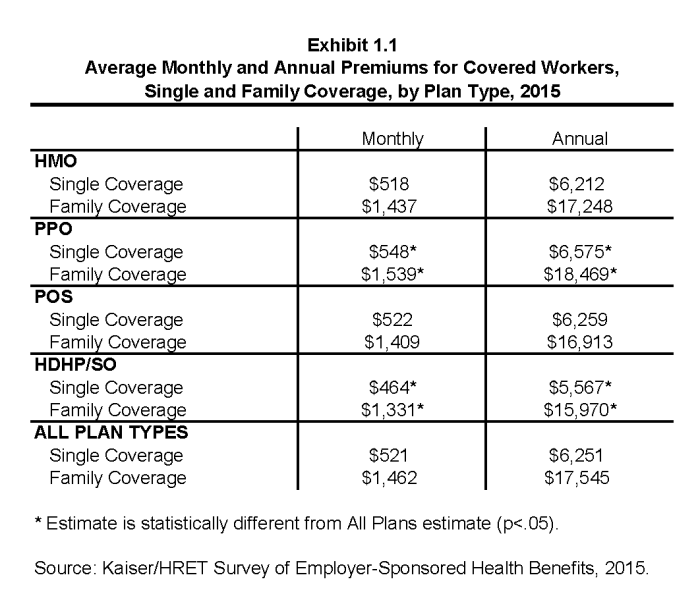

The average annual premiums in 2015 are $6,251 for single coverage and $17,545 for family coverage. The average single and family premiums increased 4% in the last year. The average family premium has increased 61% since 2005 and 27% since 2010. The average family premium for workers in small firms (3-199 workers) ($16,625) is significantly lower than average family premiums for workers in larger firms (200 or more workers) ($17,938).

Premium Costs for Single and Family Coverage

- The average premium for single coverage in 2015 is $521 per month, or $6,251 per year. The average premium for family coverage is $1,462 per month or $17,545 per year (Exhibit 1.1).

- The average annual premiums for covered workers in HDHP/SOs are lower for single ($5,567) and family coverage ($15,970) than the overall average premiums for covered workers. The average premiums for covered workers enrolled in PPO plans are higher for single ($6,575) and family coverage ($18,469) than the overall plan average. Average annual premiums for HMOs and POS plans are similar to the overall average premiums for covered workers (Exhibit 1.1).

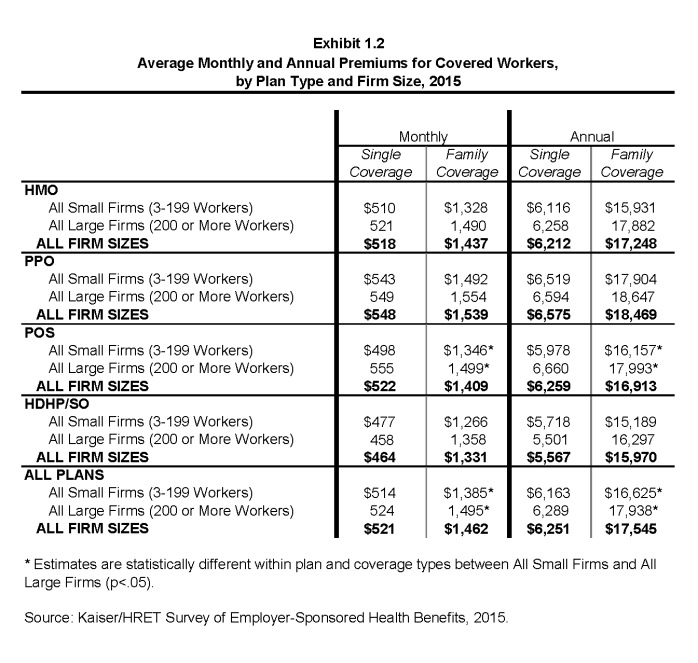

- The average annual premium for family coverage for covered workers in small firms (3-199 workers) ($16,625) is lower than the average premium for covered workers in large firms (200 or more workers) ($17,938) (Exhibit 1.2).

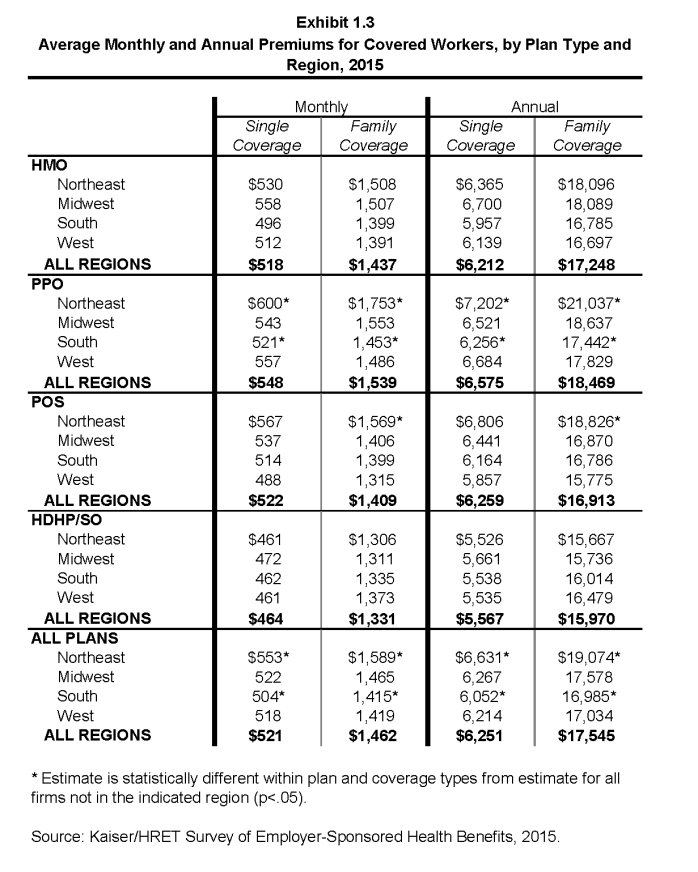

- Average single and family premiums for covered workers are higher in the Northeast ($6,631 and $19,074) and lower in the South ($6,052 and $16,985) than the average premiums for covered workers in all other regions (Exhibit 1.3).

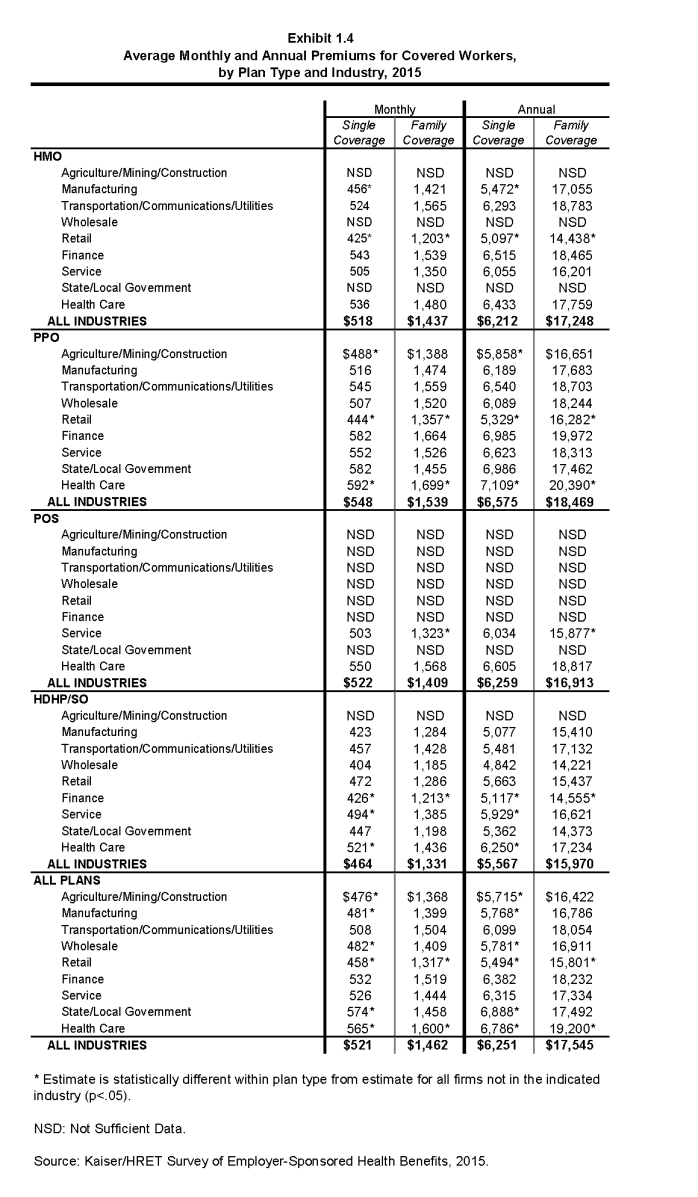

- Average family premiums for covered workers employed in the retail industry ($15,801) are lower than the average premiums for covered workers in all other industries. The average family premium for covered workers employed in the health care industry is higher than the average premium for covered workers in all other industries ($19,200) (Exhibit 1.4).

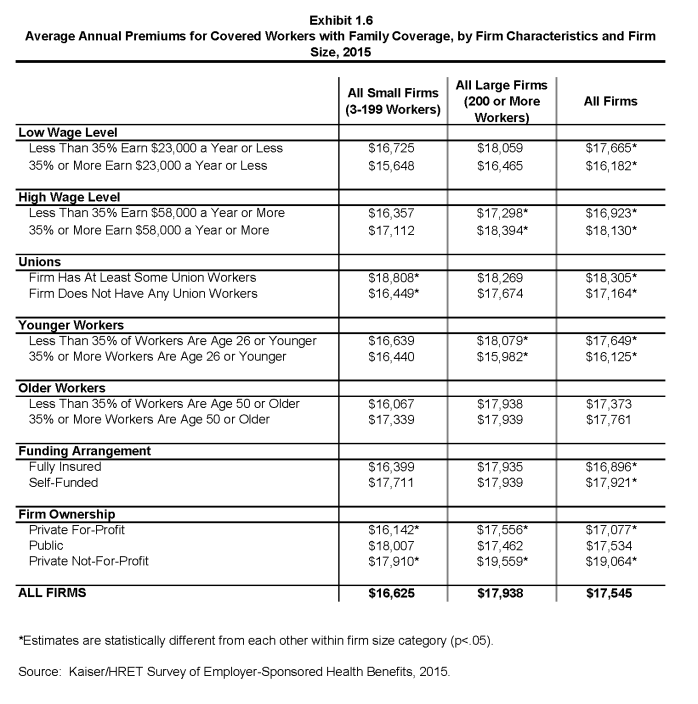

- Covered workers in firms where 35% or more of the workers are age 26 or younger have lower average family premiums ($16,125) than covered workers in firms where a lower percentage of workers are age 26 or younger ($17,649) (Exhibit 1.6).

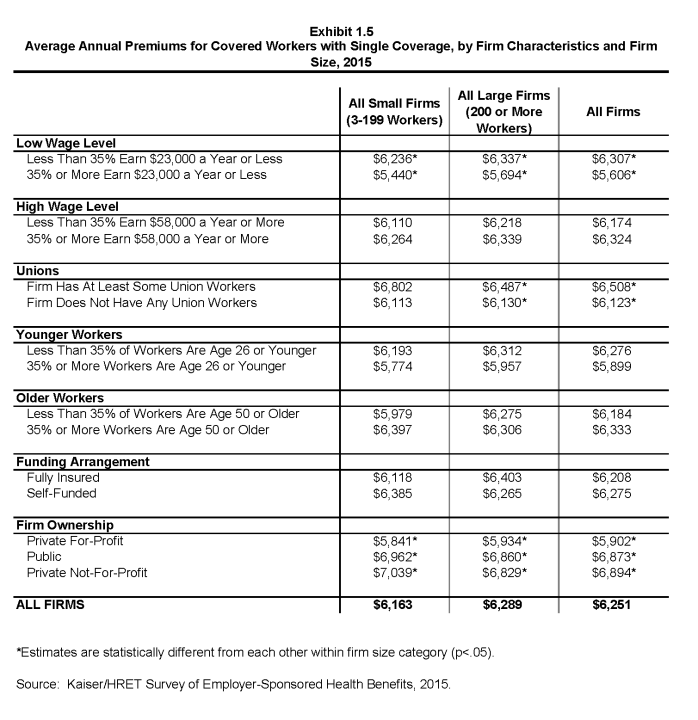

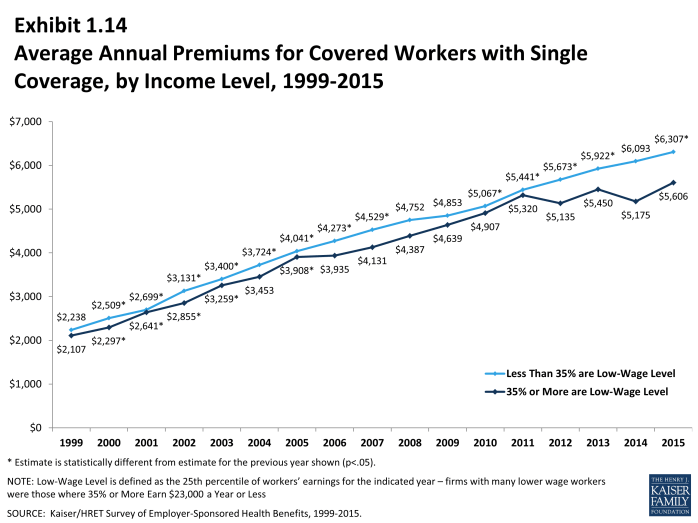

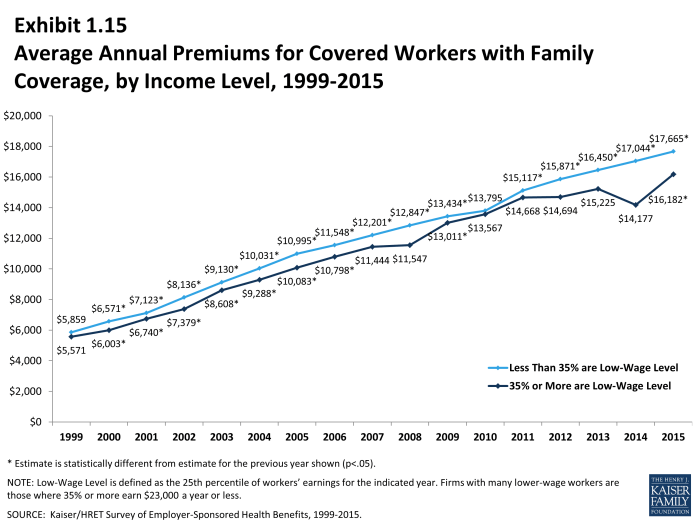

- Covered workers in firms with a large percentage of lower-wage workers (at least 35% of workers earn $23,000 per year or less) have lower average single and family premiums ($5,606 and $16,182) than covered workers in firms with a smaller percentage of lower-wage workers ($6,307 and $17,665). Covered workers in firms with a large percentage of higher-wage workers (at least 35% of workers earn $58,000 per year or more) have higher average family premiums ($18,130) than covered workers in firms with a smaller percentage of higher-wage workers ($16,923) (Exhibit 1.5) and (Exhibit 1.6).

- Covered workers in firms with some union workers have higher average premiums for single coverage and family coverage($6,508 and $18,305) than covered workers in firms without any union workers ($6,123 and $17,164).

The Distribution of Premiums

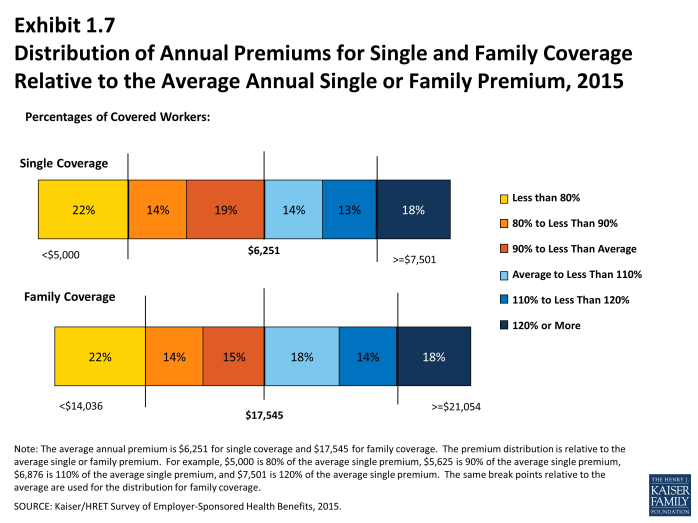

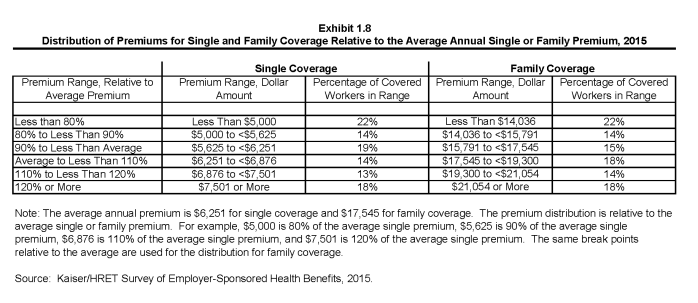

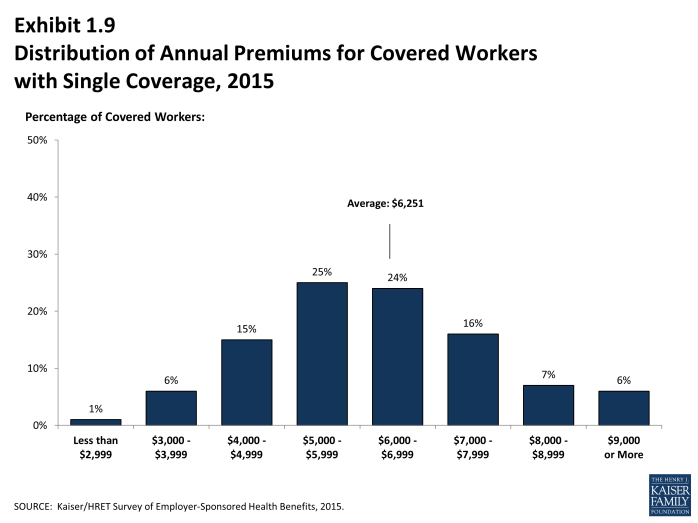

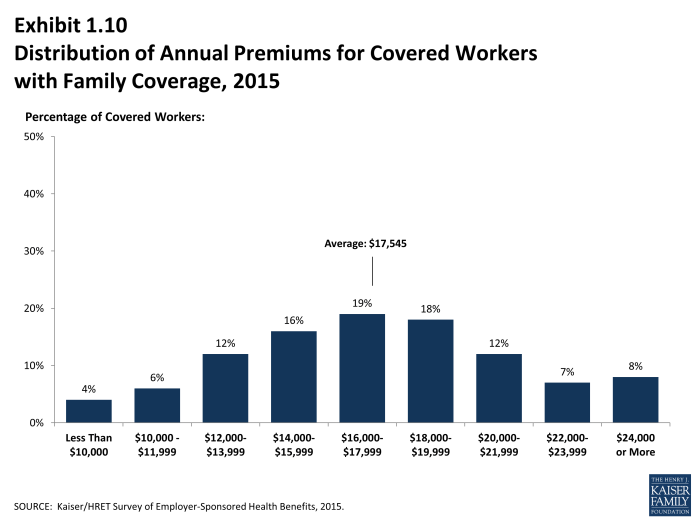

- There is considerable variation in premiums for both single and family coverage.

- Eighteen percent of covered workers are employed by firms that have a single coverage premium at least 20% higher than the average single premium, while 22% of covered workers are in firms that have a single premium less than 80% of the average single premium (Exhibit 1.7) and (Exhibit 1.8).

- For family coverage, 18% of covered workers are employed in a firm that has a family premium at least 20% higher than the average family premium, and another 22% of covered workers are in firms that have a family premium less than 80% of the average family premium (Exhibit 1.7) and (Exhibit 1.8).

- Six percent of covered workers enrolled in single coverage are in a plan with a premium of $9,000 a year or more, nearly 50% more expensive than the national average (Exhibit 1.9). Eight percent of covered workers enrolled in family coverage are in a plan with a premium of $24,000 a year or more (Exhibit 1.10).

Premium Changes Over Time

- The 2015 average single and family coverage premiums are four percent higher than the 2014 average premiums (Exhibit 1.11).

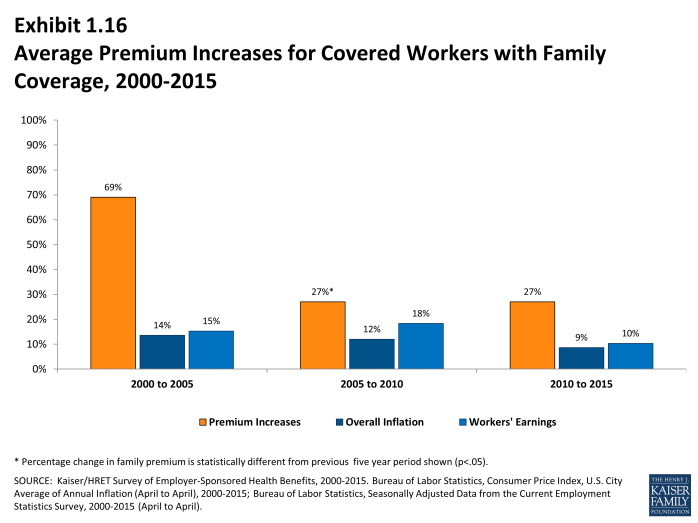

- The $17,545 average annual family premium in 2015 is 27% higher than the average family premium in 2010 and 61% higher than the average family premium in 2005 (Exhibit 1.11). The 27% premium growth in the last five years (2010 to 2015) is significantly smaller than the 69% premium growth seen between 2000 and 2005 (Exhibit 1.16).

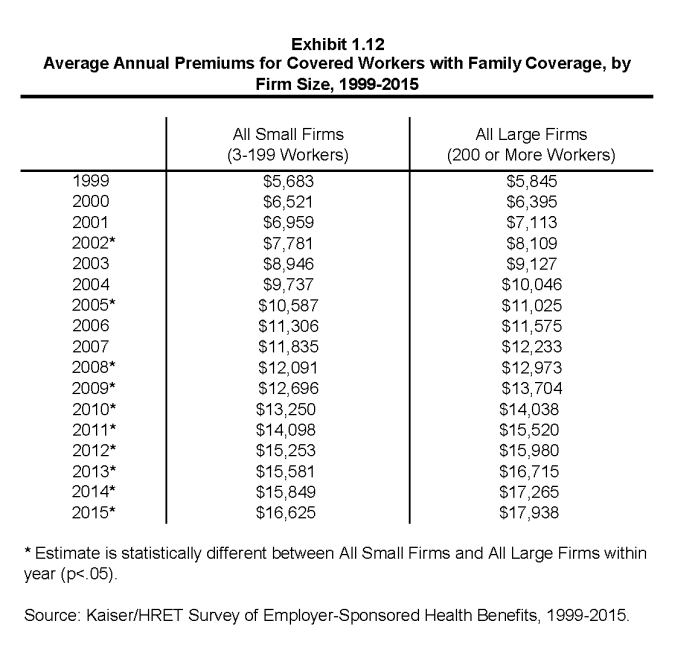

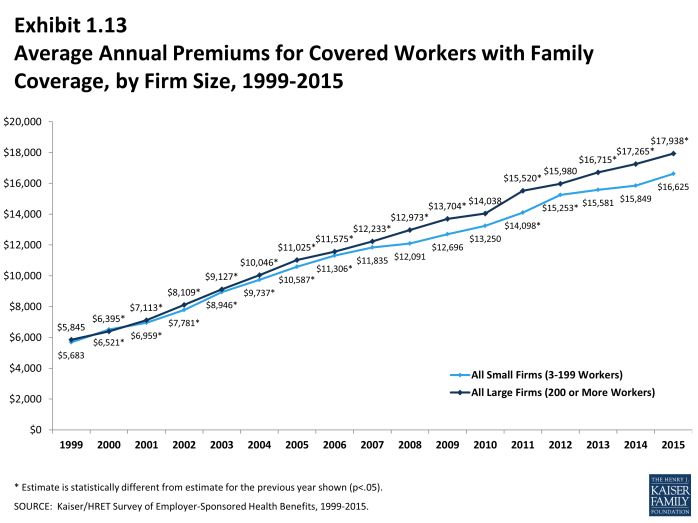

- Premiums for both small and large firms have seen a similar increase since 2010 (25% for small and 28% for large). For small firms (3 to 199 workers), the average family premium rose from $13,250 in 2010 to $16,625 in 2015. For large firms (200 or more workers), the average family premium rose from $14,038 in 2010 to $17,938 in 2015 (Exhibit 1.13).

- The rate of growth for small firms and large firms since 2005 has been similar. Since 2005, premiums for small firms (3 to 199 workers) have increased 57% ($16,625 in 2015 vs. $10,587 in 2005), and premiums for large firms have increased 63% ($17,938 in 2015 vs. $11,025 in 2005) (Exhibit 1.13).

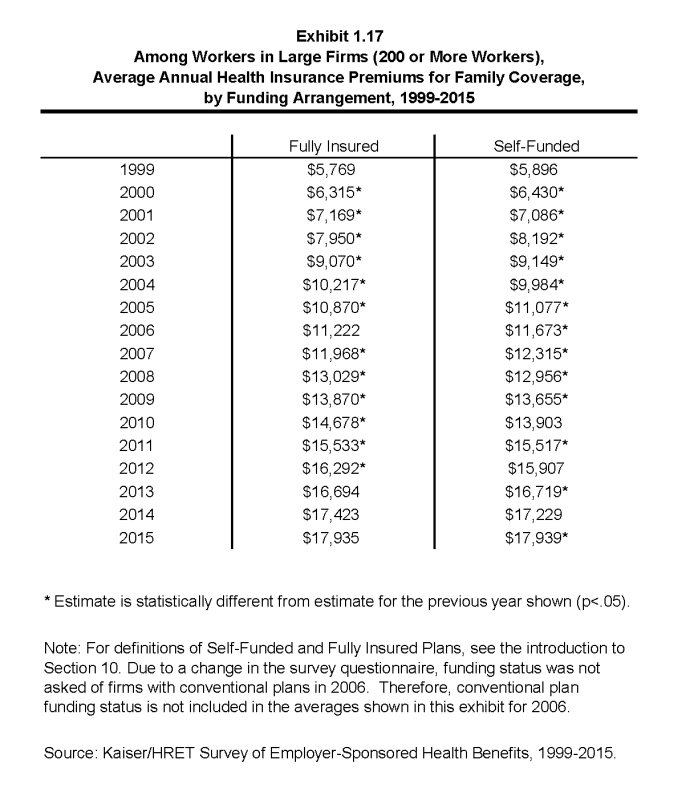

- For large firms (200 or more workers), the average family premium for covered workers in firms that are fully insured has grown at a similar rate to premiums for workers in fully or partially self-funded firms from 2010 to 2015 (22% for fully insured plans and 29% for self-funded firms) (Exhibit 1.17).

- The average family premium for self-funded plans is higher in 2015 than in 2014 ($17,939 vs. $17,229) (Exhibit 1.17).

x

Exhibit 1.1

x

Exhibit 1.2

x

Exhibit 1.3

x

Exhibit 1.4

x

Exhibit 1.6

x

Exhibit 1.5

x

Exhibit 1.7

x

Exhibit 1.8

x

Exhibit 1.9

x

Exhibit 1.10

x

Exhibit 1.11

x

Exhibit 1.16

x

Exhibit 1.13

x