2015 Employer Health Benefits Survey

Section Five: Market Shares of Health Plans

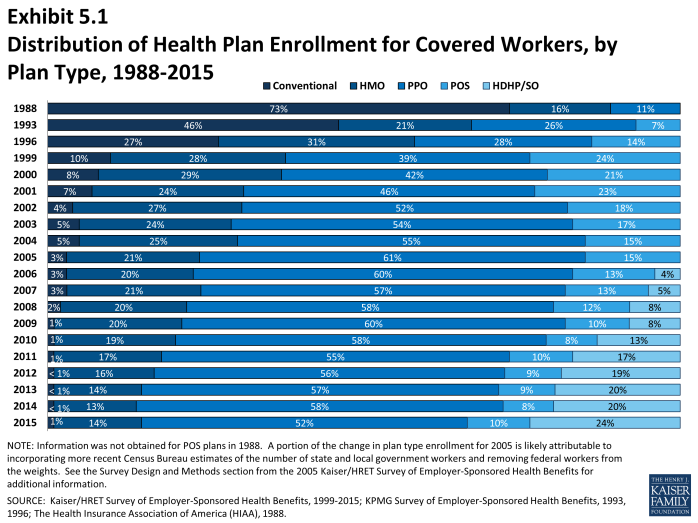

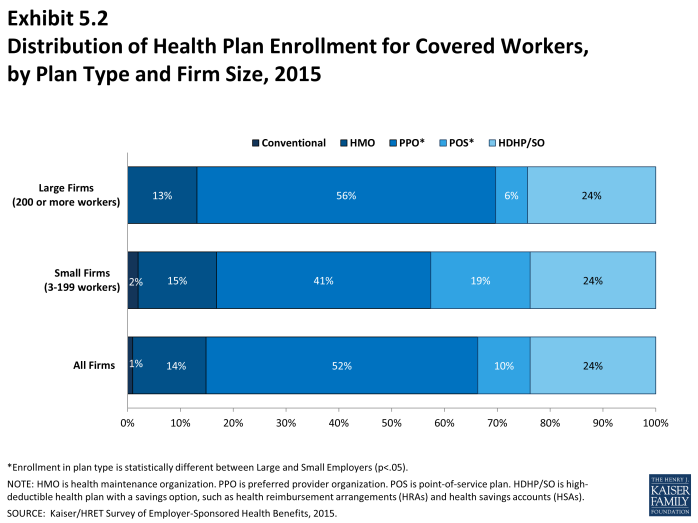

Enrollment remains highest in PPO plans, covering just over half of covered workers, followed by HDHP/SOs, HMO plans, POS plans, and conventional plans. Enrollment distribution varies by firm size: for example, PPOs are relatively more popular for covered workers at large firms (200 or more workers) than small firms (56% vs. 41%) and POS plans are relatively more popular among small firms than large firms (19% vs. 6%). While enrollment in HDHP/SO plans (24%) is statistically unchanged from 2014 (20%), it has increased from 13% in 2010. Enrollment in PPOs declined significantly from 58% in 2014 to 52% in 2015.

- Fifty-two percent of covered workers are enrolled in PPOs, followed by HDHP/SOs (24%), HMOs (14%), POS plans (10%), and conventional plans (1%) (Exhibit 5.1). More workers are enrolled in HDHP/SO plans than in HMOs in both small firms (3 to 199 workers) and large firms (Exhibit 5.2).

- The percentage of covered workers enrolled in HDHP/SOs in both large firms (200 or more workers) and small firms is similar to last year. Enrollment in HDHP/SOs increased significantly from 2009 to 2012 (Exhibit 5.1).

- Enrollment in HDHP/SOs is higher for covered workers employed at firms with many low-wage workers (at least 35% of workers earn $23,000 per year or less) than firms with fewer low-wage workers. Enrollment in HDHP/SOs is similar between large firms (200 or more workers) and small firms (Exhibit 5.2).

- Enrollment in HMOs is similar to 2014, but declined significantly from 3 years ago (16% in 2012) and 5 years ago (20% in 2009). PPO enrollment declined to just 52% after many years of growth or steady enrollment.

- Plan enrollment patterns vary by firm size. Workers in large firms (200 or more workers) are more likely than workers in small firms to enroll in PPOs (56% vs. 41%). Workers in small firms are more likely than workers in large firms to enroll in POS plans (19% vs. 6%) (Exhibit 5.2).

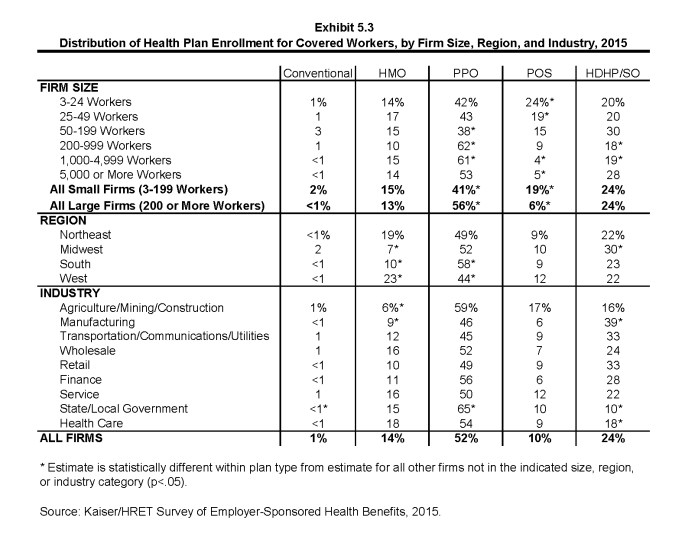

- Plan enrollment patterns also differ across regions.

- HMO enrollment is significantly higher in the West (23%) and significantly lower in the South (10%) and Midwest (7%) (Exhibit 5.3).

- Workers in the South (58%) are more likely to be enrolled in PPOs than workers in other regions; workers in the West (44%) are less likely to be enrolled in a PPO (Exhibit 5.3).

- Enrollment in HDHP/SOs is higher among workers in the Midwest (30%) than in all other regions (Exhibit 5.3).

- Plan enrollment patterns differ by industry as well.

- Covered workers in the state/local government industry (10%) and health care (18%) are significantly less likely to be enrolled in an HDHP/SO plan than covered workers in other industries (Exhibit 5.3).