2018 Employer Health Benefits Survey

Section 2: Health Benefits Offer Rates

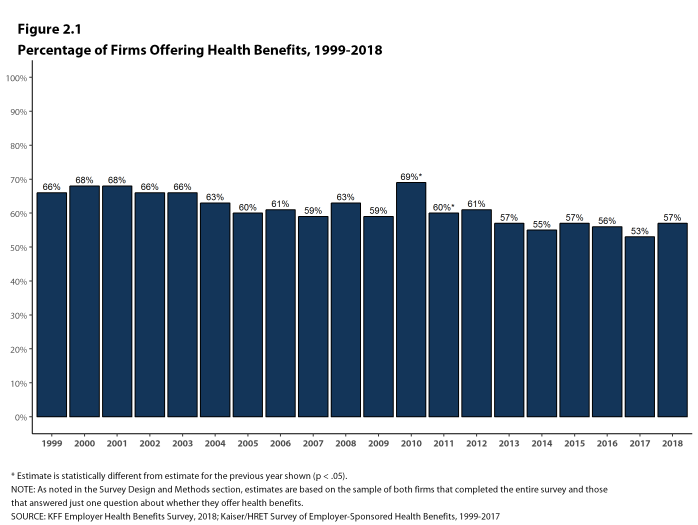

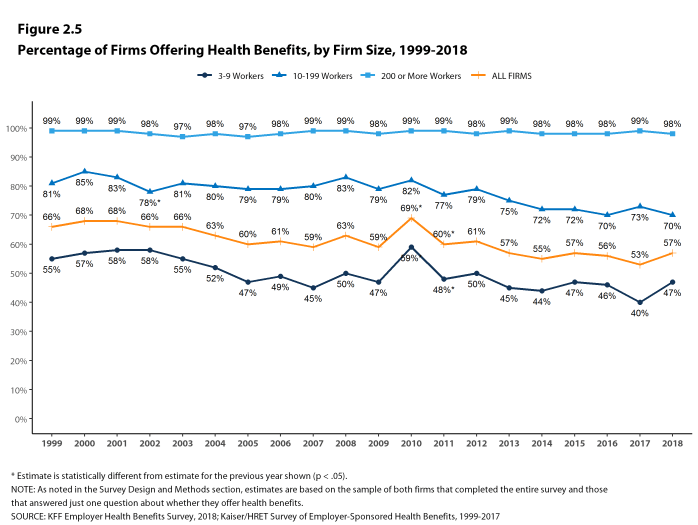

While nearly all large firms (200 or more workers) offer health benefits to at least some workers, small firms (3-199 workers) are significantly less likely to do so. The percentage of all firms offering health benefits in 2018 (57%) is similar to the percentages of firms offering health benefits last year (53%) and five years ago (57%), but lower than the percentage of firms offering health benefits ten years ago (63%). As we reported last year, there has been a long-term decline in the offer and coverage rates for employer-provided coverage, particularly among smaller firms.9

Almost all firms that offer coverage offer to dependents such as children and the spouses of eligible employees. Firms not offering health benefits continue to cite cost as the most important reason they do not do so.

FIRM OFFER RATES

- In 2018, 57% of firms offer health benefits, similar to the 53% who reported doing so in 2017 [Figure 2.1]. Because surveys only collect information from a sample of the total number of firms in the country, there is uncertainty in any estimate. Since there are so many small firms, sometimes even seemingly large differences are not statistically different.10

- The overall percentage of firms offering coverage in 2018 is the same as the percentage offering coverage in 2013 (57%) but lower than the percentage in 2008 (63%) [Figure 2.1].

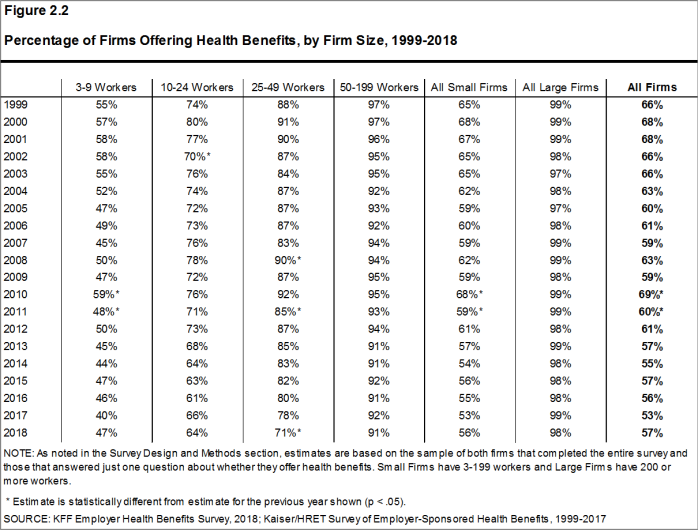

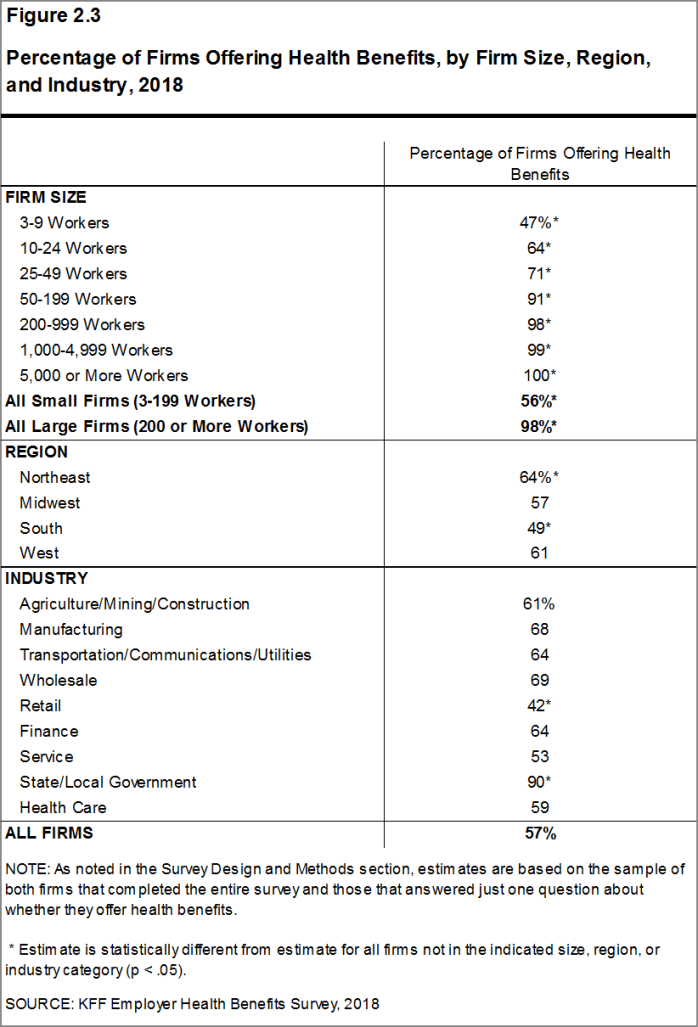

- Ninety-eight percent of large firms offer health benefits to at least some of their workers. In contrast, only 56% of small firms offer health benefits [Figures 2.2 and 2.3]. The percentages of both small and large firms offering health benefits to at least some of their workers are similar to last year [Figure 2.2].

- The smallest-sized firms are least likely to offer health insurance: 47% of firms with 3-9 workers offer coverage, compared to 71% of firms with 25-49 workers, and 91% of firms with 50-199 workers [Figure 2.3]. Since most firms in the country are small, variation in the overall offer rate is driven largely by changes in the percentages of the smallest firms (3-9 workers) offering health benefits. For more information on the distribution of firms in the country, see the Survey Design and Methods Section and Figure M.4.

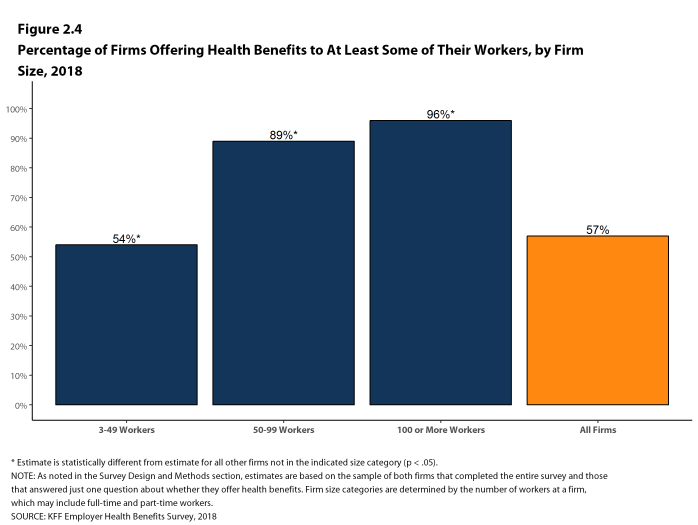

- Ninety-six percent of firms with 100 or more workers offer health benefits to at least some of their workers. Eighty-nine percent of firms with 50-99 workers offer benefits to at least some workers [Figure 2.4].

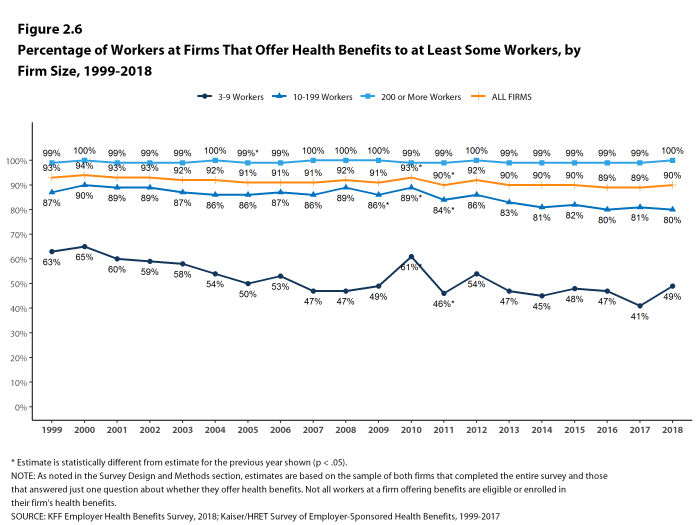

- Ninety percent of all workers are employed by a firm that offers health benefits to at least some of its workers [Figure 2.6].

Figure 2.4: Percentage of Firms Offering Health Benefits to at Least Some of Their Workers, by Firm Size, 2018

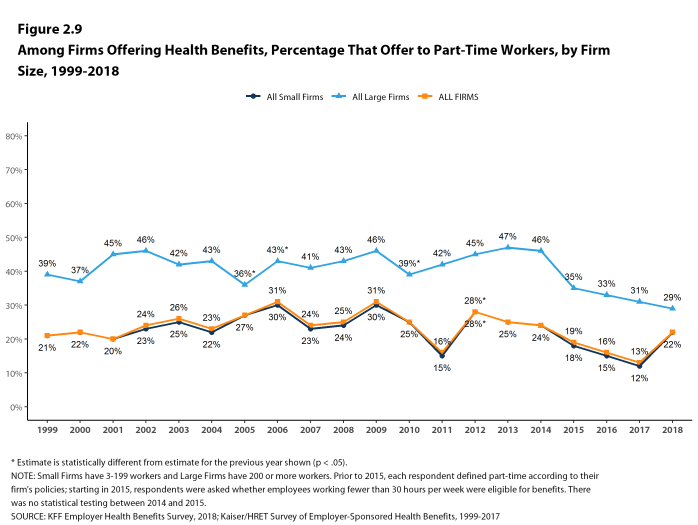

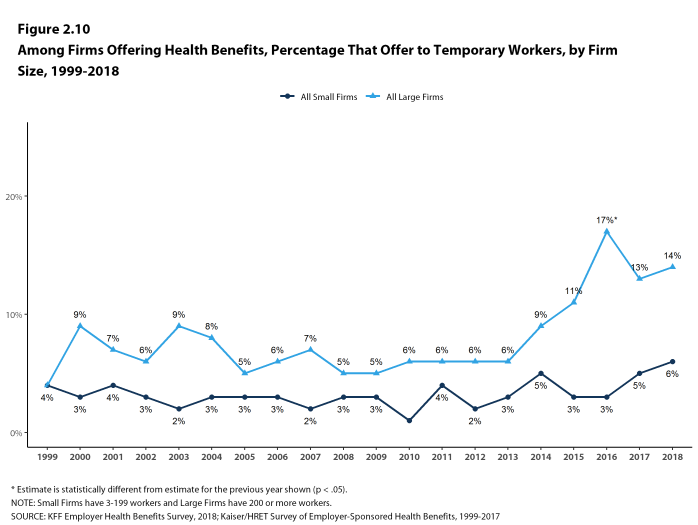

PART-TIME AND TEMPORARY WORKERS

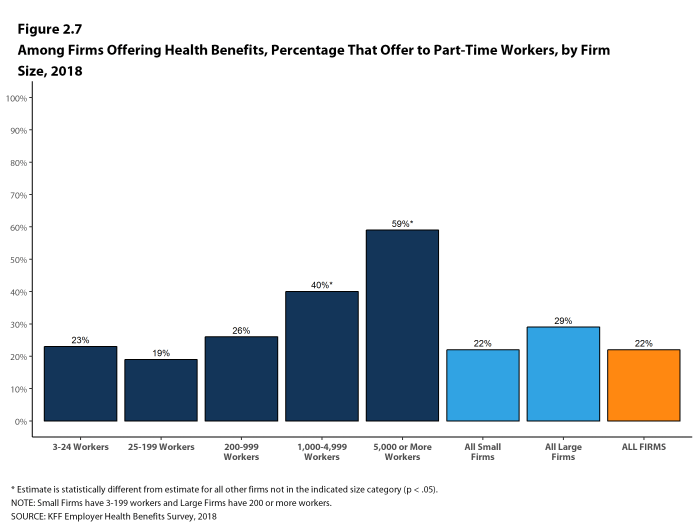

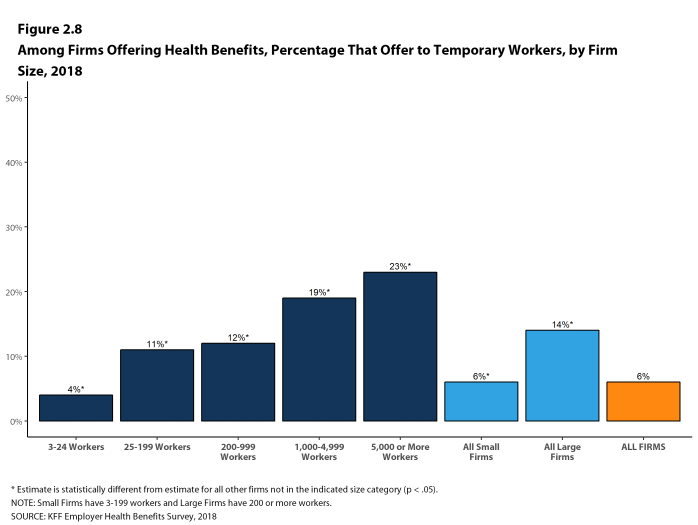

- Among firms offering health benefits, relatively few offer benefits to their part-time and temporary workers.

- The Affordable Care Act (ACA) defines full-time workers as those who on average work at least 30 hours per week, and part-time workers as those who on average work fewer than 30 hours per week. The employer shared responsibility provision of the ACA requires that firms with at least 50 full-time equivalent employees offer most full-time employees coverage that meets minimum standards or be assessed a penalty.11

Beginning in 2015, we modified the survey to explicitly ask employers whether they offered benefits to employees working fewer than 30 hours. Our previous question did not include a definition of “part-time”. For this reason, historical data on part-time offer rates are shown, but we did not test whether the differences between 2014 and 2015 were significant. Many employers may work with multiple definitions of part-time; one for their compliance with legal requirements and another for internal policies and programs.

- In 2018, 22% of all firms that offer health benefits offer them to part-time workers. Small firms and large firms have similar rates of offering to part-time workers [Figure 2.7].

- A small percentage (6%) of firms offering health benefits offer them to temporary workers [Figure 2.8].

- Among firms offering health benefits, large firms are more likely than small firms to offer benefits to temporary workers (14% vs. 6%) [Figure 2.8].

- The percentage of large firms offering health benefits to temporary workers is not statistically different from the 13% reported in 2017, but is an increase from ten years ago (5%) [Figure 2.10].

Figure 2.7: Among Firms Offering Health Benefits, Percentage That Offer to Part-Time Workers, by Firm Size, 2018

Figure 2.8: Among Firms Offering Health Benefits, Percentage That Offer to Temporary Workers, by Firm Size, 2018

Figure 2.9: Among Firms Offering Health Benefits, Percentage That Offer to Part-Time Workers, by Firm Size, 1999-2018

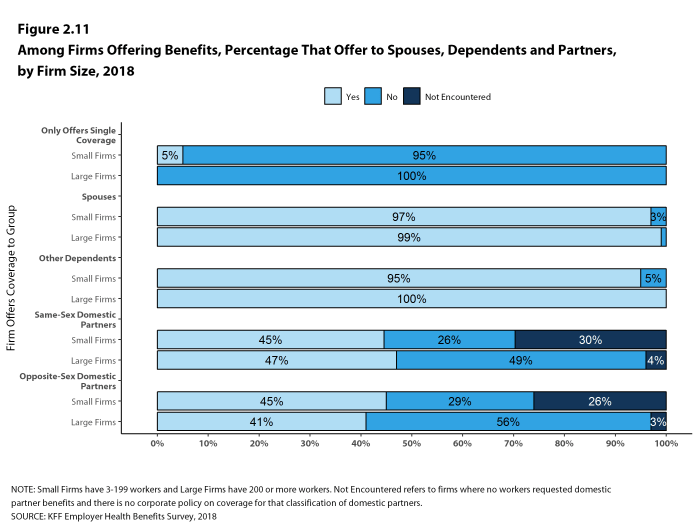

SPOUSES, DEPENDENTS, AND DOMESTIC PARTNER BENEFITS

- The majority of firms offering health benefits offer to spouses and dependents, such as children.

- In 2018, 97% of small firms and 99% of large firms offering health benefits offer coverage to spouses, similar to the percentages last year [Figure 2.11].

- Ninety-five percent of small firms and 100% of large firms offering health benefits cover other dependents, such as children, similar to last year [Figure 2.11].

- Five percent of small firms offering health benefits offer only single coverage to their workers [Figure 2.11].

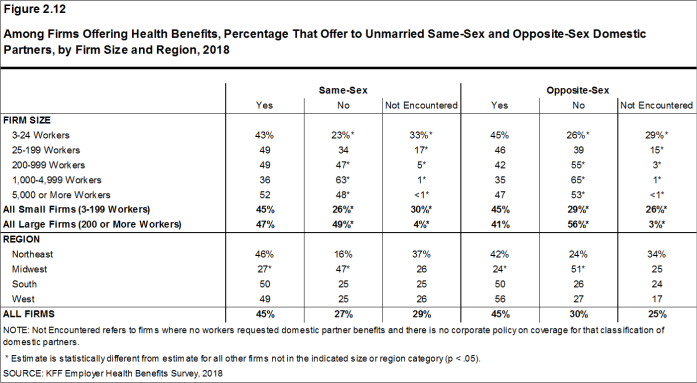

- Firms were also asked whether they offer health benefits to same-sex or opposite-sex domestic partners. While definitions may vary, employers often define domestic partners as an unmarried couple who has lived together for a specified period of time. Firms may define domestic partners separately from any legal requirements a state may have.

- Forty-five percent of firms offering health benefits offer coverage to opposite-sex domestic partners, similar to the 36% that did so last year.

- Forty-five percent of firms offering health benefits offer coverage to same-sex domestic partners, similar to the 40% that did so last year.

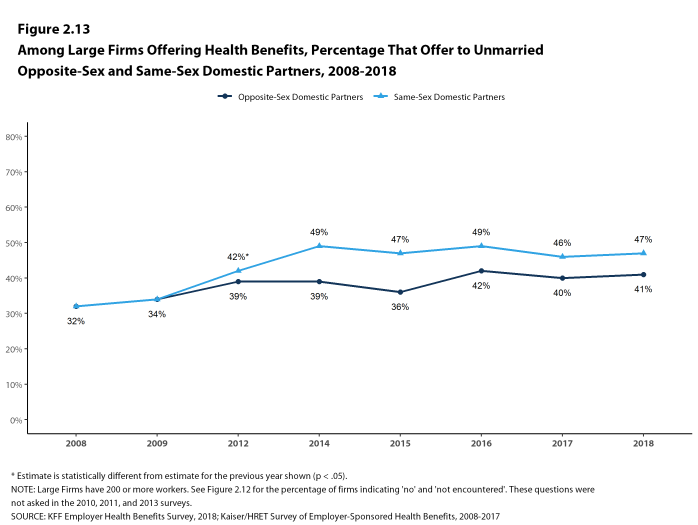

- Forty-one percent of large firms offering health benefits offer coverage to opposite-sex domestic partners, similar to the 40% that did so last year [Figure 2.13].

- Forty-seven percent of large firms offering health benefits offer coverage to same-sex domestic partners, similar to the 46% that did so last year [Figure 2.13].

- When firms are asked if they offer health benefits to opposite or same-sex domestic partners, many small firms report that they have not encountered this issue. These firms may not have formal human resource policies on domestic partners simply because none of the firm’s workers have asked to cover a domestic partner. Regarding health benefits for opposite-sex domestic partners, 26% of small firms report that they have not encountered this request or that the question was not applicable. Similarly, for health benefits for same-sex domestic partners, 30% of small firms report that they have not encountered the request or that the question was not applicable [Figure 2.12].

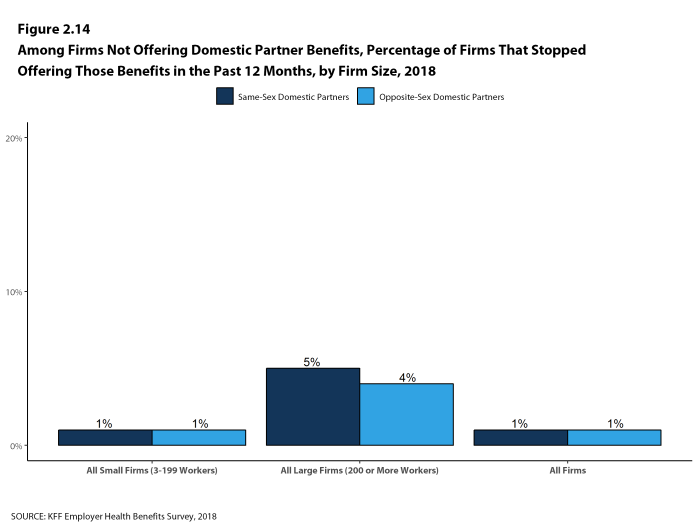

- Among large firms not offering health benefits to same-sex domestic partners, 5% stopped offering them within the past 12 months [Figure 2.14].

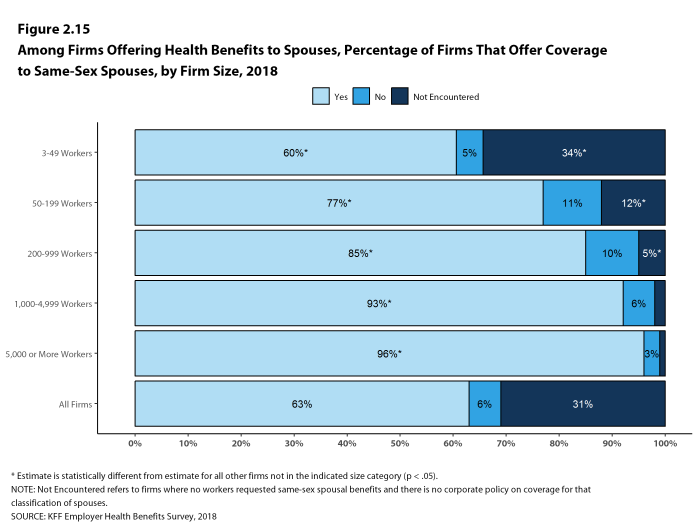

- Over half (63%) of firms that offer health benefits to spouses also offer coverage to same-sex spouses [Figure 2.15].

- Large firms are more likely than small firms to offer coverage to same-sex spouses (87% vs. 62%).

- Small firms are more likely than large firms to report that this request has not been encountered (32% vs. 4%).

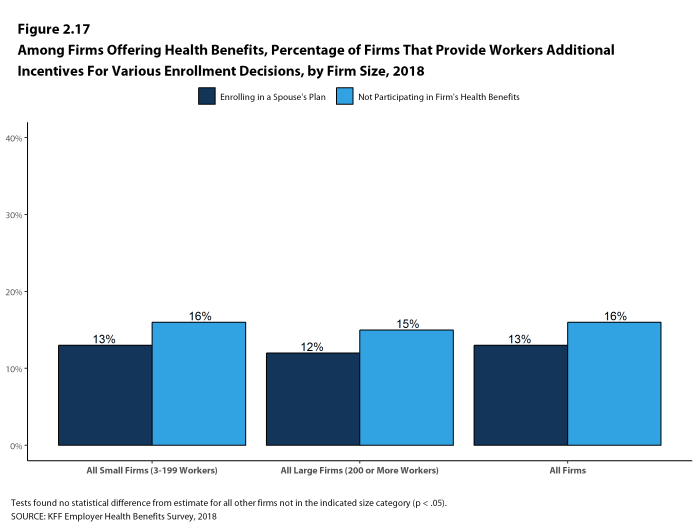

- Among all firms that offer health benefits, 13% report providing additional compensation or benefits to employees if they enroll in a spouse’s plan, and 16% provide additional compensation or benefits to employees if they do not participate in the firm’s health benefits [Figure 2.17].

Figure 2.11: Among Firms Offering Benefits, Percentage That Offer to Spouses, Dependents and Partners, by Firm Size, 2018

Figure 2.12: Among Firms Offering Health Benefits, Percentage That Offer to Unmarried Same-Sex and Opposite-Sex Domestic Partners, by Firm Size and Region, 2018

Figure 2.13: Among Large Firms Offering Health Benefits, Percentage That Offer to Unmarried Opposite-Sex and Same-Sex Domestic Partners, 2008-2018

Figure 2.14: Among Firms Not Offering Domestic Partner Benefits, Percentage of Firms That Stopped Offering Those Benefits In the Past 12 Months, by Firm Size, 2018

Figure 2.15: Among Firms Offering Health Benefits to Spouses, Percentage of Firms That Offer Coverage to Same-Sex Spouses, by Firm Size, 2018

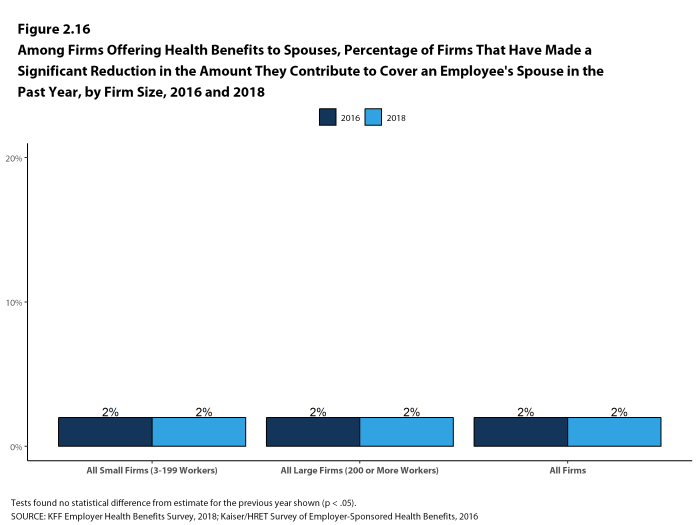

Figure 2.16: Among Firms Offering Health Benefits to Spouses, Percentage of Firms That Have Made a Significant Reduction In the Amount They Contribute to Cover an Employee’s Spouse In the Past Year, by Firm Size, 2016 and 2018

Figure 2.17: Among Firms Offering Health Benefits, Percentage of Firms That Provide Workers Additional Incentives for Various Enrollment Decisions, by Firm Size, 2018

FIRMS NOT OFFERING HEALTH BENEFITS

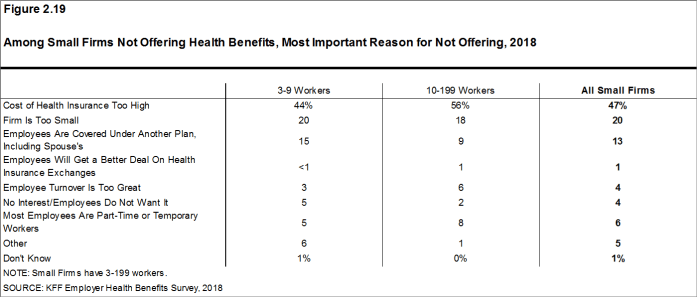

- The survey asks firms that do not offer health benefits if they have offered insurance or shopped for insurance in the recent past, and about their most important reasons for not offering coverage. Because such a small percentage of large firms report not offering health benefits, we present responses for small non-offering firms only.

- The cost of health insurance remains the primary reason cited by firms for not offering health benefits. Among small firms not offering health benefits, 47% cite high cost as “the most important reason” for not doing so, followed by “the firm is too small” (20%). Few small firms indicate that they do not offer because they believe employees will get a better deal on the health insurance exchanges (1%) [Figure 2.19].

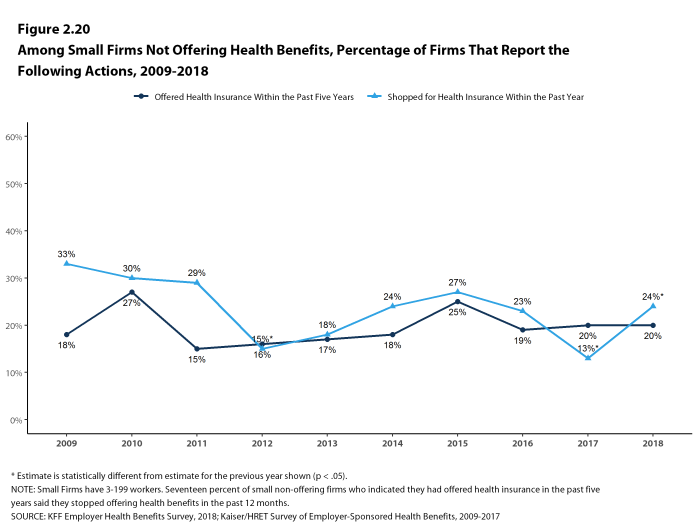

- Many small non-offering firms have either offered health insurance in the past five years or shopped for health insurance in the past year.

- Twenty percent of small non-offering firms have offered health benefits in the past five years, the same percentage reported last year [Figure 2.20].

- Twenty-four percent of small non-offering firms have shopped for coverage in the past year, an increase from last year (13%) [Figure 2.20].

- Among small non-offering firms that report they stopped offering coverage within the past five years, 17% stopped offering coverage within the past year, similar to the percentage reported last year.

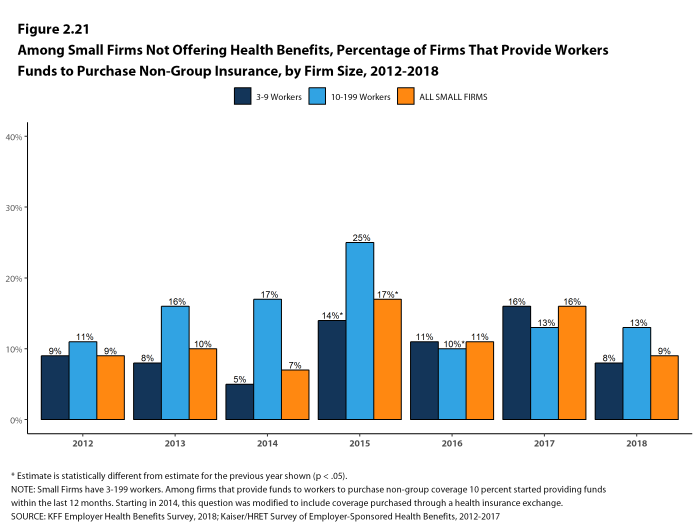

- Among small non-offering firms, 9% report that they provide funds to their employees to purchase health insurance on their own in the individual market or through a health insurance exchange [Figure 2.21].

Figure 2.19: Among Small Firms Not Offering Health Benefits, Most Important Reason for Not Offering, 2018

Figure 2.20: Among Small Firms Not Offering Health Benefits, Percentage of Firms That Report the Following Actions, 2009-2018

- Kaiser Family Foundation. Diminishing offer and coverage rates among private sector employees. Menlo Park, (CA): KFF; 2016 Sep (cited 2017 Jul 13). Available from: http://www.kff.org/private-insurance/issue-brief/diminishing-offer-and-coverage-rates-among-private-sector-employees/↩

- For more information on the Employer Health Benefits Survey’s weighting and design please see the Survey Design and Methods section.↩

- Internal Revenue Code. 26 U.S. Code § 4980H – Shared responsibility for employers regarding health coverage. 2011. https://www.gpo.gov/fdsys/pkg/USCODE-2011-title26/pdf/USCODE-2011-title26-subtitleD-chap43-sec4980H.pdf↩