2018 Employer Health Benefits Survey

Section 11: Retiree Health Benefits

Retiree health benefits are an important consideration for older workers making decisions about their retirement. Retiree benefits can be an important source of coverage for people retiring before Medicare eligibility. For retirees with Medicare coverage, retiree health benefits can provide an important supplement to Medicare, helping them pay for cost sharing, and benefits not otherwise covered by Medicare.

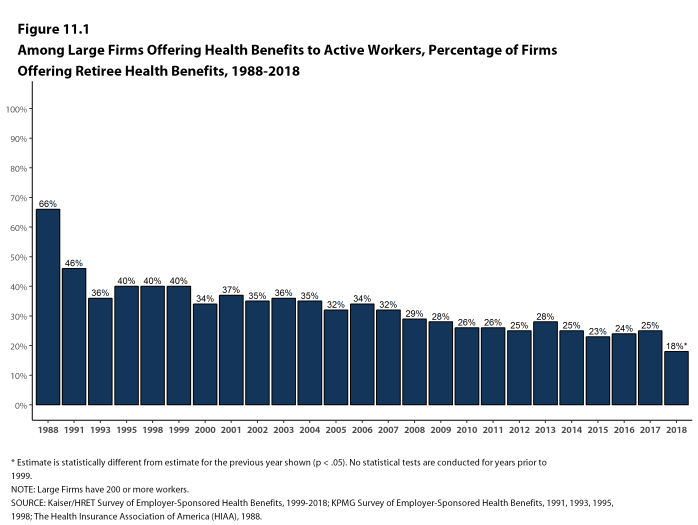

The percentage of large firms offering retiree coverage has decreased over time. This year we report a decrease in the share of large firms offering retiree health benefits, partly attributable to a 17% decline in the percentage of public employers reporting that they provide benefits to any employee that has retired from the organization. While this decline is not statistically significant in itself, it has a large influence on the overall estimate, and we are skeptical that this type of change took place over a one-year period. We would note that there has been concern about the ability of public entities to finance these benefits, with some cities and other public entities deciding to stop providing benefits to current or future employees when they retire. It is possible that some respondents may have focused on the changing eligibility for future retirees rather than on the benefits provided to current retirees in responding to this question. We note that some respondents in the panel changed their response to the question in the last year. To address this potential issue, beginning in 2019 we will include one or more follow-up questions to better ascertain whether respondents are considering only benefits offered to current retirees when answering this question.

This survey asks retiree health benefits questions only of large firms (200 or more workers).

EMPLOYER RETIREE BENEFITS

- In 2018, 18% of large firms that offer health benefits to their workers offer retiree coverage, a significantly lower percentage than in recent years [Figure 11.1]. As discussed above, despite this longer-term decrease, we are skeptical about the magnitude of this change over one year and plan to clarify the question in the future.

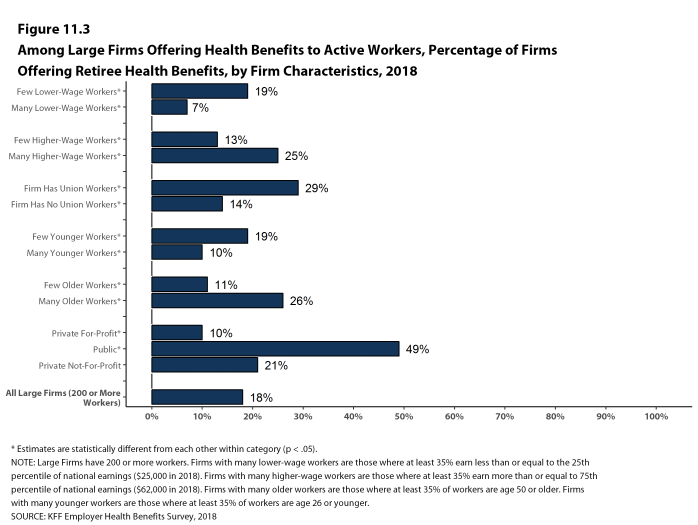

- Retiree health benefits offer rates vary considerably by firm characteristics.

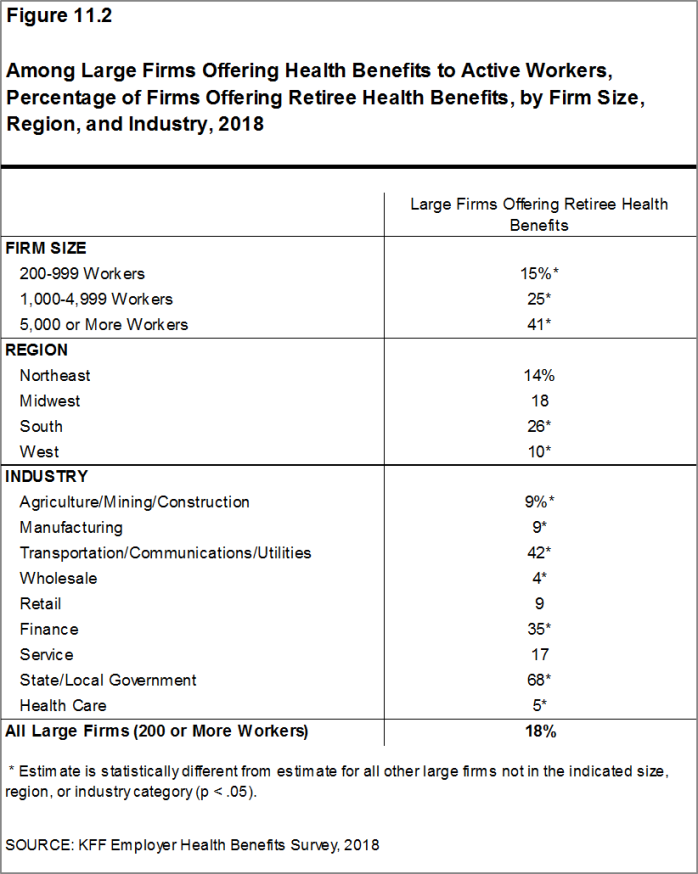

- Among large firms offering health benefits, the likelihood that a firm will offer retiree health benefits increases with firm size [Figure 11.2].

- The share of large firms offering retiree health benefits varies considerably by industry [Figure 11.2].

- Despite the lower percentage of public firms reporting that they offer retiree health benefits, among large firms offering health benefits, the share of public firms offering retiree benefits (49%) is higher than the shares of private for-profit firms (10%) or private not-for-profit firms (21%) offering retiree benefits [Figure 11.3].

- Large firms with at least some union workers are more likely to offer retiree health benefits than large firms without any union workers (29% vs. 14%) [Figure 11.3].

Figure 11.1: Among Large Firms Offering Health Benefits to Active Workers, Percentage of Firms Offering Retiree Health Benefits, 1988-2018

Figure 11.2: Among Large Firms Offering Health Benefits to Active Workers, Percentage of Firms Offering Retiree Health Benefits, by Firm Size, Region, and Industry, 2018

EARLY RETIREES AND MEDICARE-AGE RETIREES

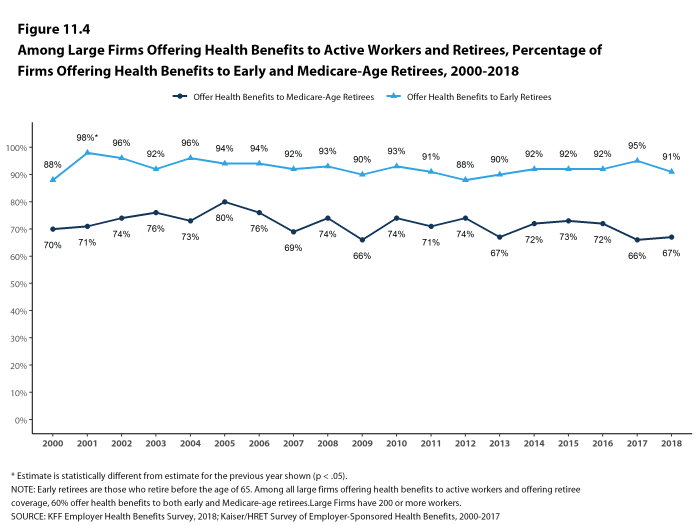

- Among large firms offering retiree health benefits, most firms offer to early retirees under the age of 65 (91%). A lower percentage (67%) of large firms offering retiree health benefits offer to Medicare-age retirees. Despite the change in the overall offer rate for retiree benefits, these percentages are similar to those last year [Figure 11.4].

- Among large firms offering retiree health benefits, 60% offer health benefits to both early and Medicare-age retirees.

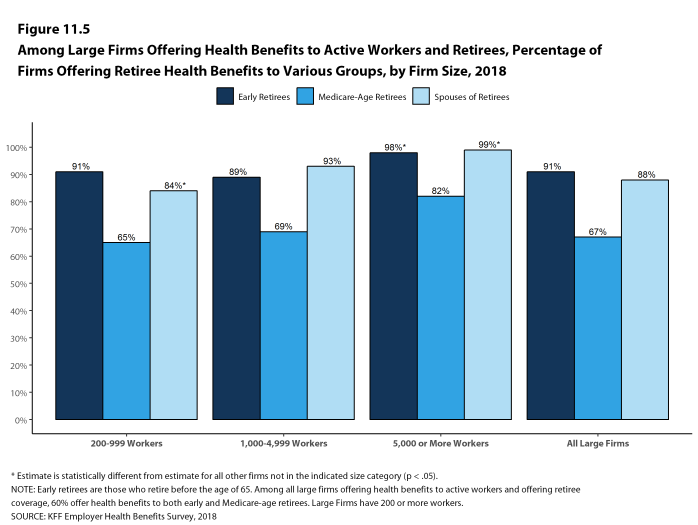

- Among large firms offering retiree benefits, a large share (88%) report offering benefits to the spouses of retirees [Figure 11.5].

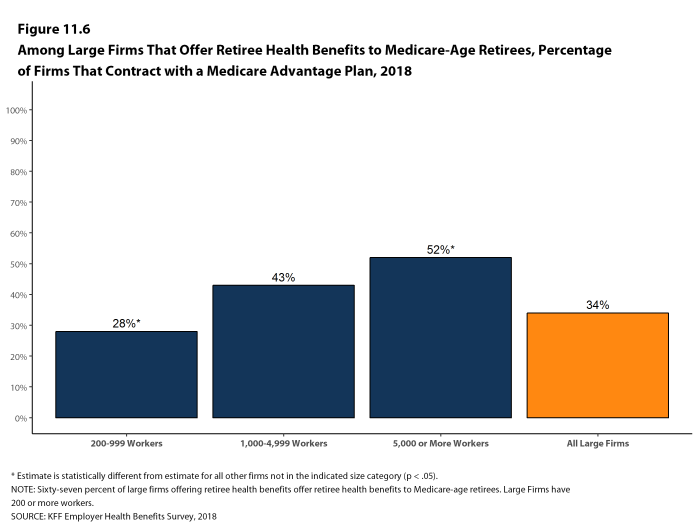

- Thirty-four percent of large employers offering retiree health benefits to Medicare-age retirees offer coverage through a contract with a Medicare Advantage plan. Firms with 5,000 or more workers are more likely to offer retiree benefits through a contract with a Medicare Advantage plan than other large firms [Figure 11.6].

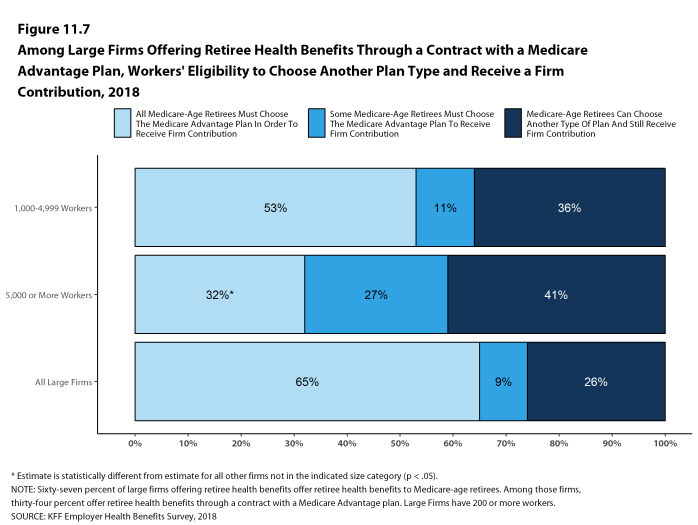

- Seventy-four percent of large firms offering Medicare-age retirees health benefits through a contract with a Medicare Advantage plan require some or all Medicare-age retirees to choose the Medicare Advantage plan in order to receive a contribution from the firm, while 26% allow Medicare-age retirees to choose another type of plan and still receive a firm contribution [Figure 11.7].

Figure 11.4: Among Large Firms Offering Health Benefits to Active Workers and Retirees, Percentage of Firms Offering Health Benefits to Early and Medicare-Age Retirees, 2000-2018

Figure 11.5: Among Large Firms Offering Health Benefits to Active Workers and Retirees, Percentage of Firms Offering Retiree Health Benefits to Various Groups, by Firm Size, 2018

Figure 11.6: Among Large Firms That Offer Retiree Health Benefits to Medicare-Age Retirees, Percentage of Firms That Contract With a Medicare Advantage Plan, 2018

ELIGIBILITY FOR NEW AND RETIRING WORKERS

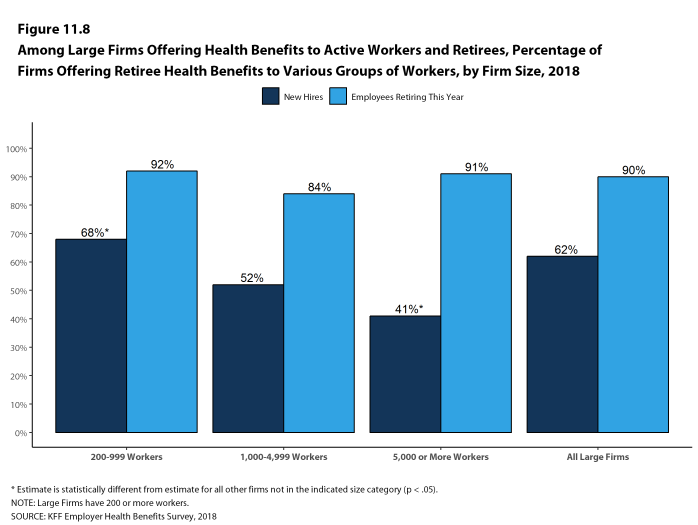

- Among large firms offering retiree health benefits, 62% report that new hires will be eligible for the firm’s retiree health benefits and 90% report that employees retiring this year will be eligible for retiree health benefits [Figure 11.8].

PRIVATE EXCHANGES

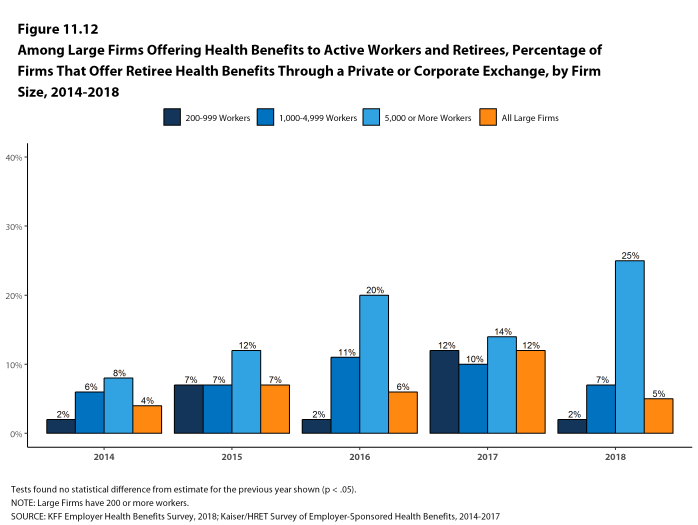

- Private exchanges have received considerable attention over the past several years. They are typically created by a consulting company, broker, or insurer, and are different than the public exchanges created under the Affordable Care Act (ACA). Private exchanges allow employees or retirees from multiple companies to choose from a larger number of health benefit options than one firm would generally provide.

- Five percent of large firms, including 25% of firms with 5,000 or more workers, offering retiree health benefits report they offer benefits through a private exchange [Figure 11.12]. For more information on the use of private exchanges for active employees, please see Section 14.

COST REDUCTION STRATEGIES

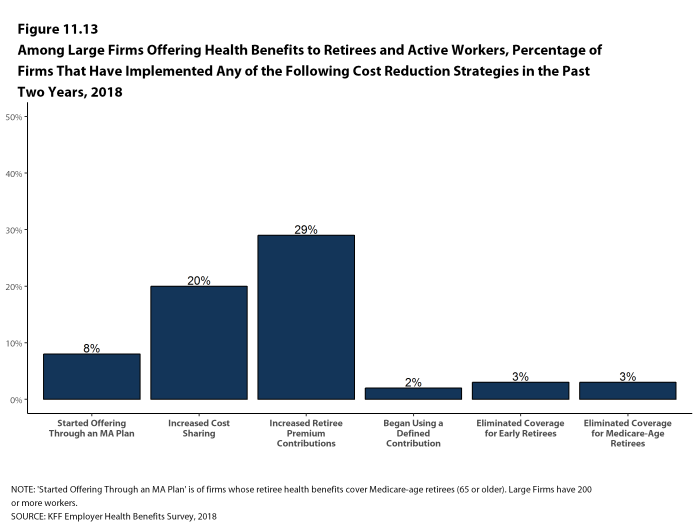

Large firms offering retiree health benefits were asked if they had implemented specified cost reduction strategies within the past two years.

- Eight percent of large firms offering retiree benefits to Medicare-age retirees reported that they started offering benefits through a Medicare Advantage Plan within the past two years [Figure 11.13].

- Among large firms offering retiree health benefits, 20% say they increased patient cost sharing and 29% say they increased retiree premium contributions in the last two years [Figure 11.13]. The percentage of firms reporting increasing retiree premium contributions increases with firm size.

- Small shares of large firms offering retiree health benefits reported other changes: 2% started using a defined contribution approach to permit retirees to purchase benefits on a public or private exchange; 3% eliminated coverage for early retirees; and 3% eliminated coverage for Medicare-age retirees [Figure 11.13].