Medicare Beneficiaries Without Supplemental Coverage Are at Risk for Out-of-Pocket Costs Relating to COVID-19 Treatment

The coronavirus outbreak has heightened concerns about out-of-pocket health care costs and the ability to pay for COVID-19 treatment. This is of particular concern for older adults who are at higher risk of getting seriously ill from the coronavirus and may require hospitalization. The Trump Administration recently announced that the uninsured will not have to pay any hospital costs for COVID-19 treatment, and many insurers are voluntarily waiving cost sharing for treatment, including firms that cover a majority of Medicare Advantage enrollees. Other Medicare beneficiaries may also have some or all of their COVID-19 treatment costs covered by supplemental coverage, such as Medicaid, employer-based insurance, or Medigap.

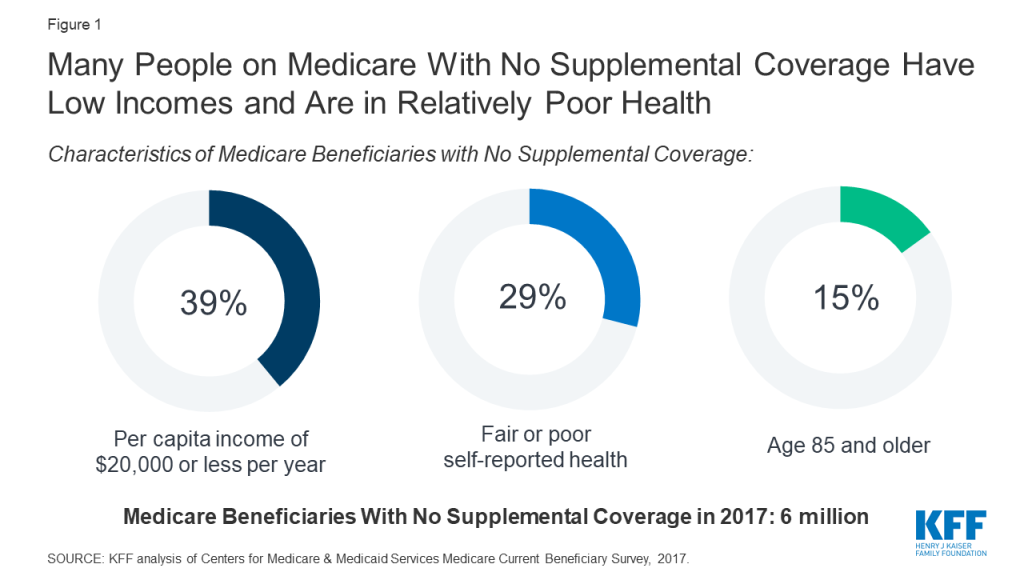

However, a significant number of Medicare beneficiaries – nearly 6 million adults 65 and older and younger adults with long-term disabilities – do not have any supplemental coverage and therefore could be hit with a large hospital bill if they are admitted for COVID-19. Nearly 4 in 10 (39%) have incomes less than $20,000 a year, nearly 3 in 10 (29%) are in fair or poor health, and 15% are age 85 or older (Figure 1). Close to 10% of these beneficiaries live in long-term care facilities, such as nursing homes, which CMS has recognized as particularly susceptible to infections.

While the Medicare program protects beneficiaries from surprise medical bills for covered services, beneficiaries are responsible for paying separate deductibles for hospitalizations, outpatient services, and prescription drugs, as well as cost sharing for almost all services they use. Without supplemental coverage, these 6 million beneficiaries would face out-of-pocket costs for any services needed to treat COVID-19, which could include, at minimum, a $1,408 deductible for an inpatient hospitalization, unless they had been hospitalized in the past couple of months.

To illustrate, for a Medicare beneficiary living on income of $20,000 per year (just above 150% of the Federal Poverty Level for one person), the $1,408 deductible for an inpatient hospitalization would, by itself, consume fully 7% of annual income. These out-of-pocket costs would come on top of other expenses for beneficiaries, many of whom were having problems paying medical bills due to costs prior to the coronavirus crisis, particularly those who do not qualify for any help with deductibles or cost sharing under Medicaid or the Medicare Savings Programs.

These estimates may be conservative because they do not take into account any additional expenses for COVID-19 treatment, such as an extended stay in a skilled nursing facility, which requires a $176 copayment for each day of care after 20 days, or other outpatient services.

These 6 million Medicare beneficiaries are not the only Americans who face potentially high out-of-pocket costs if they are hospitalized for COVID-19, though this group has received little attention so far in policy discussions. Certainly others, such as privately insured patients in high deductible plans, are also at risk of seeing a big bill for their treatment if the insurer has not waived cost-sharing for COVID-19 treatment. Unfortunately, these potentially high out-of-pocket expenses for COVID-related treatment come just when the economy is in freefall, exacerbating worries about affordability in the midst of great financial uncertainty for many Americans.