How Much Could Medicare Beneficiaries Pay For a Hospital Stay Related to COVID-19?

As the coronavirus continues to spread, the number of people on Medicare admitted to the hospital for COVID-19 related illness is expected to rise, mainly because older people are at higher risk of getting seriously ill if they get infected. According to the CDC’s analysis of preliminary data, 45% of all hospitalizations and over half (53%) of intensive care unit (ICU) admissions are for people ages 65 and older. While only a relatively small share of adults who test positive for coronavirus are expected to get sick enough to be hospitalized, those who do could face significant out-of-pocket costs for their hospital stay, and many people on Medicare already face relatively high out-of-pocket health care costs.

We analyze how much Medicare beneficiaries could pay out-of-pocket for an inpatient hospital admission under traditional Medicare (assuming no supplemental coverage) or Medicare Advantage plans. As a proxy for a hospitalization for COVID-19, we analyze costs based on an average length of stay of 5 days for an adult with simple pneumonia with pleurisy and 7 days for an inpatient admission for pneumonia involving an ICU stay. At this stage of the pandemic, we do not have more precise indicators of length of stay for people admitted specifically for COVID-19 nor precise indicators by age. For traditional Medicare, beneficiaries without supplemental coverage would incur the Part A hospital deductible of $1,408 in 2020 (for one spell of illness). For Medicare Advantage, we use 2020 Medicare Plan Finder data to calculate out-of-pocket costs for inpatient stays for Medicare Advantage enrollees, weighted by 2020 plan enrollment. Because Medicare Advantage plans typically charge a daily copayment for inpatient stays beginning on day 1, cost sharing for Medicare Advantage enrollees varies by length of stay.

Findings

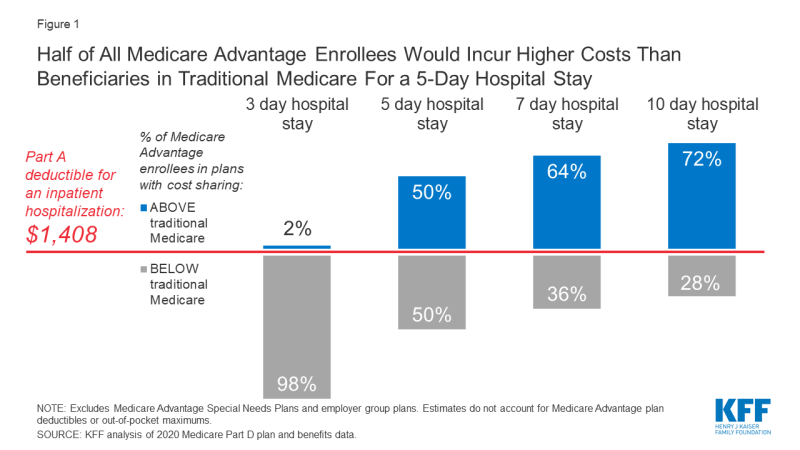

- Virtually all Medicare Advantage enrollees would pay less than the Part A hospital deductible for traditional Medicare for an inpatient stay of 3 days, but for stays of 5 day or more, at least half of Medicare Advantage enrollees would pay more (Figure 1).

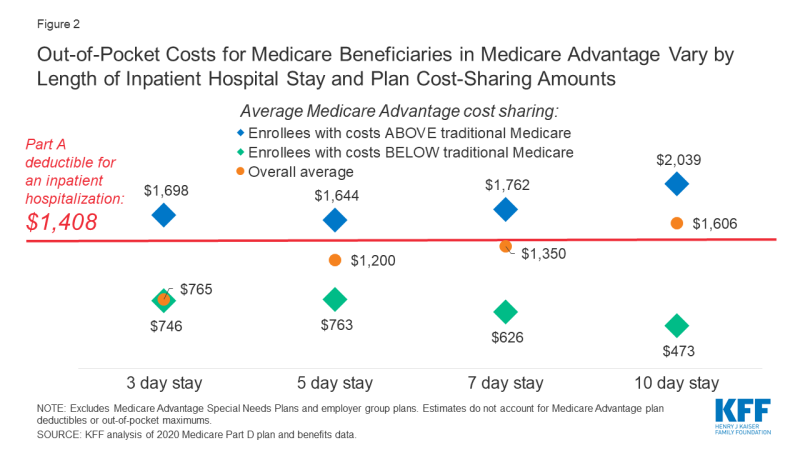

- Based on a 5-day hospital stay in 2020, beneficiaries in traditional Medicare would be responsible for the Part A deductible of $1,408 (assuming no supplemental coverage that covers some or all of the deductible) while the average Medicare Advantage enrollee overall would incur $1,200 in out-of-pocket costs (Figure 2). But for those Medicare Advantage enrollees with costs higher than under traditional Medicare for a 5-day hospital stay, their average cost sharing would be $1,644.

- Nearly two-thirds (64%) of Medicare Advantage enrollees are in a plan that requires higher cost sharing than the Part A hospital deductible in traditional Medicare for a 7-day inpatient stay, and more than 7 in 10 (72%) are in a plan that requires higher cost sharing for a 10-day inpatient stay.

- While average out-of-pocket costs for Medicare Advantage enrollees for a 7-day hospital stay are slightly lower than the Part A hospital deductible ($1,350 vs. $1,408), this $1,350 average is pulled down by a small share of enrollees with relatively low hospital copays. Most Medicare Advantage enrollees would pay more than the Part A deductible for a 7-day inpatient stay ($1,762 vs. $1,408).

- For a 10-day stay, the average Medicare Advantage enrollee would pay more out-of-pocket than the Part A deductible in traditional Medicare ($1,606 vs. $1,408). Among the majority of Medicare Advantage enrollees in plans with cost-sharing requirements that would exceed the Part A deductible for a 10-day inpatient stay, average out-of-pocket expenses would be $2,039.

This analysis does not reflect the cost of an inpatient hospitalization for all beneficiaries in traditional Medicare, because most have supplemental coverage, such as Medigap or retiree health plans, that would cover some or all of the Part A deductible. However, 6 million beneficiaries in traditional Medicare have no supplemental coverage and would be liable for the full Part A deductible if admitted to the hospital.

The analysis does not take into account deductibles that some Medicare Advantage enrollees face. Most Medicare Advantage enrollees (91%) pay no deductible for in-network services covered under Medicare Parts A and B. Among the 9% who do, the average in-network deductible is $746. Taking deductibles into account would increase costs for some enrollees. The analysis also does not take into account maximum out-of-pocket limits under Medicare Advantage, which would cap the amount enrollees pay for their care, including hospitalizations. It is possible that some Medicare Advantage enrollees would reach their out-of-pocket limit during their inpatient stay, particularly if they had incurred high expenses prior to an inpatient admission for COVID-19. However, in 2020 the average out-of-pocket maximum is $4,821, which is above the cost-sharing amount that all Medicare Advantage enrollees would pay for a 5-day hospital stay, assuming no other medical expenses during the coverage year.

Discussion

As the coronavirus spreads, the number of Medicare beneficiaries admitted to the hospital for COVID-19 related symptoms is likely to rise, and some could face significant out-of-pocket costs as a result, including the 6 million beneficiaries in traditional Medicare with no supplemental coverage, who would face the full Part A hospital deductible. Cost sharing for beneficiaries in Medicare Advantage plans would vary, depending upon the particular plan they are enrolled in and how long they remain in the hospital. For shorter hospital stays, most Medicare Advantage enrollees can expect to pay less than the Part A hospital deductible for traditional Medicare. However, for hospital stays of 5 days or more, half or more of Medicare Advantage enrollees would pay more than the Part A deductible in traditional Medicare. These findings can help to inform policymakers and others in discussions about whether to waive cost sharing for COVID-19 treatment during the emergency.

Tricia Neuman and Juliette Cubanski are with KFF. Anthony Damico is an independent consultant.