Where are California's Uninsured Now? Wave 2 of the Kaiser Family Foundation California Longitudinal Panel Survey

Section 3: The Remaining Uninsured

Who Remained Uninsured?

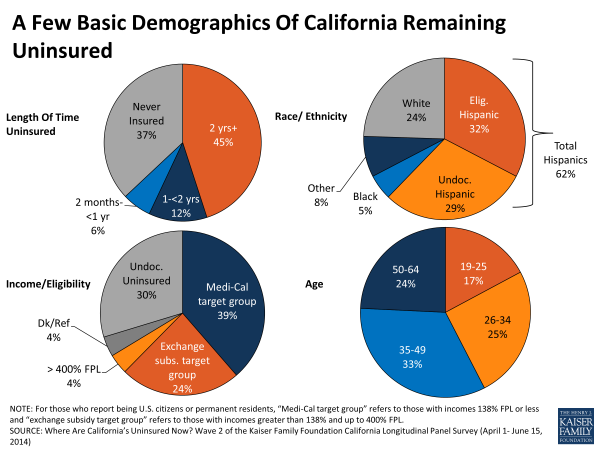

As many previously uninsured Californians gained coverage, 42 percent remained uninsured. Many of the remaining uninsured have tenuous links to health insurance posing challenges for future enrollment efforts. Forty-five percent of the remaining uninsured reported in the baseline survey that they had been without health insurance for two or more years (Figure 25) and an additional 37 percent said they have never had insurance. Hispanics make up 62 percent of the remaining uninsured and nearly half of them (29 percent) are undocumented Hispanics who are not eligible for Medi-Cal or assistance through Covered California. About 4 in 10 (39 percent) report family income that put them in the group likely eligible for Medi-Cal and another quarter (24 percent) are likely eligible for financial assistance through Covered California.1 These shares reflect the demographics of people who were uninsured prior to the first ACA open enrollment period and did not get coverage during the open enrollment period. Others may have been covered prior to open enrollment but now uninsured – a group not captured by this survey.

Why Did They Remain Uninsured?

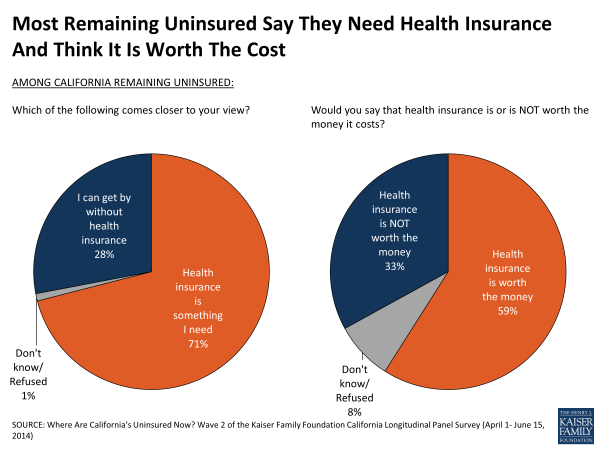

Why did 42 percent of California’s uninsured prior to open enrollment remain without coverage? Most of the remaining uninsured seem to value insurance, with majorities saying it is something they need (71 percent) and that it is worth the costs (59 percent) (Figure 26). Still roughly 3 in 10 of the remaining uninsured say they can get by without insurance (28 percent) or don’t feel coverage is worth the price (33 percent), including 4 in 10 (40 percent) of those who are likely eligible for coverage through Covered California or Medi-Cal due to their self-reported income level and immigration status.

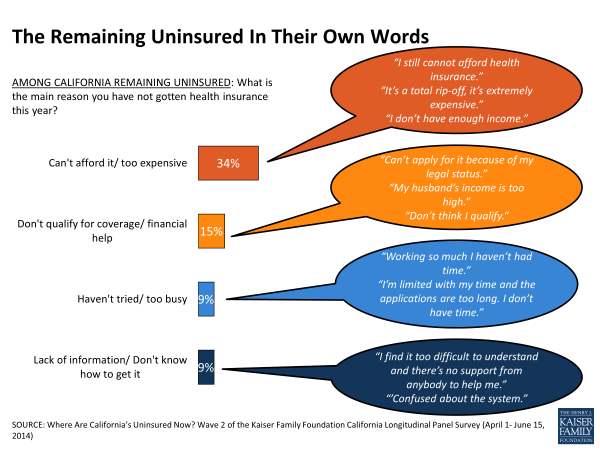

The cost of insurance (whether perceived or actual) remains a barrier. When asked in their own words why they didn’t get coverage, one-third (34 percent) point to costs as the reason. Fifteen percent say they don’t qualify or don’t think they do, including 9 percent who say they can’t enroll or are worried about signing up because of their immigration status. Other reasons the remaining uninsured give for not signing up for coverage include not having yet tried or being too busy (9 percent), not having enough information about enrolling (9 percent), having tried but not being successful (8 percent), and not wanting or needing coverage (7 percent) (Figure 27). A few (6 percent) say they didn’t get insurance because of issues associated with the application process, including three percent who say they are still awaiting contact or approval – a finding that is perhaps related to the large backlog of about 900,000 Medi-Cal applicants waiting for counties across the state to process their applications.2

Do They Think They Will Get It Later?

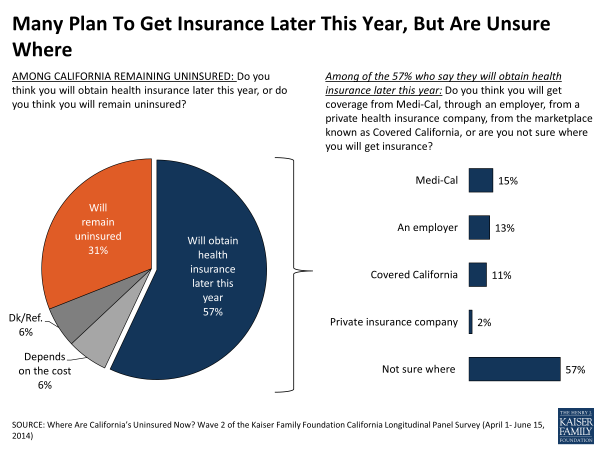

Although they missed the ACA’s first open enrollment period, almost 6 in 10 (57 percent) of the remaining uninsured think they will enroll in a plan later this year, while 3 in 10 (31 percent) think they will continue to go without health insurance (Figure 28). More than 7 in 10 (73 percent) of the remaining uninsured who are likely eligible for Medi-Cal say they plan to enroll later this year, compared to about half of those in the exchange target group (51 percent). Of those who see coverage in their future, 57 percent are uncertain where they will get insurance, and small shares say they expect to get it from Medi-Cal (15 percent), an employer (13 percent), or through Covered California (11 percent).

Some may in fact be able to enroll in coverage before the next Covered California open enrollment period. People eligible for Medi-Cal may sign up any time of the year, and others with qualifying events such as marriage may be able to enroll though Covered California outside of the specified enrollment periods. About half of the remaining uninsured say they are aware that people can still sign up for Medi-Cal (51 percent) or Covered California (54 percent); however it is unclear if they know that enrollment through Covered California is only a possibility if they have had a qualifying life event.

Did They Try To Get Coverage? Why Didn’t They Get It?

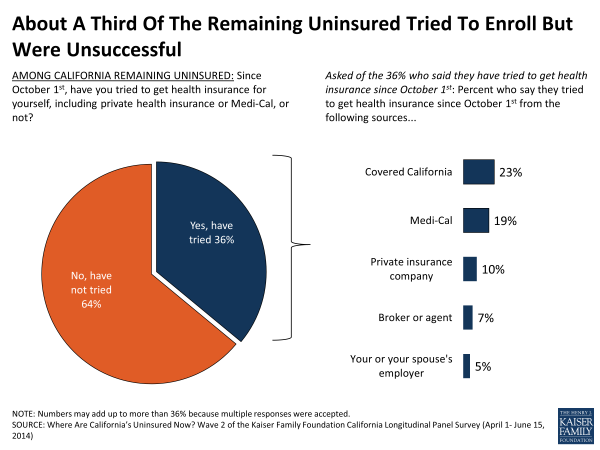

Over a third (36 percent) of the remaining uninsured say they have tried to get insurance since the open enrollment period began (Figure 29). Most of those that report trying pursued more than one avenue in their attempt to get coverage. Nearly a quarter (23 percent) of the remaining uninsured say they tried to get coverage through Covered California and 19 percent say they tried to get coverage from Medi-Cal. Smaller shares of the remaining uninsured say they looked directly to private health insurance companies (10 percent), to health insurance agents or brokers (7 percent), and to their employer (5 percent). But they ran into barriers – some remaining uninsured report trying to sign up for non-group insurance and found it too expensive (15 percent) and others were not able to complete the application process (6 percent). Eight percent of the remaining uninsured say they tried to sign up for Medi-Cal and were not eligible for coverage and another 7 percent said they tried to get Medi-Cal but were not able to complete the application process.

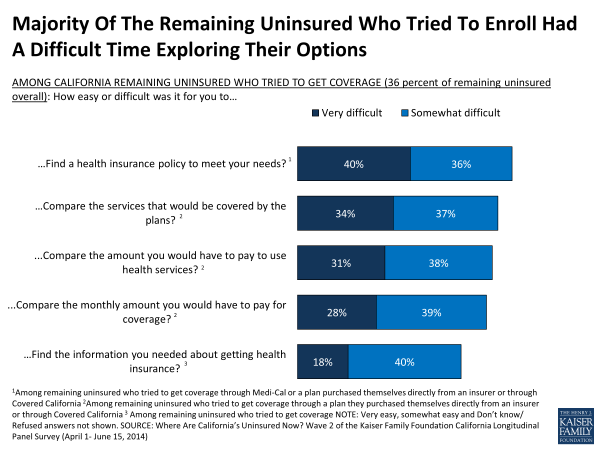

In contrast to those who got insurance, the majority of people who tried to get coverage but remain uninsured say that shopping for coverage was difficult. Those that report trying to get Medi-Cal or non-group coverage say it was hard to find a plan that met their needs (76 percent, or 25 percent of the remaining uninsured overall). Weighing the trade-offs between coverage and costs also proved difficult for most who report attempting to get non-group coverage; roughly 7 in 10 say it was difficult to compare the services the plans covered (71 percent, or 18 percent of remaining uninsured overall), the out-of-pocket costs required to use services (69 percent, or 18 percent of remaining uninsured overall), and the monthly premium payment (67 percent, or 17 percent of remaining uninsured overall). Nearly 6 in 10 (58 percent, or 20 percent of remaining uninsured overall) of those who say they tried to get insurance say it was difficult to find the information they needed about signing up for coverage (Figure 30).

Some of the remaining uninsured report visiting the Covered California website (30 percent) or calling the 1-800 number (15 percent), but unlike those who got insurance, most say they found them unhelpful (65 percent of those who visited website and 66 percent of those who called the 1-800 number).

Are The Remaining Uninsured Aware Of Coverage Options?

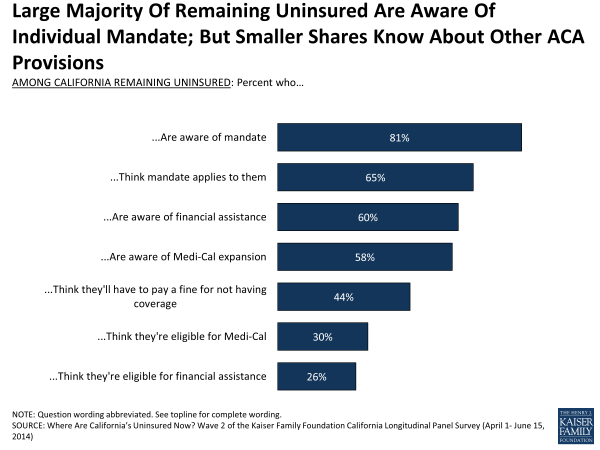

Eight in ten (81 percent) of the remaining uninsured are aware of the requirement to buy health insurance under the ACA, and most (65 percent) think the mandate applies to them (Figure 31). The remaining uninsured are divided on whether or not they’ll have to pay a fine this year with 44 percent saying they think they will be penalized and 43 percent saying they won’t. Many, in fact, may be exempt due to financial hardship or other exceptions under the law.

Other provisions are less widely recognized, including the parts of the law that may benefit the remaining uninsured most. For example, 6 in 10 remaining uninsured say they are aware of the Medi-Cal expansion (58 percent), and a similar share say they are aware the law provides financial assistance to help low and moderate income Americans (60 percent), leaving roughly 4 in 10 unaware of these aspects of the law that may open doors for them to access coverage (Figure 31).

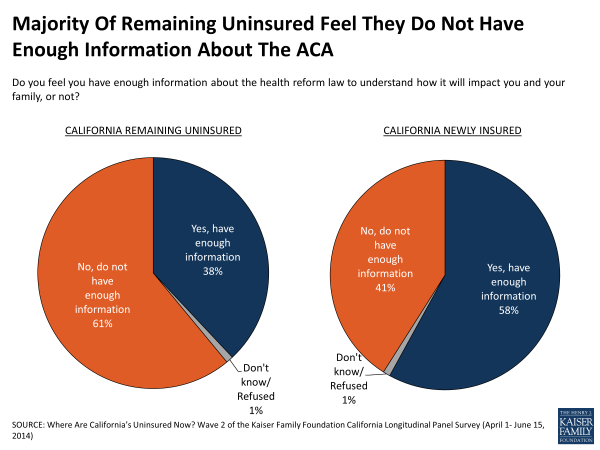

On a more personal level, 6 in 10 (61 percent) of the remaining uninsured say they are lacking information on how the law will impact them (Figure 32). Confusion about what assistance they may be eligible for is also widespread. Less than half (43 percent) of those likely eligible for Medi-Cal think they would qualify for the program. Of those in the group potentially eligible for subsidies through Covered California, about 3 in 10 (29 percent) think they are eligible for assistance.

Remaining Uninsured Hispanics

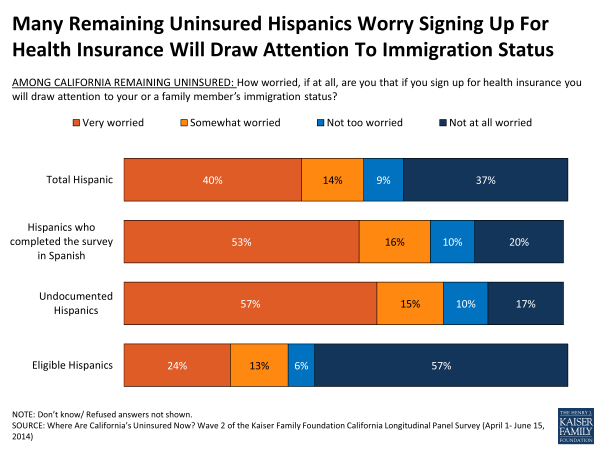

Forty-eight percent of Hispanics who were uninsured prior to open enrollment report remaining uninsured, and almost half of these remaining uninsured Hispanics (46 percent) may not be eligible for coverage under the ACA due to their immigration status (22 percent of previously uninsured Hispanics overall) (Figure 33). As a result, many worry about the potential link between health insurance and immigration authorities. Over half (54 percent) of Hispanics who remain uninsured, particularly those who prefer to communicate in Spanish or are undocumented themselves (69 percent or 73 percent, respectively), say they are worried that getting coverage will draw attention to their families immigration status (Figure 34), and despite the Administration’s assurance otherwise3 many worry it could result in deportation. Seven in 10 remaining uninsured Hispanics who say they were born outside the U.S. (72 percent, or 52 percent of remaining uninsured Hispanics overall) say they are worried that signing up for health insurance could hurt their ability to become a U.S. citizen, including half (51 percent) who say they are very worried.

| Figure 33: Demographics Of Remaining Uninsured Hispanics | |

| REMAINING UNINSURED HISPANICS | |

| AGE | |

| 19-34 | 41% |

| 35-49 | 40 |

| 50-64 | 18 |

| LANGUAGE OF INTERVIEW | |

| English | 30 |

| Spanish | 70 |

| LENGTH OF TIME UNINSURED | |

| 2 months to less than a year | 6 |

| 1 year to less than 2 years | 9 |

| 2 years or more | 38 |

| Never had insurance | 46 |

| EMPLOYMENT | |

| Employed | 67 |

| Unemployed | 14 |

| A student, retired, on disability and can’t work, or stay at home parent | 20 |

| RESIDENT STATUS | |

| Citizen/ legal immigrant | 52 |

| Undocumented immigrant | 46 |

In addition to immigration concerns, language may also present a barrier for some Hispanics who remain uninsured. Fully 70 percent of remaining uninsured Hispanics took the survey in Spanish (34 percent of Hispanics overall) and they are divided as to the amount of information about signing up for health insurance that is available in Spanish. About half (52 percent) say that, in their experience, there is at least some information in Spanish available (Figure 35) and about 4 in 10 say there is only a little or no information in Spanish. Personal assistance in Spanish may be more visible – about 6 in 10 (58 percent) remaining uninsured Hispanics who took the survey in Spanish say they are aware of people in their community trained to help them sign up for coverage in Spanish.

| Figure 35: Remaining Uninsured By Race/Ethnicity | ||

| Percent remaining uninsured Spanish-speaking Hispanics (70 percent of remaining uninsured Hispanics) reporting that… | ||

| …there are at least some information about signing up for coverage available in Spanish | 52% | |

| …there are people in their community trained to help them sign up for health insurance in Spanish | 58% | |

| Percent remaining uninsured reporting that, in their view,… | HISPANIC | WHITE, NOT HISPANIC |

| …Health insurance is something I need | 78% | 60% |

| …Health insurance is worth the money | 72% | 38% |

In spite of these potential barriers there is widespread overall support for the role of health insurance among Hispanics who remain uninsured – roughly three quarters (78 percent) say health insurance is something they need and is worth the cost (72 percent), shares that are higher than their white peers (Figure 35).

California’s Undocumented Uninsured

In California, undocumented immigrants make up about a fifth of those who were uninsured before the ACA expansions kicked in, and under the law, they are not eligible for Medi-Cal or subsidies through the exchange. As a group they are largely aware of these restrictions – 63 percent say they are not eligible for Medi-Cal and 70 percent say they don’t qualify for financial assistance through Covered California. Half say the mandate doesn’t apply to them and most (60 percent) correctly respond that they won’t have to pay a fine for not having coverage.

While the ACA restricts access to health benefits for undocumented immigrants under the law, there is still keen interest in coverage among this group. Since last summer about a third (35 percent) of California’s undocumented uninsured say they obtained coverage and of those who remain uninsured, half say they intend to get coverage later this year. In fact, the remaining undocumented uninsured are more apt to say they place a high value on insurance than other remaining uninsured Californians; nearly three quarters (73 percent) of the undocumented uninsured say health insurance is worth the cost and 85 percent say it is something they need, each 20 percentage points higher than the share for other remaining uninsured Californians.