Medicaid and CHIP Eligibility, Enrollment, and Cost Sharing Policies as of January 2020: Findings from a 50-State Survey

Enrollment and Renewal Processes

Changes under the ACA

Prior to the ACA, the enrollment and renewal process for Medicaid typically was a lengthy, paper-based process that could take weeks or, in some cases, months to complete. In many states, individuals could only apply via mail or in-person. Some states still required face-to-face interviews and/or imposed asset tests as part of the eligibility determination process and individuals generally had to provide paper documentation to verify eligibility criteria, such as income. Moreover, individuals often would have to repeat these steps at renewal, which could occur more frequently than once a year. These processes reflected the program’s historic ties to cash assistance and most states’ reliance on decades-old, mainframe-based eligibility systems that were difficult to reprogram and upgrade and generally had limited online functions or capabilities to conduct electronic data matches.

After the passage of CHIP, many states began streamlining enrollment and renewal processes to promote enrollment and retention of eligible children. For example, some states eliminated in-person interviews, worked to coordinate rules between Medicaid and CHIP, expanded availability of online and phone applications, reduced documentation requirements, and reduced the frequency of renewal for children.1 State experience showed that these actions contributed to increased enrollment and retention.2 State experience also showed that reinstatement of enrollment barriers led to significant enrollment declines. For example, in 2003, Texas experienced a nearly 30% enrollment decline after it increased premiums, established a waiting period, and moved from a 12- to 6-month renewal period for children in CHIP.3 When Washington State increased documentation requirements, moved from a 12- to 6-month renewal period, and ended continuous eligibility for children in Medicaid and CHIP in 2003, there was a sharp drop off in enrollment.4 Enrollment quickly rebounded when it reinstated the 12-month renewal period and continuous eligibility.5

In addition to expanding coverage to low-income adults, the ACA established streamlined enrollment and renewal rules that drew on previous state experience. These changes included removing face-to-face interviews and asset tests and establishing a 12-month renewal period, which became effective across all states as of January 2014. Prior to the ACA, most states had already removed face-to-face interview requirements and asset tests for children. However, as of December 2009, ten states still required in person interviews for parents and 25 states imposed an asset test for parents. Additionally, while most states had already adopted a 12-month renewal period for children (47 states) and parents (41 states), the remaining states still required renewals more frequently (e.g., every six months). The ACA required states to create a single streamlined application for Medicaid, CHIP, and Marketplace coverage and to provide options for individuals to apply for and renew coverage through multiple modes, including online and phone. The ACA also sought to modernize and improve the efficiency of eligibility determinations and renewals by requiring states to seek to use electronic data matches with reliable data sources to verify eligibility criteria before requesting information or documentation from individuals. To support states in upgrading and modernizing outdated eligibility systems to implement these processes, the Centers for Medicare and Medicaid Services (CMS) provided states 90 percent federal funding for system development and 75 percent funding for ongoing operations. This influx of federal funding was key to enabling states to upgrade and replace systems, particularly at a time when many state budgets had not recovered from the Great Recession.

Eligibility System Upgrades and Integration

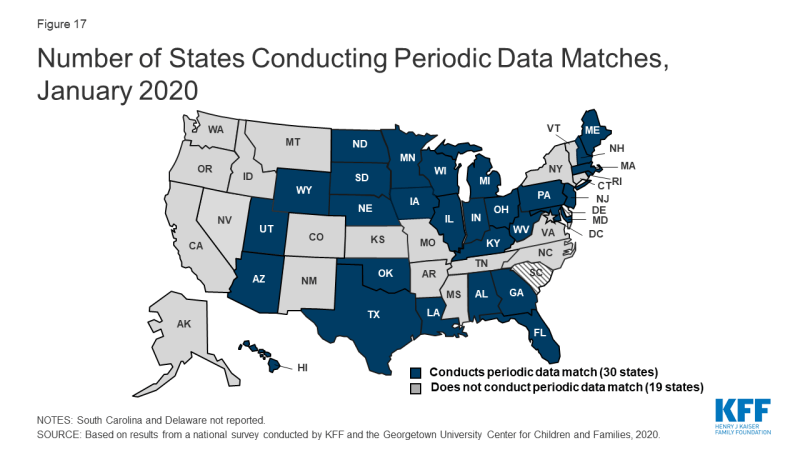

Most states report that system upgrades and modernized processes have contributed to improvements in eligibility and enrollment operations compared to before the ACA. Nearly all states have worked to upgrade or replace their eligibility systems to implement the new processes established under the ACA. However, system statuses and capabilities vary across states, reflecting differences in when they implemented system updates and whether they replaced or upgraded existing systems. The majority (37 of 46 reporting) states report improvement in at least one area of eligibility operations (Figure 10) compared to before the ACA, with 20 states indicating that operations had improved in three or more areas. Only five states report that one or more of these aspects of operations were worse, but several of those states continue to grapple with system implementation challenges, which are resolved as systems are tested and refined. Some states reported that these aspects of operations have not changed since the ACA.

Figure 10: Number of States Reporting Improvement in Operations Compared to Prior to the ACA, as of January 2020

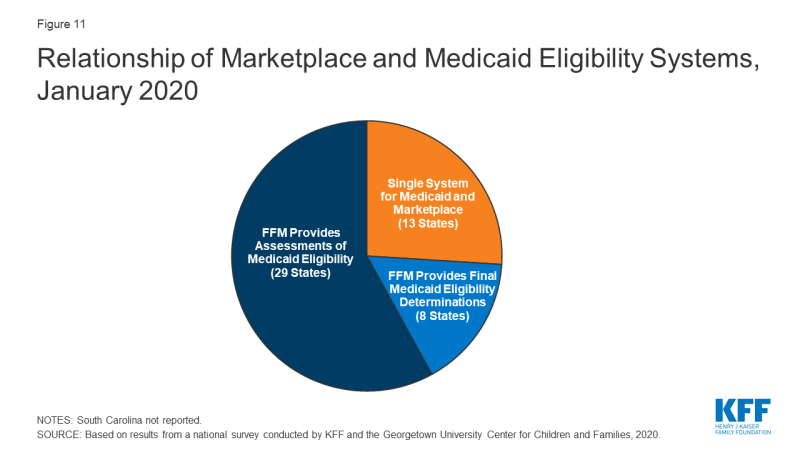

All state systems coordinate enrollment in Medicaid, CHIP, and the Marketplace coverage, but how this coordination occurs varies based on a state’s Marketplace structure. In 2019, Nevada transitioned from using the federal marketplace, Healthcare.gov, for eligibility and enrollment functions (SBM-FP) to become a State-Based Marketplace (SBM). With this transition, 13 states operate a SBM as of January 2020 (Figure 11). An additional 4 states (Maine, New Jersey, New Mexico and Pennsylvania) indicated plans to transition to an SBM in the future. SBM states typically have a single integrated system through which individuals can apply for and renew Medicaid, CHIP and Marketplace subsidies. The 38 states utilizing the FFM as of January 2020 electronically exchange data with the FFM to coordinate Medicaid and Marketplace coverage. While these transfers got off to a rocky start in 2014, states report that they are generally running smoothly with the occasional glitch that may occur when system updates are incorporated and/or amid large volume increases during the open enrollment period for Marketplace coverage. Eight states authorize the FFM to make final Medicaid eligibility determinations for MAGI groups and automatically enroll individuals the FFM deems eligible. The remaining states conduct full eligibility determinations for individuals after the FFM assesses them as eligible for Medicaid.

States continue to integrate non-MAGI Medicaid and non-health programs into their upgraded MAGI Medicaid systems. Prior to the ACA, all states determined eligibility for MAGI groups as well as seniors and individuals with disabilities (non-MAGI groups) through a single system. In addition, 44 state eligibility systems incorporated eligibility determinations for Medicaid and at least one non-health program, including the Supplemental Nutrition Assistance Program (SNAP), Temporary Aid to Needy Families with Dependent Children (TANF), and/or childcare subsidies. When states upgraded their MAGI Medicaid systems, a number separated them from non-MAGI groups and/or non-health programs. As new systems have matured, states have reintegrated determinations for non-MAGI groups and/or non-health programs into MAGI systems. As of January 2020, 31 states have an integrated system for MAGI and non-MAGI determinations and, in 24 states, the MAGI system is integrated with one or more non-health programs. A number of states reported plans to integrate non-MAGI Medicaid and/or non-health programs into their systems during or after 2020.

Applications, Online Accounts, and Mobile Access

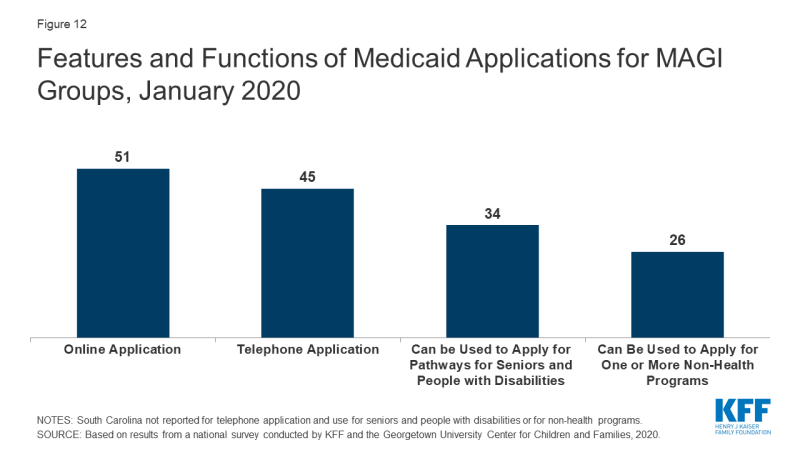

As of January 2020, online and phone applications have become standard options across the states. Just prior to the ACA in 2009, 32 states had an online application, some of which were fillable PDFs that did not connect to the eligibility system, and 16 states accepted telephone applications. Moreover, about half of states (24) had separate applications for children and parents. Today, all states offer a single application for parents and children that can be submitted online, and most states (45) process applications by phone (Figure 12). In 34 states, the application can also be used by individuals applying for non-MAGI eligibility pathways for seniors and people with disabilities and, in just over half of states (26), the application can also be used for at least one non-health program. Online applications have become the predominant mode of submission in nearly half the states (22), although the share of applications submitted online varies significantly across states and other modes of application, including in-person and mail, remain a primary method in some states.

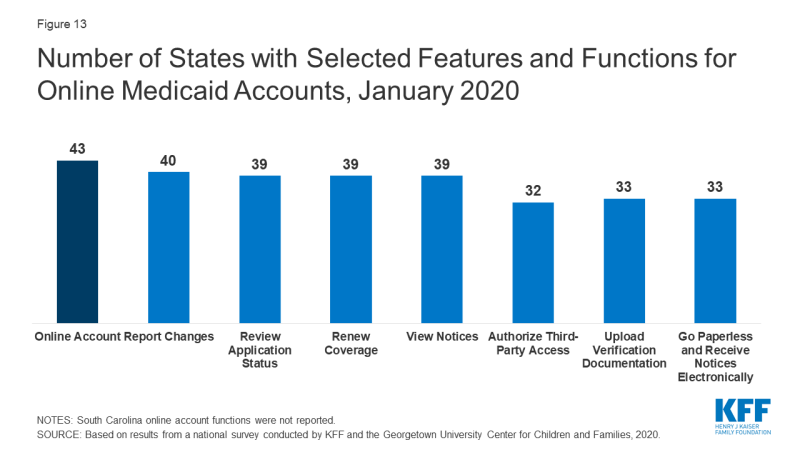

Most states (43) offer online accounts that provide options for enrollees to report changes, submit documentation, or renew coverage as of January 2020 (Figure 13). By providing individuals an avenue to self-report changes, these accounts can help states maintain up-to-date information on enrollees and may reduce administrative tasks for eligibility workers. They also provide an avenue for enrollees to elect to receive communications from the state through text or email. Only a couple of states with advanced systems had online accounts before the ACA.

Figure 13: Number of States with Selected Features and Functions for Online Medicaid Accounts, January 2020

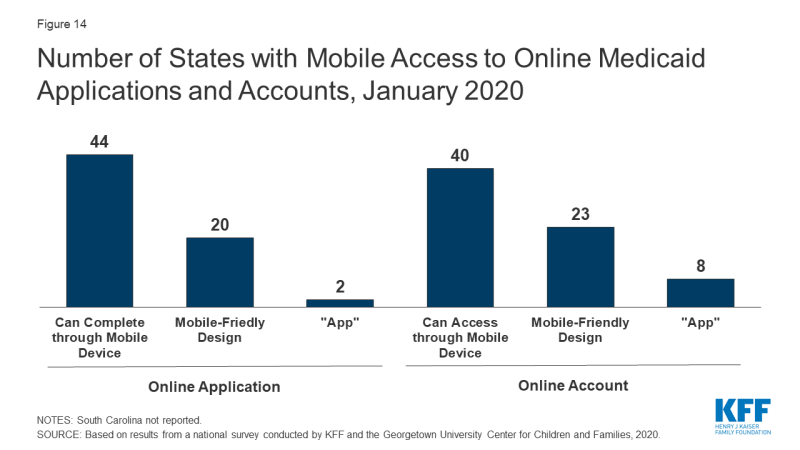

A growing number of states offer mobile access to applications and online accounts. As of January 2020, individuals can submit online applications through a mobile device in 44 states, up from 28 states in 2017, when this survey first collected these data. Enrollees can access online accounts via mobile devices in 40 states, up from 27 states in 2017 (Figure 14). Close to half of these states have taken steps to provide mobile-friendly designs for their application (20 states) and online accounts (23 states). Two states have also taken the next step to create a smart device ‘app’ for their application, while eight states offer an ‘app’ for their online account.

Figure 14: Number of States with Mobile Access to Online Medicaid Applications and Accounts, January 2020

Eligibility Verification Policies

Under the ACA, states must seek to use data available through electronic data matches with reliable data sources to verify eligibility before requesting information from the individual. This process was designed to reduce paperwork burdens on states and enrollees and to allow for faster determinations. Under the ACA, all states must verify citizenship or qualified immigration status, as well as income, to determine eligibility for Medicaid and CHIP. States can electronically verify citizenship or immigration status directly with the Social Security Administration (SSA) or Department of Homeland Security (DHS), or through the federal data services hub that consolidates access to these and other data sources. States must verify citizenship status prior to determining eligibility, however, individuals who attest to a qualified status must be given a reasonable amount of time to provide documentation if eligibility cannot be confirmed electronically. States must also verify income and can do so through the SSA; the federal data hub; state databases, including unemployment, wage, and tax databases; and/or commercial databases. States can verify income prior to enrollment or enroll based on the applicant’s reported income and verify post-enrollment. For other eligibility criteria, including age/date of birth, state residency, and household size, states can verify this information before or after enrollment or accept an individual’s self-attestation unless there is discrepant information in the agency’s records. To expedite enrollment as part of response to COVID-19, under existing rules, states can allow for self-attestation for all eligibility criteria, excluding citizenship and immigration status, on a case-by-case for individuals subject to a disaster when documentation is not available.

Today, all states use electronic data matches with one or more data sources to verify income, and most states (45) verify income prior to enrollment. Prior to the ACA, most states relied on paper documentation to verify eligibility criteria, with less than a third of states (12) using other data sources to verify financial eligibility for children at application. As of January 2020, two-thirds of the states (34) use at least four electronic data sources to verify financial eligibility. A total of 46 states use state wage databases and 46 use state unemployment databases, while 41 states utilize the federal data services hub. Additionally, two-thirds of states (33) use commercial wage databases while just under half (23) access SNAP income data. Nearly two-thirds of states (31) indicate that most income data checks are conducted automatically by the system while another third (16 states) indicate that they conduct these data matches through a mix of automatic matches and manual lookups by eligibility workers. Only three states rely mostly on manual lookups. Most states (33) utilize a reasonable compatibility standard, typically 10%, under which they will determine an individual eligible even if there is a small difference between the amount of reported income and the amount identified through electronic data matches that would otherwise affect eligibility.

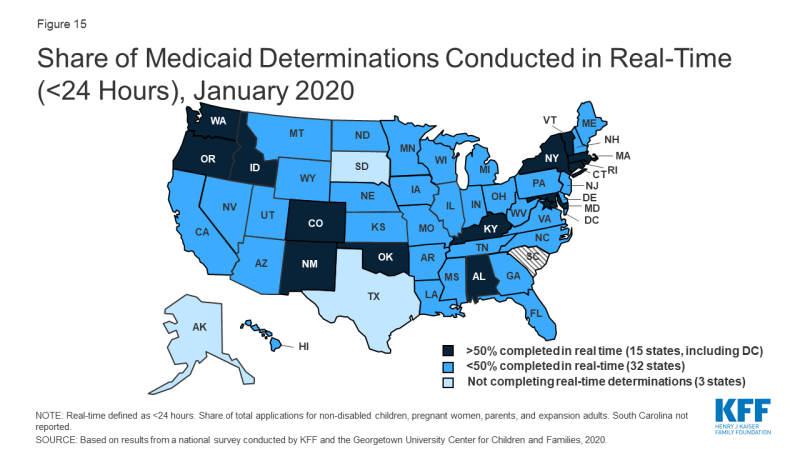

Reflecting use of electronic data matches, as of January 2020, 47 states are able to make real-time eligibility determinations (defined as within 24 hours). Nearly one third of these states (15) report that they make more than half of MAGI-based determinations in real time, including 10 that report making over three-quarters of determinations in less than 24 hours (Figure 15). States processing the majority of their applications in real-time are more likely to report that their eligibility system conducts most income verifications automatically without caseworker action. Most states (42) indicate they do not have delays or backlogs in processing applications; the 8 states reporting delays or backlogs generally cite ongoing system challenges or increased application volume due to open enrollment or implementation of the Medicaid expansion.

Renewal Processes

Under the ACA, states must seek to complete automated or ex parte renewals by verifying ongoing eligibility through available data sources before requesting a form or documentation from an enrollee. If a state cannot determine that an individual remains eligible based on available information, it must provide the enrollee with a pre-populated form containing the information relevant to renewal and a reasonable period, at least 30 days, for the individual to provide the necessary information and correct any inaccuracies online, in person, by telephone or by mail.

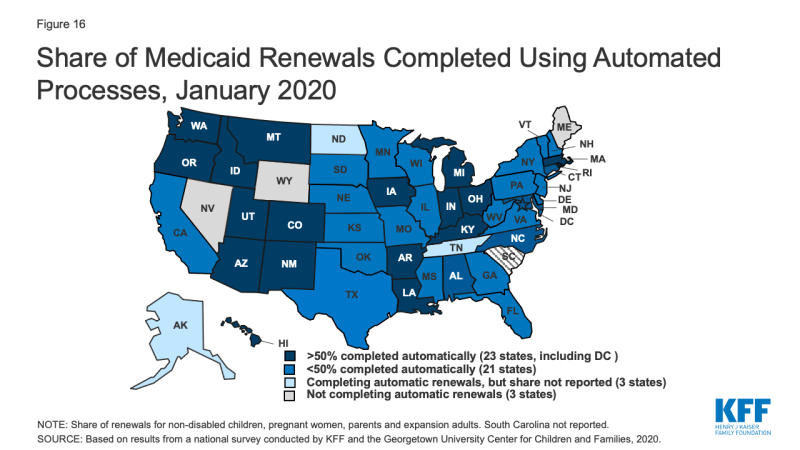

As of January 2020, 47 states are conducting automated or ex parte renewals. This count reflects two states (Alaska and Tennessee), that implemented automated renewals in 2019. In contrast, just 16 states were completing automated or ex parte renewals in 2009, prior to the ACA. In 22 states, at least half of renewals are completed automatically, including 9 states where least three-quarters of renewals are automated and do not require enrollee action (Figure 16). Nearly two-thirds of states (31) report that their system conducts most automated or ex parte renewals without any manual caseworker action, while seven states report that these transactions include a mix of automated actions by the system and manual actions by caseworkers. Nine states report that most ex parte renewals require manual caseworker action. The majority of states (41) allow enrollees to renew by phone without a paper form or signature if the state cannot complete an automated renewal and the enrollee must submit information. However, the large majority of states only contact enrollees 1-2 times to request additional information before terminating coverage, and in a number of cases, enrollees only receive a second contact if they have elected to receive electronic notices through an online account.

Ten states report delays or backlogs in processing renewals in Medicaid or CHIP. These largely are states in the midst of new system builds or major system upgrades that also have delays in processing applications. Three states report that some renewals have been temporarily suspended or delayed, a mitigation strategy that CMS has allowed when states are dealing with system issues or increased volume that inhibit timely processing of applications and renewals. Additional states may delay or suspend renewals as part of their response to COVID-19. Moreover, under the Families First Coronavirus Response Act, to receive the enhanced federal match rate provided under the law, states must provide continuous eligibility for enrollees through the end of the month of the emergency period unless an individual asks to be disenrolled or ceases to be a state resident

Identifying Changes in Circumstances

Although the ACA established a 12-month renewal period, states disenroll individuals within that 12-month period if they have a change in circumstances that affects eligibility, such as an increase in income. Enrollees are required to report changes in circumstances that may affect eligibility. States may also conduct periodic electronic data matches to identify potential changes in circumstances between annual renewal periods. If a state receives information from the enrollee or through another data source about a change that may affect eligibility, it will review the information to determine ongoing eligibility and may request additional information or documentation from the individual to continue coverage. If the individual does not respond to a request within the required timeframe, the state will disenroll the individual from coverage. The Trump administration has promoted use of periodic data matches between renewals as a program integrity strategy.6 However, as noted above, to access enhanced federal funding under the Families First Response Act, states generally must provide continuous eligibility for enrollees through the end of the emergency period.

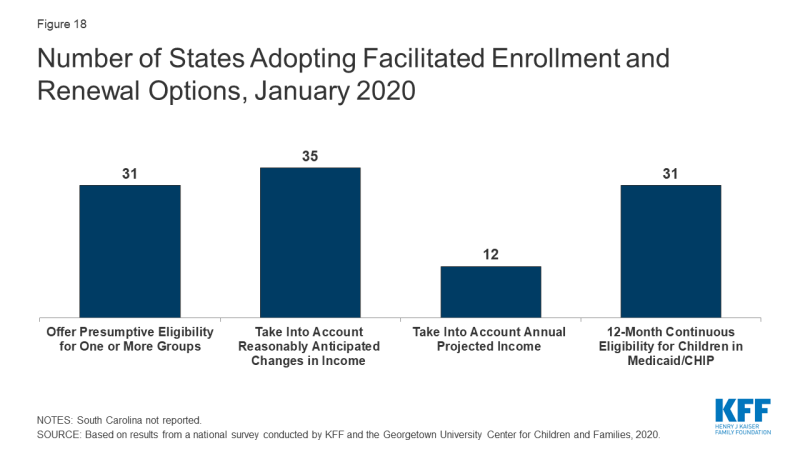

As of January 2020, 30 states reported that they conduct data matches on a periodic basis to identify potential changes that may affect financial or other eligibility criteria between annual renewal periods (Figure 17). The frequency of these checks varies across states and the data sources used for the review. For example, since 2014, Texas has checked income for households with children on Medicaid in the fifth, sixth, seventh, and eighth month of enrollment. These checks are timed to the child’s start date, so households with multiple children who enrolled in coverage at different times face checks even more frequently. In contrast to the minimum 30 days provided at renewal, a number of states that conduct data matches provide only 10 days from the date of notice for enrollees to respond to information requests. Similar to the processes used at renewal, most states only contact enrollees 1-2 times to request this information before terminating coverage with the second notice often sent only to individuals opting for electronic notices through their online accounts.

Adoption of Options to Promote Enrollment and Retention

States can adopt policy options and processes to promote continuity of coverage and minimize coverage gaps or churn—that is, people moving on and off of coverage over relatively short periods of time. These include policy options that can expedite enrollment and prevent coverage gaps due to small fluctuations in income. Income volatility is common among the low-income population, for example, due to seasonal work or fluctuating hours due to employment in industries such as food service and construction.7,8 States can also implement processes that enhance communications with enrollees to help prevent individuals from losing coverage because they are not receiving or responding to notices from the state. Enrollees may not receive mailed notices if they move frequently, which also is more common among the low-income population.9 Stable coverage and reduction of churn promotes more continuous access to care, enhances the state’s ability to measure the quality of care, and can reduce administrative costs and burden associated with moving people on and off of coverage.

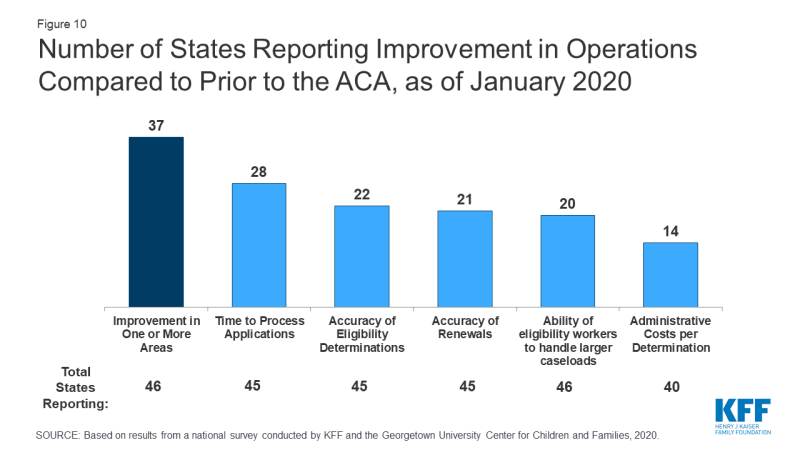

As of January 2020, 31 states are using presumptive eligibility for one or more groups to expedite enrollment in Medicaid or CHIP coverage (Figure 18). Presumptive eligibility is a longstanding option that allows states to authorize certain qualified entities, like community health centers or schools, to enroll children or pregnant women who appear likely eligible for coverage while the state processes the full application. Presumptive eligibility can be particularly helpful when individuals may need extra time to collect documents needed to complete a full eligibility determination. Under the ACA, states were required to allow hospitals to conduct presumptive eligibility determinations regardless of whether the state had otherwise adopted the policy. The ACA also allowed states that use presumptive eligibility for pregnant women or children to extend the policy for other groups, including parents and other adults. As of January 2020, most states use presumptive eligibility for pregnant women (30 states) and children (19 states) while fewer have implemented the option for parents (9 states), other adults (8 states), family planning coverage (6 states) and former foster youth (8 states).

A total of 35 states take into account reasonably predictable changes in income when determining eligibility for Medicaid as of January 2020. This option enables states to account for anticipated income changes, such as recurring seasonable employment or a job change, when determining eligibility at application or renewal. For example, under this option, if a teacher receives a salary under a 10-month contract, the state would divide that income over 12 months to determine current monthly income for assessing eligibility. In addition, 12 states have adopted a similar option to take into account projected annual income for the remainder of the calendar year when determining ongoing eligibility at renewal or when an individual has a potential change in circumstances between renewal periods. This enables individuals to maintain coverage if their projected annual income is below the Medicaid threshold, even if their current monthly income is above the threshold when eligibility is assessed.10 In most cases, the individual or an eligibility caseworker must request or take action to have anticipated income changes or projected annual considered rather than the system accounting for these options automatically.

As of January 2020, 31 states provide 12-month continuous eligibility to children in either Medicaid or CHIP. Under this option, states allow a child to remain enrolled for a full year unless the child ages out of coverage, moves out of state, voluntarily withdraws, or does not make premium payments. As such, 12-month continuous eligibility eliminates coverage gaps due to fluctuations in income over the course of the year. Additionally, two states (Montana and New York) have extended 12-month continuous eligibility to adults under waiver authority.

Some states have implemented processes to facilitate communication with enrollees. For example, ten states reported taking proactive steps to update address information for enrollees. These include regular data matches with the U.S. Postal Service National Change of Address Database and working with managed care plans and providers to update address information. In addition, just under half of states reported routinely taking additional action such as calling enrollees or sending email or text notifications when they receive returned mail from a notice sent to an enrollee.