Kaiser Family Foundation/LA Times Survey Of Adults With Employer-Sponsored Insurance

Section 4: Health insurance decision-making and trade-offs

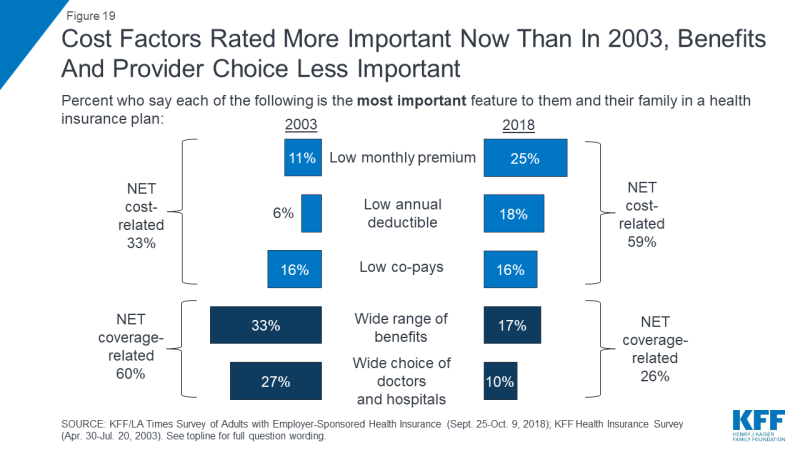

The survey finds that at the same time premiums and deductibles have been rising for people with employer-sponsored coverage, cost has taken on greater importance in health insurance decision-making compared to previous years. For example, when asked to choose the most important feature in a health plan, one quarter cite a low monthly premium, 18 percent choose a low deductible, and 16 percent cite low co-pays, amounting to six in ten (59 percent) choosing a cost-related factor. About a quarter (26 percent) choose coverage-related factors including having a wide range of benefits (17 percent) or a wide choice of doctors and hospitals (10 percent). These shares are essentially reversed from a KFF survey conducted in 2003, when one-third of people with employer coverage chose cost-related factors as the most important feature in a health plan and six in ten chose a wide range of benefits or choice of providers.

Figure 19: Cost Factors Rated More Important Now Than In 2003, Benefits And Provider Choice Less Important

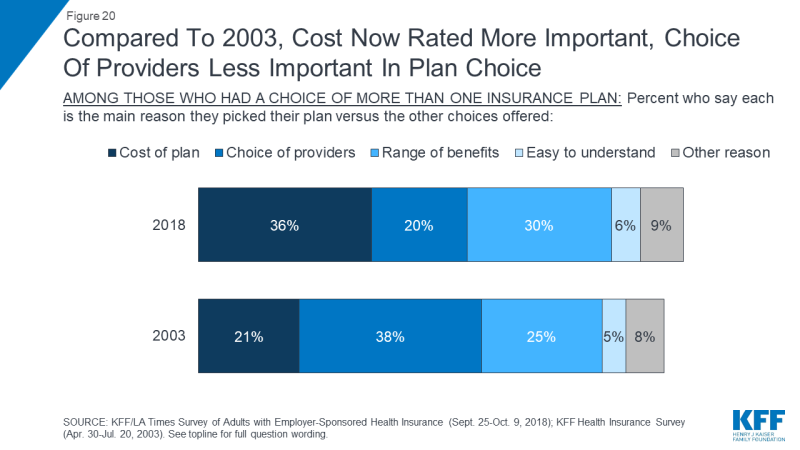

Another trend point shows a similar pattern. Among those whose employer offered a choice of plans, the share who say they picked their plan based on the cost increased 15 percentage points, from 21 percent in 2003 to 36 percent in the current survey.

Figure 20: Compared To 2003, Cost Now Rated More Important, Choice Of Providers Less Important In Plan Choice

When asked about trade-offs between premiums and out-of-pocket costs, people with ESI are pretty evenly divided between saying they would prefer a plan with a relatively low monthly premium and higher out-of-pocket costs (52 percent) or one with a relatively high monthly premium and lower out-of-pocket costs (47 percent). However, those with higher household incomes lean towards lower premiums and higher out-of-pocket costs, while those with lower incomes lean in the opposite direction.

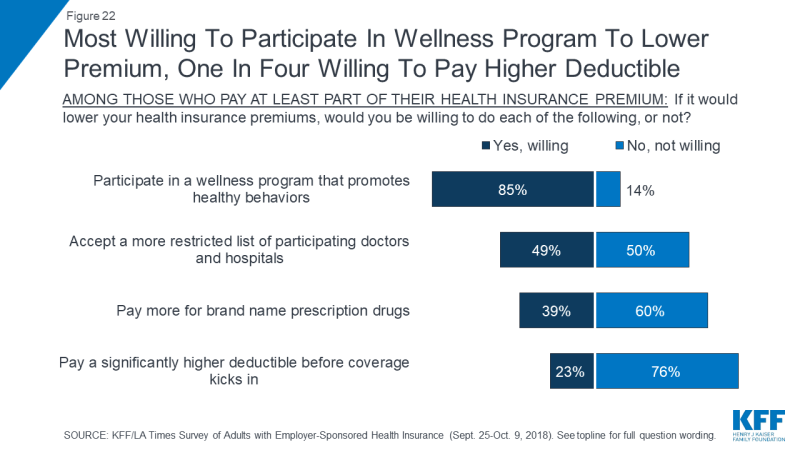

Despite this increased emphasis on cost, there is no great enthusiasm among people with employer plans for several trade-offs that might lower insurance premiums. About three-quarters say they would not be willing to pay a significantly higher deductible in exchange for a lower premium (perhaps because deductibles have risen so much already), and six in ten say they would not be willing to pay more for brand name prescription drugs. However, about half say they would be willing to accept a more restricted list of providers in exchange for lower premiums, and a large majority (85 percent) say they’d be willing to participate in a wellness program.