Medicare Advantage 2021 Spotlight: First Look

Over the last decade, Medicare Advantage, the private plan alternative to traditional Medicare, has taken on a larger role in the Medicare program. In 2020, more than 24 million Medicare beneficiaries are enrolled in a Medicare Advantage plan. This brief provides an overview of the Medicare Advantage plans that are available for 2021 and key trends over time.

Plan Offerings in 2021

Number of Plans

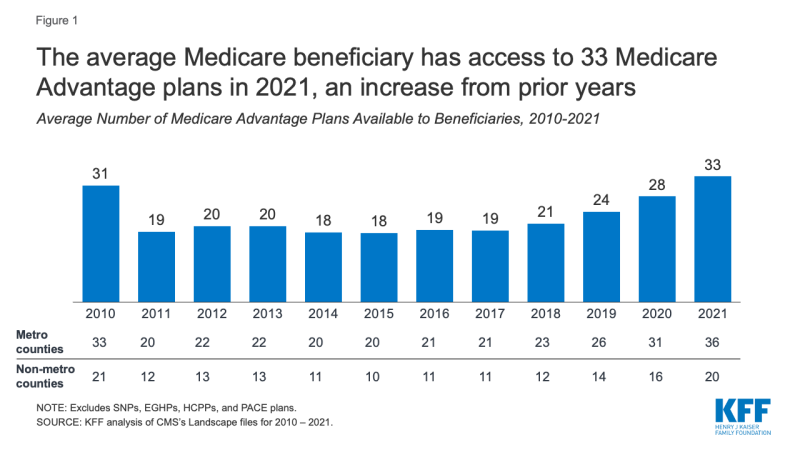

Number of Plans Available to Beneficiaries. For 2021, the average Medicare beneficiary has access to 33 Medicare Advantage plans, the largest number of options available in the last decade (Figure 1).

Figure 1: The average Medicare beneficiary has access to 33 Medicare Advantage plans in 2021, an increase from prior years

Among the 33 Medicare Advantage plans generally available for individual enrollment to the average Medicare beneficiary, 27 of the plans include prescription drug coverage (MA-PDs). These numbers exclude employer or union-sponsored group plans, Special Needs Plans (SNPs) and PACE plans, which are only available to select populations.

Total Number of Plans. In total, 3,550 Medicare Advantage plans are available nationwide for individual enrollment in 2021 – a 13 percent increase (402 more plans) from 2020 and the largest number of plans ever available (Figure 2; Appendix Table 1). The vast majority (89 percent) of all Medicare Advantage plans offered include prescription drug coverage in 2021.

.

As in prior years, HMOs continue to account for about two-thirds (62%) of all plans offered in 2021. The availability of local PPOs has increased rapidly over recent years. In 2021, one-third of plans offered are local PPOs, compared to a quarter in 2018. Between 2020 and 2021, the number of regional PPOs has remained constant, while the number of private fee-for-service plans has continued to decline.

The growth in number of plans varies across states and counties, with the preponderance of the growth occurring in Florida and California (41 more and 30 more plans, respectively; data not shown). Virginia has 6 fewer plans available for 2021 than in 2020, while South Carolina has 3 fewer plans, and Maryland and Nebraska each have one fewer plan available in 2021 than in 2020.

While many employers and unions also offer Medicare Advantage plans to their retirees, no information about these 2021 plan offerings is made available by CMS to the public during the Medicare open enrollment period because these plans are not available to the general Medicare population.

One notable change for 2021 is that people with end-stage renal disease (ESRD) are eligible to enroll in Medicare Advantage plans. Prior to this change, people with ESRD were not able to enroll in most Medicare Advantage plans, subject to limited exceptions, such as C-SNPS for people with ESRD.

Special Needs Plans (SNPs). More SNPs are available for 2021 than in any year since they were authorized, increasing from 855 plans in 2020 to 975 plans in 2021, a 14 percent increase (Figure 3).

.

The rise in SNPs for people who require an institutional-level of care (I-SNPs) has been particularly notable, more than doubling from 83 plans in 2017 to 174 plans in 2021. I-SNPs may be attractive to insurers because they tend to have much lower marketing costs than other plan types since they are often the only available option for people to receive their Medicare benefits in certain retirement communities and nursing homes. The number of SNPs for people dually eligible for Medicare and Medicaid (D-SNPs) has also increased sharply over the past five years, rising from 373 dual SNPs in 2017 to 598 dual SNPs in 2021, a 60% increase, suggesting insurers’ continue to be interested in managing the care of this high-need population.

The number of SNPs offered for people with chronic conditions (C-SNPs) is also increasing in 2021, most of which focus on people with diabetes, heart disease, or lung conditions, as has been the case since the inception of C-SNPs. For 2021, three firms are offering C-SNPs for people with dementia (the same as 2020), two firms are offering a C-SNP for people with mental health conditions (up one from 2020), three firms are offering C-SNPs for people with end-stage renal disease (one fewer than 2020) and two firms are offering C-SNPs for people with HIV/AIDS (similar to 2020).

Variation in the Number of Plans, by Geographic Area. On average, beneficiaries in metropolitan areas can choose from about twice as many Medicare Advantage plans as beneficiaries in non-metropolitan areas (36 plans versus 20 plans, respectively).

In 11 percent of counties (accounting for 41% of beneficiaries), beneficiaries can choose from more than 35 plans in 2021, including eleven counties in Ohio and five counties in Pennsylvania where more than 60 Medicare Advantage plans are available (Figure 4). In contrast, in 4 percent of counties (accounting for 1% of beneficiaries), beneficiaries can choose from two or fewer Medicare Advantage plans. The number of counties with no Medicare Advantage plans for 2021 is 82, similar to 2020. As in prior years, there are no Medicare Advantage plans offered in Alaska. Additionally, no Medicare Advantage plans are available in territories other than Puerto Rico.

.

Access to Medicare Advantage Plans, by Plan Type

As in recent years, virtually all Medicare beneficiaries (99%) have access to a Medicare Advantage plan as an alternative to traditional Medicare, including almost all beneficiaries in metropolitan areas (99.9%) and the vast majority of beneficiaries in non-metropolitan areas (97.7%). In non-metropolitan counties, a smaller share of beneficiaries have access to HMOs (87% in non-metropolitan versus 99% in metropolitan counties) or local PPOs (89% in non-metropolitan versus 96% in metropolitan counties), and a slightly larger share of beneficiaries have access to regional PPOs (77% in non-metropolitan counties versus 72% in metropolitan counties).

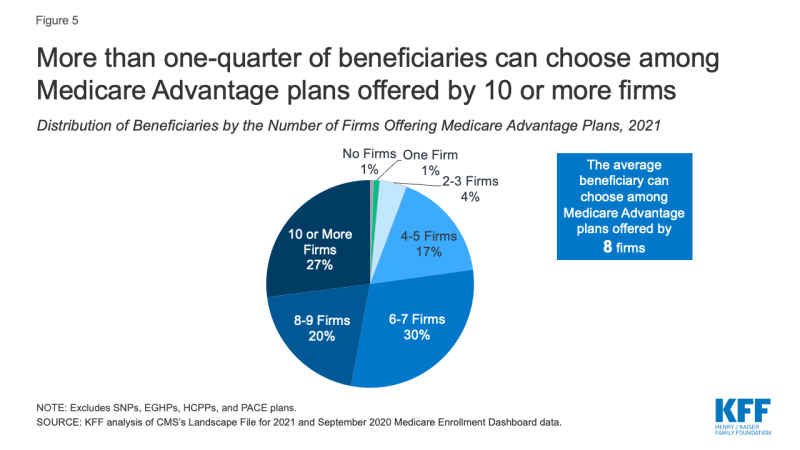

Number of Firms

The average Medicare beneficiary is able to choose from plans offered by 8 firms in 2021, one more than in 2020 (Figure 5). Despite most beneficiaries having access to plans operated by several different firms, enrollment is concentrated in plans operated by UnitedHealthcare, Humana, and Blue Cross Blue Shield affiliates.

Figure 5: More than one-quarter of beneficiaries can choose among Medicare Advantage plans offered by 10 or more firms

More than one-quarter of beneficiaries (27%) are able to choose from plans offered by 10 or more firms. Fifteen or more firms are offering Medicare Advantage plans in three counties: Orange County, California and Summit and Medina Counties in Ohio. In contrast, in 109 counties, most of which are rural counties with relatively few Medicare beneficiaries (1% of total), only one firm will offer Medicare Advantage plans in 2021. Over the past several years, the number of counties with a single firm offering Medicare Advantage plans has fallen substantially. As recently as 2019, there was a single firm offering plans in nearly 200 counties.

UnitedHealthcare and Humana, the two firms with the most Medicare Advantage enrollees in 2020, have large footprints across the country, offering plans in most counties. Humana is offering plans in 84 percent of counties and UnitedHealthcare is offering plans in 66 percent of counties in 2021 (Figure 6). More than 8 in 10 (87%) Medicare beneficiaries have access to at least one Humana plan and 86 percent have access to at least one UnitedHealthcare plans.

.

Most major Medicare Advantage firms have also expanded the number of counties where they are offering plans. UnitedHealthcare is offering plans in 2,117 counties in 2021, an increase of 245 from 2021, while Humana is offering plans in 2,703 counties in 2021, an increase of 33 from 2020. Centene is offering plans in 1,129 counties in 2021, an increase of 261 plans from 2020; Blue Cross Blue Shield Affiliates are offering plans in 1,181 counties, an increase of 152 plans; CVS Health is offering plans in 1,759 counties, an increase of 119 plans; and Cigna is offering plans in 369 counties, an increase of 67 plans. Kaiser Permanente had the smallest growth and is offering plans in 109 counties, an increase of 4 plans.

New Market Entrants and Exits

Medicare Advantage continues to be an attractive market for insurers, with 14 firms entering the market for the first time in 2021, collectively accounting for about 6 percent of the growth in the number of plans available for general enrollment and about 10 percent of the growth in SNPs (Appendix Table 2). Nine new entrants are offering HMOs available for individual enrollment. Five of the new entrants are offering SNPs; three firms are offering D-SNPs for people dually eligible for Medicaid, three firms are offering C-SNPs for people with select chronic conditions, and one firm is offering an I-SNPs Four of the new firm entrants are offering plans in California, two are offering plans in Indiana, and the remainder are offering plans in at least one of ten other states (Colorado, Georgia, Illinois, Mississippi, Missouri, Ohio, Texas, Utah, and Wisconsin).

Six firms that previously participated in the Medicare Advantage market are not offering plans in 2021. Two of the firms (ApexHealth, Inc. and Clarion Health) offered plans for the first time in 2020, but did not appear to enroll any participants. The other four firms had very low enrollment in 2020. Three of the six exiting firms offered plans in New York.

Premiums

The vast majority of Medicare Advantage plans for individual enrollment (89%) will include prescription drug coverage (MA-PDs), and 54 percent of these plans will charge no premium, other than the Part B premium, similar to 2020. More than nine out of ten beneficiaries (96%) have access to a MA-PD with no monthly premium in 2021. However, in Wyoming, beneficiaries do not have access to a zero-premium MA-PD, and in Idaho, less than half of beneficiaries have access to a zero-premium MA-PD.

In 2020, 60 percent of enrollees in MA-PD plans pay no premium other than the Medicare Part B premium of $144.60 per month. Based on enrollment in March 2020, nearly one in five enrollees (18%) pay at least $50 a month, and 6 percent pay $100 or more. CMS announced that the average monthly plan premium among all Medicare Advantage enrollees in 2021, including those who pay no premium for their Medicare Advantage plan, is expected to decrease 11 percent from 2020 to $21 a month. CMS does not disclose the methods or assumptions used in deriving their calculations, but since most Medicare Advantage enrollees pay no additional premium, the average they report is heavily influenced by zero-premium plans, and does not reflect the average premium paid by those who are in plans with an additional premium.

Extra Benefits

Medicare Advantage plans may provide extra benefits that are not available in traditional Medicare, are considered “primarily health related,” and can use rebate dollars (including bonus payments) to help cover the cost of these extra benefits. Beginning in 2019, CMS expanded the definition of “primarily health related” to allow Medicare Advantage plans to offer additional supplemental benefits. Medicare Advantage plans may also restrict the availability of these extra benefits to certain subgroups of beneficiaries, such as those with diabetes or congestive heart failure, making different benefits available to different enrollees.

Beginning in 2020, Medicare Advantage plans have also been able to offer extra benefits that are not primarily health related for chronically ill beneficiaries, known as Special Supplemental Benefits for the Chronically Ill (SSBCI). Information on the availability of SSBCI for 2021 has not yet been published by CMS, but may include services such as pest control, food and produce (beyond a limited basis), and non-medical transportation. Since plans are permitted to offer these benefits non-uniformly to enrollees, it will be important to examine how these benefits are distributed across subgroups of enrollees.

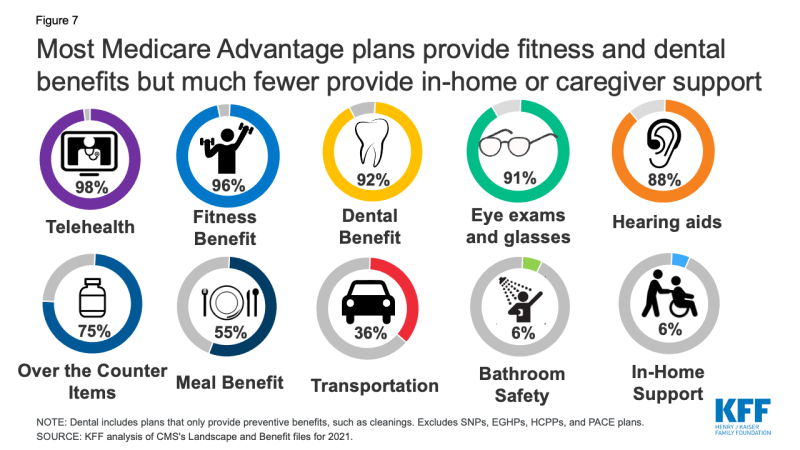

Availability of Extra Benefits in Plans for General Enrollment. Historically, the most offered extra benefits were fitness, dental, vision, and hearing; nearly two-thirds of plans (68%) provide all four of these benefits for 2021. Though these benefits are widely available, the scope of specific services varies. For example, a dental benefit may include cleanings only or more comprehensive coverage. As of 2020, Medicare Advantage plans have also been allowed to offer more telehealth benefits than traditional Medicare (though Medicare has temporarily expanded these benefits during the pandemic). The vast majority (98%) of Medicare Advantage plans are offering telehealth in 2021 (up from 91% in 2020) (Figure 7).

Figure 7: Most Medicare Advantage plans provide fitness and dental benefits but much fewer provide in-home or caregiver support

Other extra benefits that are frequently offered for 2021 include over the counter items (75%), meal benefits, such as a cooking class, nutrition education, or meal delivery (55%), and transportation benefits (36%).

Less than 10 percent of plans provide bathroom safety devices (6%) or in-home support (6%).

Availability of Extra Benefits in Special Needs Plans. SNPs are designed to serve a disproportionately high-need population, and a somewhat larger percentage of SNPs than plans for other Medicare beneficiaries provide their enrollees with over the counter items (91%), transportation benefits (85%) and meal benefits (63%). Similar to plans available for general enrollment, a relatively small share of SNPs provide bathroom safety devices (11%) or in-home support (18%).

Access to Extra Benefits. Virtually all Medicare beneficiaries live in a county where at least one Medicare Advantage plan available for general enrollment has some extra benefits not covered by traditional Medicare, with 98% having access to some dental, fitness, vision, and hearing benefits for 2021. The vast majority of beneficiaries also have access to telehealth benefits (99%), over the counter items (99%), transportation assistance (95%) and a meal benefit (98%), but far fewer have access to bathroom safety (55%) or in-home support (62%).

Discussion

More Medicare Advantage plans are being offered for 2021 than in any other year. Fourteen insurers are entering the Medicare Advantage market for the first time, and six insurers are exiting the market, suggesting thatMedicare Advantage remains an attractive, profitable market for insurers. As in prior years, some (mostly non-metropolitan) counties are less attractive to insurers, with fewer firms and plans available, though the number of areas where this is the case has declined over time. Overall, more than 99 percent of beneficiaries will have access to one or more Medicare Advantage plans in 2021, similar to prior years. With more firms offering SNPs and the number of SNPs rapidly growing, there may be greater focus on how well high-need, vulnerable beneficiaries are being served by Medicare Advantage plans, including SNPs as well as plans for general enrollment. As Medicare Advantage enrollment continues to grow, insurers seem to be responding by offering more plans and choices to the people on Medicare.

| Methods |

| This analysis focuses on the Medicare Advantage marketplace in 2021 and trends over time. The analysis includes more than 24 million enrollees in Medicare Advantage plans in 2020.

Data on Medicare Advantage plan availability, enrollment, and premiums were collected from a set of data files released by the Centers for Medicare & Medicaid Services (CMS):

In previous years, KFF has used the Medicare Advantage Penetration Files to calculate the number of Medicare beneficiaries eligible for Medicare. The Medicare Advantage Penetration Files includes people who were previously, but no longer covered by Medicare (e.g., people who obtained employer-sponsored health insurance coverage after initially enrolling in Medicare). It also includes people within 5 months of their 65th birthday, but not yet age 65. In addition, CMS has identified an issue where beneficiaries with multiple addresses were double counted in the Penetration File. KFF has refined its approach this year and is using the Medicare Enrollment Dashboard to calculate the number of Medicare beneficiaries because it only includes Medicare beneficiaries with either Part A or Part B coverage, which is a more accurate estimate of the Medicare population. The numbers published here supersede all prior estimates by KFF of the number of Medicare beneficiaries.

|

Jeannie Fuglesten Biniek, Meredith Freed, and Tricia Neuman are with KFF.

Anthony Damico is an independent consultant.