How Many Uninsured Adults Could Be Reached If All States Expanded Medicaid?

Summary

As the country grapples with the public health and economic consequences of the coronavirus pandemic, there has been a renewed focus on coverage options that may be available to individuals who lose income, jobs and potentially employer sponsored insurance (ESI). The Affordable Care Act (ACA) established new coverage options through Medicaid or subsidized coverage through ACA marketplaces. Millions of people are enrolled in or eligible for coverage through these new pathways. However, in states that do not expand Medicaid, many adults, including almost all childless adults, fall into a “coverage gap” because their incomes are above Medicaid eligibility limits but below the poverty level, which is the lower limit for Marketplace premium tax credits. As more people lose their jobs and accompanying ESI, more may fall into the coverage gap, particularly starting in 2021 after unemployment benefits expire for many who have lost their jobs and incomes are likely to drop below the minimum threshold for marketplace subsidies. This analysis estimates how many uninsured adults—including those uninsured even before the pandemic and those who could become uninsured as a result of it— could become eligible for Medicaid if states that have not yet expanded the program do so. Methods underlying the analysis are detailed in the methods section at the end of the brief. Key findings include the following:

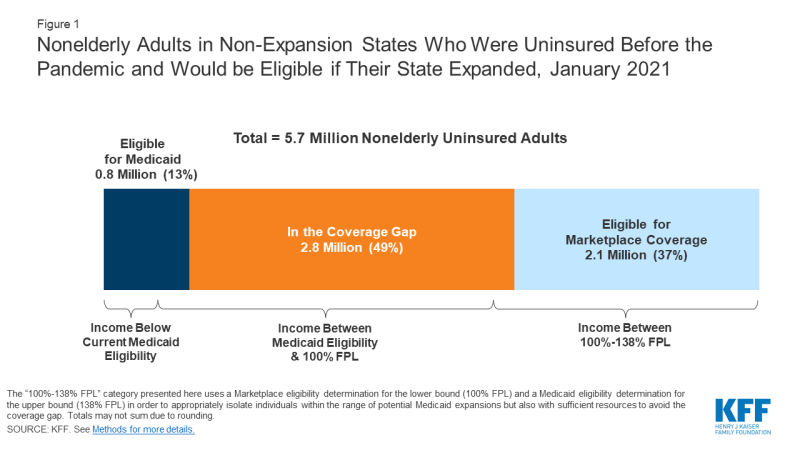

- If the 14 states that have not adopted the Medicaid expansion to date do so, an estimated 2.8 million adults who were uninsured in 2020 would move out of the coverage gap by 2021 and instead have access to Medicaid coverage. An additional 2.1 million previously uninsured adults who are eligible for marketplace subsidies in non-expansion states would instead become eligible for Medicaid, with much lower out-of-pocket costs for premiums and cost sharing.

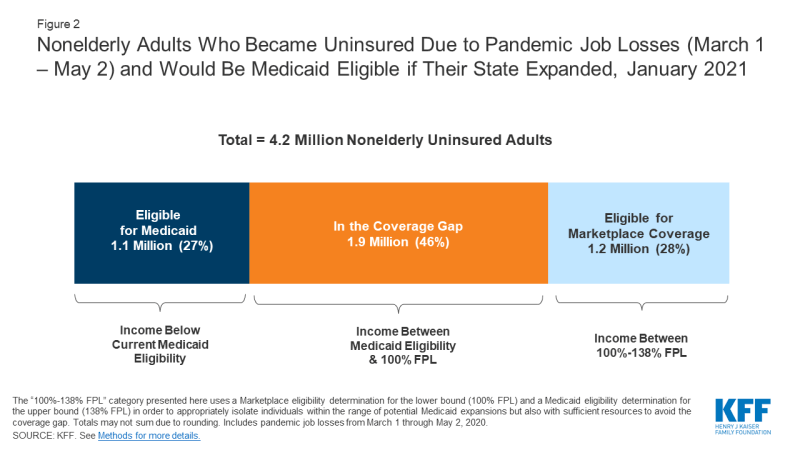

- In addition, some people who lose employer sponsored coverage and become uninsured as a result of the current economic downturn would become eligible for Medicaid rather than fall into the coverage gap. Based on analysis estimating that nearly 27 million could lose ESI and became uninsured as a result of recently becoming unemployed, we find that 1.9 million more who otherwise would be in the coverage gap could gain Medicaid eligibility by January 2021 if all states adopted the expansion. Just over a million additional people who could potentially lose ESI and became uninsured with incomes between 100-138% FPL would also become eligible for Medicaid instead of marketplace subsidies.

- In total, if non-expansion states expanded Medicaid under the ACA, about 4.7 million adults who would otherwise fall into the coverage gap by 2021 would gain eligibility, and an additional 3.3 million adults would become newly eligible for Medicaid coverage instead of marketplace coverage. In addition, there are a small number of uninsured adults already eligible for Medicaid in non-expansion states; their eligibility would not change if their states expanded, but increased outreach could lead them to enroll in coverage. Including the small number of currently eligible non-elderly adults in these states, the total reach of Medicaid among uninsured nonelderly adults in non-expansion states could be nearly 10 million.

Potential Reach of Expansion among Adults Uninsured Prior to Pandemic

In states that have not expanded Medicaid, many uninsured adults below poverty, including most childless adults, fall into a “coverage gap.” Under the ACA, Medicaid eligibility is extended to nearly all low-income individuals with incomes at or below 138 percent of poverty ($17,609 for an individual in 2020). While the Medicaid expansion was intended to be national, the June 2012 Supreme Court ruling essentially made it optional for states. As of May 2020, 14 states had not expanded their programs. Medicaid eligibility for adults in states that did not expand their programs is quite limited: the median income limit for parents in these states is just 41% of poverty, or an annual income of $8,905 for a family of three in 2020, and in nearly all states not expanding, childless adults remain ineligible. Further, because the ACA envisioned low-income people receiving coverage through Medicaid, it does not provide financial assistance to people below poverty for other coverage options. As a result, in states that do not expand Medicaid, many adults, including all childless adults, fall into a “coverage gap” of having incomes above Medicaid eligibility limits but below the poverty level, which is the lower limit for Marketplace premium tax credits.

Among adults uninsured even before the pandemic, an estimated 2.8 million poor uninsured adults would fall into the “coverage gap” that results from state decisions not to expand Medicaid by 2021. This number includes the 2.3 million in the coverage gap without accounting for the effects of the pandemic and an additional half a million individuals in non-expansion states who did not have insurance in early 2020 and are estimated to lose Marketplace eligibility by 2021 due to job losses. Individuals in the gap have income that is above current Medicaid eligibility but below the lower limit for Marketplace premium tax credits. Reflecting limits on Medicaid eligibility outside ACA pathways, most people in the coverage gap (81%) are adults without dependent children. Adults left in the coverage gap by 2021 are concentrated in the South, which accounts for 9 out of 14 states that have not expanded. Of those in the gap, one-third live in Texas, 18 percent in Florida, 12 percent in Georgia, and eight percent in North Carolina. There are no uninsured adults in the coverage gap in Wisconsin because the state is providing Medicaid eligibility to adults up to the poverty level under a Medicaid waiver.

If states that are currently not expanding their programs adopt the Medicaid expansion, all of the 2.8 million adults in the coverage gap would gain Medicaid eligibility (Table 1 and Figure 1). In addition, 2.1 million uninsured adults with incomes between 100 and 138% of poverty (most of whom are currently eligible for Marketplace coverage) would also gain Medicaid eligibility, substantially lowering the out-of-pocket costs for premiums and cost-sharing they would otherwise face. A smaller number (about 757,000) of uninsured adults in non-expansion states are already eligible for Medicaid under eligibility pathways in place before the ACA. If all states expanded Medicaid, those in the coverage gap and those who are instead eligible for Marketplace coverage would bring the number of nonelderly uninsured adults eligible for Medicaid to about 5.7 million people in the fourteen current non-expansion states. The potential scope of Medicaid varies by state.

Figure 1: Nonelderly Adults in Non-Expansion States Who Were Uninsured Before the Pandemic and Would be Eligible if Their State Expanded, January 2021

Potential Reach of Expansion among People Losing ESI after Job Loss

The economic consequences of the coronavirus pandemic have led to historic level of job loss in the United States. Social distancing policies required to address the crisis have led many businesses to cut hours, cease operations, or close altogether. Between March 1st and May 2nd, 2020, more than 31 million people filed for unemployment insurance and an estimated nearly 78 million people lived in a family in which someone lost a job. Most people in these families (61%, or 47.5 million) were covered by ESI prior to job loss. Previous KFF estimates showed that nearly 27 million people could lose ESI and became uninsured following job loss. In some cases, employers may be continuing health benefits for furloughed or laid off workers, but that will likely end if unemployment remains high. Some people in this group can elect to continue ESI for a period by paying the full premium (called COBRA continuation) or may become eligible for Medicaid or subsidized coverage through the ACA marketplaces. While the state unemployment insurance benefit payments and federal supplement available to most people mean few will fall into the coverage gap immediately, a larger number could find themselves in the gap after these benefits expire.

Nationally, coverage losses among people who previously had ESI and lost their jobs could lead an additional 1.9 million adults to fall into the coverage gap by January 2021. Recent analysis shows that by January 2021, when unemployment insurance (UI) benefits cease for most people, an estimated 1.9 million could fall into the coverage gap. People who lose ESI and find themselves in the coverage gap by January 2021 are concentrated in Georgia (21%), Texas (20%), and Florida (18%).

If all states adopted the expansion, 1.9 million newly uninsured adults who otherwise would fall into the coverage gap would instead be eligible for Medicaid (Figure 2 and Table 2). If all states adopted the expansion, these individuals would be eligible for Medicaid. In addition, an estimated 1.2 million individuals with incomes between 100-138% FPL who otherwise would be eligible for marketplace subsidies would also become eligible for Medicaid if all states expanded. Counting the 1.1 million adults in non-expansion states who are already eligible for Medicaid even without expansion (and whose eligibility would not change), the total number of newly-uninsured adults who could be eligible for Medicaid in non-expansion states would be 4.2 million.

Figure 2: Nonelderly Adults Who Became Uninsured Due to Pandemic Job Losses (March 1 – May 2) and Would Be Medicaid Eligible if Their State Expanded, January 2021

In total, if non-expansion states expanded Medicaid under the ACA, about 4.7 million adults who would otherwise fall into the coverage gap by 2021 would gain eligibility (Table 3). An additional 3.3 million adults would become newly eligible for Medicaid coverage instead of marketplace coverage. Including the small number of currently eligible non-elderly adults in these states, the total reach of Medicaid among uninsured nonelderly adults in non-expansion states could be nearly 10 million.

Looking Ahead

Given the health risks facing all Americans right now, access to health coverage after loss of employment provides important protection against catastrophic health costs and facilitates access to care. This is the first economic downturn during which the ACA will be in place as a safety net for people losing their jobs and health insurance. Without it, many more people would likely end up uninsured as the U.S. heads into a recession. However, if all states adopted the expansion, more people would have options for affordable coverage and not fall into the coverage gap. These estimates show increases in eligibility but do not account for take-up or enrollment in coverage. Individuals currently in the coverage gap as well as those who may be newly eligible for coverage due to job loss may not know they are eligible for ACA coverage or may need assistance in applying to enroll in coverage. The federal government covers 90% of the cost of coverage for Medicaid expansion enrollees, leaving states with 10% of the expense, an amount that could grow if job losses increase. However, some research that pre-dates the pandemic shows that states may experience net budget savings following Medicaid expansion after accounting for resulting reductions in the cost of other state programs.

| Methods |

| This analysis draws on KFF’s estimates of the number of adults that fall into the Medicaid coverage gap as well as ACA eligibility among people losing employer-sponsored insurance (ESI) due to the coronavirus pandemic. Detailed methods underlying both those analyses, both of which are based on the 2018 American Community Survey, are available via the links above. Notably, in contrast to previous coverage gap estimates, the estimates in this brief are based on estimated 2020 population. In order to estimate the 2020 population within each state, we linearly extrapolated 2020 state population estimates based on 2018 and 2019 population estimates from the U.S. Census Bureau to determine a population increase factor between 2018 and 2020 within each state. We then applied this multiplier to the weight of each individual in the microdata to approximate state population sizes in mid-2020 rather than mid-2018. Coverage gap numbers in this analysis also differ from previous KFF estimates in that they include people who, absent the pandemic and estimated related job loss/loss of income, were uninsured but eligible for marketplace premium subsidies; with the loss of jobs and income, they instead fall into the coverage gap. |

Robin Rudowitz and Rachel Garfield are with KFF. Anthony Damico is an independent consultant.