The Uninsured at the Starting Line: Findings from the 2013 Kaiser Survey of Low-Income Americans and the ACA

I. Patterns of Coverage and the Need for Assistance

Coverage Dynamics among the Insured and Uninsured

Health insurance coverage is dynamic, and every year millions of Americans gain, lose, or change their health coverage. However, for most uninsured adults, lack of coverage is a long-term issue that spans many years. Many uninsured adults report trying to obtain coverage in the past but were unsuccessful due to barriers such as ineligibility for public coverage or high costs of private coverage. Under the ACA, millions of uninsured are projected to gain coverage as those barriers are removed, but some may continue to experience gaps or changes in coverage.

For most currently uninsured adults, lack of coverage is a long-term issue.

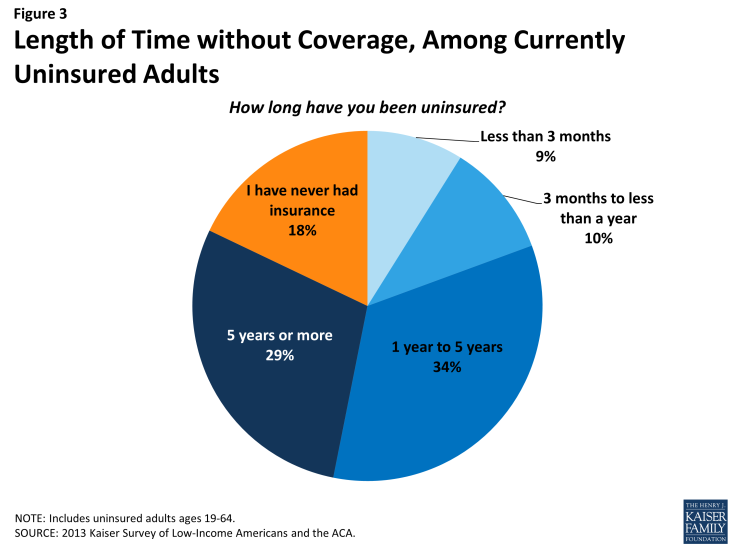

While some people lack health insurance coverage during short periods of unemployment or job transitions, for many uninsured adults, lack of coverage is a chronic problem. The survey shows that a large share of uninsured adults have been without insurance for a very long period of time: Almost half (47%) report being uninsured for 5 years or more, and 18% report that they have never had coverage in their lifetime (Figure 3 and Appendix Table A2).

Perhaps not surprisingly, adults who have been without insurance coverage for at least five years are, on average, older than those who have been uninsured for shorter periods of time. Nearly two-thirds (63%) of adults who have been uninsured for five years or more are ages 35-64, compared to just 47% of adults who have been uninsured for less than a year (data not shown). However, on other characteristics, such as race, gender, citizenship, income, and health status, long-term and short-term uninsured adults resemble each other.

“I don’t know how to go about getting insurance.”

Alexa (TX), long-term uninsured

It is important for policymakers implementing coverage expansions to be aware that people targeted by the ACA have varying levels of experience with the insurance system. While some only recently lost coverage, a large share of uninsured adults has been outside the insurance system for quite some time. The long-term uninsured may require targeted outreach and education efforts to link them to the health care system and help them navigate their new health insurance.

Many uninsured adults report trying to obtain insurance coverage in the past, but most did not have access to affordable coverage.

The uninsured report a desire to obtain coverage, but prior to implementation of the ACA, options for coverage—particularly for the low-income—were limited. The vast majority of uninsured adults do not have access to employer coverage. Eight in ten uninsured adults report no access to employer insurance, either because no one in their family is working for an employer, their or their spouse’s employer does not offer coverage, or they are ineligible for that coverage (Table 1). For example, 47% of uninsured adults are in a family without an employer, meaning both they and their spouse (if married) are either not working or are working but are self-employed. A quarter of uninsured adults are in a family that has an employer who does not offer coverage to any workers, and 10% are in a family that works for an employer who offers coverage but they are ineligible for that coverage. Most are ineligible because they work part-time or are in a waiting period. Less than one in five (18%) uninsured adults does have access to coverage through an employer, but the majority of those people report that the coverage offered to them is not affordable.

| Table 1: Access to Employer Health Coverage Among Uninsured Adults | |||||

| All Uninsured | Uninsured by Income | ||||

| <138% FPL | 139-400% FPL | >400% FPL | |||

| % | % | % | % | ||

| No Access to ESI | 82% | 86% | 78%^ | 78% | |

| No one in family has an employer* |

47% | 54% | 37%^ | 51% | |

| Firm doesn’t offer coverage | 25% | 25% | 30% | — | |

| Not eligible for coverage | 10% | 7% | 12% | — | |

| Access to ESI | 18% | 14% | 22%^ | — | |

| Cannot afford premium | 11% | 8% | 12% | — | |

| Don’t think need coverage | — | — | — | — | |

| Some other reason | 6% | 5% | 9% | — | |

| Note: Don’t Know and Refused responses are not shown, they account for less than 3% of the uninsured population. “–“: Estimates with relative standard errors greater than 30% or cell sizes below 50 are not provided. NA: Not applicable * Individuals who are self-employed without other employment are treated as not having an employer. ^ Estimate statistically significantly different from <138% FPL estimate at the 95% confidence level. SOURCE: 2013 Kaiser Survey of Low-Income Americans and the ACA. |

|||||

Prior to the ACA, Medicaid eligibility for adults was very limited in most states. Eligibility generally was limited to parents with very low incomes (often below about half the federal poverty level), and in all but a handful of states, adults without dependent children were ineligible for Medicaid regardless of their income.1 Further, application processes were sometimes very complex, requiring face-to-face interviews, assessments of assets, or paper documentation.2 Eligibility and application processes posed barriers for many low-income adults seeking Medicaid coverage.

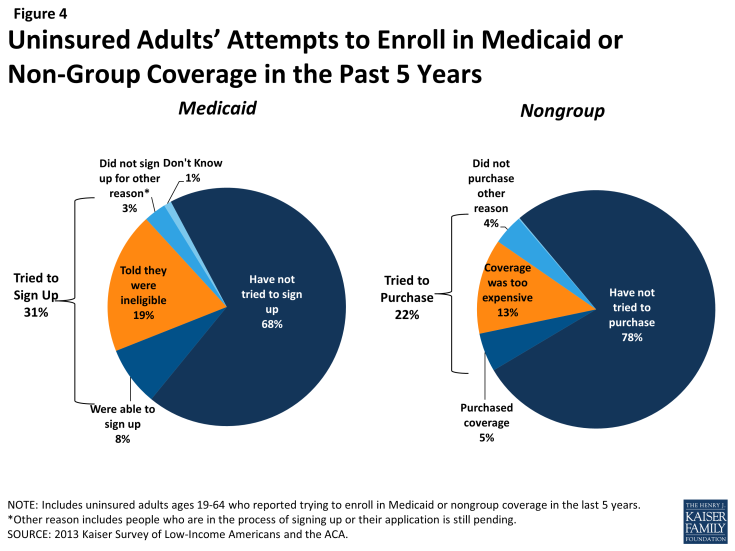

One in three uninsured adults (31%) reported trying to sign up for Medicaid in the past five years (Figure 4). Low-income uninsured adults (those with family income up to 138% FPL) were more likely than those with moderate incomes to report trying to sign up for Medicaid (38%) (see Appendix Table A2). The majority of adults who tried to sign up for Medicaid (22% of the uninsured) were unsuccessful, and among those, most (19% of the uninsured) were unable to sign up because they were told they were ineligible. Notably, a quarter of uninsured adults in the income range for Medicaid expansion under the ACA (<138% FPL) have tried to sign up for Medicaid in the past but were told they were ineligible.

Figure 4: Uninsured Adults’ Attempts to Enroll in Medicaid or Non-Group Coverage in the Past 5 Years

Prior to the ACA, there were also barriers to obtaining coverage on the non-group, or individual market. This type of coverage was not guaranteed in all states, and insurance companies could often charge higher premiums for sicker individuals or place limits on coverage for pre-existing conditions, making coverage unaffordable for many uninsured adults. The uninsured also report trying to obtain non-group coverage prior to the ACA. One in five uninsured adults (22%) reported trying to obtain non-group coverage in the past five years. Most of these adults (13% of the uninsured) did not purchase a plan because the policy they were offered was too expensive (Figure 4).

“We are very lucky that we have not had any catastrophic incidents, because we could not afford the catastrophic insurance premiums [for nongroup coverage] that we were quoted.”

Jose (FL), on trying to buy coverage on his own before the ACA

Many of the barriers to coverage that the uninsured report facing in the past are addressed by the ACA. Large employers (>50 workers) face penalties if they do not offer affordable coverage to their workers, and in states that chose to expand Medicaid, eligibility for Medicaid includes almost all adults with incomes at or below 138% FPL. Further, millions of uninsured families are now able to purchase coverage in the Marketplaces and receive premium tax credits to reduce the cost. Insurers are no longer able to deny coverage based on health status and are limited in what they charge people based on age, location, and tobacco use status. However, some uninsured adults may continue to face barriers to coverage. Employers are not required to offer coverage to part-time employees, and only large businesses will be subject to a fine for not offering affordable coverage to full-time employees, beginning in 2015. In states that did not expand Medicaid, eligibility remains limited, leaving many ineligible for Medicaid and without an affordable coverage option. Last, people who have attempted to obtain coverage in the past may be unaware that rules and costs have changed under the ACA. Outreach and education will be needed to inform people that eligibility rules have changed and that financial assistance is available to offset the cost of coverage.

Health insurance coverage is not always stable.

For most insured adults, coverage is continuous throughout the year and over time, but a sizable number experience a gap or change in coverage. When accounting for both insured people with a gap in their coverage and uninsured people who recently lost coverage, the survey indicates that nearly 18 million adults lose or gain coverage over the course of a year.

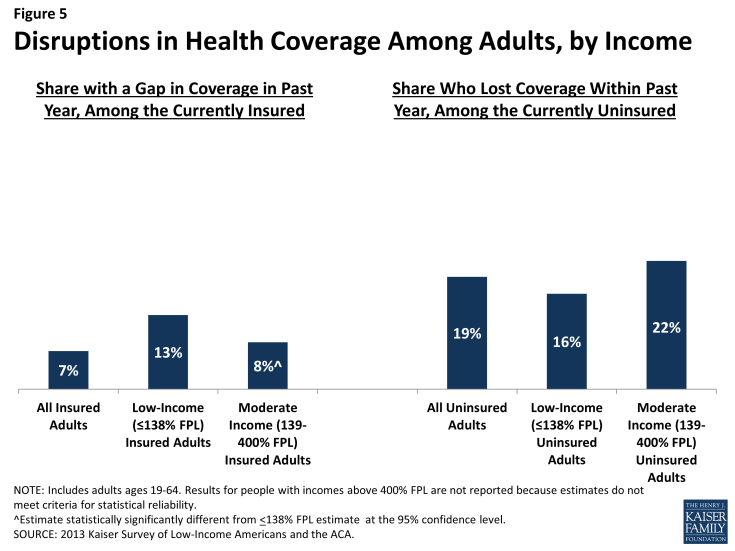

Among adults who were insured at the time of the survey, 7% reported being uninsured at some point in the past year (see Figure 5 and Table 2), and those who had a gap in coverage were uninsured for nearly half the year (5.7 months) on average (data not shown). Low-income insured adults (those with family income up to 138% FPL) are particularly vulnerable to gaps in coverage, with 13% reporting a coverage gap in the past 12 months compared to 8% of those with incomes between 139 and 400% FPL (Figure 5).

Further, some currently uninsured adults had coverage at some point within the past year. Among uninsured adults, nearly one in five (19%) report having lost coverage within the last year. Among both those with a gap in coverage or who recently lost coverage, the majority report that they most recently had employer coverage (data not shown).

| Table 2: Coverage Dynamics among Insured and Uninsured Adults, by Income and Current Coverage | |||||||||

| All | By Income | By Current Coverage | |||||||

| <138% FPL | 139-400% FPL | >400% FPL | Employer | Nongroup | Medicaid | ||||

| % | % | % | % | % | % | % | |||

| Insured Adults | 100% | 100% | 100% | 100% | 100% | 100% | 100% | ||

| Gap in Coverage in Past Year | 7% | 13% | 8%^ | — | 5%* | — | 13% | ||

| Changed Coverage During Year | 12% | 7% | 11%^ | 16%^ | 14%* | — | 3% | ||

| Same Coverage for Full Year | 81% | 79% | 81% | 82% | 80% | 84% | 81% | ||

| Uninsured Adults | 100% | 100% | 100% | 100% | 100% | 100% | 100% | ||

| Uninsured Full Year | 80% | 83% | 78% | 75% | NA | NA | NA | ||

| Lost Coverage Within Past Year | 19% | 16% | 22% | — | NA | NA | NA | ||

| Notes: Don’t Know and Refused responses not shown. Excludes people covered by other sources, such as Medicare, VA/CHAMPUS, or other state programs. “–“: Estimates with relative standard errors greater than 30% or cell sizes below 50 are not provided. NA: Not applicable. ^ Estimate statistically significantly different from <138% FPL estimate at the 95% confidence level. * Estimate statistically significantly different from Medicaid estimate at the 95% confidence level. SOURCE: 2013 Kaiser Survey of Low-Income Americans and the ACA. |

|||||||||

In addition to those who lose or gain coverage over the course of a year, millions of adults who have coverage throughout the entire year have a change in their health insurance plan. Among adults with insurance coverage, 12% (17 million people) had coverage for the entire year but report that they had a change in their coverage (Table 2). Coverage changes may be due to a number of different factors including changes in employment, changes in eligibility for public programs, or simply a change in insurance carrier. The most common reasons for a change in coverage appear to be related to employment, as most people with a coverage change report changing from an employer plan to another employer plan.

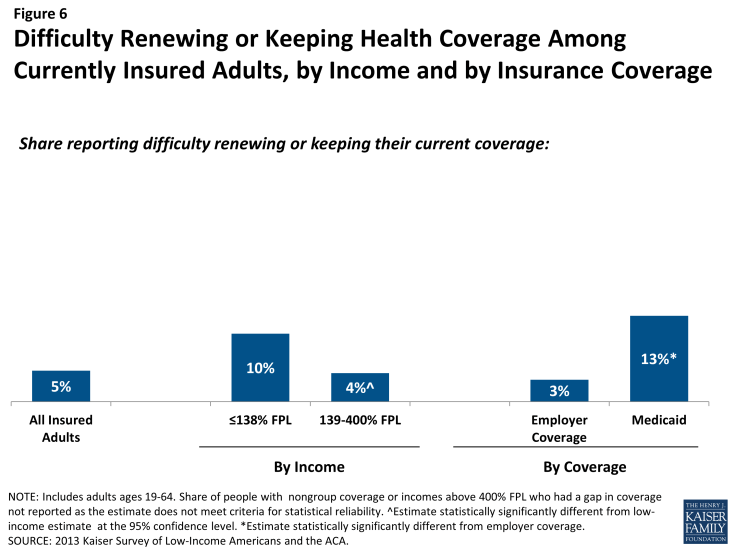

Last, a small number of insured adults report challenges in either renewing or keeping their coverage, another indication of instability in coverage throughout the year. Reflecting eligibility rules and sometimes burdensome renewal processes, adults with Medicaid are the most likely to report a challenge (13%) compared to adults with employer coverage (Figure 6). Medicaid eligibility is closely tied to income, and adults’ income may fluctuate throughout the year; in addition, adults must renew their Medicaid coverage annually.

Figure 6: Difficulty Renewing or Keeping Health Coverage Among Currently Insured Adults, by Income and by Insurance Coverage

“So there for a while, for a few weeks, a month, 6 weeks, I’m without insurance. And then during that time, I cannot get medical care.”

Julie (MO), on having gaps in coverage

The survey findings on changes in insurance coverage over the course of the year have implications for implementation of health reform. Prior to the ACA, many people lost and gained employer coverage over the course of a year, due to changing economic conditions and the delicate relationship between employment and health insurance. Further, there was some churning in insurance coverage resulting from Medicaid income eligibility limits: as adults’ income fluctuates, they may gain or lose Medicaid eligibility. Adults also experienced gaps in Medicaid coverage due to frequent renewal requirements. Gaps in coverage can cause people to postpone or forgo health care or accumulate medical bills.3 By providing for insurance options across the income spectrum and facilitating coverage outside the employment-based system, the ACA may help adults have coverage continuously throughout the year. However, even after implementation, adults are likely to experience coverage changes due to job changes or income fluctuation. While there has been much focus on the early effort to enroll currently uninsured people in coverage, these findings demonstrate that people will continue to move around within the insurance system throughout the year. Thus, implementation is not a “one shot” effort that will be done once people are enrolled in the early part of 2014 but rather will require a continuous effort to enroll and keep people in coverage.