The Uninsured at the Starting Line: Findings from the 2013 Kaiser Survey of Low-Income Americans and the ACA

V. Poised at the Starting Line

Low- and Moderate-income Uninsured Adults’ Readiness for the ACA

Low-and moderate income adults are the main targets of the ACA expansions, but prior to the start of open enrollment, many remained unaware of their coverage options under the law. Confusion over state decisions about whether to expand their Medicaid programs or operate their own Marketplaces may have clouded messaging on new coverage options. Further, while there were well-documented technical problems with initial enrollment efforts, some uninsured adults may face additional challenges in signing up for coverage, as they lack basic tools needed for this process such as internet access or bank accounts. Outreach and enrollment will be crucial to the ultimate success of the ACA in expanding coverage, yet many uninsured adults have limited connection to potential outreach avenues. Past experience demonstrates that both broad and targeted outreach efforts and direct one-on-one enrollment assistance will be key for successful enrollment.1

A majority of uninsured adults who are income eligible for coverage expansions reported knowing little or nothing about Medicaid and Marketplace programs prior to the start of open enrollment.

Despite ongoing media attention to the ACA, most uninsured adults who are likely eligible for coverage under the law2 reported that they knew little about either Medicaid or Marketplaces prior to the start of open enrollment. Seven in ten uninsured adults with incomes in the Medicaid target range (<138% FPL) say they knew nothing at all or only a little about their state’s Medicaid program, and eight in ten uninsured adults in the income range for Marketplace subsidies (139-400% FPL) reported that they knew nothing at all or only a little about the Marketplaces. While these shares are fairly constant across coverage categories (see Appendix Table A6), they point to the need for substantial outreach and education efforts among the target population for coverage expansions. Recent media attention to the challenges faced in initial enrollment efforts likely has increased awareness of coverage options; however, it is not clear to what extent media attention has translated to understanding of what is available and how to enroll, or discouraged attempts to enroll. More recent polling data indicates that 46% of the nonelderly uninsured of all incomes were not aware that the law provides help to low- and moderate-income Americans to help them purchase coverage, and two-thirds (66%) of nonelderly uninsured (all incomes) say they don’t have enough information to understand how the law will impact their families, a share that has been fairly consistent since Fall 2013.3

While most uninsured adults have the necessary tools for enrolling in coverage, some will experience additional logistical issues in signing up.

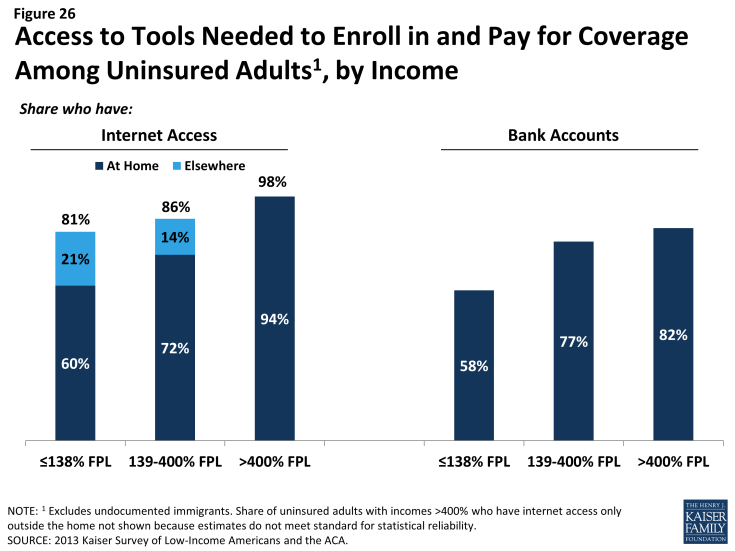

Under the ACA, online applications through Healthcare.gov or state-specific Marketplace sites are intended to be the primary mode for signing up for coverage in the Marketplace. In addition, all states are required to accept online applications for Medicaid (in addition to paper, phone, and in-person applications), and many people who are eligible for Medicaid may first apply for coverage through the Marketplace web site. Thus, internet access is an important tool in accessing coverage under the law. While the majority of uninsured adults have access to the internet either at home or outside the home (Figure 26), 19% of low-income (<138% FPL) and 14% of moderate income (139-400% FPL) uninsured adults report that they do not have internet access readily available. Further, some people who report having internet access may be using their mobile devices for access, but currently healthcare.gov (and most states) are not configured to allow for application via mobile device. People without internet access via a computer may be able to enroll through other more traditional avenues such as over the phone or in person at county offices or providers, but efforts may be needed to inform people about these other application routes, and some using them may experience a slower enrollment process than they would if they applied online.

Once people are enrolled in coverage, they will require a means to pay their premiums on a regular basis (if enrolled in Marketplace coverage). While plans must accept various forms of payment,4 direct withdrawal from a checking account is a simple and reliable way to ensure that premiums are paid on time. However, nearly a quarter (23%) of uninsured adults in the income range for Marketplace subsidies (139-400% FPL) and nearly one in five (18%) of uninsured adults who could gain unsubsidized coverage through the Marketplace report that they do not have a checking or savings account (Figure 26). These “unbanked” uninsured adults may face some logistical barriers to paying premiums that those who can use direct withdrawal do not.

Many uninsured adults could be reached through targeted outreach avenues.

Across states, a variety of outreach and enrollment efforts are underway to help connect eligible people to coverage, ranging from broad marketing and media campaigns to direct one-on-one assistance. Moreover, a wide array of groups and individuals are involved in outreach and enrollment, including community-based organizations, providers, health centers, and faith-based groups.5 Some states are also utilizing new “fast track enrollment” opportunities to efficiently enroll large numbers of eligible individuals in their Medicaid programs.6 Specifically, CMS offered states the opportunity to facilitate enrollment of eligible people into Medicaid by using data already available to states through the Supplemental Nutritional Assistance Program (SNAP) and children’s eligibility data for Medicaid and the Children’s Health Insurance Program (CHIP). Experiences in states that have already launched these strategies indicate they can be highly successful in connecting people to coverage, reaching a significant share of adults eligible for the Medicaid expansion while minimizing burdens for both individuals and eligibility staff.7

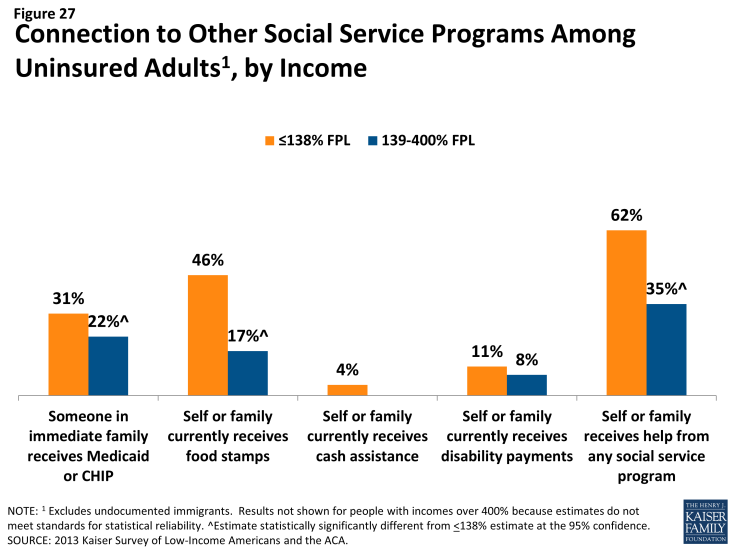

Many uninsured adults report that they or their family already have a link to a social service program, making fast track enrollment efforts a promising avenue for outreach. Among uninsured adults with incomes in the range for Medicaid eligibility (<138% FPL), over six in ten (62%) report that they or someone in their immediate family receives either SNAP, cash assistance, disability payments, or Medicaid or CHIP (Figure 27). SNAP is the most common connection to social services programs among the low-income uninsured (46%). These programs already have much of the information needed to determine eligibility for Medicaid under the ACA, such as income, residence, and family structure, and could provide an efficient route to enrolling the uninsured in coverage. While lower shares of moderate-income uninsured adults report a connection to a social service program, outreach to this group of uninsured adults could also reach many eligible for coverage.

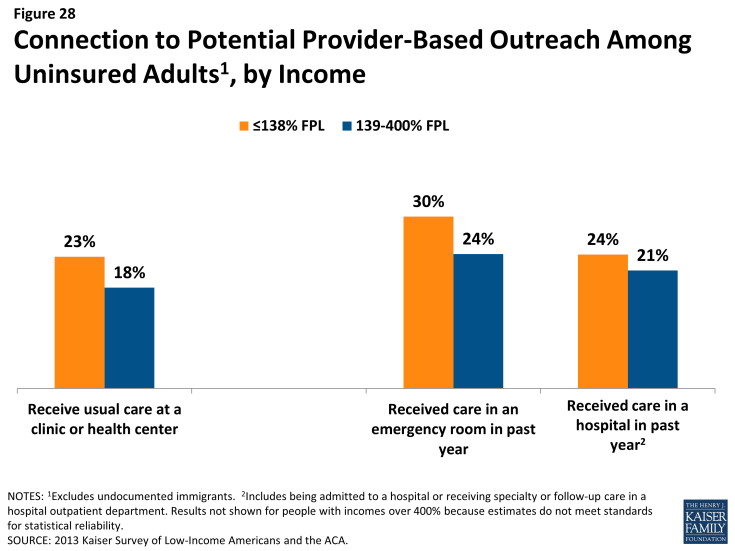

For those without a connection to social services agencies, outreach through providers may be a promising approach. Many community health centers or hospitals and health systems are very involved with outreach and enrollment efforts, sometimes having enrollment workers in-house to help patients with ACA enrollment. Clinics in particular are an important outreach location, as about one in five low- or moderate-income uninsured adults report that they use a clinic or health center as their usual source of care (Figure 28). Hospitals reach many uninsured adults through periodic visits: at least one in five uninsured low- or moderate-income adults report visiting a hospital in the past year for either emergency services or for inpatient or outpatient care. Patients who seek episodic care in emergency rooms or hospitals may be receptive to outreach efforts, as they have a demonstrated need for services and are likely to face high bills if they remain uninsured; however, outreach workers may be challenged to engage individuals in the application process at a time when they are seeking services for an urgent or acute problem.8