The Status and Likely Impact of Final Regulations on Payments for Abortion Coverage in ACA Marketplace Plans

| Key Takeaways |

On December 27, 2019, the Trump Administration published final regulations that change how ACA Marketplace plans that include coverage for abortion must bill and consumers must pay premiums for that coverage.

|

Introduction

On December 27, 2019, the Trump Administration issued final regulations to address “Exchange Program Integrity.” A major element of the rules affects insurers, consumers, and state insurance regulators in the states that either allow or require abortion coverage. The Affordable Care Act (ACA) allows states to ban plans from offering abortion as a benefit on their Qualified Health Plans (QHPs) and requires plans that cover abortion to segregate policyholder payments for abortion coverage from all other premium charges. The Administration issued the proposed rules in November 2018 and received over 75,000 comments from a range of stakeholders, including insurers, state-based exchanges, state insurance regulators, and consumer advocacy organizations. Many commented that HHS had underestimated the burdens and costs to issuers and consumers. The final regulations maintain most of the elements of the proposed rules with some minor changes. In addition, following the comments, HHS increased its estimates for the costs that these regulations will have for consumers, issuers, and exchanges. This provision was originally slated to become effective June 27, 2020; however, in response to the COVID-19 pandemic, the Center for Medicare and Medicaid Services (CMS) pushed the effective date back by 60 days to August 26, 2020. However, three federal district courts have issued orders blocking the implementation of the regulations.

The Trump administration says the new regulations will be confusing for consumers and burdensome to issuers, but believes it is more consistent with “congressional intent” and is a “better implementation” of the ACA’s statutory requirement for separate payments. These rules could disrupt coverage for many consumers, add to coverage costs, place administrative and reporting requirements on issuers, and add new oversight responsibilities for state insurance regulators. Also, this regulation will likely result in plan decisions (when permitted by state law) to eliminate abortion coverage from their policies in order to avoid additional administrative requirements, placing the costs of abortion care directly on women enrollees and potentially limiting their access to these services. The rule is consistent with ongoing Trump Administration efforts to limit the number of abortions in the U.S. This brief provides an overview of current ACA-related abortion coverage policies, analyzes the potential impact of the new regulations and provides an overview of the legal challenges to the final rule.

How have ACA Marketplace plan policyholders been paying for abortion coverage?

The ACA requires all QHPs to provide coverage for 10 Essential Health Benefits (EHB), but prohibits abortion services from being included as an EHB. States may ban plans offered through the ACA Marketplace from covering any abortions–even if the pregnancy is a result of rape or incest or a threat to the woman’s life as permitted under the Hyde Amendment. Since the ACA was implemented, 26 states have banned abortion coverage on their ACA Marketplace (Figure 1).

Figure 1: In 17 States and DC, at Least One ACA Exchange Plan Offers Benefits that Include Abortion Coverage

As of February 2020, however, six states require abortion coverage in all state regulated plans including all the plans on their ACA Marketplace.1 Eleven states and DC neither ban nor require abortion coverage but offer at least one plan on their ACA Marketplace that includes abortion coverage.

The ACA and the relevant regulatory section requires plans that offer coverage for abortion beyond Hyde limitations to segregate the federal funds used to subsidize premium costs for the EHBs from the premiums costs that pay for that coverage. Plans have been required to collect a separate payment for abortion coverage and notify consumers regarding the inclusion or exclusion of abortion in the Summary of Benefits and Coverage at enrollment. Any plan that includes coverage of abortions beyond Hyde limitations must estimate the actuarial value of such coverage by taking into account the cost of the abortion benefit, but it must be valued at least $1 per enrollee per month. This estimate cannot take into account any savings that might be achieved as a result of the abortions (such as the savings of not paying claims for prenatal care, delivery or postnatal care).

In 2015, the Obama Administration provided guidance on how this statute should be implemented, allowing options that simplified the billing and payment process for plans that include abortion coverage yet kept funds segregated. They allowed insurers to send “the enrollee a single monthly invoice or bill that separately itemizes the premium amount for non-excepted abortion service” or “sending the enrollee a notice at or soon after the time of enrollment that the monthly invoice or bill will include a separate charge for such services and specify the charge.”

In October 2017, the Trump Administration issued a bulletin reinforcing the 2015 notice. They also indicated that the Center for Medicare and Medicaid Services (CMS) would fully enforce the requirements related to abortion coverage in the Federally Facilitated Exchange (FFE) and, if states failed to require compliance in plans offered by the State-Based Exchanges (SBE), CMS would step in. In August 2018, 101 members of Congress signed a letter to Secretary Alex Azar stating their dissatisfaction with the Obama Administration policy, and urging the Trump Administration to issue new regulations that they believe were needed to reflect the intent of the law.

What do the new regulations change?

On December 27, 2019, the Trump Administration published final regulations addressing exchange program integrity that make made significant changes to how issuers must bill and consumers should pay for non-Hyde abortion coverage in Marketplace plans that include abortion coverage. HHS takes the position that the Obama-era regulation fail to consider that “Congress intended that QHP issuers collect two distinct (that is, ‘‘separate’’) payments, one for the coverage of non-Hyde abortion services, and one for coverage of all other services covered under the policy, rather than simply itemizing these two components in a single bill, or notifying the enrollee that the monthly invoice or bill will include a separate charge for these services.”

Under the final rule:

- Issuers must send two separate monthly bills, either by mail or electronically to each policyholder: one bill would be for the non-Hyde abortion coverage (at least $1 per member per month) and one bill would be the premium for everything else excluding the non-Hyde abortion coverage. Issuers may send two separate bills in a single envelope, but must send two separate emails if billing electronically.

- Consumers will be instructed by the issuer to pay in two separate transactions. If the consumer is paying by mail, the consumer may send two checks in one envelopes or but in the cases where the policyholder pays through electronic funds transfer, the consumers must make two electronic payments.

How could the new regulations affect enrollees and insurers?

HHS projects that the new regulation will cause enrollment to decrease slightly and ACA premiums to increase by up to 1 percent in plan year 2021 and each year thereafter. They also project federal outlays for premium tax credits to increase by about $106 million in 2021 and $96 million in 2022 and

HHS also estimates the separate billing and payment policy will result in significant costs. They project that costs to insurers, state-based exchanges, the federal exchange, and consumers will be about $546.1 million in 2020, $232.1 million in 2021, $230.7 million in 2022, and $229.3 million annually in 2023 and onwards.

Consumers enrolled in 24 States and DC (that do not bar abortion coverage) will be affected, but the impact will be greatest for enrollees residing in the six states that mandate abortion coverage and in the additional 11 states and DC that offer plans with coverage.

HHS revised its initial estimate of 1.3 enrollees and now estimates that 3.4 million enrollees to Marketplace plans will be impacted by the regulation (Table 1). HHS estimates that in 2020 consumer costs will total $35.5 million, but this estimate does not factor in the costs to consumers of a separate payment, the potential loss of coverage nor the costs to re-enroll. For all policyholders, HHS estimates that the annual enrollee burden will be approximately 2 million hours with an associated annual cost of approximately $25.1 million.

| Table 1: State Abortion Coverage Policies and Enrollment | ||

| State Abortion Coverage Rules for QHPs | Number of States | Number of Enrollees |

| Mandatory in all plans | 6 | 2.3 million |

| No ban, at least one plan offers abortion coverage | 11 and DC | 1.1 million |

| No ban, no plans offer abortion coverage | 7 | 321,500 |

| Abortion coverage is banned | 26 | 6.5 million |

| NOTES: For details by state, see Appendix. This estimate is based on a review of 2020 state policies and ACA Marketplace plans, using HHS enrollment statistics for 2019 Effectuated enrollment data which is final as of the first half of 2019. SOURCES: KFF, Interactive: How State Policies Shape Access to Abortion Coverage, February 2020; KFF State Health Facts, Marketplace Effectuated Enrollment and Financial Assistance, 2019. |

||

Some consumers will be confused by receiving separate invoices for the same insurance policy and the need to make two separate payments each month. HHS states that sending policyholders two separate bills will cause confusion because they might not understand why they are getting two different bills and why they need to make these payments separately. However, HHS has said that “. . .although policy holders may experience burden related to reading and understanding the separate bills, there are non-quantifiable benefits to policy holders in QHPs covering non-Hyde abortion who hold conscience objections to such coverage or policy holders who seek a better understanding of what their health care dollars are purchasing. HHS continues to believe that, although these changes will increase enrollee burden, this burden is reasonable and justified because it will achieve better alignment of the regulatory requirements for QHP issuer billing of premiums with the separate payment collection requirement in section 1303 of the PPACA.”2

While the final rule allows insurers to send the two bills in one envelope, saving insurers the cost of two mailings, some consumers may not notice two bills sent in the same envelope for the same plan. HHS took the position in the proposed rule that sending two separate bills will reduce consumer confusion because consumers may “inadvertently miss or discard a second paper bill in a single envelope.” In addition, HHS acknowledges that some banks might flag payments as potentially fraudulent because two payments are made in the same day or because one payment is for $1. This could result in the termination for the consumer, and additional costs for issuers.

Men and women who are beyond their reproductive years may be most likely to be confused about the separate bill for abortion coverage. They may think the abortion coverage is a rider and not part of their plan, and decide not to pay the $1 without recognizing that they are making incomplete payments on their full insurance. Abortion coverage is not a rider. In fact, the CMS prohibits plans from selling any coverage riders on the Marketplace and a recent review of insurance plans finds there are no abortion riders available to individuals outside the Marketplace.

Some consumers may fail to pay their premium in full and have their coverage terminated for delinquent payment. The rule states that if a subscriber fails to pay in separate transactions but pays the total amount in one payment, then the issuer is not permitted to cancel the coverage. It does not speak, however, to what issuers should do if the payment is not made in full—that is, if the policyholder pays for the EHB share of the premium but does not make the abortion payment.

| What happens when individuals fail to pay some or all of their premiums? |

If the premiums are not paid in full, insurers may terminate coverage. The grace period and the timing of the loss of coverage depend on whether the individual qualifies for the federal Alternative Premium Tax Credit (APTC) and state law,

|

| SOURCE: CMS, Health Plan Coverage Effectuation: Payments, Grace Periods, and Terminations, 2019. |

When an issuer may begin the termination process for delinquent payments varies. Insurers could terminate coverage if QHP premium payments are not made in full following a grace period. Some insurers may have opted to set a premium threshold, which is a dollar amount or a percentage of the premium that the policyholder may owe before the process to terminate the policy for nonpayment is initiated. The amount the policyholder owes for non-payment is cumulative and over time, even a premium threshold will not be protective for policyholders who may be confused about or unaware they have not paid their premiums in full.

While, HHS has stated that they will not take enforcement action against issuers who do not initiate a grace period and termination for nonpayment in full because of this new policy, they also will not permit issuers to waive the separate premium payment for abortions because policyholders must pay the cost. States have different laws about grace periods, and terminations, and not all states will be able to provide any leeway to issuers to not terminate policyholders who fail to pay the full premium.

HHS will permit issuers to change benefits mid plan year or allow consumers to opt out of abortion coverage, but this will conflict with many states’ laws.

In the preamble to the rule, HHS states in order to mitigate the current lack of transparency for non-Hyde abortion coverage in plans, they will not take enforcement action against issuers of ACA Marketplace plans that “modify the benefits of a plan at the time of enrollment or during a plan year to effectively allow enrollees to opt out of coverage of non-Hyde abortion services by not paying the separate bill for such services.” Because modifying benefit midyear or altering benefits for just some enrollees may be violate state insurance law, HHS is encouraging states and their exchanges to also not take enforcement action against issuers.

It is not clear how issuers could modify plan benefits midyear or change the benefits only for some policyholders, or how issuers would be able to distinguish between consumers opting out and those failing to pay the full premium. Also, this new federal flexibility is in direct conflict with state laws that require abortion coverage to be included in all ACA Marketplace plans, and is contrary to many state insurance regulations on altering benefit packages mid-year.

Some issuers might eliminate abortion coverage from their plans altogether because of the additional cost and administrative requirements. As a result, women enrollees will bear the cost of abortion services, even in states that permit Marketplace plans to offer abortion coverage. To implement this process, issuers will need to establish a protocol for sending two separate bills. HHS has calculated that this would affect 94 issuers with 1,467 plans (representing 32 percent of individual market on-Exchange plans in 21 states and estimated costs per issuer ($4.1 million)) totaling an estimated $385 million for all plans. These estimates do not include the cost of printing the extra bills as well as additional staffing that will be needed to answer enrollee questions and address delinquent payments. Insurers could experience declining enrollment when enrollees default on coverage payments, even when they have the resources to cover the costs.

The preamble to the final regulations specify that plans may take into account the administrative expense of including coverage of non-Hyde abortions in calculating the premiums associated with that abortion coverage. However, this is in direct conflict with the statutory language that states these funds are to be “used exclusively to pay for [abortion] services” not an issuer’s administrative cost of providing that service.3

States that operate their own ACA Marketplaces will face additional costs and new administrative responsibilities.

There are 12 states that face additional impacts because they operate their own state-based ACA Marketplace. HHS estimates the total one-time cost for all 12 State Exchanges affected by these requirements will be approximately $9 million in 2020. Total ongoing costs for all 12 State Exchanges is estimated to be approximately $2.4 million in 2020, $4.8 million in 2021, $3.6 million in 2022 and $2.4 million 2023 onwards. HHS estimates that on average, each of these states will incur in 2020 one-time costs of $750,000 and ongoing annual costs of approximately $200,000 for the six months of implementation in 2020, and $400,000 in 2021. HHS estimates cost will decrease in the following year.

In addition, HHS estimates an additional administrative responsibility for a State Exchange that performs premium billing and payment processing. For all three state exchanges (MA, RI, VT) that perform premium billing and payment processing, HHS estimate the total one-time cost will be 94,500 hours totally approximately $12.3 million for these three exchange to implement the final rule. While many comments for the proposed rule outlined additional expenses for state regulators and exchanges to counter consumer confusion by creating consumer notices, responding to increased demand at call centers, and re-enrolling consumers who are dropped from their insurance, HHS does not include any additional costs for these groups to implement the new regulation.

What is the current availability of abortion coverage in 2020 ACA Marketplaces?

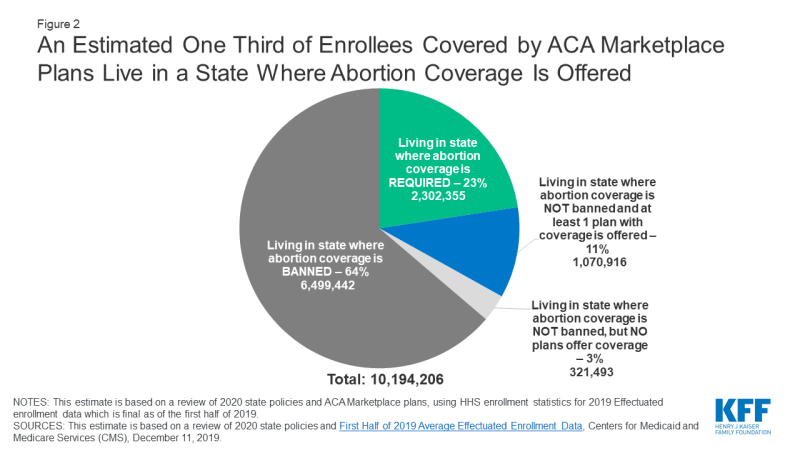

Even before the new regulations were issued, abortion coverage was only available to a minority of ACA plan policyholders. As a result of state decisions to ban abortion coverage and issuers’ choices to exclude abortion coverage where there is no state ban, only one third of enrollees live in a state where abortion coverage is offered in the ACA Marketplace (Figure 2). At the time of the ACA debate about abortion coverage, some experts predicted that imposing these kinds of requirements on plans that cover abortion services would have a chilling effect on abortion coverage. This prediction has been borne out. Seven states have no formal legal ban on abortion coverage, yet no plans are available that offer coverage. The exact reasons why the plans do not offer abortion coverage is not clear.

Figure 2: An Estimated One Third of Enrollees Covered by ACA Marketplace Plans Live in a State Where Abortion Coverage Is Offered

This regulation adds to the challenge of including abortion coverage and it is likely that the newly required payment process will make additional insurers consider dropping abortion coverage to simplify their billing practices and avoid the need for additional paperwork, staffing, reporting, and oversight. Abortion coverage is particularly at risk in DC and the 11 states currently offering plans that cover abortion, but that do not have a mandate. In Colorado and New Jersey, only one issuer on the ACA Marketplace offer abortion coverage and does not offer plans in every county.

What have been the legal challenges to the final rule?

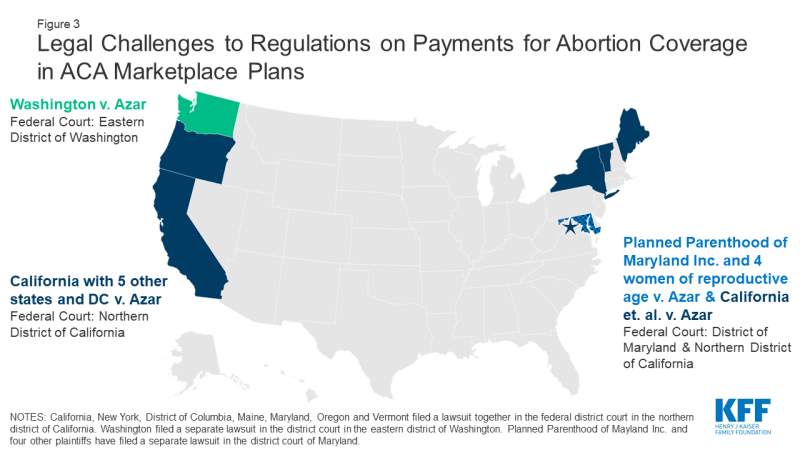

Three federal district courts have ruled in favor of the plaintiffs challenging the regulations, and the Administration is blocked from implementing the regulations. Seven states and DC have filed legal challenges to this final rule alleging irreparable injuries to the states’ sovereign and proprietary interests (Figure 3). California, New York, District of Columbia, Maine, Maryland, Oregon and Vermont filed a lawsuit together in the federal district court in the northern district of California. Washington filed a separate lawsuit in the district court in the eastern district of Washington. The states claim the implementation of the final regulation should be blocked because the regulation:

Figure 3: Legal Challenges to Regulations on Payments for Abortion Coverage in ACA Marketplace Plans

- Imposes onerous and unnecessary regulatory barriers aimed at restricting women’s constitutionally protected right to access abortion care;

- Seeks to frustrate state sovereignty by coercing states to change their policies relating to the protection of abortion care;

- Violates Section 1554 of the ACA, which prohibits the promulgation of any regulation that creates unreasonable barriers to the ability of individuals to obtain appropriate medical care; and

- Exceeds HHS’s statutory authority under Section 1303 of the ACA, the section of the law that describes the requirements for segregating premium payments for abortion services.

Planned Parenthood of Maryland and four individual consumers represented by the ACLU also filed a lawsuit in the district court of Maryland. They also allege the Administration violated the Administrative Procedures Act by not adequately quantifying the costs and benefits of the rule, conflicting with Sections 1303 (the and 1554 of the ACA, and providing no opportunity for public comment on the “opt-out” provision included in the final rule but not in the proposed rule.

Rulings in Favor of the Plaintiffs Block the Implementation of the Regulations

- On April 9, 2020, the U.S. District Court in the Eastern District of Washington ruled that the regulations clearly conflict with Washington’s Single Invoice State, and “cannot be squared with the ACA’s multiple non-preemption provisions.” The court ruled the regulation invalid and without force in the State of Washington. The Trump Administration has appealed this decision to the 9th Circuit Court of Appeals.

- On July 10, 2020, the U.S. District Court for the District of Maryland found the regulations arbitrary and capricious, vacated the regulations and enjoined the enforcement. The Trump Administration has appealed this decision to the 4th Circuit Court of Appeals.

- On July 20, 2020, the U.S. District Court in the Northern District of California ruled in favor of the State of California and the five other states, finding that the regulations are arbitrary and capricious.

Looking Forward

This rule is consistent with the Trump Administration’s stated priority to limit abortion access and other regulatory actions that could lead to the erosion of ACA related improvements for women’s health coverage. HHS itself finds that these regulations will likely cause consumer confusion, lead to coverage terminations. Prior experience in other states confirms that insurers could move to drop abortion coverage, further eroding the availability of coverage for a health service that many women rely on. Depending on the outcome of the presidential election, the legal challenges may become moot or may ultimately be decided by the Supreme Court.