Pre-Existing Condition Prevalence Among Women Under Age 65

The Affordable Care Act (ACA) guarantees that people cannot be denied coverage or charged higher premiums in the individual insurance market due to their health status. While most adults under age 65 have health insurance coverage through an employer, many turn to the non-group market at some point in their lives, such as if they lose a job, become self-employed, get divorced, age off of a parent’s policy, retire early, or lose eligibility for public coverage. Prior to 2014, when most of the Affordable Care Act’s (ACA) consumer protections took effect, people seeking non-group coverage in all but five states1 were routinely denied or charged more based on their health status and history, pregnancy status, prescription medications, and lab results. In 2013, 18% of individual market applicants were denied coverage; this figure does not account for the many people with pre-existing health conditions who did not even try to apply.

In November, the Supreme Court will hear oral arguments on California v. Texas, a lawsuit brought by Republican state officials and supported by President Trump, that seeks to invalidate the ACA entirely. If the ACA is overturned, federal protections for people with pre-existing health conditions would end and access to high quality, affordable individual market insurance for them could be drastically reduced.

We analyzed data from the 2018 National Health Interview Survey (NHIS) and 2018 Behavioral Risk Factor Surveillance System (BRFSS) to calculate prevalence rates of declinable health conditions.2 This data note looks at the share of adults ages 18-64 with declinable pre-existing conditions, with a particular focus on women.

Estimates of the Share of Women Under Age 65 with Pre-Existing Conditions

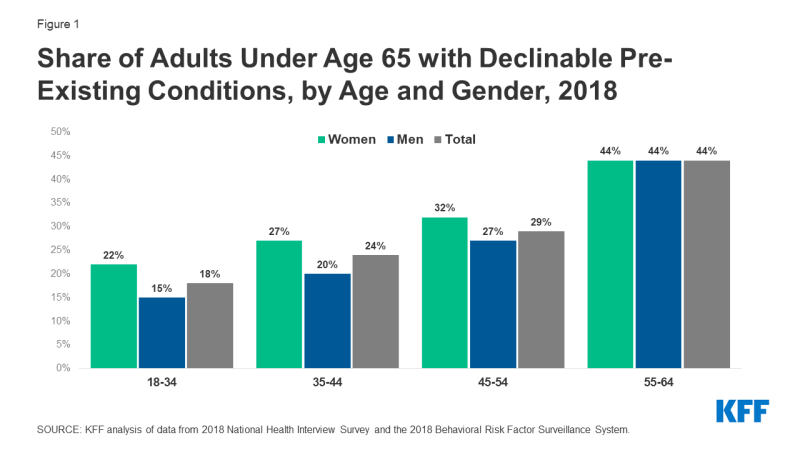

53.8 million (27%) adults under 65 have at least one pre-existing condition that would have rendered them ineligible for individual insurance prior to the ACA, with higher rates among women than men. The prevalence of declinable conditions increases with age, ranging from 18% of those ages 18-34 to 44% of those ages 55-64 (Figure 1).

Figure 1: Share of Adults Under Age 65 with Declinable Pre-Existing Conditions, by Age and Gender, 2018

We estimate that 30.1 million (30%) women have a pre-existing condition that would have left them uninsurable in the individual market pre-ACA, compared to 23.7 million (24%) men (Table 1). These estimates are conservative because the NHIS and BRFSS do not contain data for all conditions that were often declinable (e.g., HIV/AIDS), nor for use of prescription medications that could have triggered a coverage denial. Some conditions disproportionately affect women, such as pregnancy and certain types of cancer.

| Table 1: Among Adults Ages 18-64 with Declinable Pre-Existing Health Conditions, Types of Conditions, by Gender, 2018 | |||

| Women | Men | Total | |

| Current pregnancy | 12% | NA | NA |

| Crohn’s disease, ulcerative colitis, or ulcers | 45% | 47% | 46% |

| Ever had diabetes | 24% | 29% | 26% |

| Difficulty due to depression | 22% | 21% | 21% |

| Any other heart condition | 20% | 23% | 21% |

| BMI > 40 | 23% | 16% | 20% |

| Chronic bronchitis in past 12 months | 14% | 9% | 12% |

| Ever had non-skin cancer | 15% | 9% | 12% |

| Melanoma skin cancer | 8% | 6% | 8% |

| Ever had congenital heart disease | 4% | 10% | 7% |

| Ever had COPD | 6% | 8% | 7% |

| Ever had stroke | 5% | 7% | 6% |

| Ever had heart attack | 3% | 8% | 6% |

| Weak or failing kidneys | 5% | 5% | 5% |

| SOURCE: KFF analysis of data from 2018 National Health Interview Survey and the 2018 Behavioral Risk Factor Surveillance System. | |||

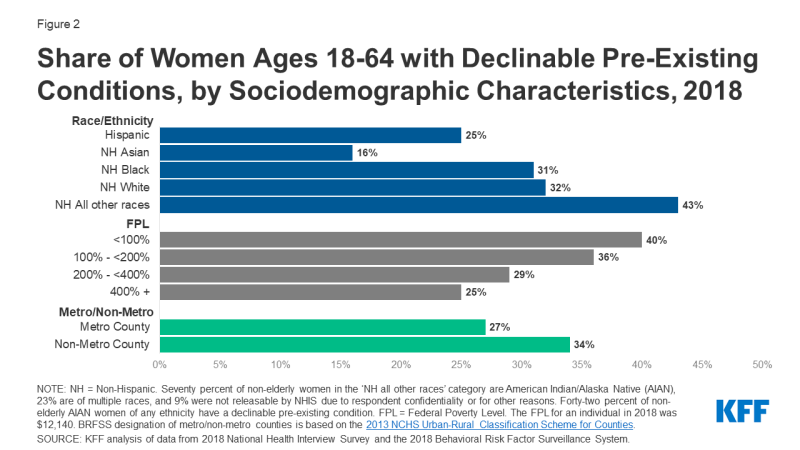

Older women, certain women of color, low-income women, and women living in non-metropolitan counties experience pre-existing health conditions at higher rates than their counterparts (Figure 2).

Non-Hispanic women under age 65 of ‘other’ races (43%) have a prevalence of declinable pre-existing conditions nearly three times higher than non-Hispanic Asian women (16%). One in four (25%) Hispanic women have a have a pre-existing condition, which is also lower than the national average. Seventy percent of women under 65 in the ‘NH All other races’ category are American Indian/Alaska Native (AIAN), 23% are of multiple races, and 9% were not releasable by NHIS due to respondent confidentiality or for other reasons. Forty-two percent of AIAN women under 65 of any ethnicity have a declinable pre-existing condition. Approximately one-third of non-Hispanic white (33%) and black (31%) women under 65 have a declinable condition.

The share of women under 65 with a declinable health condition decreases with income, ranging from 40% of those with household incomes below 100% of the federal poverty level (FPL) to 25% for those at or above 400% of FPL. Twenty-seven percent of women under 65 residing in a metropolitan county have a pre-existing condition compared to 34% in non-metropolitan counties.3

Figure 2: Share of Women Ages 18-64 with Declinable Pre-Existing Conditions, by Sociodemographic Characteristics, 2018

Estimates of the Share of Women Ages 18-64 with Pre-Existing Conditions by State

Rates of declinable pre-existing conditions vary from state to state (Figure 3). On the low end, less than one-quarter (23%) of women under age 65 in Massachusetts have conditions that would likely be declinable under pre-ACA underwriting practices in the individual market. For men under age 65 (19%), the rate is lowest in Colorado. On the high ends, more than one-third of women (39%) and men (34%) in West Virginia have a declinable health condition. Overall, rates of pre-existing conditions are higher in the South – such as Arkansas (34%), Kentucky (34%), Mississippi (34%), and West Virginia (37%), where at least one-third of adults under 65 have declinable conditions.

.

Discussion

We estimate that 27% (53.8 million) of adults under age 65, including 30% (30.1 million) of women, have at least one pre-existing health condition that would have left them uninsurable in the medically-underwritten, pre-ACA individual market. The ACA’s prohibition on denying health insurance based on health status, or charging more for coverage, has been of particular importance to women, who have higher rates of pre-existing conditions than men. If the ACA is overturned, these protections would disappear, leaving many women vulnerable to difficulties obtaining insurance that addresses all of their health needs should they need to secure coverage through the individual insurance market either as their regular source of coverage or temporarily during life transitions.