Medicare

10 Things to Know About Medicare Advantage Dual-Eligible Special Needs Plans

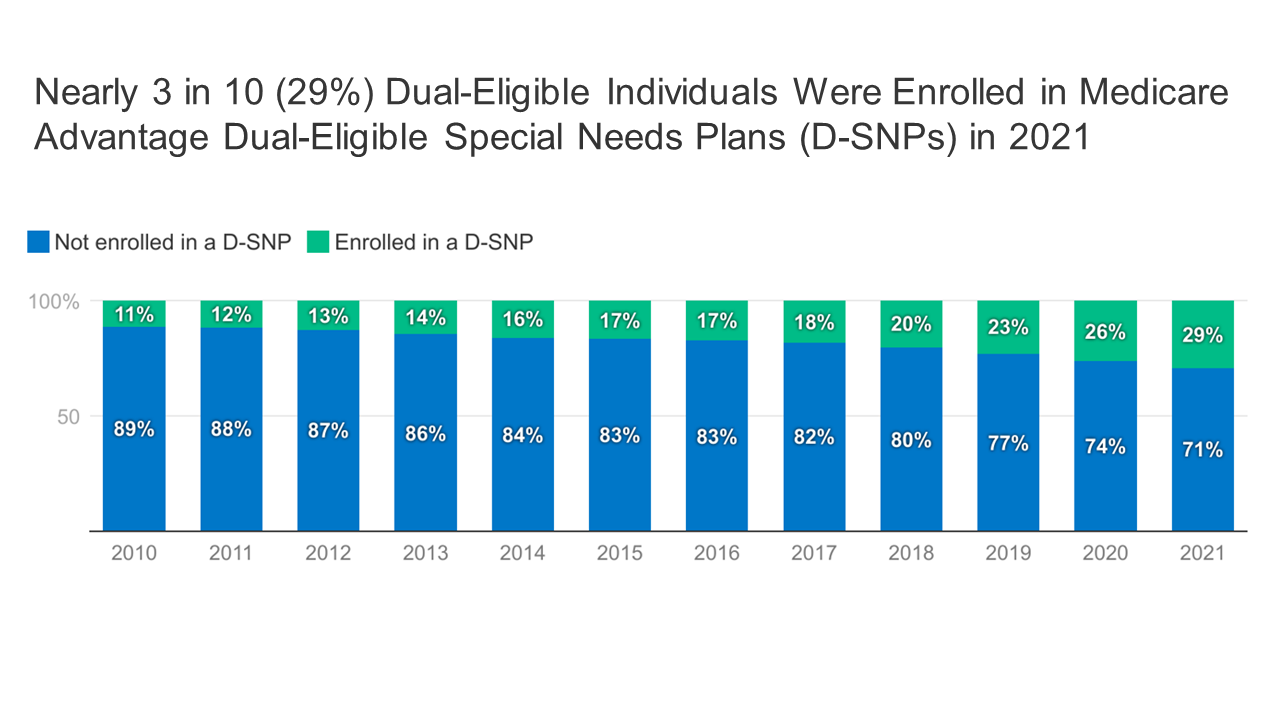

In 2021, 29% of dual-eligible individuals (people covered by both Medicare and Medicaid) received their Medicare coverage through a type of Medicare Advantage plan known as a Dual-Eligible Special Needs Plan (D-SNP).

In 2021, 29% of dual-eligible individuals (people covered by both Medicare and Medicaid) received their Medicare coverage through a type of Medicare Advantage plan known as a Dual-Eligible Special Needs Plan (D-SNP).A Snapshot of Sources of Coverage Among Medicare Beneficiaries

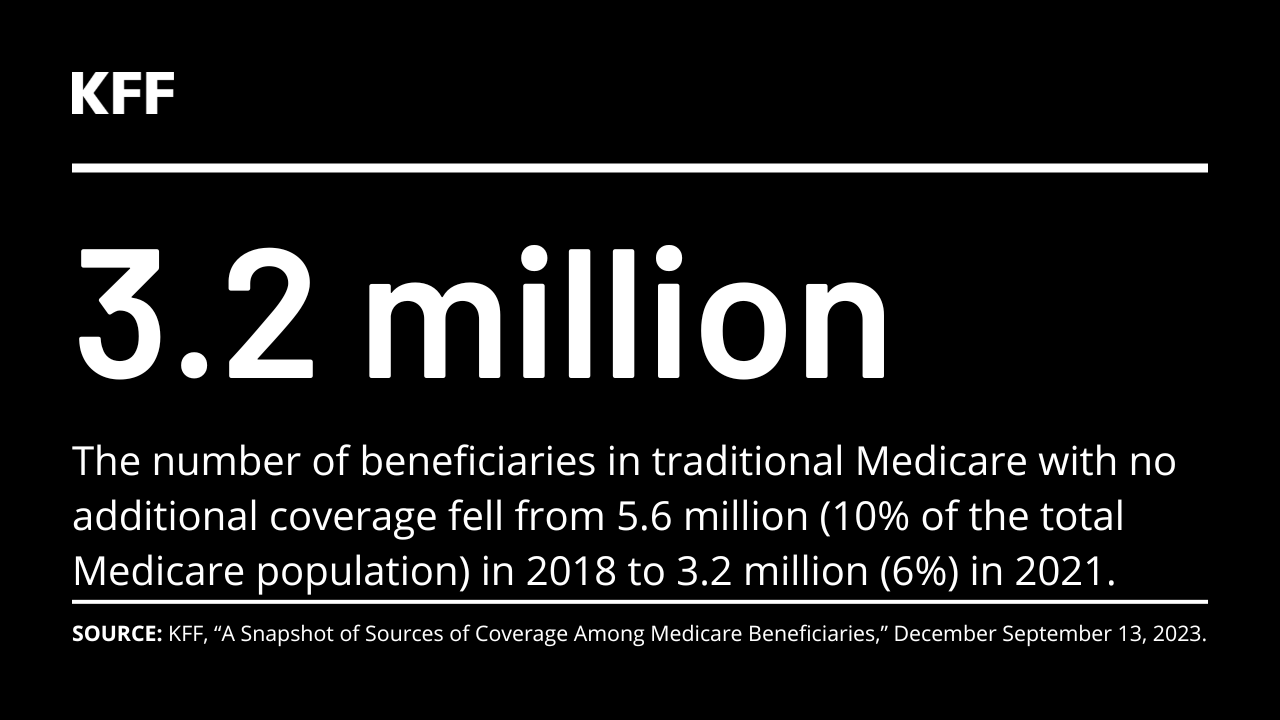

Nearly everyone with Medicare had coverage through Medicare Advantage or traditional Medicare paired with some type of other coverage in 2021. But 3.2 million beneficiaries had no additional coverage, raising their risk of high out-of-pocket medical costs.

Nearly everyone with Medicare had coverage through Medicare Advantage or traditional Medicare paired with some type of other coverage in 2021. But 3.2 million beneficiaries had no additional coverage, raising their risk of high out-of-pocket medical costs.Medicare Households Spend More on Health Care Than Other Households

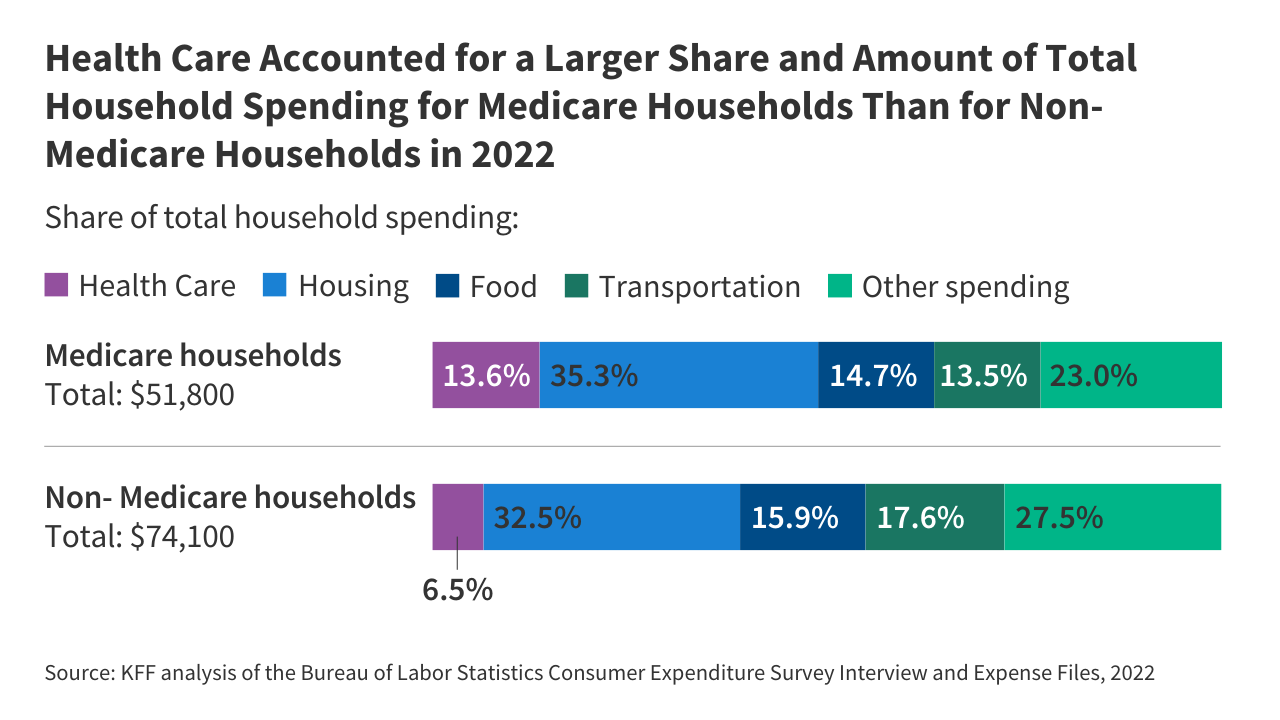

People on Medicare spent a larger share of their household budgets on health care than other households (13.6% vs 6.5%). And a larger share of Medicare households spent at least 20% of their total household budgets on health-related expenses than non-Medicare households (29% v 7%).

People on Medicare spent a larger share of their household budgets on health care than other households (13.6% vs 6.5%). And a larger share of Medicare households spent at least 20% of their total household budgets on health-related expenses than non-Medicare households (29% v 7%).Gaps in Medicare Advantage Data Remain Despite CMS Actions to Increase Transparency

Despite improvements in transparency by the Centers for Medicare & Medicaid Services, substantial data gaps still limit the ability of policymakers and researchers to oversee Medicare Advantage and examine plans’ performance, and limit beneficiaries’ ability to compare plans offered in their area.

Despite improvements in transparency by the Centers for Medicare & Medicaid Services, substantial data gaps still limit the ability of policymakers and researchers to oversee Medicare Advantage and examine plans’ performance, and limit beneficiaries’ ability to compare plans offered in their area.

Data Visualization

The Facts About Medicare Spending

This interactive provides the facts on Medicare spending. Medicare, which serves 65 million people and accounts for 13 percent of the federal budget and 21 percent of national health spending, is often the focus of discussions about health expenditures, health care afforbability and the sustainability of federal health programs.

Explore data on enrollment growth, Medicare spending trends overall and per person, growth in Medicare spending relative to private insurance, spending on benefits and Medicare Advantage, Part A trust fund solvency challenges, and growth in out-of-pocket spending by beneficiaries.

Read More

Latest News

-

KFF Health News' 'What the Health?': Abortion — Again — At the Supreme Court

-

Medicare Stumbles Managing a Costly Problem — Chronic Illness

-

Medical Providers Still Grappling With UnitedHealth Cyberattack: ‘More Devastating Than Covid’

-

Medicare’s Push To Improve Chronic Care Attracts Businesses, but Not Many Doctors

-

An Arm and a Leg: Attack of the Medicare Machines

-

Rising Complaints of Unauthorized Obamacare Plan-Switching and Sign-Ups Trigger Concern