Millions of People with Medicare Will Benefit from the New Out-of-Pocket Drug Spending Cap Over Time

Issue Brief

Millions of People with Medicare Will Benefit from the New Out-of-Pocket Drug Spending Cap Over Time

Issue Brief

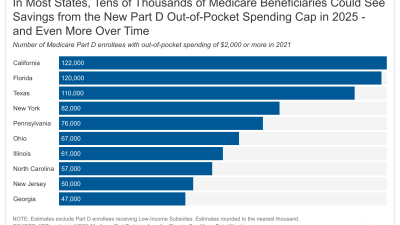

In 2025, Medicare beneficiaries will pay no more than $2,000 out of pocket for prescription drugs covered under Part D, Medicare’s outpatient drug benefit, due to a provision in the Inflation Reduction Act of 2022. This analysis examines how many Medicare Part D enrollees spent $2,000 or more out of pocket in 2021 and over multiple years, both nationally and at the state level, to show how many people over time could benefit from the new Part D spending cap.