The independent source for health policy research, polling, and news.

People with Medical Debt are Much More Likely to Experience Other Forms of Financial Stress

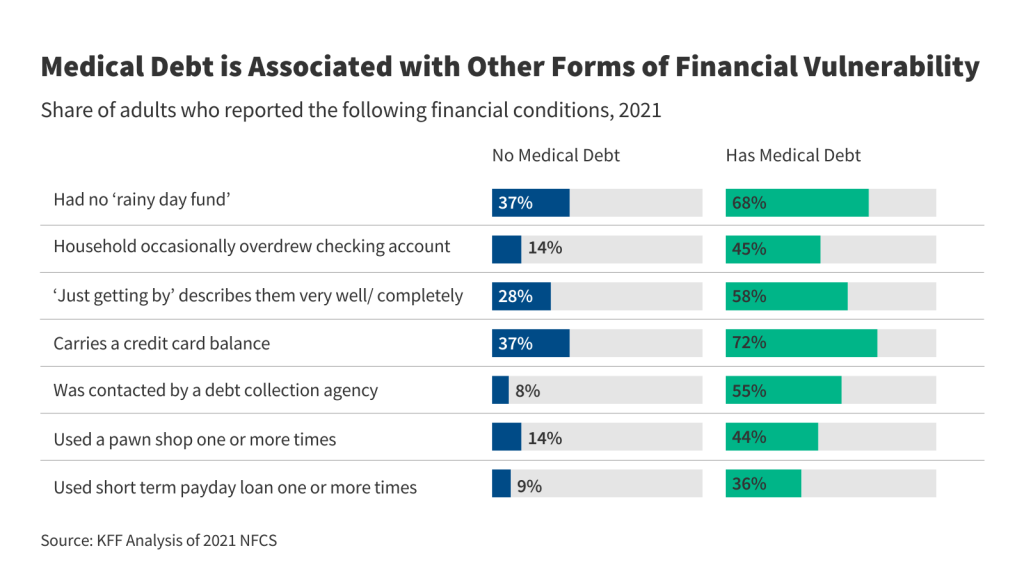

People with medical debt are much more likely than those without such debt to show other signs of financial vulnerability, like having no “rainy day” fund, overdrawing a checking account, or relying on costly loans, according to a new KFF analysis of national survey data.

Medical debt remains a significant issue in the U.S., including among people with health insurance. In 2021, 23% of U.S. adults had one or more unpaid and past due bills from a medical service provider.

KFF’s 2022 Health Care Debt Survey found similar results: Among adults, 24% say they had medical or dental bills that were past due or that they could not pay, and a total of 41% had some type of health care debt, including on credit cards or owed to family members.

Medical debt and other forms of financial instability affect people and households across the income spectrum and can cause individuals to forgo needed care. In its award-winning series, “Diagnosis: Debt”, KFF Health News examined the epidemic of medical debt that has become a defining feature of the U.S. health care system.

The Consumer Financial Protection Bureau is expected to release requirements that remove medical debt from credit reports and could crack down on certain debt collection practices. Some states and localities have also bought or are seeking to buy their residents’ medical debt, in part with remaining COVID relief funds.

KFF’s new analysis relies on data from the 2021 National Financial Capabilities Survey. The survey uses information from more than 27,000 adults in each state and D.C.